Happenings in the Cryptoverse

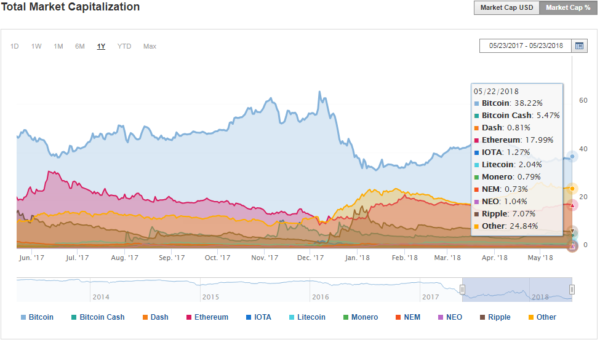

Bitcoin Vs Altcoins: The Cryptocurrency field is in quite of a rough spot when it comes to price at the moment. With altcoins being pegged to the price of Bitcoin, any movement seems to affect cryptocurrencies globally. Why is this happening and what to do?

Why Are Altcoins Dropping In Price More Than Bitcoin?

If, however, Bitcoin is rising in price, they are winding up slower because traders are riding the wave that Bitcoin created. After the spike up happens, altcoins take over and people diversify their portfolios from the previous gains they had.

Bitcoin price manipulation or something else?

Is this price fall an “attack” on Bitcoin and all of the Cryptocurrencies, or something else?

As you know, I am very conservative when it comes to accusing someone of price manipulation. There is always (in a way) a form of price manipulation from the big holders, but it’s usually not to shut down an asset, but rather just to profit from it. Also, the MtGox trustee has been a great source of fear and FUD with people, which further decreased optimism when it comes to Crypto.

So, it is price manipulation?

Only a small part of the price drop (I believe) is price manipulation. Investors were panic selling every step of the way down. Ultimately, the biggest reason for the drop in the value of Cryptocurrencies is nothing else but levelling of expectations and capabilities.

People had great expectations from day 1 of investing, but the truth is that Cryptocurrencies (most of them) were not ready for mass adoption and mass use, especially Bitcoin. This situation made the Crypto field a speculative field rather than an objective one. The price drop that happened levelled the expectation that people had regarding what Blockchain and Crypto could do for the world, rather than just turn a dollar into a few more, or into none.