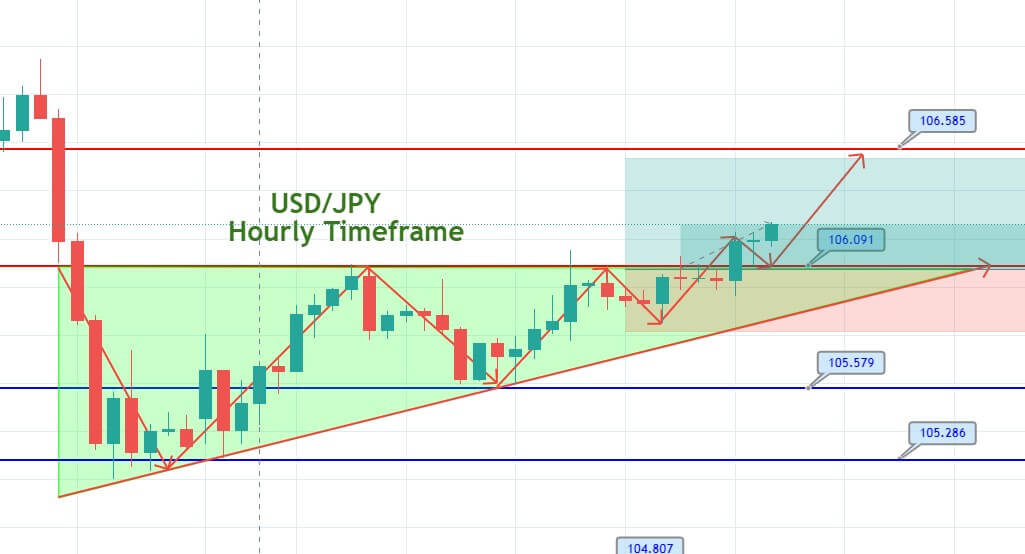

The USD/JPY has violated the ascending triangle pattern at 106.08 level, and it may head further higher until the next target level of 106.500 level. On the data front, at 04:30 GMT, the Unemployment Rate from Japan dropped to 2.9% from the expected 3.0% in July and supported the Japanese Yen. At 04:50 GMT, the Capital Spending from Japan dropped by -11.3% against the estimated -4.0% and weighed heavily on the Japanese Yen. At -5:30 GMT, the Final Manufacturing PMI for August from Japan expanded to 47.2 against the projected 46.6 and supported the Japanese Yen.

The strong data from Japan supported the safe-haven Japanese Yen and weighed on the USD/JPY pair that kept the currency pair’s gains on Tuesday. Meanwhile, from the U.S. side, the Final Manufacturing PMI in August dropped to 53.1 from the anticipated 53.6 and weighed on the U.S. dollar. Whereas, the highly awaited ISM Manufacturing PMI for August that was released at 19:00 GMT, advanced to 56.0 against the estimated 54.6, and supported the U.S. dollar that helped the USD/JPY pair’s bullish trend on Tuesday.

Moreover, the Construction Spending from the U.S. in July declined to 0.1% from the expected 1.0% and weighed on the U.S. dollar. The ISM Manufacturing Prices in August increased to 59.5 from July’s 53.2. The Wards Total Vehicle Sales from the U.S. came in as 15.2M against the expected 15M and supported the U.S. dollar added in the gains of USD/JPY.

Furthermore, on Tuesday, the U.S. dollar also gained some traction after the comment from the Fed Governor Lael Brainard, who said that to overcome the impact of coronavirus from the economy, the central bank would have to roll out new efforts. She also said that the Fed should adopt an aggressive approach to live up to its promise of stronger job growth and higher inflation. She also stressed the important role massive asset purchases would play in achieving the new policy shift’s targeted goals.

The USD/JPY prices may continue to trade higher until the 106.550 level. The pair has violated the ascending triangle pattern at 106, and above this, the USD/JPY may trade bullish. The MACD and RSI are both suggesting a buying trend. Let’s consider taking buying trade today.

Entry Price – Buy 106.199

Stop Loss – 105.799

Take Profit – 106.599

Risk to Reward – 1:1

Profit & Loss Per Standard Lot = -$400/ +$400

Profit & Loss Per Micro Lot = -$40/ +$40

Fellas, now you can check out forex trading signals via Forex Academy mobile app. Follow the links below.

iPhone Users: https://apps.apple.com/es/app/fasignals/id1521281368

Andriod Users: https://play.google.com/store/apps/details?id=academy.forex.thesignal&hl=en_US