Token swap explained – part 4

This is the final part of the token swap series. For more explanation, check the previous parts.

Tier 3 Exchanges – explanation

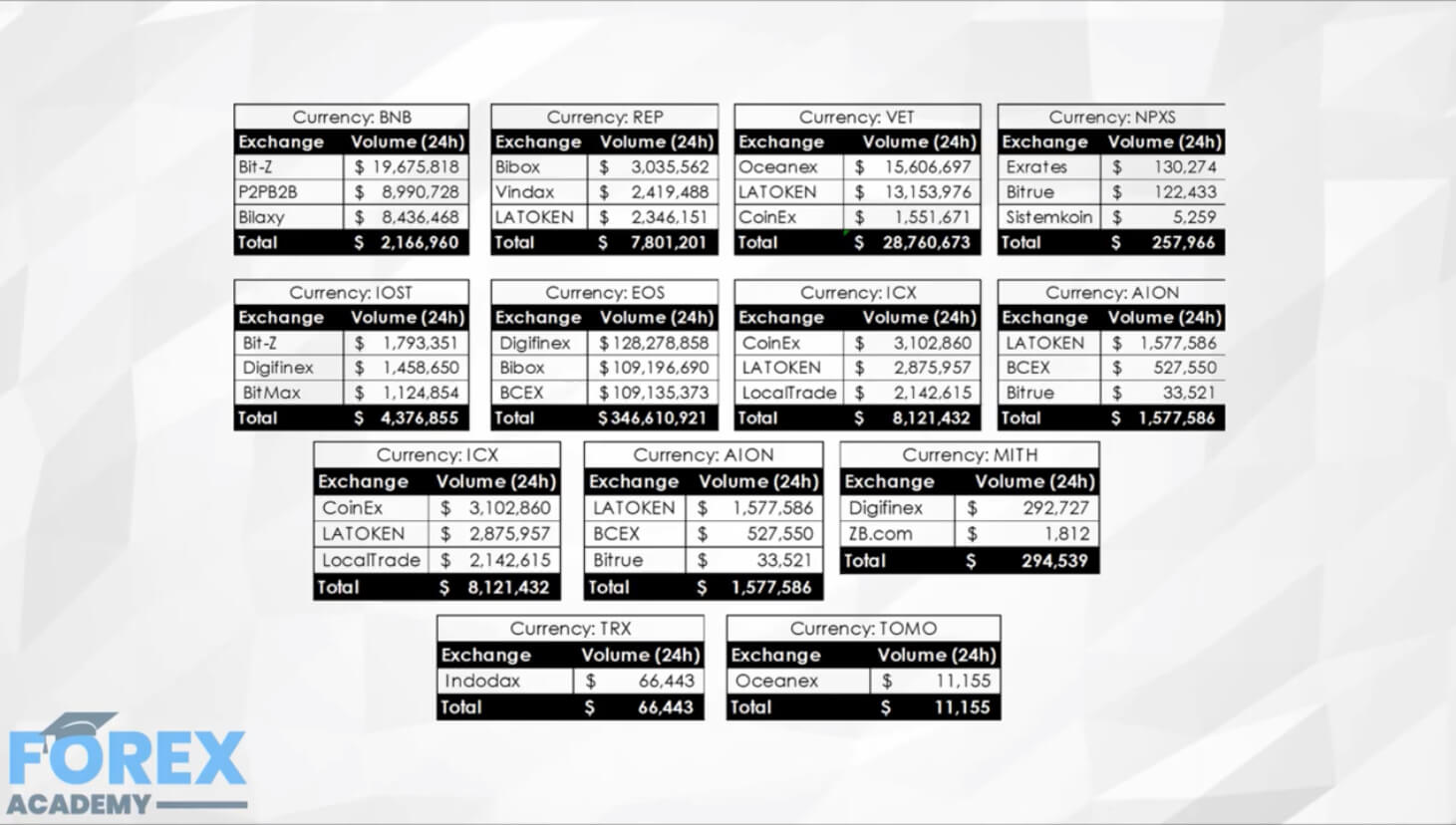

We have analyzed the trading volumes of the 13 coins that were listed on Tier 3 exchanges. The graphs below show the data that focuses solely on the daily trading volume generated by the Tier 3 exchanges. The volume is clearly minuscule and has no impact on price discovery. If we take a look at the data, only EOS has respectable liquidity on these exchanges. Other projects have low volumes on these exchanges, which makes the listing on the exchange virtually worthless.

Exchanges VS. Token Swaps

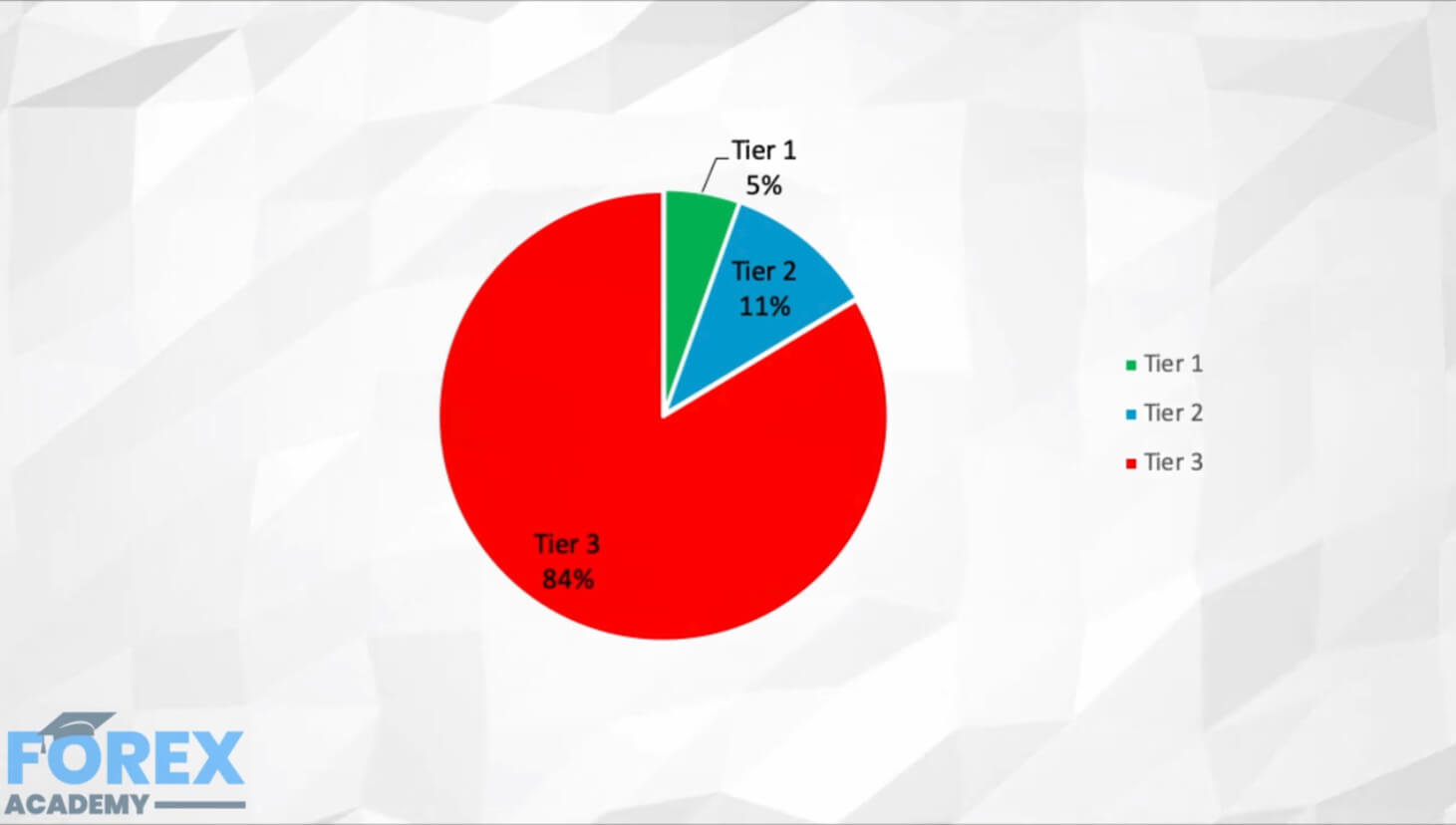

This pie chart below highlights the category of exchanges each coin was listed on. The majority of the coins (84% to be precise) are listed on Tier 3 exchanges.

A few things can be concluded from the analysis:

Tier 1 exchanges are extremely picky when listing tokens. If a project is not following the ERC20 standard, they need to have a big brand name or to be ready to pay a hefty “fee” for listing their currency on the Tier 1 exchange.

84% of native tokens managed to list their tokens only on Tier 3 exchanges. Another 11% managed to list their tokens on Tier 2 exchanges.

Tier 1 VS. Tier 2 Exchanges

If we take a look at the average daily trading volume on the three exchange ranks, we can see that the:

• Average Daily Trading Volume of Tier 1 exchanges (6) = $129,342,307

• Average Daily Trading Volume of Tier 2 exchanges (12) = $22,659,579

• Average Daily Trading Volume of Tier 3 exchanges (92) = $2,495,216

Even though the average trading daily volume of Tier 3 exchanges is well over $2 million, this number is significantly lower as many of these exchanges are engaged in fake trading. We can also see that there is a massive difference in volume when we compare Tier 1 and Tier 2.

It is significantly cheaper and faster to list the token on Tier 2 exchanges, which can provide the necessary liquidity to the token. On top of that, having a decent daily trading volume in Tier 2 pushes Tier 1 exchanges to list the token much faster and cheaper.

Conclusion

Many projects launched their projects using the ERC20 standard as it provided the necessary speed as well as the ability to raise funds quickly. It also provided a more accessible pathway to list the token on exchanges as almost all exchanges support ERC20 tokens. The challenge comes when these projects want to launch their main-net and conduct a token swap, which transforms their ERC20 token into their native token.

This part of the article focused on one of the reasons why the native token price fades away, which is the inability to list their tokens on Tier 1 exchanges. Most of the native tokens could not get listed on Tier 2 exchanges. The data shows an immediate and long-term negative impact token liquidity and pricing after the token swap.