Blockchain has been touted as a solution to countless modern-day problems. But what if it could be seen as a catalyst for innovation? You know, innovation that brings us products and services that we simply hadn’t fathomed about before.

Fetch.ai is an intelligence lab that wants to harness blockchain to power a decentralized digital economy. The platform will enable the sharing and connection of data globally and driven by machine learning and artificial intelligence. Fetch.ai will be open-source, allowing anyone from anywhere to connect to the network and carry out safe and secure tasks in a modern economy.

This article explores the Fetch.ai network in-depth, from how it works to use cases, right down to its native token and where to purchase it.

Understanding Fetch.ai

Fetch.ai is an artificial lab that wants to bring together tools and develop an infrastructure to power a decentralized digital economy. Based in Cambridge, Fetch.ai intends to create a distributed ledger platform to facilitate secure and safe sharing connection and data transfer on a global scale.

Fetch wants to automate countless markets that currently require a lot of manual intervention. The goal is to have frictionless transactions at digital speeds. The Fetch.ai team imagines an evolved world where everybody has numerous economic agents on the platform, each operating to provide solutions for some of the most challenging today and tomorrow’s problems.

Some of the highlights of the platform include:

- A near-autonomous integration for various components of complex systems

- Frictionless integration and the deployment of machine learning (ML) and artificial intelligence (AI) in decision making without necessarily understanding how the two technologies work

- Combining machine intelligence and human intelligence model to optimize decision-making processes

Key Features of Fetch.ai

Some of the notable features of Fetch.ai include:

- A digital infrastructure optimized for multi-agent systems.

- A scalable ledger to power massive transaction volumes

- Synergetic computing to support ‘intelligent’ smart contract contracts

- An economic infrastructure to support dynamic market places

- Navigation based on semantics and geography, and through which autonomous agents can oversee the smooth solving of problems

Key Products of Fetch.ai

#1. Consensus Mechanism:

Fetch.ai utilizes a combination of proof of stake consensus and other protocols that oversee the delivery of the consensus. New blocks are produced via the PoS protocol, with the transaction verified through the work put in between every two blocks. The work is then recorded on a directed acyclic graph (DAG) created between the two blocks. The DAG is ‘stamped’ by the blockchain, removing the need for a supervisor.

#2. Fees and Rewards

Fetch.ai runs a fees and rewards program, whereby processing nodes are incentivized with system incentives. Processing nodes are also in charge of data mining – the process through which transactions are produced and confirmed.

Performance of the Fetch.ai Network

The Fetch.ai ledger is designed to scale, and its performance will differ depending on the current configured resources at the given moment. However, the network claims to have achieved speeds of up to 30,000+ transactions per second (TPS). The network is expected to increase configured resources as demand balloons.

Open Economic Framework

The Open Economic Framework (OEF) is a second-layer protocol that provides services to participants (agents). Agents connect to the framework to connect with other agents to do business together. OEF is created to show the semantic, geographic, and economic views of that time to participants.

Network nodes can either be just blockchain nodes or be both blockchain/OEF nodes. Initially, the OEF nodes will be either “trusted” or “trustless.” The “trustless” nodes can support the network anonymously, as can the pure blockchain nodes. However, the “trusted” nodes are eligible for access to agents’ information so they can render their intelligence and discovery capabilities to the network. Operators of trusted nodes must submit a legitimate public and legal identity and be accredited by the Fetch.ai Foundation.

Example Use Cases of Fetch.ai

Fetch.ai could potentially revolutionize a lot of industries, helping to improve efficiency and optimize processes. The project wants to increase efficiency and enhance solutions to daily problems via intelligent data sharing, ML, and AI.

#1. Decentralized marketplace and decentralized finance

Fetch.ai will be used for decentralized commodity exchange, an innovative platform that will support improved liquidity in the trading of base metals and other commodities. Fetch.ai will assist market participants in circumventing barriers to entry via innovative technology. It will facilitate the digitalized trading of various materials, enabling market players to have at their disposal new risk management tools.

#2. Transportation

Current transportation systems are mainly self-service, with commuters having to do so much just to move from one point to another. Fetch.ai will feature Autonomous Economic Agents who will do the heavy lifting on behalf of individuals. The Autonomous Economic Agents will be able to adjust to individuals’ preferences as they go, and they’ll be able to react in real-time to any unforeseen scenarios.

#3. Smart parking and congestion solution

Fetch.ai’s autonomous agents can search and inform you about the available parking space and book it for you in advance. When you come back to your car, the system calculates the bill for you and completes the payment. This not only saves time, but it also removes the hassle of a manual process. And it can greatly help reduce congestion in cities.

#4. Powering electric cars

Fetch.ai wants to be at the forefront of powering the next generation of cars, which are likely to take on in the near future like never before. For the technology to advance, major changes will have to be made.

Fetch.ai’s intelligent ecosystem will enable the autonomous agent in your car to scour for the nearest charging system, book a space and direct you there, instead of having to go and wait at a filling station. As smart vehicles become more popular, more users will be flocking at recharge points. Smart optimization tech powered by Fetch.ai will ensure that increased demand is met by the nearest possible charging point. The system will also guide users to charging points near a coffee shop or playground, making their charging stop more enjoyable.

#5. Supply chain

Fetch.ai-powered supply chains will allow businesses to study future patterns, which will enable them to plan for potential disruptions for months while responding appropriately to changing customer behavior.

Both AI and blockchain tech will assist companies in achieving more efficiency. For instance, AI can use real-time info to enable a company to choose the best trading partner for their current business situation.

The FET Token

FET tokens will be the native tokens of the Fetch.ai system and will play many roles, including the following:

- Connect participants and nodes to the Fetch.ai ecosystem: agents and network nodes will have to stake in FET to demonstrate their goodwill and intention to maintain good behavior. As the cost of joining the network escalates, it will be more difficult for undesirable elements to attempt to join the network.

- As a value exchange mechanism: FET tokens will be required to exchange value between and among agents, no matter their location. FET will be infinitely divisible, which means it can support very low-value transactions.

- Facilitate access to the Fetch.ai search engine: Network users will have to stake in FET to assess search and discovery capabilities of the Fetch.ai perform.

- Facilitate access to Fetch.ai’s multi-dimensional space: Agents on Fetch.ai will need agents to interact with its digital world geographically, semantically, and economically.

FET Token Allocation

As of October 15, 2020, Fetch.ai traded at $0.047499, with a market cap of $35,439,353, which placed it at #175 in the market. The token’s 24-hour volume was $4,706,418. It had a circulating supply of 746,113,681, a total and maximum supply of 1,152,997,575. FET had an all-time high of $0.0432695 (Mar 03, 2019) and an all-time high of $0.008270 (Mar 23, 2020), according to Coinmarketcap.

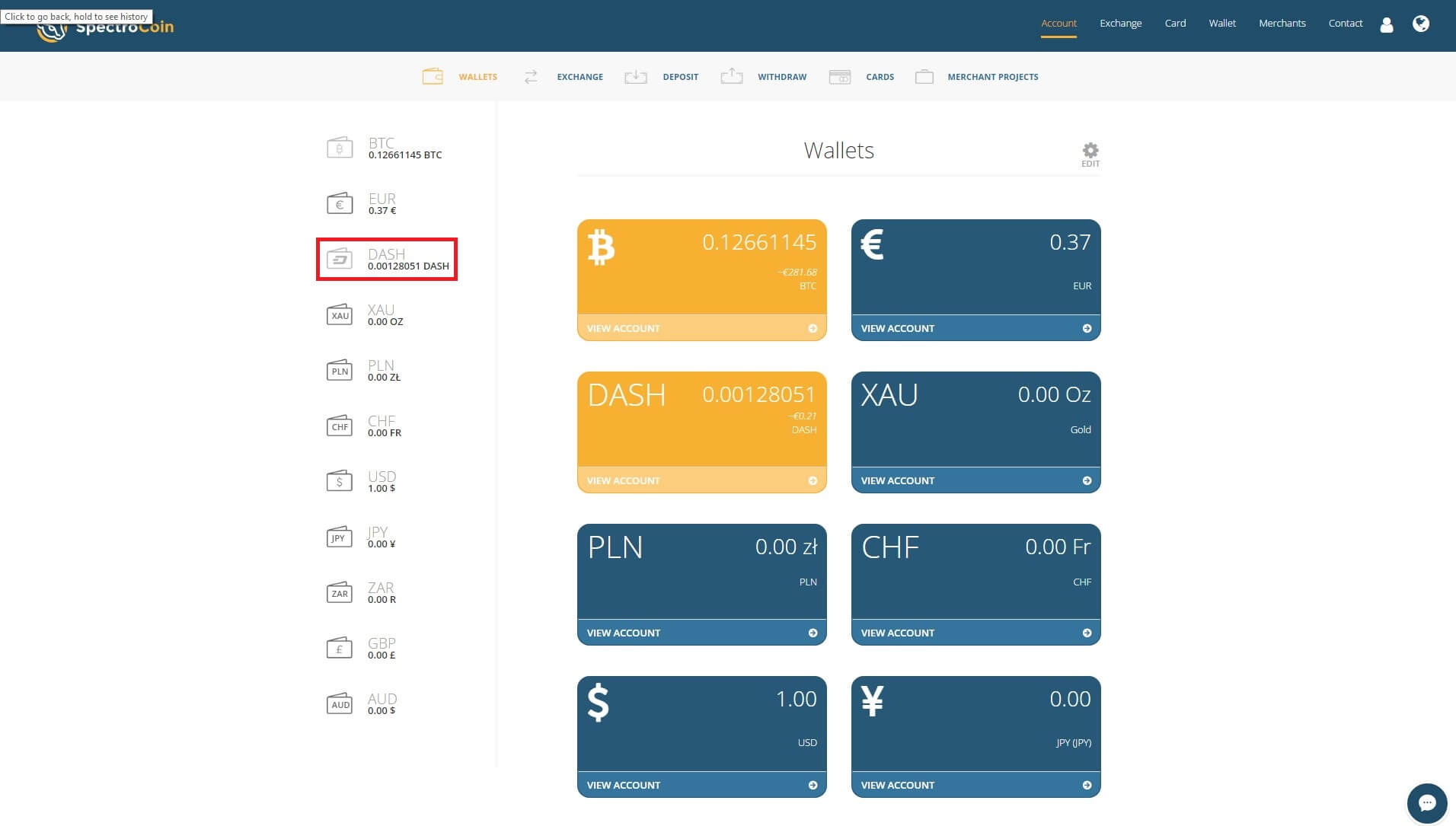

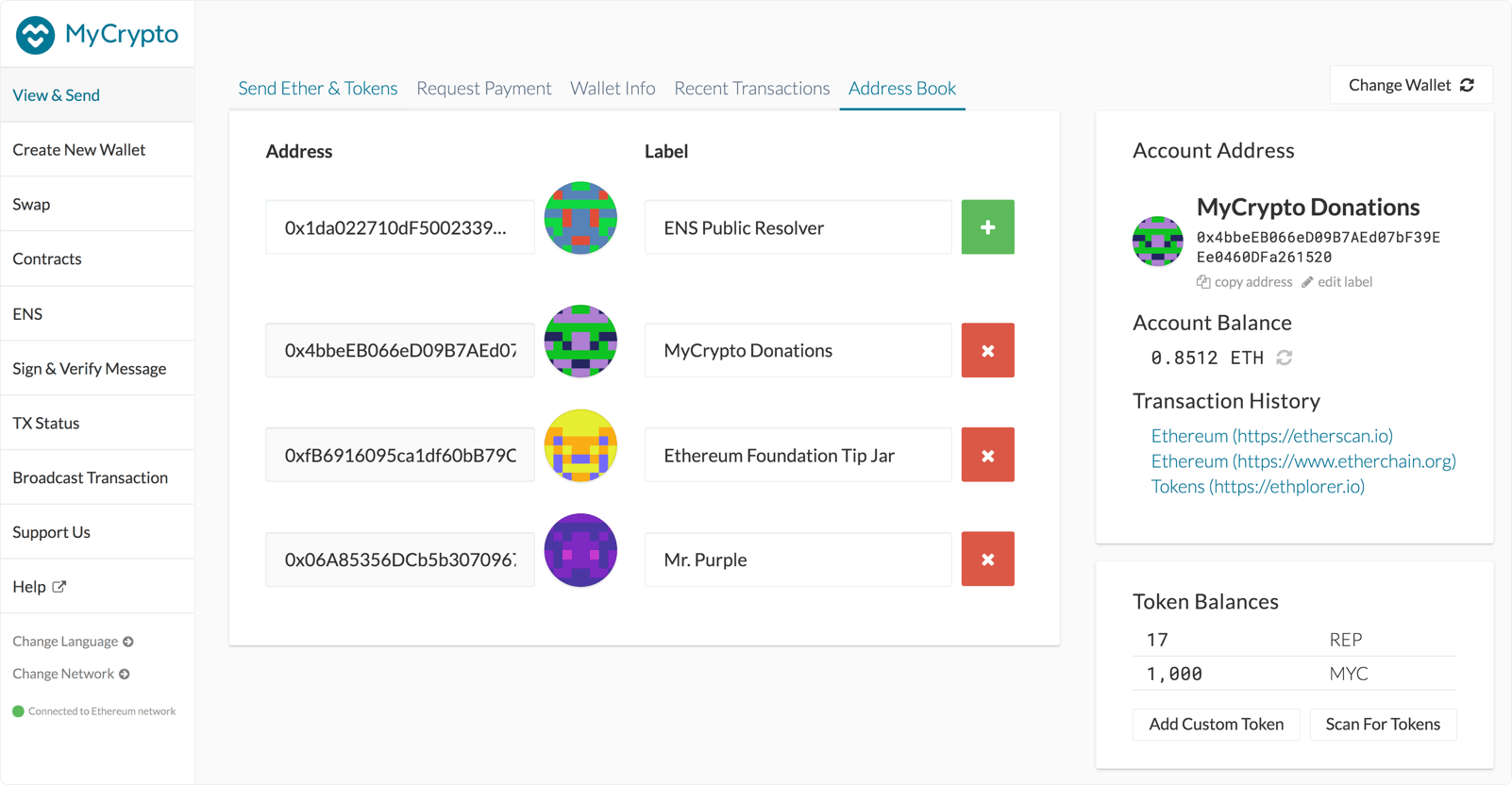

Buying and Storing FET

The FET token is currently listed on quite a variety of exchanges, including Binance, BitMax, MXC, HotBit, Bitfinex, Folgory, KuCoin, WazirX, BiKi, CoinDCX, Omgfin, IDEX, Bitsonic, Coinall, Fatbtc, Giotus, and Bitbns.

FET tokens are compatible with the ERC-20 standard and hence can be kept in any wallet supporting Ethereum. Great options include Trust Wallet, MetaMask, Ledger, ethaddress, Parity, and more. Once Fetch.ai migrates to its mainnet, token users will be able to “easily convert ERC20 FET into native FET tokens and back again.”