Risk is essentially one of the crucial factors which have the power to endanger your entire forex trading career. Understanding how poor judgment and unsafe decision-making can impact individual accounts is key for all traders, be they at the beginning of their trading experience, or be they professionals. Because of the topic’s profound importance, this article will also discuss how each trader should address limits or at what point they should stop investing more money. Besides stressing the need for developing a wise and safe approach, we are going to provide practical advice on how to use the ATR indicator in order to assess risk levels in your trading and help you analyze how much pip value you should use in every trade. In addition, you will find out how many trades should be open at the same time as well as discover a comprehensive list of instructions that will save you from overlooking any high-risk aspects of swing type trading in the fiat market.

Processional traders often point out the importance of creating a detailed plan which naturally includes thorough risk assessment. A great number of traders nowadays appear to be focused on trade entries alone, which repeatedly leads to one of the three outcomes – a severe money loss, a break-even, or a barely significant gain. Such an approach neither allows these traders to grow their trading skills and reach the expert level nor does it help them build their finances as they imagined at first. Therefore, to prevent yourself from making the very same mistake as the majority of traders who experienced the above-mentioned scenarios, you need to take an entirely different approach to swing trading and invest in learning about the steps successful traders take to maintain their trading expertise and financial abundance.

Before proceeding to what makes a successful trader, let us first examine the choices that can hinder a forex trading career. Primarily, most of those who fail at forex either do not have a set risk or they opted for a random number without any prior logical analysis. The risk involved in trading is, in this case, a rather loose category as it depends on how traders feel, whether the previous trade was successful, upcoming news events, and other transient factors. To make matters even worse, this group of traders frequently does not stop after a loss, but they continue on to chase another win, thus entering a vicious circle of illogical thinking, occasional wins, and great losses.

When a trader does not include risk in trading, this individual inevitably imperils his/her account. We often see how a trader loses 20% of their account and believes that immediate return to the initial break-even point is possible. This, however, is highly unlikely considering the fact that such percentage equals some of the most successful traders’ average annual return. Bearing in mind the factors that led them to this stage, the probability of these traders suddenly becoming that good is very low. Unfortunately, despite it being a very common scenario, this challenge is one of the most difficult to surpass. Therefore, if your value dropped by half, from 50 to 25 thousand USD for example, you would actually need a 100% return just to get to your break-even, which is very much impossible at this point.

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.

This market is not risk-free, so it all boils down to the question of whether doing trading has a point. If you see that your finances are not developing accordingly, you may consider doing demo trading to learn how to set risk sensibly. If you have yet to do demo trading, you should bear in mind that this will help you build your system, psychology, money management, and trade management skills so that your account reflects these in a positive way and that you can transfer and exhibit the same level of skillfulness in real trading. Both demo and real trading, however, should not be void of risk since the most prosperous traders take many risks, but they know how to manage them properly, successfully minimizing the chance to fail. Consequently, the word risk does not imply that you are acting carelessly, but that you are intelligently assessing where you can invest to have financial benefits.

As risk is a necessary part of this line of business, but also the one that we need to control, we have to consider which percentage of the account any individual should be trading. Most of the available sources advise traders not to go above 2% of their entire trading accounts on each trade. Nevertheless, what this means is that the suggested percentage is the maximum limit, not the average one. While your stop loss should always reflect this, you can feel at ease knowing that most losses rarely exceed this amount. So, if you have 50 thousand USD, the 2% value would equal 1000. Although this may seem like a large quantity of money, and thus a large amount to risk, we need to understand that timid trading will not get you far and that you will not lose the entire thousand even if you happen to fail. Therefore, what understanding risk means is that every trader should allow themselves the opportunity to take risks, but also apply a strategy to minimize those risks.

To successfully track and control the risk level, you can always rely on the ATR, an indicator that tells traders how many pips on average a currency pair moves from the top to the bottom of the candle. While this tool cannot exactly predict the future, it can assist traders with money management, seeing how a currency pair is moving at present and what direction it may take later. Some of the best traders in this market suggest that the stop loss should be set at 1.5 times the ATR (default MT4 settings) value at the moment of position opening to see the greatest benefits, on the daily timeframe. Therefore, if a currency pair’s average true range (ATR) is 80 pips, the stop loss should be 120 pips away from the current price. With the help of this tool, you will always be able to set your stop loss and secure your trading, although once your profit starts to accrue, this limit is going to change.

How can we find out what the pip value is going to be? Even though we cannot expect to have the same pip value across the chart, what you can do is see how much the 2% of your account actually is. As the account will keep increasing and decreasing in value, the risk limit is naturally going to follow these oscillations. Afterward, we will need to count the 1.5 ATR of the currency pair and put the stop loss there. The last step to take here is to divide the risk (a dollar amount) by the 1.5 ATR (pips amount) to learn how much money you should put per pip on each trade. You can rely on this simple calculation for each trade you enter and apply it in your daily chart to get specific insight and information.

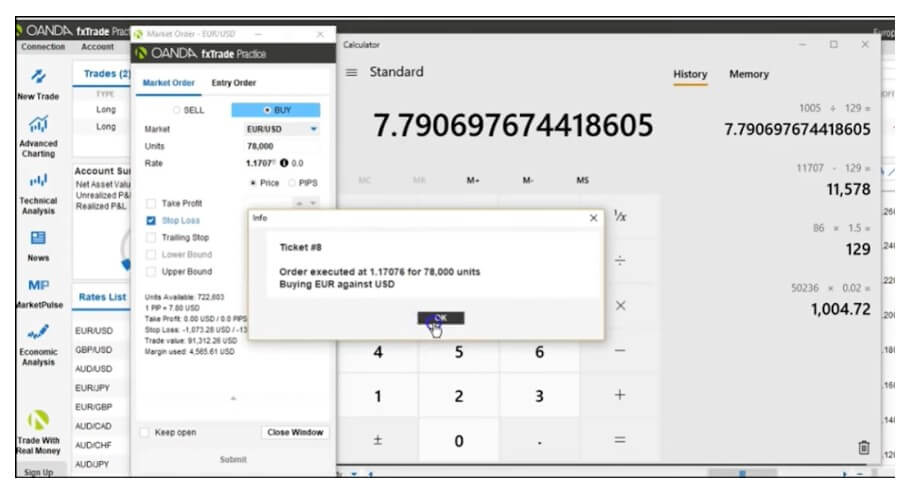

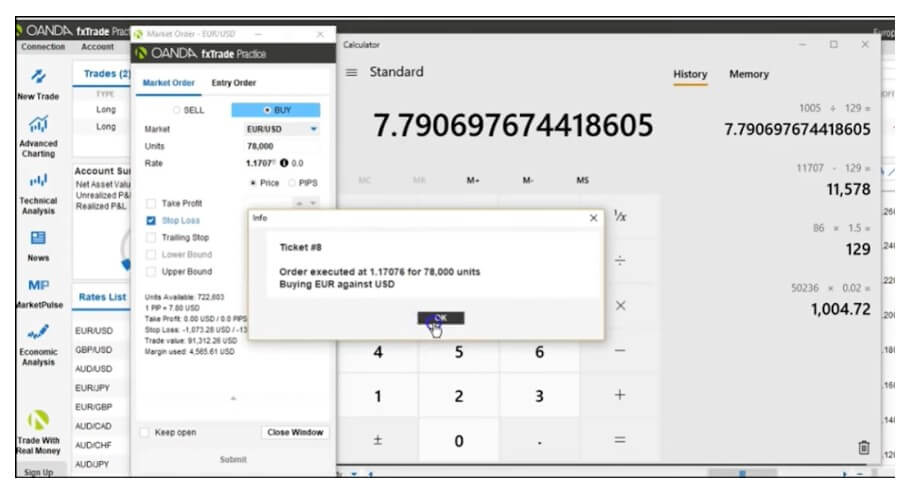

Most trades do not involve exact numbers, so let us say that your net account value is 50,263 USD. To estimate the risk, you will multiply this number by 0.02. Upon calculating the 2% of the account (roughly amounting to 1005 USD), we will seek the currency pair we want to trade and find the ATR only to multiply it by 1.5. If your ATR is 86 as in the example below, you should get a pip stop loss of 129.

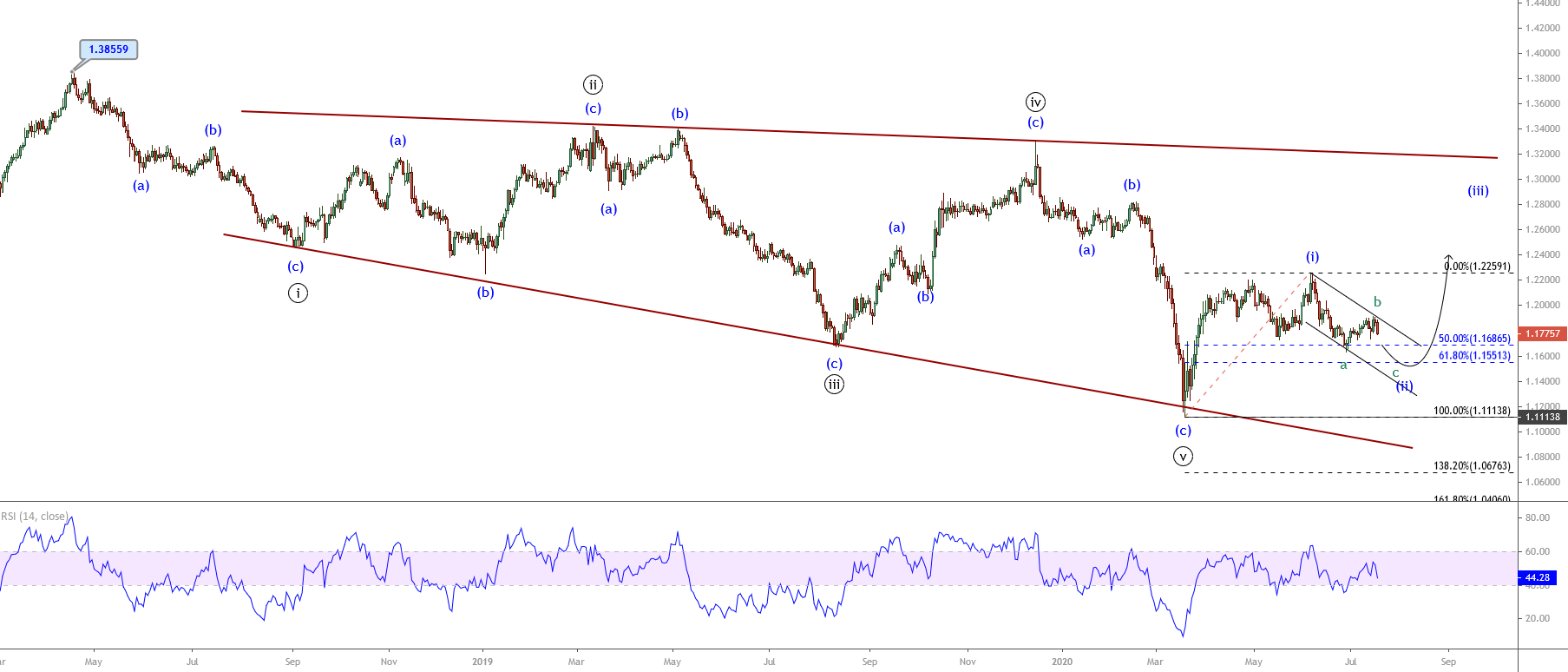

If you focus on the tip of the pointer, you will see that the price is at 1.1707. We can, in this case, decide to go long, which is why we are going to use this number and deduct 129 (we would do addition if we were going short) to learn where we should enter the stop loss order. Finally, we are going to calculate the pip value by dividing 1005 by 129, which approximately equals 7.7 USD. After acquiring the necessary information, we know that one pip equals $7.7, so we can estimate that the trade unit value should be 78,000 for the EUR/USD currency pair, or 0.78 lots. We will insert the stop loss afterward and enter the trade, as shown in the image below. Note that in the MT4 platform you can use different tools published on the MQL 5 market for this purpose to automate the whole process. There are even some EAs. If you want to really get this easy, try to use Tipu Stops and IceFX Trade Info panel so everything is precalculated for each asset. Just use the drag option to the Stop Loss line on the chart.

While this is a secure way to assess risk, you should always look for the right indicator which will signal you to exit bad trades on time. What is more, you should previously make use of an indicator that can tell you that you are on the right path and inform you that you should stop trading before your price hits your stop loss. By researching and creating your own indicator algorithm, and combining these confirmation and exit indicators as well, you will successfully trade in this market and mitigate the amount of incurring risk.

In terms of how many trades we can do at the same time, the information provided by professional traders suggests that any individual can enter as many trades as they want under the condition that the 2% rule is applied. However, we should also be mindful of the fact that the same currency is not to be traded more than once at the 2% risk. Even if your chart is signaling that you should be investing in a particular currency, you should not by any means be investing in several pairs involving this particular currency (e.g. EUR/USD, USD/JPY, and AUD/USD) long or short at the same time. Should you fail to abide by this rule, you will suddenly have 6% of your account on this one currency (USD) and, having done this, you have actually taken on too much risk all at once. In case this currency goes the opposite direction, you may be damaging your account to an irreversible extent.

Therefore, despite the fact that this approach has been used by various professional traders, you may want to pay close attention not to fall for the trap of over-leveraging. To avoid making this mistake, you should always follow the first signal for that particular currency. Should you, then, receive a long signal on the EUR/JPY pair and another long signal on the EUR/AUD one, you should opt for the one you saw first and follow through. Although we may see the opportunity and potential financial rewards, sometimes less is more in this world. Having said this, you can also apply the half-and-half approach and put 1% on each pair, which can almost function as a hedge saving you from loss should one on the pairs fail to bring you profit. You may also decide to take half the risk and wait for another trade as you can see some favorable progressions coming your way soon, which is not something professionals would advise you to do very frequently because you may be stopping yourself from earning sufficiently by trading timidly.

Risks have often been disregarded as inherently bad, but in the world of forex trading, we know that they are unavoidable and necessary to make a profit. By adopting these practical steps in your everyday trading, even if you are doing demo trading now, you will learn how to set the risk level properly, without protecting you too hard from failure or playing recklessly. A smart trader is thus not the one who fears risk or casts it away as an unimportant factor, but the one who deals with it effectively, applying the strategies discussed in this article intelligently and consistently.

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.