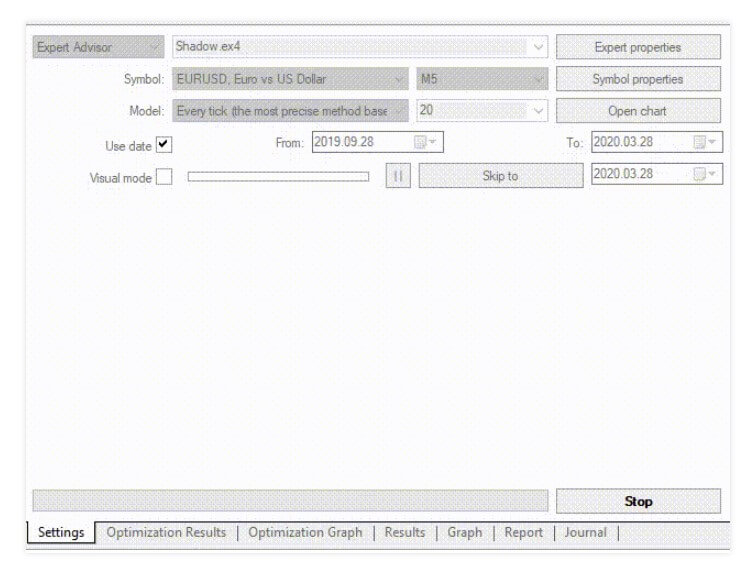

FXCharger is an Expert Advisor (EA) for the MetaTrader 4 platform. It is on the scene since 2016 and is updated in 2019 to look more professionally. According to external sources, the company behind FXCharger also has other domains and products such as FXMower.com, ForexBringer.com, ForexSeven.com, and so on. Some of these brands are out of business. FXChrger has performance charts uploaded on myfxbook.com and some of them are verified. Note that this EA still does not have wide popularity and according to the charts has good performance.

Overview

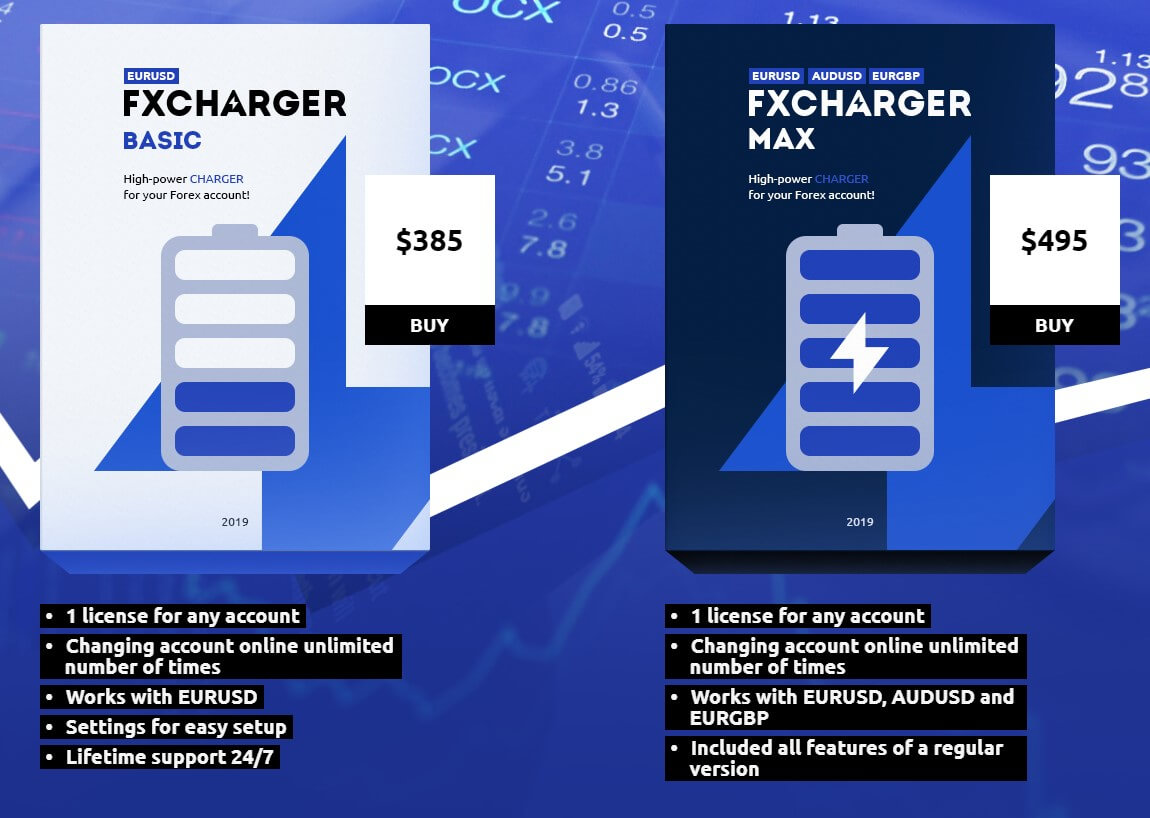

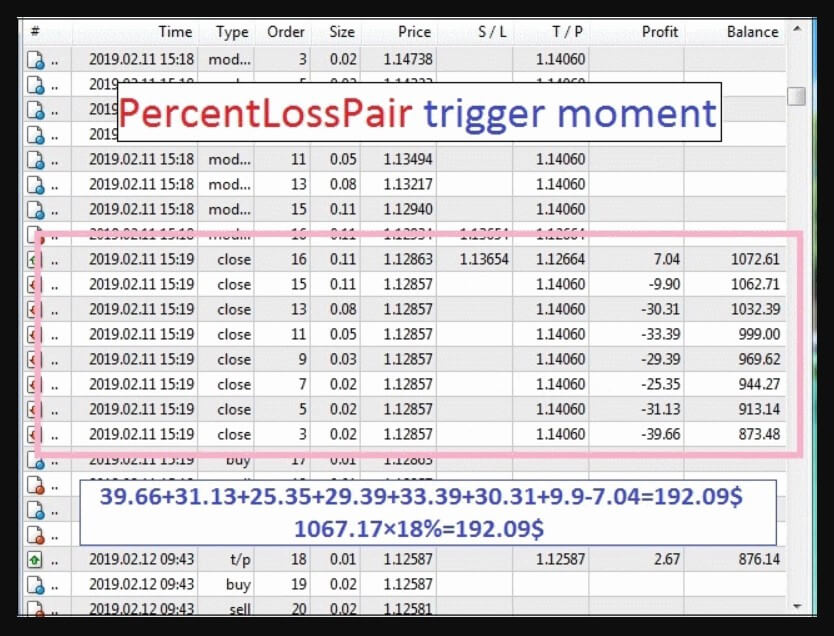

FXCharger is a martingale EA at its base but includes adaptive Stop Loss and Take Profit levels according to market conditions. We believe this is based on volatility but it could be some other indicator values. There are two versions, FXCharger Basic and FXCharger Max. They are essentially the same EAs except the Max version is also applicable for the AUD/USD and EUR/GBP currency pairs, not only for the EUR/USD as the Basic version.

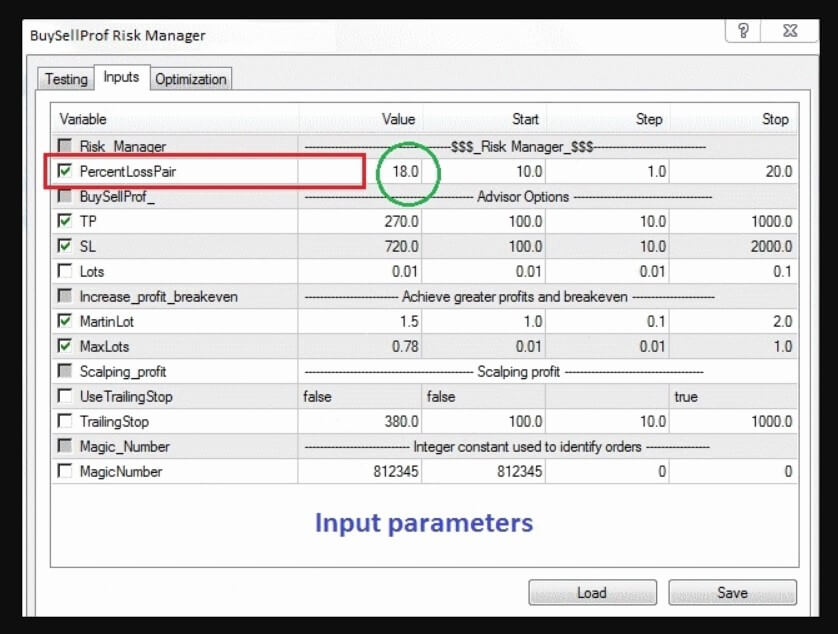

According to the developer, the EA is designed to have frequent trades, trades every day. This means the EA is also for the less patient, young traders that like to see results right away. The EA does not hold positions for long, it should end a trade in 1 to 4 days max. The EA setting allows the user to ser the maximum possible risk amount so every position has its limit to how much drawdown per position EA can tolerate. This function is more or less common with many EAs, although, for promotional reasons, the devs decided to state it as a special feature. Even if the EA is not connected to the market anymore for any reason, the Stop loss should be executed. This means the Stop Loss or Take Profit is set onto the broker server thus it is not invisible and acts like a normal Stop Loss set from the MT4.

Now, this setting could be crucial for martingale EAs. As with other martingales EAs, FXCharger has the same sudden drop patterns in the chart followed by gradual and smooth gains until the next drop and so on. Setting the low-risk tolerance could mean the trades will be closed before they can rebound to positives and Take Profit levels. As such, if this setting is not optimal, or better to say not by developer defaults, the EA performance could be very different.

On the website, there are 3 points where it is described (1) you will trade in profit thanks to smart Take Profit levels, (2) save deposit with smart Stop Loss, and (3) use reliable setting to get a stable profit. We cannot agree that even the best Take Profit leveling can make you profits but we agree that optimal Stop Loss protection can at least save you from complete account busting in a short time. FXCharger settings should not be tickled with is seems, as the devs have a refund policy in 30 days only if the EA is working by default settings.

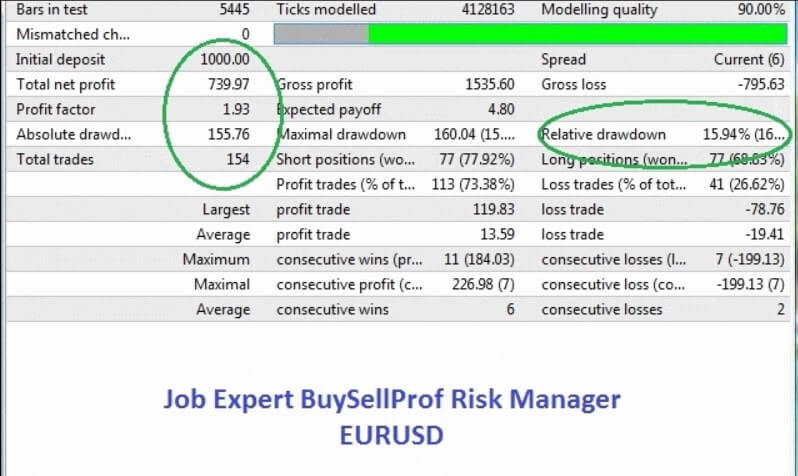

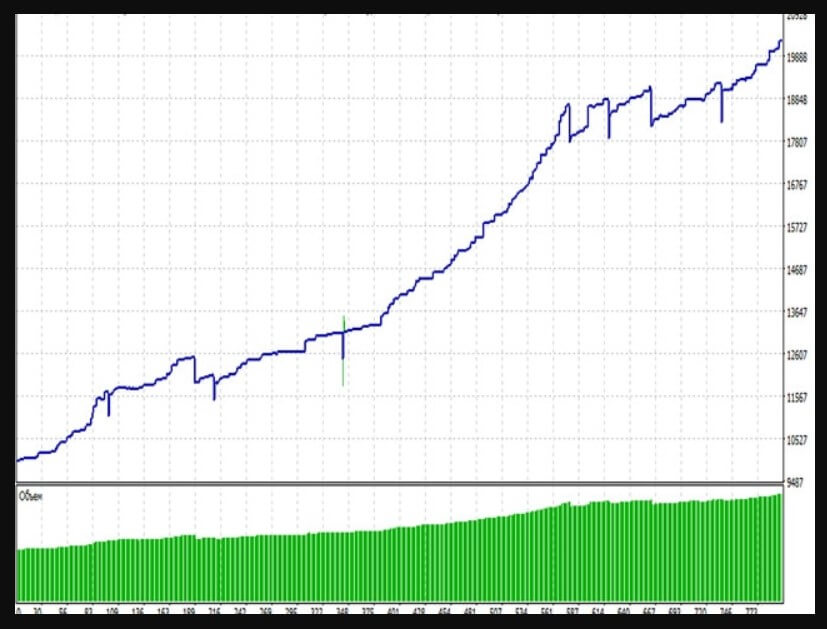

Myfxbook performance charts show high levels or return. The EUR/USD pair shows gains of 1528.63% since Merch 2016. Three dips are evident, showing the Stop Loss in effect and according to our estimates, even after FXCharger made about 1400% gain, in May it dropped to 1100% from one Stop Loss trigger, 4 Stop Loss triggers in that month would almost bring the account to breakeven. Drawdown is increased to 29.46% in 2020 since the EA performed poorly in January and February piling the losses up to -15% per month. FXCharger average trade length is 5 days, a bit longer than advertised, won 60% of trades, winning 55.59 pips on average, and losing -79.86 pips. The Sharpe ratio is very low with this EA, a mere 0.01, meaning the returns do not compensate for the risk taken. The year 2016 and 217 were much better for this EA, none of the months ended negative and in 2018 19 and especially the beginning of 2020 is disappointing. Still, the EA has a total positive gain. The broker used for the testing is FXOpen.

The AUD/USD testing gained 580% since min 2018 and 14% on average per month. In contrary to the EUR/USD, the 2018 and 2019 year are all positive for FXCharger but seems to be off since July 2019. The trade success rate is 60%, the same as with the EUR/USD with a bit better Sharpe ratio of 0.04. The average win per trade is 54.57 pips and the average loss is -62.08 pips. The exposure is set to private. The drawdown presented on the website is an extreme 54.72%. The EUR/GBP pair performance chart and analysis is not published.

Service Cost

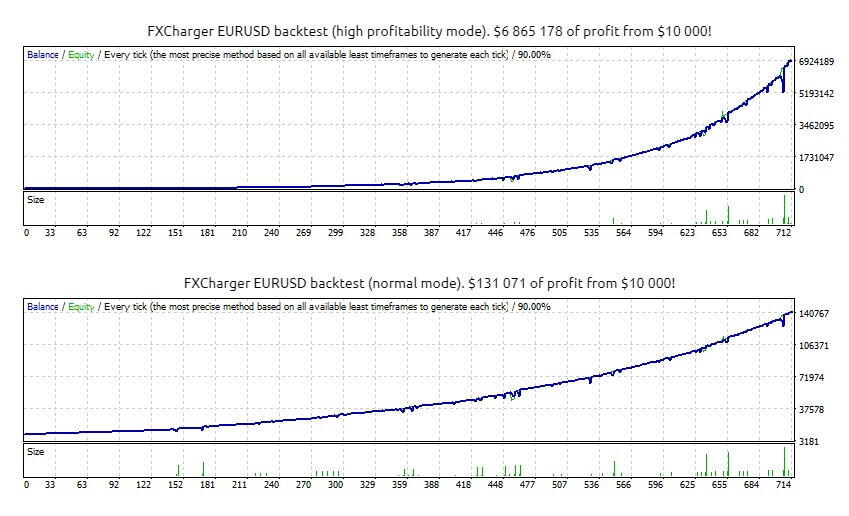

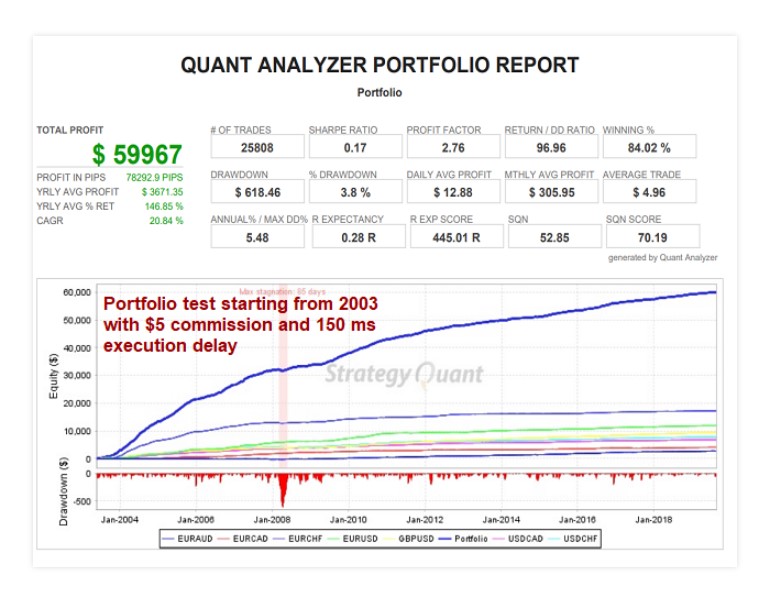

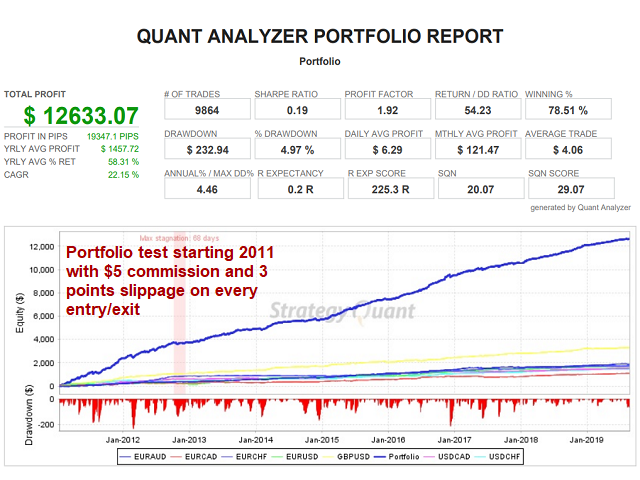

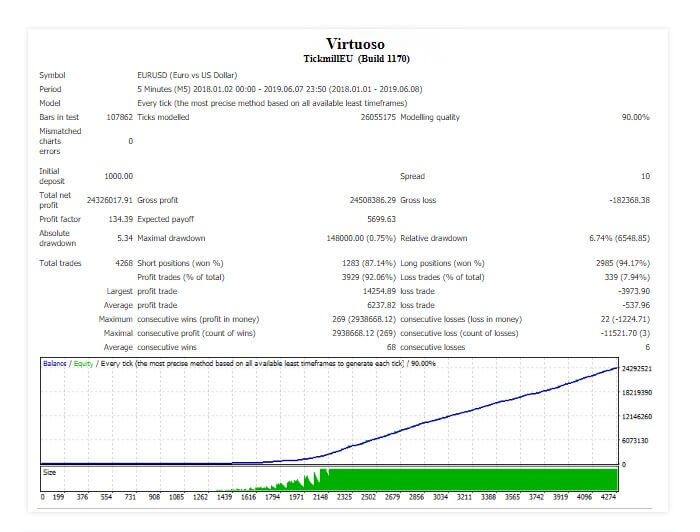

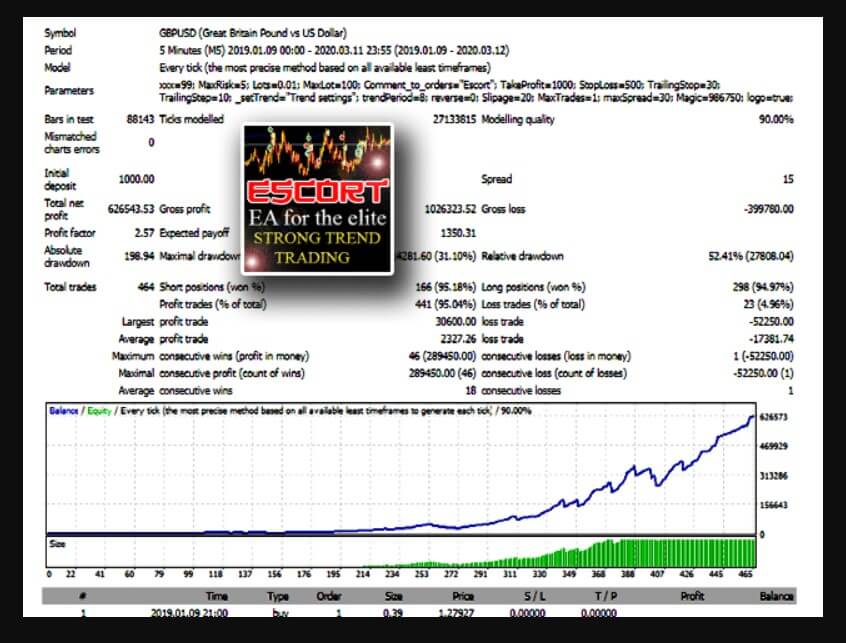

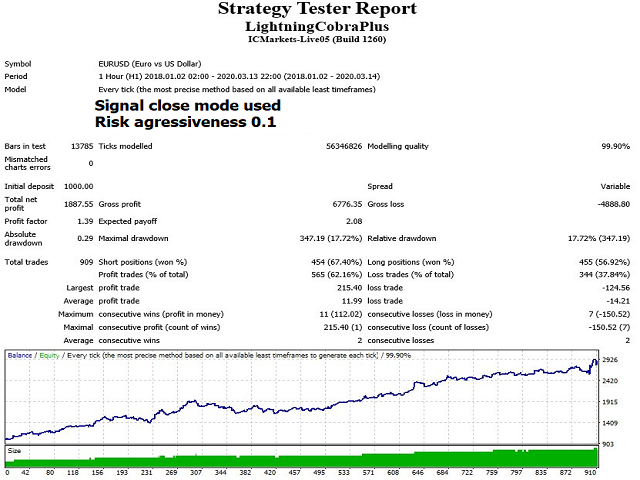

The FXCharger website will not disclose what indicators are used and the major content will be the statistics section. You will see multiple charts for the backtesting results for the EUR/USD, AUD/USD, and the EUR/GBP pair. FXCharger works on the 1-hour timeframe and has the normal and High Profitability modes.

The cost for the Basic version that works only on the EUR/USD is $385, which puts this EA in the mid to higher price range. For this price, you will get one license for any account, unlimited account online changes, and lifetime 24/7 support. A 30-day refund policy is valid if settings are not modified. FXCharger Max version is $495 which is regarded as expensive. The Max version has the same benefits but works with the other currency pairs mentioned. No demo is available.

Conclusion

In our opinion, this website does not give out enough information about this EA given the price range and does not mention the martingale strategy that is applied. Users report mixed results from major benchmark sites. Some of them state the refund policy is just a fake promotion:

“Fraud, a liar company. 5 days ago I bought it on the forexstore.com. Thither are written that 30 day warranty for the EA, I wrote that the robot did margin call on the demo account , he’s wrote this is not enough for a refund. I question what the warranty applies to??? If i could not give an asterisk. Nobody take the https://forexstore.com page for anything. Company fraud and criminals.”

Another seemingly unhappy reviewer wrote:

“Other reviewer is right that this company and other sites own by this EA developer are luring people in by fake 30 day money back guarantee. Run away.”

Others, however, say the support is responsive and that they have solid results. The final rating is mixed but not enough for anyone at this price for a martingale EA, especially concerning the extreme drawdowns and inconsistent results in 2020. Another concern is the undisclosed exposure and no performance since 2019 on the AUD/USD pair. Finally, we can only see backtesting results and no live results for the EUR/GBP. The website does not set strong selling points and even the 30-day return policy validity is arguable.

This Forex service can be found at the following web address: https://fxcharger.com/

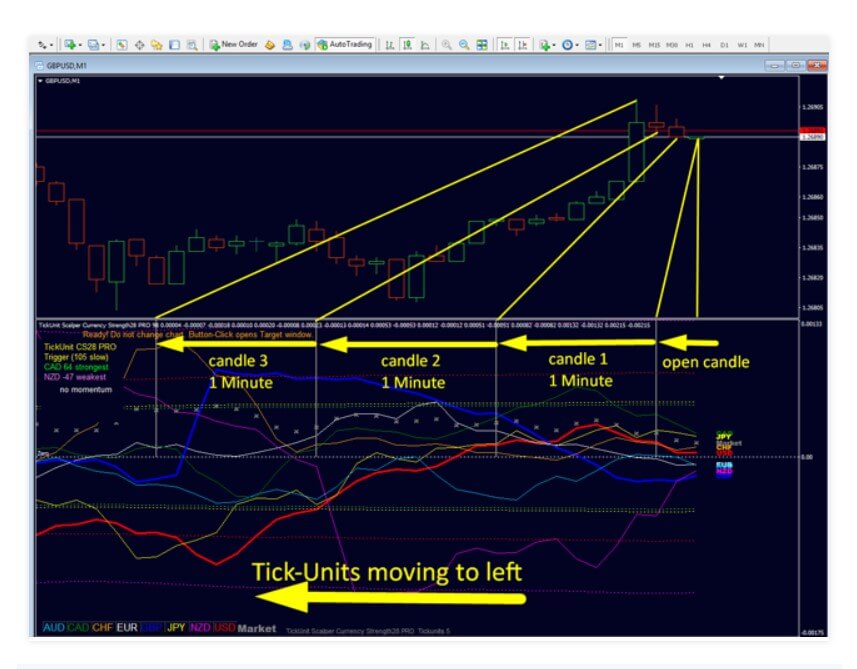

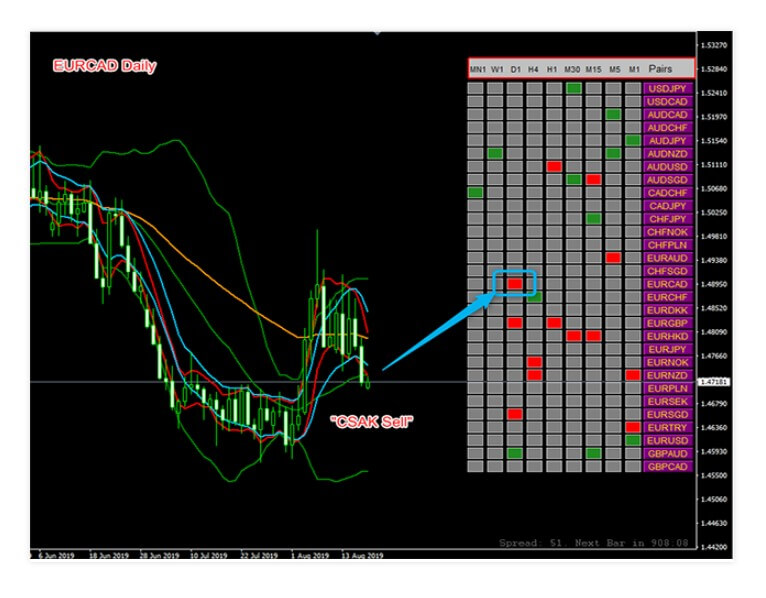

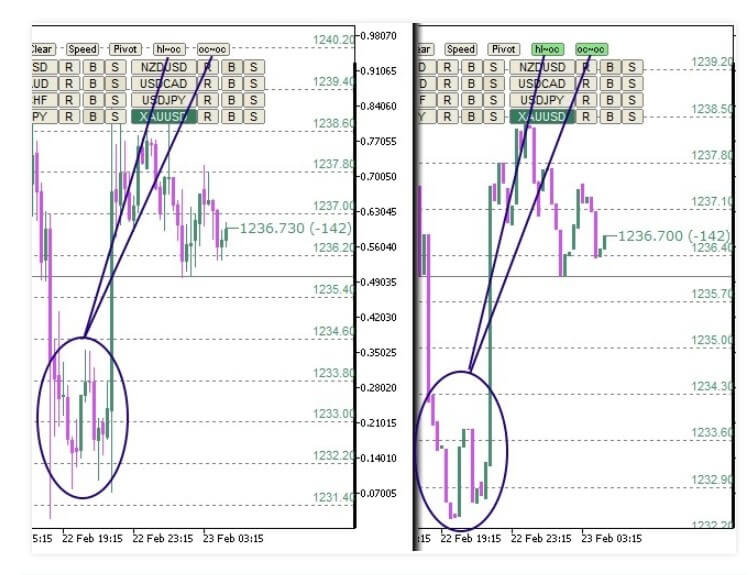

TickUnit Scalper Currency Strength28 PRO is a new indicator type on the scene popular with the scalper trading strategies. It is designed for the MetaTrader 4 and published on 5th July 2019. Since then it has received frequent updates with very good additions such as to save tick data for faster recovery. The developer of this combo indicator is Bernhard Schweigert from Morroco and he has 12 products offered on the MQL5 repository, most of them are popular and have very high ratings from the users. He made a currency correlation/strength indicator using Tick-Units data on 28 currency pairs, or all of the major currency combinations. It belongs to the paid category and could be regarded as a complete trading system.

TickUnit Scalper Currency Strength28 PRO is a new indicator type on the scene popular with the scalper trading strategies. It is designed for the MetaTrader 4 and published on 5th July 2019. Since then it has received frequent updates with very good additions such as to save tick data for faster recovery. The developer of this combo indicator is Bernhard Schweigert from Morroco and he has 12 products offered on the MQL5 repository, most of them are popular and have very high ratings from the users. He made a currency correlation/strength indicator using Tick-Units data on 28 currency pairs, or all of the major currency combinations. It belongs to the paid category and could be regarded as a complete trading system.

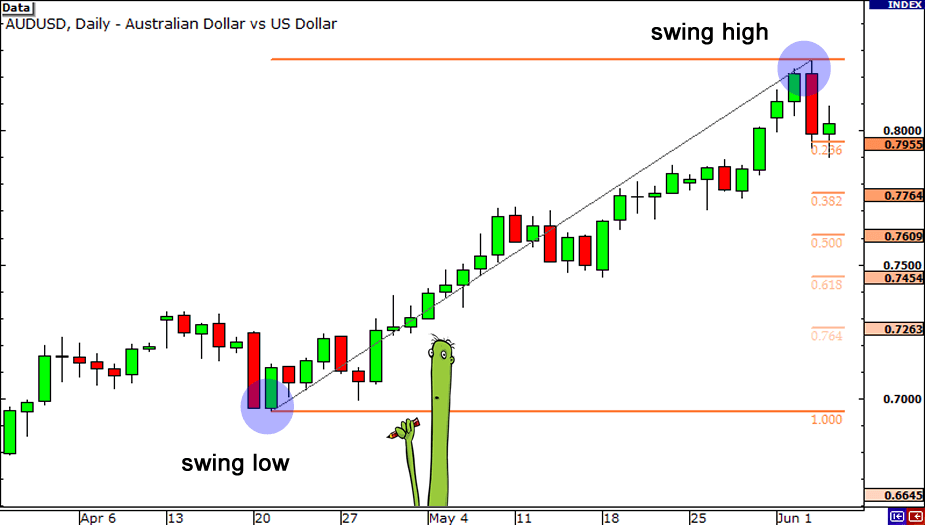

Scalp Tools Support and Resistance Levels is designed to do one thing, to identify the Support and Resistance levels. Usually, indicators that are specialized to do one thing are the ones that do this very well. Most successful trading systems are composed of a few specialized indicators for every aspect of the system. Even though the indicator name has the Scalp word, it is not limited just for scalper systems, most Price Action systems will rely on the Support and Resistance levels. This word is probably included in the name of the indicator for SEO purposes.

Scalp Tools Support and Resistance Levels is designed to do one thing, to identify the Support and Resistance levels. Usually, indicators that are specialized to do one thing are the ones that do this very well. Most successful trading systems are composed of a few specialized indicators for every aspect of the system. Even though the indicator name has the Scalp word, it is not limited just for scalper systems, most Price Action systems will rely on the Support and Resistance levels. This word is probably included in the name of the indicator for SEO purposes.

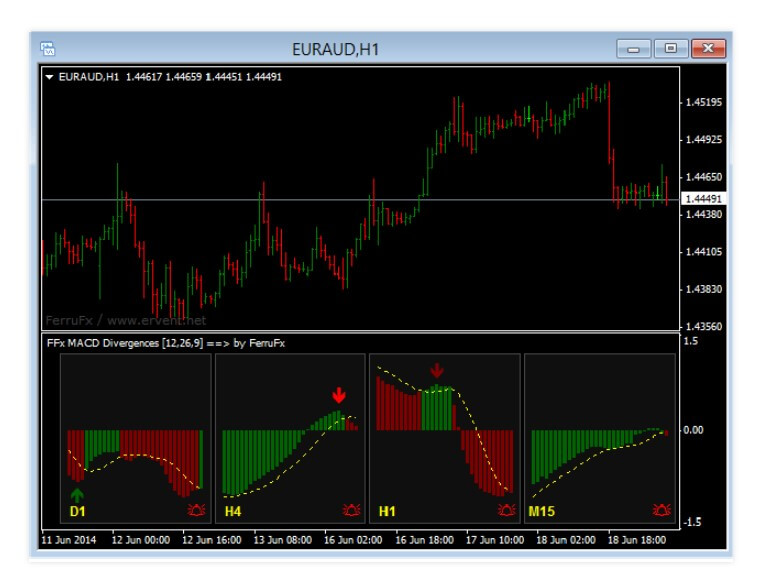

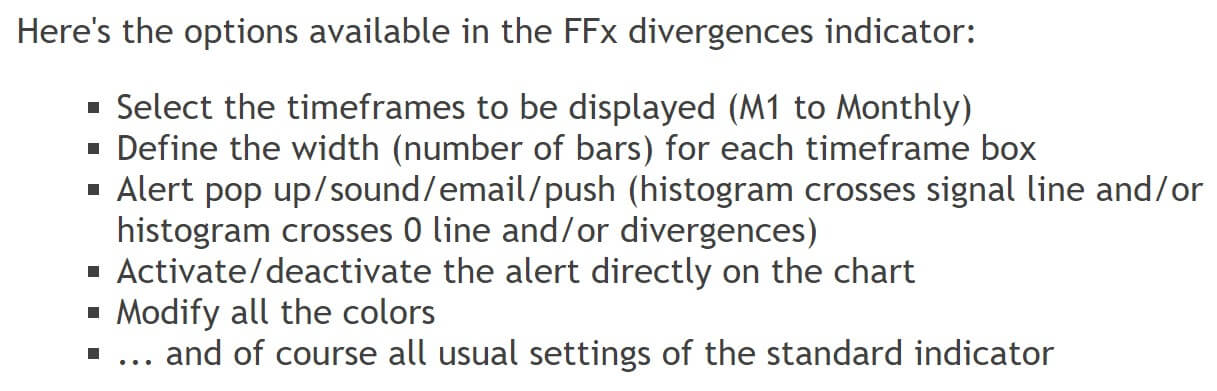

The MetaTrader 4 and 5 platforms come with one of the most popular indicators known to traders – MACD. FFx MACD Divergences build upon the already integrated indicator in the MT4 platform, extending the functionality especially useful for divergence strategy traders. This paid indicator is published on 4th July 2014 on the MQL5 repository and since then has no received much attention. The latest version has not changed since the initial placement and remains at 1.0. The author of this extension tool is Eric Venturi-Bloxs from Thailand. This author has no less than 52 products on the mql5.com, a good portion of that is free.

The MetaTrader 4 and 5 platforms come with one of the most popular indicators known to traders – MACD. FFx MACD Divergences build upon the already integrated indicator in the MT4 platform, extending the functionality especially useful for divergence strategy traders. This paid indicator is published on 4th July 2014 on the MQL5 repository and since then has no received much attention. The latest version has not changed since the initial placement and remains at 1.0. The author of this extension tool is Eric Venturi-Bloxs from Thailand. This author has no less than 52 products on the mql5.com, a good portion of that is free.

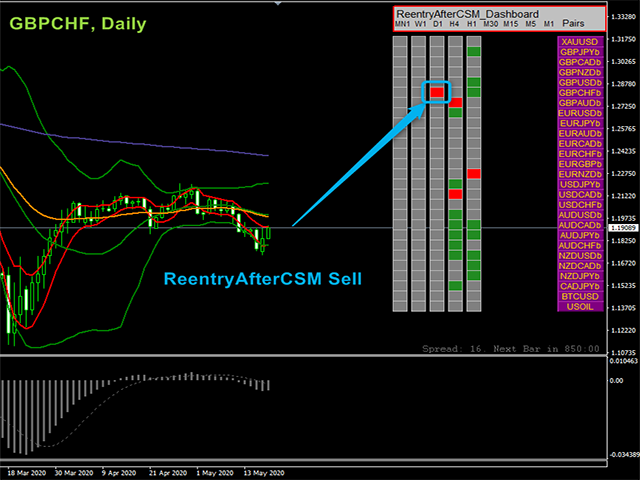

Currency Strength Matrix is a paid indicator published on the MQL5 marketplace designed for the MetaTrader 4 platform. It belongs to the trend confirmation category although it is used in conjunction with other indicators. It tries to differentiate by offering better information for Price Action, Reversal, and Momentum trading strategies, according to the developer’s words. The initial version was published on 5th July 2017 by Raymond Gilmour from the United Kingdom, author of just one more indicator called Cycle Finder Pro.

Currency Strength Matrix is a paid indicator published on the MQL5 marketplace designed for the MetaTrader 4 platform. It belongs to the trend confirmation category although it is used in conjunction with other indicators. It tries to differentiate by offering better information for Price Action, Reversal, and Momentum trading strategies, according to the developer’s words. The initial version was published on 5th July 2017 by Raymond Gilmour from the United Kingdom, author of just one more indicator called Cycle Finder Pro.

The latest version is 2.4 updated recently, on the 10th of March 2020 during the latest COVID-19 world market event. The base code and idea of this EA are not new from the author, the previous product called NY Close Scalper is using the same principles except Density Scalper is optimized for better slippage management. Therefore the release date does not mean the EA does not have enough forward testing done.

The latest version is 2.4 updated recently, on the 10th of March 2020 during the latest COVID-19 world market event. The base code and idea of this EA are not new from the author, the previous product called NY Close Scalper is using the same principles except Density Scalper is optimized for better slippage management. Therefore the release date does not mean the EA does not have enough forward testing done.

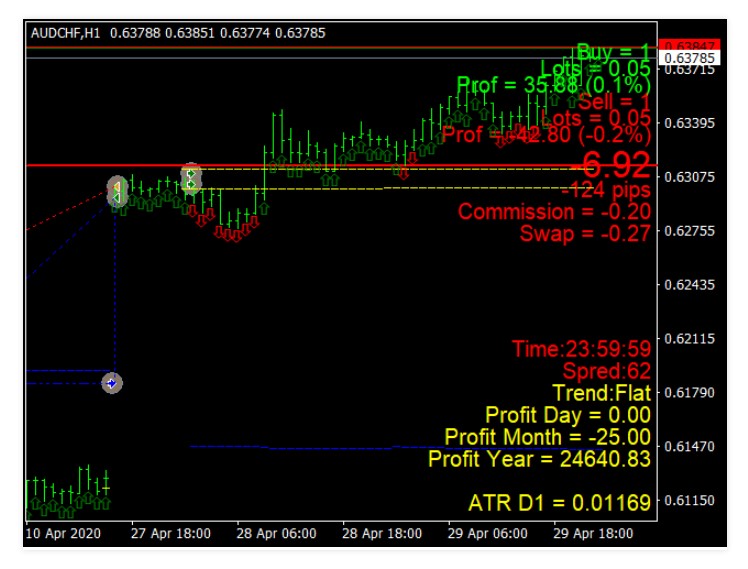

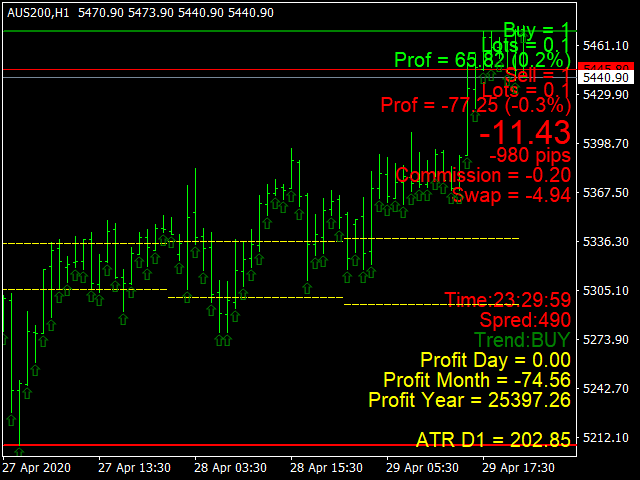

Do IT is an Expert Advisor developed for the MetaTrader 4 platform and is published on the MQL5.com by Ildar Kabirov from Russia. The EA is also available for the MT5. The latest version is 7.77 updated in March 2020. Ratings received are generally positive and there is a high activity in the comments section. Do IT is designed to be fully automated and specialized for Forex, and indices on the 1H timeframe.

Do IT is an Expert Advisor developed for the MetaTrader 4 platform and is published on the MQL5.com by Ildar Kabirov from Russia. The EA is also available for the MT5. The latest version is 7.77 updated in March 2020. Ratings received are generally positive and there is a high activity in the comments section. Do IT is designed to be fully automated and specialized for Forex, and indices on the 1H timeframe.

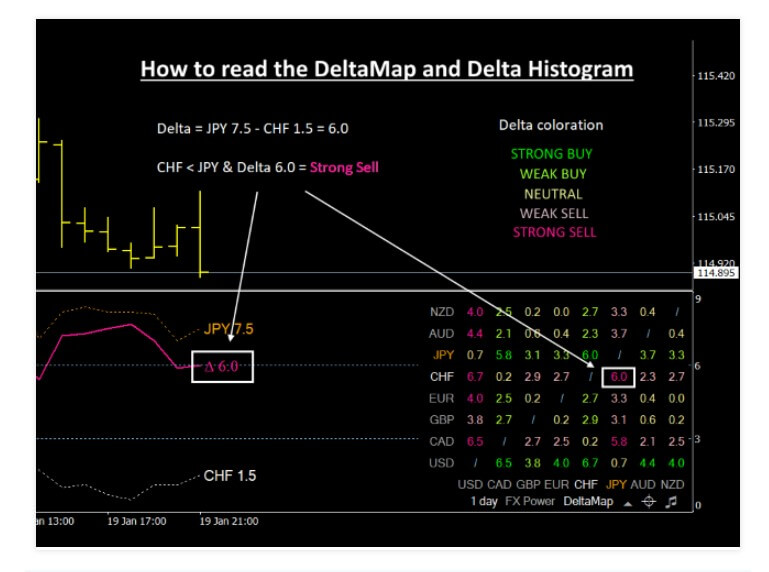

FX Power for the MetaTrader 5 (MT4 also available) is an indicator presented as “the first currency strength meter with a complete history across all timeframes”. Essentially it can be used standalone or as one of there indicators that compose the author’s Simple Trading System. The FX Power indicator developers are the Stein Investments team from Germany. The latest version is 3.76 updated in March 2020 and the first version is published in 2016.

FX Power for the MetaTrader 5 (MT4 also available) is an indicator presented as “the first currency strength meter with a complete history across all timeframes”. Essentially it can be used standalone or as one of there indicators that compose the author’s Simple Trading System. The FX Power indicator developers are the Stein Investments team from Germany. The latest version is 3.76 updated in March 2020 and the first version is published in 2016.

EMA Cross alert is a simple but paid category indicator created by Suriya Thammalungka from Thailand. The EMA means Exponential Moving Average, an indicator used very frequently in many combinations but mostly as a two-line crossing for trend following. The indicator is simple and is never updated since the initial version in June 2016 for MetaTrader 4. It is interesting to see this indicator in the paid category as it is too simple to belong here and the indicators used are basic.

EMA Cross alert is a simple but paid category indicator created by Suriya Thammalungka from Thailand. The EMA means Exponential Moving Average, an indicator used very frequently in many combinations but mostly as a two-line crossing for trend following. The indicator is simple and is never updated since the initial version in June 2016 for MetaTrader 4. It is interesting to see this indicator in the paid category as it is too simple to belong here and the indicators used are basic.

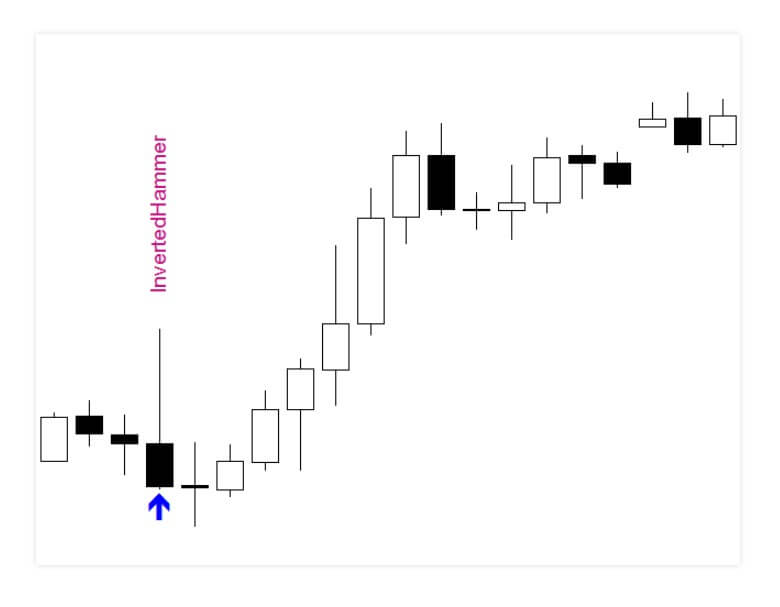

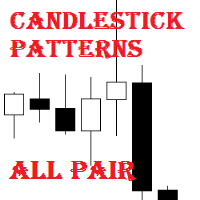

Candlestick Patterns All Pair is an indicator developed for automatic pattern recognition and plotting them on the MetaTrader 4 chart. The tool belongs to the paid category on the MQL5 market and is developed by Denis Luchinkin from Russia. He has over 20 published products but without notable popularity or ratings. This tool is published on the 23rd of March 2017 and has not been updated since. The candle patterns are used as predictive signals and could be reversal, trend, and sometimes scalp strategy elements.

Candlestick Patterns All Pair is an indicator developed for automatic pattern recognition and plotting them on the MetaTrader 4 chart. The tool belongs to the paid category on the MQL5 market and is developed by Denis Luchinkin from Russia. He has over 20 published products but without notable popularity or ratings. This tool is published on the 23rd of March 2017 and has not been updated since. The candle patterns are used as predictive signals and could be reversal, trend, and sometimes scalp strategy elements.

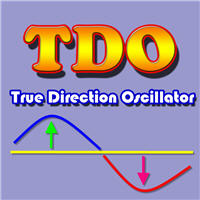

True Direction Oscillator or TDO is a trend gauging oscillator type indicator using a simple but effective formula. The developer is very open and transparent on how the indicator works and the Overview page has professionally made content. TDO has been initially published on the MQL5 market on 23rd November 2015 and since has received many updates. The latest version is v9.1, freshly updated in February this year. The author of this very interesting and popular indicator is Muhammad Al Bermaui from Egypt, showing great dedication to support his work.

True Direction Oscillator or TDO is a trend gauging oscillator type indicator using a simple but effective formula. The developer is very open and transparent on how the indicator works and the Overview page has professionally made content. TDO has been initially published on the MQL5 market on 23rd November 2015 and since has received many updates. The latest version is v9.1, freshly updated in February this year. The author of this very interesting and popular indicator is Muhammad Al Bermaui from Egypt, showing great dedication to support his work.

This EA is based on several trading algorithms and designed for major currency pairs. It is not known how it works or what is the strategy behind it. What is certain is the absurd price and the extremely low rating raising the question if this is a serious offer after all. The latest version is 2.4 updated in October 2019 with the additions of controlling module that adapts to trading conditions. Also, some new settings are added for better risk management. The initial version is published on 11th June 2019 by the developer Aleksandr Shurgin from Russia.

This EA is based on several trading algorithms and designed for major currency pairs. It is not known how it works or what is the strategy behind it. What is certain is the absurd price and the extremely low rating raising the question if this is a serious offer after all. The latest version is 2.4 updated in October 2019 with the additions of controlling module that adapts to trading conditions. Also, some new settings are added for better risk management. The initial version is published on 11th June 2019 by the developer Aleksandr Shurgin from Russia.

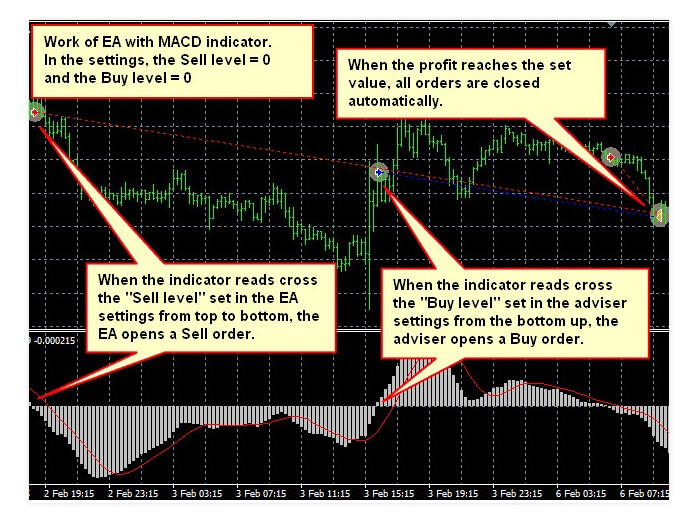

Most of the EAs follow a certain method or strategy, but it is uncommon to see an Expert Advisor made for traders to make their custom automated trading system. EA for Any Levels Indicators is such a product published on the MQL5 market. It is coded for the MetaTrader 4 platform and recently published, on the 14th of March 2020. The developer of this EA is Vyacheslav Nekipelov from Russia, selling 16 other products on the same market that do not have much popularity but they are useful and simple. There are no updates to this EA yet but it can certainly be upgraded with many ideas.

Most of the EAs follow a certain method or strategy, but it is uncommon to see an Expert Advisor made for traders to make their custom automated trading system. EA for Any Levels Indicators is such a product published on the MQL5 market. It is coded for the MetaTrader 4 platform and recently published, on the 14th of March 2020. The developer of this EA is Vyacheslav Nekipelov from Russia, selling 16 other products on the same market that do not have much popularity but they are useful and simple. There are no updates to this EA yet but it can certainly be upgraded with many ideas.

EMA or Exponential Moving Average is one of the most used and classic indicators for technical analysis. This indicator measures the difference between the closing candle prices and creates a momentum presented as an EMA in the MetaTrader 4 separate window chart. This idea is not new and is one of the classic ways of measuring momentum. The author made a simple indicator but it is very useful.

EMA or Exponential Moving Average is one of the most used and classic indicators for technical analysis. This indicator measures the difference between the closing candle prices and creates a momentum presented as an EMA in the MetaTrader 4 separate window chart. This idea is not new and is one of the classic ways of measuring momentum. The author made a simple indicator but it is very useful.

This product does not leave enough information for a trader to understand what kind of Expert Advisor Big Bang MT4 is. Nothing is disclosed about the indicator used or the system, even the settings range does not point to a specific strategy used. However, the EA is new, from April 2020 and probably the Overview page will be updated. The updated version is already out on the MQL5 market, reaching label 1.2. The update contains major improvement, specifically the entry signal is improved and added the filter to only apply strong signals. This way the signals are more reliable although less frequent.

This product does not leave enough information for a trader to understand what kind of Expert Advisor Big Bang MT4 is. Nothing is disclosed about the indicator used or the system, even the settings range does not point to a specific strategy used. However, the EA is new, from April 2020 and probably the Overview page will be updated. The updated version is already out on the MQL5 market, reaching label 1.2. The update contains major improvement, specifically the entry signal is improved and added the filter to only apply strong signals. This way the signals are more reliable although less frequent.

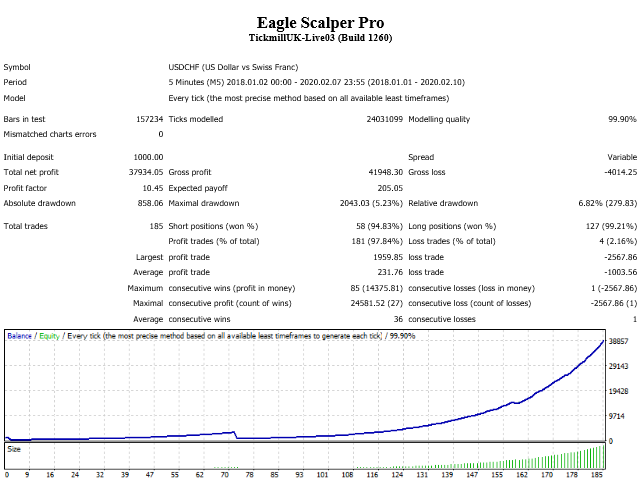

Eagle Scalper Pro is a new Expert Advisor published on the MQL5 market that reached significant popularity and user review rating already. The initial version was uploaded on the 10th of February 2020 and has been updated in March to the current 1.50 version. Updates are minor, just bug fixing and FIFO compatibility in case traders have this ordering method imposed by their broker. This EA belongs to the Trend Following strategy category and it is not frequently used the same as the scalper EAs. It does not use the Arbitrage method which is commonly frowned upon by brokers and traders alike.

Eagle Scalper Pro is a new Expert Advisor published on the MQL5 market that reached significant popularity and user review rating already. The initial version was uploaded on the 10th of February 2020 and has been updated in March to the current 1.50 version. Updates are minor, just bug fixing and FIFO compatibility in case traders have this ordering method imposed by their broker. This EA belongs to the Trend Following strategy category and it is not frequently used the same as the scalper EAs. It does not use the Arbitrage method which is commonly frowned upon by brokers and traders alike.

This EA belongs to the Grid strategies with integrated averaging. It is developed for the MetaTrader 4 platform by Sergey Kruglov from Russia. The initial version was published on 6th February 2017 on the MQL5 market set in the paid category. It is updated once in late 2017 adding a few functional averaging parameters such as Averaging Point, Averaging Take Profit points, and Auto Averaging. Sergey Kruglov has 26 other products on the market but none of them have any notable ratings or popularity. He seems to develop mostly Grid-based EAs.

This EA belongs to the Grid strategies with integrated averaging. It is developed for the MetaTrader 4 platform by Sergey Kruglov from Russia. The initial version was published on 6th February 2017 on the MQL5 market set in the paid category. It is updated once in late 2017 adding a few functional averaging parameters such as Averaging Point, Averaging Take Profit points, and Auto Averaging. Sergey Kruglov has 26 other products on the market but none of them have any notable ratings or popularity. He seems to develop mostly Grid-based EAs.

If you are familiar with the BBMA trading system, then this indicator or tool is the perfect addon. It is a specialized tool but can also be considered a complete trading system. It consists of multiple indicators designed for this algorithm trading. BBMA system is made by Mr. Oma Ally and the BBMA Dashboard tool is published by Alireza Yadegar from Iran. The system is relatively new, from mid-2016, and the tool soon followed a release on the

If you are familiar with the BBMA trading system, then this indicator or tool is the perfect addon. It is a specialized tool but can also be considered a complete trading system. It consists of multiple indicators designed for this algorithm trading. BBMA system is made by Mr. Oma Ally and the BBMA Dashboard tool is published by Alireza Yadegar from Iran. The system is relatively new, from mid-2016, and the tool soon followed a release on the

Traders familiar with Elliot Waves know there are a few elements that need to be determined before executing a trade. This indicator is developed with the idea to trade towards the 5th Elliot Wave in conjunction with other indicators, as a part of the “Trade The Fifth” swing strategy. This is a commercialized product also published in the MQL5 market for the MetaTrader 4 platform. Other platforms are supported but on the owner’s website. The developer is Paul Bratby from Spain who is the presenter of this swing strategy using Elliot Waves, publishing one more product related to this group strategy ideas. The first version is published on 13th December 2019 and has never been updated to date. Elliot Wave Indicator belongs to the paid category but it is not available to buy, this is a subscription-based service with several options.

Traders familiar with Elliot Waves know there are a few elements that need to be determined before executing a trade. This indicator is developed with the idea to trade towards the 5th Elliot Wave in conjunction with other indicators, as a part of the “Trade The Fifth” swing strategy. This is a commercialized product also published in the MQL5 market for the MetaTrader 4 platform. Other platforms are supported but on the owner’s website. The developer is Paul Bratby from Spain who is the presenter of this swing strategy using Elliot Waves, publishing one more product related to this group strategy ideas. The first version is published on 13th December 2019 and has never been updated to date. Elliot Wave Indicator belongs to the paid category but it is not available to buy, this is a subscription-based service with several options.

Eng GBP is a modest product by a Kuwait developer using a breakout strategy with Fibonacci levels. This Expert Advisor for the MetaTrader 4 is new, published on the 5th of April 2020 on the MQL5 market. It has no updates yet although it is evident Ahmad Alsaegh, the author of Eng GBP, is still testing new settings and uploads them in the Comments section. He has one other product also specialized for certain Indicies, using a similar breakout strategy. Eng GBP, as the name applies, is specialized for the GBP/USD currency pair although the author states it is suitable for all currency pairs. The Overview page does not have enough information about how the EA is working or anything about the set of indicators aside Fibonacci. According to the settings, it is clear additional Risk management tools are integrated.

Eng GBP is a modest product by a Kuwait developer using a breakout strategy with Fibonacci levels. This Expert Advisor for the MetaTrader 4 is new, published on the 5th of April 2020 on the MQL5 market. It has no updates yet although it is evident Ahmad Alsaegh, the author of Eng GBP, is still testing new settings and uploads them in the Comments section. He has one other product also specialized for certain Indicies, using a similar breakout strategy. Eng GBP, as the name applies, is specialized for the GBP/USD currency pair although the author states it is suitable for all currency pairs. The Overview page does not have enough information about how the EA is working or anything about the set of indicators aside Fibonacci. According to the settings, it is clear additional Risk management tools are integrated.

This is one of the most popular Expert Advisors that implement the Grid and the Martingale methods without using any indicators. Brazil System Premium is designed for the MetaTrader 4 platform and published on the MQL market in the paid category. This EA appeared on 11th October 2016 and has been updated many times, finalizing with version 13.0 from the 6th of April 2020. The updates contained bugfixes, additional functionalities, and optimizations.

This is one of the most popular Expert Advisors that implement the Grid and the Martingale methods without using any indicators. Brazil System Premium is designed for the MetaTrader 4 platform and published on the MQL market in the paid category. This EA appeared on 11th October 2016 and has been updated many times, finalizing with version 13.0 from the 6th of April 2020. The updates contained bugfixes, additional functionalities, and optimizations.

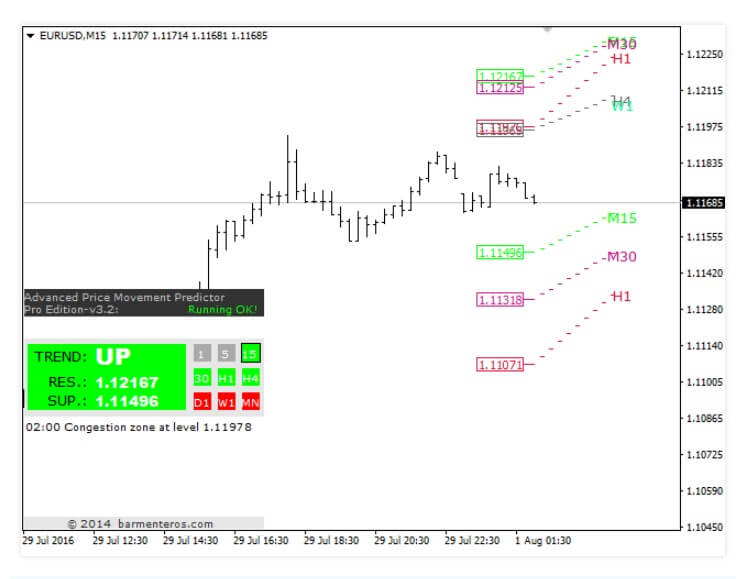

Given by the name one could think this indicator uses candle patterns or other non-lagging methods to predict trends. However, this is not true, this is a combo indicator for the trend following strategies using Price Action methodology. It is developed for the MetaTrader 4 client by Boris Armenteros from Spain, as the leader of the Barmenteros team. This team has some trading and coding experience having at least 15 products released on the MQL5 market. Advanced Price Movement Predictor is initially published in January 2014, however, it is not updated frequently.

Given by the name one could think this indicator uses candle patterns or other non-lagging methods to predict trends. However, this is not true, this is a combo indicator for the trend following strategies using Price Action methodology. It is developed for the MetaTrader 4 client by Boris Armenteros from Spain, as the leader of the Barmenteros team. This team has some trading and coding experience having at least 15 products released on the MQL5 market. Advanced Price Movement Predictor is initially published in January 2014, however, it is not updated frequently.

Currency Strength meter indicators are interesting to many traders and have many uses, not necessarily to enter new positions. CSM indicator is the work of Aliakbar Kavosi from Iran releasing the first version of CSM in March 2016 for the MetaTrader 4 platform and updated it twice in late 2019, giving the indicator a new code and better symbols integration with various brokers. This author is the owner of 18 published products on the MQL5 market without significant attention from the users. CSM is not free but seems to do other Currency Strength meters do, just with a small deviation.

Currency Strength meter indicators are interesting to many traders and have many uses, not necessarily to enter new positions. CSM indicator is the work of Aliakbar Kavosi from Iran releasing the first version of CSM in March 2016 for the MetaTrader 4 platform and updated it twice in late 2019, giving the indicator a new code and better symbols integration with various brokers. This author is the owner of 18 published products on the MQL5 market without significant attention from the users. CSM is not free but seems to do other Currency Strength meters do, just with a small deviation.

Price Action traders know Support and Resistance levels are the dominant element in their analysis, as well as other strategies. Support and Resistance is an elementary factor assessed for the prediction of points of trend reversals in both directions. This indicator is designed for the MetaTrader 4 for automatic recognition of concentrated prices based on which the zones are plotted on the chart. The indicator that can determine these levels instead of the trader makes the whole process faster, more precise, and non-subjective.

Price Action traders know Support and Resistance levels are the dominant element in their analysis, as well as other strategies. Support and Resistance is an elementary factor assessed for the prediction of points of trend reversals in both directions. This indicator is designed for the MetaTrader 4 for automatic recognition of concentrated prices based on which the zones are plotted on the chart. The indicator that can determine these levels instead of the trader makes the whole process faster, more precise, and non-subjective.

Judging by the provided video presentation on the Overview page of Greed GvGold for MT4 platform, this is a grid-like channel breakout strategy used with mixed performance results. Its first appearance was on the MQL5 marketplace in late March 2020, without much attention from the users. A couple of weeks later, it has been updated to version 2.1 introducing new features that dramatically change the final results from backtesting. It looks like the product was released in an incomplete stage or still in the testing.

Judging by the provided video presentation on the Overview page of Greed GvGold for MT4 platform, this is a grid-like channel breakout strategy used with mixed performance results. Its first appearance was on the MQL5 marketplace in late March 2020, without much attention from the users. A couple of weeks later, it has been updated to version 2.1 introducing new features that dramatically change the final results from backtesting. It looks like the product was released in an incomplete stage or still in the testing.

The Final Code is a relatively new EA without a clear description of how it works or any meaningful overview. It is made by Vitalii Zakharuk who has at least 46 products put into the MQL5 market. Final Code EA is published on 9th February 2020 without any updates so far. Based on what we have seen in the screenshots, The EA is a fast reversal strategy scalper working on lower timeframes. It belongs to the paid category and has no reviews or comments to date. The overview page presentation is very ambiguous, lacks even the elementary highlights, certainly inappropriate for the price set.

The Final Code is a relatively new EA without a clear description of how it works or any meaningful overview. It is made by Vitalii Zakharuk who has at least 46 products put into the MQL5 market. Final Code EA is published on 9th February 2020 without any updates so far. Based on what we have seen in the screenshots, The EA is a fast reversal strategy scalper working on lower timeframes. It belongs to the paid category and has no reviews or comments to date. The overview page presentation is very ambiguous, lacks even the elementary highlights, certainly inappropriate for the price set.

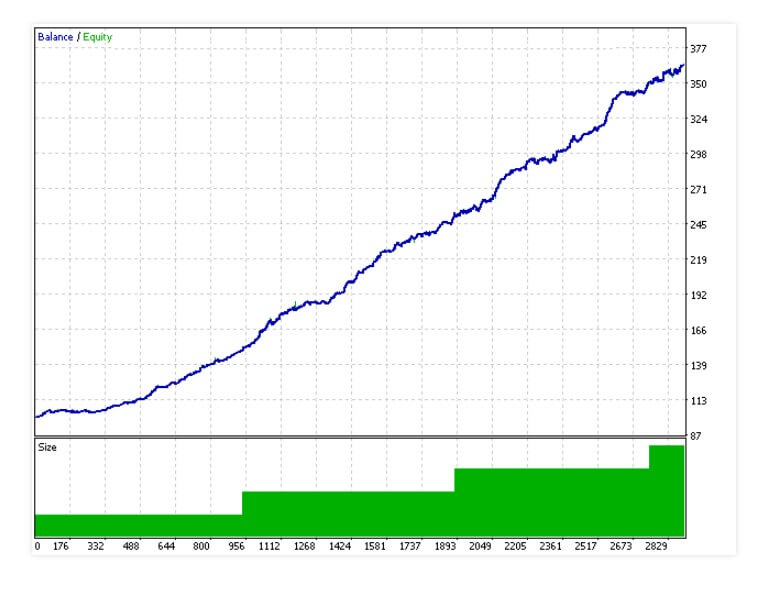

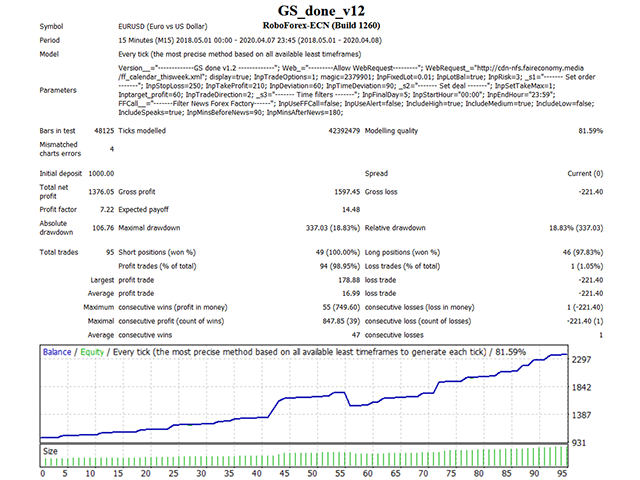

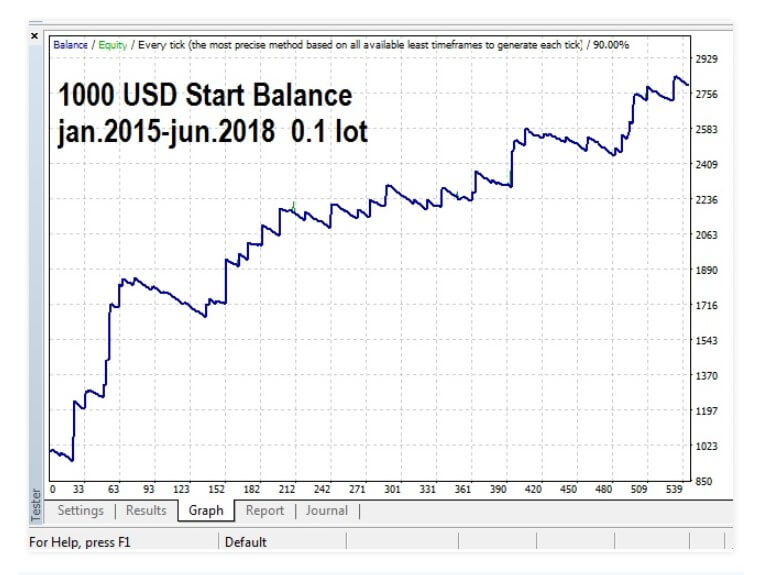

GS Done is an Expert Advisor made for the MetaTrader 4 platform that does not use Martingale or Grid methods in its strategy. The exact strategy and indicators used are not disclosed in the Overview page for this product published on the MQL5 market. The developer is Aleksander Gladkov from Russia, who has 11 product total on the market. This author is relatively new on the scene, only a handful of products have received attention form the community. Other products use Martingale methods in his EAs, but this one is different.

GS Done is an Expert Advisor made for the MetaTrader 4 platform that does not use Martingale or Grid methods in its strategy. The exact strategy and indicators used are not disclosed in the Overview page for this product published on the MQL5 market. The developer is Aleksander Gladkov from Russia, who has 11 product total on the market. This author is relatively new on the scene, only a handful of products have received attention form the community. Other products use Martingale methods in his EAs, but this one is different.

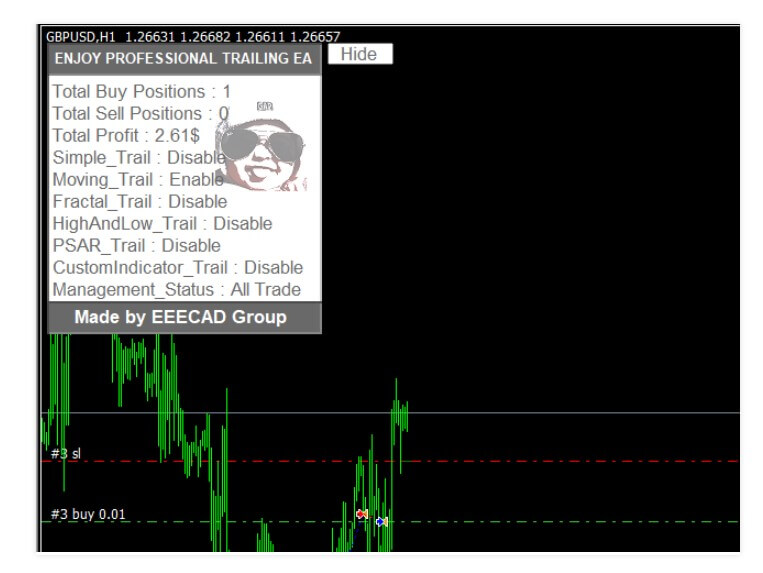

Based on the information and the settings for this EA we have determined it is using a channel breakout strategy for trade entries with several modifications and indicator combos for Risk Management and exits. HitAndRun is developed by Catalin Zachiu from Romania who has at least 26 other products, a couple of them having notable popularity and high ratings. The initial version of HitAndRun was published on the MQL5 market for the MetaTrader 4 platform on 10th February 2019. Updates are frequent with many new functionalities, the latest version 3.6 is from 31st of March 2020. The author’s dedication is notable as it is also evident in the comments page with the users. This EA is in the paid category but also has a free version linked.

Based on the information and the settings for this EA we have determined it is using a channel breakout strategy for trade entries with several modifications and indicator combos for Risk Management and exits. HitAndRun is developed by Catalin Zachiu from Romania who has at least 26 other products, a couple of them having notable popularity and high ratings. The initial version of HitAndRun was published on the MQL5 market for the MetaTrader 4 platform on 10th February 2019. Updates are frequent with many new functionalities, the latest version 3.6 is from 31st of March 2020. The author’s dedication is notable as it is also evident in the comments page with the users. This EA is in the paid category but also has a free version linked.

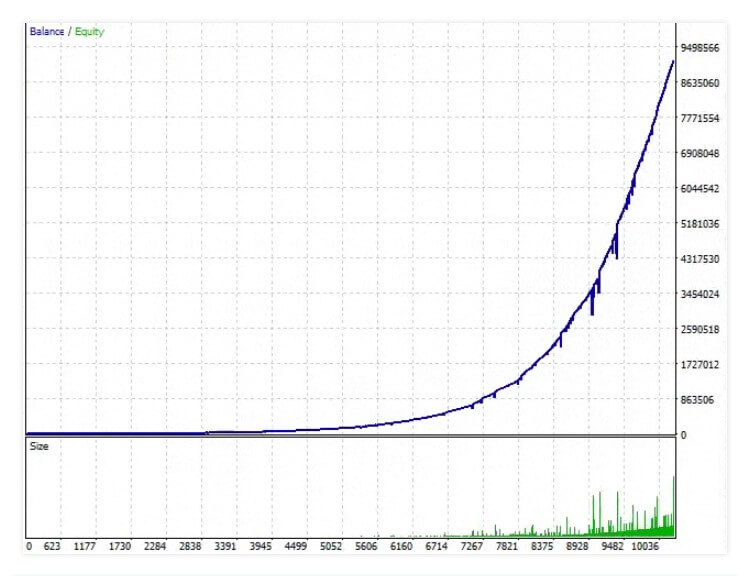

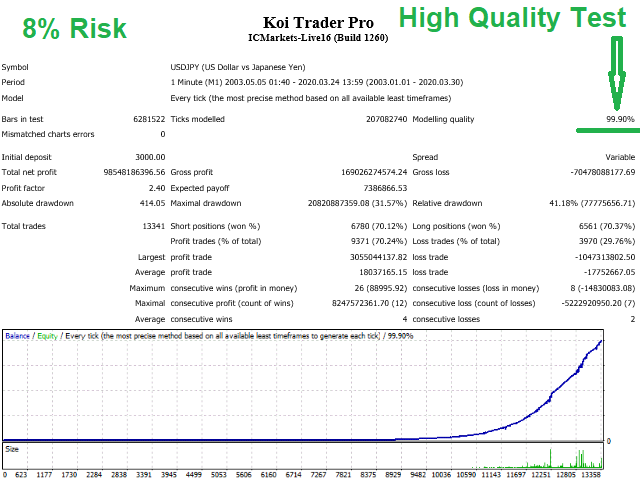

The developer of this Expert Advisor for the MetaTrader 4 platform has received some attention from the MQL5 community publishing many EAs with great ratings. Koi Trade Pro is Michaela Russo’s newly developed EA released on the 28th of March 2020. It is a trend-following EA that is not suited to higher timeframes and has plenty of settings. Since the EA is new it is still waiting for updates, however, it has received comments and reviews already. Michaela Russo has 20 total products published on the

The developer of this Expert Advisor for the MetaTrader 4 platform has received some attention from the MQL5 community publishing many EAs with great ratings. Koi Trade Pro is Michaela Russo’s newly developed EA released on the 28th of March 2020. It is a trend-following EA that is not suited to higher timeframes and has plenty of settings. Since the EA is new it is still waiting for updates, however, it has received comments and reviews already. Michaela Russo has 20 total products published on the

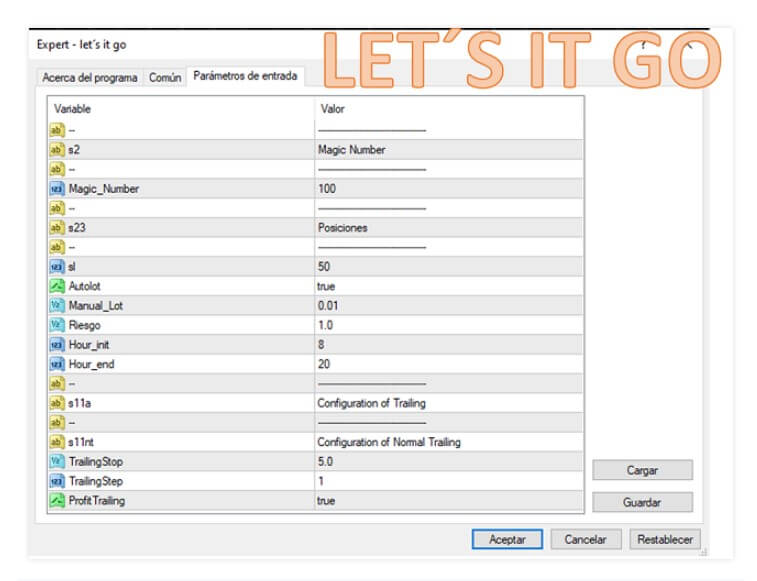

This version of the Let’s Do it EA is designed for the MetaTrader 4 platform and published on the MQL5 market as a simple averaging method EA for beginners. There are no specific traits about this EA and probably it is meant to avoid the promotion of any content that they could not consume. Let’s Do it is developed by Marta Gonzalez from Spain who has at least 53 products published on the MQL5 market and mostly works as a freelance programmer receiving good ratings. The first version of this EA is published on the 8th of February 2020, it is a new product with one update bringing the current version to 1.1. The update contains just the adaptation to Asian traders.

This version of the Let’s Do it EA is designed for the MetaTrader 4 platform and published on the MQL5 market as a simple averaging method EA for beginners. There are no specific traits about this EA and probably it is meant to avoid the promotion of any content that they could not consume. Let’s Do it is developed by Marta Gonzalez from Spain who has at least 53 products published on the MQL5 market and mostly works as a freelance programmer receiving good ratings. The first version of this EA is published on the 8th of February 2020, it is a new product with one update bringing the current version to 1.1. The update contains just the adaptation to Asian traders.

This is a classic composite trend confirmation indicator designed for trend following on the MetaTrader 4 platform. The author is Andrey Kozak who also has no less than 85 other products published on the MQL5 market. None of these products received any notable attention for the community. This is also the case with the Market Trend, even though the indicator may produce good results. The initial version was published on 16th January 2018 and has never been updated. It may be reasonable not to put effort into a product that is not needed. Still, trend confirmation indicators like this may be hidden gold to someone.

This is a classic composite trend confirmation indicator designed for trend following on the MetaTrader 4 platform. The author is Andrey Kozak who also has no less than 85 other products published on the MQL5 market. None of these products received any notable attention for the community. This is also the case with the Market Trend, even though the indicator may produce good results. The initial version was published on 16th January 2018 and has never been updated. It may be reasonable not to put effort into a product that is not needed. Still, trend confirmation indicators like this may be hidden gold to someone.

Candle pattern is a popular Price Action method for discovering trends and reversals. By discovering patterns traders can predict the price move making this method non-lagging although the reliability is relative. SmartPattern is published on 20th November 2017 with version 2.1 for the MetaTrader 4 platform and not updated meaning this indicator was probably already developed before publishing on the MQL5 market.

Candle pattern is a popular Price Action method for discovering trends and reversals. By discovering patterns traders can predict the price move making this method non-lagging although the reliability is relative. SmartPattern is published on 20th November 2017 with version 2.1 for the MetaTrader 4 platform and not updated meaning this indicator was probably already developed before publishing on the MQL5 market.

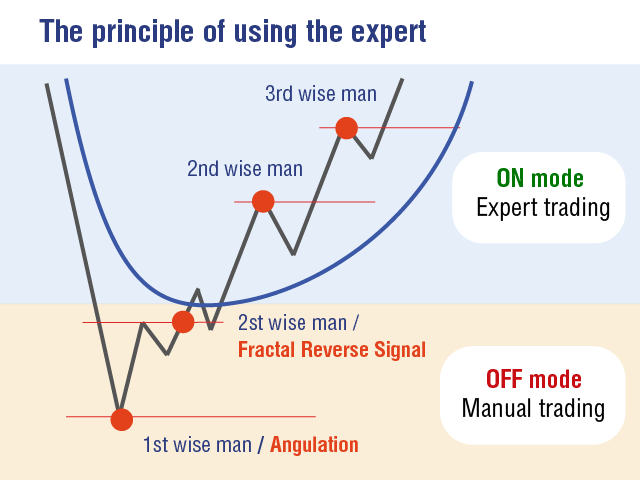

Originally made for the MetaTrader 5 platform, but soon after the updates this Expert Advisor and a manual trading tool are also released for the MetaTrader 4 platform too. Both products are listed on the MQL5 market in late February and March 2020. MAFiA Scalper is a mix of strategies and indicators designed for scalping although no timeframe or currency pairs are suggested. The developer, Andrey Dyachenko from Ukraine, has either just a publisher for another company products or he has invested a lot of time to develop a complex EA with many elements. Most of his 4 released products are related to Fractals method EA and tools, all are new.

Originally made for the MetaTrader 5 platform, but soon after the updates this Expert Advisor and a manual trading tool are also released for the MetaTrader 4 platform too. Both products are listed on the MQL5 market in late February and March 2020. MAFiA Scalper is a mix of strategies and indicators designed for scalping although no timeframe or currency pairs are suggested. The developer, Andrey Dyachenko from Ukraine, has either just a publisher for another company products or he has invested a lot of time to develop a complex EA with many elements. Most of his 4 released products are related to Fractals method EA and tools, all are new.

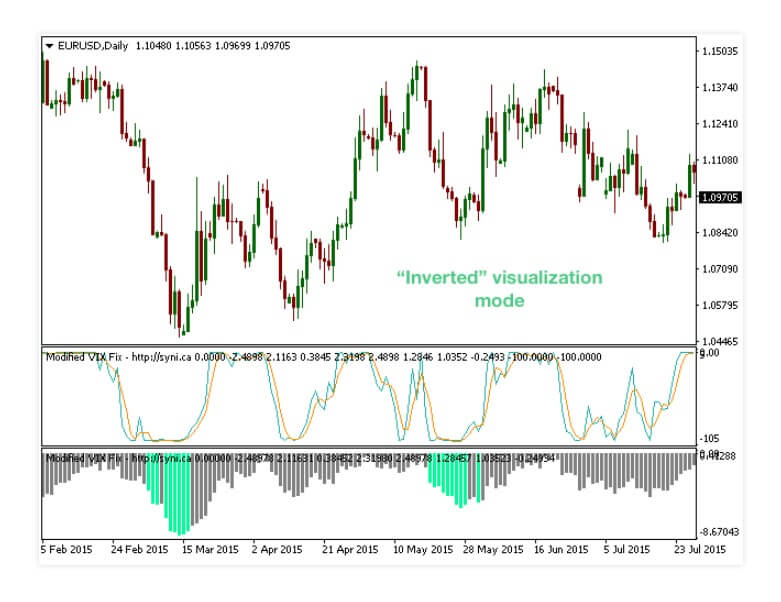

VIX is a volatility index used worldwide to measure this parameter crucial to many trading strategies for various tasks. Chicago Board Options Exchange calculates this Index and is available at cboe.com. The author of Modified VIX Fix is Jay Jantz from Canada working at Synapse Investments Research Group, publishing this indicator for the MetaTrader 4 platform on the MQL5 market. It belongs to the paid category, initially uploaded on 25th October 2016, and updated to version 1.1 in March 2017. The updates are minor, mostly visual additions and alert functionalities.

VIX is a volatility index used worldwide to measure this parameter crucial to many trading strategies for various tasks. Chicago Board Options Exchange calculates this Index and is available at cboe.com. The author of Modified VIX Fix is Jay Jantz from Canada working at Synapse Investments Research Group, publishing this indicator for the MetaTrader 4 platform on the MQL5 market. It belongs to the paid category, initially uploaded on 25th October 2016, and updated to version 1.1 in March 2017. The updates are minor, mostly visual additions and alert functionalities.

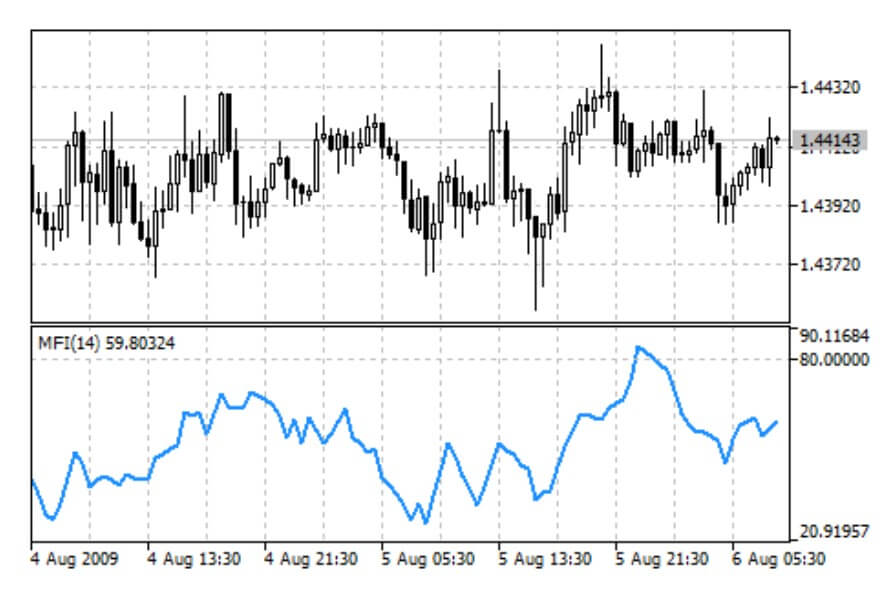

Money Flow Index or MFI is a commonly used oscillator indicator that can generate a few signals for reversals, trend confirmation, and even continuations. The specifics of this MFI is the Multi-timeframe dimension that gives trades more information on the higher timeframe without the need to switch to another chart. This is a very simple indicator modification without any other extras that could make it a versatile tool or an Expert Advisor.

Money Flow Index or MFI is a commonly used oscillator indicator that can generate a few signals for reversals, trend confirmation, and even continuations. The specifics of this MFI is the Multi-timeframe dimension that gives trades more information on the higher timeframe without the need to switch to another chart. This is a very simple indicator modification without any other extras that could make it a versatile tool or an Expert Advisor.