During Wednesday’s early European trading session, the USD/JPY currency pair failed to stop its Asian session bearish moves and dropped further near 105.30 level mainly due to the broad-based U.S. dollar weakness, triggered by the cautious mood of traders ahead of the Federal Open Market Committee (FOMC) meeting. Moreover, backed by the recently positive coronavirus (COVID-19) vaccine news, the upbeat market sentiment also weighed on the safe-haven U.S. dollar.

Across the ocean, the currency pair’s losses were further bolstered after the upbeat Japanese Industrial Production details, which eventually underpinned the Japanese yen and contr3bited to the currency pair losses. Apart from this, the latest positive headline that the world’s 3rd-largest economy is gradually overcoming the coronavirus (COVID-19) pandemic also boosted the yen currency and dragged the currency pair down. On the contrary, the latest optimism over a potential vaccine for the highly contagious coronavirus disease keeps supporting the market trading sentiment, which undermined the safe-haven Japanese yen and became the key factor that cap further downside for the currency pair.

Many factors tend to undermine the U.S. dollar. Be it the ongoing impasse over the next round of the U.S. fiscal stimulus or the upbeat market sentiment, not to forget traders’ cautious mood ahead of the Federal Open Market Committee (FOMC) meeting. However, the market trading sentiment was remained supported by optimism over a potential vaccine for the highly contagious coronavirus disease.

Meanwhile, the U.S. and China’s positive data, which suggests gradual recoveries in global economics, also boosted the market trading tone. Detail Suggested, China’s Industrial Production and Retail Sales surpassed forecasts for August, the U.S. NY Empire State Manufacturing Index also recovered to 17.00 and pleased the optimists.

As in result, the broad-based U.S. dollar failed to keep its overnight gains and edged lower on the day mainly due to the risk-on market sentiment. Moreover, the U.S. dollar losses could also be associated with cautious sentiment ahead of the U.S. Federal Reserve’s policy meeting, which is scheduled to take place on the day. However, the losses in the U.S. dollar kept the USD/JPY currency pair under pressure.. Whereas, the U.S. Dollar Index Futures that tracks the greenback against a bucket of other currencies dropped by 0.03% to 93.085 by 9:76 PM ET (2:57 AM GMT), giving up some earlier gains.

The upbeat Industrial Production details remained supportive of the Japanese yen at home, which kept the currency pair down. At the data front, Japan’s August month Merchandise Trade Balance Total rose to ¥248.3 B versus ¥-37.5 B market consensus and ¥10.9 B (revised). Further details suggest the Imports dropped below -18% YoY forecast to -20.8, whereas Exports recovered from -16.1% to -14.8% in the reported month.

Besides, the positive news suggesting that the world’s 3rd-largest economy is gradually overcoming the coronavirus (COVID-19) pandemic also underpinned the Japanese yen. Across the pond, the upbeat market tone, supported by multiple factors, tends to undermine the safe-haven Japanese yen and becomes the key factor that helps the currency pair limit its deeper losses.

Looking ahead, the Bank of Japan is also scheduled to announce its policy decision on Thursday, which will key to watch for the fresh direction in the pair. Meanwhile, the market traders will keep their eyes on Japan’s trade numbers and Aussie housing data. Whereas, investors are also looking to the U.S. Federal Reserve’s policy meeting, scheduled to take place on the day. Meanwhile, New Zealand’s Current Account and the Pre-Election Economic and Fiscal Update (PREFU) will also key to watch. All in all, the updates surrounding the Brexit, virus, and US-China tussle will not lose their importance.

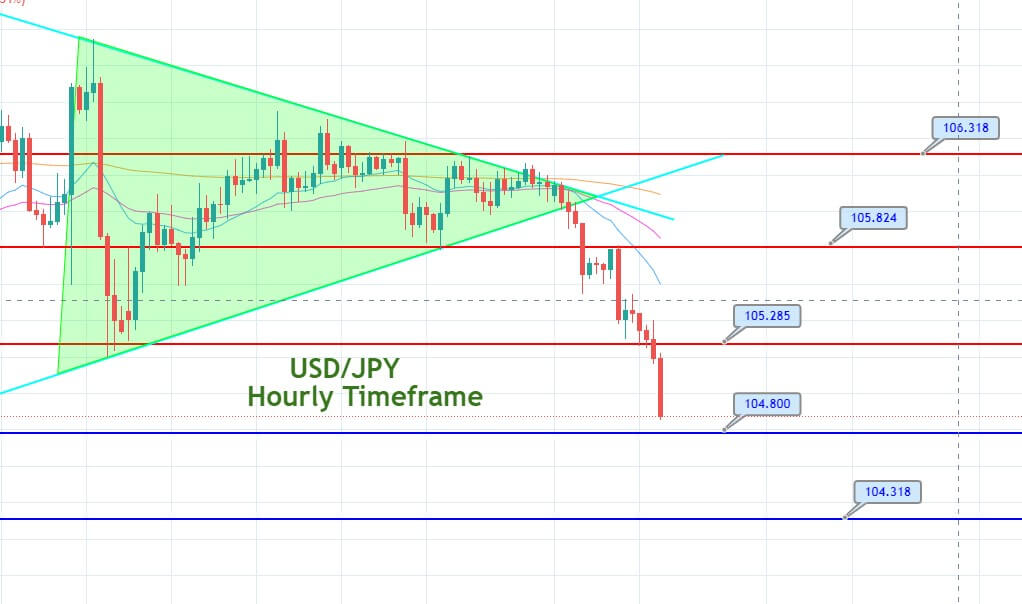

The USD/JPY currency pair has dropped sharply amid increased safe-haven appeal and weakness in the U.S. dollar. The pair fell from 105.800 to 104.860 level, and now it’s facing resistance at 105.285 level. On the lower side, the USD/JPY pair may drop until 104.800 and 104.318. Good luck!

Entry Price – Sell 104.98

Stop Loss – 105.38

Take Profit – 104.58

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US