General Overview

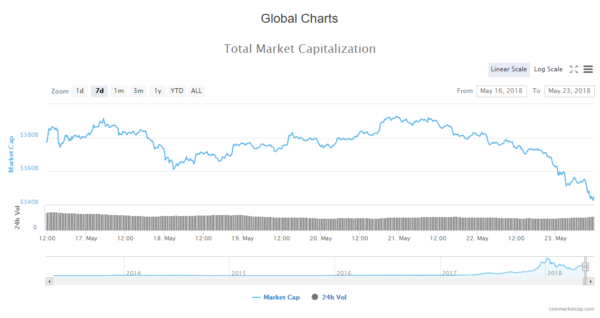

Market Cap: $344,628,122,166

24h Vol: $16,760,046,234

BTC Dominance: 37.8%

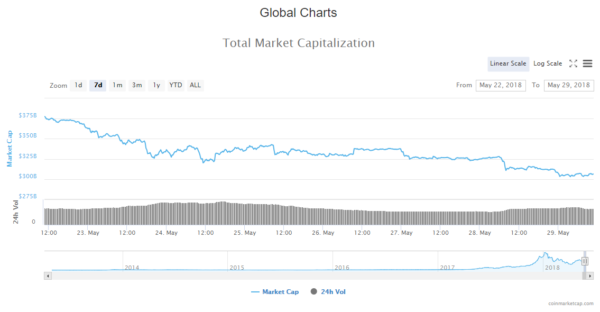

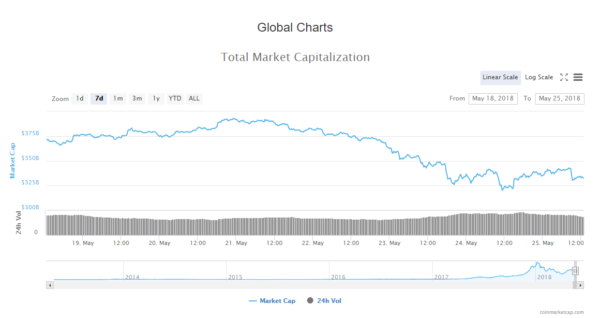

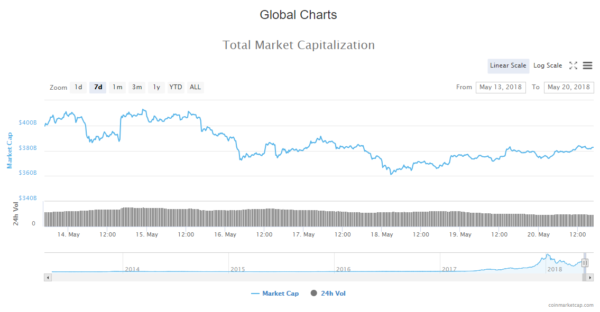

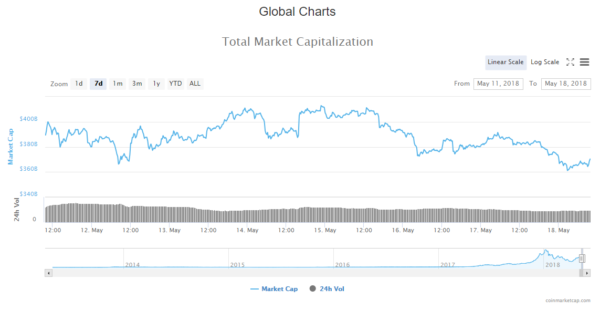

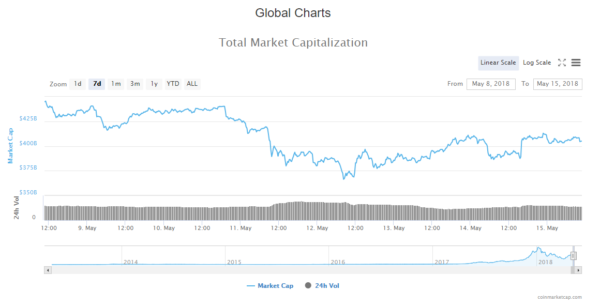

From Monday 28th May, the cryptocurrency market cap evaluation has been rising overall, but it experienced a lot of choppy movement, as for every new high it made, a sharp downward movement occurred. That means the market sentiment is still bearish as sellers are waiting anxiously for the right price in order to sell.

The resistance line at around 342 billion dollars has been crossed and it is now being retested for support.

News

This weeks top headlines are the following:

South Korea is in the process of lifting the ICO ban

The National Assembly has officially made a proposal to allow domestic initial coin offerings (ICOs). As the administration is sitting on its hands after imposing a total ban on ICOs in September last year, the National Assembly has come forward with an official recommendation.

Source: http://www.businesskorea.co.kr

Major vulnerability found in the EOS blockchain days before the mainnet launch.

China’s largest Internet security company, Qihoo 360, has found several high-risk security vulnerabilities in EOS’s blockchain platform. These vulnerabilities would enable remote attacks on all EOS nodes, Qihoo 360 claimed on Weibo Tuesday, May 29.

Crypto exchange Binance plans to create 1 billion dollar fund.

Binance, currently the world’s largest cryptocurrency exchange by trade volume, plans to create a $1 bln cryptocurrency-based fund, an executive confirmed June 1. Using only Binance’s BNB tokens as an investment vehicle, the fund will be administered through the exchange’s incubator spin-off Binance Labs.

Source: cointelegraph.com

Analysis

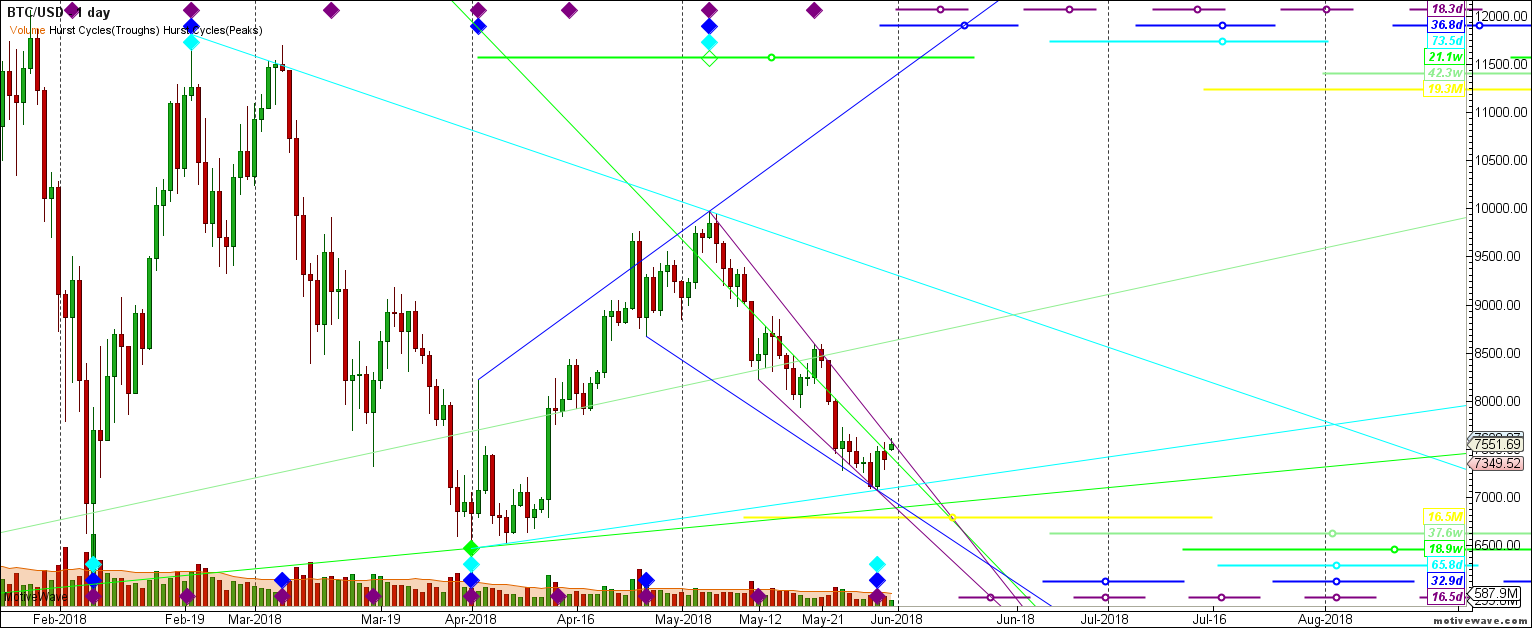

BTC/USD

From Mondays open, the price of Bitcoin has increased by 4.2% coming from 7294$ to 7608$ where it is currently. The rise was in the form of an upward channel/wedge.

On the daily chart, we can see that the price was at its lowest last Monday and below the baseline support (bold black line). Since then the price went above the baseline support with strong momentum, as those lows triggered buyers who have pushed the price higher. The price is currently inside the triangle again and was repealed by the triangle resistance line and 0.236 Fibonacci retracement level, so the price fell back to the baseline support again.

Market sentiment

Bitcoin daily chart technicals signal a sell.

Oscillators are on buy, but moving average signal a strong sell.

Pivot points

S3 6141.4 S2 6800.2 S1 7219.1 P 7459.0 R1 7877.9 R2 8117.8 R3 8776.6

ETH/USD

From Monday, May 28. Ethereum’s price increased by staggering 22.27% from 494$ which was the week’s low, to 605$ where it is currently sitting.

Looking at the daily chart, we can see that the price found support at the 0.236 Fibonacci retracement level and the unconfirmed support, and is currently repealed by the downward channel resistance line and is heading down to the 0.382 Fibo level. Overall last week was bullish for Ethereum, but judging by how much has the price increased and the interaction with the significant trendlines, this week may not be the same.

Market sentiment

Ethereum is in the sell zone.

Oscillators are signalling a buy, but with 8 on neutral, and moving averages are signalling a strong sell.

Pivot points

S3 343.61 S2 452.53 S1 521.49 P 561.45 R1 630.41 R2 670.37 R3 779.29

XRP/USD

In the last 7 days, the price of Ripple has been increasing steadily from 0.544$ to 0.656$ which is a 19.54% increase overall.

On the daily chart, we can see that Monday’s opening was the weeks low. From there the price went above the 0.573 with a strong momentum as indicated by the big green candle on Tuesday. Since then the price has been steadily increasing but it was now stopped out by prior range support, which now serves as resistance at 0.699$ levels.

Market sentiment

Daily chart technicals are signalling a sell.

Oscillators are on buy, and moving averages are signalling a sell.

Pivot point

S3 0.39577 S2 0.50453 S1 0.57380 P 0.61329 R1 0.68256 R2 0.72205 R3 0.83081

LTC/USD

From last Monday’s open, the price of Litecoin has increased by 9.73% from the weeks low on Monday at 110.2$ to 121$ where it is currently.

Looking at the daily chart we can see that the price of Litecoin fell below the retracement zone which is at the 111$ level on last Monday which triggered some buying. That buying pressure was short lived as the price failed to stay above the retracement zone level at 124$ and is now back in it again.

Market sentiment

Litcoin is in the sell zone.

Oscillators are on buy but with 8 on neutral, and moving averages are signalling a strong sell.

Pivot points

S3 88.590 S2 103.930 S1 113.810 P 119.270 R1 129.150 R2 134.610 R3 149.950

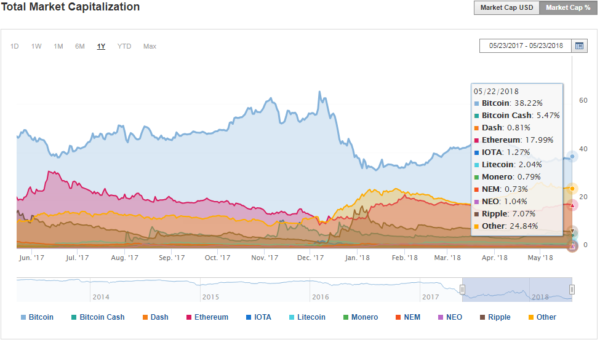

Conclusion

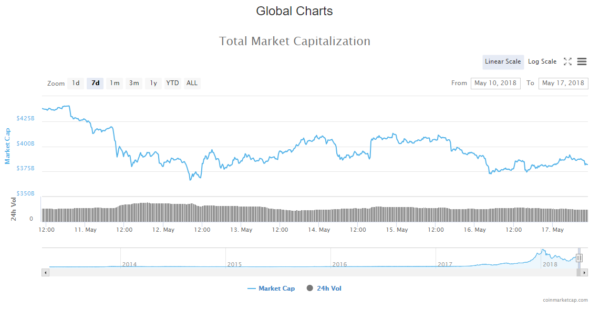

The market conditions are now similar to that of Jun 2014. After a strong runup, we are seeing a triangle being formed on the global chart.

Market cap chart back in 2014.

As you can see after the evaluation broke out from the triangle it halved in evaluation from the first high that was formed outside of the triangle.

So if the similar thing happens again this would be something that I would expect – a downfall to around $178B which would bring the price of Bitcoin to around 4500$ which would correlate perfectly with my Elliot Wave correction count which can be seen on the weekly update video.

In any way, I would be expecting a lot of sideways movement in the following weeks as the evaluation is clearly in a range.