The Basics Of Statistical Analysis In Forex Part 1 – Understand Your Edge

Anyone interested in Forex trading needs a basic knowledge of statistics, and even the basic rules governing probabilistic calculation. Do not quiver yet. We promise you that this will be simple and entertaining, at the same time.

But why do we need all this?

A possible answer can be found in our latest video article “Why Knowing your Strategy parameters makes sense.” But, ultimately, because if you are serious about your profession as a trader, this is one essential ability to hold.

Basic terms we need to know

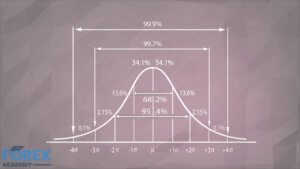

Probability: this area of math study involves predicting the likelihood of various outcomes. For instance, the possibility of your next trade is a winner. This mathematical area is a modern development of what early on was the mathematics of gambling. Probability theory is also related to the theory of errors, of which Pierre-Simon Laplace was the first to propose back in 1774 analytical formulas about the frequency of errors.

Statistics: We can define statistics as a collection of facts belonging to a collection of events, objects, or, more generally, a set. There are two kinds of statistics: Descriptive statistics try to describe a set in such a useful way. We can, for instance, describe a typical Englishman by its average height, weight, number of hours of sleep, the average income, the average number of males, and so on. Another type of statistics is “Inferential statistics” or statistical inference. Sometimes, it is not practical (or impossible) to measure all items produced by a process, such as on trading. Therefore, we take a sample of the whole data collection, and through it, try to infer general properties or forecast or approximate its future events.

Chance: We refer to chance if we know the event is uncertain to occur. Of course, if we see the event will always happen, for instance, the sunrise, the chance is 100 percent sure to occur. In trading, we use it in connection with the probability of a trade to be a winner or a loser. Generally, we refer to the chance of occurrence when we lack the specific knowledge for an event to happen. Still, we might infer its probability based on the previous events statistics.

Stochastic: When the chance is involved, the process is called stochastic or having stochastic relations. Stochastic is the opposite of deterministic. Newton’s Laws are deterministic. There is no element of chance involved. But practical measurements of objects following these laws involve some elements of chance since instruments have intrinsic errors and people measuring it also err.

Random: Random is an event that cannot be predicted. For instance, Nobody can predict the future price of an asset. Not even the price it will have the next mintute. A random sample is when every member of the set or collection has an equal probability of being chosen for the sample set. If some elements are more likely to appear then others, then this particular sample is not random. In trading, a random market is unpredictable. Is the noise of the price. Nobody can profit in a random market long term. But, sometimes, the market is a mix of randomness and bias or trend. In that case, traders who caught the trend can be profitable.