Today in the early European trading session, the AUD/USD currency pair extended its Asian session winning streak and took further bids around an intraday high closer to 0.7200 level mainly due to the risk-on market sentiment, backed by the on-going optimism over treatment for the highly infectious coronavirus. Moreover, the expectations of U.S. stimulus also favored the market’s risk-on, which underpinned the perceived risk currency Australian dollar and contributed to the currency pair gains.

Besides this, the currency pair got an extra boost mainly after the welcome number of China PMIs and US ADP, which extended further support to the market trading sentiment. Across the pond, the broad-based U.S. dollar weakness, triggered by the market risk-on tone, also played a significant role in supporting the currency pair. On the contrary, the renewed tension between the US-China, as well as, the rising COVID-19 cases all over the Europe and U.S. keeps challenging the upbeat market mood and becomes the key factor that keeps the lid on any additional gains in the currency pair. At this time, the AUD/USD currency pair is currently trading at 0.7 86and consolidating in the range between 0.7155 – 0.7198.

However, the reason for the risk-on market sentiment could be associated with the renewed probabilities of the further stimulus package as well as the hopes of the coronavirus (COVID-19) vaccine also favoured the market risk tone, which tends to underpin the perceived risk currency Australian dollar and helps the pair to put strong bids. The U.S. Congress tries hard to agree on the coronavirus (COVID-19) aid package with Republicans up for $1.5-$1.6 trillion against Democratic demand of $2.2 trillion. While the immediate discussions have failed, the policymakers pushed back the final voting on the stopgap funding, giving indirect hints of one more day for the politicians to agree on the much-awaited stimulus. Across the pond, the call of the Japanese stimulus also helps the risk-tone sentiment on the day.

On the other hand, the market trading sentiment was further bolstered by optimism over a possible vaccine and treatment for the highly infectious coronavirus. Furthermore, the Brexit-positive sentiment, backed by the reports suggesting that the E.U. stepped back from warnings to leave the trade and security talks, also exerted a positive impact on the market trading sentiment. This, in turn, underpinned the perceived risk currency Australian dollar and contributed to the currency pair gains.

As in result, the Wall Street benchmark succeeded to extend its overnight positive tone, despite stepping back during the last hour. While the U.S. 10-year Treasury yields also gained over 4-basis points (bps) to 0.686% on the day. The U.S. dollar remains depressed during the Asian session amid market risk-on sentiment. On the other hand, the cautious mood of traders ahead of the U.S. presidential election also weighed on the U.S. dollar.

The fears of the coronavirus (COVID-19) and political uncertainty are also challenging the market risk-on tone, which becomes the key factor that kept the lid on any additional gains in the currency pair. Elsewhere, the rising COVID-19 cases are causing major problems all over the U.S., Europe, and the U.K., which keep fueling the fears of lockdown restriction. As per the latest report, the coronavirus has infected more than 7.2 million and killed more than 206,000 people in the United States.

Looking ahead, the market traders will keep their focus on the key US ISM Manufacturing PMI for September, and the weekly Jobless Claims data. Across the pond, Australia’s AiG Performance Mfg Index and Commonwealth Bank Manufacturing PMI will also be key to watch. Whereas, the headlines concerning Brexit, pandemic, and the U.S. Presidential Election will not lose their importance.

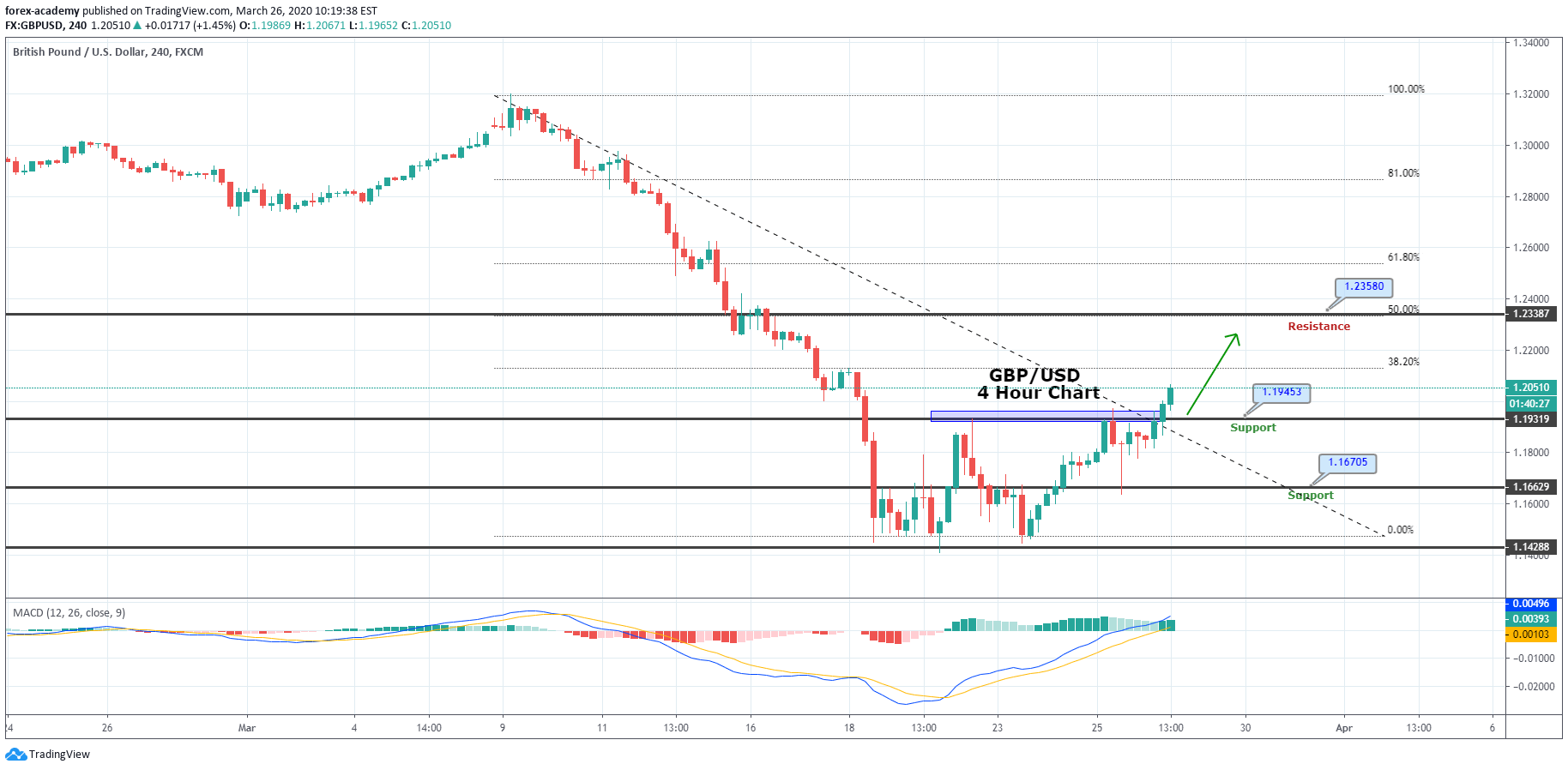

Daily Support and Resistance

S1 0.7025

S2 0.7106

S3 0.7137

Pivot Point 0.7186

R1 0.7217

R2 0.7266

R3 0.7346

The AUD/USD has violated the double top resistance level of 0.7142, and bullish crossover of this level makes 0.7142 a support for the AUD/USD pair. On the higher side, the AUD/USD pair may go after the next resistance area of 0.7235 level. Conversely, the bearish breakout of 0.7142 may drive further selling until 0.7084. Bullish bias seems stronger today.

Entry Price – Buy 0.71844

Stop Loss – 0.71444

Take Profit – 0.72244

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US