The assumption in some quarters is that cryptocurrencies will replace gold as money, or at least challenge it. This is a mistake that comes from a misunderstanding of exchange theory ( is a theory of how a free market fixes prices and trade in a spontaneous mechanism, which normally takes place without the need for common or planned objectives between economic operators). We must also know that in addition to a few European countries and North America, gold is money that is firmly in the minds of ordinary people.

Some economists have concluded that cryptocurrencies are probably the purest form of financial bubble in all the history of speculation, and will end up being of great theoretical interest to the next generations, as will the phenomenon of the tulip bubble.

Some economists have concluded that cryptocurrencies are probably the purest form of financial bubble in all the history of speculation, and will end up being of great theoretical interest to the next generations, as will the phenomenon of the tulip bubble.

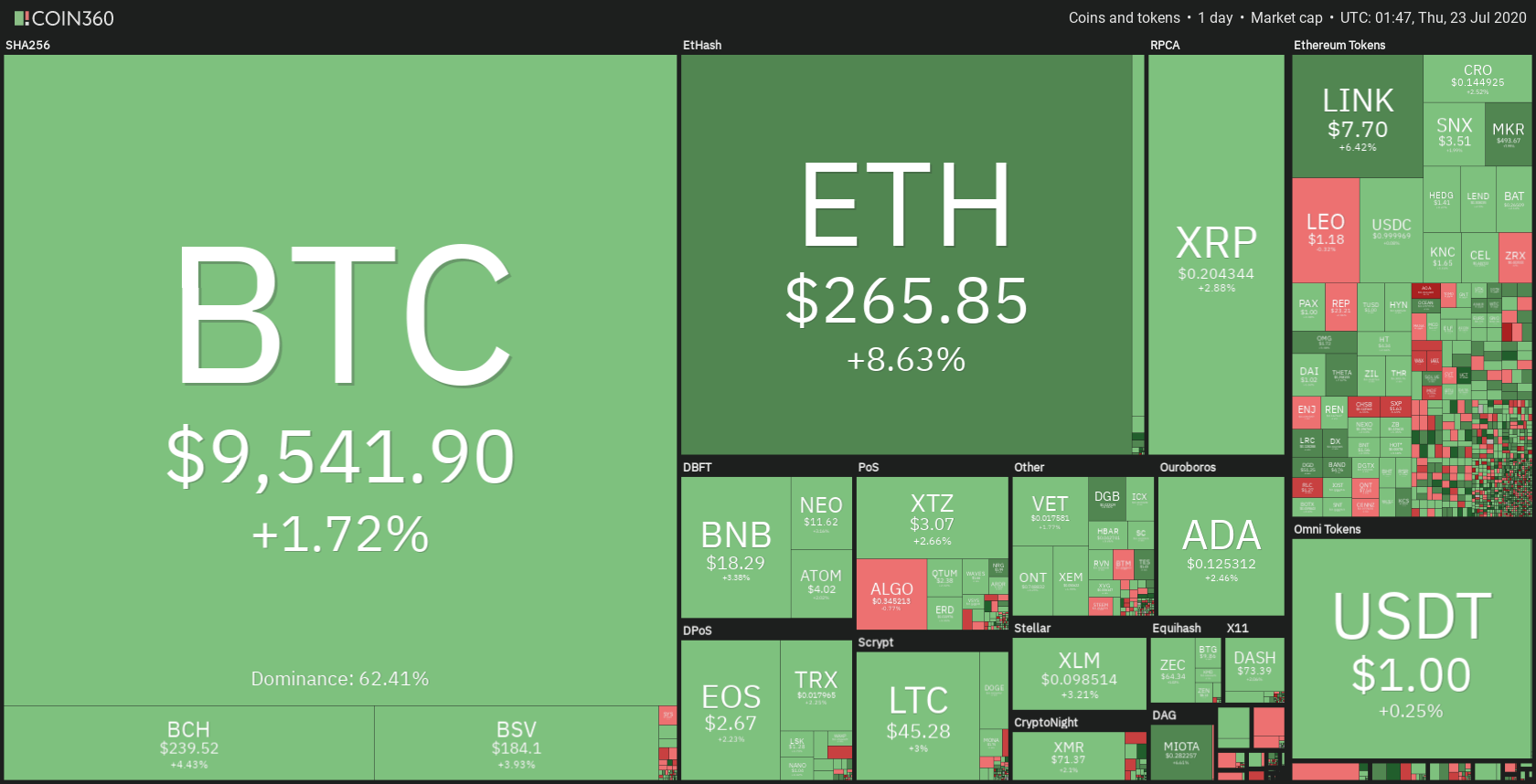

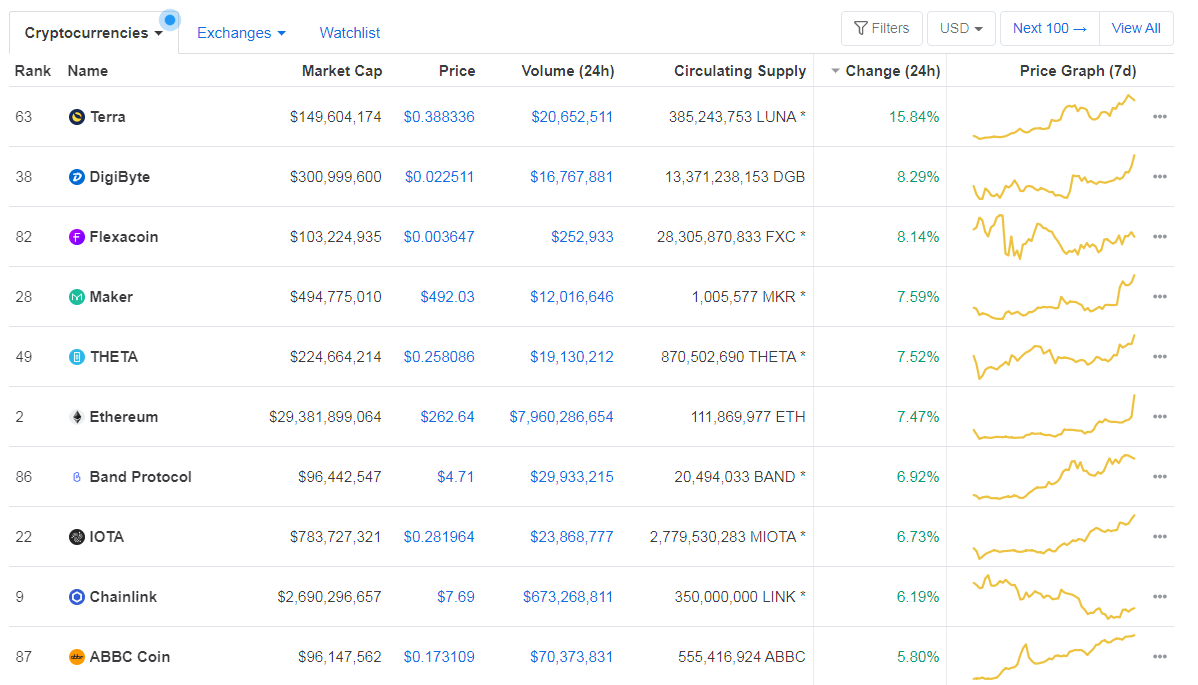

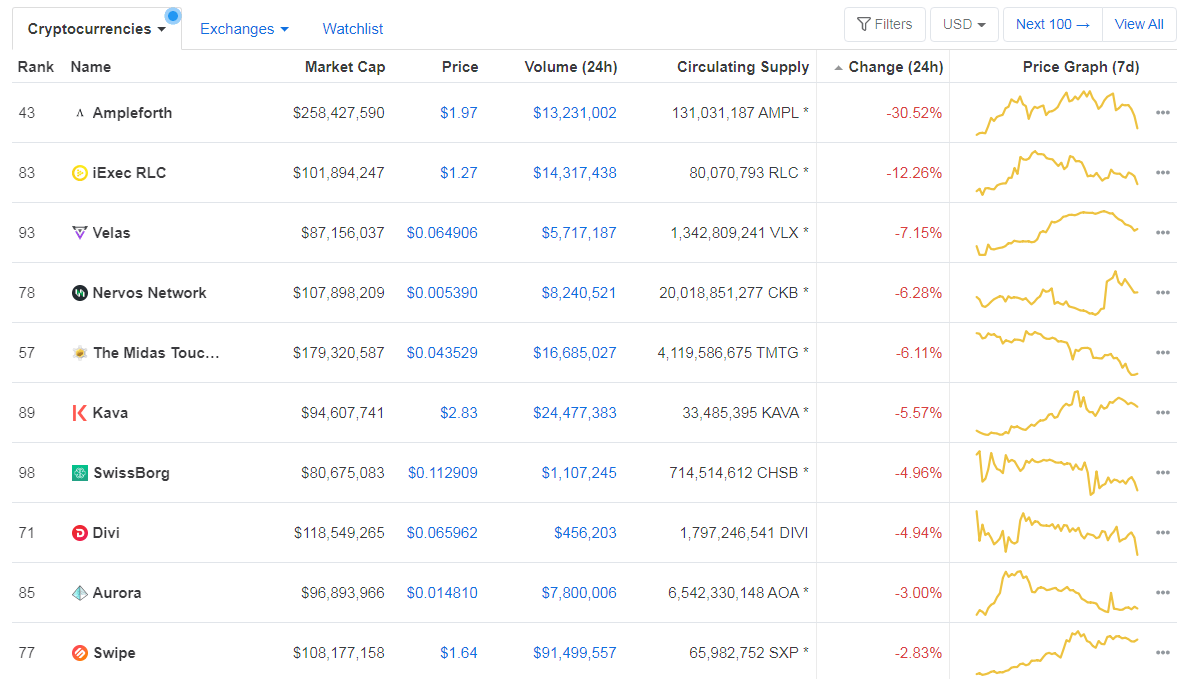

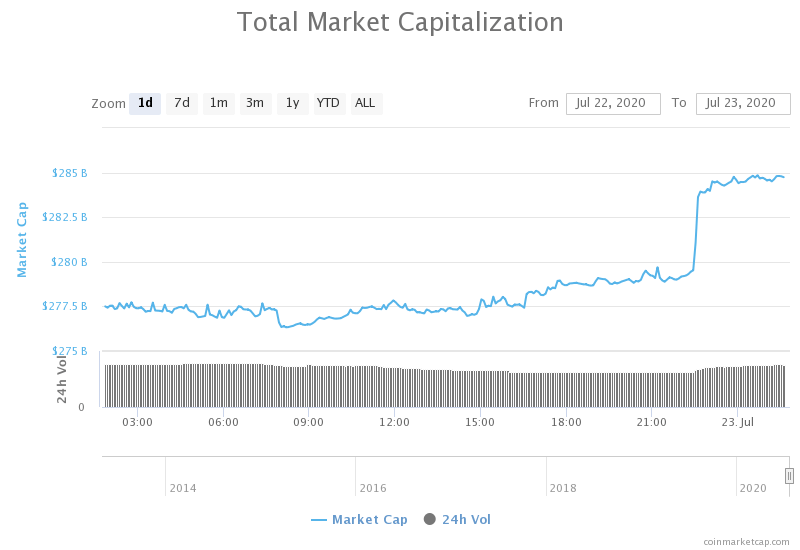

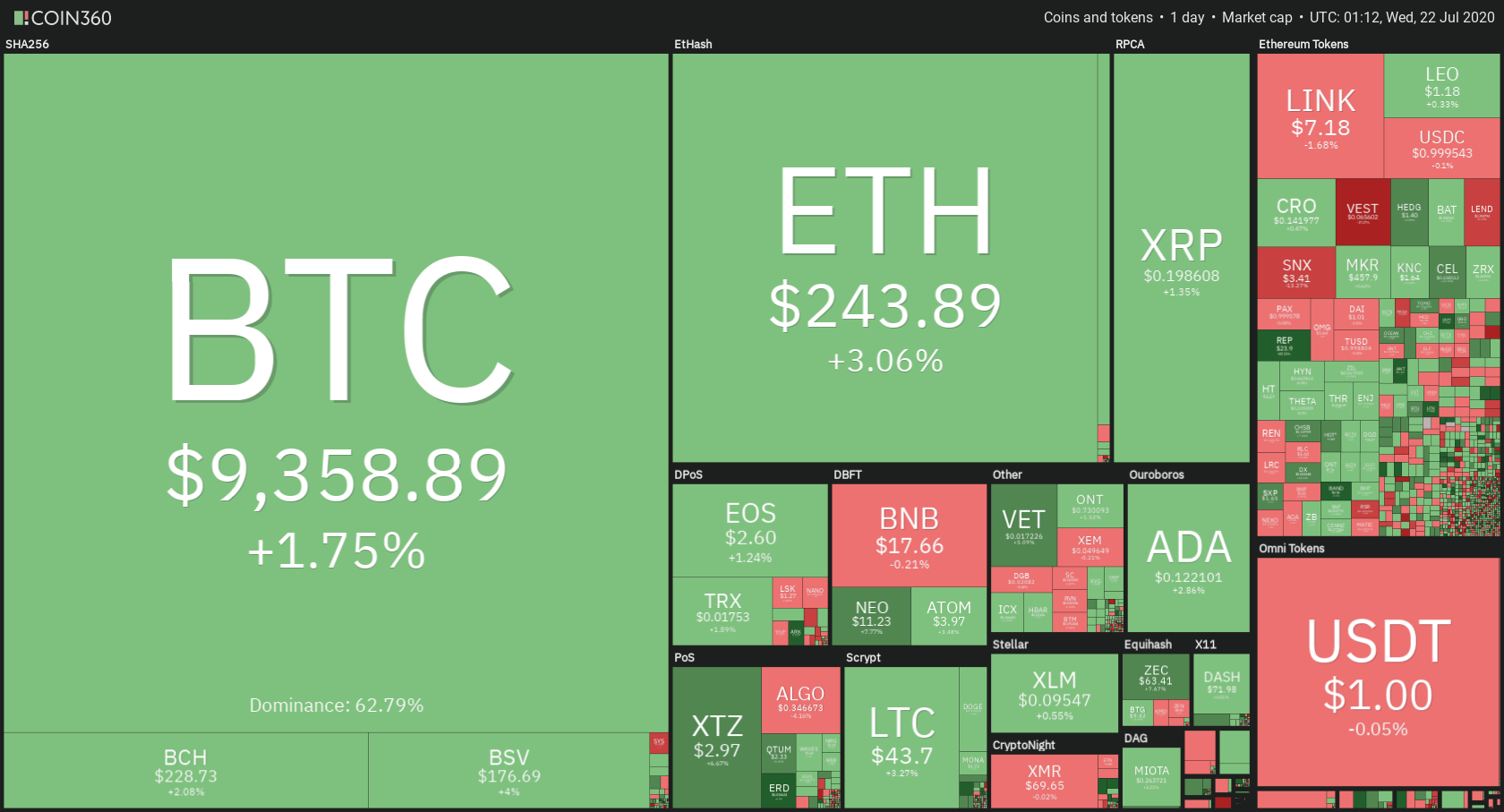

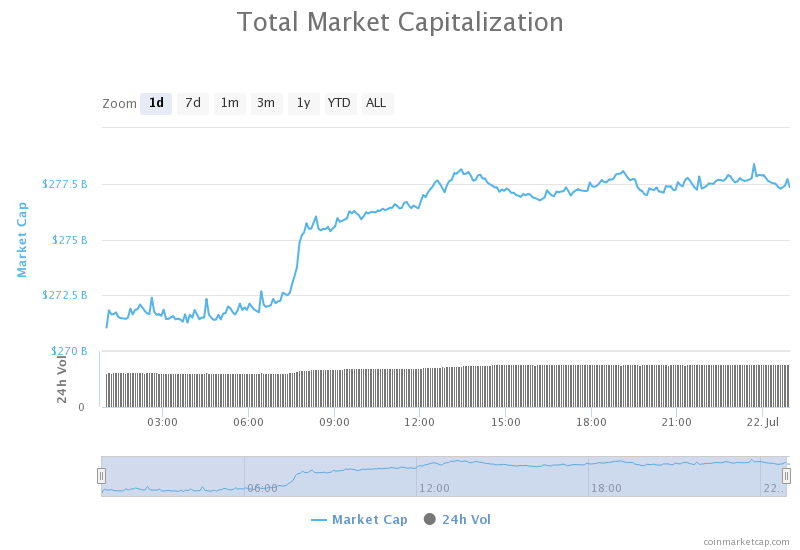

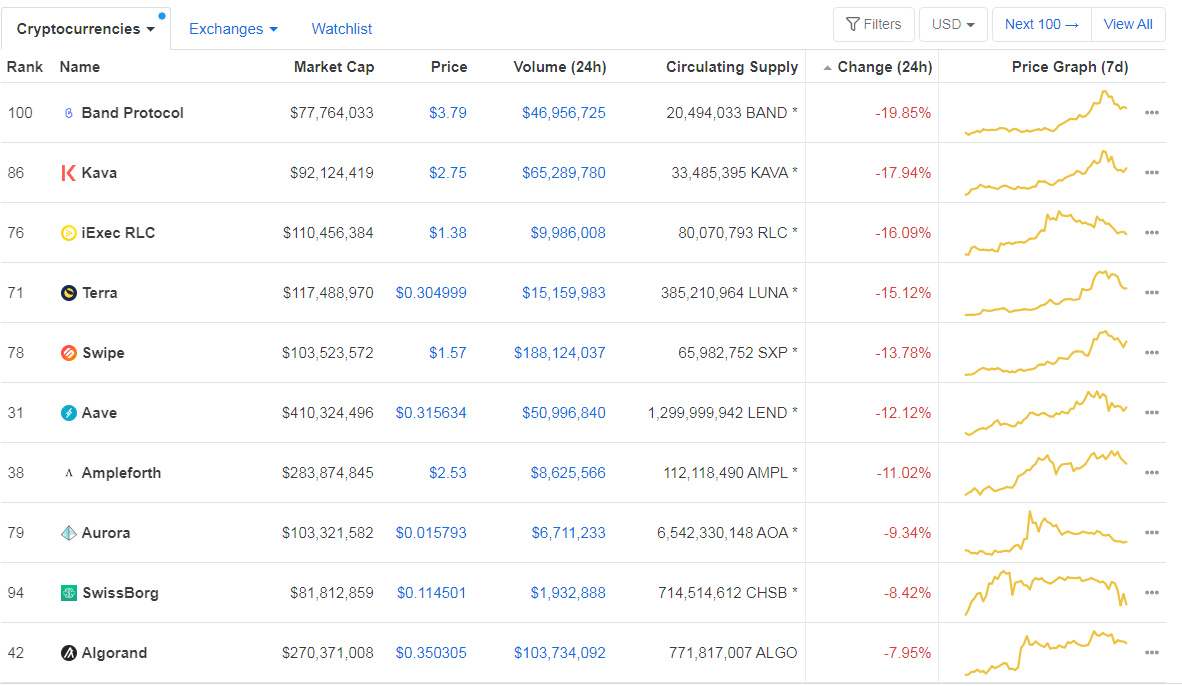

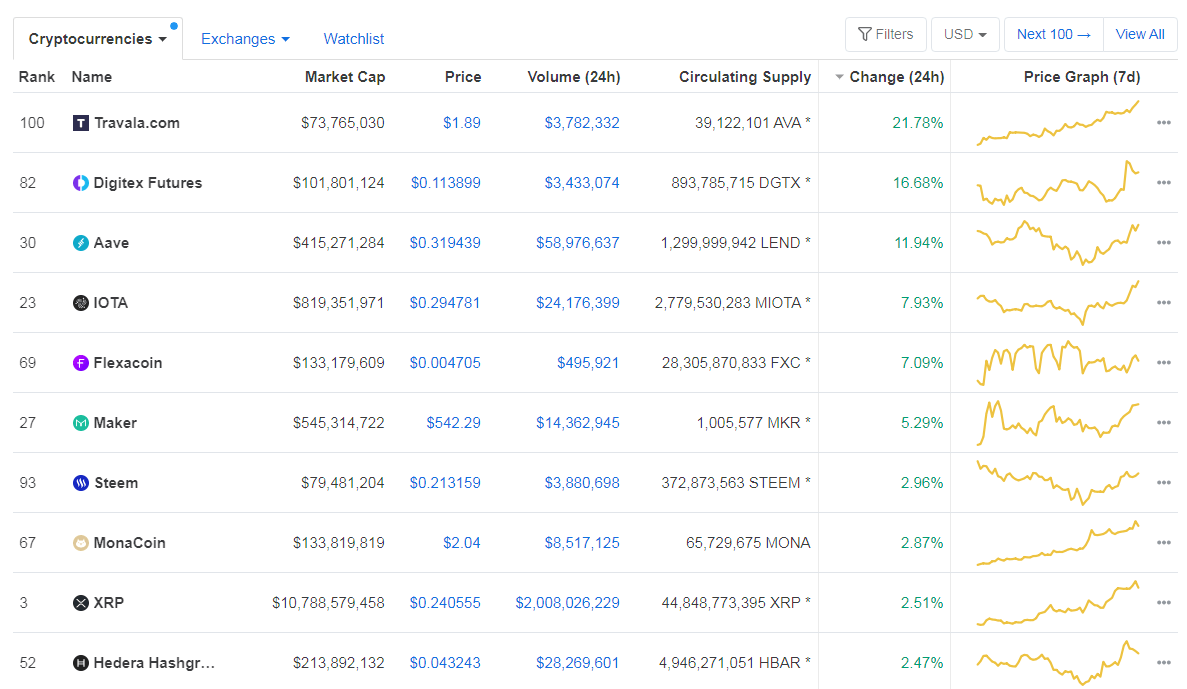

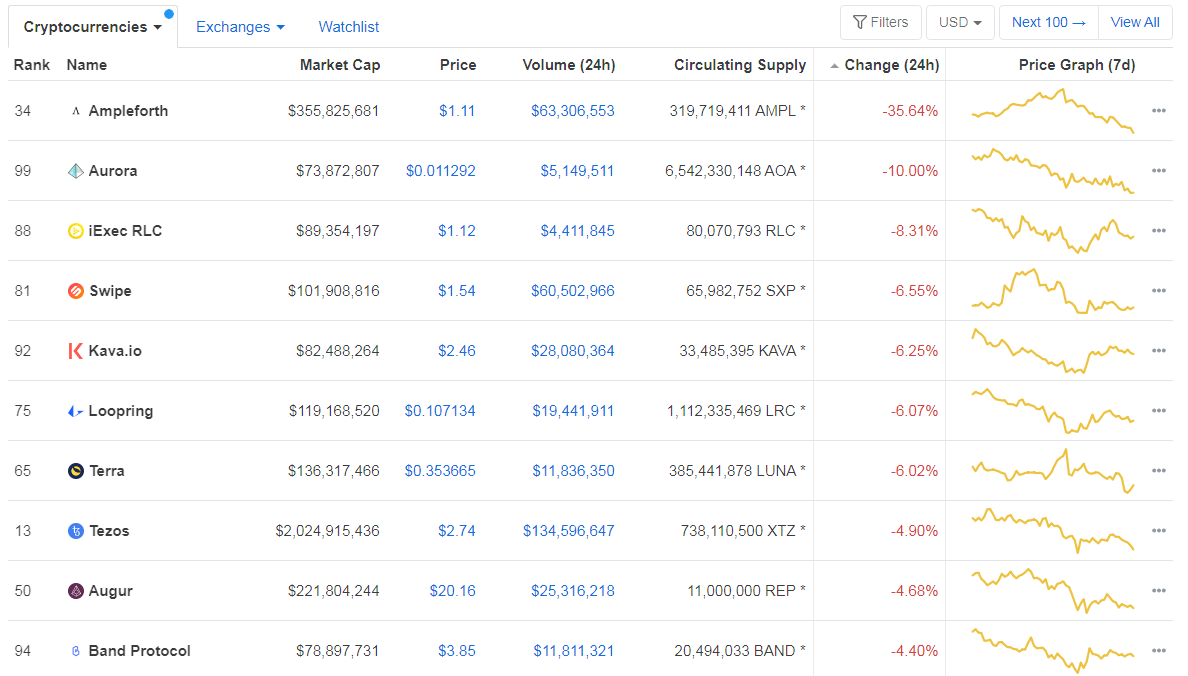

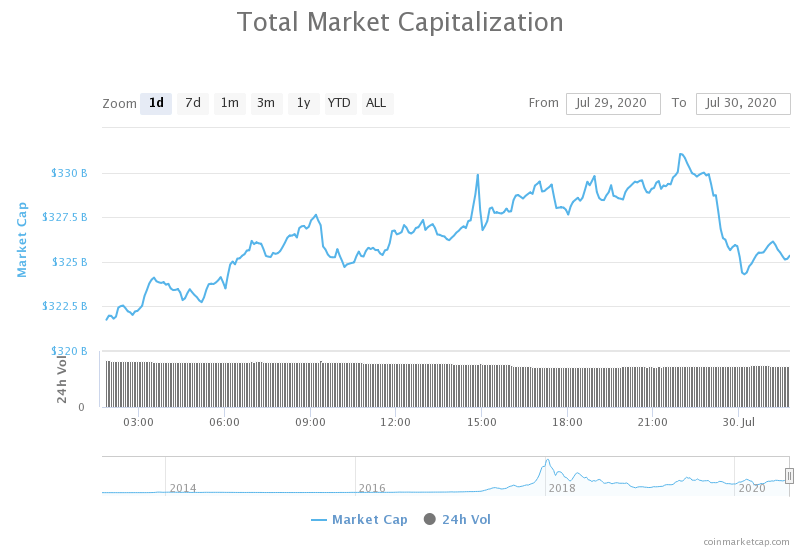

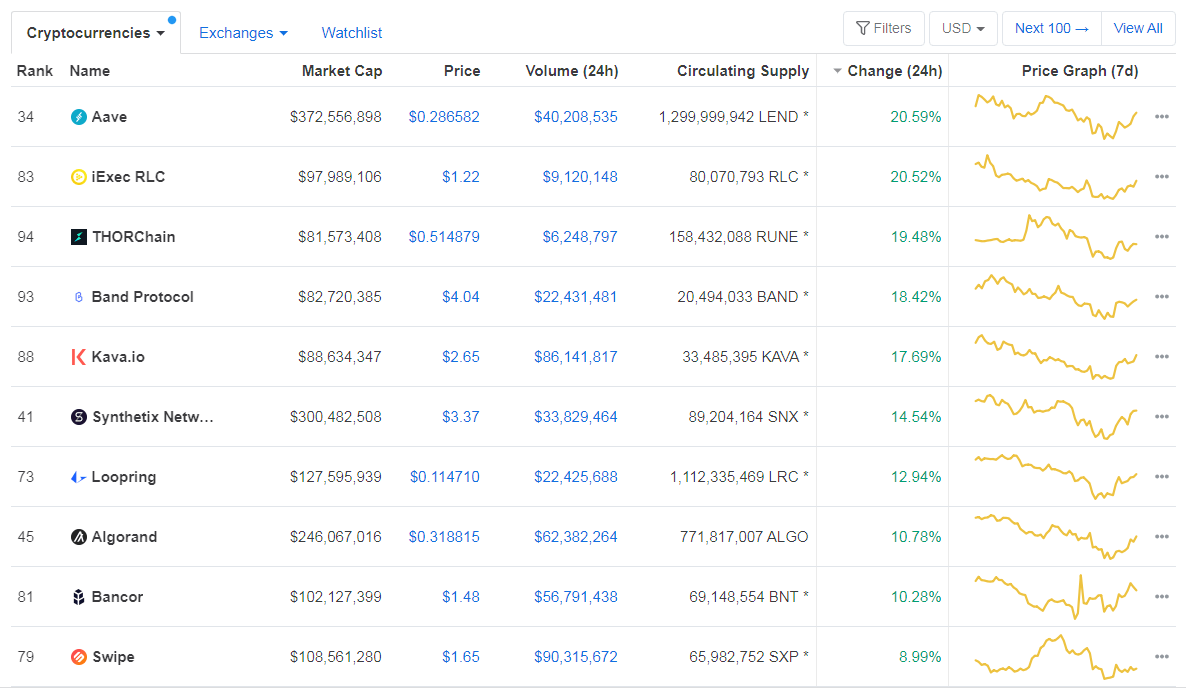

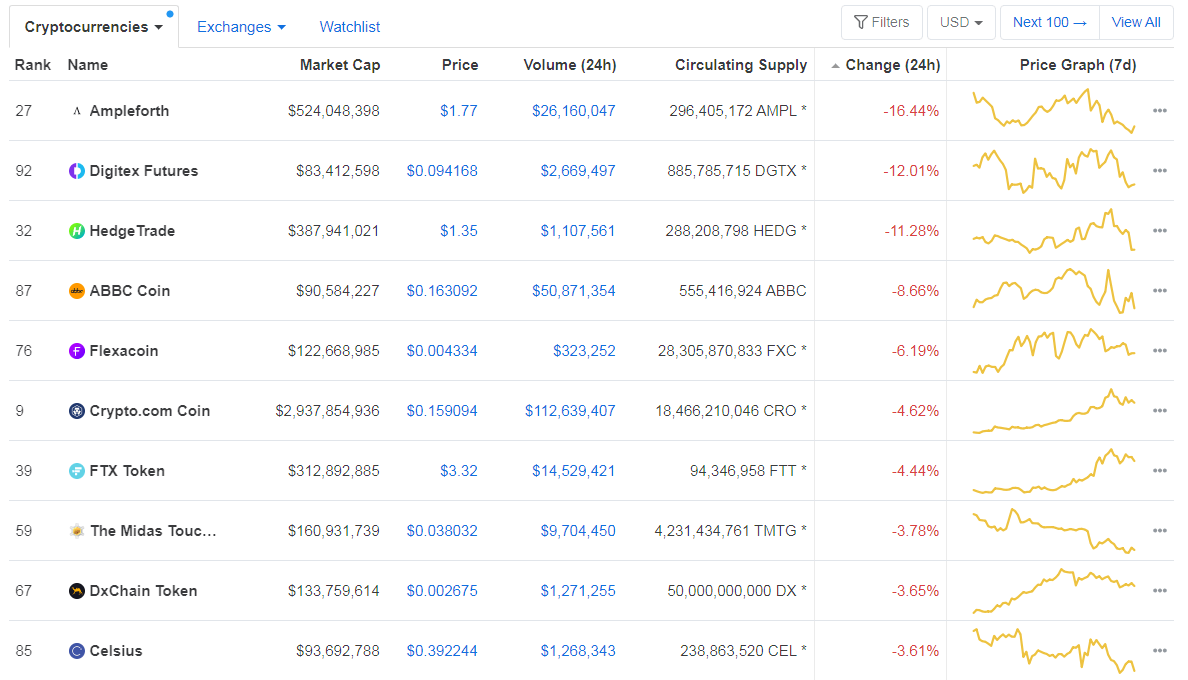

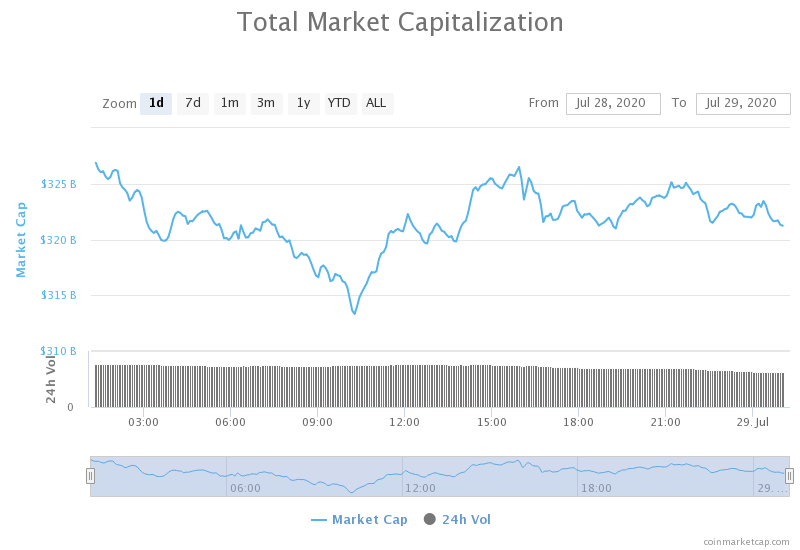

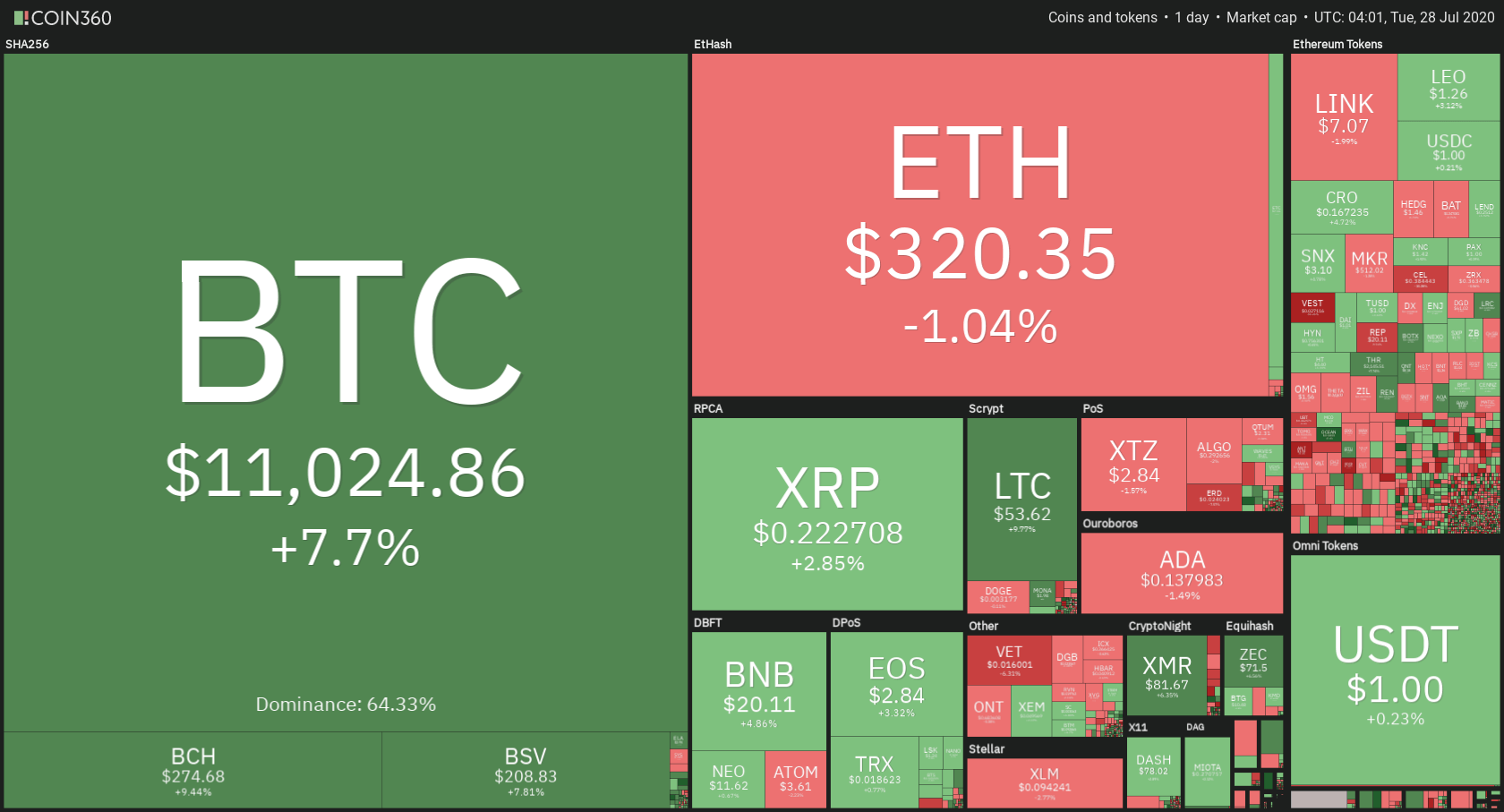

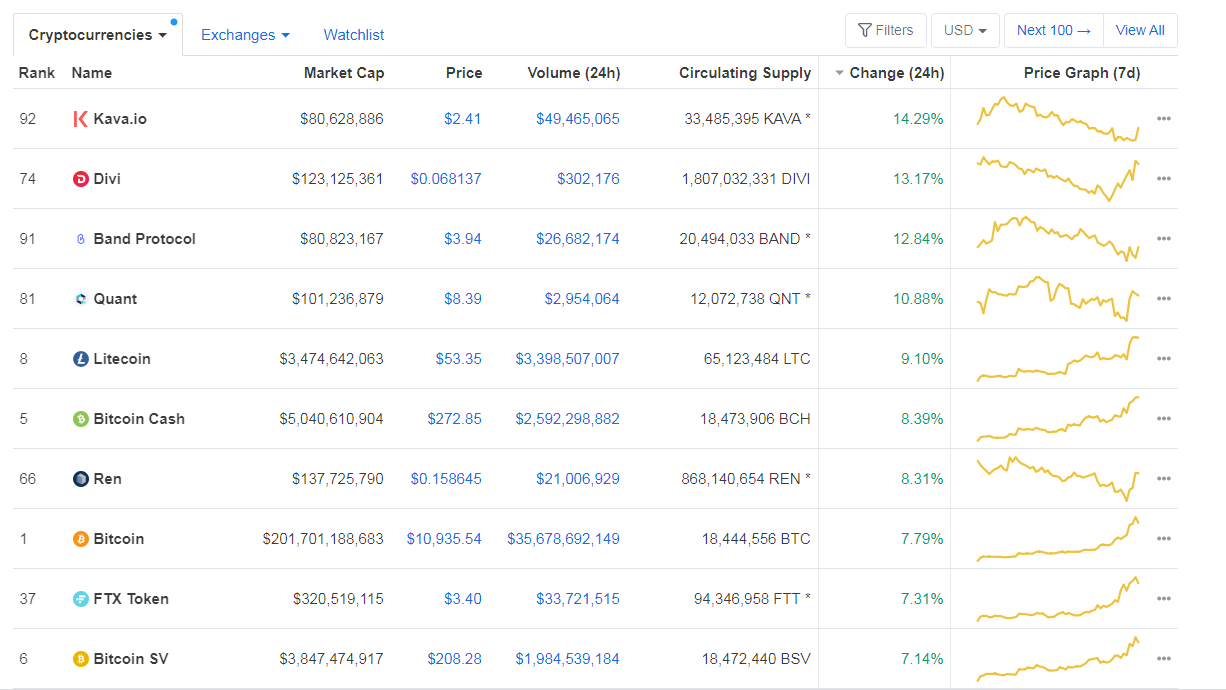

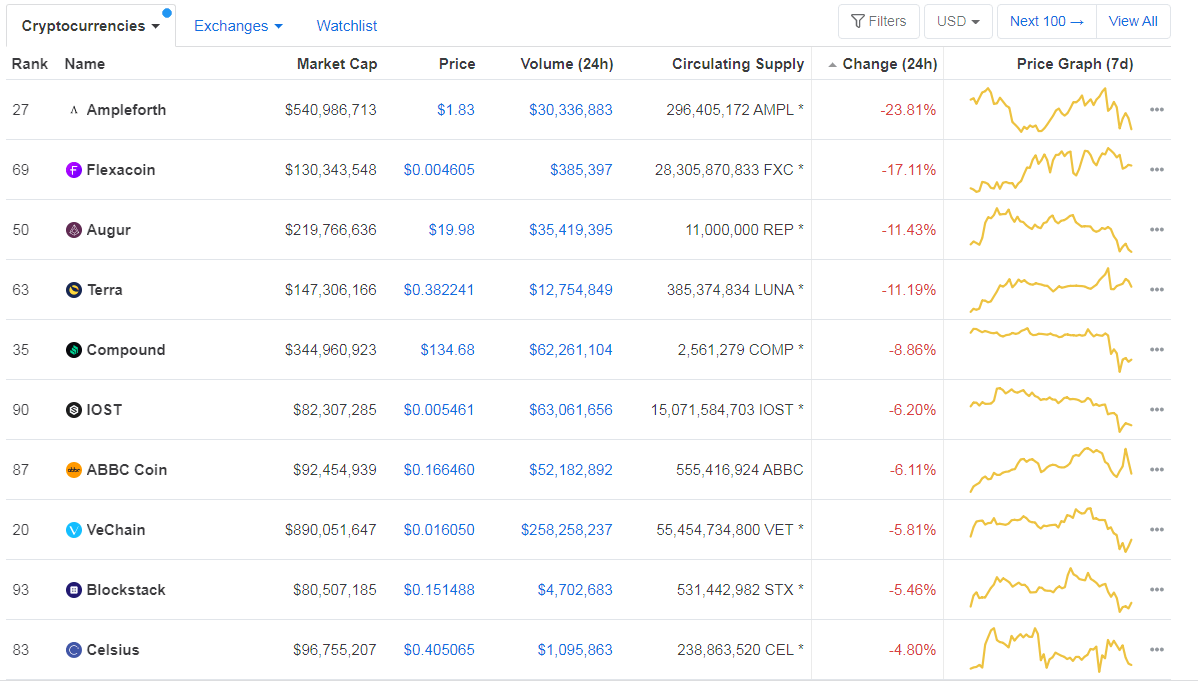

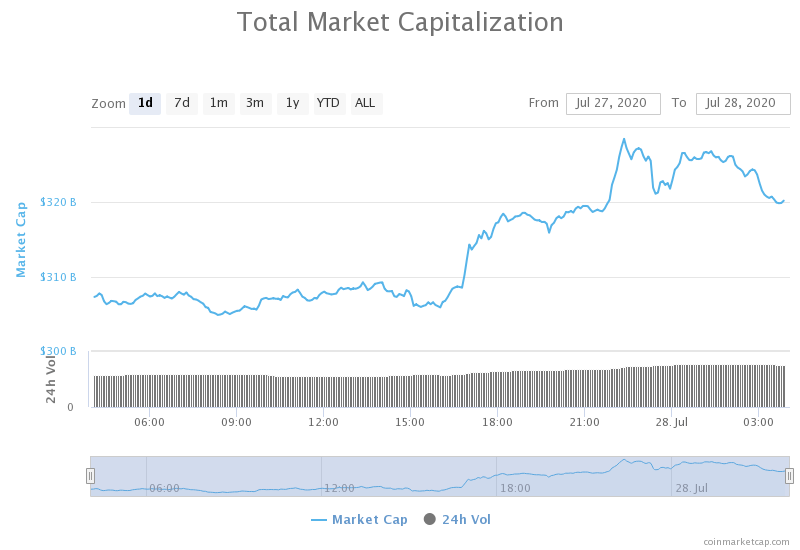

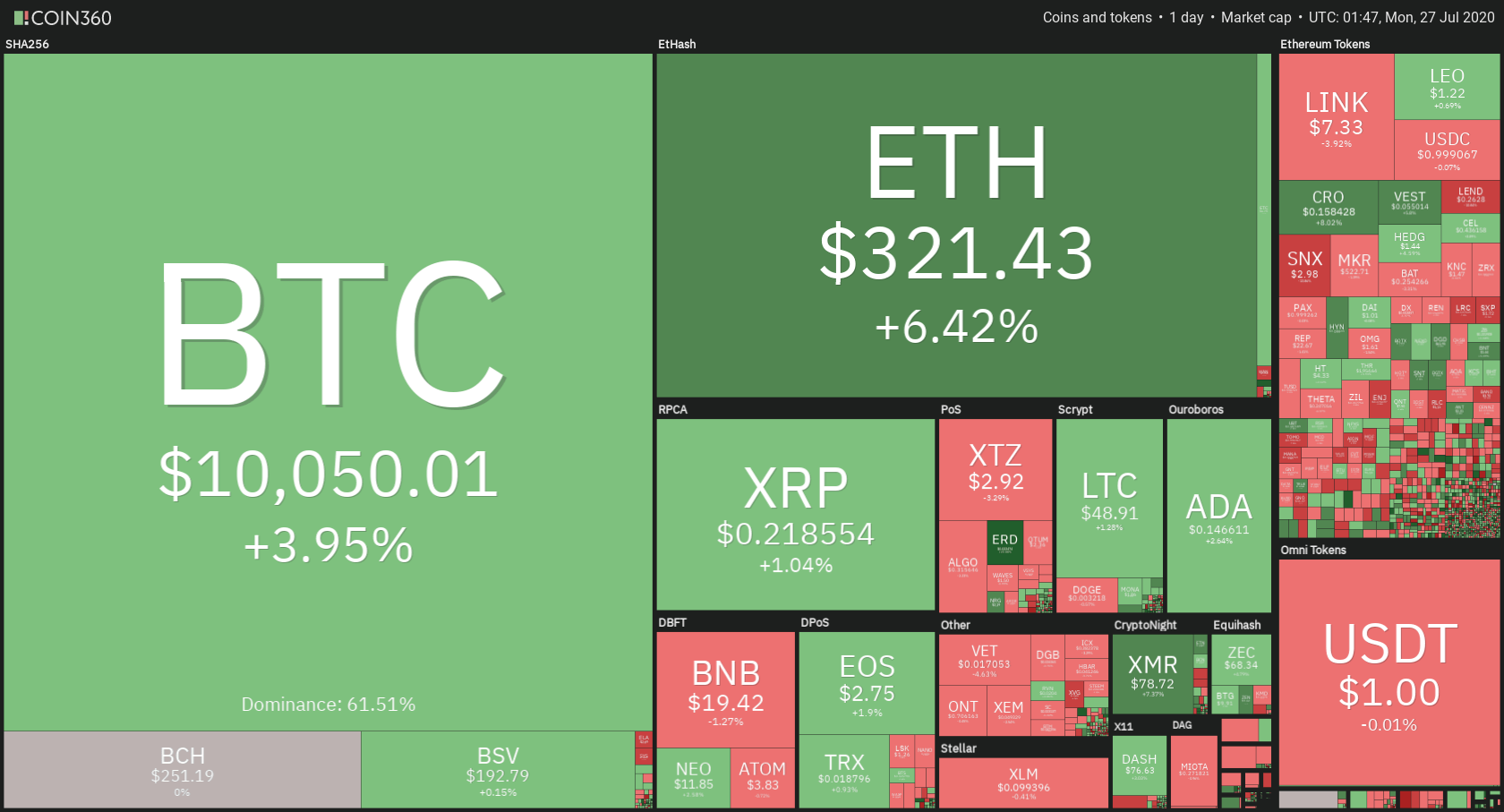

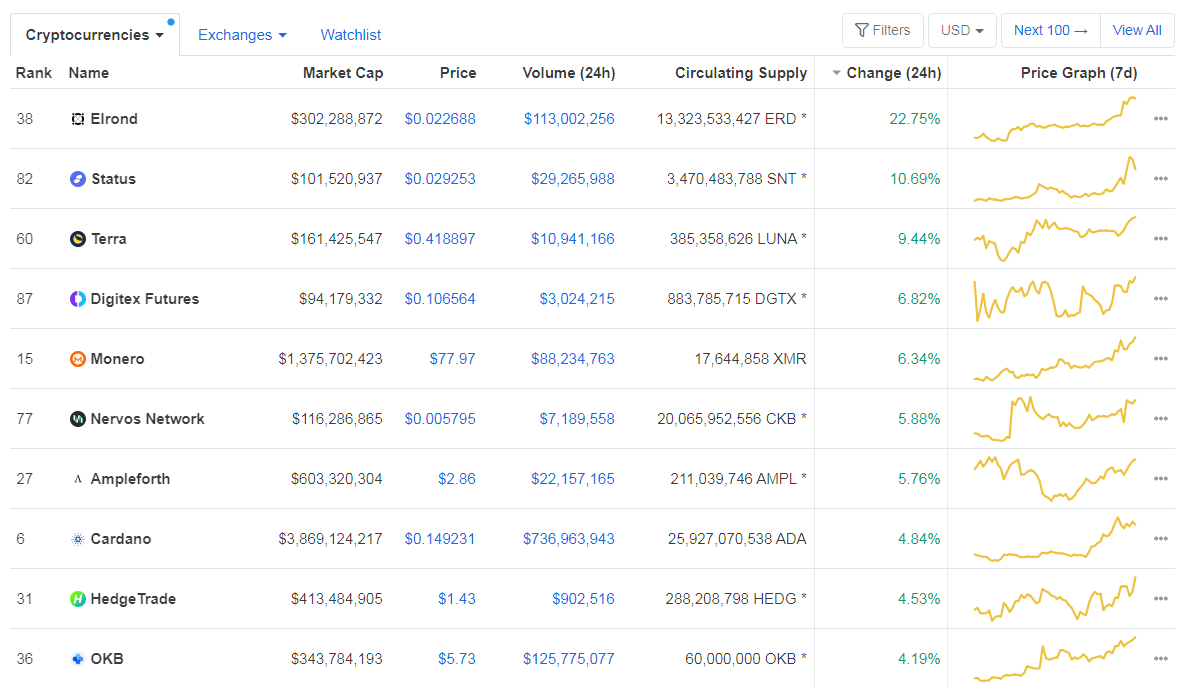

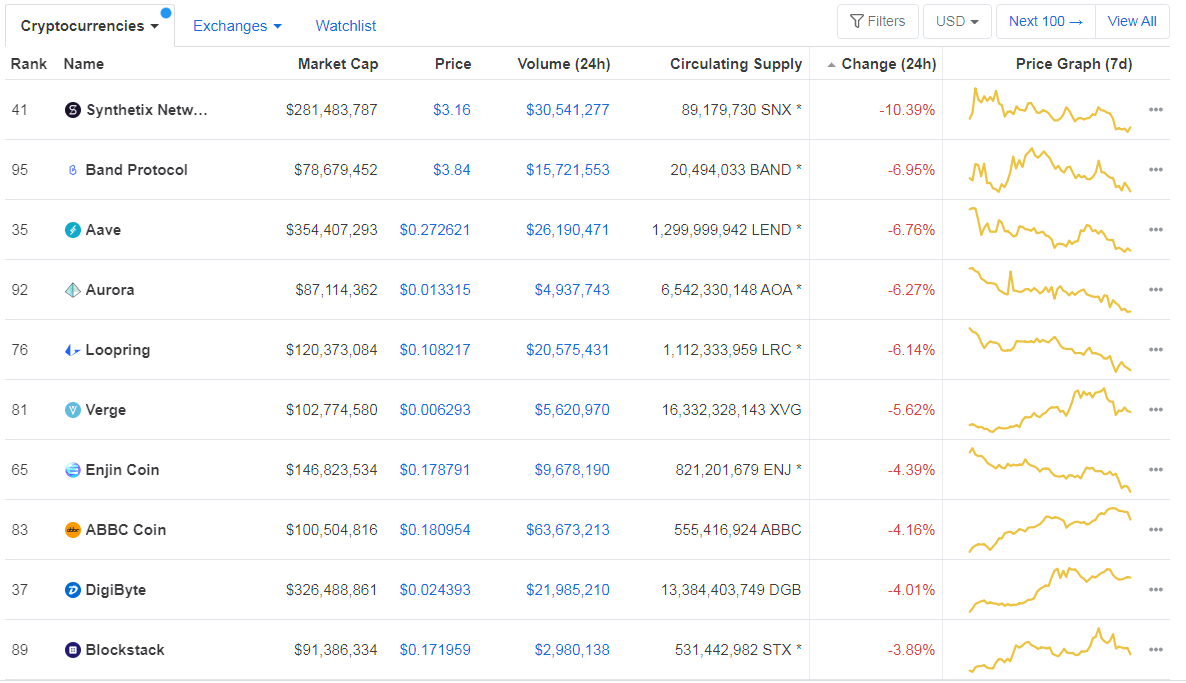

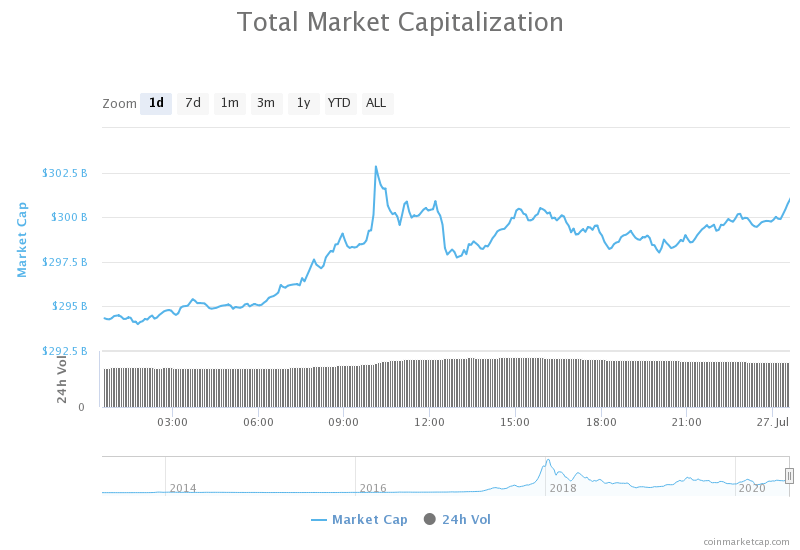

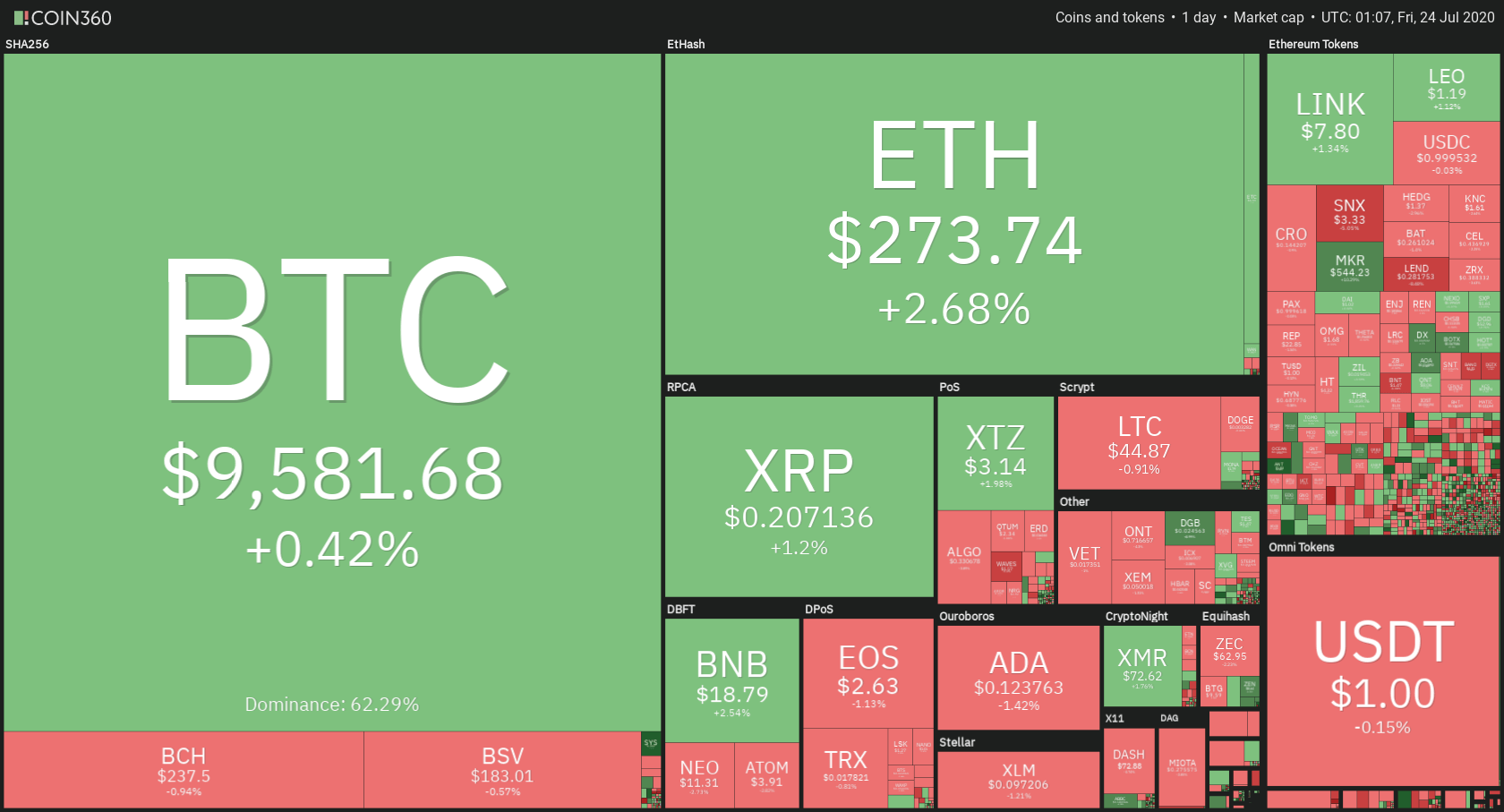

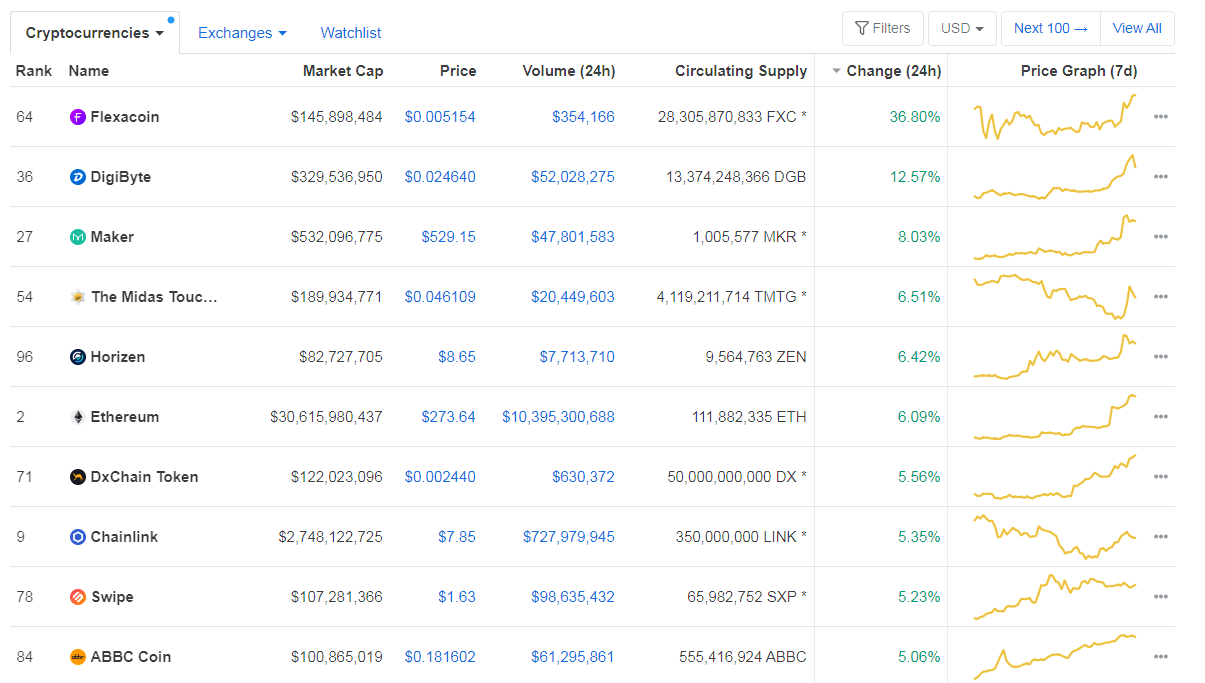

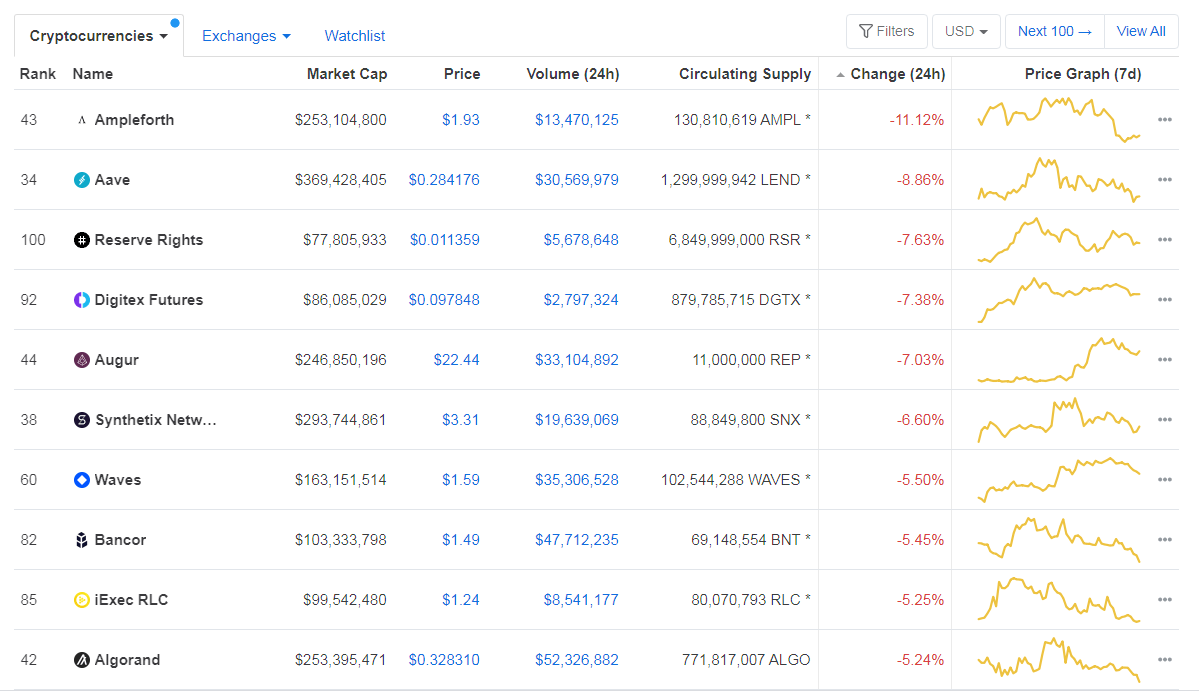

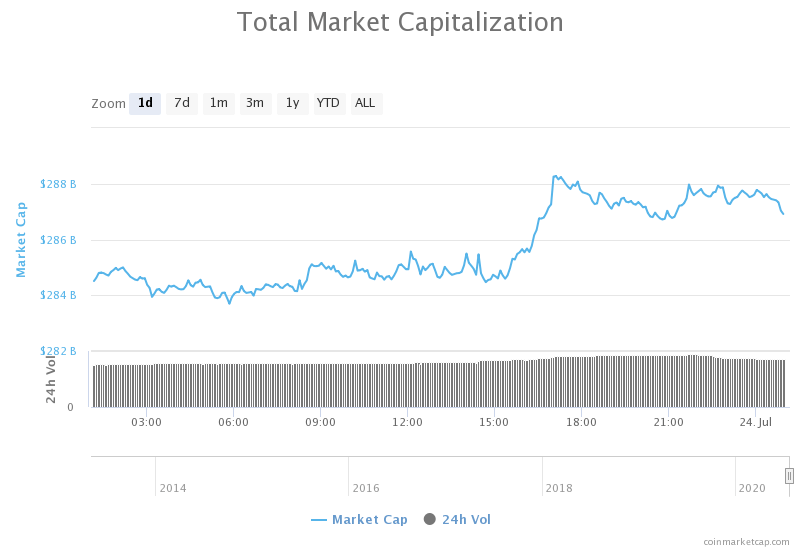

It is worth noting that all cryptocurrencies together are worth about $120 billion, with Bitcoin having a market capitalization that represents $55 billion of that total. Although this seems like a lot of money, it is only a very small fraction with respect to FIAT cash and deposits worldwide. Therefore, the point where new money is exhausted to feed the madness of cryptocurrencies does not seem to have been reached, and this market could have much more to go”.

That was in August 2017, when bitcoin cost $3,000 against the current price of more than quadruple. In the short term, all sorts of dubious promoters are sending out unsolicited invitations to buy, promising price gains of thousands percent. In many cases, these developers also own the cryptocurrencies themselves and are inflating the price in their own interest. If potential buyers do not bite the bait in sufficient quantities, then these markets may end up suffering a sharp correction.

We must look beyond this. This article aims to learn more about the dynamics that drive the price of Bitcoin and other cryptocurrencies, and concludes that instead of destabilizing gold. If madness continues, it is much more likely to destabilize fiduciary currencies.

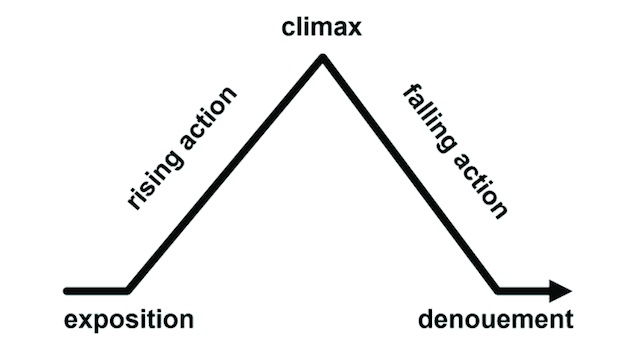

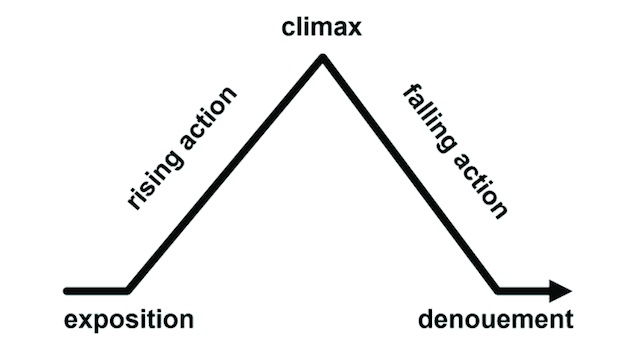

But first, we need to understand how bubbles form and progress. A warning: what follows is a theoretical description of how bubbles evolve and eventually implode, including points that may be relevant to cryptocurrencies. It is almost certain that other factors will affect how prices will move forward, in particular the dynamics behind the global credit cycle designed by the banking system. On its own, the impending credit crunch, regardless of the madness of cryptocurrencies, threatens to be the most damaging in our lives and could easily override the cycle of the cryptocurrency bubble. This article does not claim to examine all the risks of these new assets.

Dynamics of a Financial Bubble: The Start-Up Phase

Bubbles, like markets, tend to go through three distinct phases. The first is the initial movement, driven by participants with knowledge, or by those close to promoters who initiate a scheme or form of investment. Sensible and experienced investors realize from the start that the prices of a new company, a financial instrument is being inflated, irrationally in their opinion, so they do not participate. At this point, the general public is unaware of what is happening, and many of those who could have made an investment and entered early end up falling into heavy price corrections, counterpart failures, or outright fraud. As a result, prices are mostly driven by the initiates, the first to adopt, the creators of the new opportunity to make money.

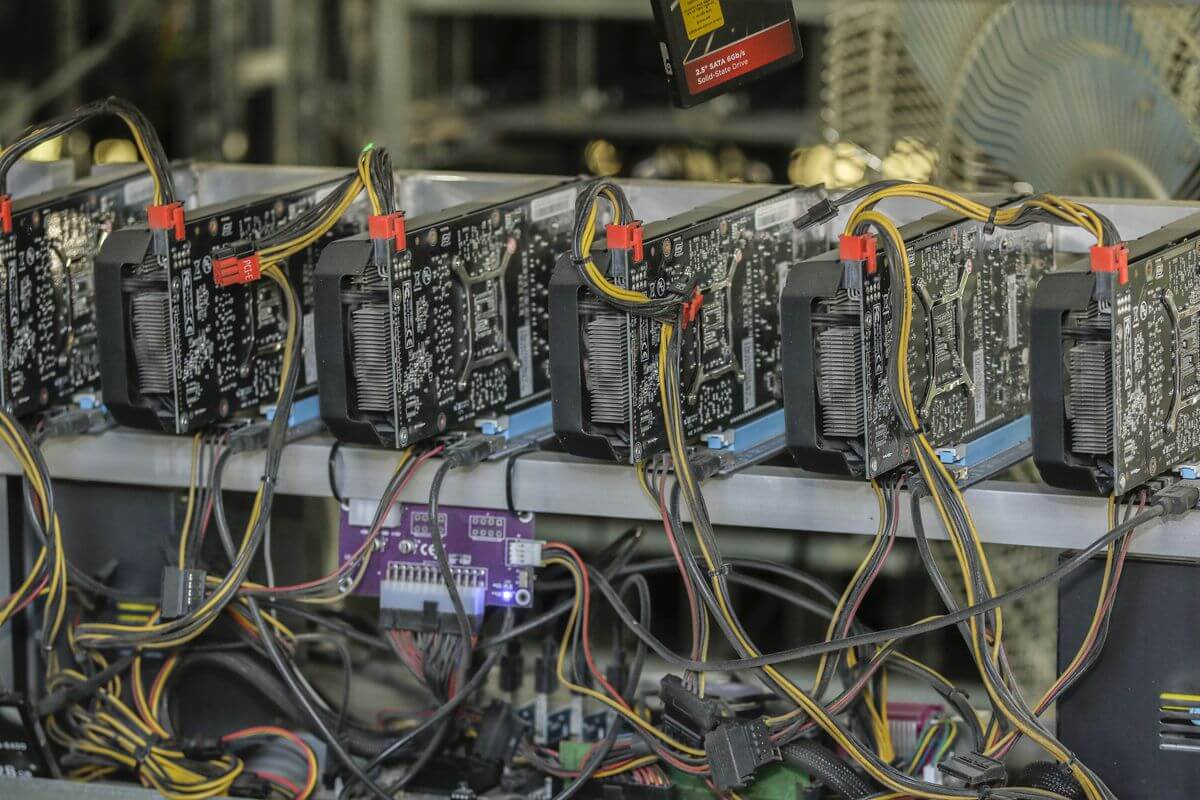

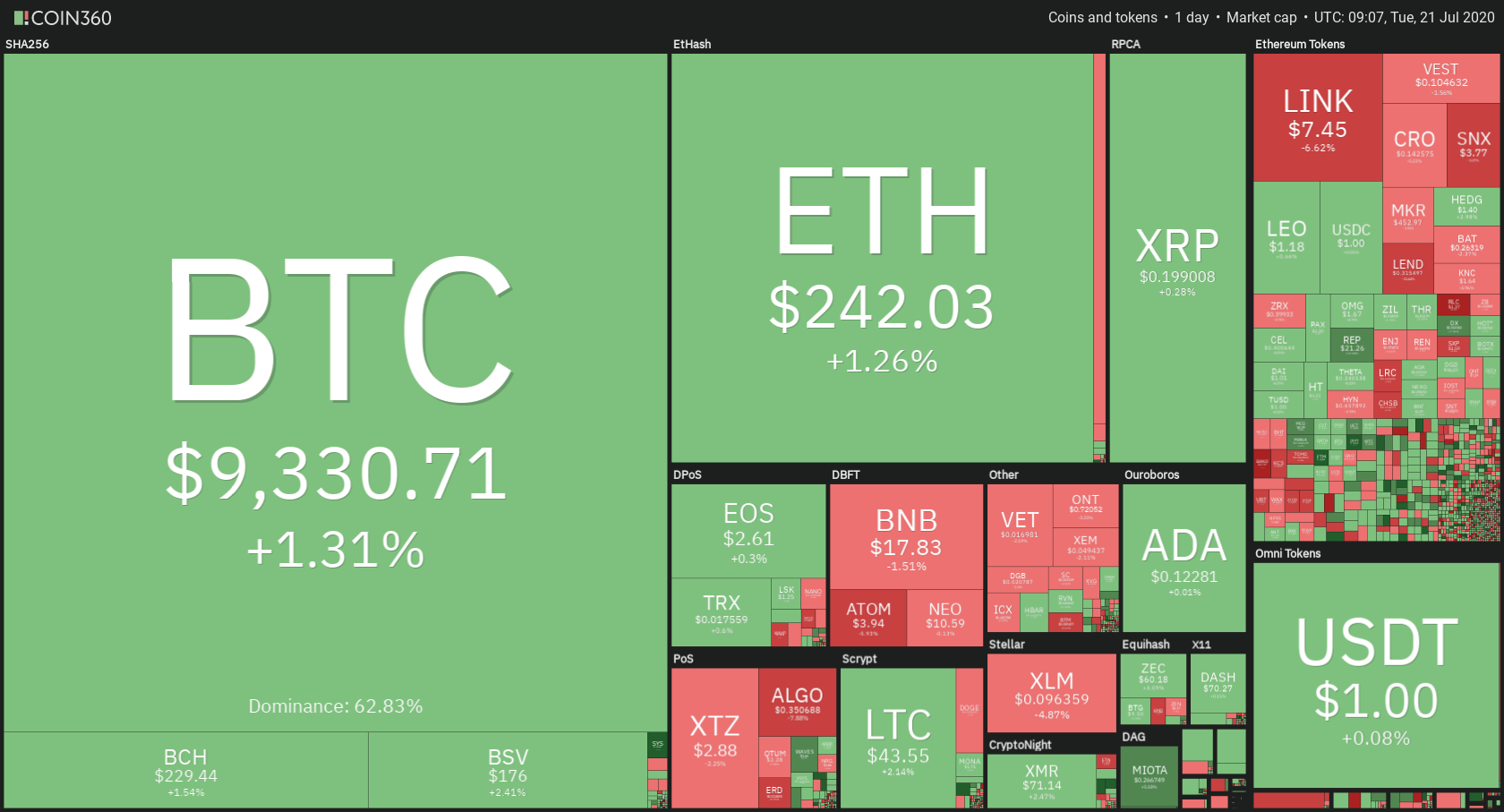

In the specific case of cryptocurrencies, these are the geeks and technology-savvy entrepreneurs who have a good understanding of the dynamics that drive the values of these assets. This has been the story of cryptocurrencies so far. Bitcoin, the leader of a package of around 1,000 different cryptocurrencies, has risen from nothing to more than $11,000 at the time of writing this article, in less than a decade.

Currently, this is already an almost record-high inflation bubble. Each bubble has its own personal characteristics, but this one is special. The invention of blockchain technology, Bitcoin’s central self-audit process, ensures that payments are confirmed and that property rights are undisputed. Blockchain itself could become one of the greatest financial and technological legacies of our time. The combination of financial and technological elements is the backdrop to cryptocurrencies, a powerful combination, compared to the one-dimensional bubbles of the past.

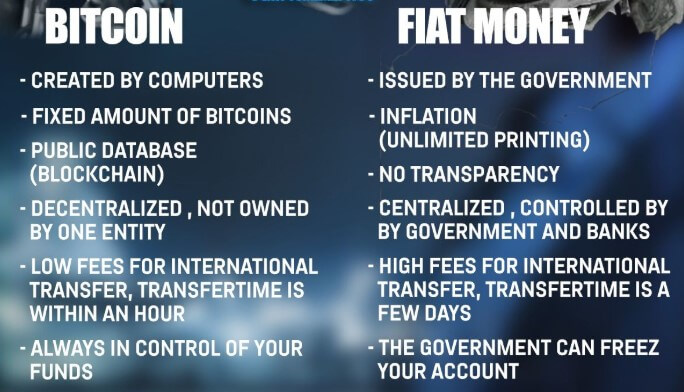

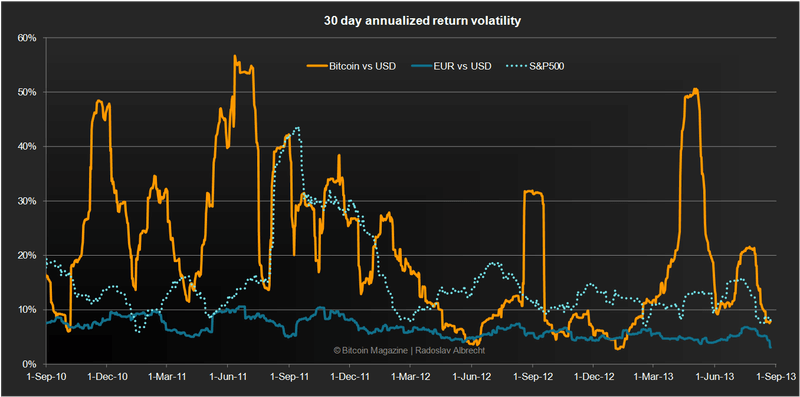

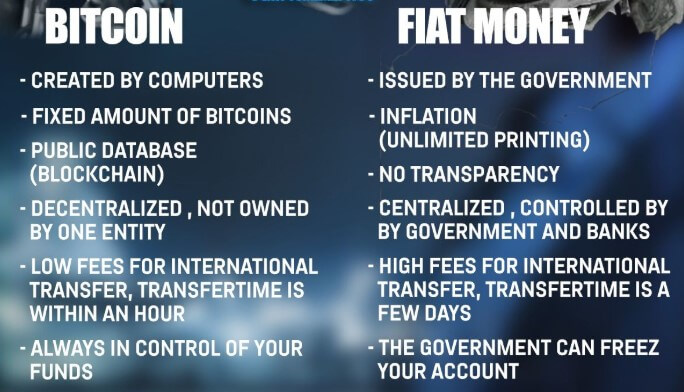

The limitation in the supply of new individual cryptocurrencies is designed to ensure that the growing popularity drives prices upwards. This contrasts with fiduciary currencies, which through the expansion of credit on an elastic base of base money, means that the increase of its supply is virtually unlimited. It is very likely that the difference between these two characteristics will in the future be more important for future cryptocurrency prices, measured in fiduciary currencies.

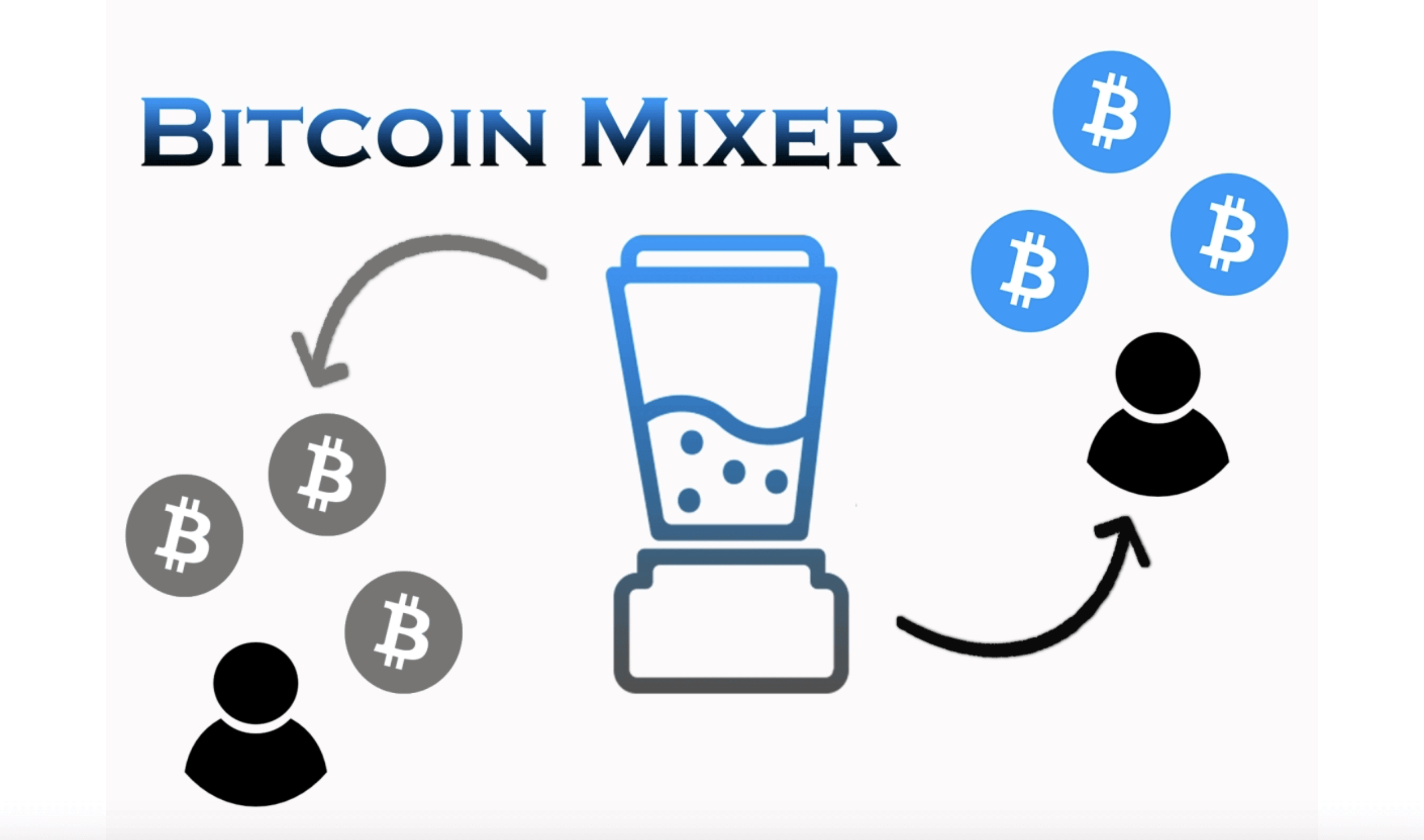

The limitation of new demand has been significant so far because it has had to overcome some disadvantages. In addition to the widespread rejection of the phenomenon by the general investor sector, the market has also not been regulated and has therefore been considered dangerous for investment. Governments have shut down Bitcoin exchanges on the pretext that cryptocurrencies are used to evade taxes and launder the proceeds of crime. While the technological side of the phenomenon has been advanced and generally competent, the financial aspects have been on a scale ranging from amateur to fraudulent. It has been a new version of the Wild West, driven by anti-government libertarianism.

Governments have not yet decided their response, but aside from expressing interest in blockchain technology, most have no idea and have been taken by surprise. Cryptocurrencies can undermine capital controls, important for China and many other countries that seek to protect their own fiduciary currency values and have caused discomfort to Governments as a result.

However, we are now going through the early stages of development, when cryptocurrencies were mainly the exclusive domain of technophiles and libertarians. The transition may not be clear. Almost all major market drivers and agitators have already made their investment in this market, so a significant drop could create problems for them. An unpleasant wake-up call of this nature, after such huge initial gains, should not be dismissed lightly.

With or without such price correction, cryptocurrency exchanges and other related service providers are beginning to realize that dealing with unknown clients on a completely question-free basis is impractical, especially when governments want to be able to control all transactions. Companies moving into Phase 2 will work to improve their reputation and are likely to adopt regulations. This brings us to Phase 2.

Phase 2: Acceptance in the Traditional Investment Sector

The interest generated by the first phase of the bubble has attracted a lot of attention from professional investors, particularly the bolder hedge funds and some other quasi-institutional actors. They point out that conventional investments appear to be fully valued, for this reason, the alternatives are being actively considered. Well, finally, if the rates of now on, bonds and therefore stocks are likely to fall in value. There are options, like playing the commodity cycle and maybe gold, for those who understand it. However, the vast majority of investments are made in regulated assets that are likely to have little or no upside benefits.

These professional speculators will closely follow government policy on cryptocurrencies. Cryptocurrencies are unregulated, and this is a serious impediment for investment institutions. Therefore, the recent announcement by the CME that they will introduce a Bitcoin futures contract by the last part of the year is a tremendous development for the digital currency sector that gives them greater credibility. Futures are regulated investments and will allow the money category managed at Comex to speculate on the price of Bitcoin. The proposed contract will be settled in cash, based on a Bitcoin reference rate, which means that delivery cannot be required. It seems ironic that the first Bitcoin-regulated investment medium uses the same mechanism that links betting to a horse race, but at least the futures contract is divorced from unregulated counterparts.

Assuming that the CME goes ahead with this contract, other regulated exchanges around the world are likely to do the same and demand will arise for futures that cover other credible cryptocurrencies, such as Ethereum, for example. In a short time, wealthy clients will ask their fund on its investment policy with respect to cryptocurrencies, and it will no longer be reasonable to dismiss them as irrelevant. That’s why the CME futures contract is such an important development. While it will divert part of the demand from the second phase of buying real bitcoins by creating a parallel market of speculation, it will legitimize investment in the underlying product, namely Bitcoin.

Governments and their central banks will then face a great challenge. This is a new phenomenon, and you know it’s not money, but you’re worried it’s going to turn into money. In reality, government economists do not have the theoretical knowledge necessary to control the issue in a convenient way. Some, like the Chinese, could continue to repress when they can the users and markets of Bitcoin, due to the threat to their capital controls. It is very likely that other governments will choose the opposite view, on the premise that if cryptocurrency service providers are regulated, or at least comply with financial regulation, then the huge profits that are made are an additional and welcome source of tax revenue.

The tax is the carrot and could become an important key to the future acceptance of cryptocurrencies. And if governments allow cryptocurrencies to become a form of investment and even money, only an overzealous fund manager will still refuse to get involved. We will see a momentum reversal against value, and a new paradigm, such as the technology bubble of the late 1990s.

It is highly unlikely that the division between the completion of Phase 2 and the start of Phase 3 is clear. When investment institutions get involved in a bubble, the public is obliged to start doing so as well. Our theoretical assessments are just that, but in reality, it is very likely that there is a division between the third and the second phase. The second phase, once it moves forward, you could see a huge amount of money looking to enter this type of market, and it is at this time when we start with the third phase, the real madness of the crowds.

Phase 3: A Market Driven by Public Greed

No one knows how high Bitcoin and the other cryptocurrencies will rise in Phase 2. One thing is certain, in the end, a person will have to be a true financial hermit not to know that the surest way to make money, More money than you can possibly earn by doing anything else is buying cryptocurrencies. Undoubtedly, by then Bitcoin will not have a price in tens, or hundreds of thousands of dollars, because they will be divided, thousand, or even ten thousand against one. All a greedy, profit-hungry audience will want to know is that the price is low, affordable, and can only go up.

It’s the same with every bubble in history, but this one is potentially much bigger. To enjoy the thrill of the Mississippi bubbles and the South Seas, one had to be at a communicable distance from Paris and London, respectively. If the person lived outside these capitals, he probably risked being the victim of bandits, took a stagecoach with his gold, and looked for accommodation to be close to intermediaries. The hysteria of these bubbles probably did not infect more than a few tens of thousands of people. These were the rich when there was hardly an independent so-called middle class.

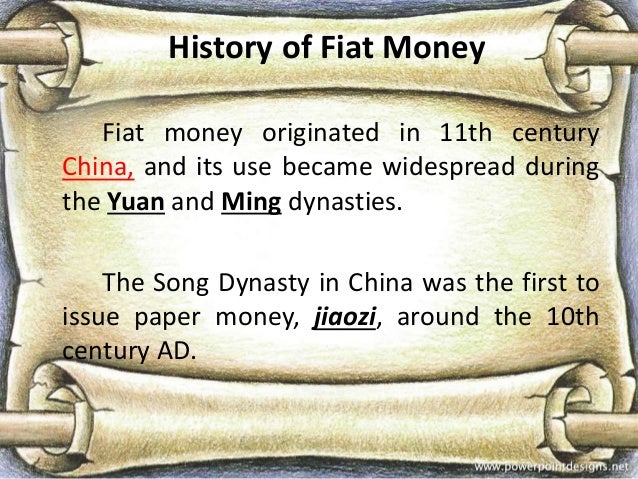

When those bubbles are given, the money was mainly real cash. In other words, speculative purchases should be paid for with FIAT money and diverted from other uses. The result was price inflation in Paris and London, reflecting the amount of money that flowed to those centers. At the same time, prices in the nearby provinces would have been depressed due to the lack of circulating money. Those who accumulated profits were made with FIAT money, silver, and gold.

Richard Cantillon, who was John Law’s personal banker in France, lent real money (his own and the gold from his depositors) for the Parisian nobility to buy John Law’s paper scheme. He took Mississippi stock as collateral and secretly sold it for gold. Cantillon withdrew to Italy to await events, and the Mississippi bubble collapsed as expected.

Bubble deflation generally reflects an adjustment in values and expectations rather than a real sale. Enough money had been taken out of Paris, thanks mainly to some smart gamblers like Cantillon, to make sure the bubble imploded. Wealth disappeared, leaving everyone, including those who had not bought shares, impoverished.

It cannot be said that there was no credit behind the bubble, but before the days of fractional reserve banking, unsecured lending was too risky for a bank, being fraudulent. Today, cryptocurrencies are not so hampered. Your purchase is fully paid for by extended bank credit and unsupported trust money, both created from nothing. Modern banking practice could allow cryptocurrencies to be accepted as collateral, and bankers will only know that prices are rising and that it is a profitable lending business.

Not only is the trust money available, but it is no longer necessary to be a day’s drive away to make the investment. Any citizen with a bank account and a mobile phone can join; not just the aristocracy of Paris or London, but billions in the world. The offer, which was materialized in the form of new currencies and yet-to-be-invented means of investment, is unlikely to keep pace with rising public demand, at least for a time. Methods of channeling public money into cryptocurrencies will be appropriately regulated, granting them public respectability.

When people know only one thing, and that is that cryptocurrencies are a financial miracle and a sure way to make money, they will be ready to collapse, if the bubble story is a guide. The last question we must address is how this can happen.

The Denouement

The collapse of a bubble always occurs when the supply increase is adjusted to demand or, alternatively, demand cannot keep pace with supply. Long before fractionated reserve banking was sanctioned by the government, the demand limitation was the availability of money, which, as stated earlier, meant that money had to be diverted from other activities to feed the bubble. Today, the expansion of bank credit, at least in theory, allows bubbles to extend in terms of both duration and extent.

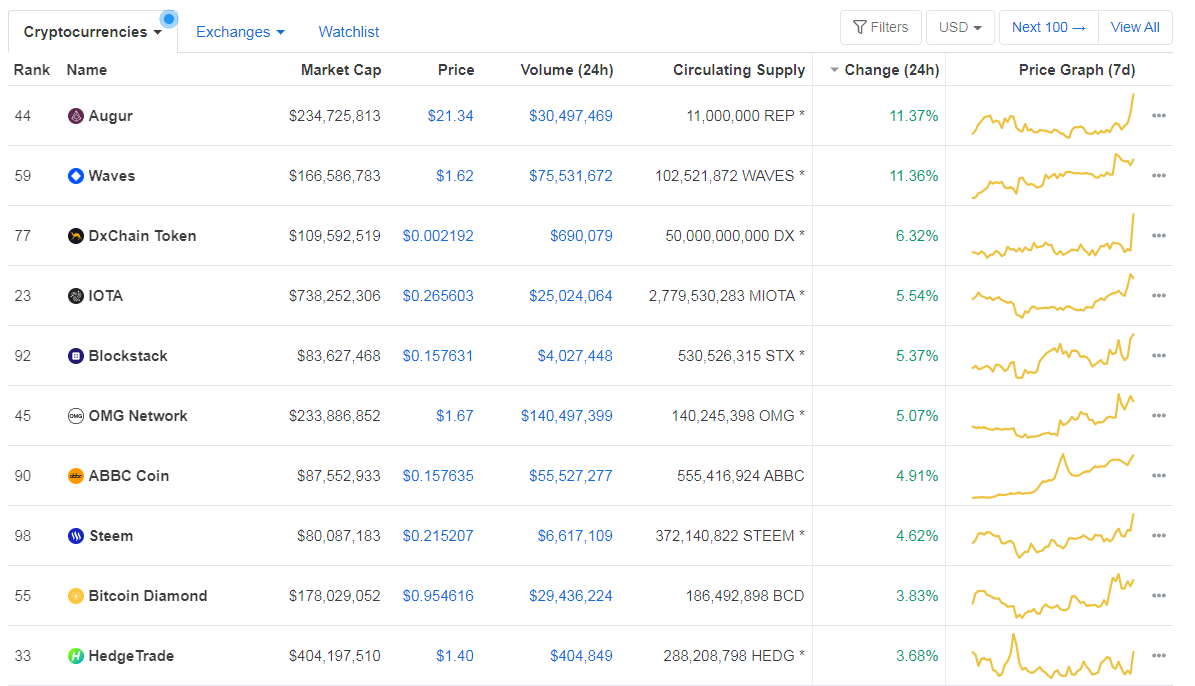

In practice, the supply in a bubble is always restricted, even for nothing else, to the desire of individual promoters to see the prices of their investment schemes rise. But the bubble of the South Seas showed that a successful promotion leads to a plethora of imitations, which is already being demonstrated with cryptocurrencies. Very few of these imitations have gained traction in the market so far, but future cryptocurrencies could be more credible, increasing the means available. Therefore, although bitcoins in this world individually have supply limitations, the market, in general, does not.

Derivatives and associated developments are likely to evolve outside the market, and will certainly be more sophisticated and acceptable. Funds that invest in public subscription and cryptocurrency futures could obtain official approval by regulating themselves through stock market listings. Their listing on stock exchanges will create additional demand, but it is inevitable that a point will come when that additional demand is completely absorbed. In theory, at least that time is a bit far.

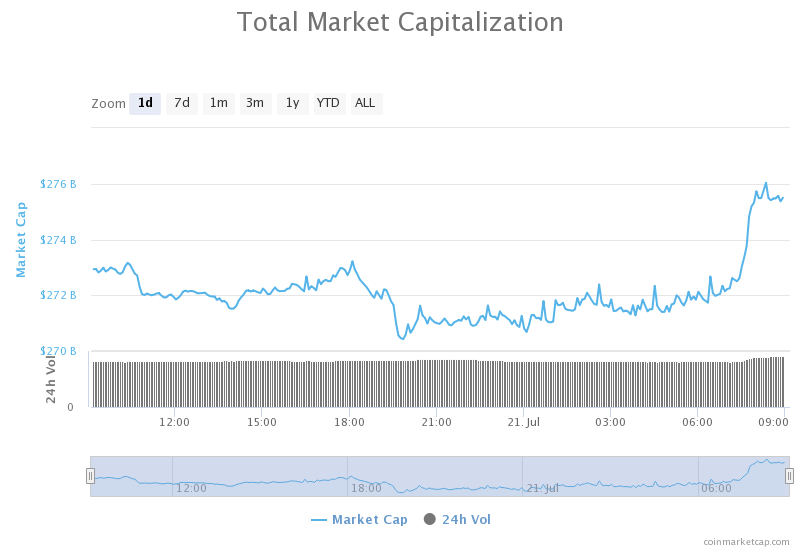

Given the ability of banks to create credit to inflate the bubble, it is difficult to visualize that there will be an end to madness just by analyzing cryptocurrencies for themselves. Therefore, we must consider the prospects of fiduciary currencies being sold to buy cryptocurrencies, and how the expansion of the cryptocurrency bubble may affect fiduciary currencies. Because it’s from that angle that the end is likely to happen.

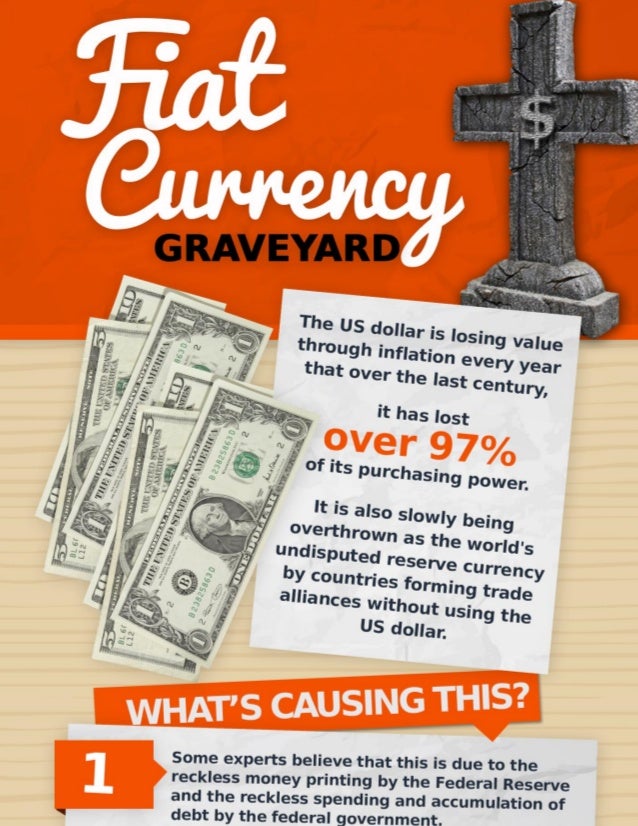

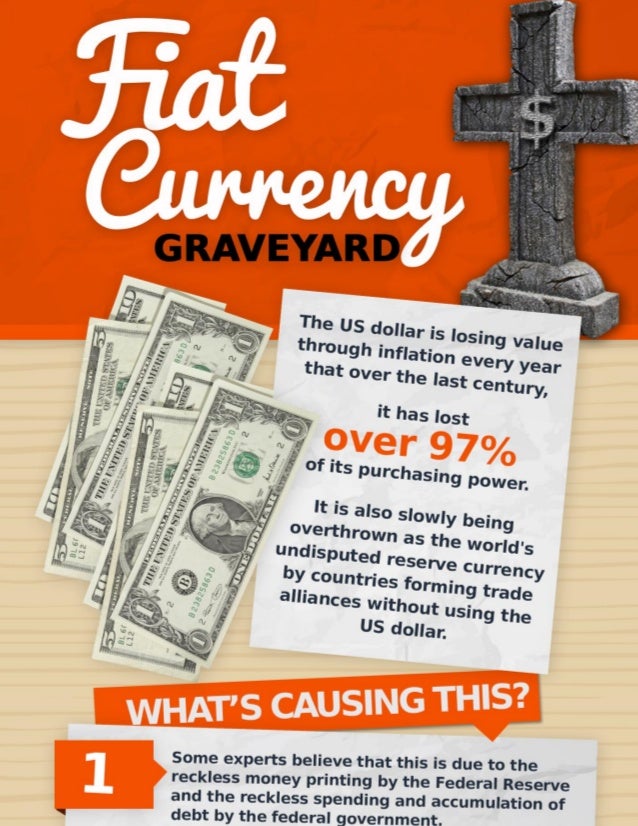

Measured in terms of fiduciary currencies, any bubble is price inflation. The exclusion of relevant assets from government inflation statistics means that the effect on consumer prices will be a second-rate event.

For purposes of illustration and assuming that all other things are the same, suppose that at the height of the bubble, five percent of the world’s population is trading cryptocurrencies. This is possible given the ubiquity of mobile phones and other electronic devices. The paper wealth created by some 350 million people who enjoy the bubble, as well as a small part of the huge amount of money under professional management, will at that time be in the order of billions, possibly in the order of tens of billions. That wealth will extend to spending on services and goods, raising consumer prices in all areas. The effect is likely to be much more pronounced in advanced economies, where very few people lack banking services, and their successful speculation is more likely to translate more directly into spending.

It is at this time that it would seem that cryptocurrencies will replace government currencies, which could become a dangerous illusion. Central banks will soon realize that widespread public profits in cryptocurrencies are undermining the purchasing power of unsupported government currencies. At that time they will have no choice but to raise interest rates enough to stifle demand for these currencies. And when demand declines, it’s almost certain that there will be a rapid collapse.

In the absence of other factors, there is no doubt that this is how the bubble should develop. It has the characteristics of being the purest bubble in the history of money, following the three impulse movements traditionally associated with bullish markets. There is no definite difference between a bullish market and a bubble, except for the degree, just as there is no point where inflation becomes hyperinflation, and socialism becomes communism.

Underlying Credit Cycle and its Effects

It is very likely that the advance of this phenomenon is affected or reduced by other factors, especially the existing credit cycle. The industrial revolution across Asia, led by China and Russia, will almost certainly have a profound impact on world prices of goods and services over the next year or two. Not only are commodity prices expected to rise, but funds are expected to flow from conventional investments to capital projects, increasing demand for skilled workers, and increasing their wages.

Price increases and production shortages will force nominal interest rates to rise anyway, whether central banks want it or not. Any expansion of bank credit to support cryptocurrency speculation will add to these end-of-cycle factors. Therefore, it seems likely that interest rates will rise enough to trigger a credit crunch before the cryptocurrency bubble has the time to continue its theoretical course completely.

Price increases and production shortages will force nominal interest rates to rise anyway, whether central banks want it or not. Any expansion of bank credit to support cryptocurrency speculation will add to these end-of-cycle factors. Therefore, it seems likely that interest rates will rise enough to trigger a credit crunch before the cryptocurrency bubble has the time to continue its theoretical course completely.

Assuming that commercial banks are rescued after the next credit crunch, it is possible that the disrupted cryptocurrency bubble will continue, probably after a strong negative swing. Bank deposits will remain intact, and depositors as a whole will have a much greater amount of fiduciary money than they need. It is almost entirely certain that central banks be forced to lower interest rates to zero, or to negative territory, making cryptocurrencies a more attractive alternative to bank deposits.

This should lead to a conclusion, which is that if it continues, the cryptocurrency bubble will play a major role in weakening the purchasing power of fiduciary currencies, potentially dramatically. If public participation in the final phase of the bubble occurs before the next credit crunch, it could advance and magnify the credit crunch itself. If it still runs its course after the credit crunch, it could undermine the buying power of fiduciary currencies in its wake, in a way we could never see after the Lehman crisis.

Will the price of gold be negatively affected? Surely, some members of the public, particularly in North America and Europe, will think so and will delay or sell gold purchases so they can invest in cryptocurrencies. But the truth is that gold is real money and has survived other episodes like this before. The eventual victim in this bubble will be money without state-issued backing. Gold will remain solid money long after the cryptocurrency bubble is recorded in the history books as the most convincing and pure evidence of the madness and delusions of the crowds.

Some economists have concluded that cryptocurrencies are probably the purest form of financial bubble in all the history of speculation, and will end up being of great theoretical interest to the next generations, as will the phenomenon of the tulip bubble.

Some economists have concluded that cryptocurrencies are probably the purest form of financial bubble in all the history of speculation, and will end up being of great theoretical interest to the next generations, as will the phenomenon of the tulip bubble.

Price increases and production shortages will force nominal interest rates to rise anyway, whether central banks want it or not. Any expansion of bank credit to support cryptocurrency speculation will add to these end-of-cycle factors. Therefore, it seems likely that interest rates will rise enough to trigger a credit crunch before the cryptocurrency bubble has the time to continue its theoretical course completely.

Price increases and production shortages will force nominal interest rates to rise anyway, whether central banks want it or not. Any expansion of bank credit to support cryptocurrency speculation will add to these end-of-cycle factors. Therefore, it seems likely that interest rates will rise enough to trigger a credit crunch before the cryptocurrency bubble has the time to continue its theoretical course completely.