For the first time in history, there is the possibility of creating a new decentralized monetary system where all of us would benefit greatly. Throughout this article, it will be shown how money is being created from nothing and how Bitcoin solves the problems of the current system.

Jamie Dimon, CEO of JPMorgan, the world’s largest bank, commented that bitcoin was a bubble. In my opinion, this man being one of the only billionaire bankers earning almost 30 million a year, thanks to the current financial and banking system, it is normal that he opposes what competition does to him and can take him out of business, that is, bitcoin. The funny thing is that while Jamie Dimon was making these statements against cryptocurrency, his own bank was buying a lot of bitcoins.

Something similar happens with China, while its Central Bank wants to outlaw investments in ICOs, claiming that this new type of investment is seriously disrupting the financial and economic order, what it is doing is creating its own cryptocurrency. In fact, it is most likely the first country to create its own blockchain, since they have been experimenting for three years and have already commissioned several experts to help them carry it out.

So when this kind of negative news comes out, prices drop sharply. What happened in early September 2017 reminded me a lot of what happened last February 9 of the same year, when bitcoin plummeted by more than 10% when it became known that the Chinese Central Bank forced exchange houses to ban bitcoin withdrawals from their platforms for a month, and warned them that it would shut them down if they violated regulations.

The fact that central banks like China were so nervous about bitcoin, gave me more confidence to invest in this cryptocurrency, as the situation indicated that bitcoin should be much more powerful than most people imagined, to the extent that it could bypass the central banks, which currently have the greatest control over the economies.

A funny investment strategy would be to invest in what China prohibits, since in the past this country has banned Google, Facebook, Twitter, cloud services, Instagram, Snapchat, Pinterest, etc. So wanting to ban bitcoin, Makes me want to buy even more.

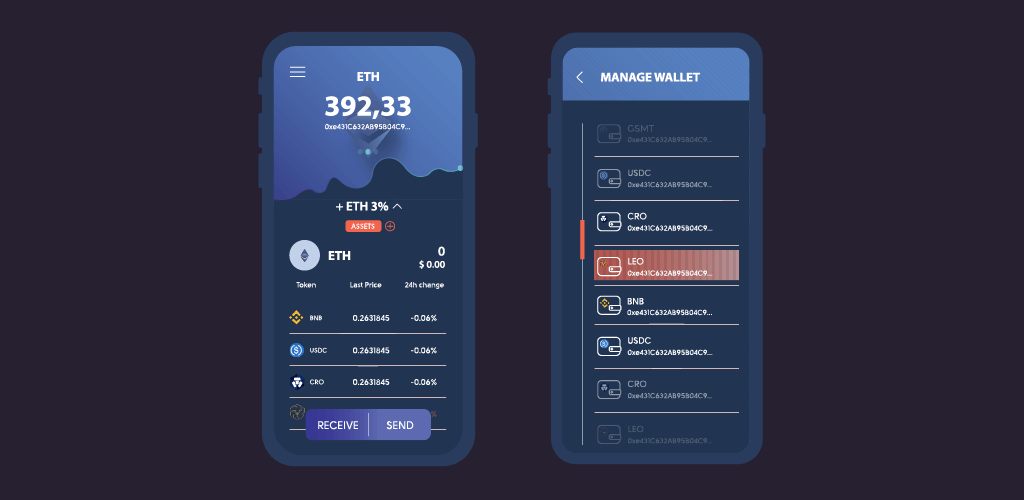

I want to point out that it is impossible to ban bitcoin or any other cryptocurrency. What governments can prohibit, is the activities of the exchange houses, that is, that these companies cannot open accounts to the citizens of the country, but they can never have any power over cryptocurrencies. In the event that a country bans these activities, its citizens could continue to have bitcoins, and from their wallets, they could continue to receive and send them. The only thing they couldn’t do is set up an account at the exchange houses.

In this way, I continue to think that prohibitions or negative comments from institutions or important people who are doing business in the traditional sector, do nothing but validate the great value of the cryptocurrency and ICOs market. So even if in the shortest term prices fall when news of this type is published, these facts will have to raise prices in the medium and long term, since this acceptance of value is what matters in the long run.

The Central Banks of other countries also start using blockchain. In the case of Russia, its central bank is also investigating and developing a blockchain. Vladimir Putin met with Vitalik Buterin, one of the founders of Ethereum, as he believes that the digital economy is essential for creating new business models, and sees Ethereum as a great tool to help Russia grow without so much dependence on oil and gas.

In this way, the Central Banks will no longer depend on monthly business surveys or the collection of data from the statistical centres, but in real-time, all the data will be available in a transparent and truthful manner, able to adapt monetary policies to an unprecedented level of precision.

But while I love to see the blockchain increasingly applied, I don’t like the central banks, banks, or governments to do it because they want to have even more control of the economy and that the current closed and centralized system will have even greater power.

How Money is Created

Governments spend more than they earn by creating deficits, and by financing it, they issue bonds, thus increasing the national debt, which we citizens pay through taxes. Banks buy these bonds and sell them to the Central Bank, with profits. To pay for this, the Central Bank, what it does, it creates money. That’s it, out of nowhere! And the banks with the money they get buy more bonds. The curious thing is that the Central Banks are private, that is, they have owners. In the case of the Fed (Banco Central Americano), its owners are also those of the big banks and oil companies. In other words, they themselves “play” with this process.

What is impressive is that more than 90% of the money is created not by the Central Banks, but by the banking system. Let’s take an example: With the money that the government obtains, it pays the salary to a soldier (most countries spend inordinately in wars), this soldier deposits 100€ to the bank. The bank keeps 10€ and 90€ it lends to Antonio. (In this case, the reserve ratio, which is the portion of deposits of a bank that must be kept in liquid reserves, is 10%). Well, from 100€ there are now 190€. Let’s continue: Antonio buys a t-shirt with his 90€, and David, who is the seller, deposits this money to the bank. Automatically, the bank again lends 90%, or 81€, so now there are 271€.

This is repeated, making an initial deposit of €100 can be converted to €1,000. And the truth is that the reserve ratio has typically been around 3% or 4%, causing even more money to be created than described in this example.

All this leads to inflation, because the more money there is in circulation, the higher the prices. In fact, the real definition of inflation should be the increase in circulating money, with rising prices simply being the symptom. So as you can see, people work in exchange for this money, which is printed or simply created by typing into a computer. Truly, each one’s wealth is his time.

To finish the process of creating money that we have just seen, what happens is that a large part of the money that is received goes into taxes. The collection of this money goes to the government to be able to pay the principal and interest of the bonds that they issue, that they possess the Central Bank, that as I have explained, they have bought previously creating the money.

During the process, interest is paid on government bonds issued and also on loans given by banks. This means that there is an intrinsic interest in every euro that exists, being a debt-based system.

To make it clear, let’s look at this example: suppose there is only one euro on the planet, and they lend it to you in exchange for interest (you have to return this euro + another euro of interest), where do you get this other euro to pay the interest? The answer is that you have to borrow this other euro, which obviously will also leave you with interest (owing this to other euro + one euro interest). So now there are 2 euros, but you owe 4.

In other words, there is never enough money to pay off the debt having there is always much more debt in the system than the money there is to pay it. The point is that with the current monetary system, debt cannot be stopped, because otherwise new money would not be created that is needed to pay off debts. In short, the inflation that results from this system is like a hidden tax that we all pay.

Currencies vs Money. Why Bitcoin

So, in view of the above, for me, the euro or any other conventional currency is not money, since one of the properties that I believe should have money is the preservation of value over time because there is a limited amount without it being possible to create new monetary units.

In this way, for me, the euro (and all other conventional currencies) is a currency in which it is better not to have our assets. I want to point out that throughout history and in any region, there have been more than 5,000 FIAT coins (which are not backed by gold or anything). The statistics are overwhelming: 100% of them have ended up worth 0. Yes, all of them!

What I do consider money is gold as it meets all the requirements to be considered money. I had always considered this metal as the best form of existing money until recently bitcoin was born. I consider bitcoin to be like digital gold, because looking at it well, I realize that it works even better than gold as money. Let us see according to the characteristics that the money must have:

Generally accepted: In this case, the bitcoin at the moment has nothing to do against gold, but therein lies the great opportunity to invest in bitcoins today, that if it becomes generally accepted by society, its price will have risen dramatically from current levels.

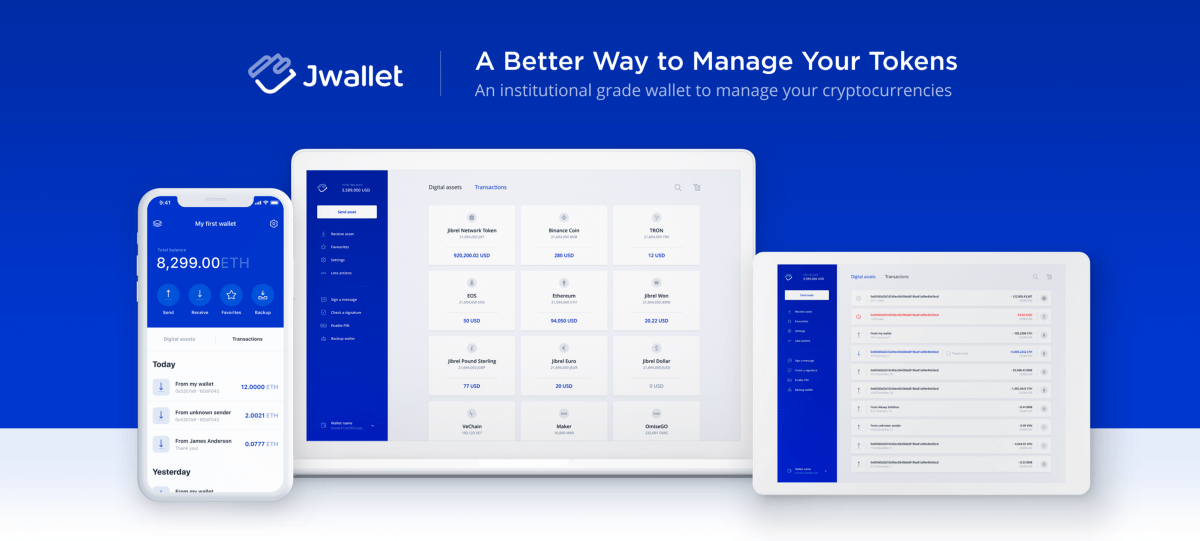

Portability (easily transported): With Bitcoins, I could carry billions of dollars on my mobile, pen, or app.

Indestructibility/durability: Bitcoin has no limitations or physical deterioration, within a million years every bitcoin will be exactly the same.

Homogeneity (All coins of the same quality, same weight, or same value): Undoubtedly, each bitcoin is exactly the same as another.

Divisibility: Bitcoin is divided up to 8 decimal places, with each bitcoin having 100 million units that are exactly the same.

Limited amount: There will never be more than 21 million bitcoins.

Difficult to fake or copy: It is impossible to create fake bitcoins, it is impossible for the blockchain system to accept them.

Given this, it stands to reason that bitcoin can become the money of reference. The problem that has existed recently with gold is that it is heavily manipulated by banks and central banks because it is not in their interest for them to revalue themselves and for the population to prefer to use this type of money instead of the currencies like the euro that they can print unlimited. So, without a doubt, another advantage of bitcoin over gold, is that it cannot be manipulated or controlled by anyone.

Throughout history, all empires have followed the same pattern:

-You start using good money (gold, silver, or gold-backed coins).

-Taxes are imposed and public works are created.

-As the economy grows, politics is increasingly influential, and spending on armies is rising sharply.

-Normally there are wars and expenses are enormous.

To finance the war, they “steal” the wealth of citizens by degrading the value of coins with conventional metals (in our case, today, the euros are made of nickel, steel, copper, aluminum, zinc, and tin. If we melted a 2 euro coin, the value of the material would barely exceed 2 cents). In this way, in every empire, there always comes a time when money can be created unlimitedly. It is usually followed by an economic crisis.

The loss of purchasing power is perceived by the population as prices rise, and confidence in the currency is lost. (We are currently at this point. It is not uncommon to hear on the street “politicians are thieves”, “banks are scammers”… In addition, today, with the internet, I think it will take less time to move to the next phase.)

There is a large movement of money from currencies to precious metals or other tangible assets. The currency falls into nothing, and assets like gold and silver go up a lot in price by hoarding the value that was in the currency. This great transfer of wealth benefits those who have real money, such as gold or bitcoins. And this is the interesting point: whoever owns bitcoins can rest assured that he will maintain his purchasing power and if the day of the great transfer of value comes, then he will benefit greatly.

Changes in the Monetary System – What’s Next?

Let’s see what changes have taken place in the global monetary system in the last century and a half:

- Gold-Standard (1879-1914): each dollar is backed by the equivalent value in gold (100%)

- Gold Exchange Standard (1914-1944): the dollar is partially backed by gold. (40%)

- Bretton Woods System (1944-1971): Virtually every currency in the world is backed by the dollar, with a fixed exchange rate. The dollar also continues to be partially backed by gold.

- Dollar-pattern (1971-present): the dollar completely abandons the backing of gold (0%). This means that all other currencies, too.

Seeing that the previous monetary systems lasted 35, 30, and 27 years respectively and that now we have already 46 years with the Pattern-Dollar, it is not uncommon to think that it is time for the current system to change and that possibly in the future we will find the point “5)” starting in this decade, to be called something like “Pattern-Decentralized”, representing the new model with bitcoin and other cryptocurrencies.

As for the acceptance of Bitcoin, today there are already many large companies that accept it, such as Microsoft, Tesla, Dell, Paypal, Subway, WordPress, Expedia, Bloomberg, Virgin, Zynga, Lionsgate, Rakuten, Victoria’s Secret, etc.. in fact there are thousands and it grows exponentially. Right here in Spain, the Red Lyra consortium was formed a few months ago, where companies such as Santander, BBVA, B.Sabadell, Bankia, Iberdrola or Endesa are entering this sector. The same applies to other consortia, with companies such as IBM, Samsung, Intel, Cisco, JPMorgan, Accenture, Deloitte, SAP, Airbus, and hundreds more.

How can we take advantage of all this? Very simple, investing in Bitcoins. The most sensible thing would be to have much of the personal wealth in assets such as real estate or precious metals such as gold. Now, I think a part should be kept in Bitcoins and by the way, some other cryptocurrencies in particular. The cryptocurrency market is full of opportunities.