The GBP/USD trades bullish around 1.2030 in the wake of less dovish than expected monetary policy decisions. The central bank left the interest rate unchanged at 0.10%. However, it has warned that the measure and term of the economic collapse arising from the coronavirus pandemic will be “wide and dramatic but should eventually prove short-lived.”

The BOE Monetary Policy Committee (MPC) fixes monetary policy to reach the 2% inflation mark and whereby advocates to support growth and employment. In that context, its challenge over recent weeks has been to return to the severe economic and financial disorder produced by the spread of Covid-19.

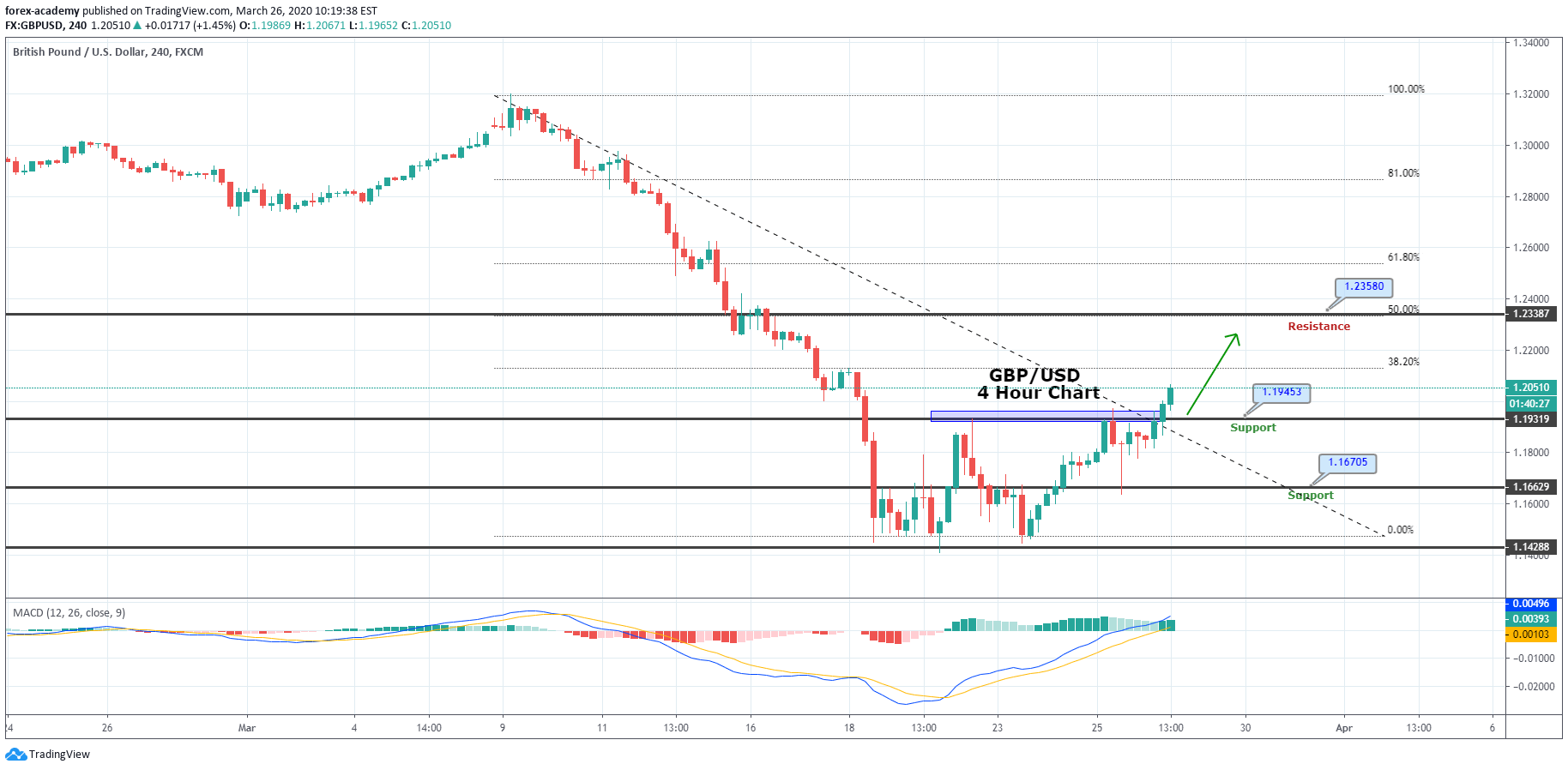

Technically, the GBP/USD pair has violated the double top resistance level of 1.1930 level on the 4-hour chart. Closing of candles above this confirms bullish breakout and opens up further room for buying until 38.2% Fibonacci resistance level of 1.2135. At the same time, the MACD is also staying in a bullish zone. Support can be found around the 1.1946 zones.

Entry Price: Buy at 1.20286

Take Profit 1.21686

Stop Loss 1.19086

Risk/Reward 1.17

Profit & Loss Per Standard Lot = -$1200/ +$1400

Profit & Loss Per Micro Lot = -$120/ +$140