BitMEX in-depth guide (part 3/5) – TT International partnership and insurance fund

This part of the BitMEX guide will show its partnership with Trading Technologies International and how it affects the users, as well as the insurance fund’s importance in ensuring that every trader gets their fair share of profits.

Trading Technologies International – BitMEX partnership

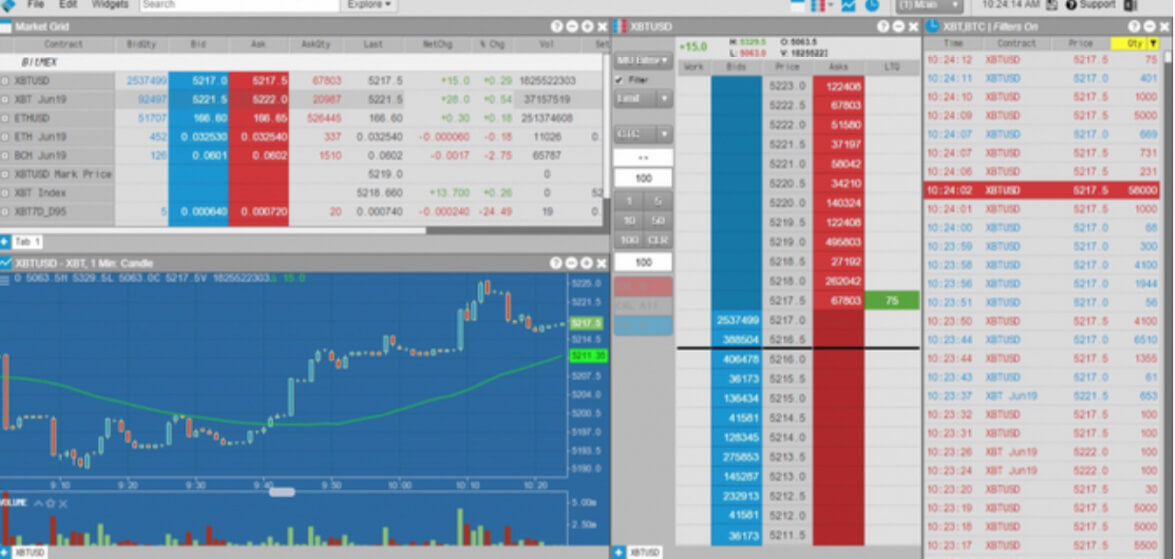

HDR Global Trading, the company behind BitMEX, has partnered with Trading Technologies International in 2019. Trading Technologies International is a leading high-performance trading software provider. The TT platform’s design is aimed specifically at professional traders, brokers, as well as market-access providers. It incorporates a wide variety of both trading tools as well as analytical indicators. This partnership is crucial because it provides BitMEX traders with global market access as well as trade execution through TT’s privately managed infrastructure.

The BitMEX insurance fund

One of the main selling features of most trading platforms is margin trading. However, as a result of how much leverage is involved on these platforms, it’s entirely possible that the losers could not be able to cover the margin in their positions in order to pay the winners.

Traditional exchanges such as the CME (Chicago Mercantile Exchange) try to offset this problem by using multiple layers of protection. Cryptocurrency trading platforms are currently unable to match these levels of protection provided to winning traders.

To solve this issue, BitMEX created an insurance fund system. When a trader opens a leveraged position, the position is unwilling and forcefully liquidated as soon as their maintenance margin drops too much.

A trader’s profits and losses do not reflect the actual position price. When a trader is liquidated on BitMEX, their equity previously associated with the open position goes down to zero.

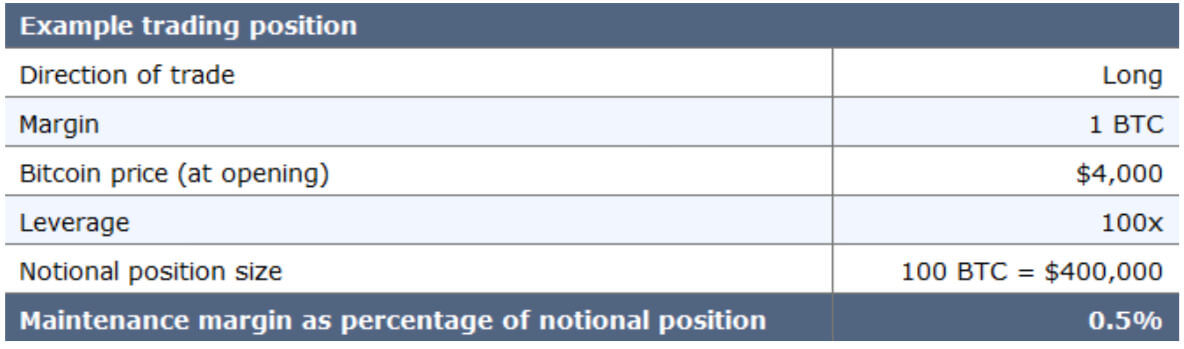

To better explain it, we will present you with an example. The trader has taken a long position with leverage of 100x. If the price of Bitcoin drops 0.5%, their position will get liquidated.

It doesn’t matter what the exact price of this trade is when it is executed. From the view of the trader, whatever their liquidation price is, they lose all the funds they had previously put into this position.

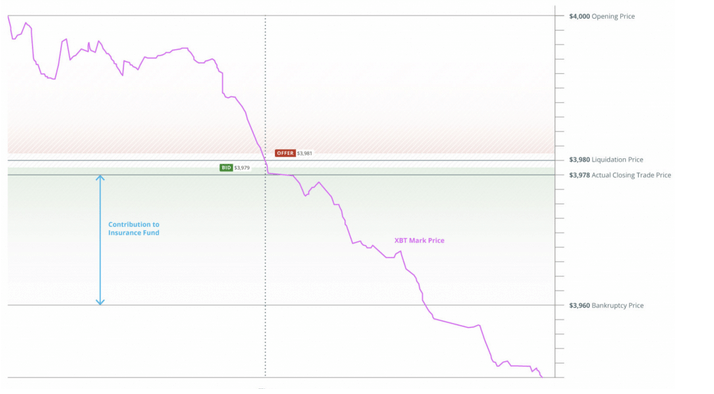

Assuming that the market is fully liquid, the bid/ask spread will be tighter than the maintenance margin. In this case, liquidations will manifest as contributions to the insurance fund, as the maintenance margin is 50bps while the market is 1bp wide. The insurance fund should, in this case, rise by around the same amount as the maintenance margin as soon as the position is liquidated. The insurance fund will continue its steady growth as long as the market is fully liquid.

The first chart shows healthy market conditions with a narrow bid/ask spread of just $2 at the liquidation time. The closing trade, in this case, occurs at a higher price than what the bankruptcy price is. Therefore, the insurance fund will benefit from the liquidation.

Example of insurance contribution – 100x long with 1 BTC collateral

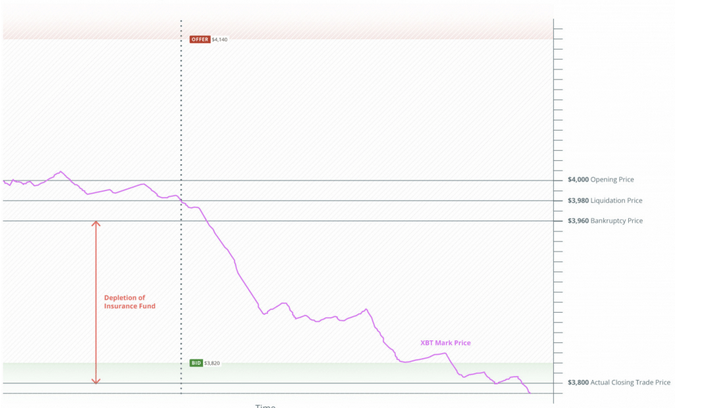

The second chart, on the other hand, shows a wide bid/ask spread at the liquidation time. In this case, the closing trade will take place at a lower price than what the bankruptcy price is. Therefore, the insurance fund will have to make sure that the winning traders receive a fair share of profit.

Example of insurance depletion – 100x long with 1 BTC collateral

The bid and offer prices show the state of the order book when the liquidation occurs. The closing price is $3,800, which represents $20 of slippage when compared to the $3,820 bid price.

Note that the illustrations are just oversimplified examples that do not take into consideration fees or other adjustments.

Make sure to check out the fourth part of our BitMEX in-depth guide, where we will look into BitMEX’s beginner-friendliness and customer support.