Five trading strategies for trading crypto during turbulent periods – part 1/2

The cryptocurrency market is known to be quite volatile. Volatility brings a lot of opportunities, but also a lot of risk to the traders. These are five of the best ways to make a profit when markets are turbulent.

Scalping

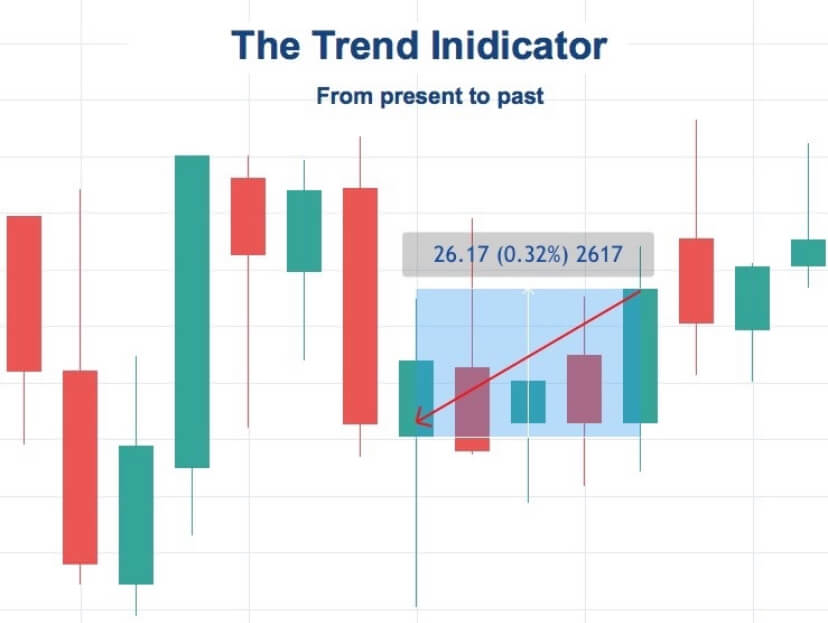

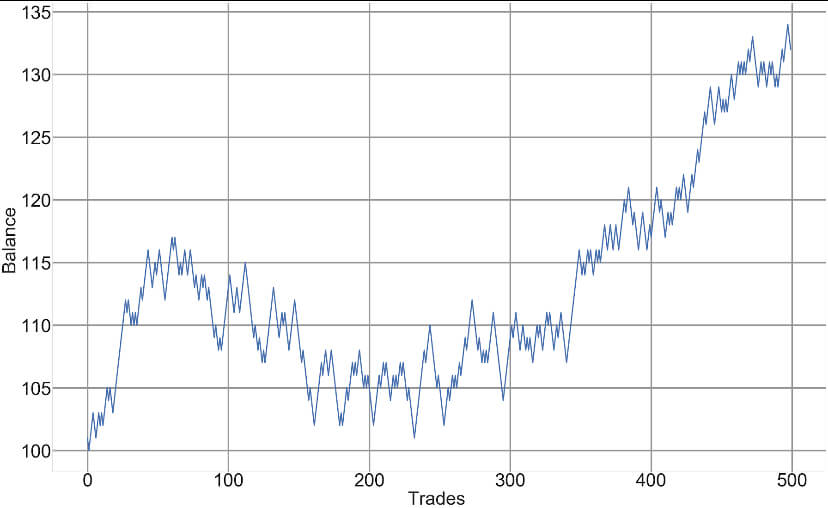

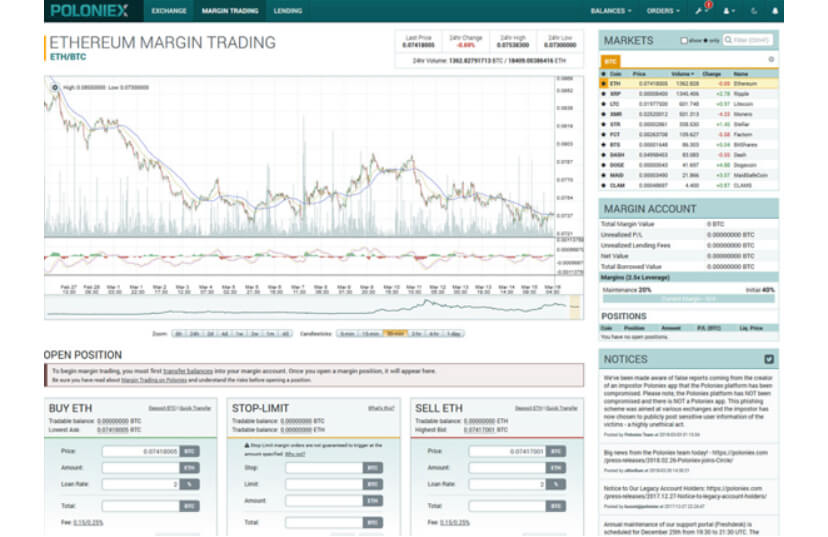

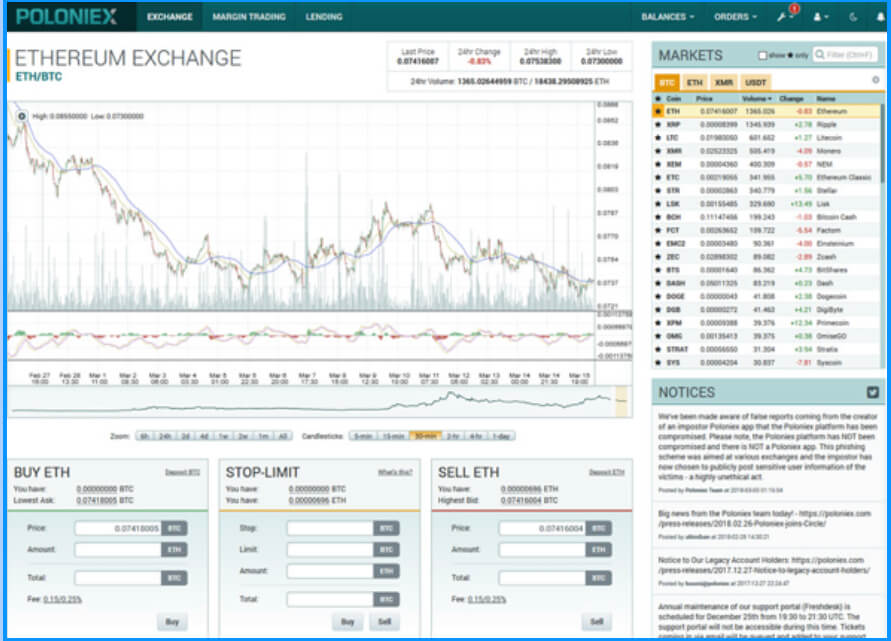

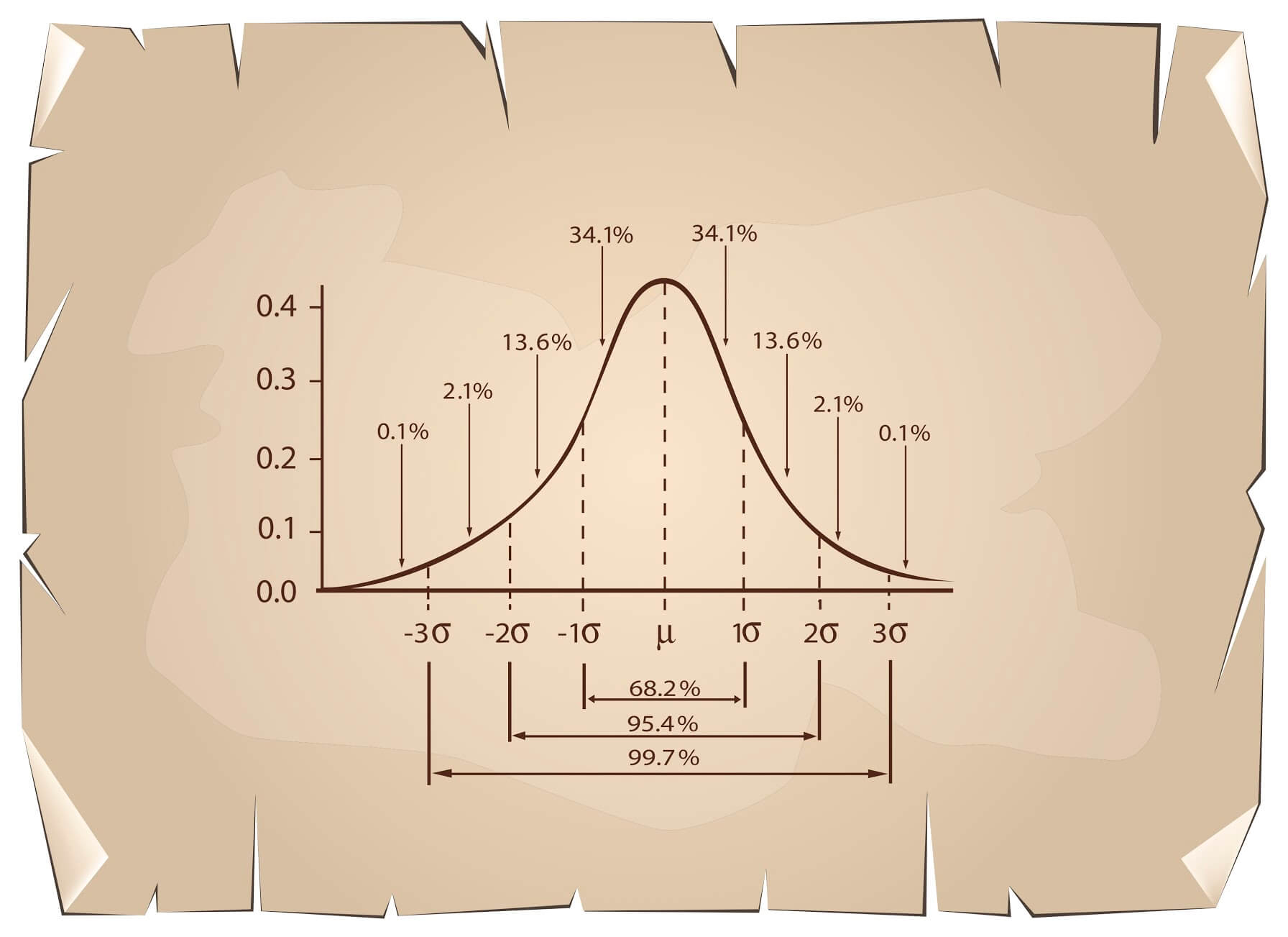

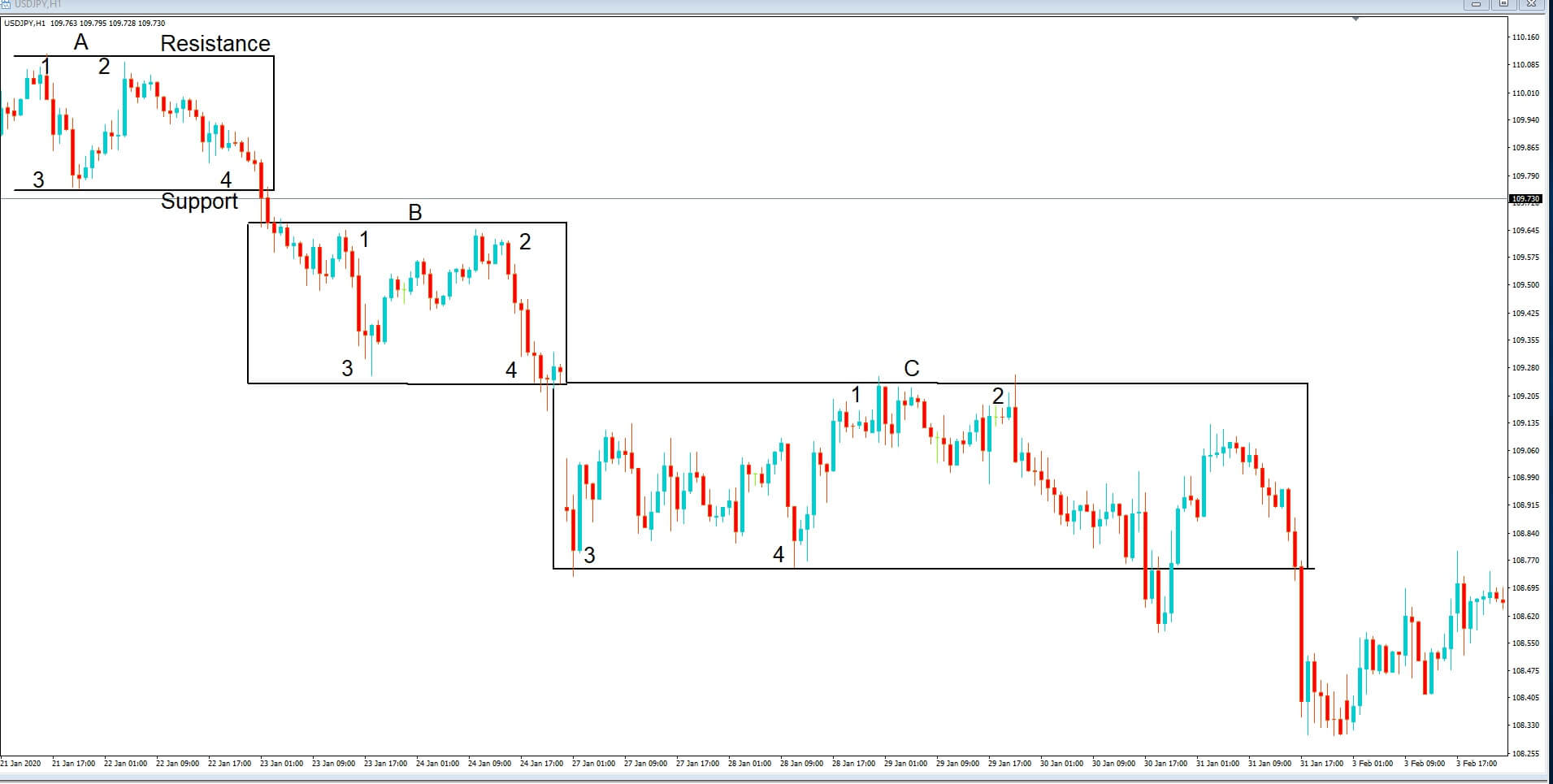

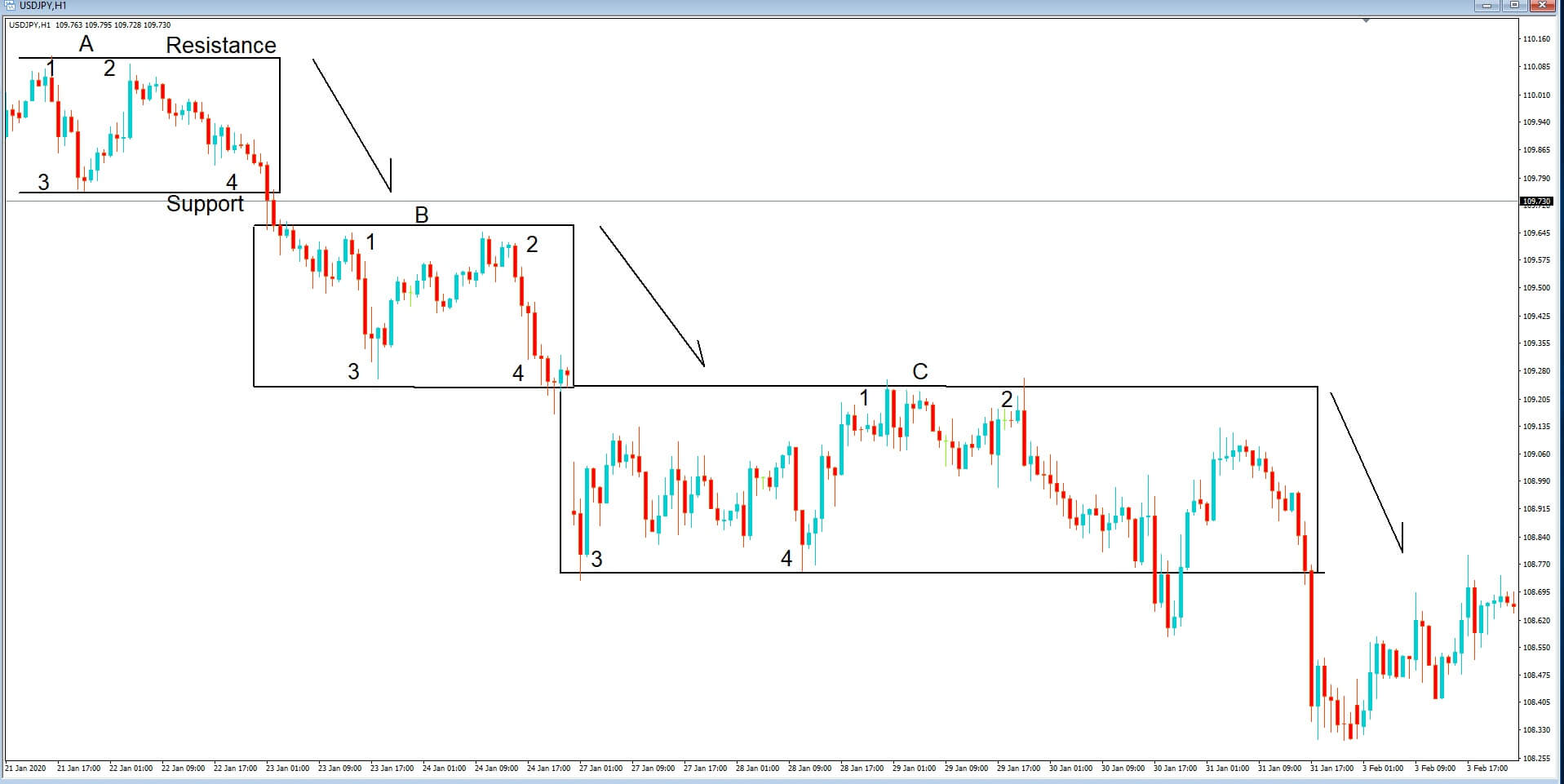

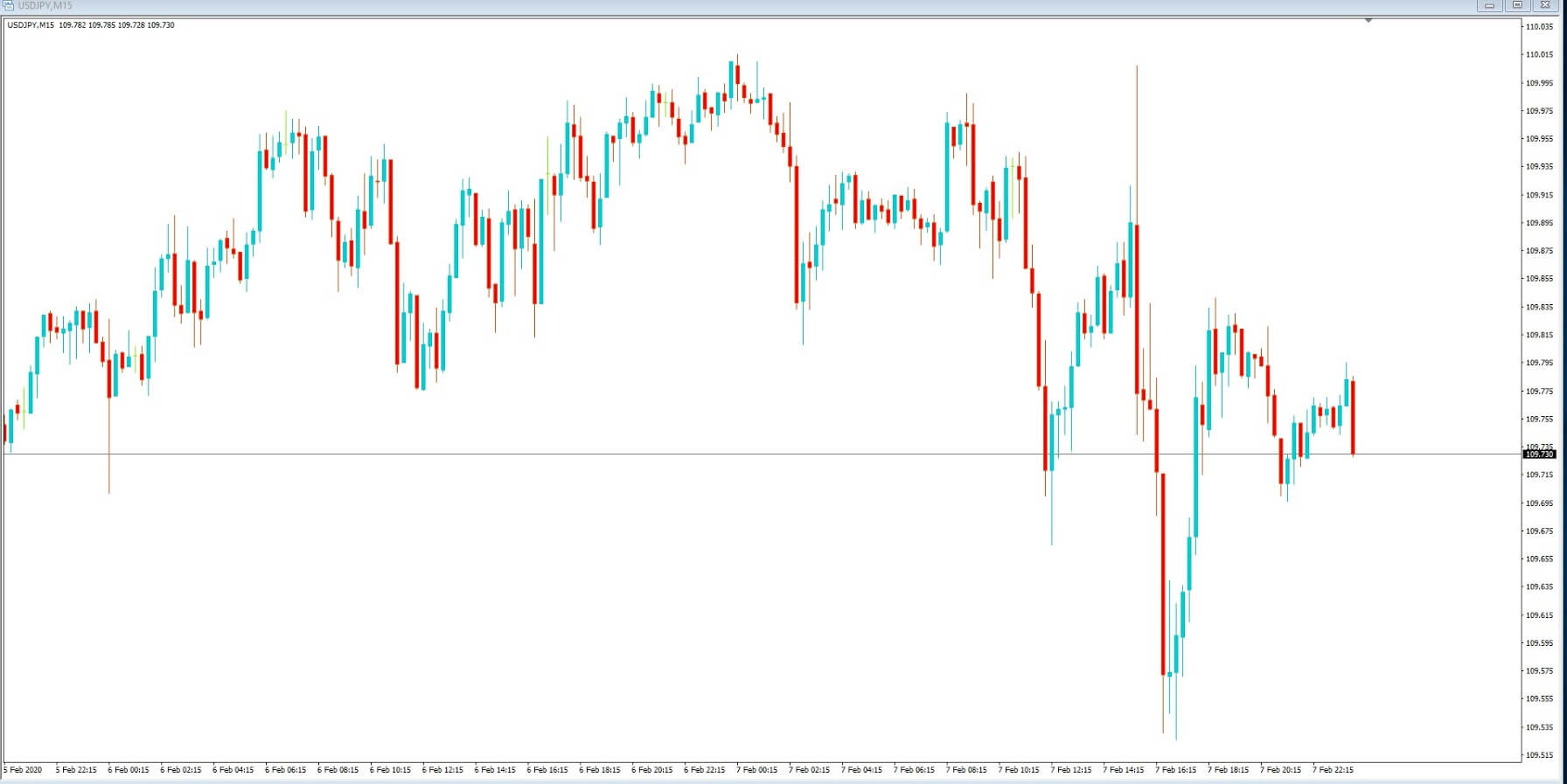

Scalping is a well-known strategy amongst traders. This strategy takes advantage of small market movements and requires precision and decisiveness. Traders are quickly entering and exiting positions during an hour, a minute, or even just a few seconds. The key to this strategy is making many small trades. There is no need for high returns per trade, as there are many opportunities for scalpers. You should rather be aiming to maintain or increase your win/loss ratio. With this strategy, the size of winning and losing trades is almost the same as there is no opportunity to maintain a high reward-to-risk trade setup. Therefore, in order to profit, you need to win more often than to lose.

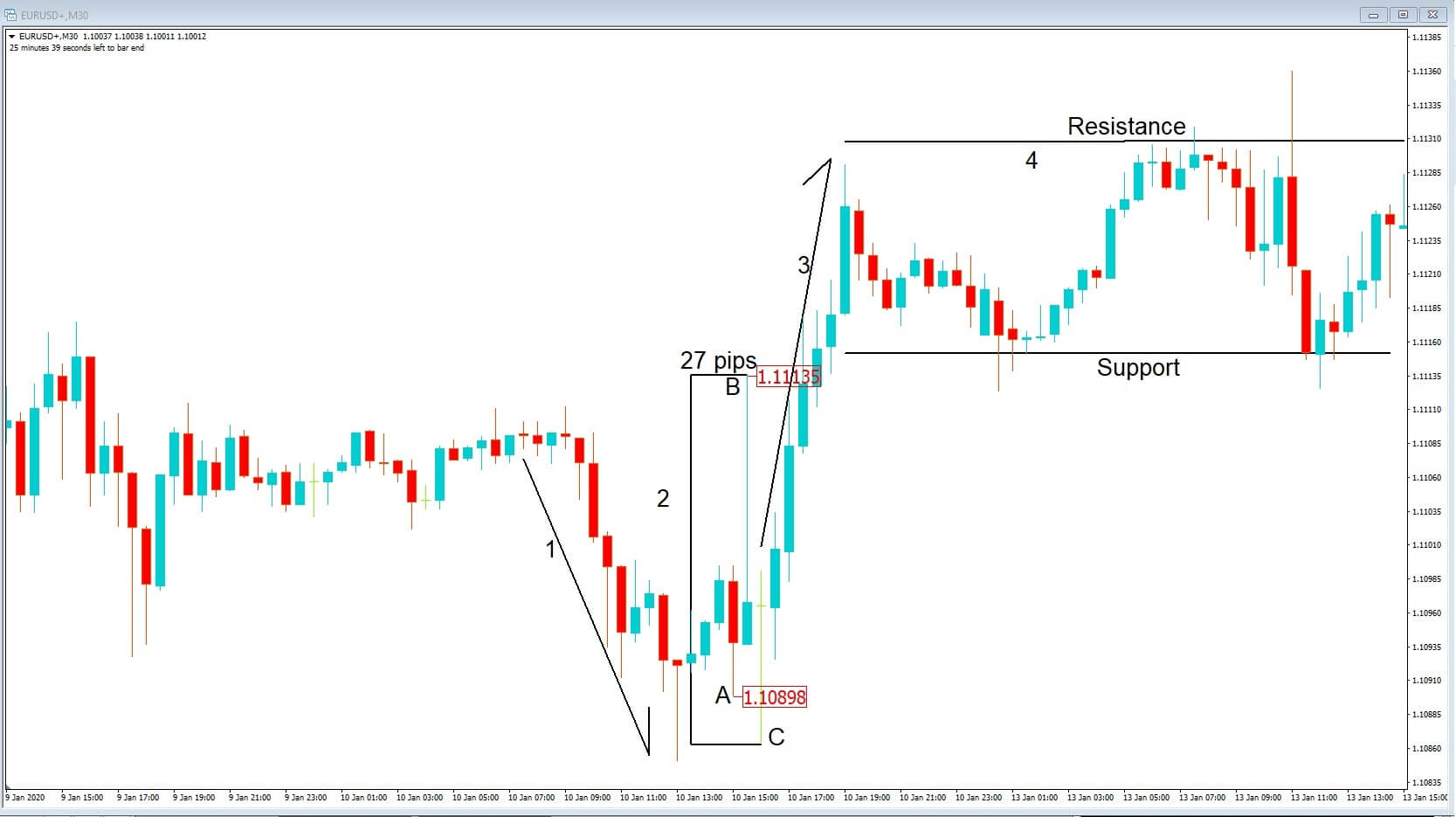

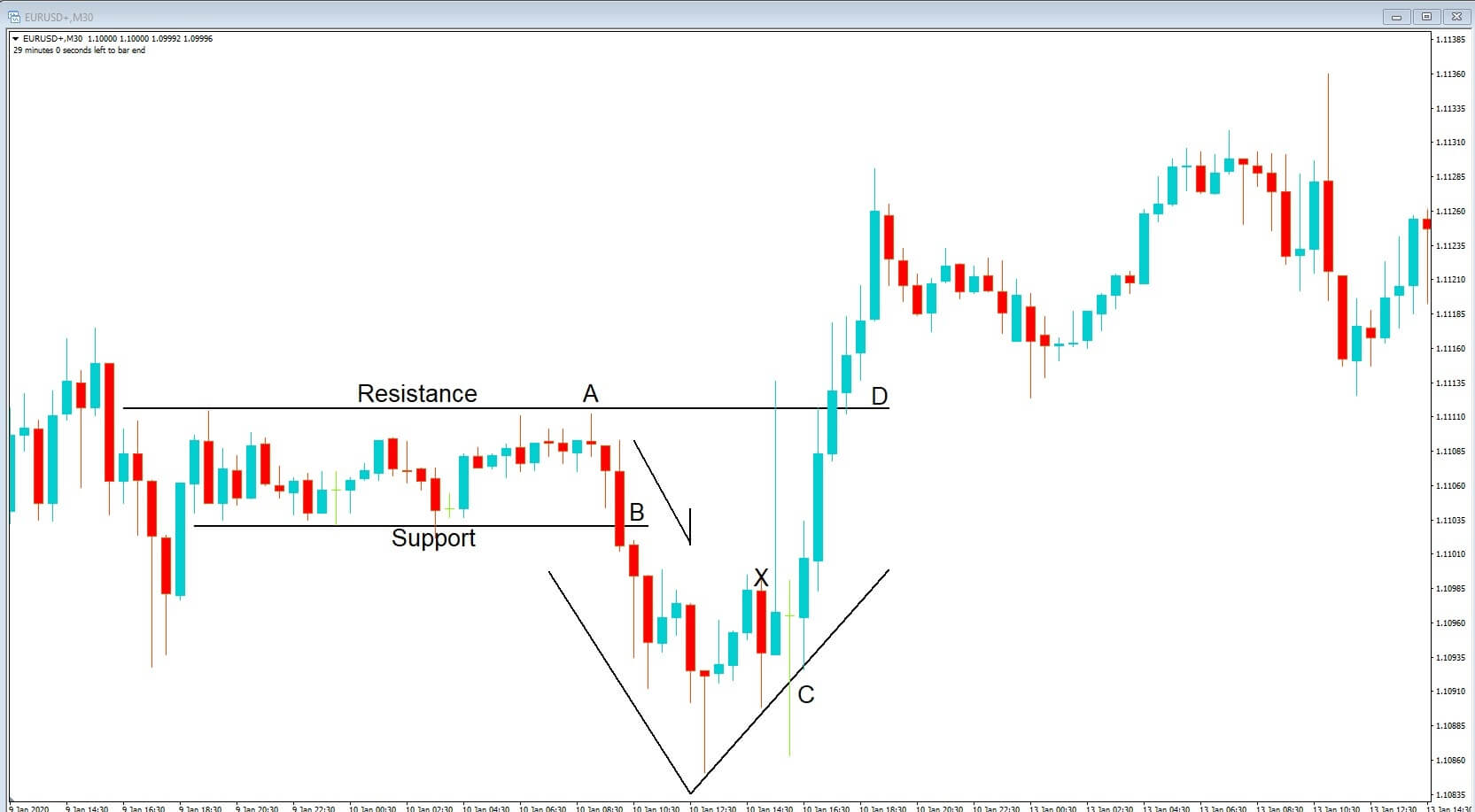

Scalper traders usually want to avoid high volatility because this trading strategy does not cope well with unpredictable moves. The best time for a scalper to trade is during a ranging market bound by strict support and resistance levels.

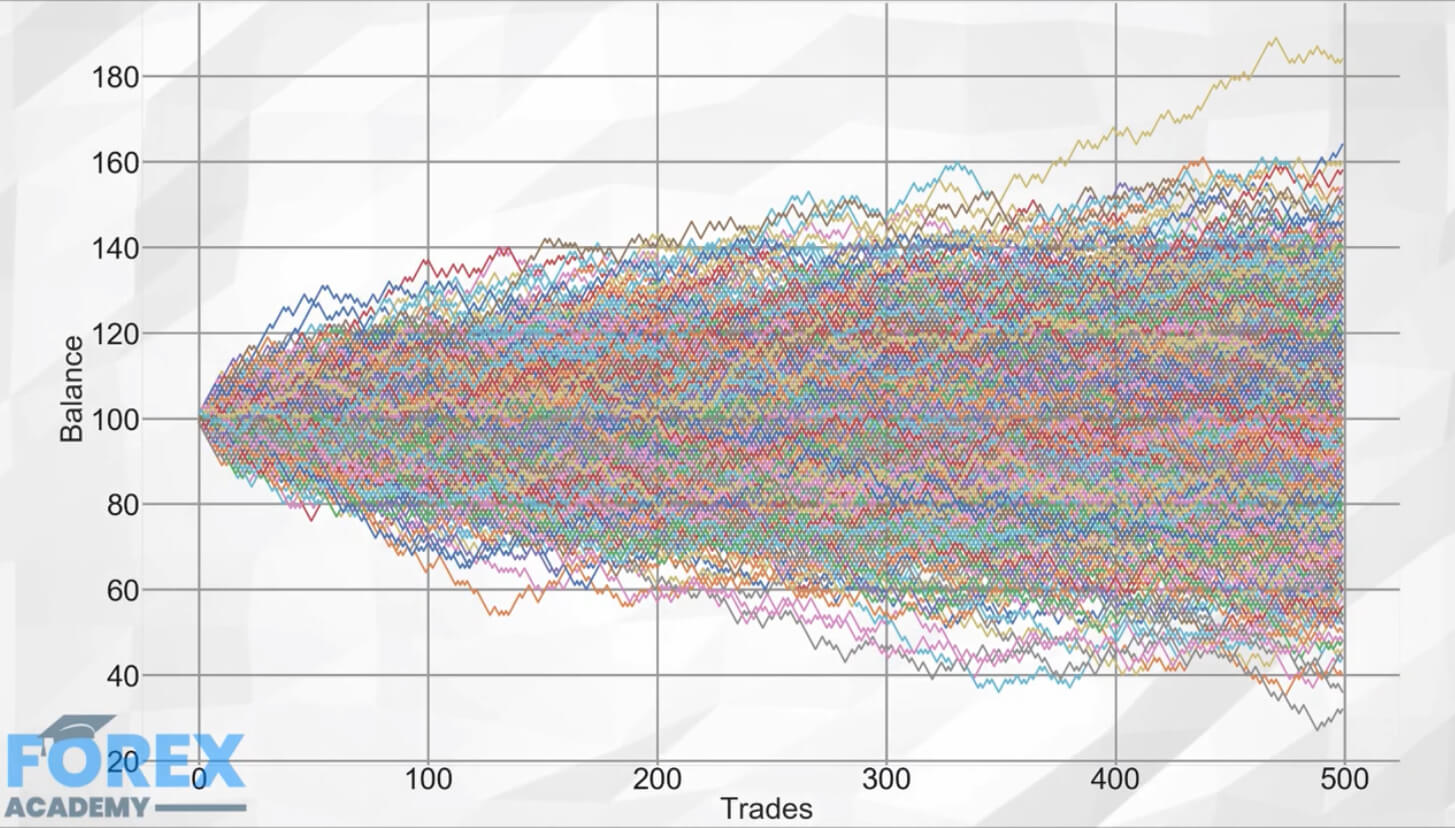

While scalping is considered relatively safe, it requires patience and discipline as well as some experience in reading the charts. Scalpers may utilize trading algorithms and bots to make trades for them, therefore avoiding any emotion-based trades.

Buying the Dips

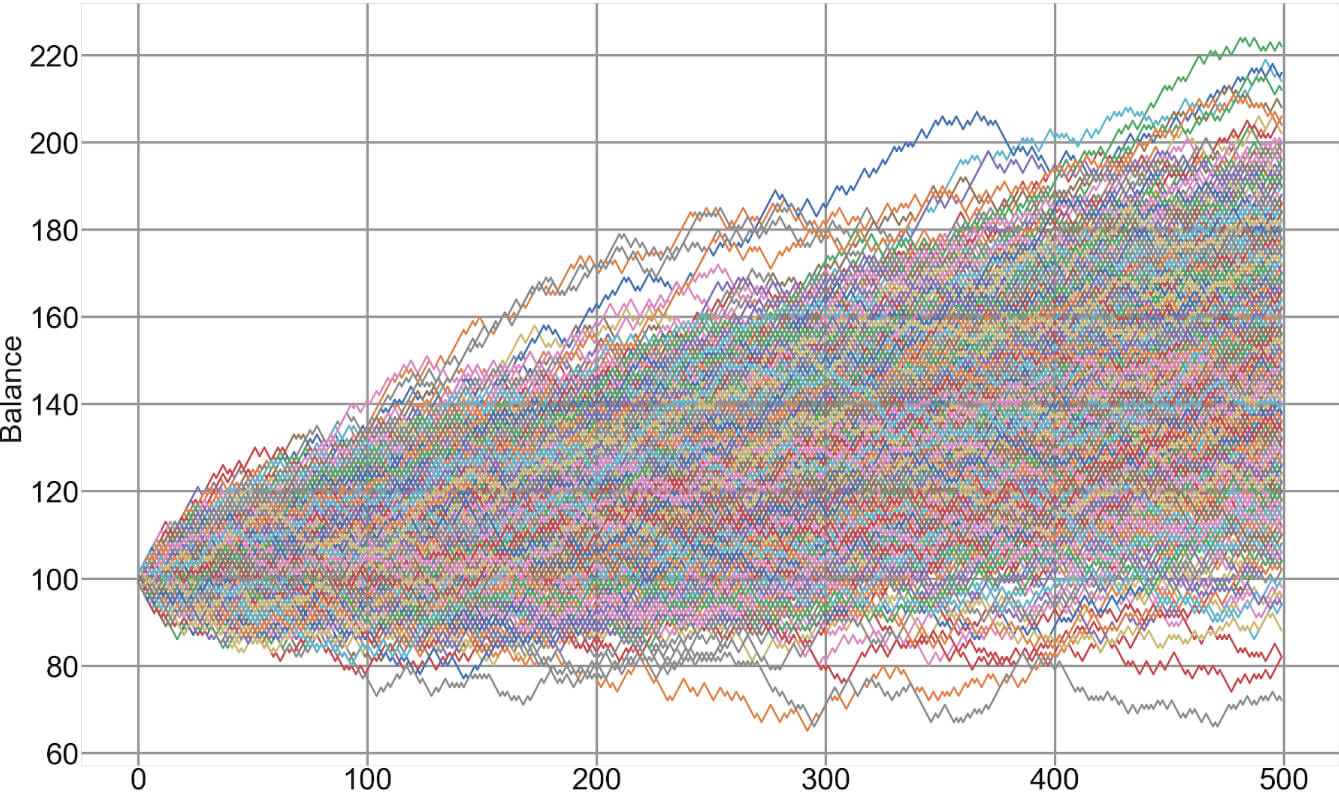

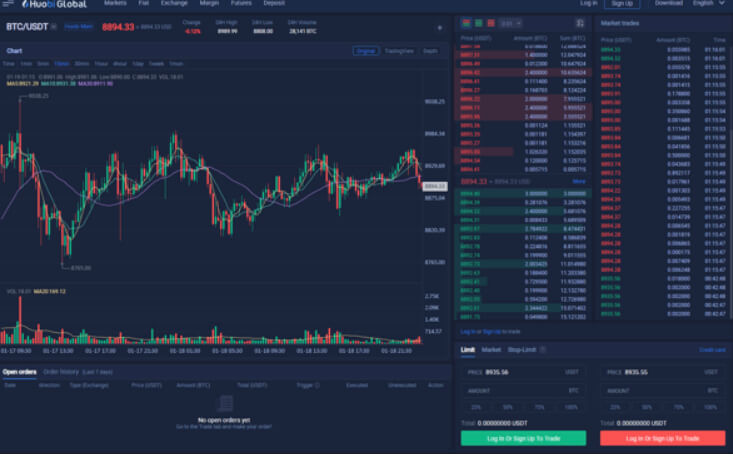

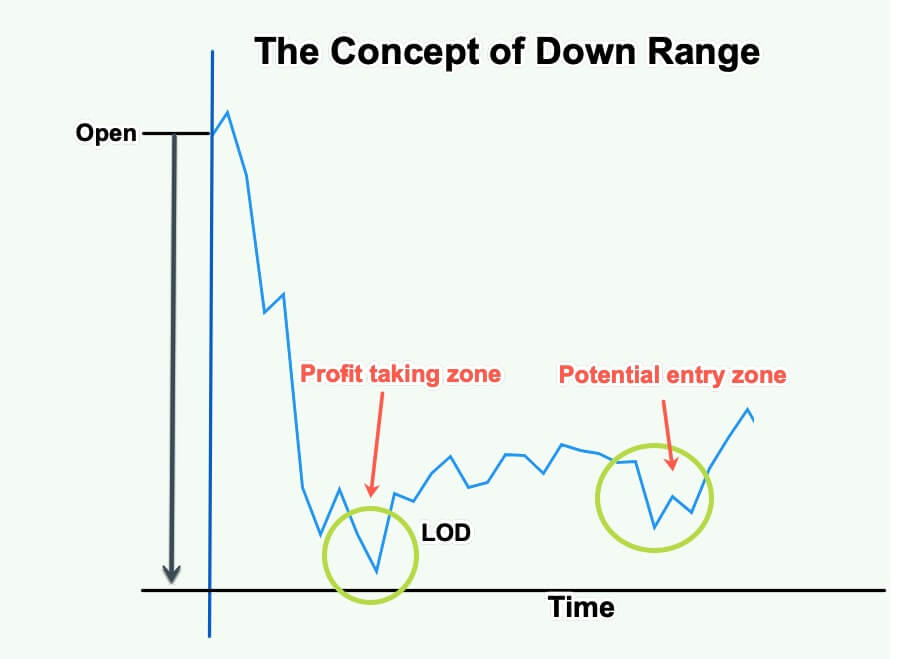

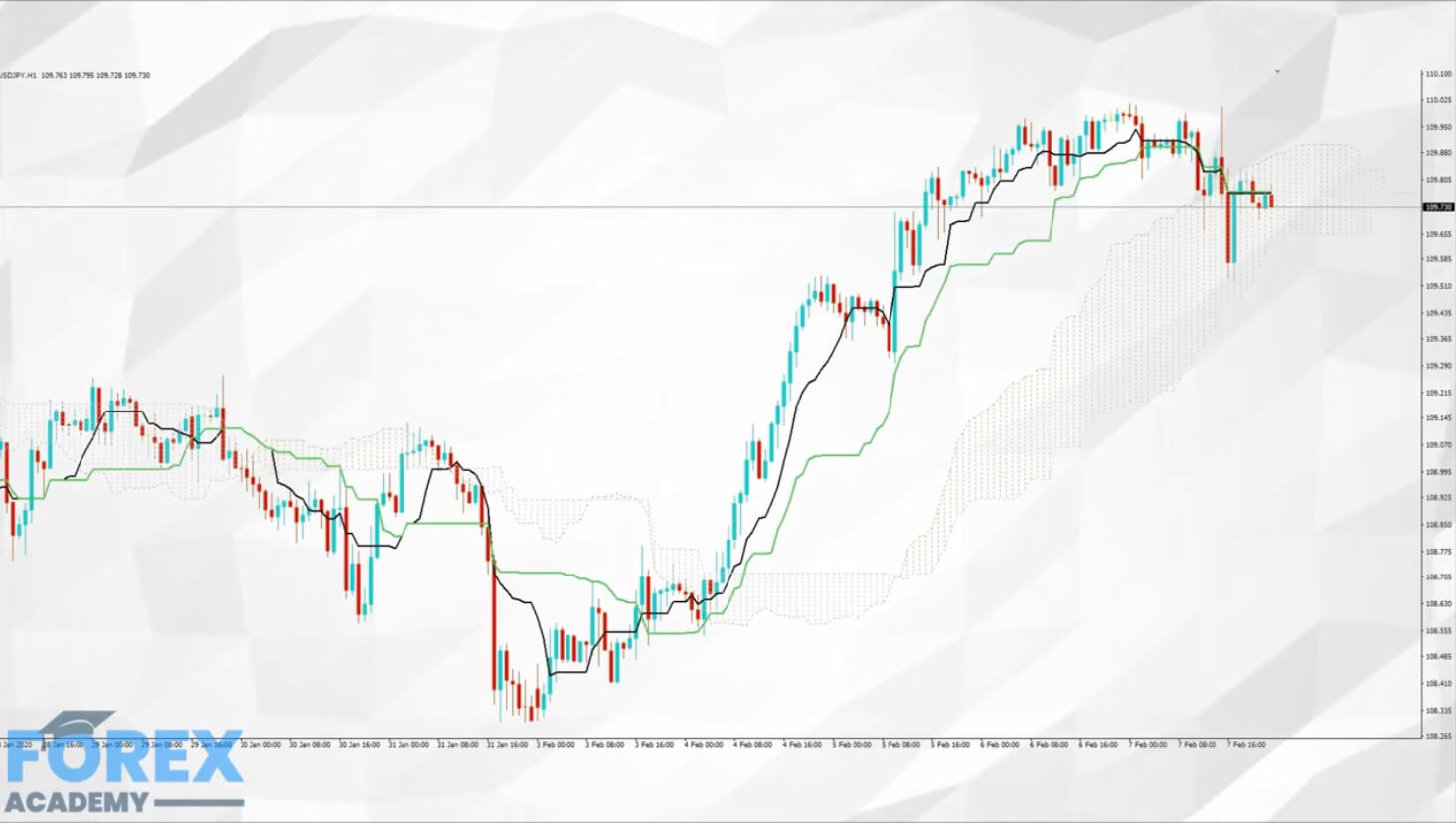

This strategy may seem counterintuitive to some people, but a drop in any asset’s price is a great time to buy it, as long as the asset is known for being volatile. Assuming we are talking about a strong asset, the price will revert and reach the previous highs as soon as the market regains its confidence.

When taking a quick look at the Bitcoin price over the past decade, we can see a strong upward trend, but also times when the price was over and undervalued. As most buyers and sellers are just regular people and not professional traders and investors, the crypto market is extremely sensitive to news stories and media hype. When the good news gets published, people rush to buy already overvalued cryptocurrencies. On the other hand, when something bad happens, people panic and sell their holdings at below their true value.

Times such as these are the perfect opportunity for investors to buy the undervalued cryptocurrencies. Using their expertise to assess the market conditions and fundamentals, they predict when the market is most undervalued. When they determine that the market is likely to make a recovery, they buy.

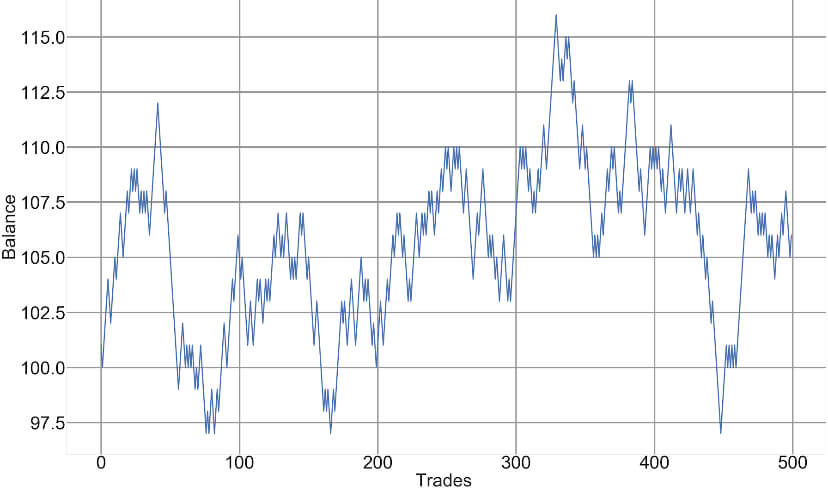

As an opposite strategy to scalping, buying the price dips doesn’t require much precision, but rather expertise and “feel” in order to recognize when an asset is undervalued. You only need to make a single trade and wait for the profit from the upward trajectory to kick in. However, you probably won’t see any quick profits. On top of that, perfect market timing is everything with this strategy as you need to recognize market reversals.

Check out part 2 of our trading strategies to find out more about how to trade during volatile periods of the crypto market.

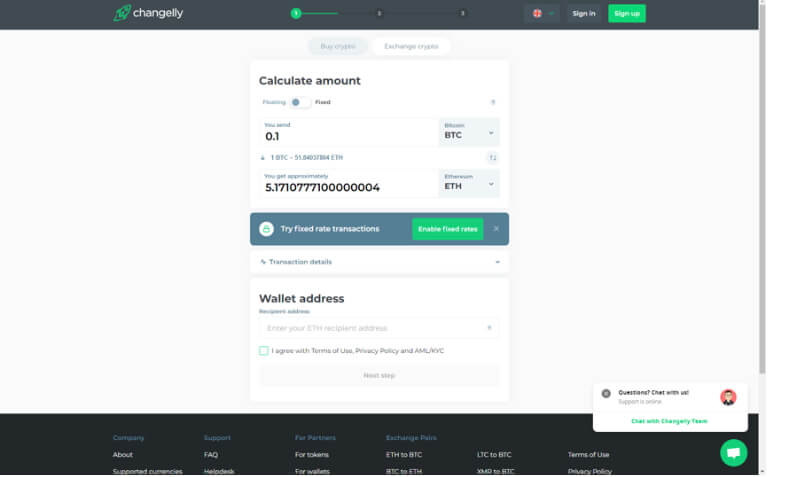

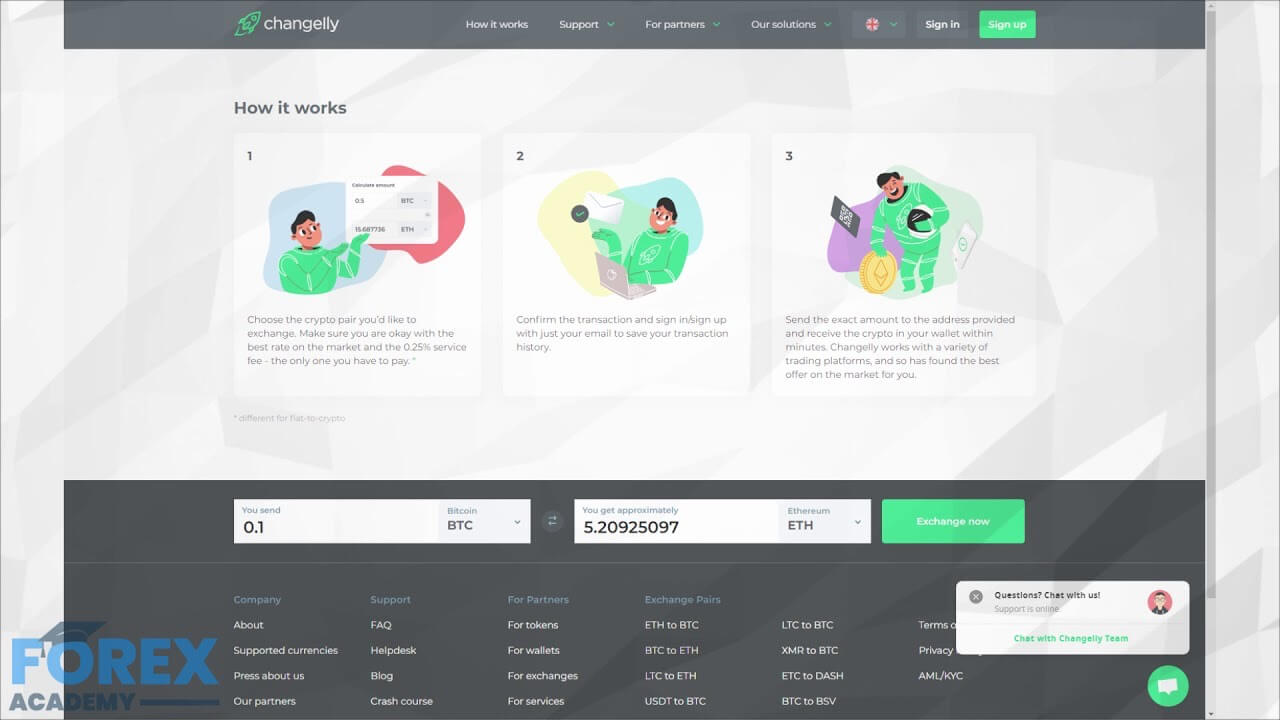

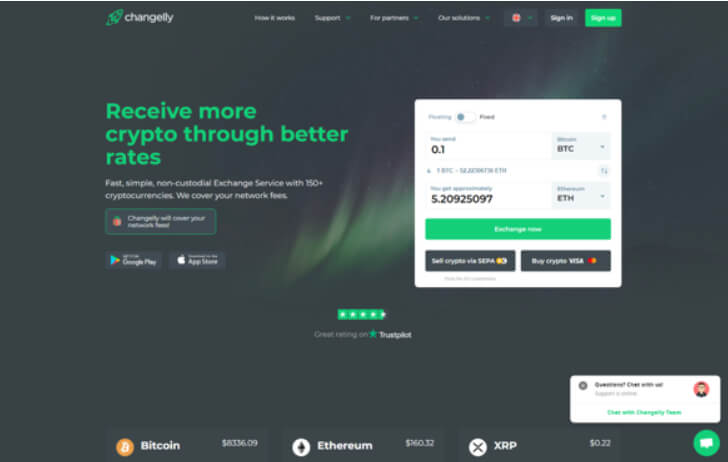

Changelly is not an exchange like the others. This platform is an instant crypto exchange that started operating in 2015. While it was previously headquartered in the Czech Republic, it is now based in Hong Kong. It also has offices around the world, including Malta, Great Britain, and Brazil.

Changelly is not an exchange like the others. This platform is an instant crypto exchange that started operating in 2015. While it was previously headquartered in the Czech Republic, it is now based in Hong Kong. It also has offices around the world, including Malta, Great Britain, and Brazil.