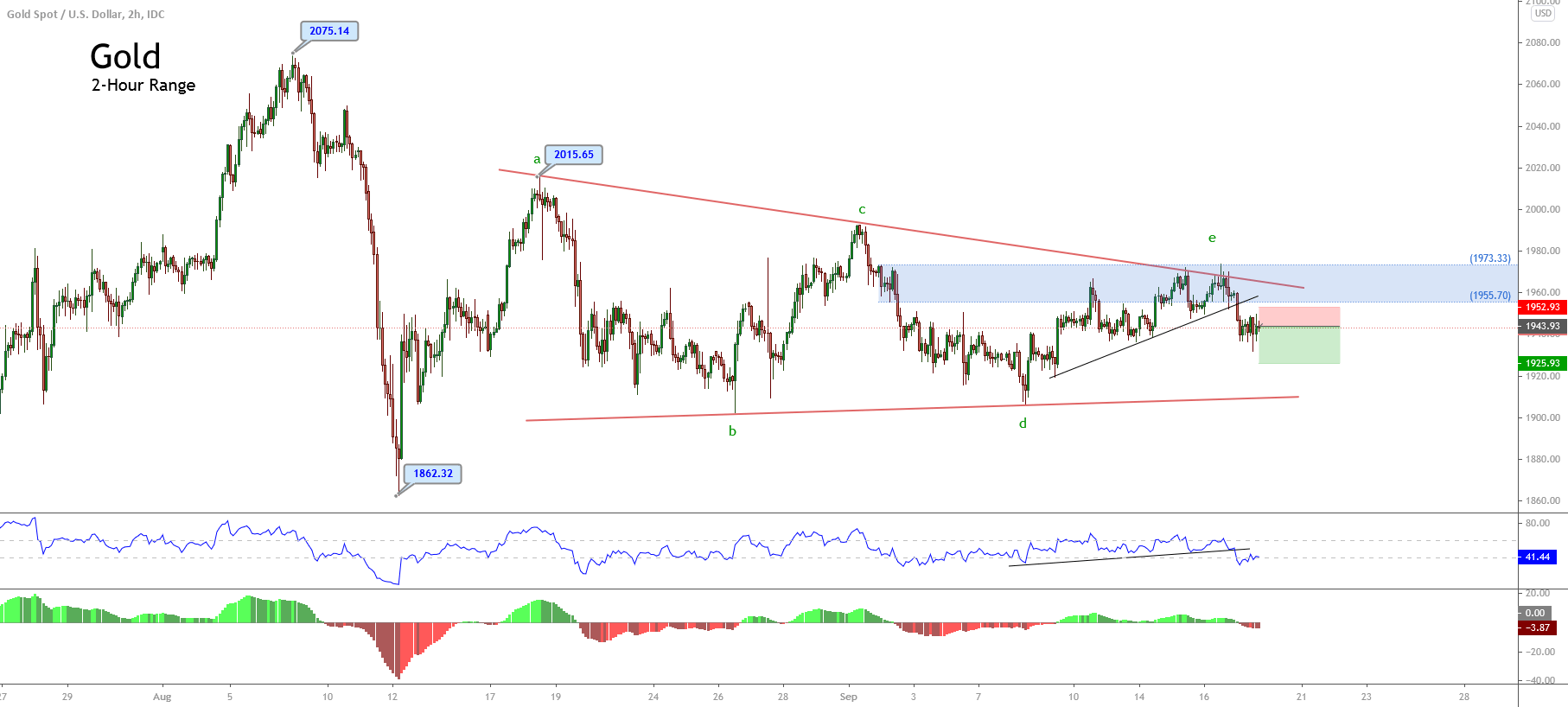

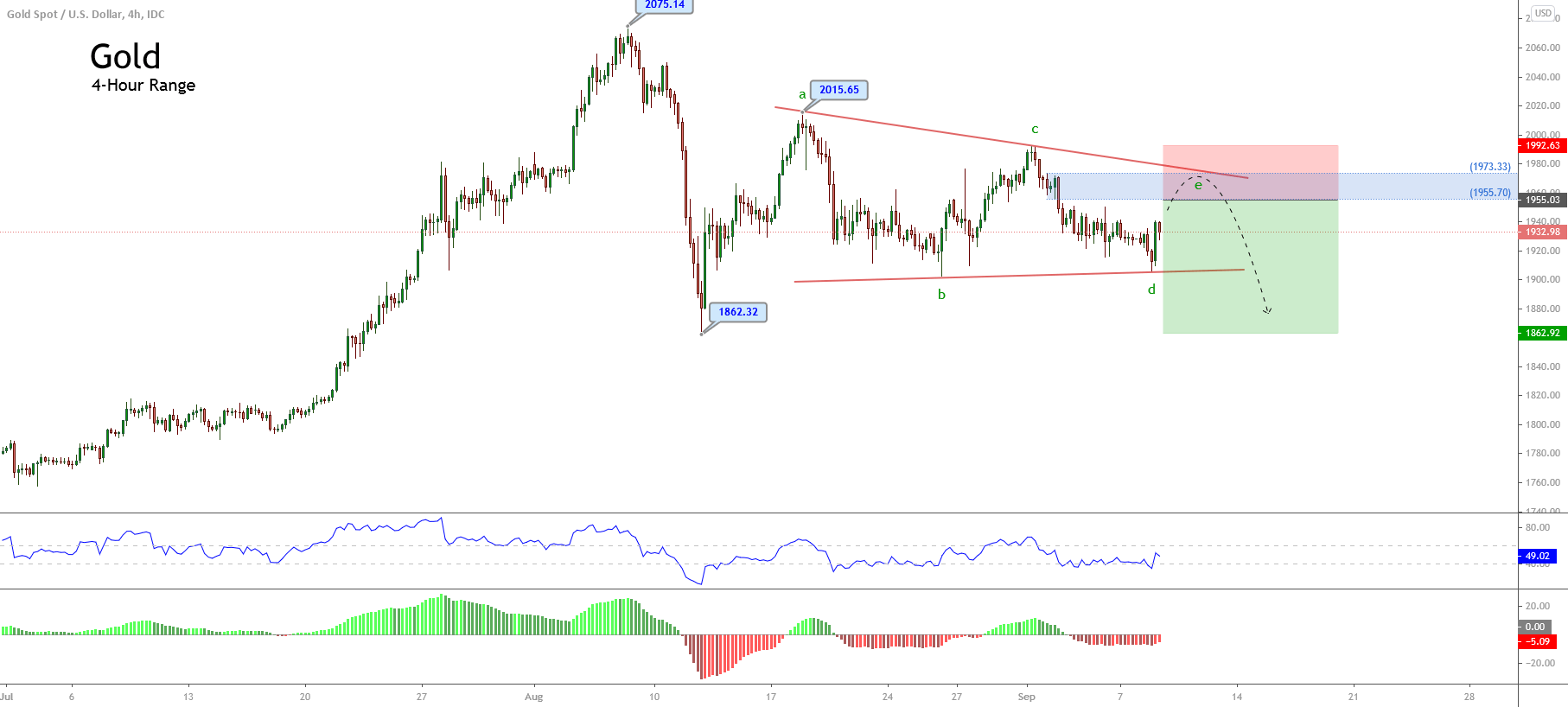

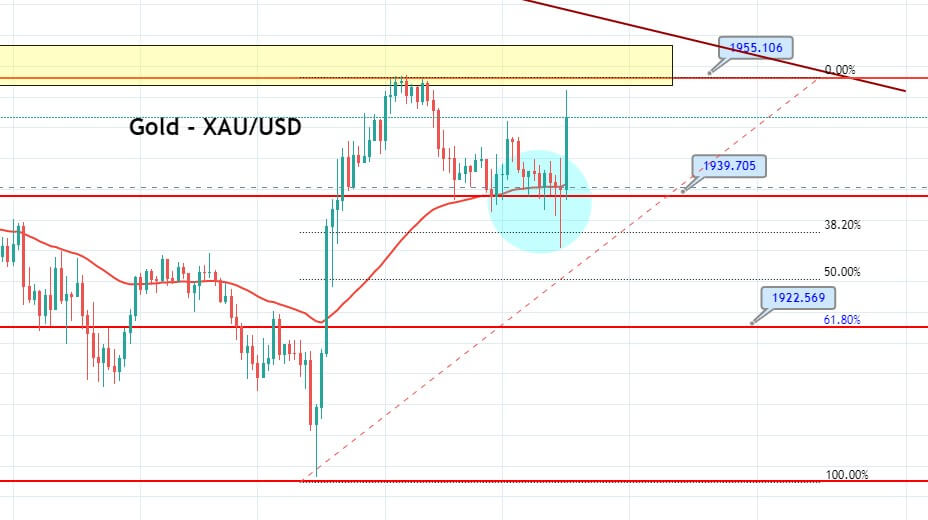

The safe-haven-metal prices failed to stop its previous session losing streak and catch further offers near below $1,900 level, mainly due to the broad-based U.S. dollar strength triggered by the risk-off market sentiment. Thus, the broad-based U.S. dollar strength from the multi-month low could be recognized as one of the main causes behind the yellow-metal latest weakness as the market’s risk-off wave tend to prefer the U.S. dollar above all, which in turn has an inverse correlation with the safe-haven yellow metal. The losses in the safe-haven U.S. dollar could be short-lived or temporary as the second wave of coronavirus continuously picks up the pace, which fuels worries over the U.S. economic recovery.

On the contrary, the market risk-off sentiment, triggered by the reappearance of coronavirus cases, becomes key factors that kept a check on any additional losses in the gold. Apart from this, the on-going US-China tussle over the South China Sea might also help the gold prices to limit its deeper losses. As of writing, the yellow metal prices are currently trading at 1,901.96 and consolidates in the range between the 1,894.90 – 1,919.90.

As we all know, the market risk tone has been sour since the day started, and the reason could be associated with the long-lasting US-China tussle and growing market worries about the ever-increasing number of coronavirus cases. Elsewhere, the risk-off market sentiment was further bolstered by the long-lasting tussle between the United States and China, which became further soured after U.S. Secretary of State Mike Pompeo took helps from France, Germany, and the U.K. to reject China’s claims of the South China Sea at the United Nations (U.N.). This eventually placed a downside pressure on the market trading sentiment and underpinned the safe-haven assets.

Apart from the Sino-American tussle, the expectations that the much-awaited U.S. phase 4 fiscal package will also be delayed favored the risk-off market. The U.S. dollar succeeded in stopping its early-day losses and took the safe-haven bids on the day amid market risk-off sentiment. However, the U.S. dollar gains could be short-lived or temporary due to the worries that the economic growth in the U.S. could be stopped because of the reappearance of coronavirus cases. However, the U.S. dollar gains kept the gold prices under pressure as the price of gold is inversely related to the price of the U.S. dollar. Whereas, the U.S. Dollar Index, which tracks the greenback against a basket of other currencies, edged higher 0.04% to 93.602 by 9:48 PM ET (1:48 AM GMT).

Looking forward, the market players will keep their eyes on the comments from the U.S. Federal Reserve Chairman Jerome Powell and other Fed policymakers. Meanwhile, the on-going drama surrounding the US-China relations and updates about the U.S. stimulus package will not lose its importance. Given the holiday in Japan, due to the Autumnal Equinox Day, coupled with an absence of major data/events, the USD moves and coronavirus headline will be key to watch.

Daily Support and Resistance

S1 1920.66

S2 1941.35

S3 1950.45

Pivot Point 1962.04

R1 1971.14

R2 1982.73

R3 2003.42

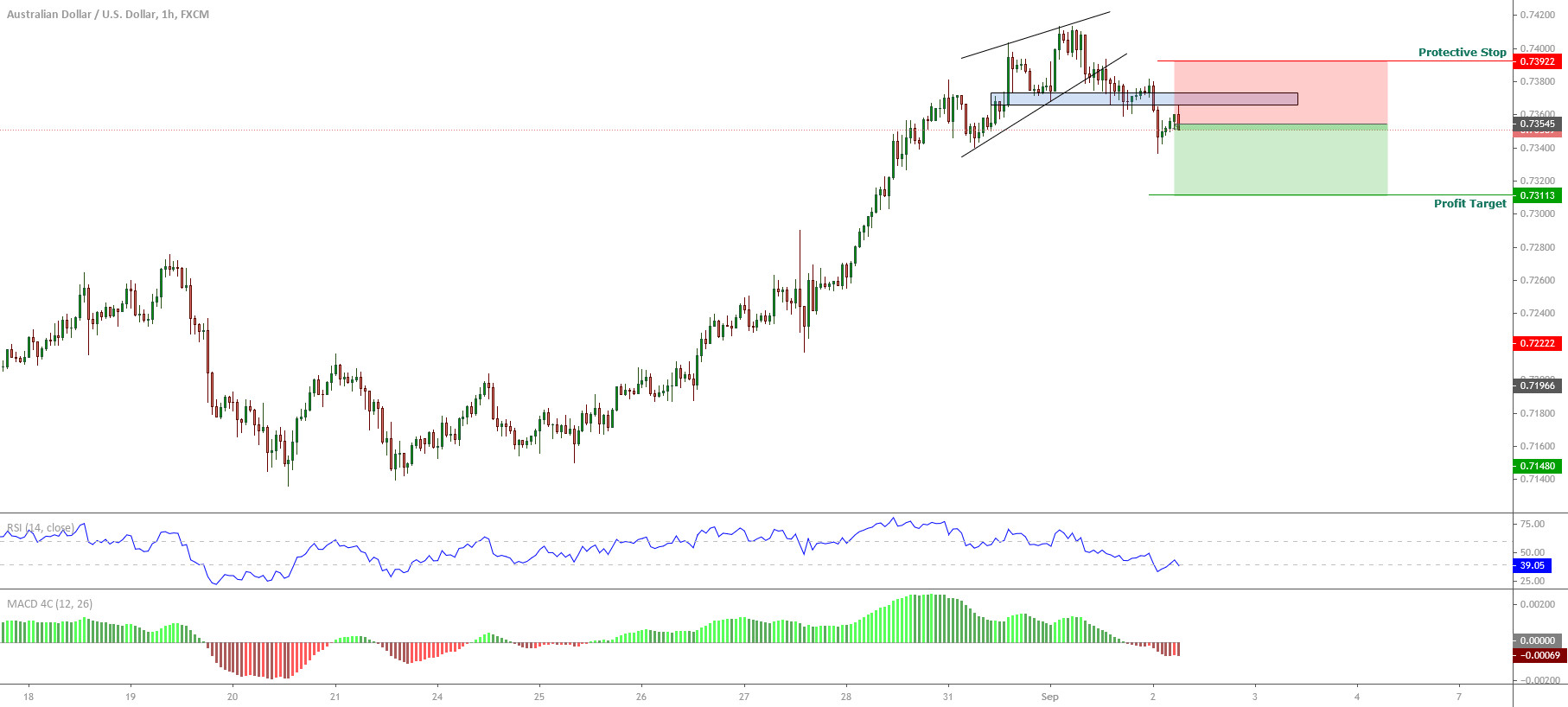

Gold prices dropped distinctly from 1,935 mark to 1,888 level in the wake of the hawkish Fed Chair Jerome Powell’s speech. The precious metal is currently jumping off to achieve 38.2% Fibonacci retracement at 1,914, and beyond this, the following resistance lingers at 1,921 and 1,930. Let’s keep a focus on 1,907 today as gold can trade bullish beyond this and bearish beneath the same level today. Good luck!