GMI Edge is a forex broker that is registered and regulated in Vanuatu, there isn’t much information on their website about them, no about ‘About Us’ page or outline of their goals. So we will be going into this review blind, looking at all aspects of their service and site to see if they stand up to the competition and so you can decide if they are the right broker for your trading needs.

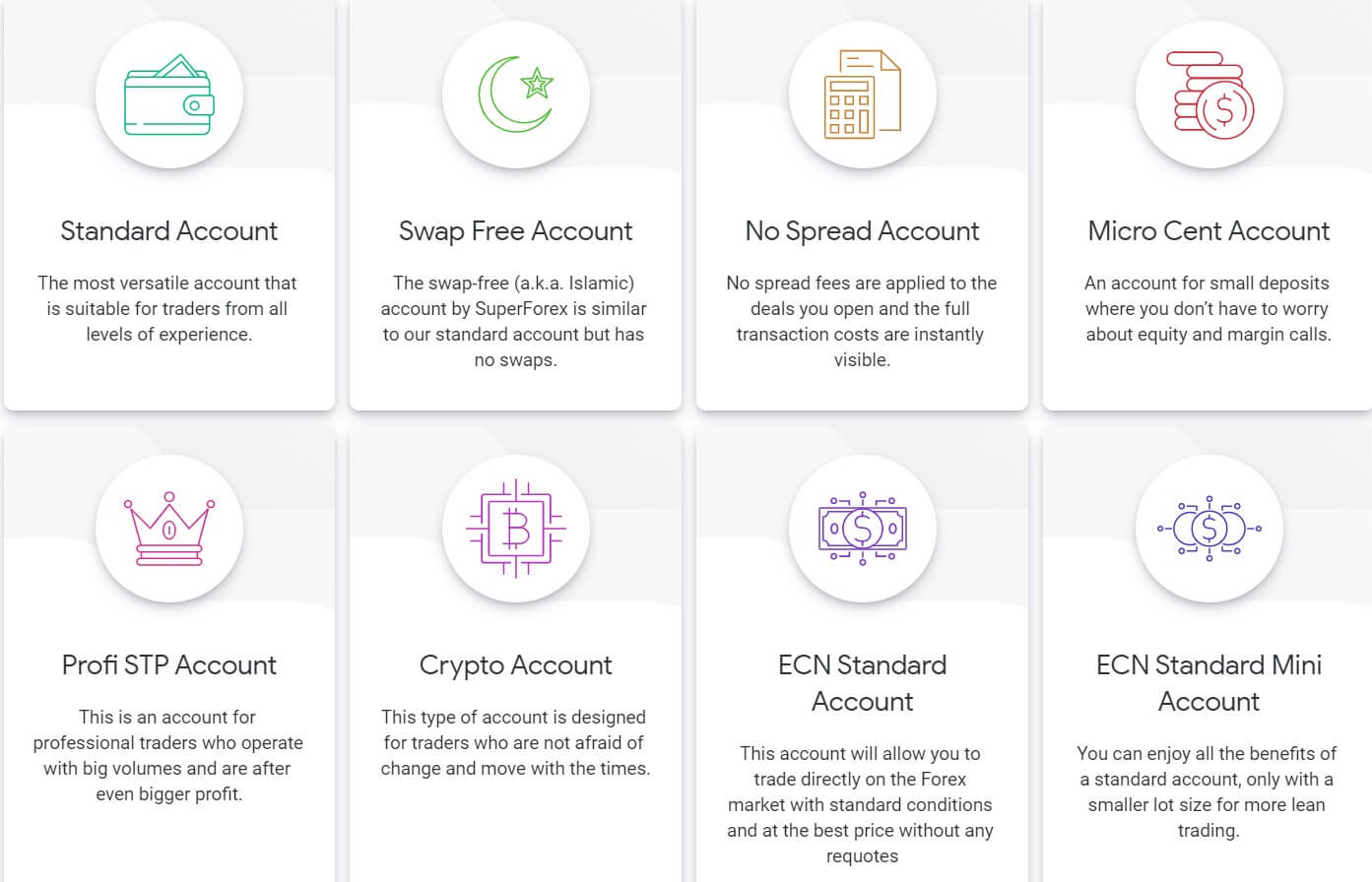

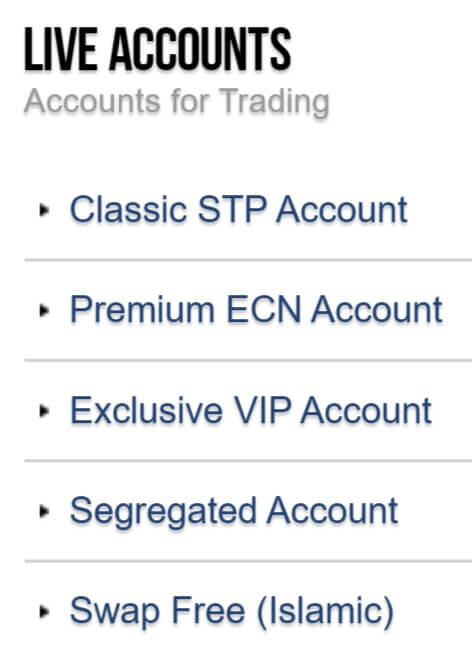

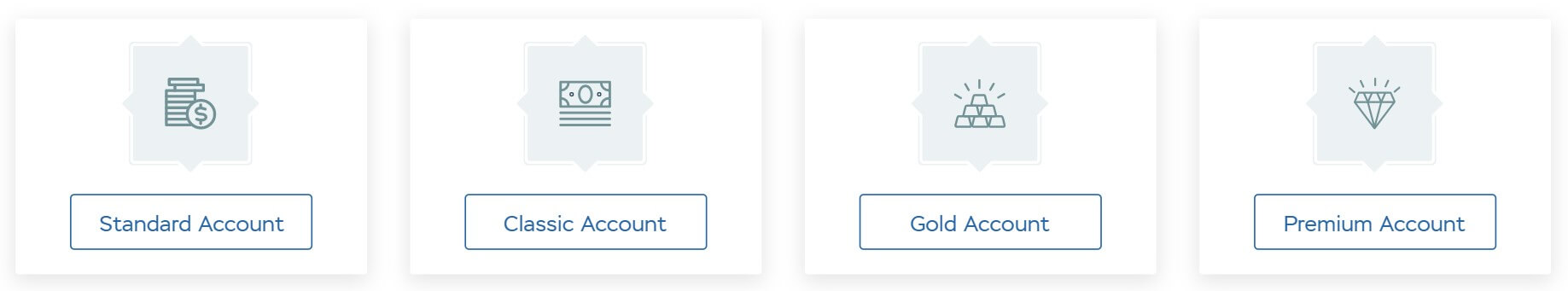

Account Types

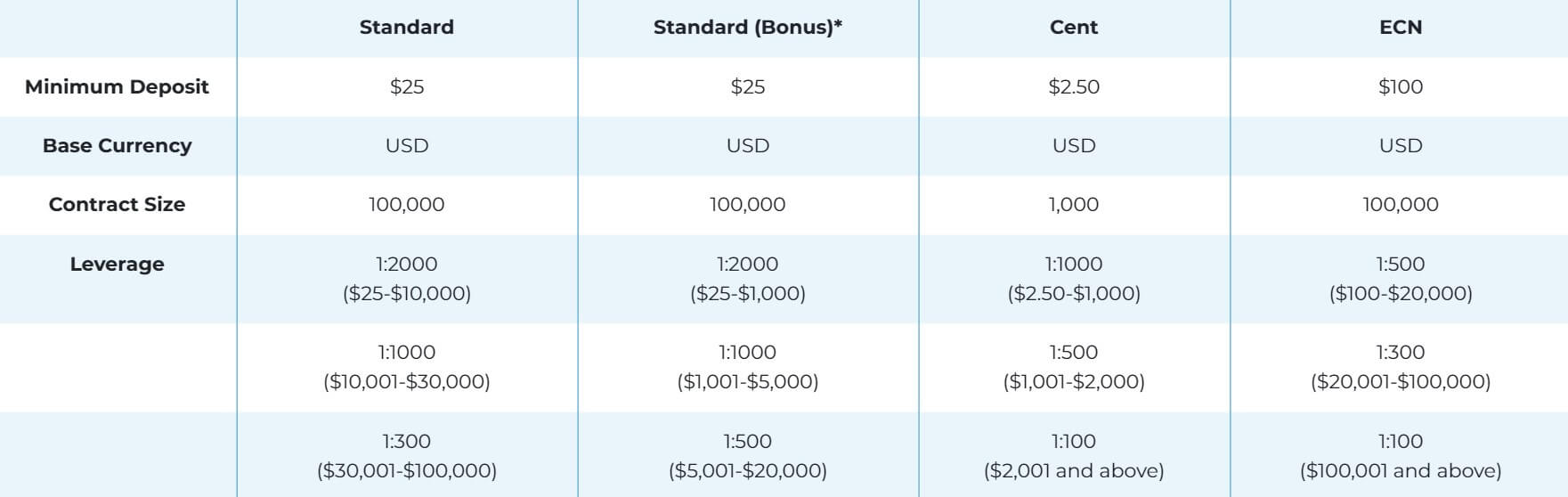

There are four different accounts available to choose from, each with its own features, so let’s outline what they are.

Standard Account:

This account has a deposit requirement of $25 and must be in USD. The contract size is 100,000 units and leverage can go as high as 1:2000. Expert advisors are allowed as is hedging. There are no added commissions on the account which has a minimum trade size of 0.01 lots, a maximum of 50 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

Standard (Bonus) Account:

This account has a deposit requirement of $25 and must be in USD. The contract size is 100,000 units and leverage can go as high as 1:2000. Expert advisors are allowed as is hedging. There are no added commissions on the account which has a minimum trade size of 0.01 lots, a maximum of 50 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

Cent Account:

This account has a deposit requirement of $2.50 and must be in USD. The contract size is 1,000 units and leverage can go as high as 1:1000. Expert advisors are allowed as is hedging. There are no added commissions on the account which has a minimum trade size of 0.01 lots, a maximum of 150 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

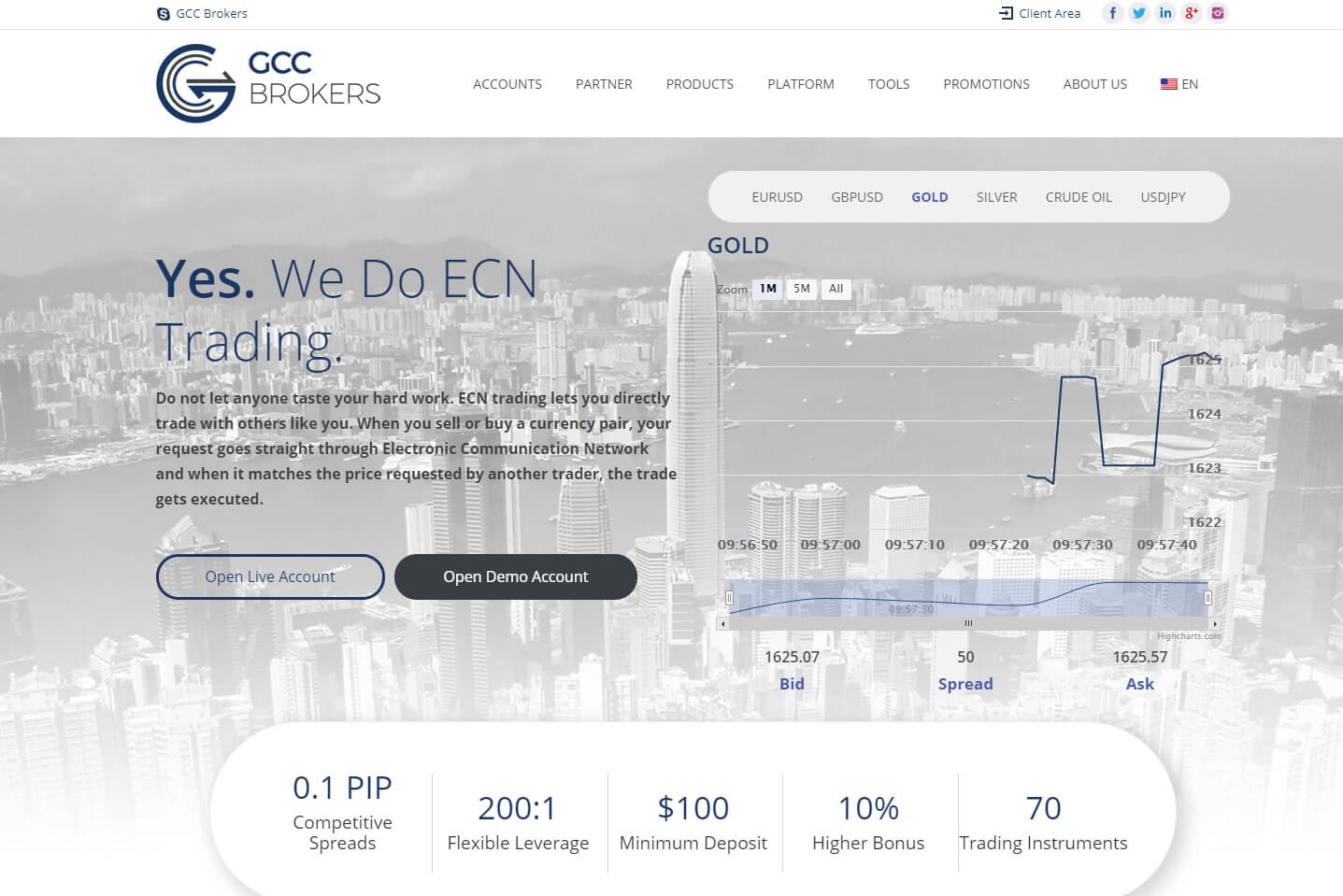

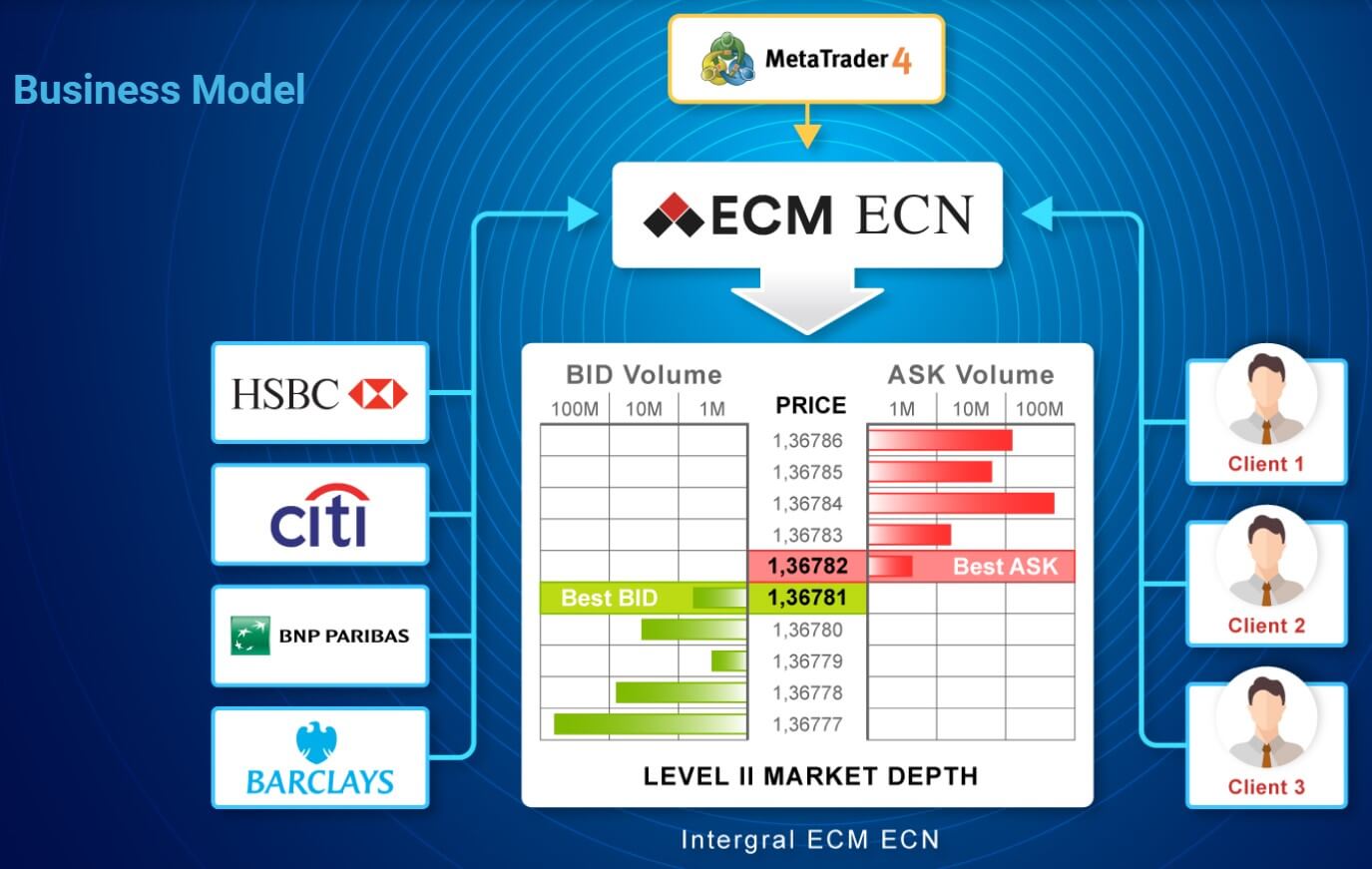

ECN Account:

This account has a deposit requirement of $100 and must be in USD. The contract size is 100,000 units and leverage can go as high as 1:5000. Expert advisors are allowed as is hedging. There is an added commission of $4 per lot on the account which has a minimum trade size of 0.01 lots, a maximum of 50 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

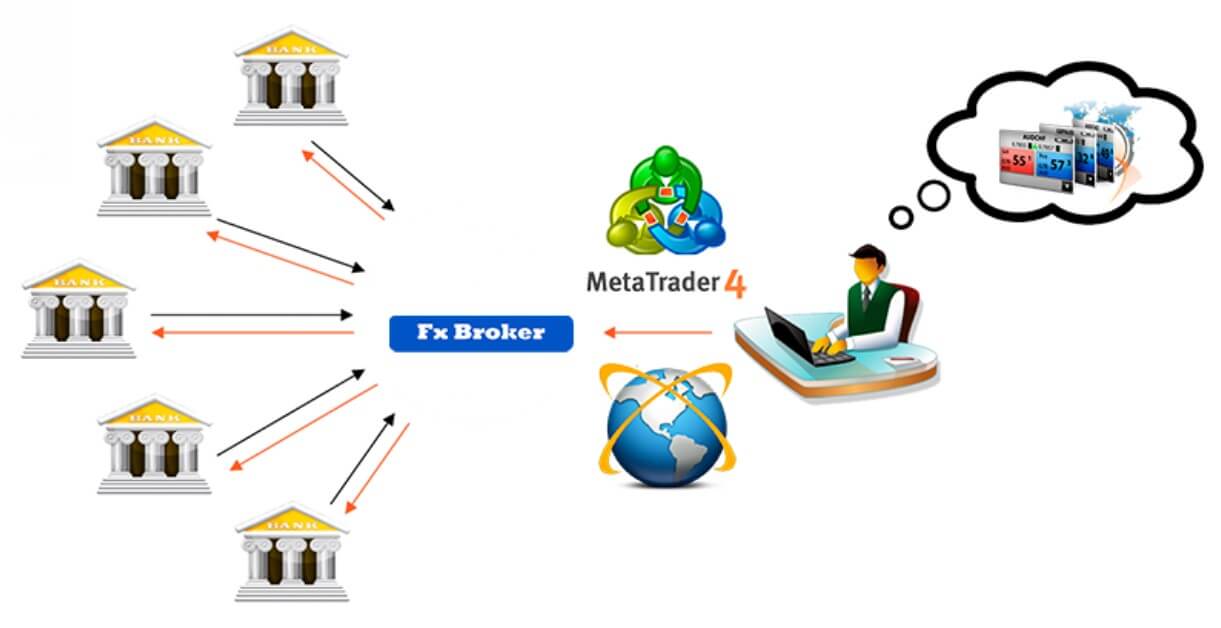

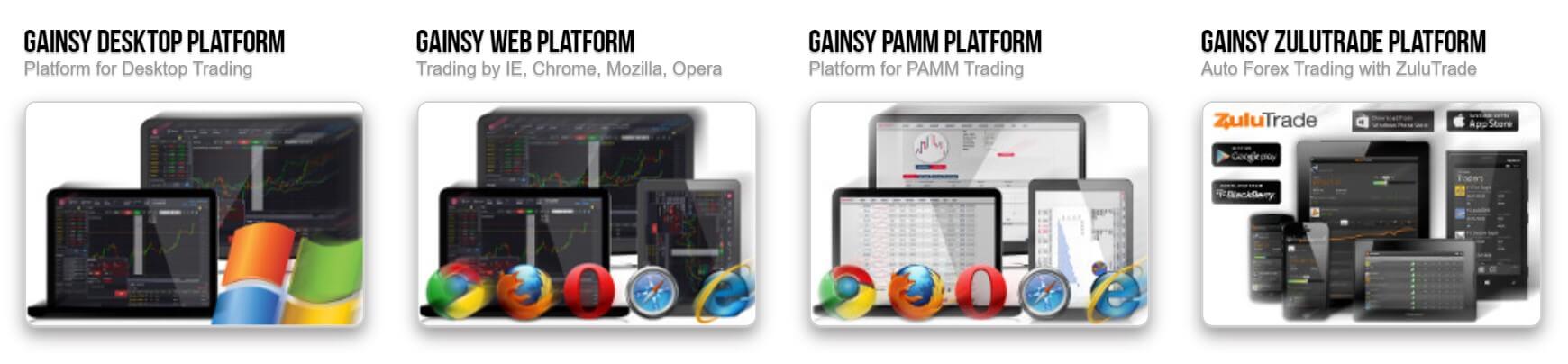

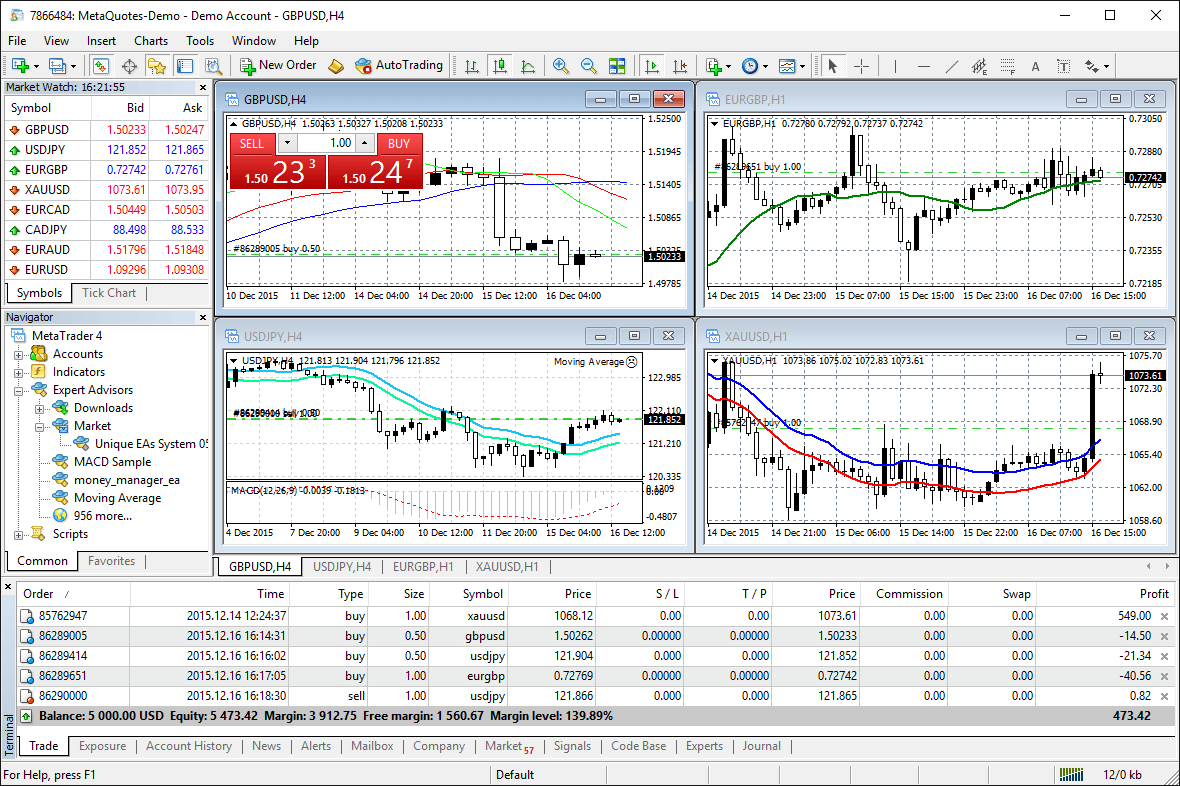

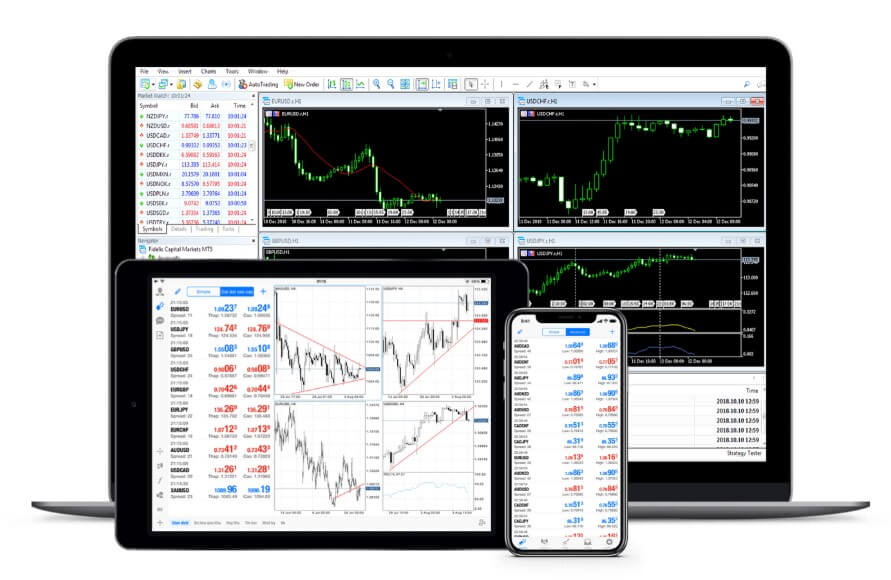

Platforms

Platforms

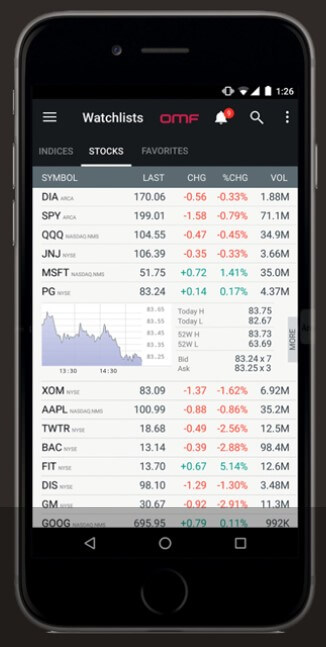

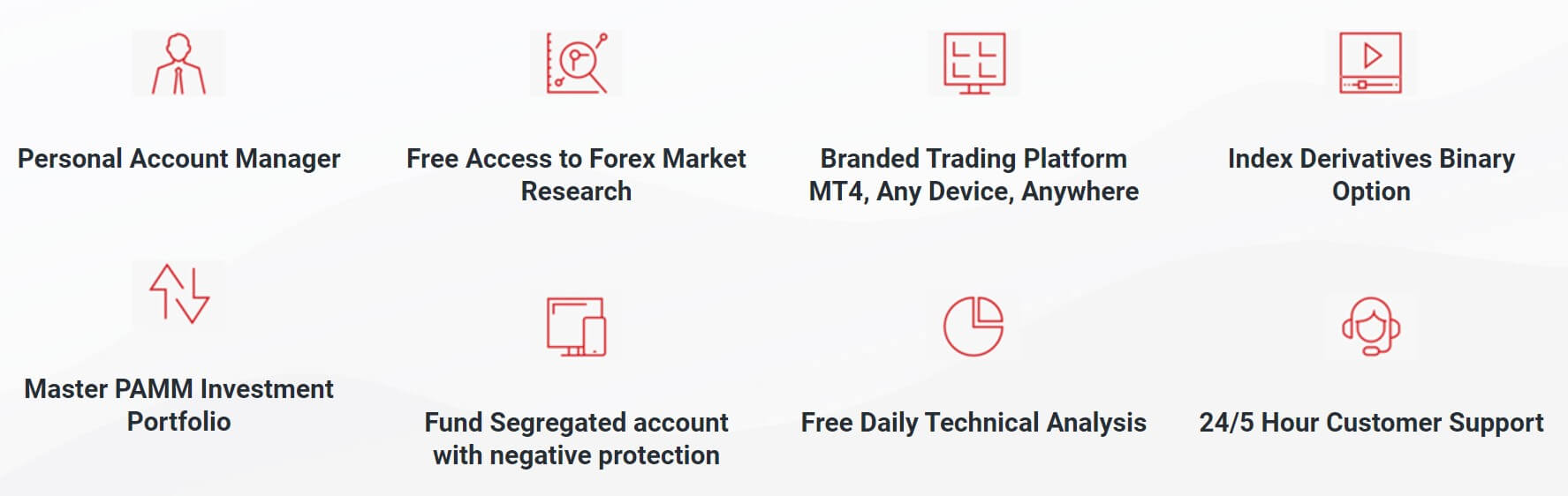

The only platform on offer is MetaTrader 4 which is one of the most used and secure platforms for trading Forex, allowing you to analyze the financial markets, use Expert Advisors (EA) and use a whole host of indicators and scripts to analyze your next move and transaction. Millions of traders with a wide range of needs choose MetaTrader 4 to trade in the market. Usable and accessible by all, MT4 is available as a mobile application, web trader and as a download for your desktop or laptop.

Leverage

The leverage that you get depends on the account you use and the balance you have. We have outlined the differences in available leverage below.

Standard Account:

$25 – $10,000 = 1:2000 max

$10,001 – $30,000 = 1:1000 max

$30,001 – $100,000 = 1:300 max

$100,001 and above = 1:100 max

Standard (Bonus) Account:

$25 – $1,000 = 1:2000 max

$1,001 – $5,000 = 1:1000 max

$5,001 – $20,000 = 1:500 max

$20,001 – $100,000 = 1:200 max

$100,001 and above = 1:100 max

Cent Account:

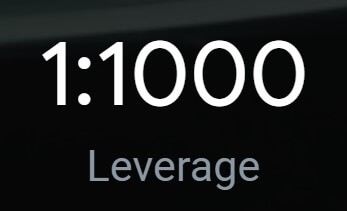

$2.50 – $1,000 = 1:1000 max

$1,001 – $2,000 = 1:500 max

$2,001 and above = 1:100 max

ECN Account:

$100 – $20,000 = 1:500 max

$20,001 – $100,000 = 1:300 max

$100,001 and above = 1P:100 max

The leverage is fixed and selected when opening up an account.

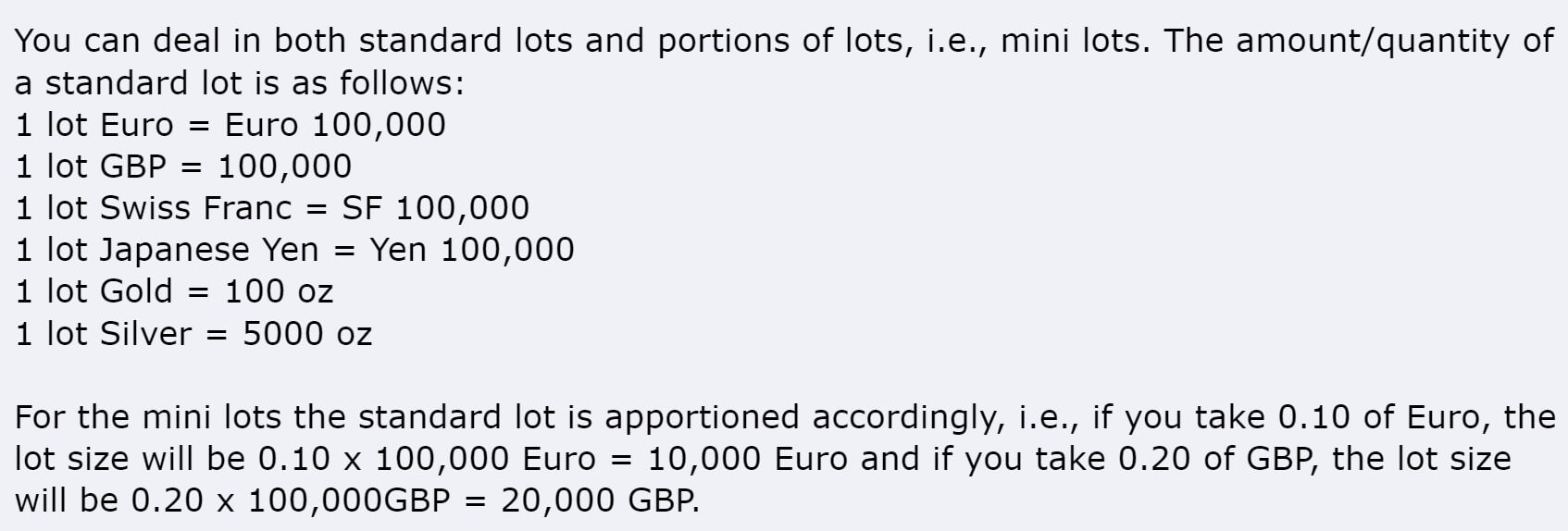

Trade Sizes

Trade sizes for all accounts start from 0.01 lots and go up in increments of 0.01 lots. The Standard, Standard (bonus) and ECN accounts have a max trade size of 50 lots and the Cent account has a maximum of 150 lots. You can also have a maximum of 200 orders at any one time.

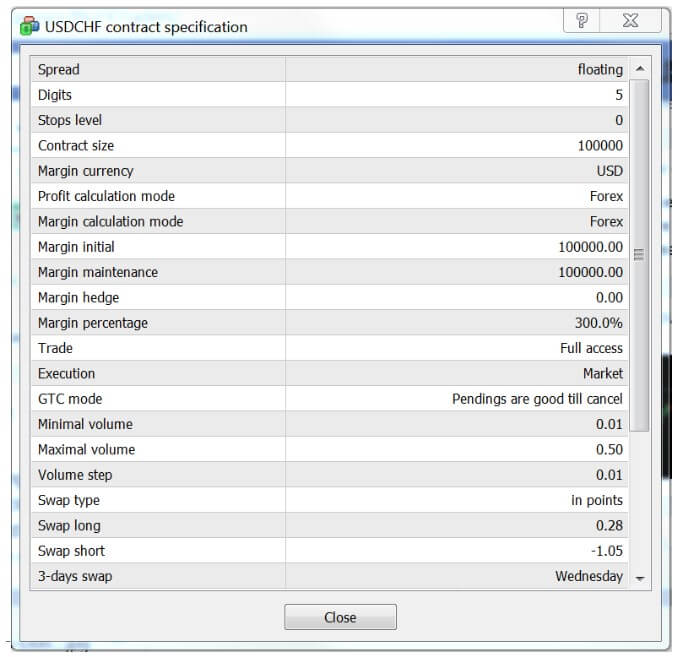

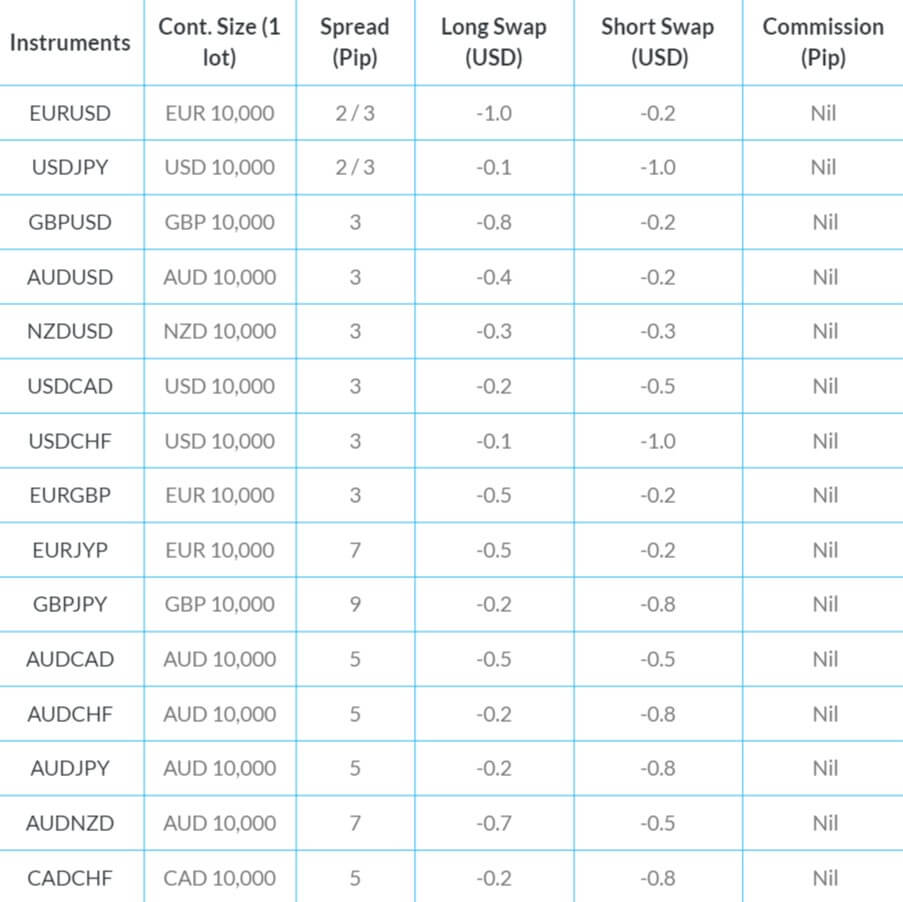

Trading Costs

The ECN account is the only account that has an added commission, the commission of $4 per lot traded. The other accounts use a spread based system that we will look at later. There are also spread charges which are charged for holding trades overnight. Islamic swap-free versions of each account are also available.

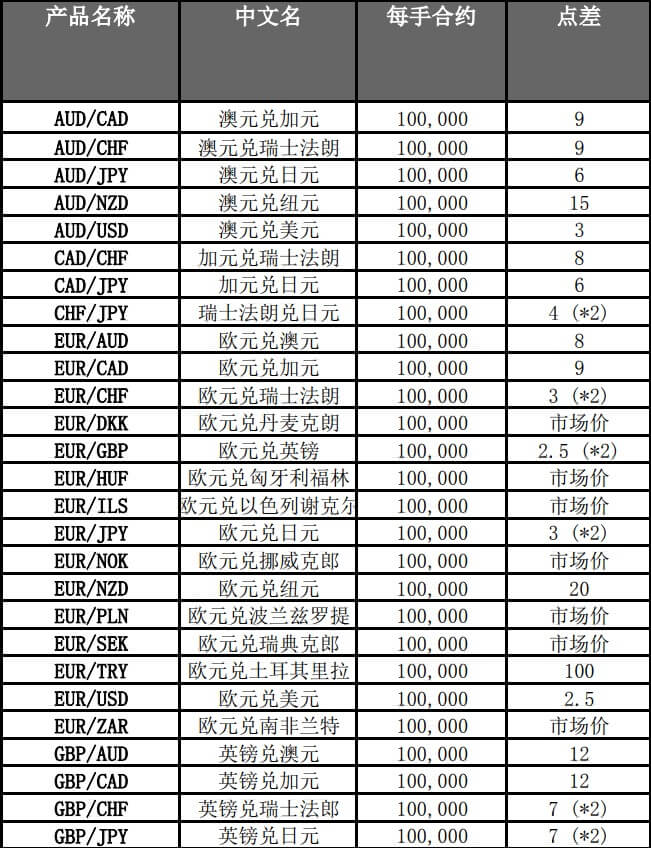

Assets

The assets have been broken down into a few different categories. We have outlined them below including the instruments within them.

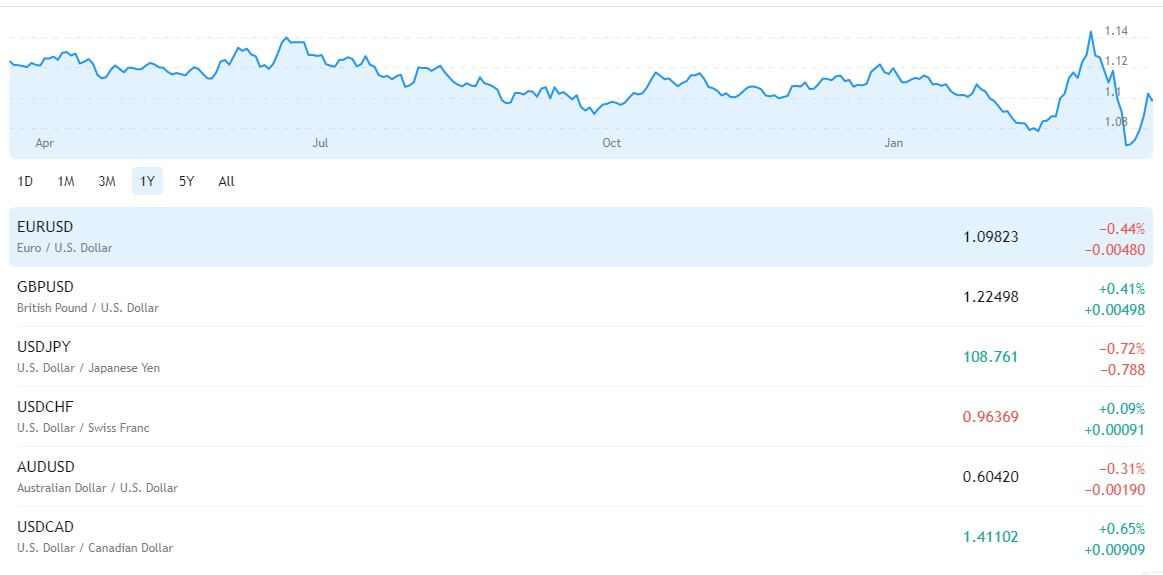

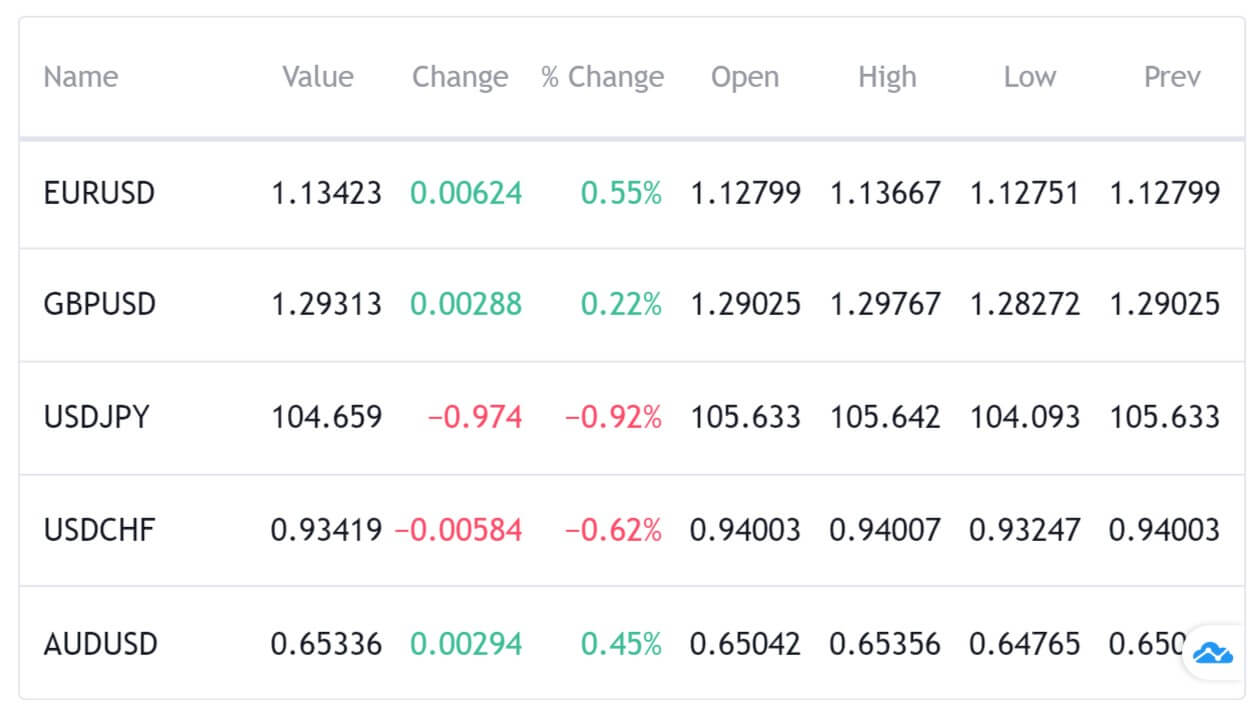

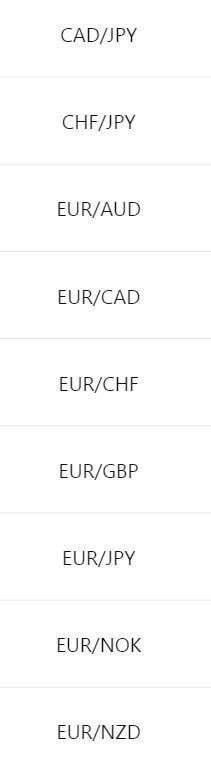

Forex: EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD, NZDUSD, USDCAD, EURGBP, EURCHF, EURJPY, GBPJPY, CHFJPY, AUDJPY, NZDJPY, CADJPY, AUDNZD, EURAUD, EURCAD, GBPCHF, GBPAUD, GBPCAD, GBPNZD, EURNZD, AUDCHF, AUDCAD, CADCHF, NZDCAD, NZDCHF, USDMXN, USDHKD, USDCNH, EURSEK, EURNOK, USDSEK, USDDKK, NOKSEC, USDZAR, USDNOK, EURTRY, USDTRY, USDSGD.

Metals: Gold and Silver.

Energy: US Crude Oil and UK Crude Oil.

Indices: These are not yet available and the site states that it is coming soon.

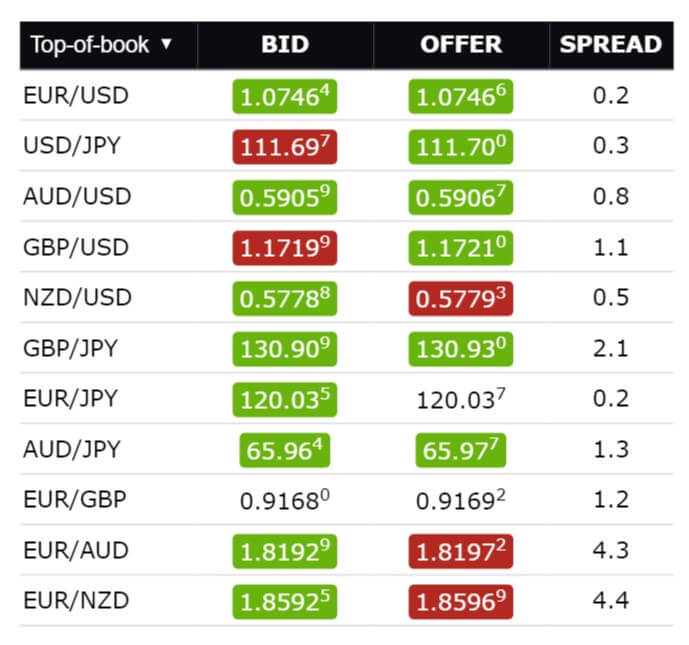

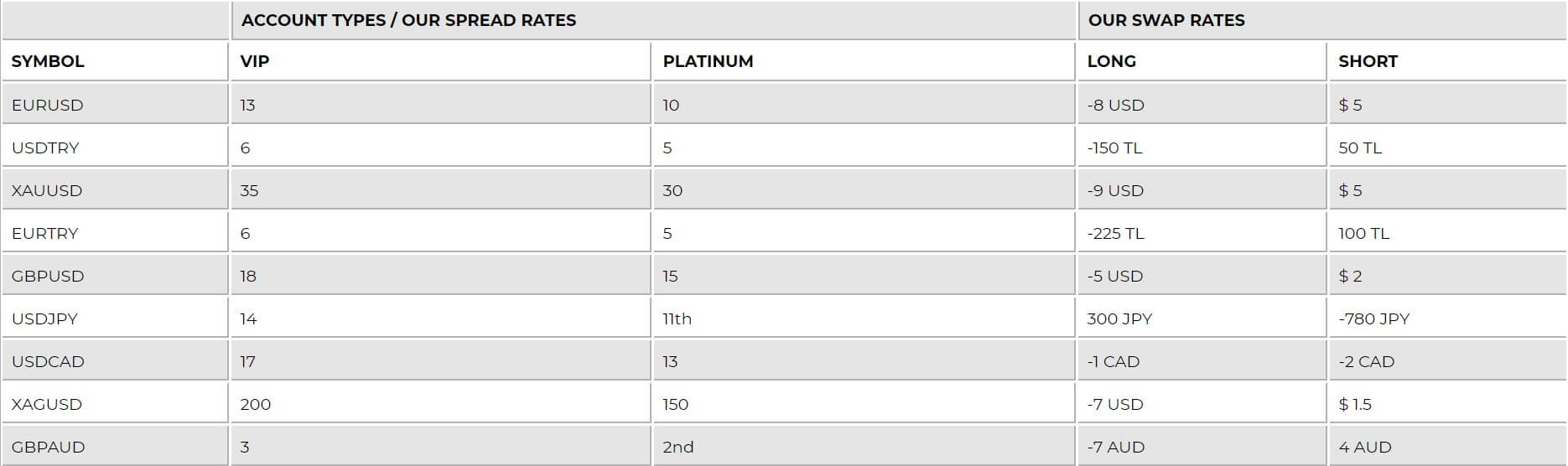

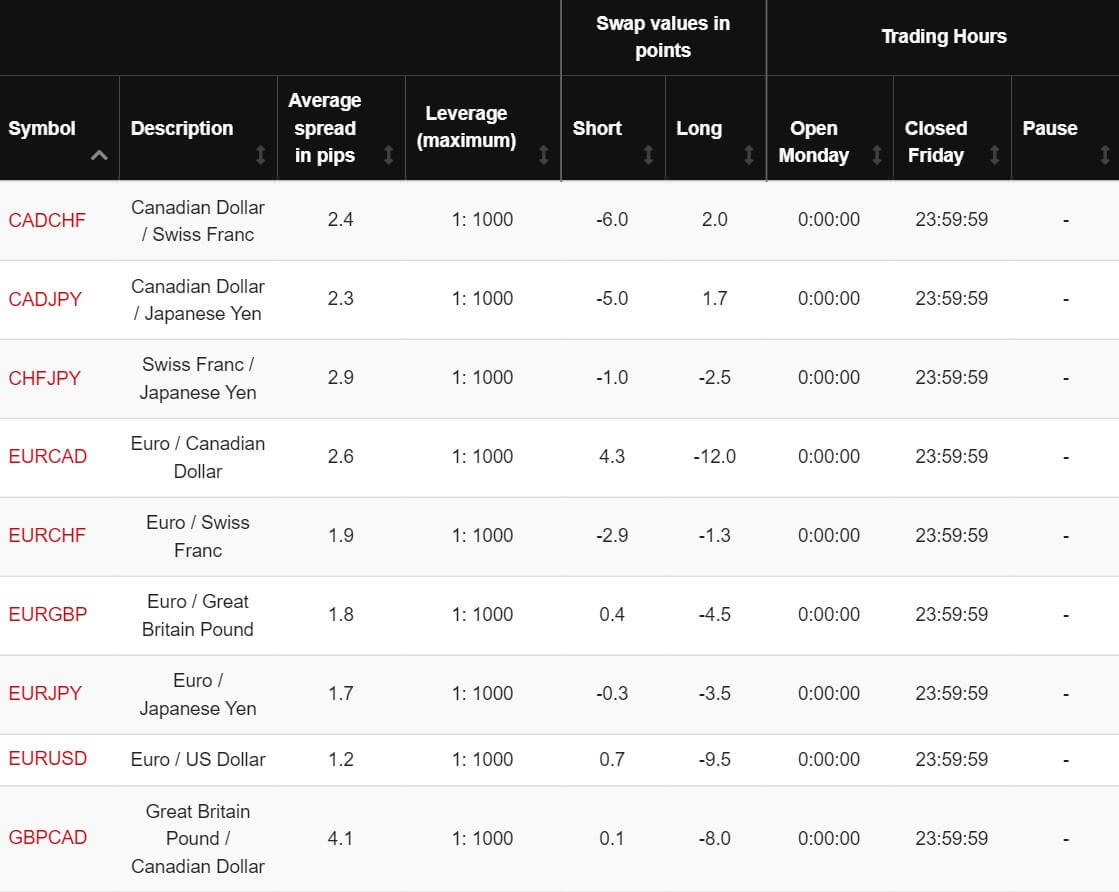

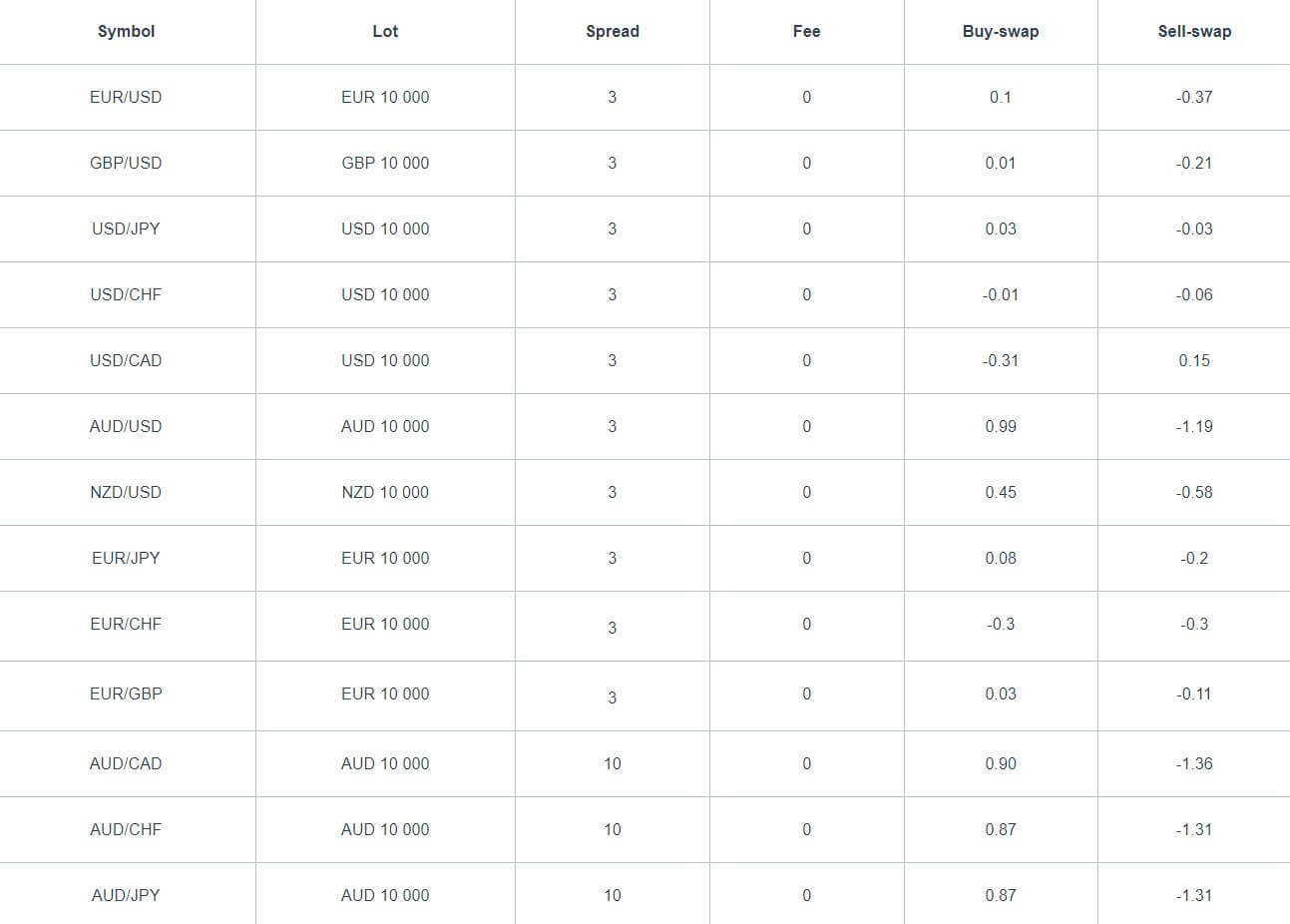

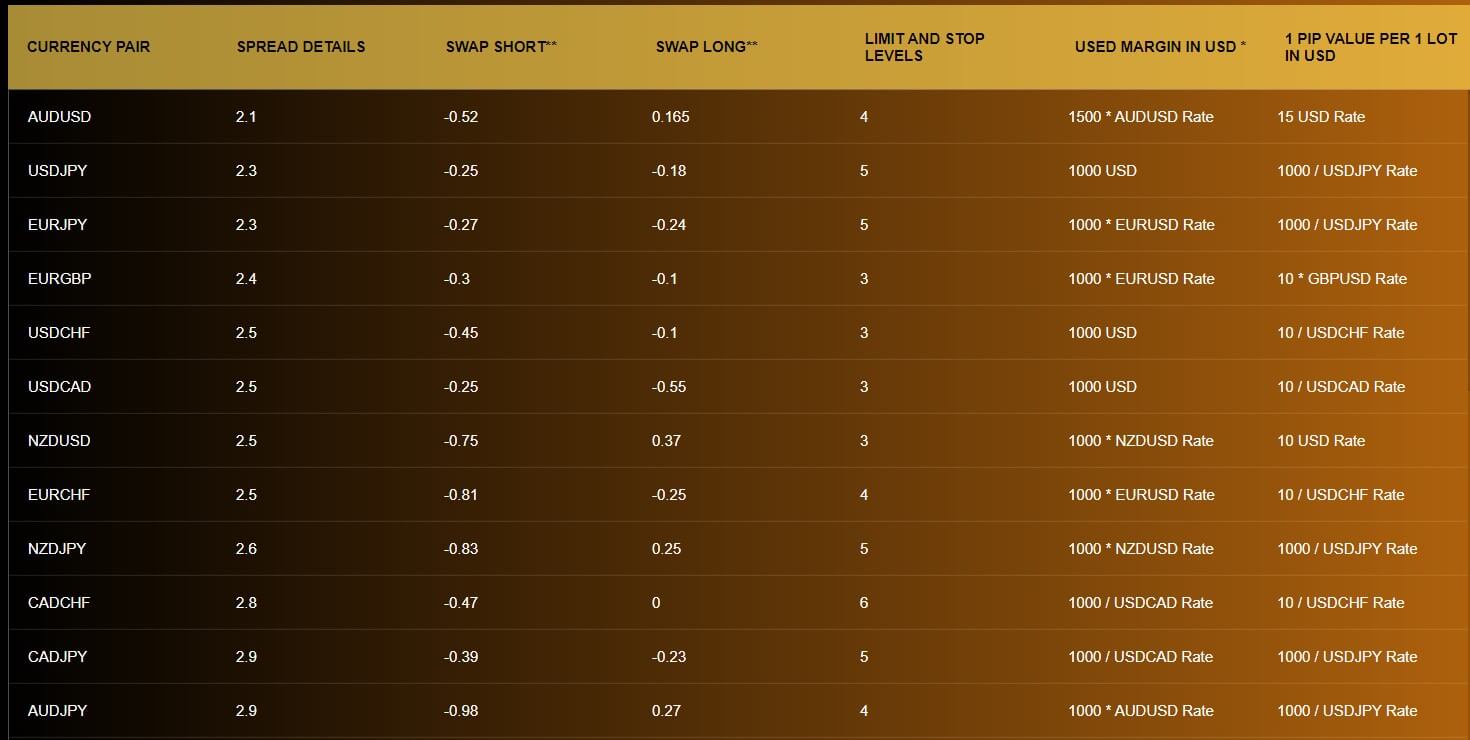

Spreads

The different accounts have different spreads if we look at EURUSD, the Standard and ent accounts have an average spread of 1.6 pips, the ECN account has an average spread of 0.2 pips. The spreads are variable which means they move with the markets when there is added volatility they will be seen higher. Different instruments also have different spreads so while EURUSD has an average of 1.6 pips, GBPJPY has an average of 2.8 pips.

Minimum Deposit

The minimum deposit amount is $2.50 which will allow you to open up a cent account if you want a standard account the minimum deposit required is $25.

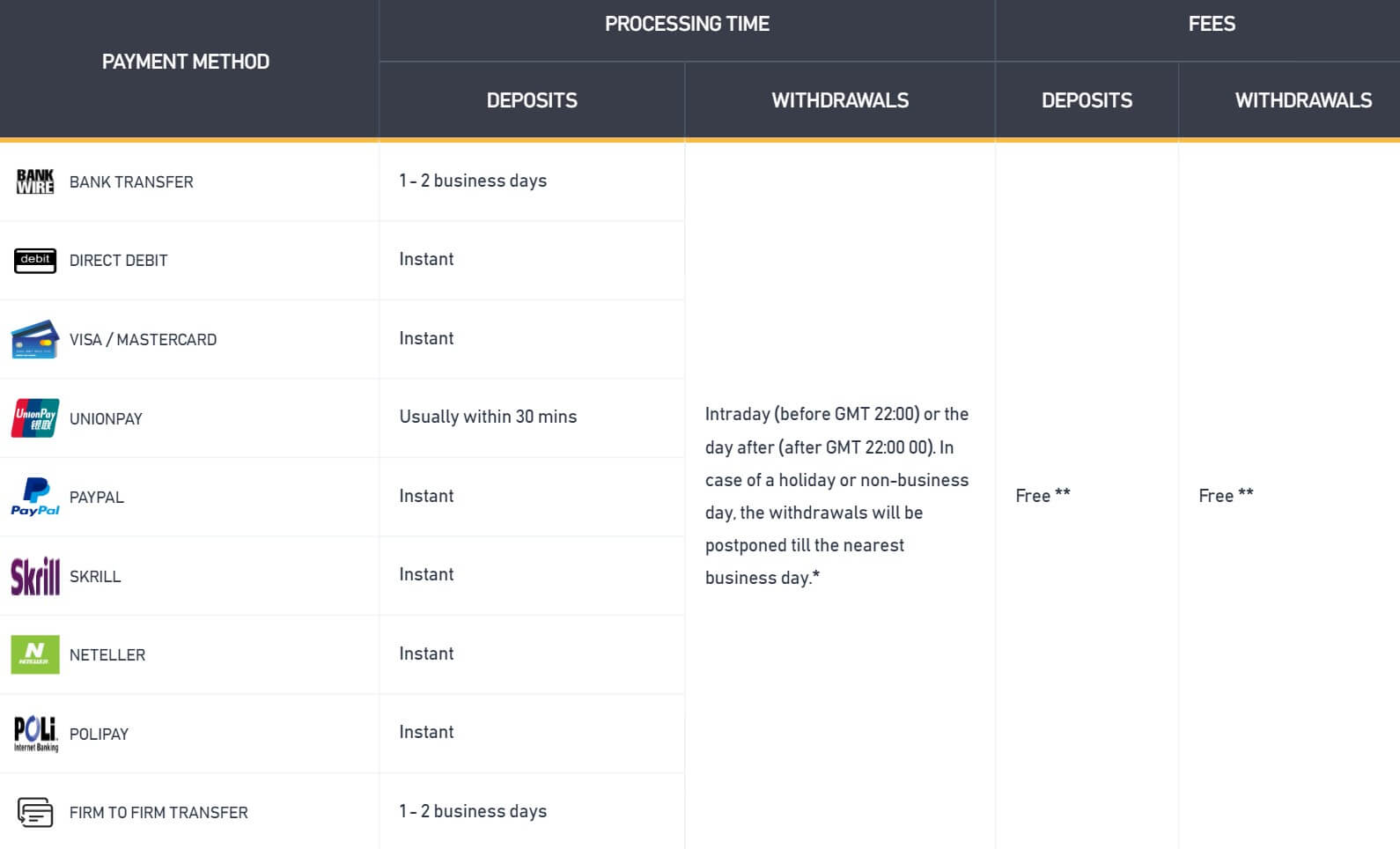

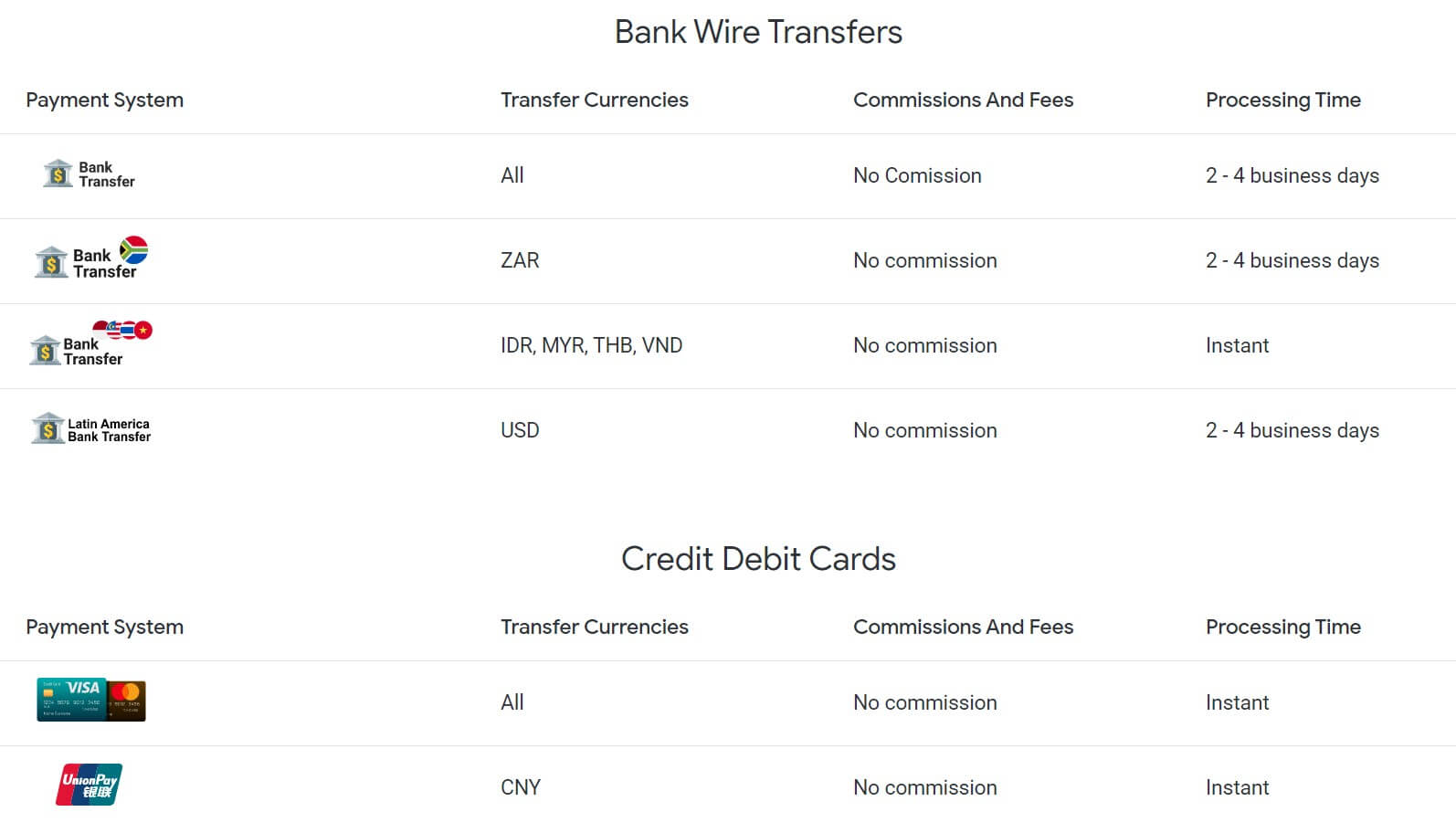

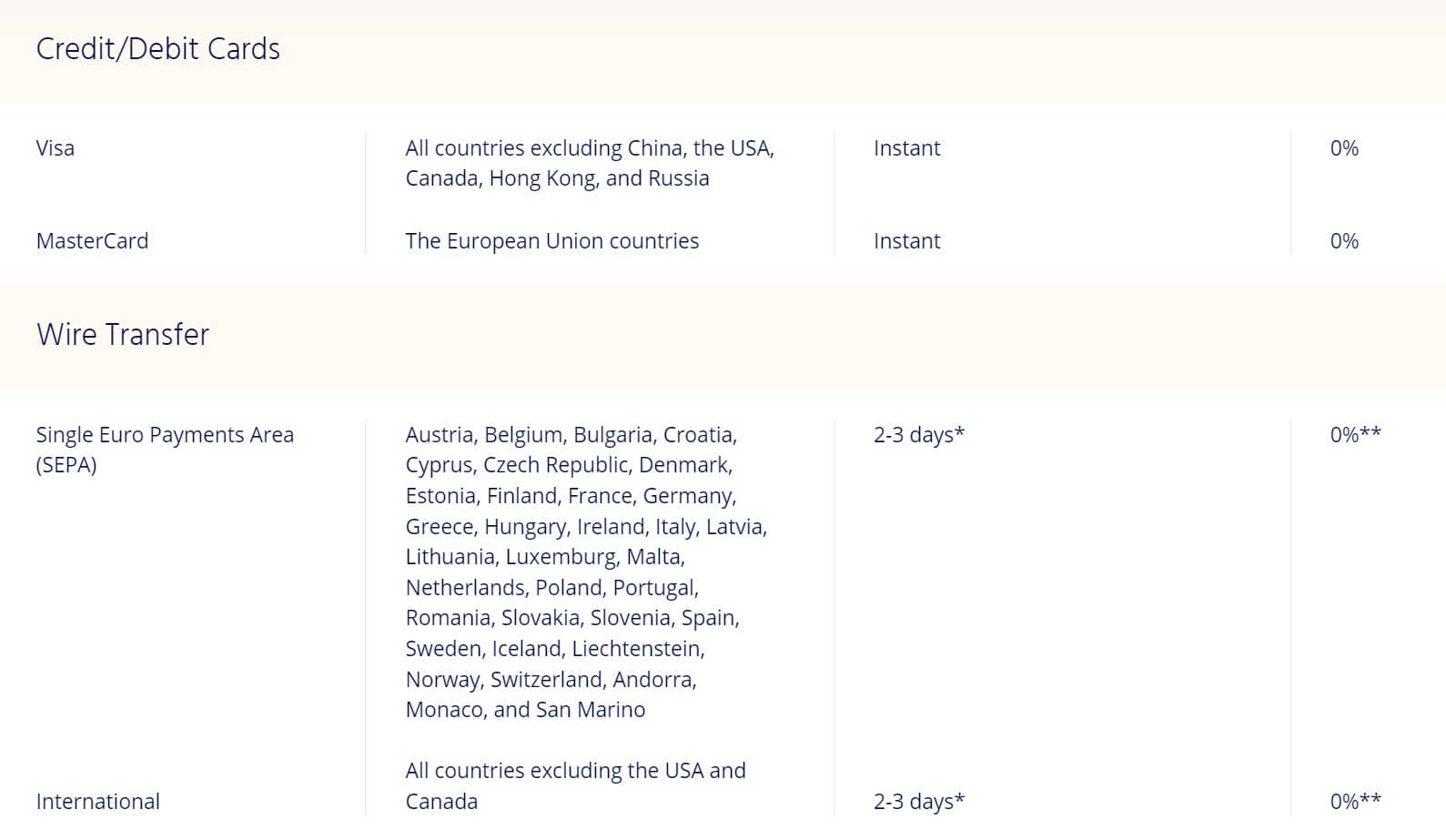

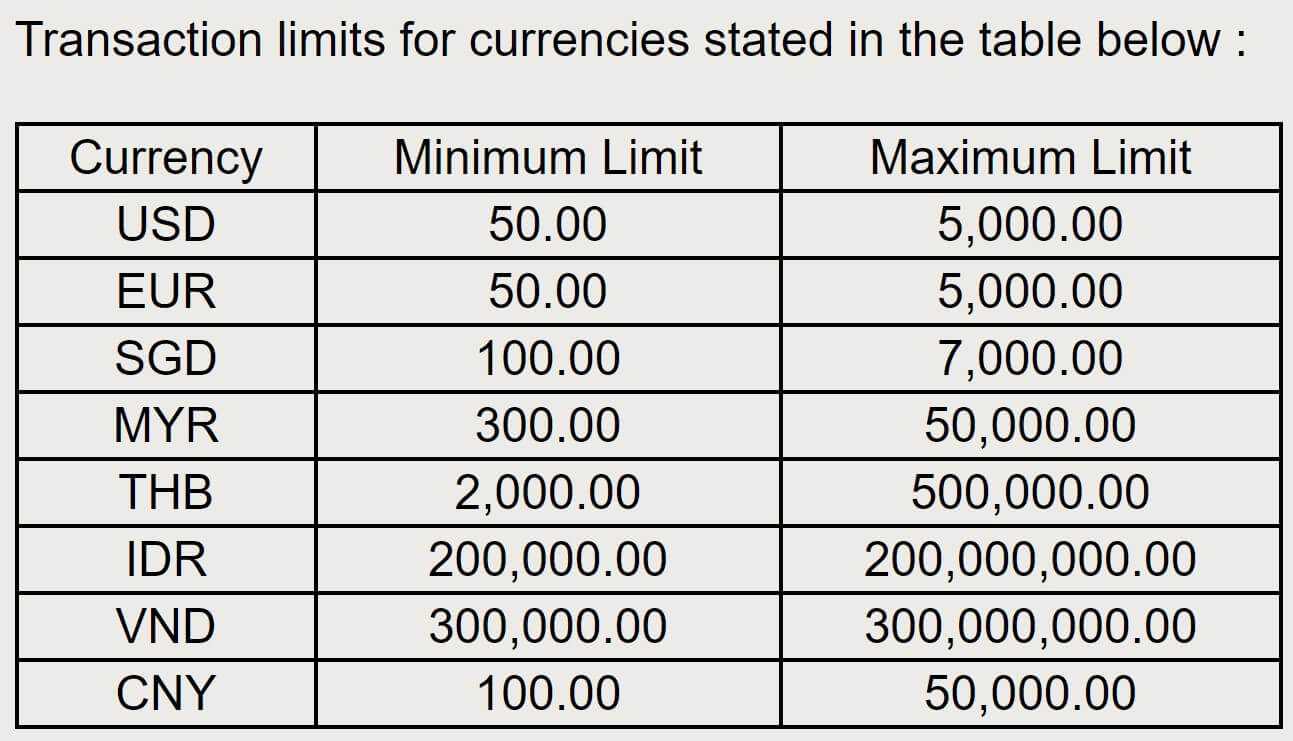

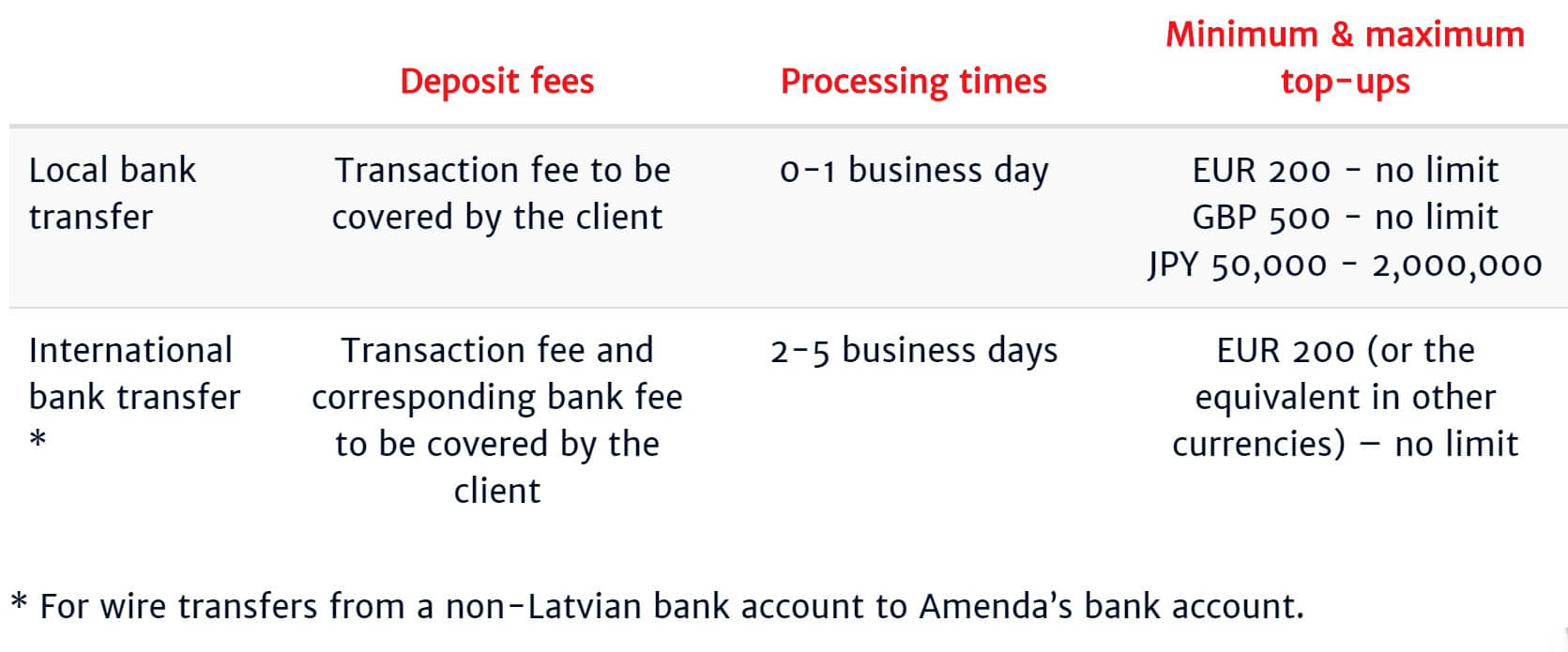

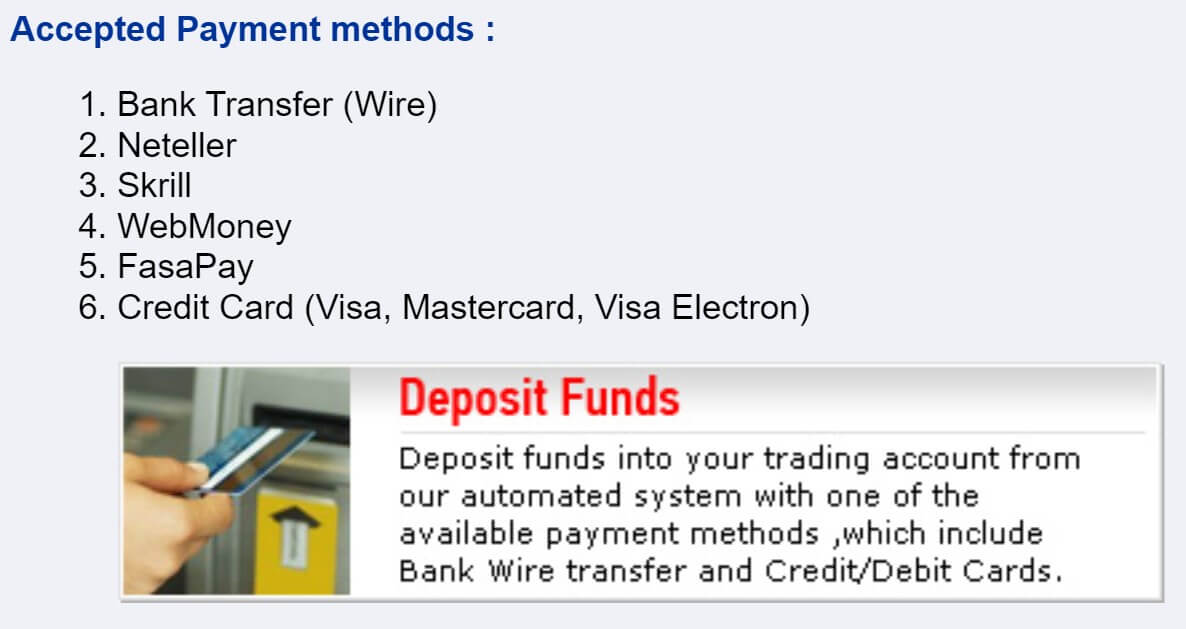

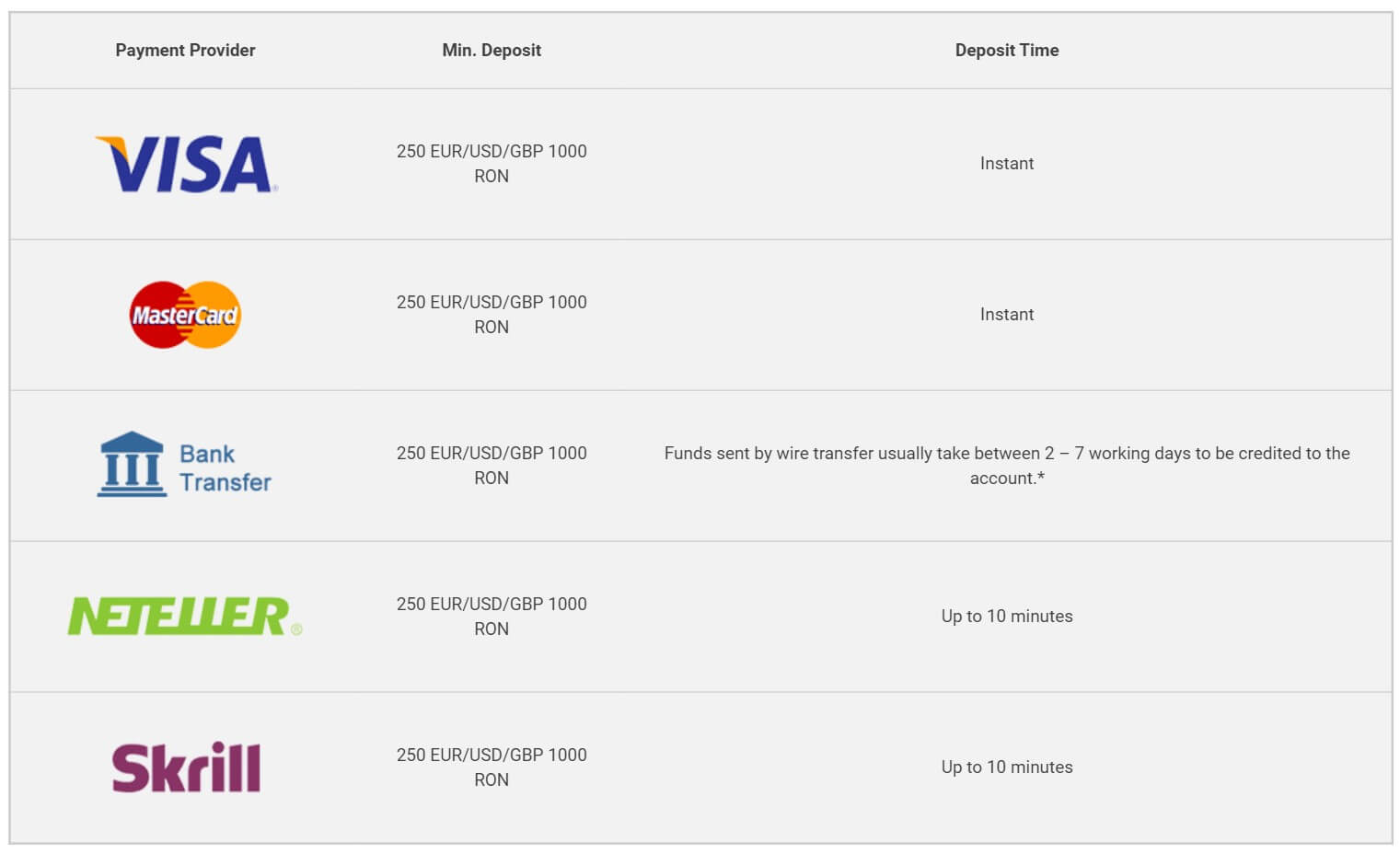

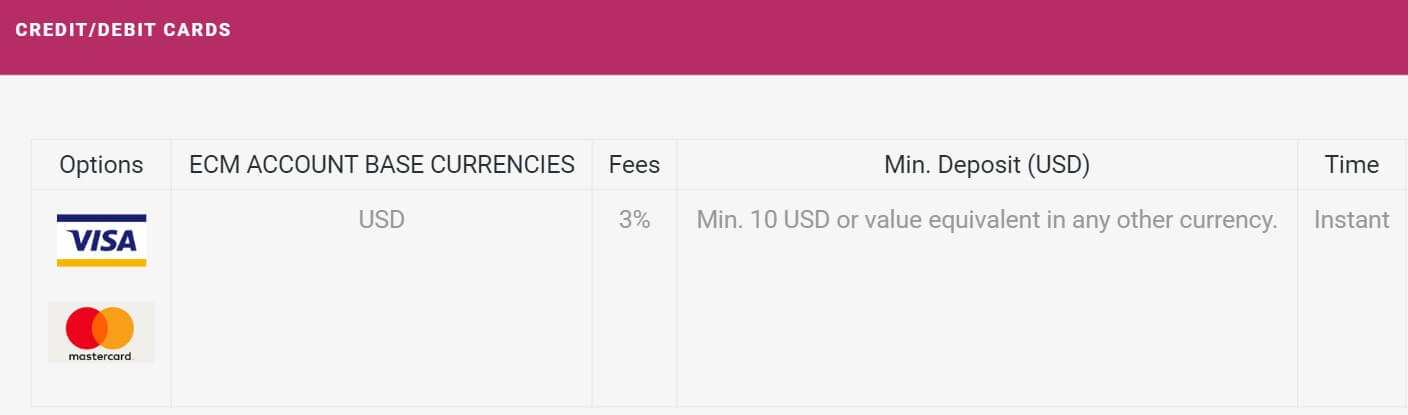

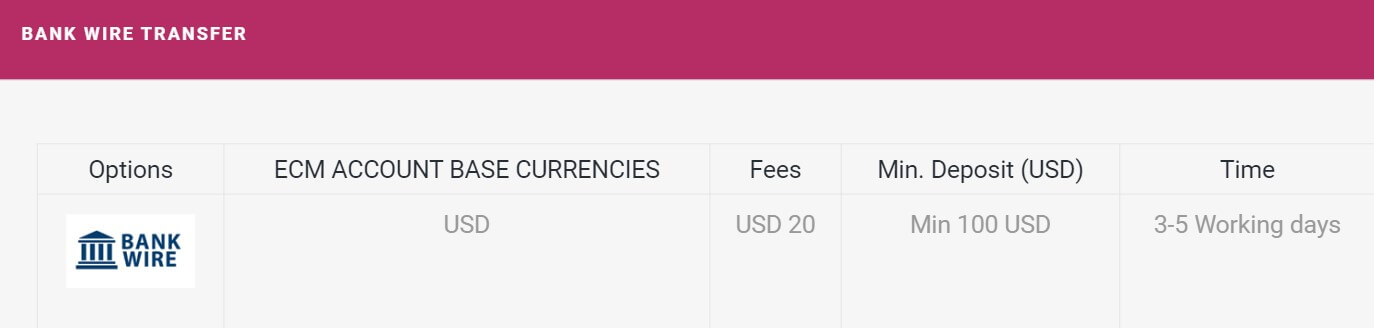

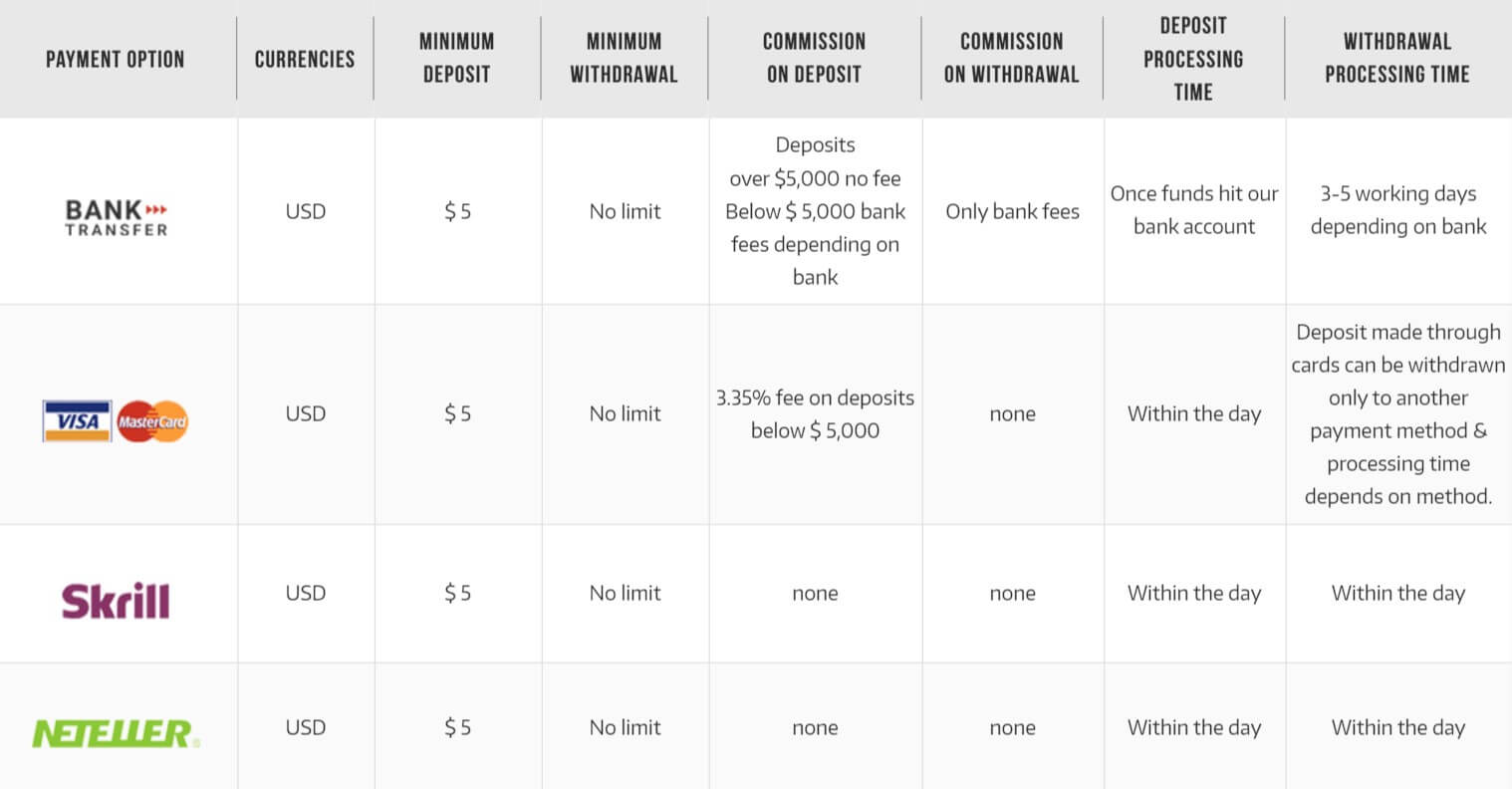

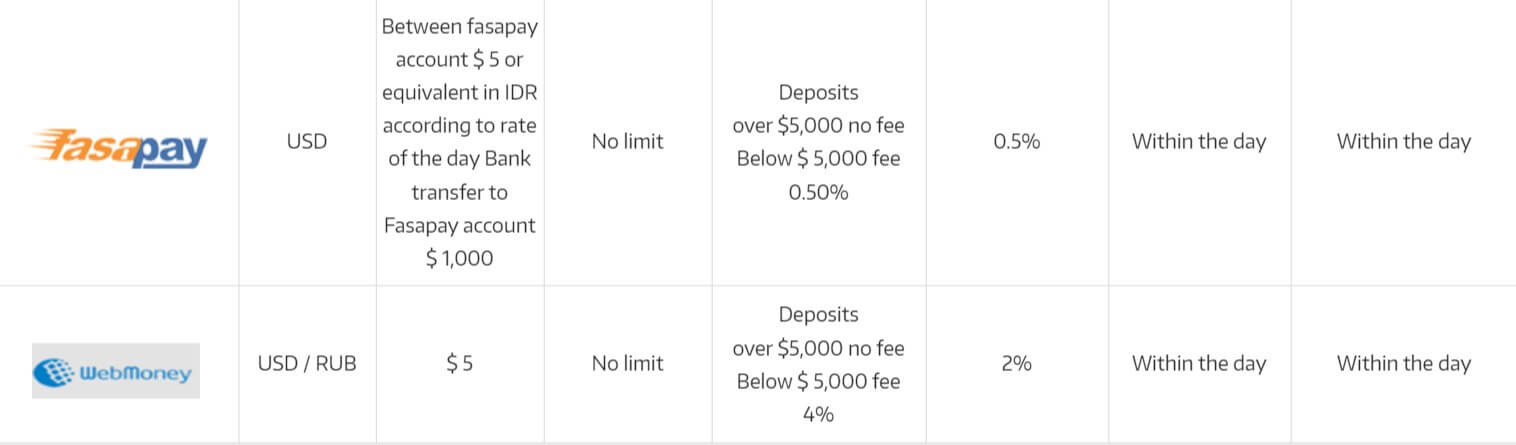

Deposit Methods & Costs

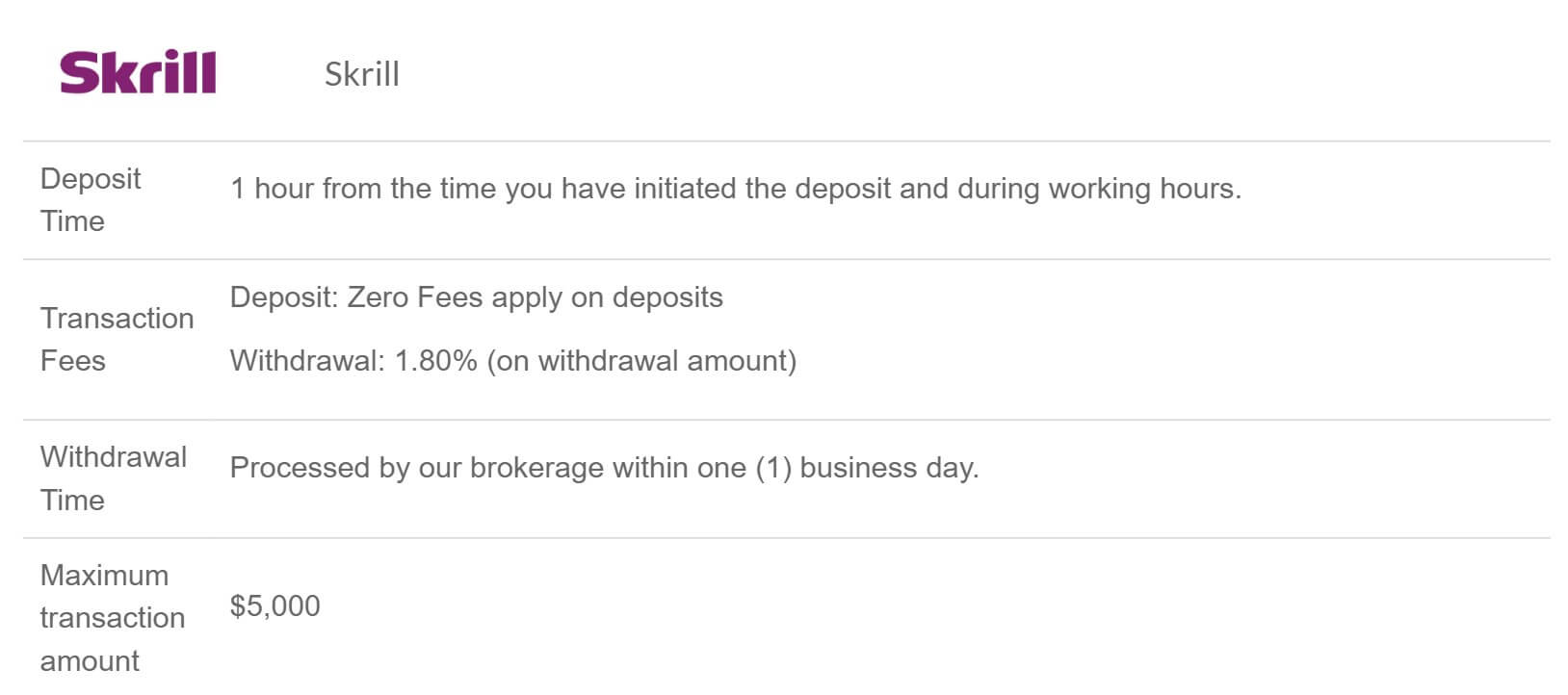

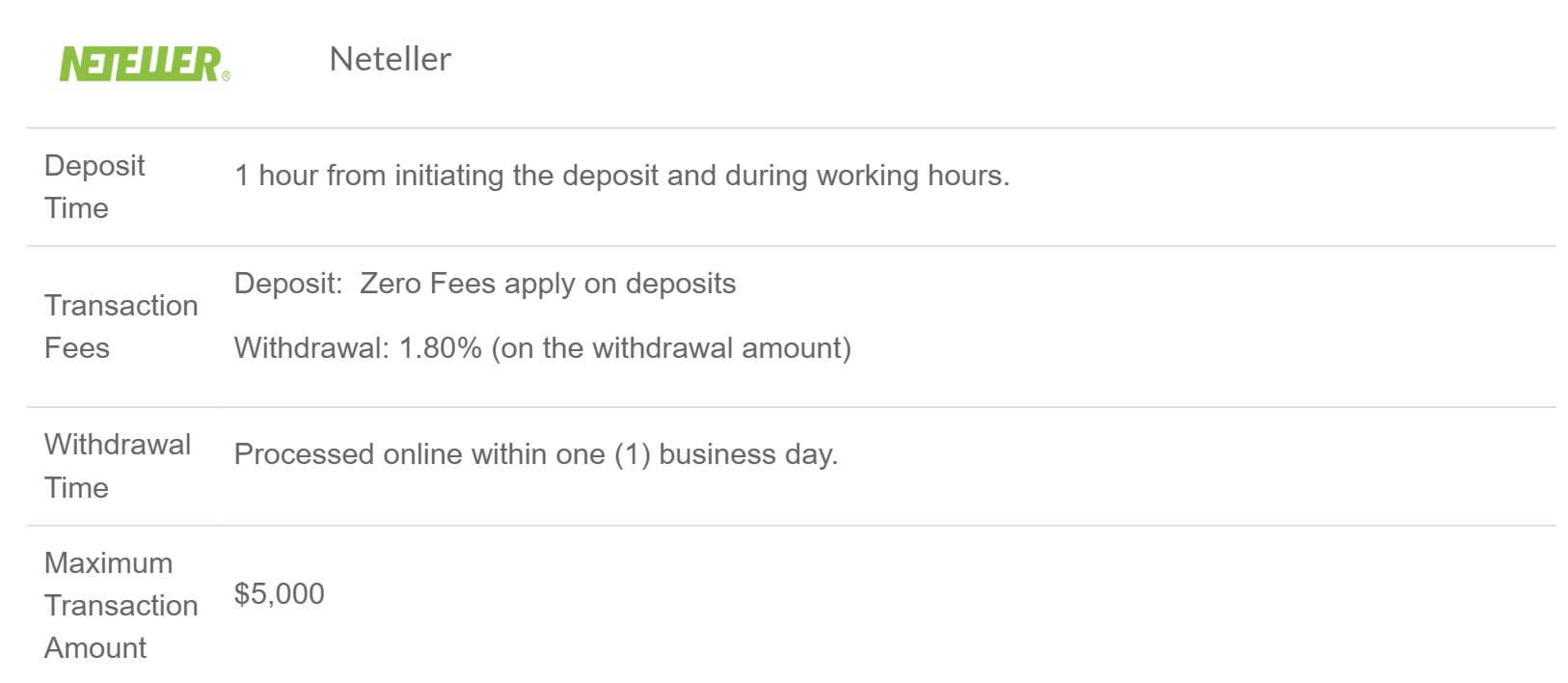

There are a number of different ways to deposit, these are Local Bank Transfer, Neteller, Skrill, Perfect Money, DragonPay and FasaPay. The site states that there are no added fees from GMI Edge, however, there is an added fee of 3.95% on all deposits from Neteller, Skrill, Perfect Money, DragonPay and FasaPay. So there is, in fact, an added fee.

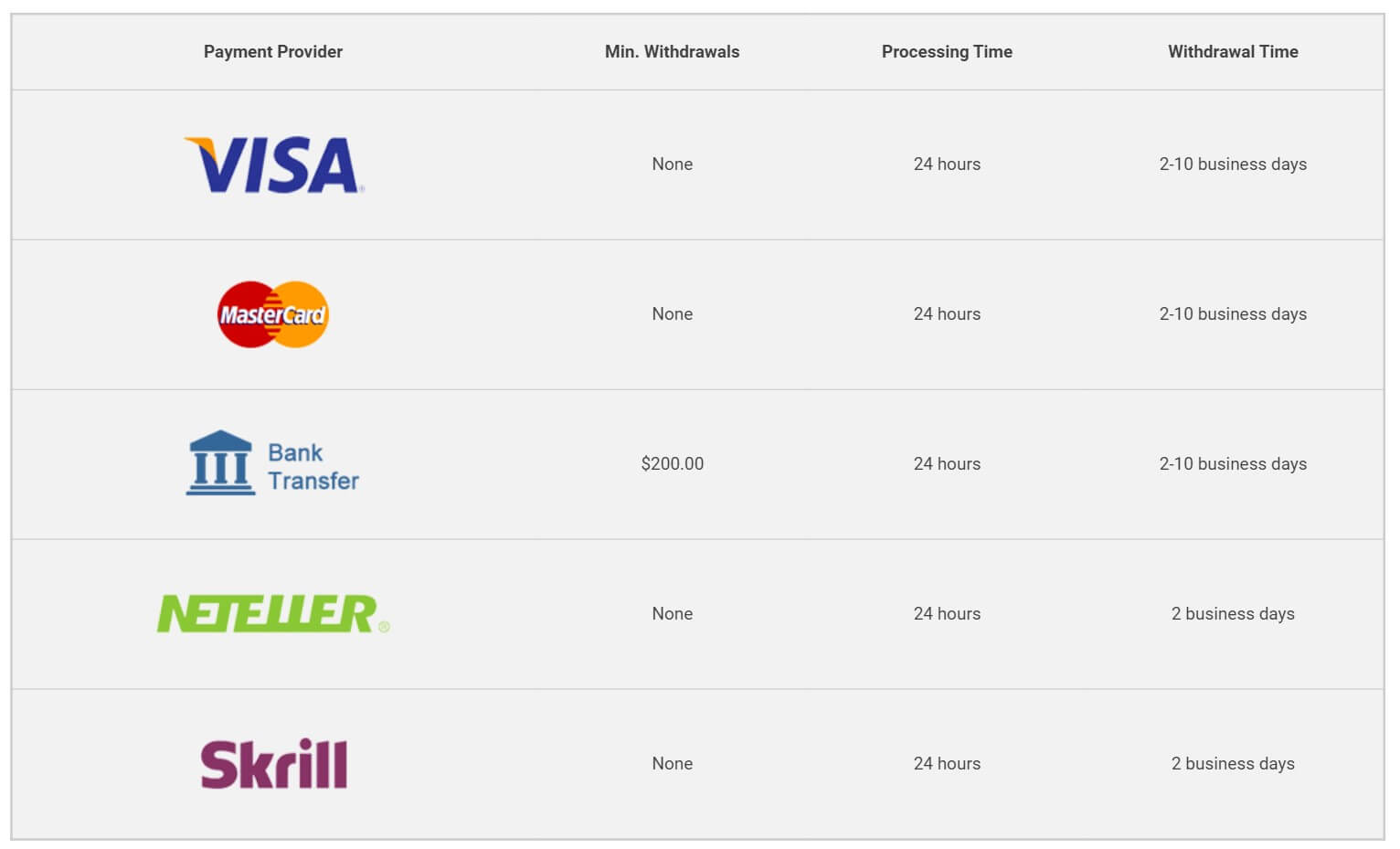

Withdrawal Methods & Costs

The same methods are available to withdraw with, for clarification these are Local Bank Transfer, Neteller, Skrill, Perfect Money, DragonPay and FasaPay. There are no added fees for withdrawals but be sure to check with your own bank to see if they will add any incoming transaction fees.

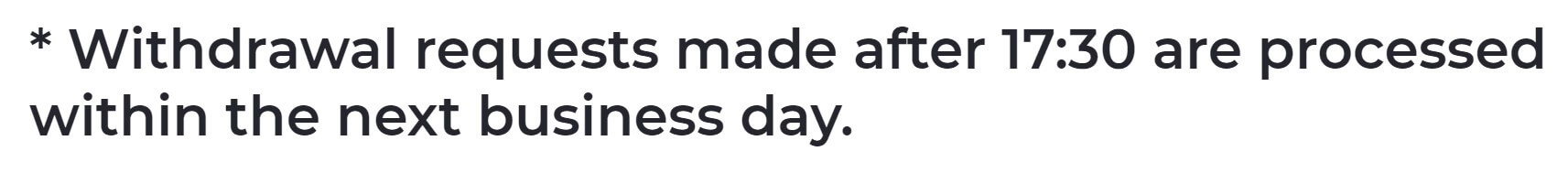

Withdrawal Processing & Wait Time

GMI Edge will aim to process any withdrawals within 24 hours of the request. All methods are then transferred instantly apart from Local Bank Transfer which will be available the next working day.

Bonuses & Promotions

There are two different promotions on offer.

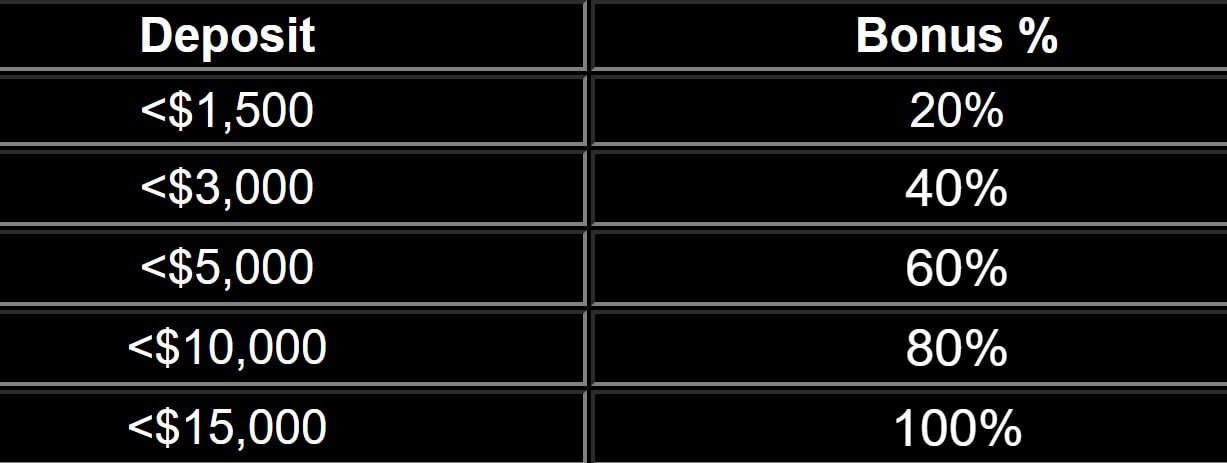

30% Bonus: You can receive a 30% bonus up to $500 on your first deposit. This bonus is automatically available for all clients who deposit into their trading accounts with the maximum bonus amount of $500. Your bonus can be used to open positions as well as cover losses in floating positions. Any profits generated can be withdrawn at any point in time, however, any withdrawal of funds will result in the full removal of your trading bonus.

15% Bonus: You can receive a 15% bonus of up to $5,000. This bonus is automatically available for all clients who have used the 30% Deposit Bonus and continue to make deposits into their trading accounts. You will continue to receive the 15% bonus until you reach the maximum total bonus amount of $5000. Your bonus can be used to open positions as well as cover losses in floating positions. Any profits generated can be withdrawn at any point in time, however, any withdrawal of funds will result in the full removal of your trading bonus.

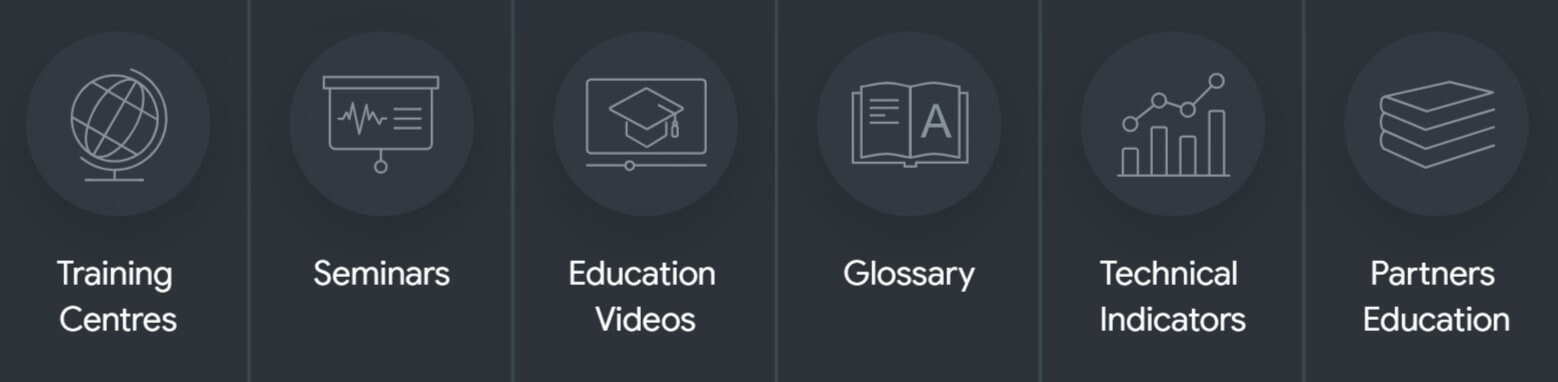

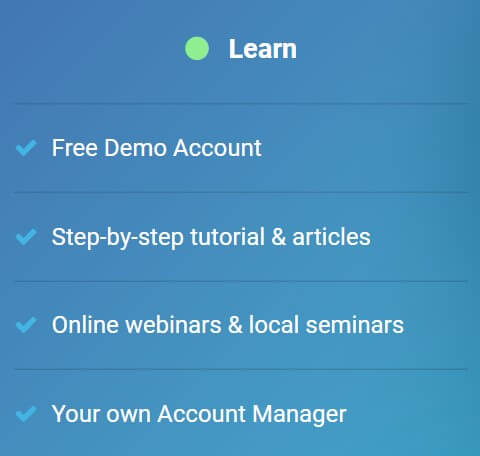

Educational & Trading Tools

There doesn’t seem to be any educational material available, many brokers are now looking to help their clients improve their trading so it would be good to see GMI Edge follow this route and add some educational material.

Customer Service

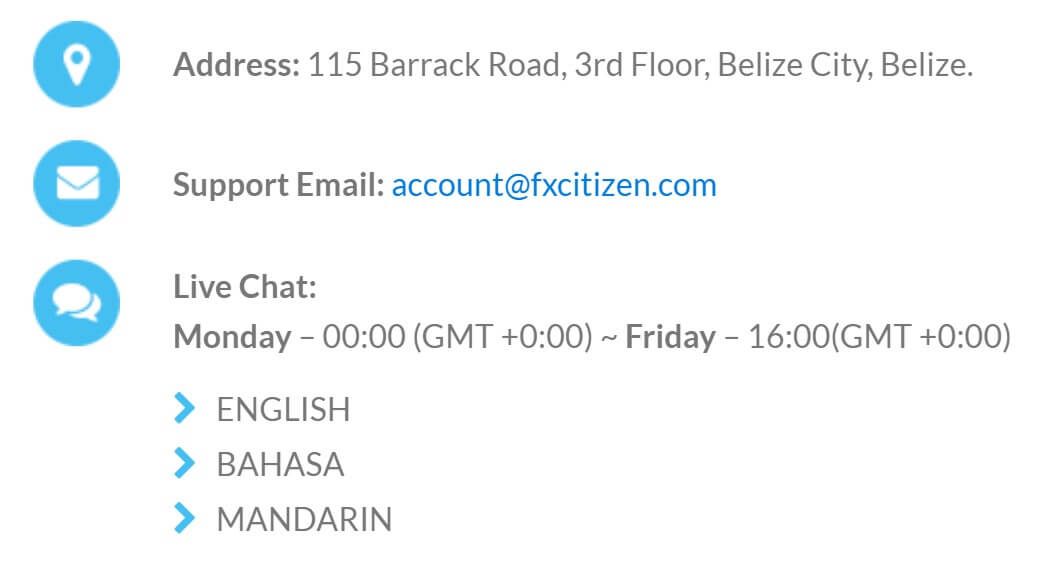

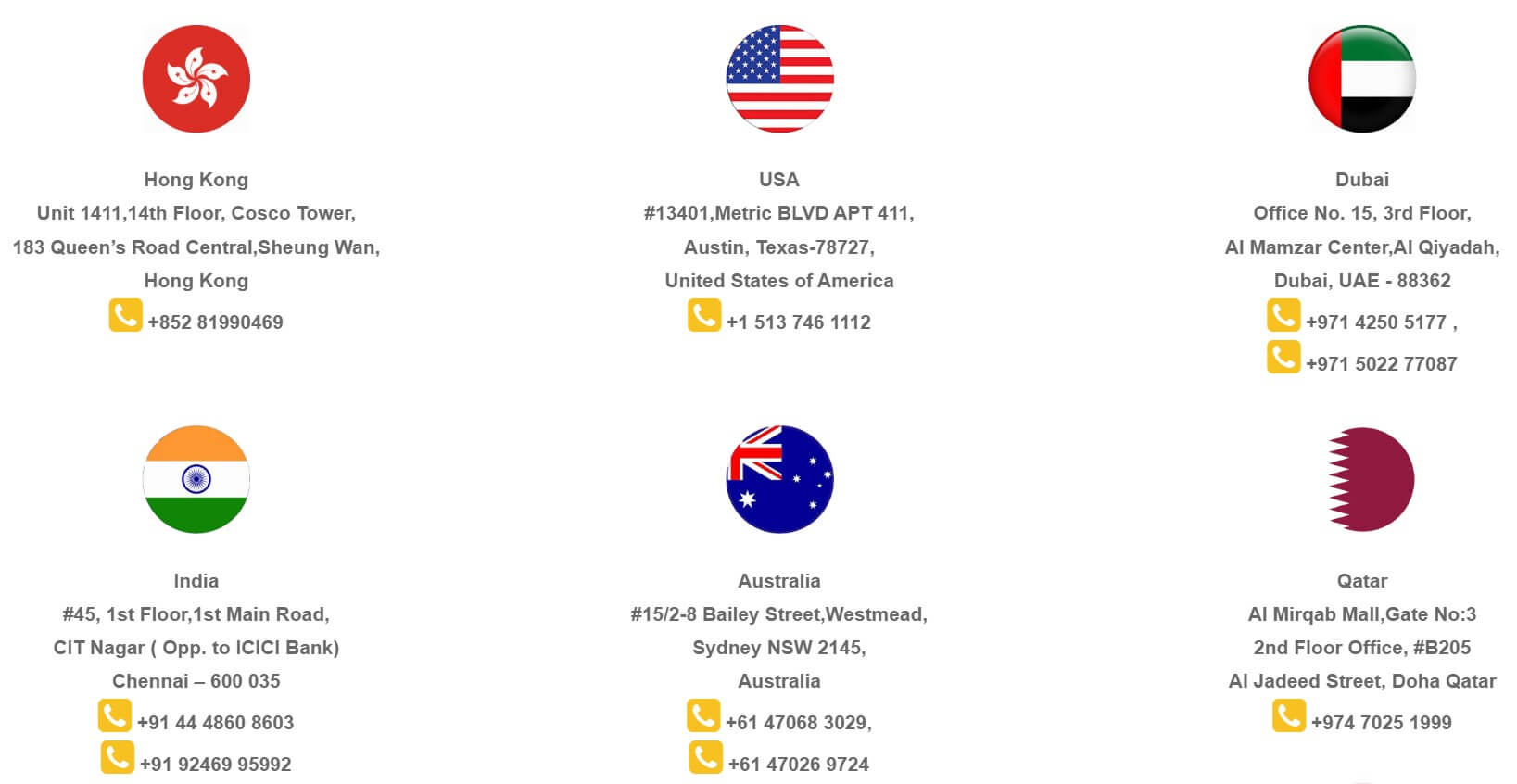

Should you need to contact GMI Edge, you can do so by using the online submission form to fill in your query and get a reply via email You can also use the available email address and phone number. There is also a live chat feature available.

Email: [email protected]

Phone: 1800 282260

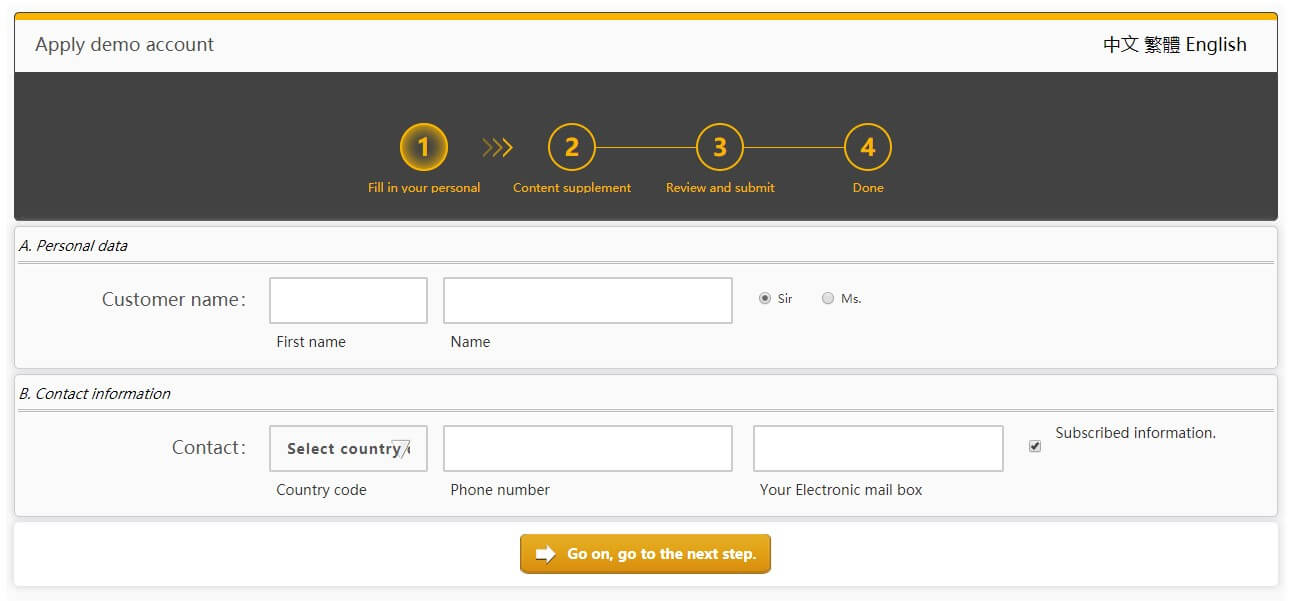

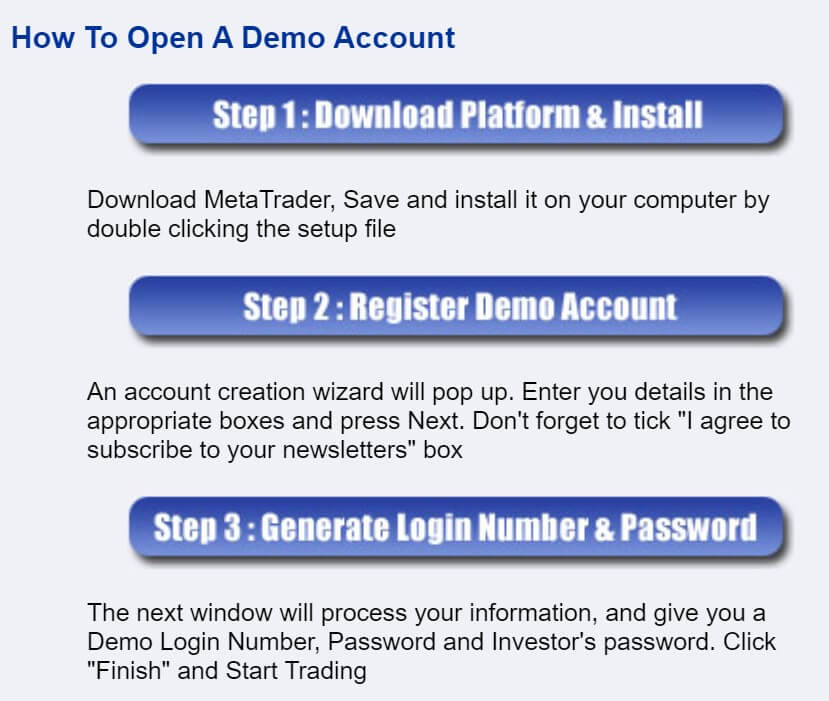

Demo Account

Demo accounts are available and allow you to test out the trading conditions and strategies with no risk. We do not know the details of the account such as what account it mimics or any potential expiration times.

Countries Accepted

This information is not available on the site so if you are interested in joining, get in touch with the customer service team first to see if you are eligible or not.

Conclusion

GMI Edge is offering a few different accounts, each having its own conditions, they cater to everyone with both Cent accounts and Standard lot size accounts. The spreads and commissions are ok, the commission is below the industry average but the spreads are a little higher. There is also a small lack of tradable assets with indices coming soon it will help to improve this issue. Looking at deposits and withdrawals, there are enough options available and withdrawals are fee-free, there are some fees for depositing which could be a little expensive at just under 4%. Whether they are the right broker to sue is up to you.

Blue Bull Capital has chosen MetaTrader 4 as their only trading platform, so let’s see what it offers. MetaTrader 4 is compatible with hundreds and thousands of different indicators, expert advisors,

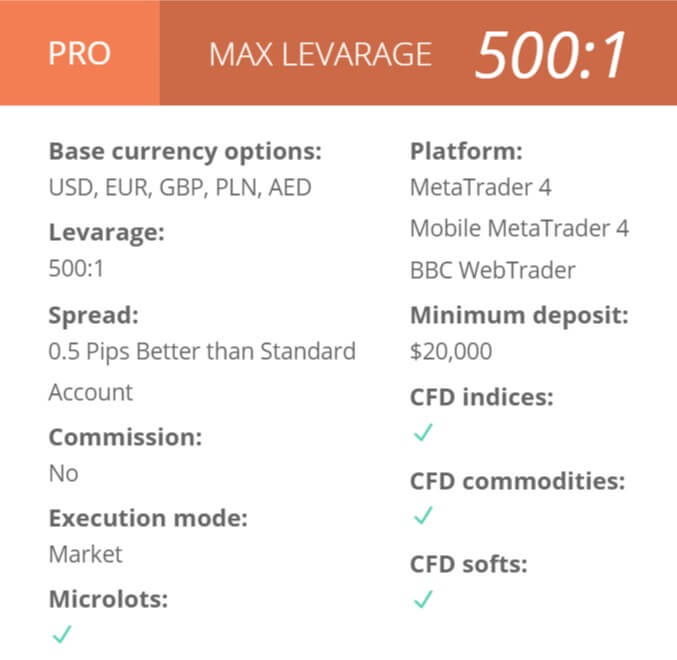

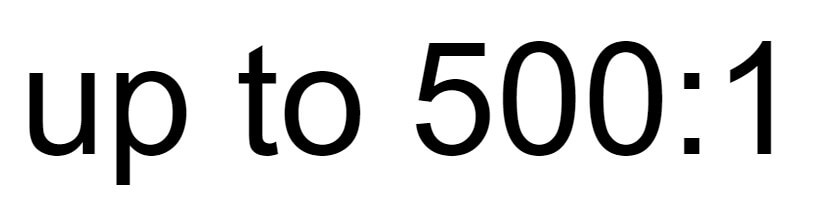

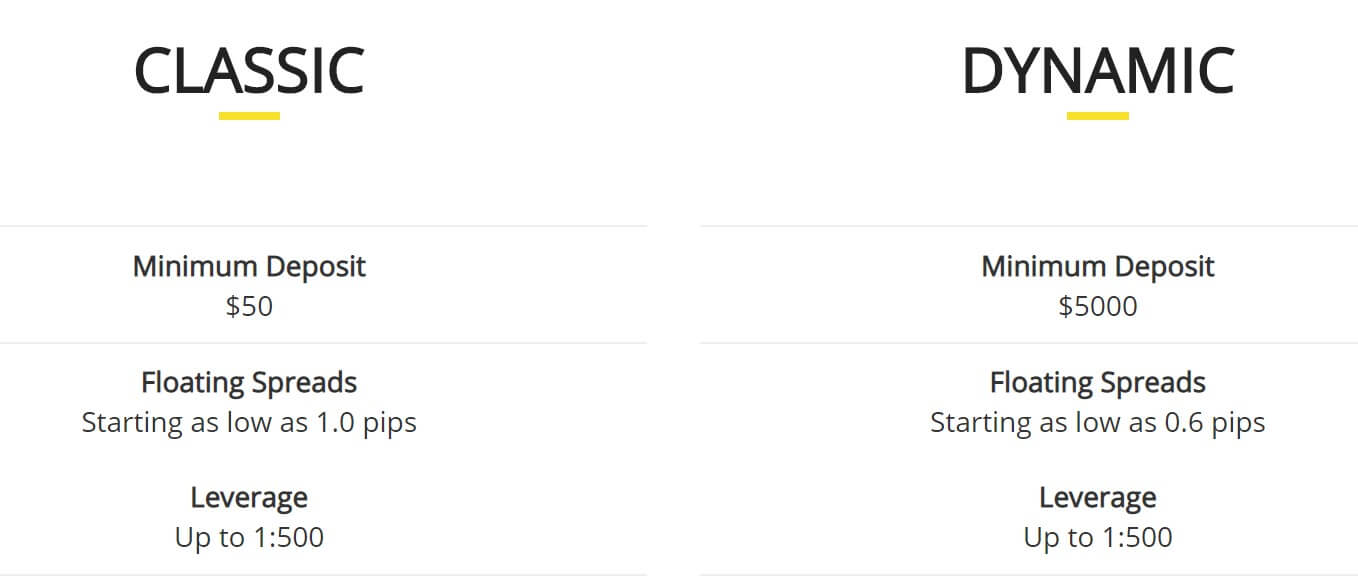

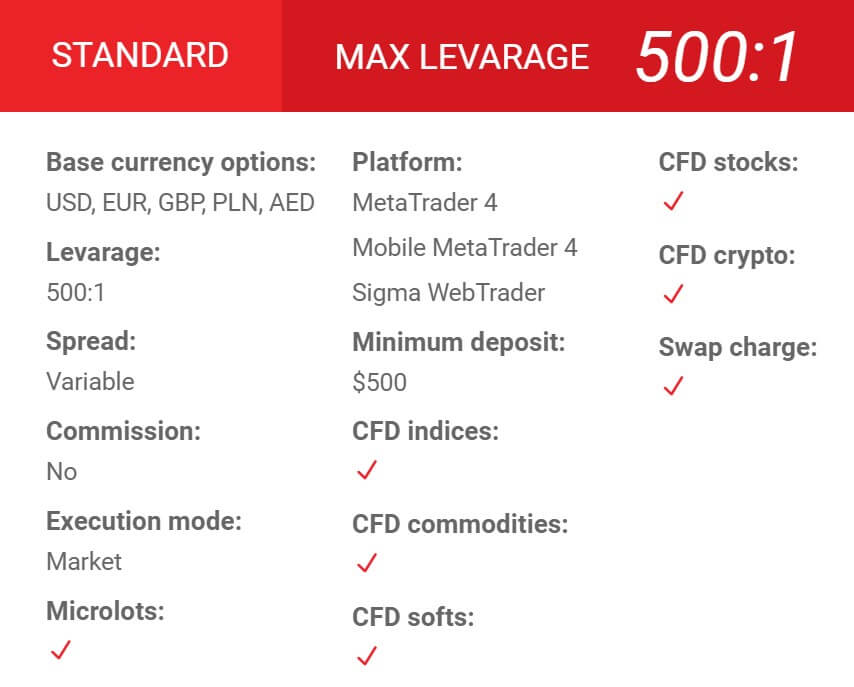

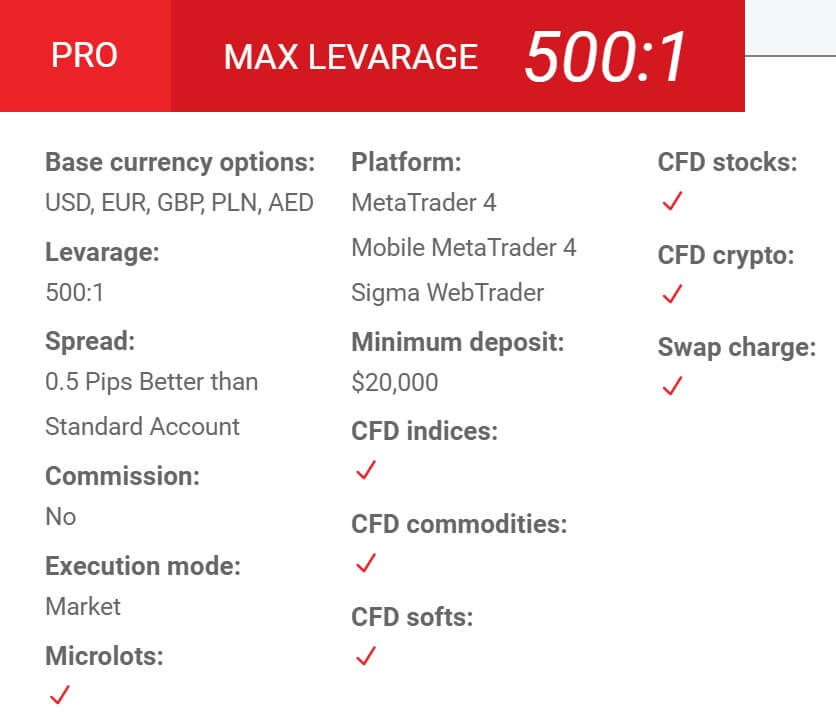

Blue Bull Capital has chosen MetaTrader 4 as their only trading platform, so let’s see what it offers. MetaTrader 4 is compatible with hundreds and thousands of different indicators, expert advisors,  The maximum leverage for both account types is 1:500 which is what a lot of brokers are now aiming for. The leverage can be selected when opening up an account and should you wish to change it on an already open account, you should get in contact with the customer service team with this request.

The maximum leverage for both account types is 1:500 which is what a lot of brokers are now aiming for. The leverage can be selected when opening up an account and should you wish to change it on an already open account, you should get in contact with the customer service team with this request. The assets available from Blue Bull Capital have been broken down into 6 different categories, we will briefly look at each to see some examples of what is available to trade.

The assets available from Blue Bull Capital have been broken down into 6 different categories, we will briefly look at each to see some examples of what is available to trade.

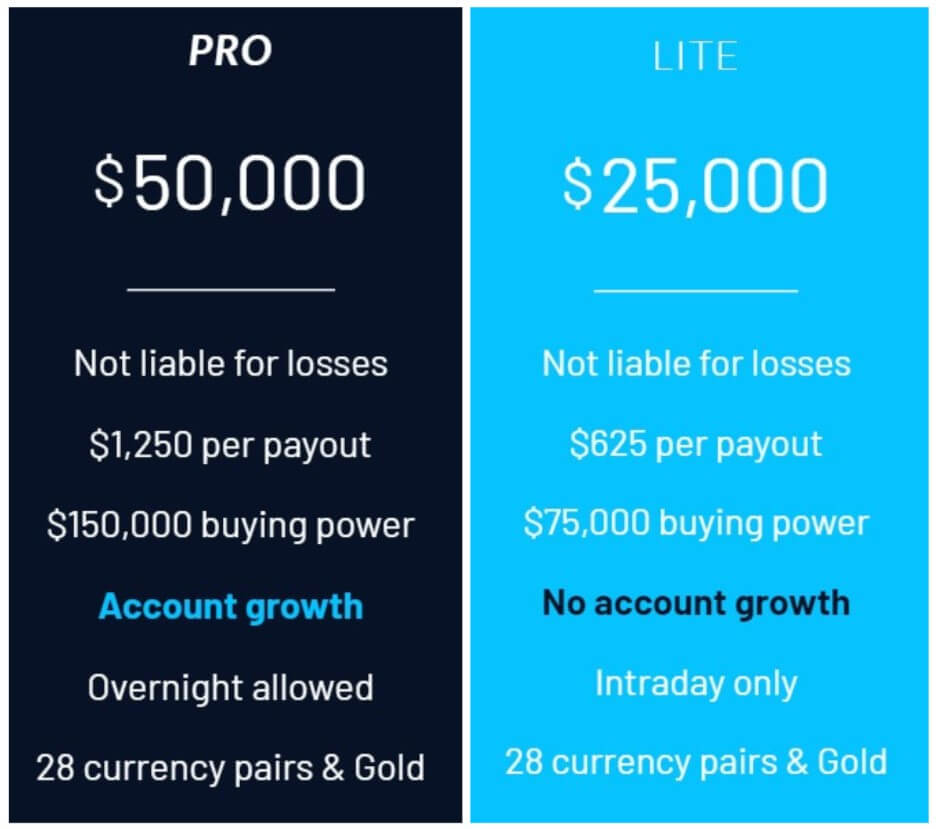

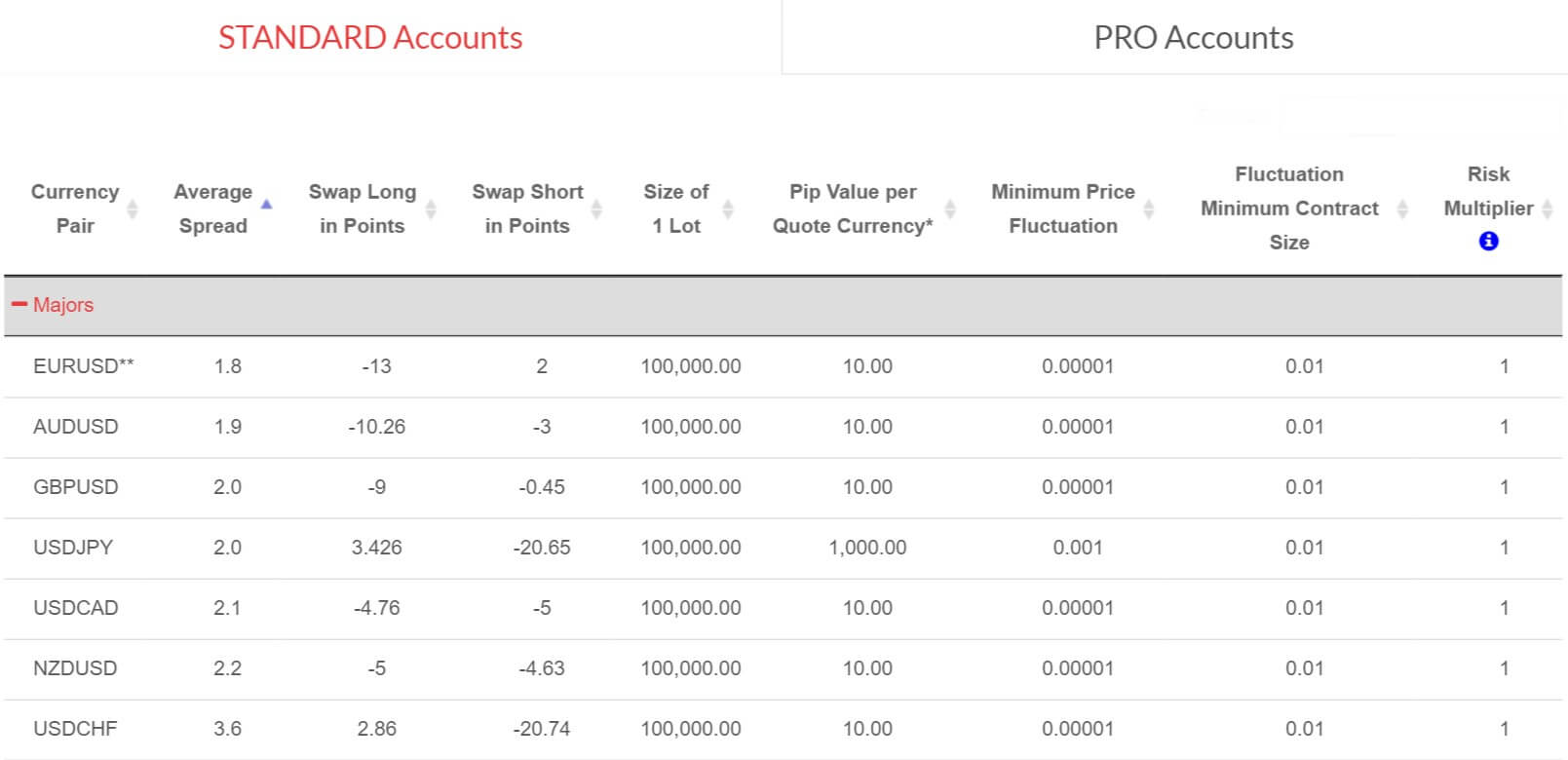

The minimum amount required to open an account is $500 which gets you the Standard account, if you want the Pro account you will need to deposit $20,000. Once an account is open, further top-ups are as low as $5 depending on the method used.

The minimum amount required to open an account is $500 which gets you the Standard account, if you want the Pro account you will need to deposit $20,000. Once an account is open, further top-ups are as low as $5 depending on the method used.

1:1000: STP Standard, STP Swap Free, STP No Spread, STP Micro Cent, ECN Standard, ECN Standard Mini, ECN Swap Free, ECN Swap-Free Mini

1:1000: STP Standard, STP Swap Free, STP No Spread, STP Micro Cent, ECN Standard, ECN Standard Mini, ECN Swap Free, ECN Swap-Free Mini The majority of accounts do not have any added trading commissions, the STP No Spread account has an added commission of 0.038 and 0.062 depending on the instrument. The rest of the accounts do not seem to have any according to the product specifications.

The majority of accounts do not have any added trading commissions, the STP No Spread account has an added commission of 0.038 and 0.062 depending on the instrument. The rest of the accounts do not seem to have any according to the product specifications. Forex:

Forex: There are plenty of ways to deposit, the good news is that there are no added fees, however, you should contact your own bank or processor to see if they will add any fees of their own. Bank Wire Transfer, Visa/MasterCard, China UnionPay, Skrill, Sticpay, Neteller, PayCo, Triv, FasaPay, Perfect Money, Payeer, OnlineNaira, iPay, FlutterWave, Cryptocurrencies, and local payments are all available to use.

There are plenty of ways to deposit, the good news is that there are no added fees, however, you should contact your own bank or processor to see if they will add any fees of their own. Bank Wire Transfer, Visa/MasterCard, China UnionPay, Skrill, Sticpay, Neteller, PayCo, Triv, FasaPay, Perfect Money, Payeer, OnlineNaira, iPay, FlutterWave, Cryptocurrencies, and local payments are all available to use.

Educational & Trading Tools

Educational & Trading Tools

Assets

Assets

MetaTrader 4 is the available trading platform, released by MetaQuotes in 2005, MT4

MetaTrader 4 is the available trading platform, released by MetaQuotes in 2005, MT4

The news and education side of the site is a little sparse, there is just the one page which is for news events, unfortunately, it does not look like the page has been updated since February 2019, so we do not a thin kit is still being actively used.

The news and education side of the site is a little sparse, there is just the one page which is for news events, unfortunately, it does not look like the page has been updated since February 2019, so we do not a thin kit is still being actively used.

Withdrawal Processing & Wait Time

Withdrawal Processing & Wait Time

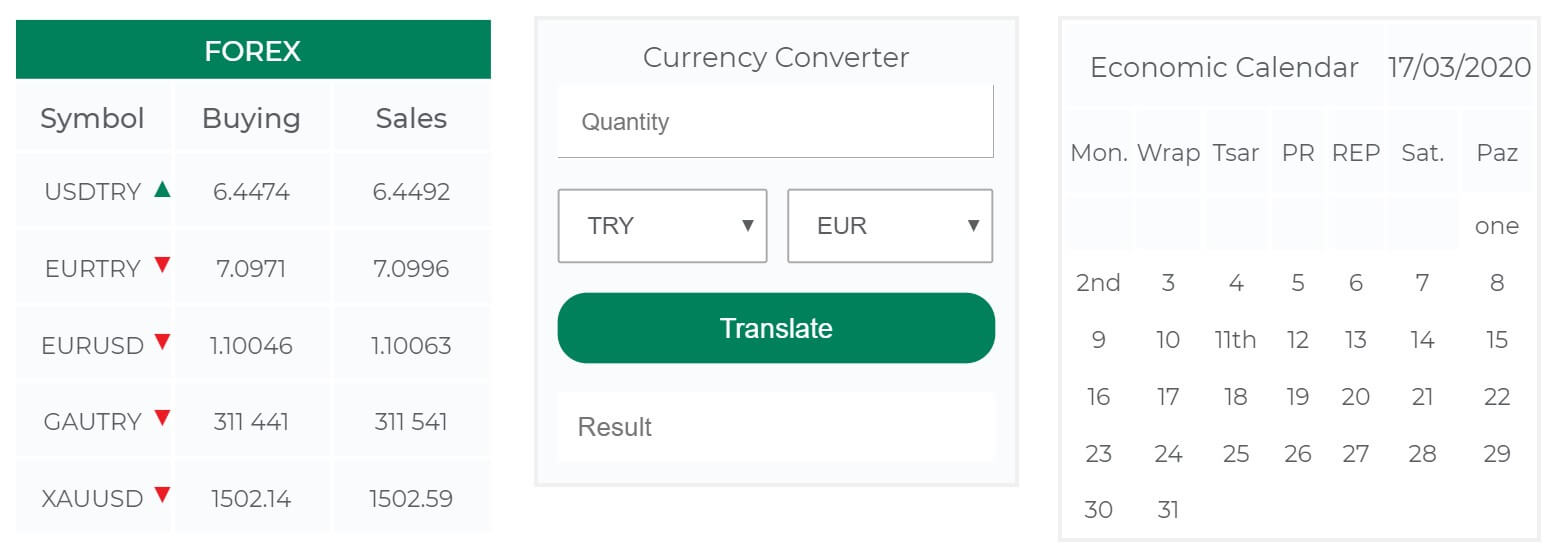

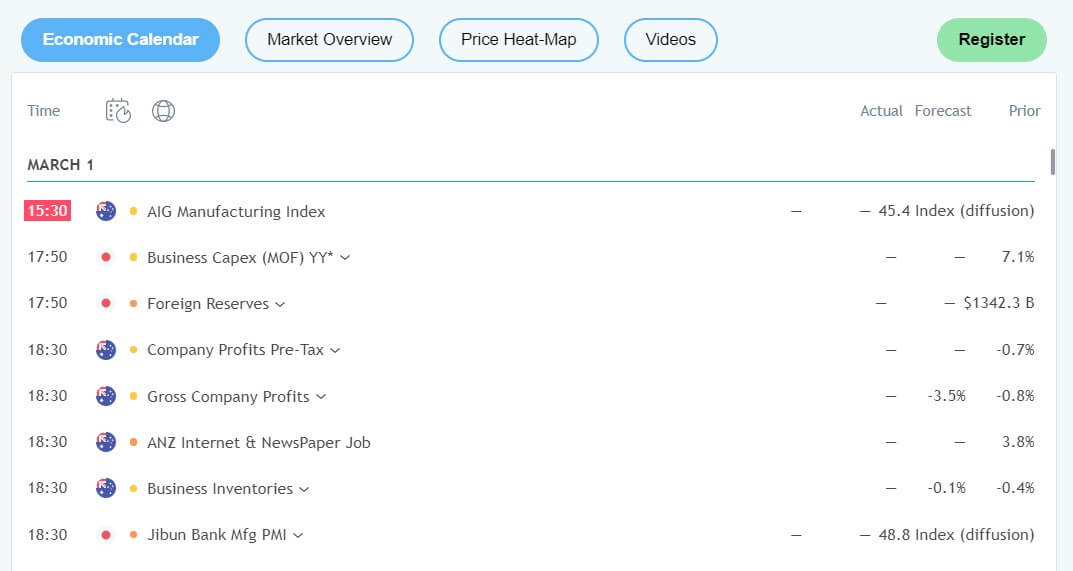

There are some very basic educational tools, the main one being an introduction to the markets, this is very basic and won’t be making you into an expert. There is also an economic calculator which details upcoming news events along with the currencies that they may affect. There are video tutorials but these are based around how to use the MetaTrader 5 trading platform rather than how to trade. Finally, there are some articles and a glossary of terms should you come across something you do not understand the meaning of.

There are some very basic educational tools, the main one being an introduction to the markets, this is very basic and won’t be making you into an expert. There is also an economic calculator which details upcoming news events along with the currencies that they may affect. There are video tutorials but these are based around how to use the MetaTrader 5 trading platform rather than how to trade. Finally, there are some articles and a glossary of terms should you come across something you do not understand the meaning of. Address: Suite, 305 Griffith corporate center, PO Box 1510, Beachmont Kingstown, St.Vincent and the Grenadines

Address: Suite, 305 Griffith corporate center, PO Box 1510, Beachmont Kingstown, St.Vincent and the Grenadines

The maximum leverage available to you depends on the account you are using. The

The maximum leverage available to you depends on the account you are using. The

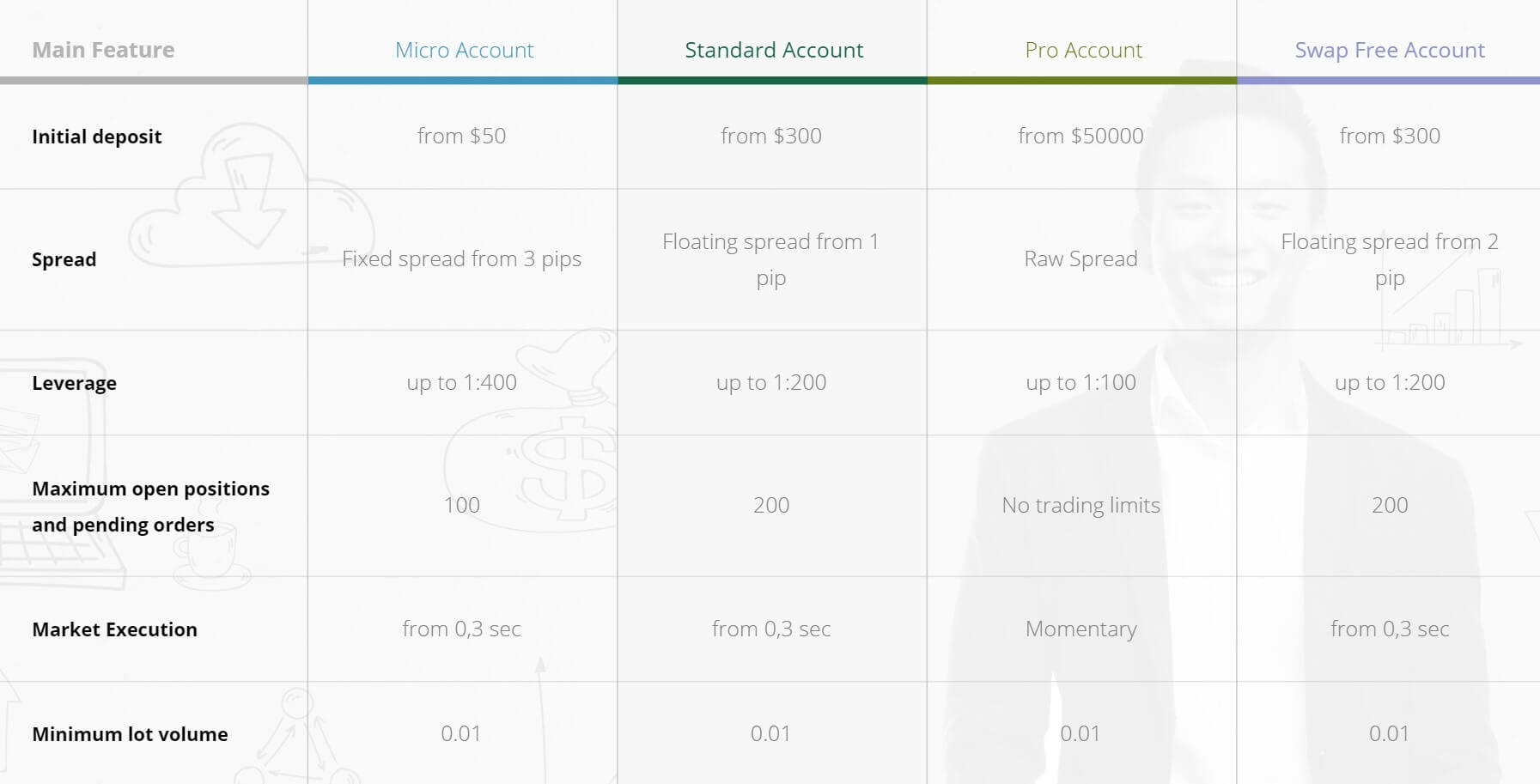

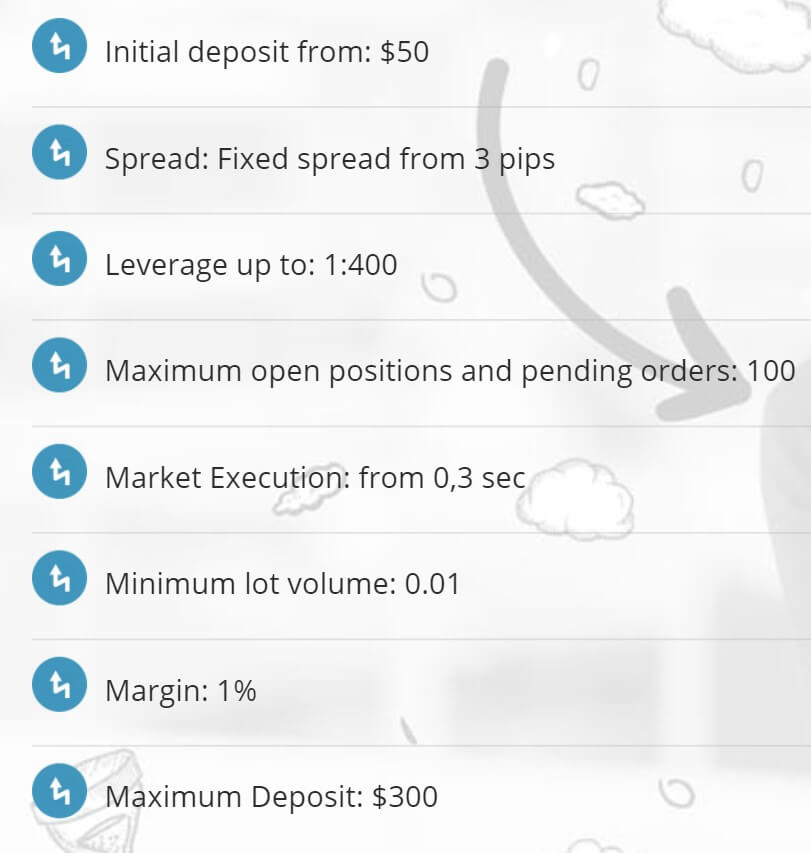

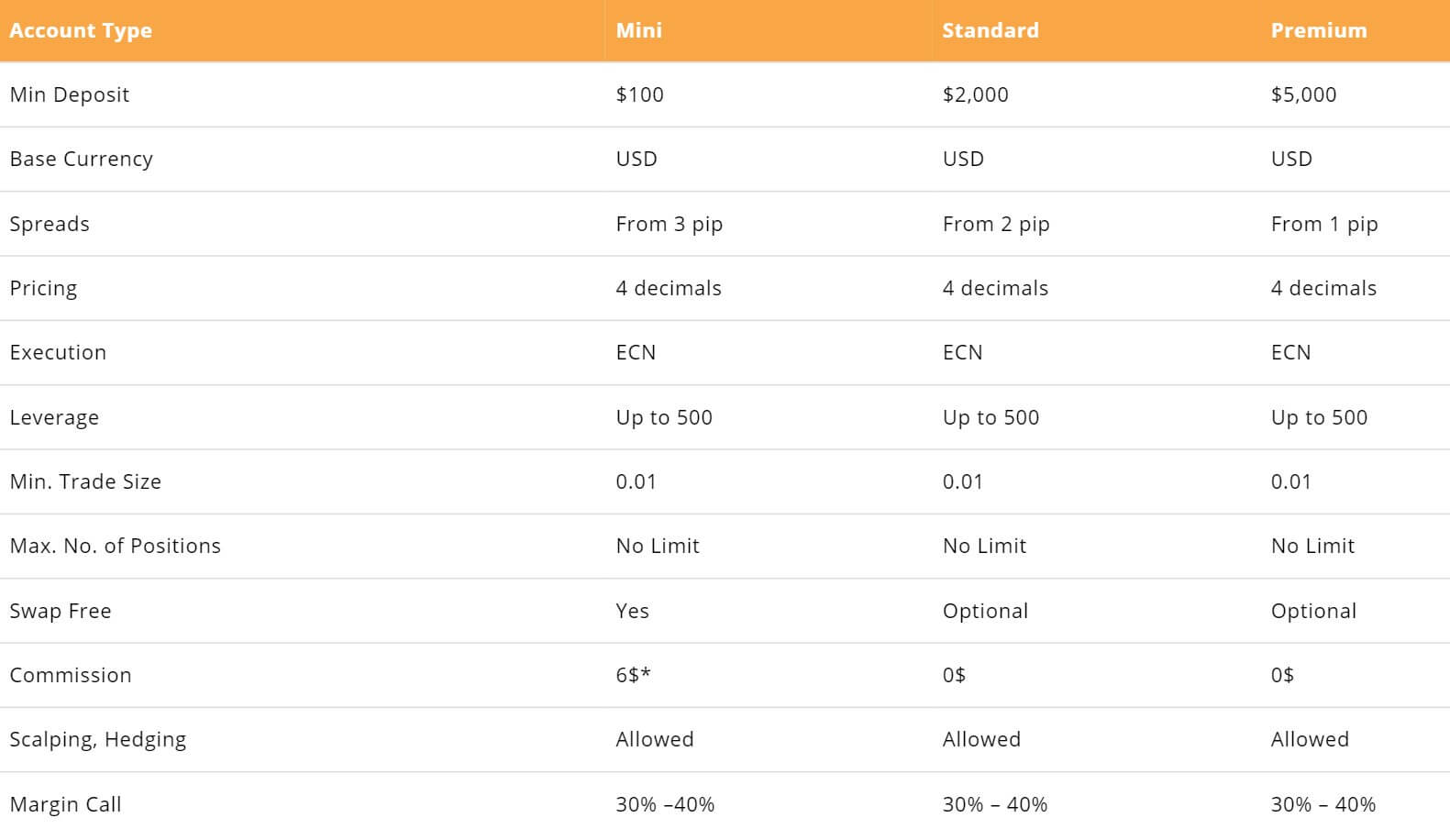

The Micro account has fixed spreads starting from 3 pips, the Standard account has floating spreads starting from 1 pip, the Pro account has raw spreads and the Swap-Free account has floating spreads starting from 2 pips.

The Micro account has fixed spreads starting from 3 pips, the Standard account has floating spreads starting from 1 pip, the Pro account has raw spreads and the Swap-Free account has floating spreads starting from 2 pips. The minimum amount required to open up an account is $50, this will get you access to the Micro account, if you want a higher tier account then you will need to deposit at least $300 or $50,000 for the Pro account.

The minimum amount required to open up an account is $50, this will get you access to the Micro account, if you want a higher tier account then you will need to deposit at least $300 or $50,000 for the Pro account.

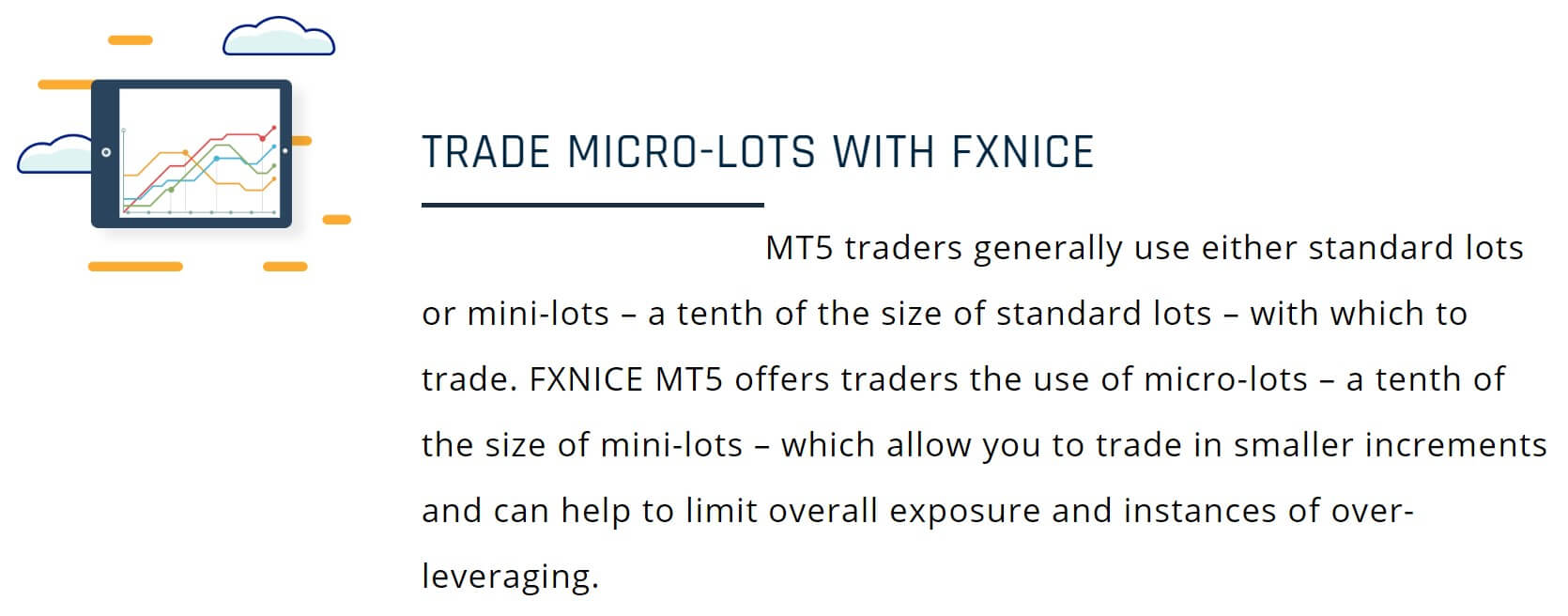

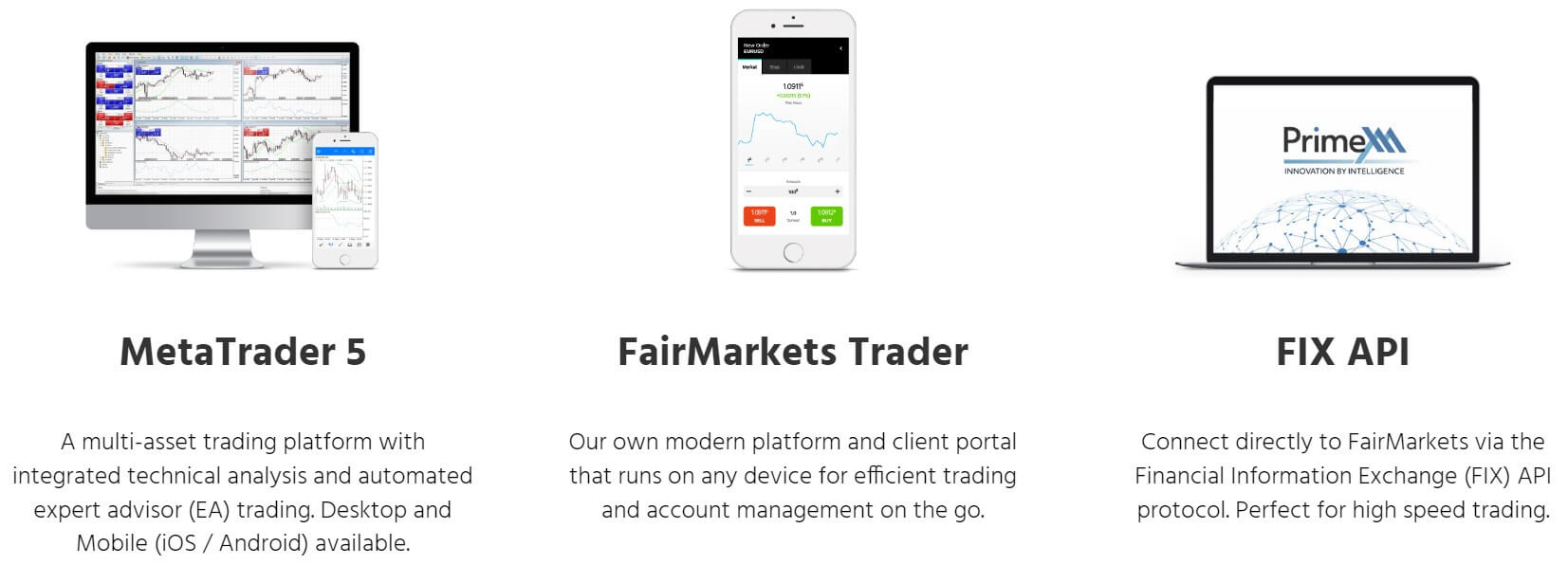

Just the single trading platform on offer from FxNice, this is MetaTrader 5 (MT5), a trading platform by MetaQuotes. MT5 is a well known and widely used trading platform providing a whole host of features. It has the ability to show multiple charts at the same time, to trade micro-lots, offers one-click trading, hedging, and is compatible with hundreds and thousands of indicators and expert advisors. MT5 is also highly accessible as it can be used as a desktop download, a mobile application or as a web trader in your internet browser, ensuring you can access it and trade wherever you are.

Just the single trading platform on offer from FxNice, this is MetaTrader 5 (MT5), a trading platform by MetaQuotes. MT5 is a well known and widely used trading platform providing a whole host of features. It has the ability to show multiple charts at the same time, to trade micro-lots, offers one-click trading, hedging, and is compatible with hundreds and thousands of indicators and expert advisors. MT5 is also highly accessible as it can be used as a desktop download, a mobile application or as a web trader in your internet browser, ensuring you can access it and trade wherever you are.

There are a few different ways to deposit, these are Bank Wire Transfer, Credit / Debit Card (Both Vias and MasterCard), Neteller, Bitcoin, and Skrill.

There are a few different ways to deposit, these are Bank Wire Transfer, Credit / Debit Card (Both Vias and MasterCard), Neteller, Bitcoin, and Skrill.

Commissions and swap charges are not known to us so we cannot state what they are or if there are any included in the accounts.

Commissions and swap charges are not known to us so we cannot state what they are or if there are any included in the accounts.

MetaTrader 4 (MT4):

MetaTrader 4 (MT4): There are only three categories of assets available. The first is Forex, and there isn’t a full breakdown of these instruments or even a statement to say how many there may be, we just know that there are some

There are only three categories of assets available. The first is Forex, and there isn’t a full breakdown of these instruments or even a statement to say how many there may be, we just know that there are some

You are able to get in contact with BrightWin in a number of ways. You can use the online submission form, fill it in and you should then get a reply via email. You can also use the provided postal address, email address or phone numbers. We don’t know what the opening times of the customer service are but we would assume that they would close over the weekends at the same time as the markets.

You are able to get in contact with BrightWin in a number of ways. You can use the online submission form, fill it in and you should then get a reply via email. You can also use the provided postal address, email address or phone numbers. We don’t know what the opening times of the customer service are but we would assume that they would close over the weekends at the same time as the markets. Demo accounts are available, but they don’t give any information about them. We know that you get a balance of $10,000 when using the account but nothing else. We would expect them to mimic the trading conditions of the available accounts but we are not sure exactly which one. We also do not know if there is an expiration on the accounts. The demo account will allow you to test out the trading conditions and also new strategies without having to risk any of your own capital.

Demo accounts are available, but they don’t give any information about them. We know that you get a balance of $10,000 when using the account but nothing else. We would expect them to mimic the trading conditions of the available accounts but we are not sure exactly which one. We also do not know if there is an expiration on the accounts. The demo account will allow you to test out the trading conditions and also new strategies without having to risk any of your own capital.

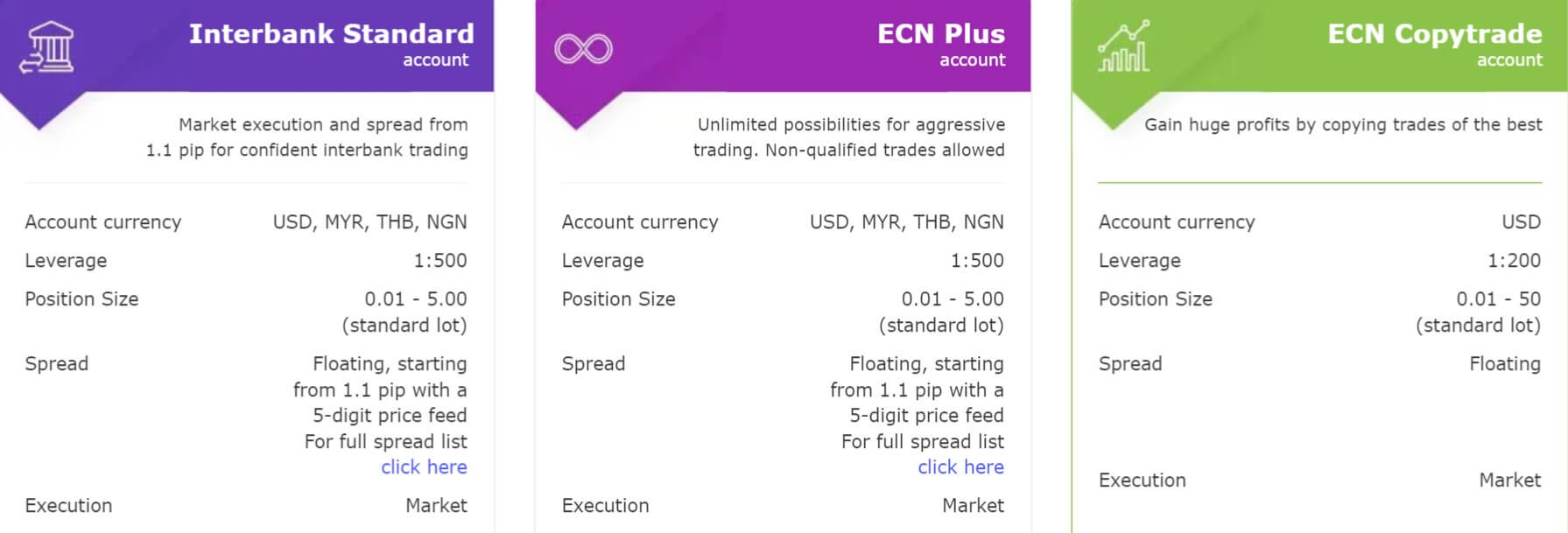

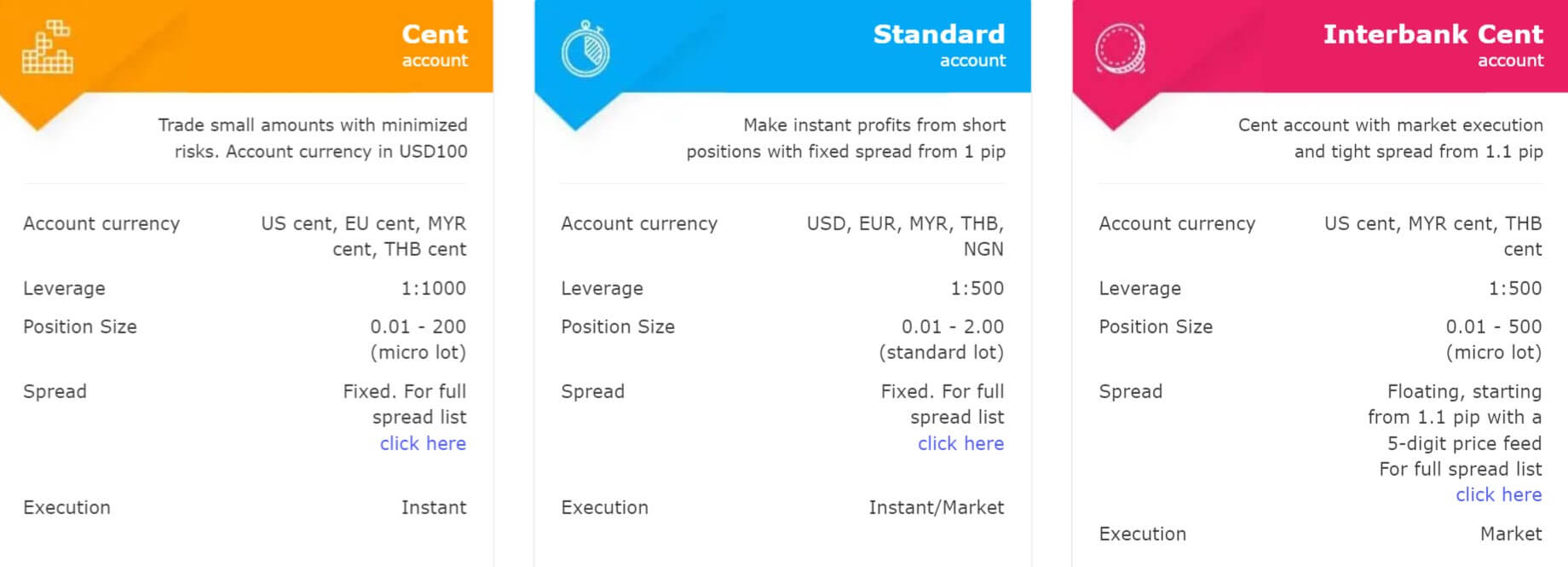

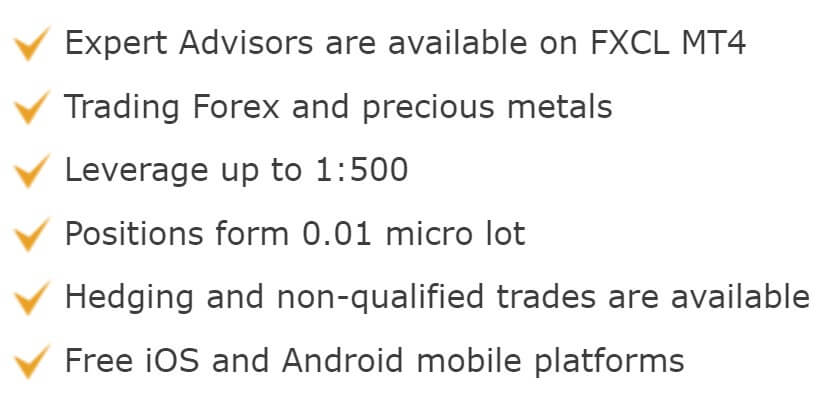

MetaTrader 4 (MT4) is the only platform on offer from FXCL. This is one of the most popular trading platforms in the world due to its reliability, adaptability, and it is easy to use. It is also highly accessible as you can use it as a desktop download, a web trader or as an application for your mobile devices. MetaTrader 4 is compatible with thousands of expert advisors and indicators to make your trading and analysis as easy as possible. Normally being stuck with a single platform is a negative, but there could be far worse platforms to be stuck with.

MetaTrader 4 (MT4) is the only platform on offer from FXCL. This is one of the most popular trading platforms in the world due to its reliability, adaptability, and it is easy to use. It is also highly accessible as you can use it as a desktop download, a web trader or as an application for your mobile devices. MetaTrader 4 is compatible with thousands of expert advisors and indicators to make your trading and analysis as easy as possible. Normally being stuck with a single platform is a negative, but there could be far worse platforms to be stuck with.

Deposit Methods & Costs

Deposit Methods & Costs 200% New Year Bonus:

200% New Year Bonus:

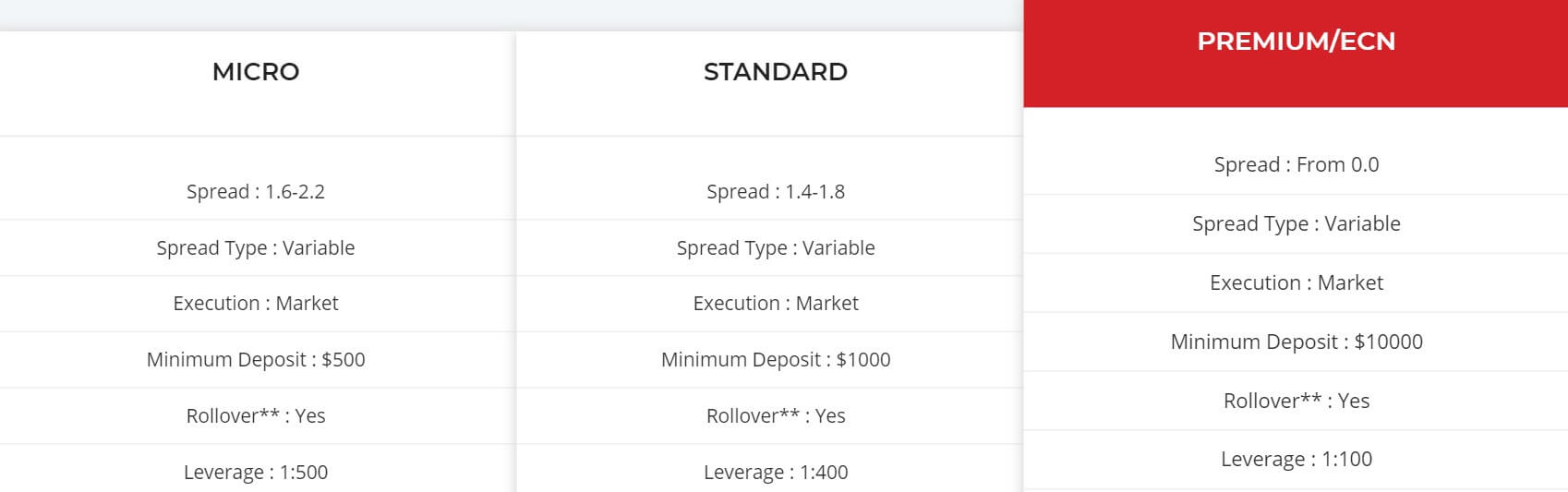

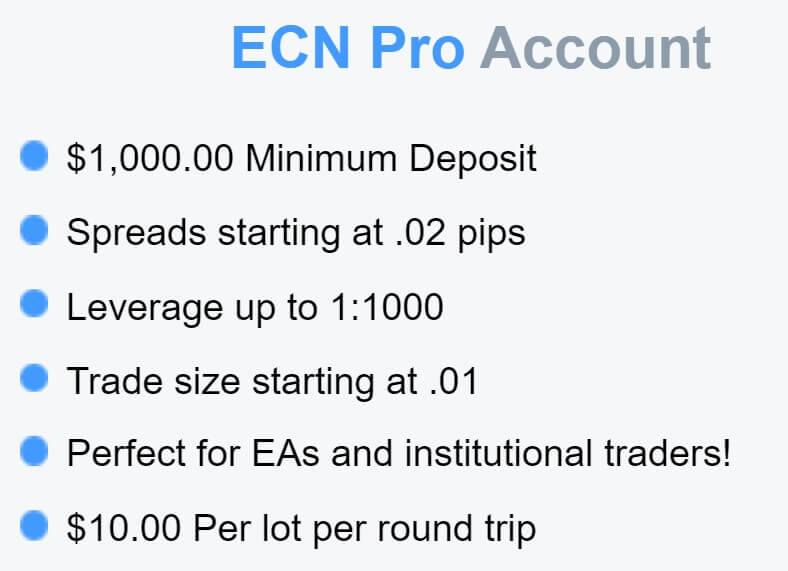

Premium ECN Account:

Premium ECN Account:

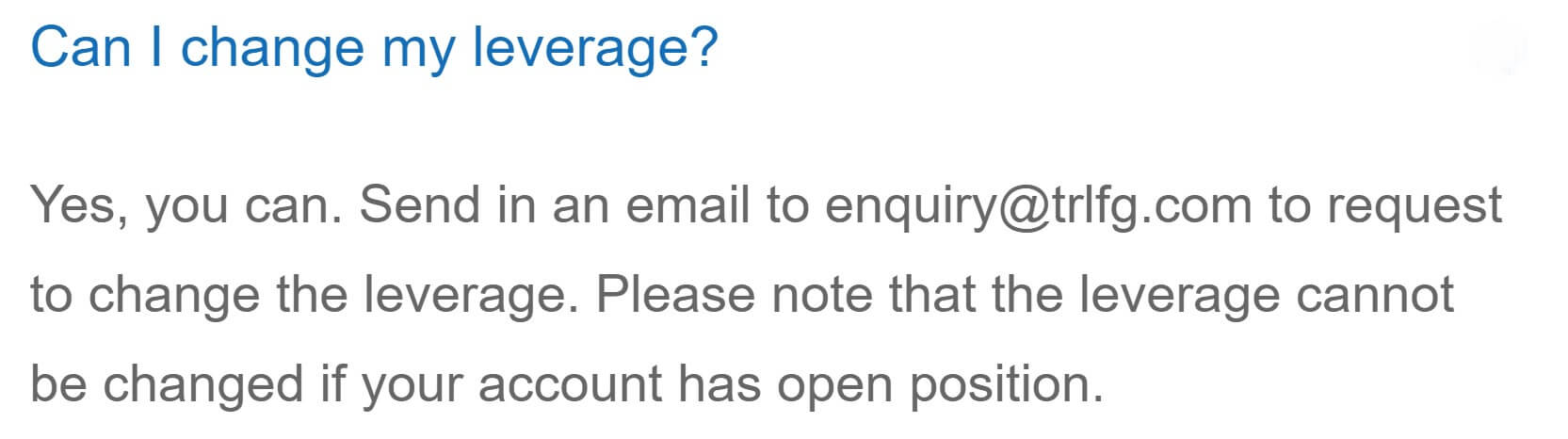

The leverage that you get depends on the account you are using. The Classic STP account holder can have a leverage up to 1:500, while the Premium ECN account can be leveraged up to 1:100, and the Exclusive VIP account holder can select what leverage they want the account to use. This can be selected when opening up an account and can be changed by contacting the customer service team with the request to change it.

The leverage that you get depends on the account you are using. The Classic STP account holder can have a leverage up to 1:500, while the Premium ECN account can be leveraged up to 1:100, and the Exclusive VIP account holder can select what leverage they want the account to use. This can be selected when opening up an account and can be changed by contacting the customer service team with the request to change it.

There is a large selection of tradable assets available, we have outlined them below so you can get an understanding of what is available to trade.

There is a large selection of tradable assets available, we have outlined them below so you can get an understanding of what is available to trade.

You can use the online submission form, simply fill it in and wait for a reply via email. They have also provided a postal address, email address, and phone number so you have a choice of methods available to use.

You can use the online submission form, simply fill it in and wait for a reply via email. They have also provided a postal address, email address, and phone number so you have a choice of methods available to use.

Liirat offers MetaTrader 4 as its go-to trading platform. It is an extremely popular trading platform that hosts more than 1,000,000 users trading activities. It can be used from anywhere in the world as it comes as a desktop download, mobile application and web trader. The main features stated by Liirat is that the platform comes with 3 execution modes, 2 market orders, 4 pending orders, 2 stop orders, and trailing stops. You can also perform analysis within the platform or use automated trading with the thousands of compatible indicators and expert advisors.

Liirat offers MetaTrader 4 as its go-to trading platform. It is an extremely popular trading platform that hosts more than 1,000,000 users trading activities. It can be used from anywhere in the world as it comes as a desktop download, mobile application and web trader. The main features stated by Liirat is that the platform comes with 3 execution modes, 2 market orders, 4 pending orders, 2 stop orders, and trailing stops. You can also perform analysis within the platform or use automated trading with the thousands of compatible indicators and expert advisors.

The maximum leverage available to all four accounts is 1:500. The leverage that you want can be selected when opening up an account. You can get the leverage changed on an already open account by contacting the customer service team with the change request.

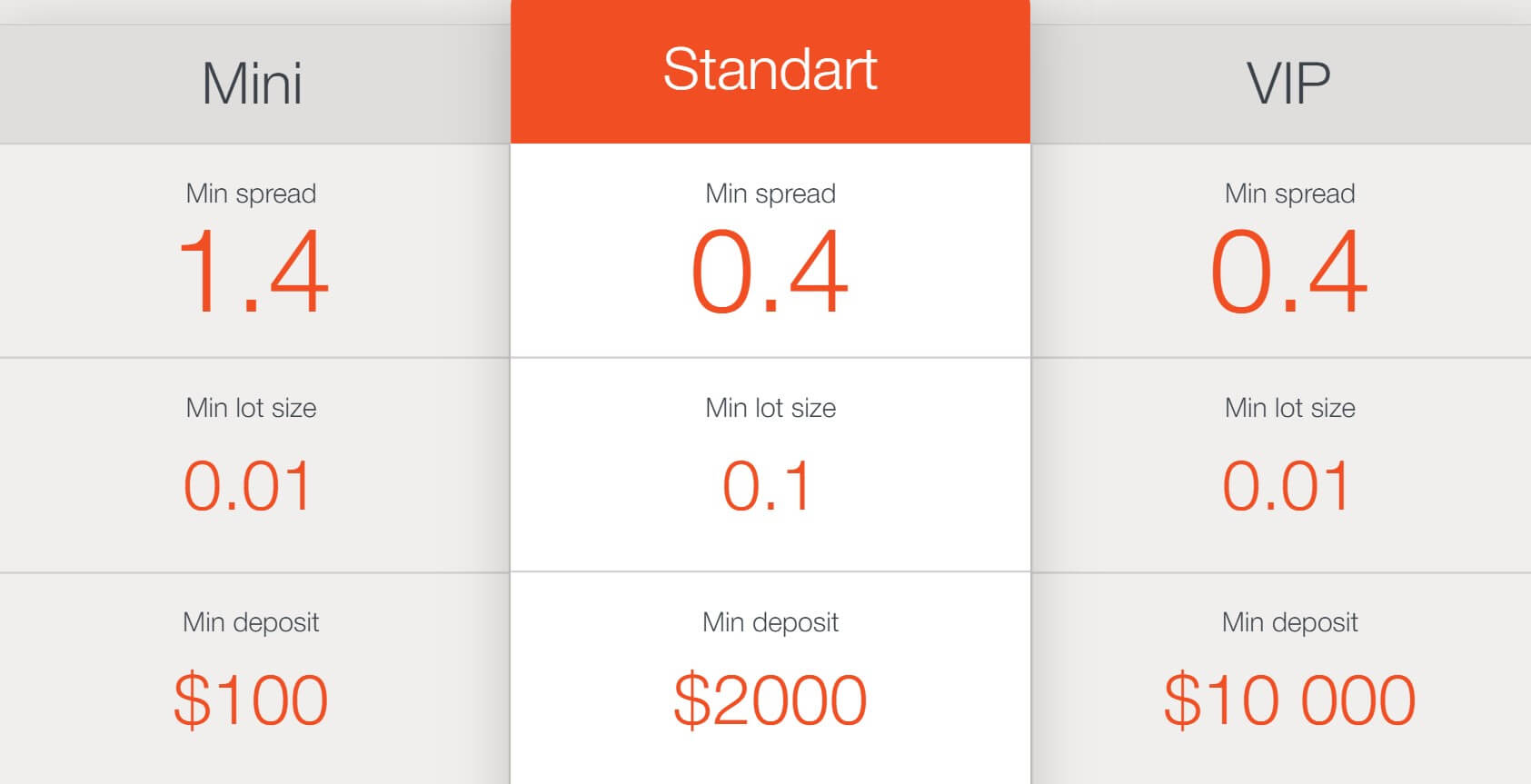

The maximum leverage available to all four accounts is 1:500. The leverage that you want can be selected when opening up an account. You can get the leverage changed on an already open account by contacting the customer service team with the change request. The spreads that you get depends on the account you are using, the Cent account has spreads starting from 2.4 pips, the Mini account from 1.4 pips, the Standard account 0.4 pips and the VIP account also start from 0.4 pips. The spreads are variable which means they move with the markets, the more volatility or lower liquidity will cause the spreads to grow larger. Different instruments will also have different spreads, so while the typical spread for EURUSD maybe 0.8 pips, it will be 2.5 pips for

The spreads that you get depends on the account you are using, the Cent account has spreads starting from 2.4 pips, the Mini account from 1.4 pips, the Standard account 0.4 pips and the VIP account also start from 0.4 pips. The spreads are variable which means they move with the markets, the more volatility or lower liquidity will cause the spreads to grow larger. Different instruments will also have different spreads, so while the typical spread for EURUSD maybe 0.8 pips, it will be 2.5 pips for

x24:

x24:

Assets

Assets

Educational & Trading Tools

Educational & Trading Tools

Platforms

Platforms There are plenty of assets and instruments available, and we have outlined them below.

There are plenty of assets and instruments available, and we have outlined them below.

Phone: +44 208 089 2065

Phone: +44 208 089 2065

Account Types

Account Types

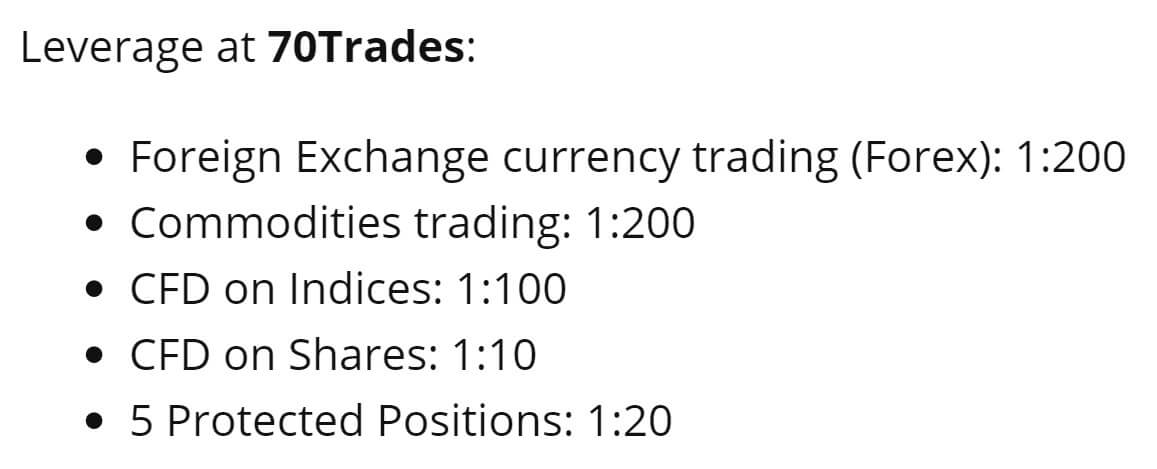

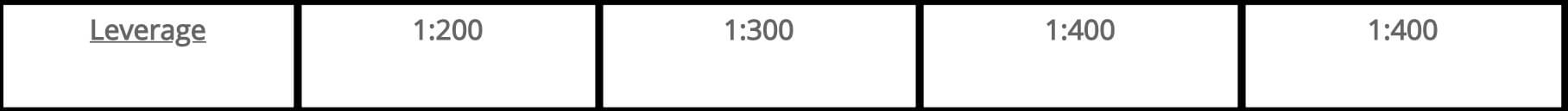

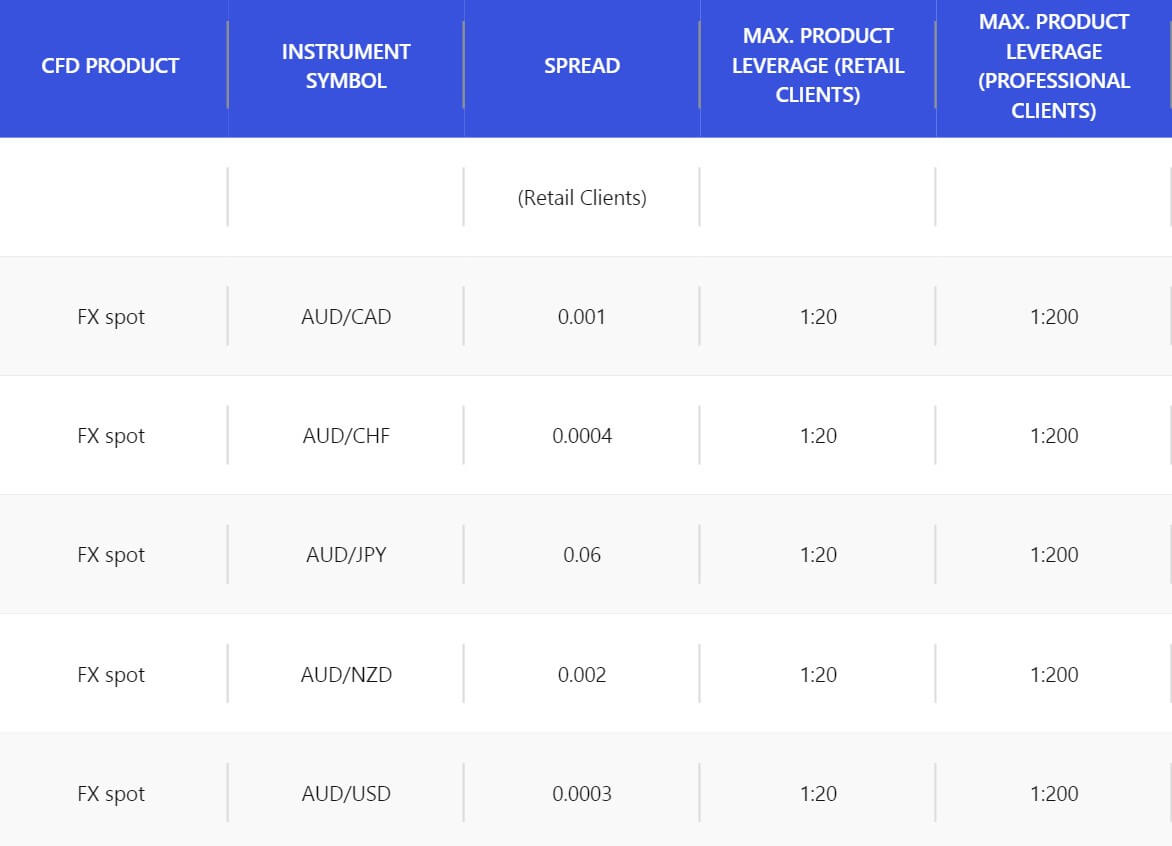

The leverage stated on the main page of the site is 1:200. This is all we have to go on as the accounts page doesn’t actually detail any differences in trading conditions and there are none mentioned anywhere else so it seems that all accounts have the same leverage. This can be selected when opening an account and we are not sure if it can be changed once an account has already been opened. Typically,

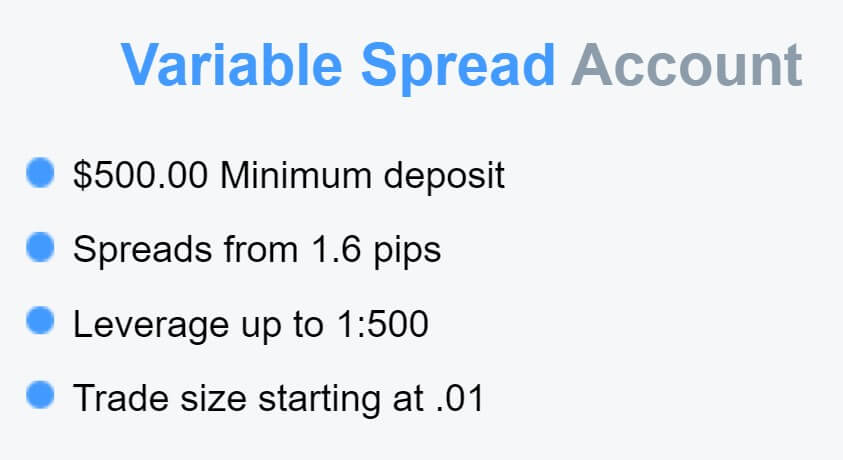

The leverage stated on the main page of the site is 1:200. This is all we have to go on as the accounts page doesn’t actually detail any differences in trading conditions and there are none mentioned anywhere else so it seems that all accounts have the same leverage. This can be selected when opening an account and we are not sure if it can be changed once an account has already been opened. Typically,  The only spreads that we have to go on are what is mentioned on the home page of the site. It states that the spread for EUR/USD is 1.6 pips. This is the starting spread as they are variable which means they will move with the markets. Different instruments will also have different starting spreads, 1.6 pips is the smallest they will be. It would be helpful for the broker to provide a full list of average spreads for most of the major assets.

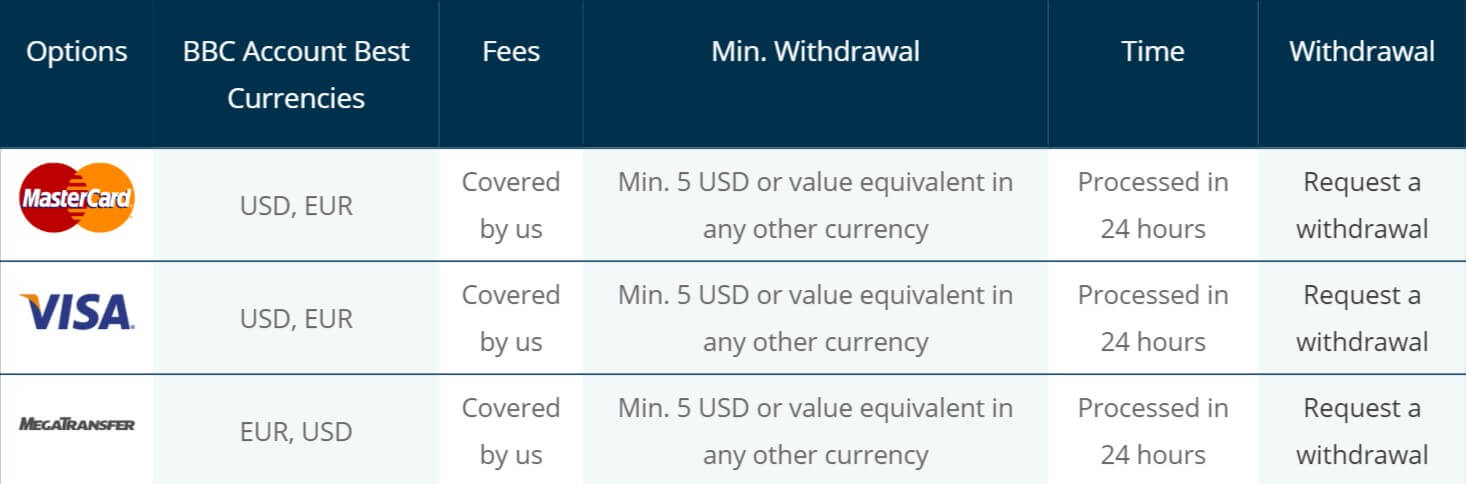

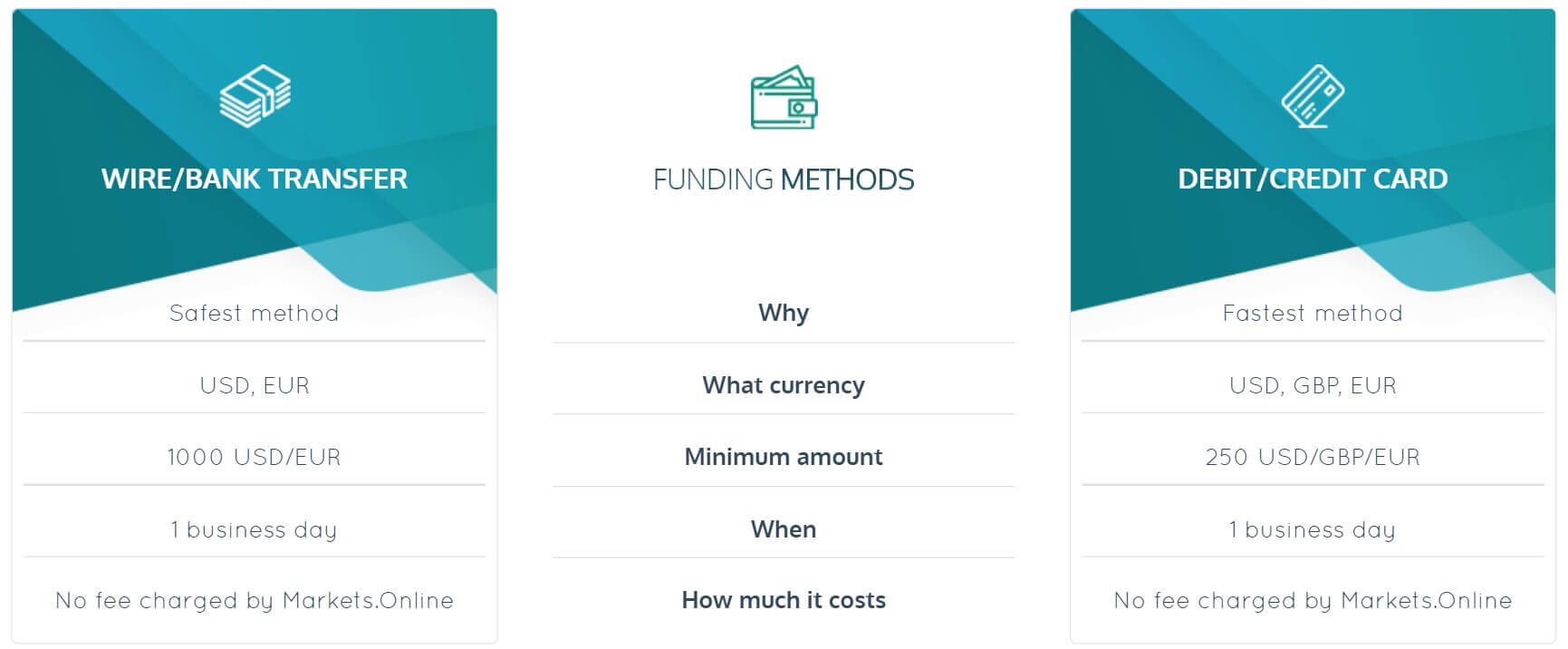

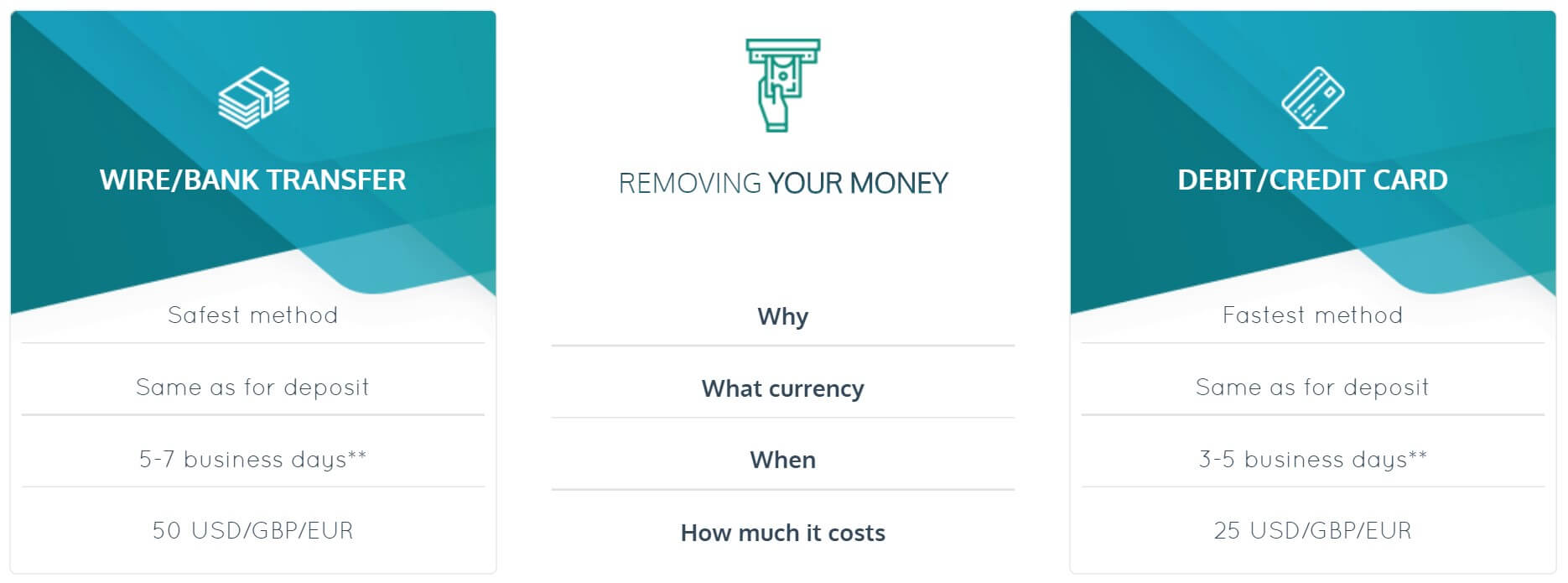

The only spreads that we have to go on are what is mentioned on the home page of the site. It states that the spread for EUR/USD is 1.6 pips. This is the starting spread as they are variable which means they will move with the markets. Different instruments will also have different starting spreads, 1.6 pips is the smallest they will be. It would be helpful for the broker to provide a full list of average spreads for most of the major assets. Sadly there isn’t a dedicated page for funding, the only information we have is some images at the bottom of the website. They indicate that Visa, Maestro, MasterCard, Neteller, and AstroPay are available to use, but we have no confirmation of this. We also do not know if there are any added fees when depositing.

Sadly there isn’t a dedicated page for funding, the only information we have is some images at the bottom of the website. They indicate that Visa, Maestro, MasterCard, Neteller, and AstroPay are available to use, but we have no confirmation of this. We also do not know if there are any added fees when depositing. When signing up for an account there is a bonus mentioned. There is a 100% welcome bonus however the terms of the bonus are rather confusing. It states that if you make a deposit of at least $5,000 you will receive a bonus of $1,500, which indicates that it is a 30% bonus and not a 100% bonus. As there are not dedicate terms and conditions for this bonus we do not know which one actually is or how to convert the bonus funds into real funds.

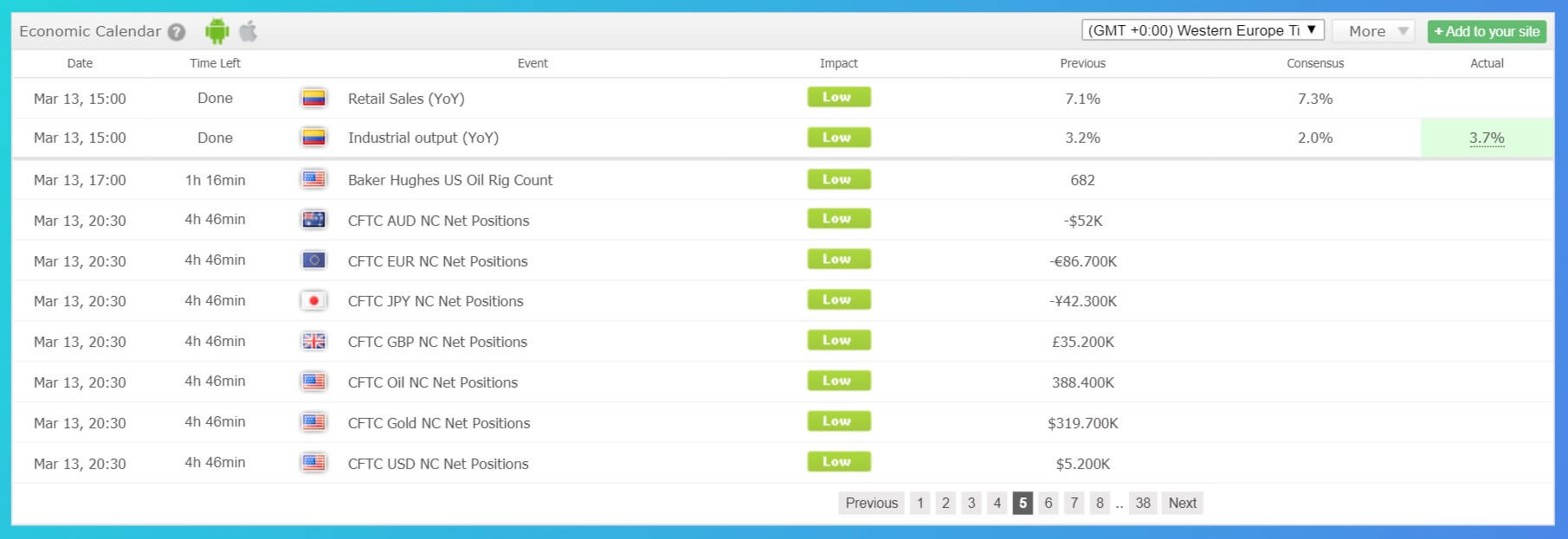

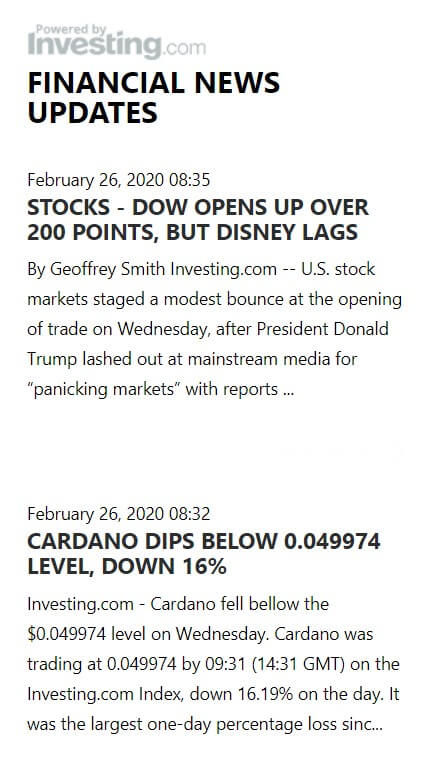

When signing up for an account there is a bonus mentioned. There is a 100% welcome bonus however the terms of the bonus are rather confusing. It states that if you make a deposit of at least $5,000 you will receive a bonus of $1,500, which indicates that it is a 30% bonus and not a 100% bonus. As there are not dedicate terms and conditions for this bonus we do not know which one actually is or how to convert the bonus funds into real funds. There is a news section of the site which details news from around the world which could be affecting the markets. There is also an economic calendar available that details different upcoming news events and the currencies or markets that they may affect.

There is a news section of the site which details news from around the world which could be affecting the markets. There is also an economic calendar available that details different upcoming news events and the currencies or markets that they may affect.

Entry Account:

Entry Account: Pro Account:

Pro Account:

Trading Costs

Trading Costs Forex:

Forex: Minimum Deposit

Minimum Deposit

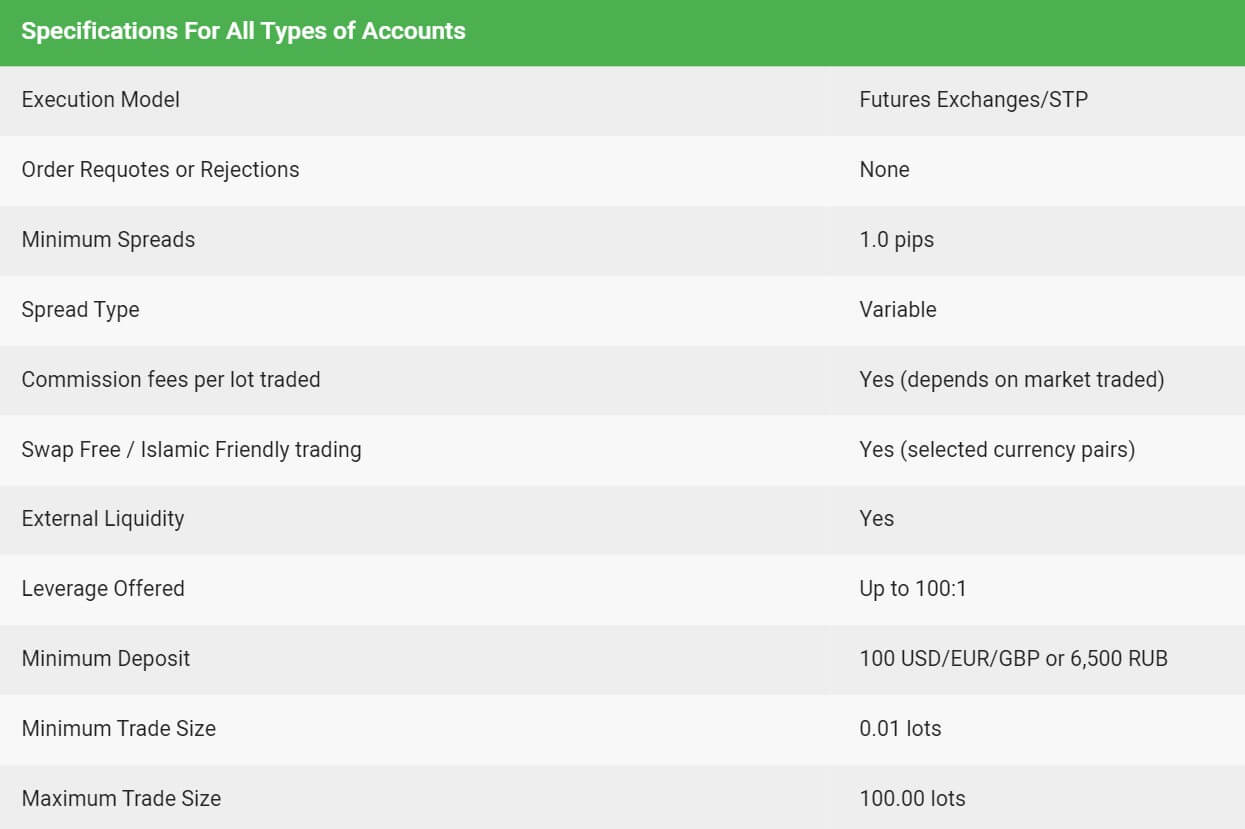

Demo accounts are available and allow you to test out the servers, conditions, platforms, and new strategies without any risk to your own capital. The demo account offers conditions such as spreads starting from 1 pip, this is a variable spread, it is commission-free, swap-free, can be leveraged up to 1:100, can have a minimum balance of 100 USD/EUR/GBP. The trade sizes start from 0.01 lots and go up to 100 lots with a lot being worth 100,000 base currency units.

Demo accounts are available and allow you to test out the servers, conditions, platforms, and new strategies without any risk to your own capital. The demo account offers conditions such as spreads starting from 1 pip, this is a variable spread, it is commission-free, swap-free, can be leveraged up to 1:100, can have a minimum balance of 100 USD/EUR/GBP. The trade sizes start from 0.01 lots and go up to 100 lots with a lot being worth 100,000 base currency units.

We would advise not trading over 50 lots in a single trade, but instead break up larger requests into smaller trades to help with execution and slippage issues.

We would advise not trading over 50 lots in a single trade, but instead break up larger requests into smaller trades to help with execution and slippage issues.

Leverage

Leverage

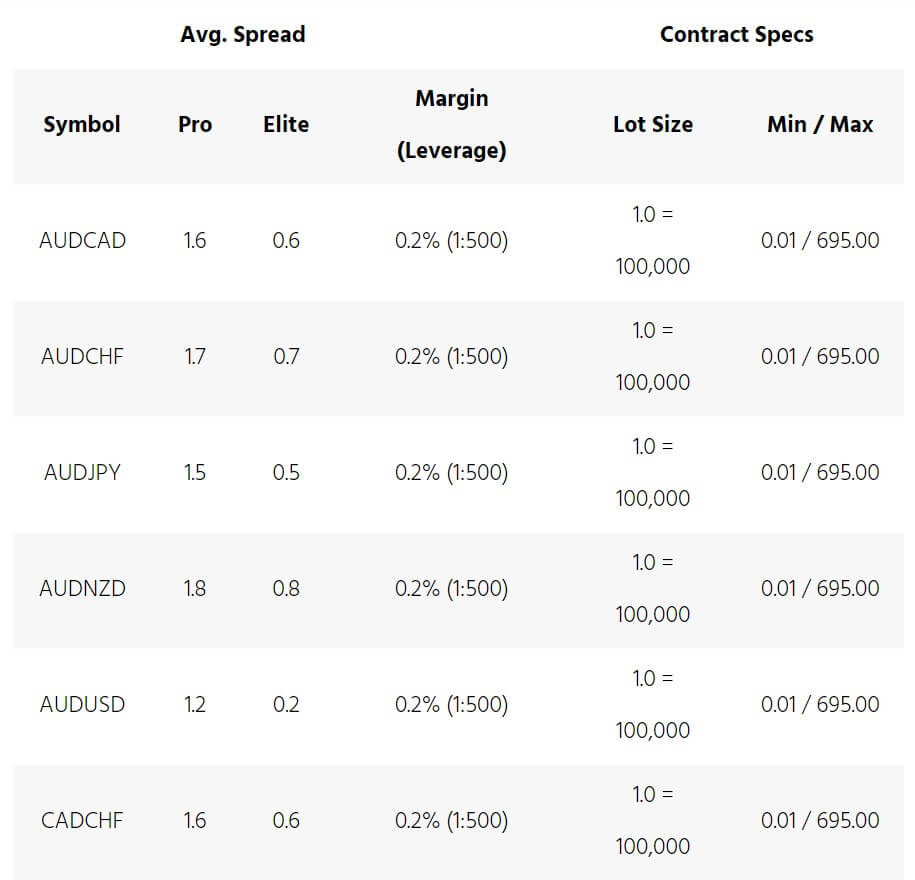

The spreads you receive depend on a few different factors, the first being the account you are using. The Pro account has spreads starting from 1 pip while the Elite account has spreads starting from 0.1 pips. The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads. So while EURUSD may start at 1.

The spreads you receive depend on a few different factors, the first being the account you are using. The Pro account has spreads starting from 1 pip while the Elite account has spreads starting from 0.1 pips. The spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads. So while EURUSD may start at 1.

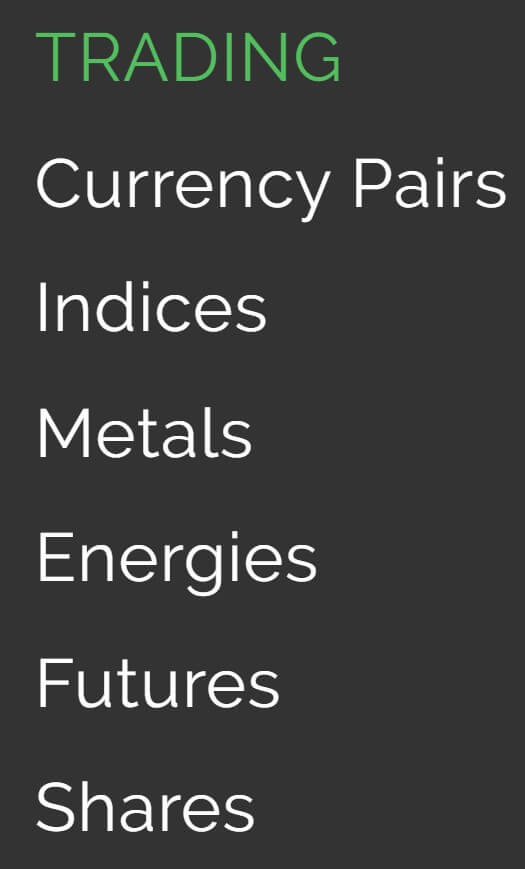

The assets on Dax1001 have been broken down into various categories. Unfortunately, there is not a full breakdown of the available assets. We have outlined the information we do know in each category below.

The assets on Dax1001 have been broken down into various categories. Unfortunately, there is not a full breakdown of the available assets. We have outlined the information we do know in each category below.

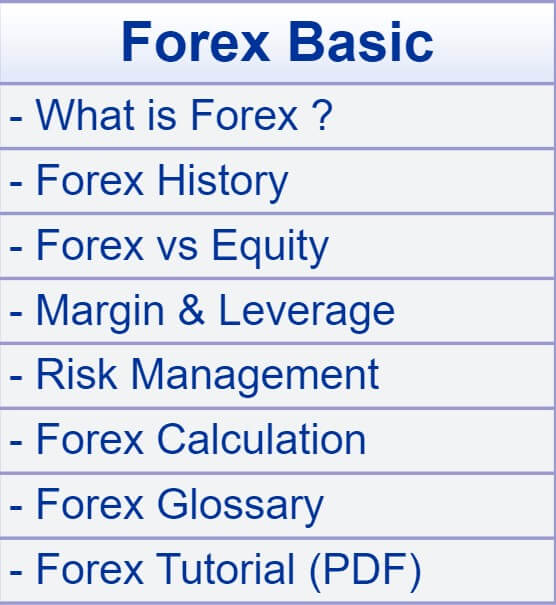

There are some very basic information pages provided which make up the majority of this section, they cover topics such as: What is Forex?, Forex History, Margin & Leverage, What is CFD?, Technical Analysis and Fundamental Analysis. There is also a

There are some very basic information pages provided which make up the majority of this section, they cover topics such as: What is Forex?, Forex History, Margin & Leverage, What is CFD?, Technical Analysis and Fundamental Analysis. There is also a

The only platform on offer is MetaTrader 4 which is a great option to have. MetaTrader 4 is a highly popular trading platform due to its many features. These include its accessibility, it is available as a desktop download, web trader and as an application for your mobile devices. Its distributed architecture, robust security system and convenient mobile trading are some of the core competencies that give MetaTrader 4 its compelling competitive advantages, offering the perfect solution to the even most demanding trading needs.

The only platform on offer is MetaTrader 4 which is a great option to have. MetaTrader 4 is a highly popular trading platform due to its many features. These include its accessibility, it is available as a desktop download, web trader and as an application for your mobile devices. Its distributed architecture, robust security system and convenient mobile trading are some of the core competencies that give MetaTrader 4 its compelling competitive advantages, offering the perfect solution to the even most demanding trading needs.

We have outlined below the different minimum trade sizes as well as the maximum trade size of each account.

We have outlined below the different minimum trade sizes as well as the maximum trade size of each account.

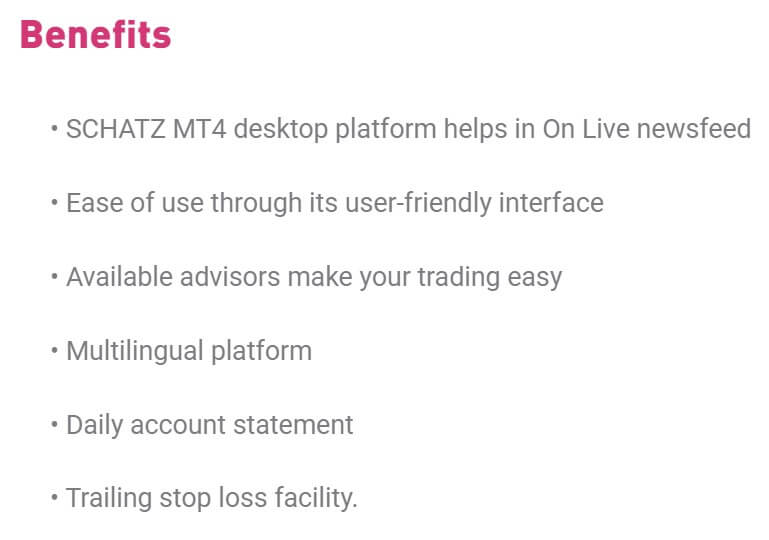

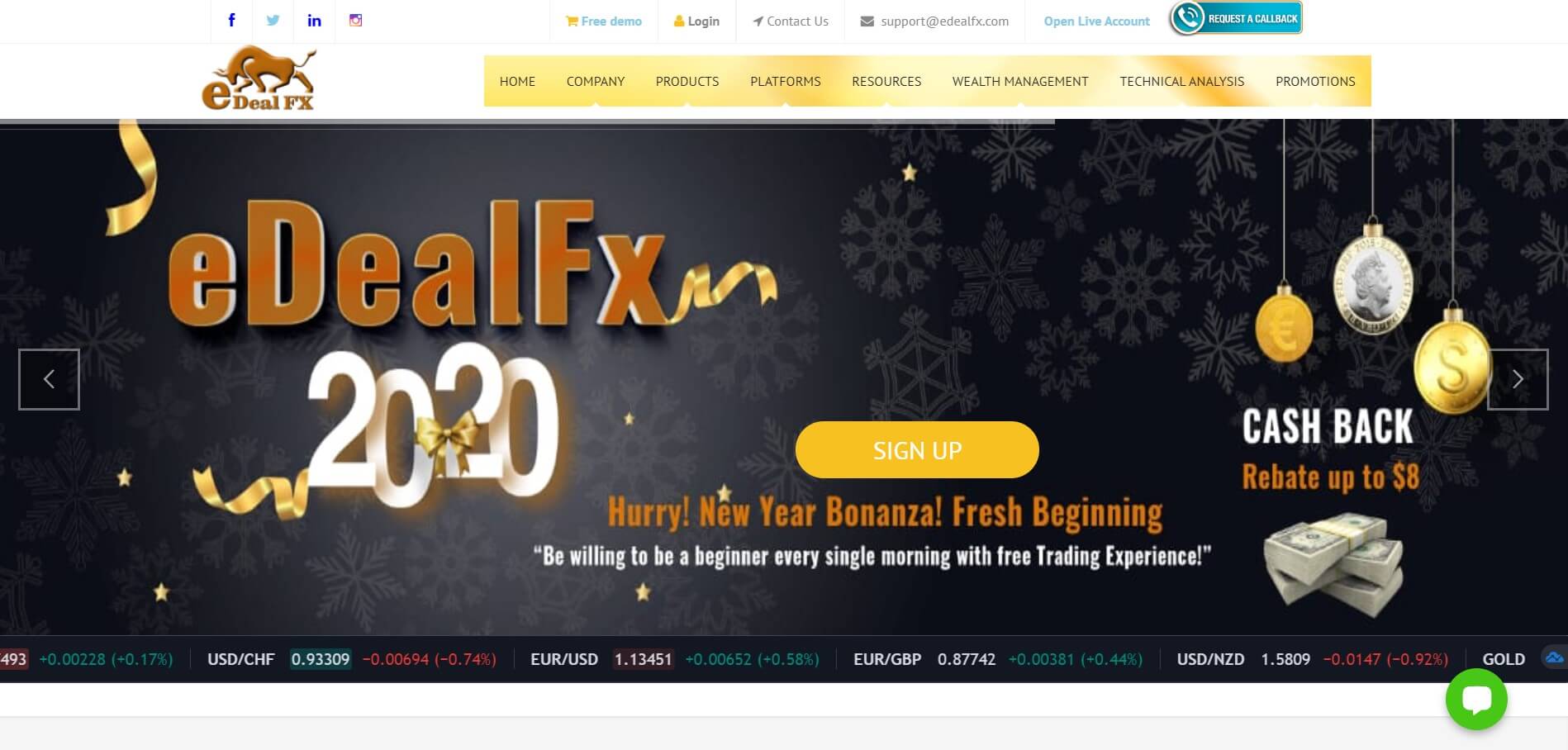

eDeal FX uses MetaTrader 4 from the MetaQuotes company as their only trading platform. It is one of the world’s most popular trading platform and comes with a whole host of features to make your trading life easier. These features include a complete friendly interface for ease of use, news feeds every second to keep traders updated, ready state analytical tools for your requirement, various best in class charts and calculations, developing advises from experts to use them on the go, multilingual platform, anytime account statement, real-time fund details, a summary of portfolios, unrealized/realized profits and loss and allocations and, effective and efficient indicators to determine trade dependencies and trailing stop loss facility. MetaTrader 4 is available on multiple paltforms including desktop, mobile devices and as a trader on your web browser.

eDeal FX uses MetaTrader 4 from the MetaQuotes company as their only trading platform. It is one of the world’s most popular trading platform and comes with a whole host of features to make your trading life easier. These features include a complete friendly interface for ease of use, news feeds every second to keep traders updated, ready state analytical tools for your requirement, various best in class charts and calculations, developing advises from experts to use them on the go, multilingual platform, anytime account statement, real-time fund details, a summary of portfolios, unrealized/realized profits and loss and allocations and, effective and efficient indicators to determine trade dependencies and trailing stop loss facility. MetaTrader 4 is available on multiple paltforms including desktop, mobile devices and as a trader on your web browser.

The contact us page is what you would expect of a Forex broker. There is an online submission form as well as a postal address, email address and phone number to choose your method of contact from.

The contact us page is what you would expect of a Forex broker. There is an online submission form as well as a postal address, email address and phone number to choose your method of contact from. There are plenty of options when it comes to accounts, but it is not fully clear what the differences between them are. Different bonus amounts, spreads, and commissions, all with no information on what any of them actually are. We have no idea what the trading costs are and even more worryingly, we have no idea how to deposit or withdraw and if it will cost us to do so. Not to mention the complete lack of information on available assets. With so much information missing, we cannot recommend Double Million as a broker to use at this point in time.

There are plenty of options when it comes to accounts, but it is not fully clear what the differences between them are. Different bonus amounts, spreads, and commissions, all with no information on what any of them actually are. We have no idea what the trading costs are and even more worryingly, we have no idea how to deposit or withdraw and if it will cost us to do so. Not to mention the complete lack of information on available assets. With so much information missing, we cannot recommend Double Million as a broker to use at this point in time.

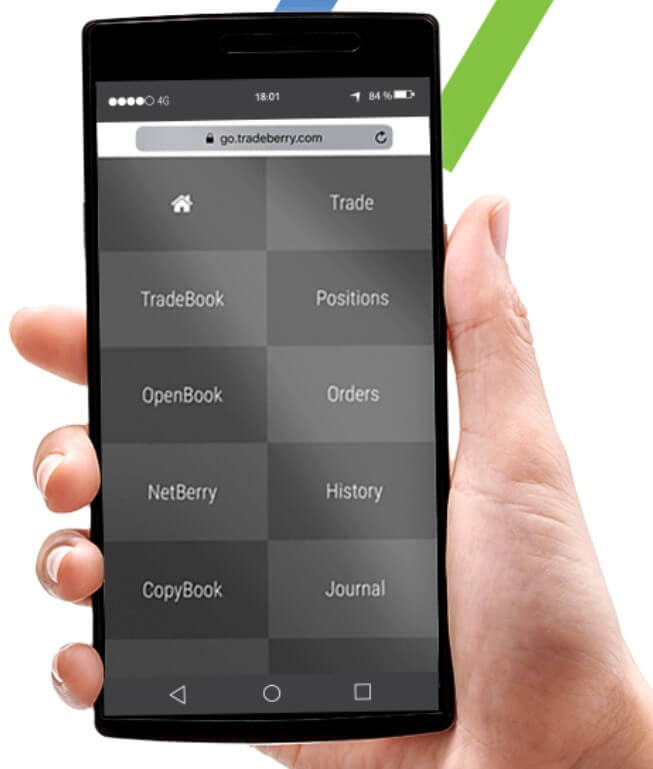

TradeBerry uses its own trading platform that they have developed themselves. Trade.Berry’s vision is to host the most transparent social trading community ever created. That is why they joined forces with TOOMIT to create an ultra-fast platform offering the transparency they want for their community of traders. Features include execution in milliseconds,

TradeBerry uses its own trading platform that they have developed themselves. Trade.Berry’s vision is to host the most transparent social trading community ever created. That is why they joined forces with TOOMIT to create an ultra-fast platform offering the transparency they want for their community of traders. Features include execution in milliseconds,

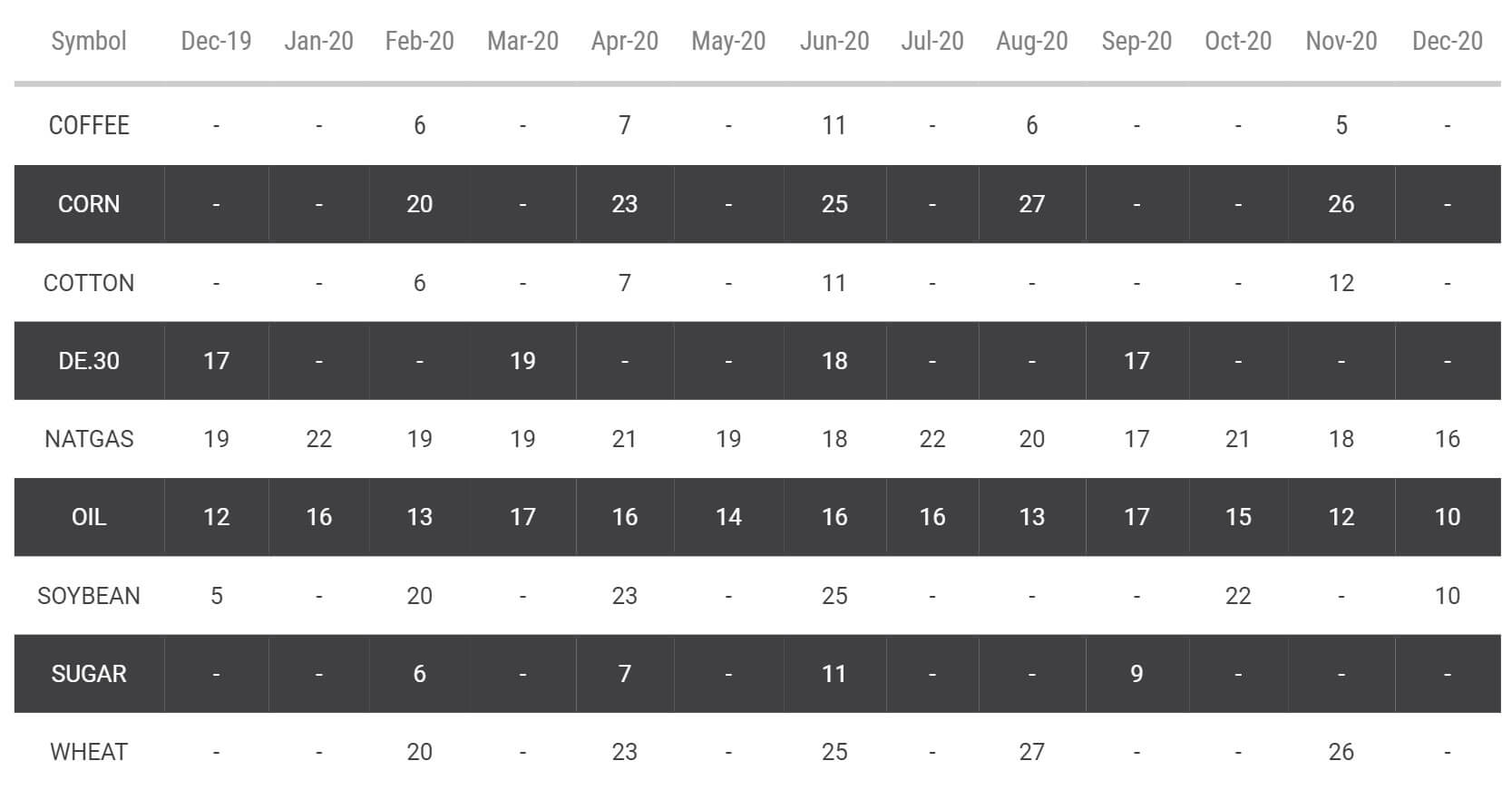

Trade.Berry has broken down its assets into 5 different categories, each with different instruments within them. They haven’t broken down their assets into each one so we will just give a little overview.

Trade.Berry has broken down its assets into 5 different categories, each with different instruments within them. They haven’t broken down their assets into each one so we will just give a little overview. There are a few examples of spreads available on the site. There is also a little confusion, on the accounts page it states that all the account shave fixed spreads. However, when looking at the product specification, they all say variable, so we are not sure which one it is. EUR/USD seems to have a spread of 1.2 pips, other instruments will naturally have a different spread and if we look at

There are a few examples of spreads available on the site. There is also a little confusion, on the accounts page it states that all the account shave fixed spreads. However, when looking at the product specification, they all say variable, so we are not sure which one it is. EUR/USD seems to have a spread of 1.2 pips, other instruments will naturally have a different spread and if we look at

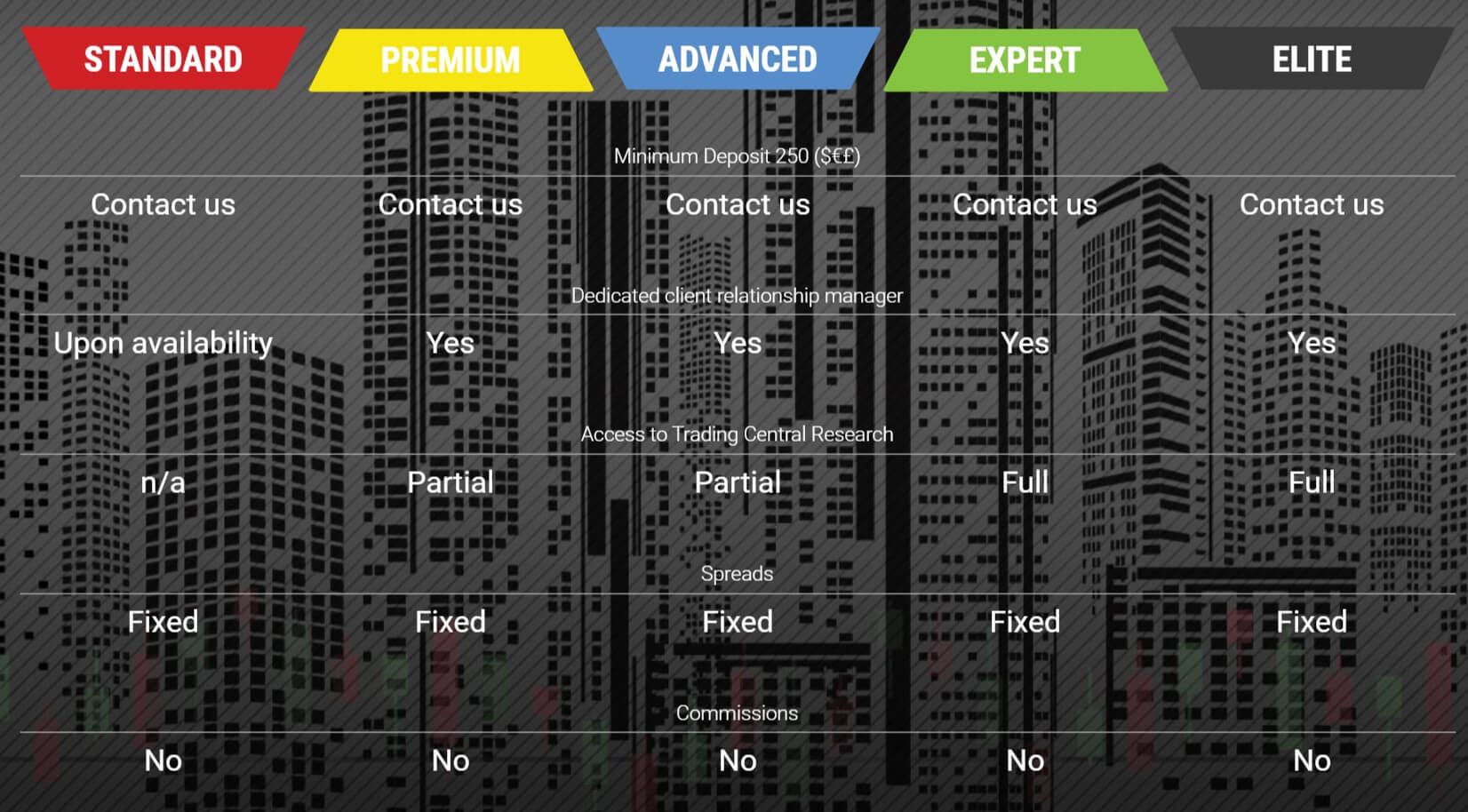

Trade.Berry confused us a little with their accounts, as they all seem to have the same entry requirements and the same trading conditions The only differences are a few educational tools, but with the entry requirement being the same, everyone will just go for the Elite account. The spreads are average. For non-commission accounts, they are in line with the rest of the industry. There are a few different ways to deposit and withdraw and each having no additional fees is a big plus. The full break down of assets and instruments is a little overwhelming as it is all on a single page rather than broken down into categories. Overall, there seems to be plenty to trade at Trade Berry and the broker seems poised to meet the needs of a wide variety of Forex traders.

Trade.Berry confused us a little with their accounts, as they all seem to have the same entry requirements and the same trading conditions The only differences are a few educational tools, but with the entry requirement being the same, everyone will just go for the Elite account. The spreads are average. For non-commission accounts, they are in line with the rest of the industry. There are a few different ways to deposit and withdraw and each having no additional fees is a big plus. The full break down of assets and instruments is a little overwhelming as it is all on a single page rather than broken down into categories. Overall, there seems to be plenty to trade at Trade Berry and the broker seems poised to meet the needs of a wide variety of Forex traders.

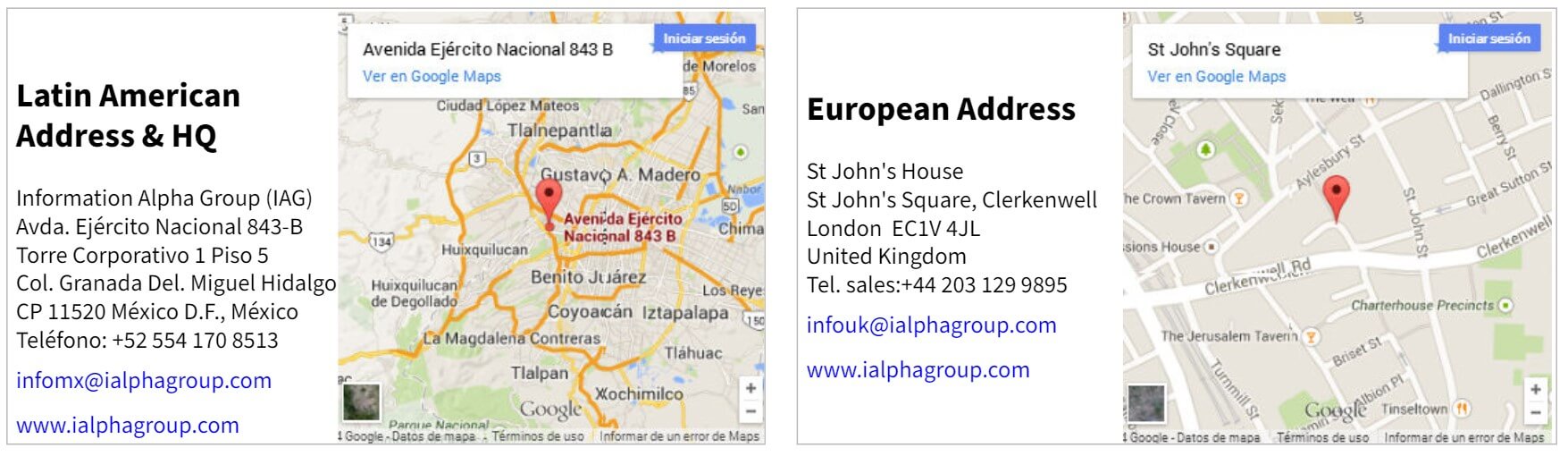

As mentioned above there isn’t any information available on the site that relates to funding, so this included the available deposit methods or any fees that come with them. This is a shame as Alpha Group will be dealing with our money so the least they could do is detail the methods are available and any fees relating to them.

As mentioned above there isn’t any information available on the site that relates to funding, so this included the available deposit methods or any fees that come with them. This is a shame as Alpha Group will be dealing with our money so the least they could do is detail the methods are available and any fees relating to them.

Educational & Trading Tools

Educational & Trading Tools

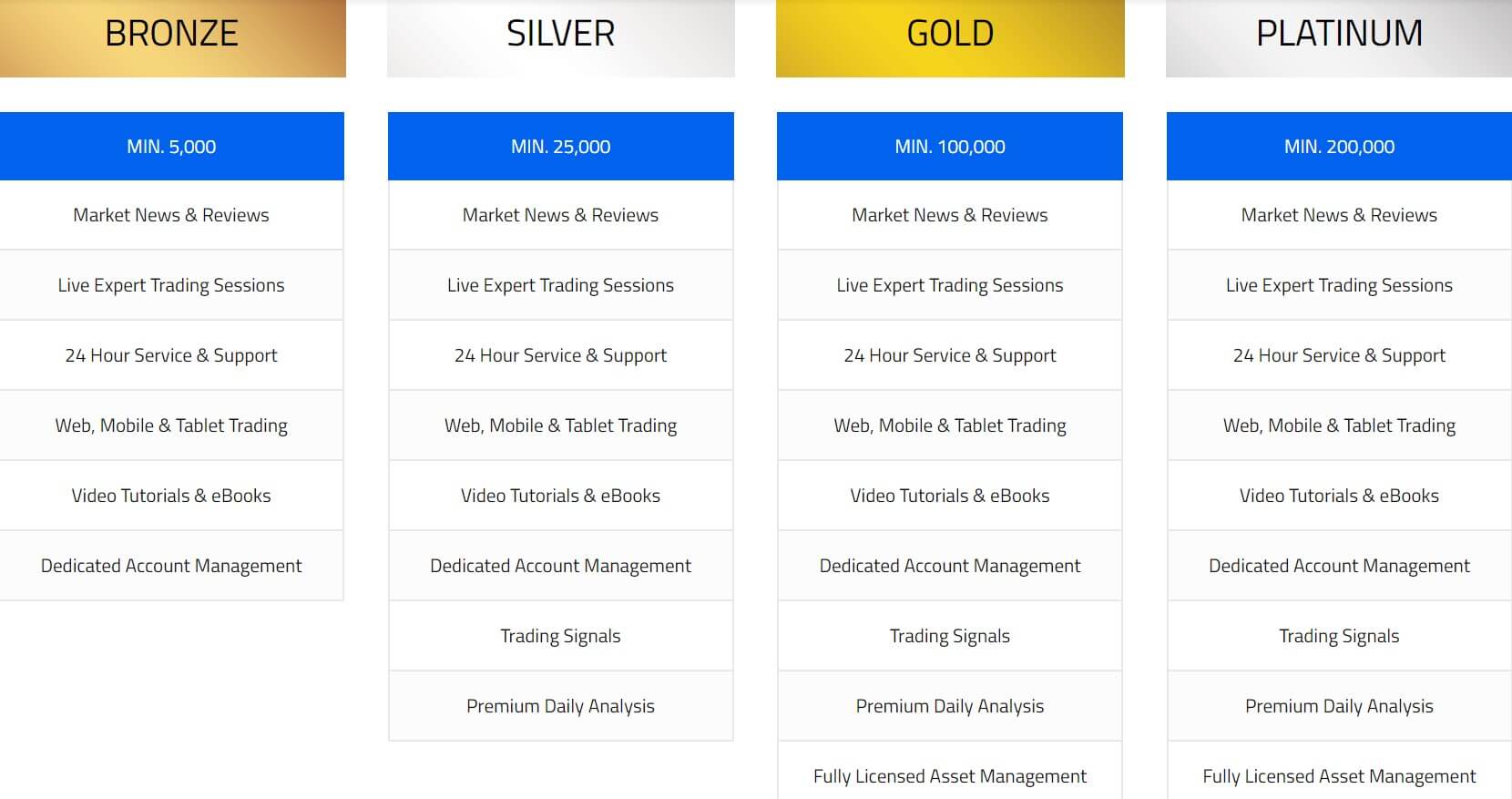

There are over 470 total assets and we have been broken down into a number of different categories, including FX pairs, commodities, stocks, metals, and more. We did not see any cryptocurrencies, and this could certainly be an issue for a number of traders.

There are over 470 total assets and we have been broken down into a number of different categories, including FX pairs, commodities, stocks, metals, and more. We did not see any cryptocurrencies, and this could certainly be an issue for a number of traders.

Minimum Deposit

Minimum Deposit

Customer Service

Customer Service

The assets have been broken down into a number of different categories, we have outlined them below along with the available instruments.

The assets have been broken down into a number of different categories, we have outlined them below along with the available instruments.

Educational & Trading Tools

Educational & Trading Tools

MT4: MT4 is one of the worlds most popular trading platforms, it offers a whole host of features that can help benefit you as a trader, some of these include ZERO commission account on spreads account, spreads from 0.0 pips on commission account, all accounts are STP accounts, direct market Access, micro Lots available for Spot Forex and Metals, no Dealing Desk, EA, scalping, and hedging allowed

MT4: MT4 is one of the worlds most popular trading platforms, it offers a whole host of features that can help benefit you as a trader, some of these include ZERO commission account on spreads account, spreads from 0.0 pips on commission account, all accounts are STP accounts, direct market Access, micro Lots available for Spot Forex and Metals, no Dealing Desk, EA, scalping, and hedging allowed

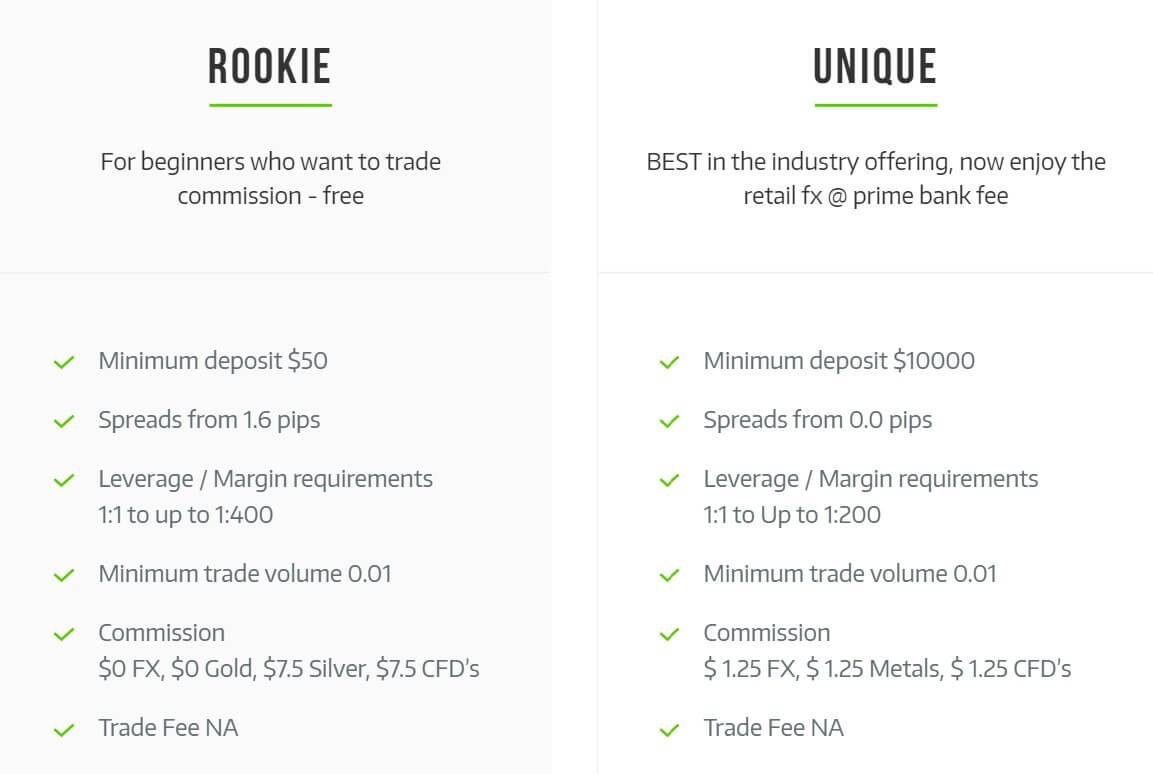

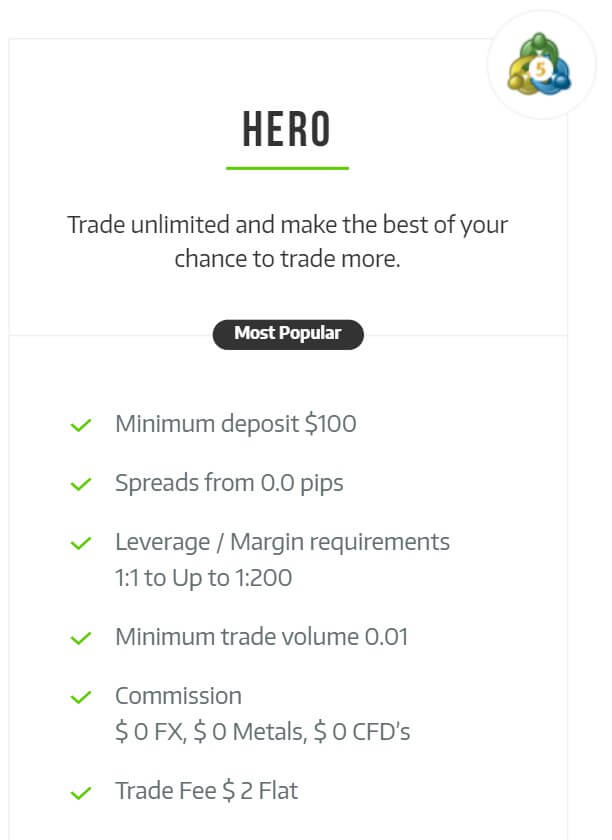

The Mini, Rookie, Prime and Elite accounts all have leverage that can go as high as 1:400, the Unique and Hero accounts have leverage as high as 1:200. Leverage can be selected when opening up a new account and you can change it on an account that is already open by contacting the customer service team.

The Mini, Rookie, Prime and Elite accounts all have leverage that can go as high as 1:400, the Unique and Hero accounts have leverage as high as 1:200. Leverage can be selected when opening up a new account and you can change it on an account that is already open by contacting the customer service team.

Forex: There are 62 different pairs available to trade, some of them include AUDCAD, CASCHF, EURAUD, EURGBP, EURUSD, GBPJPY, GBPNOK, NZDUSD, USDSEK, USDTRY and, USDZAR.

Forex: There are 62 different pairs available to trade, some of them include AUDCAD, CASCHF, EURAUD, EURGBP, EURUSD, GBPJPY, GBPNOK, NZDUSD, USDSEK, USDTRY and, USDZAR.

Withdrawal Methods & Costs

Withdrawal Methods & Costs

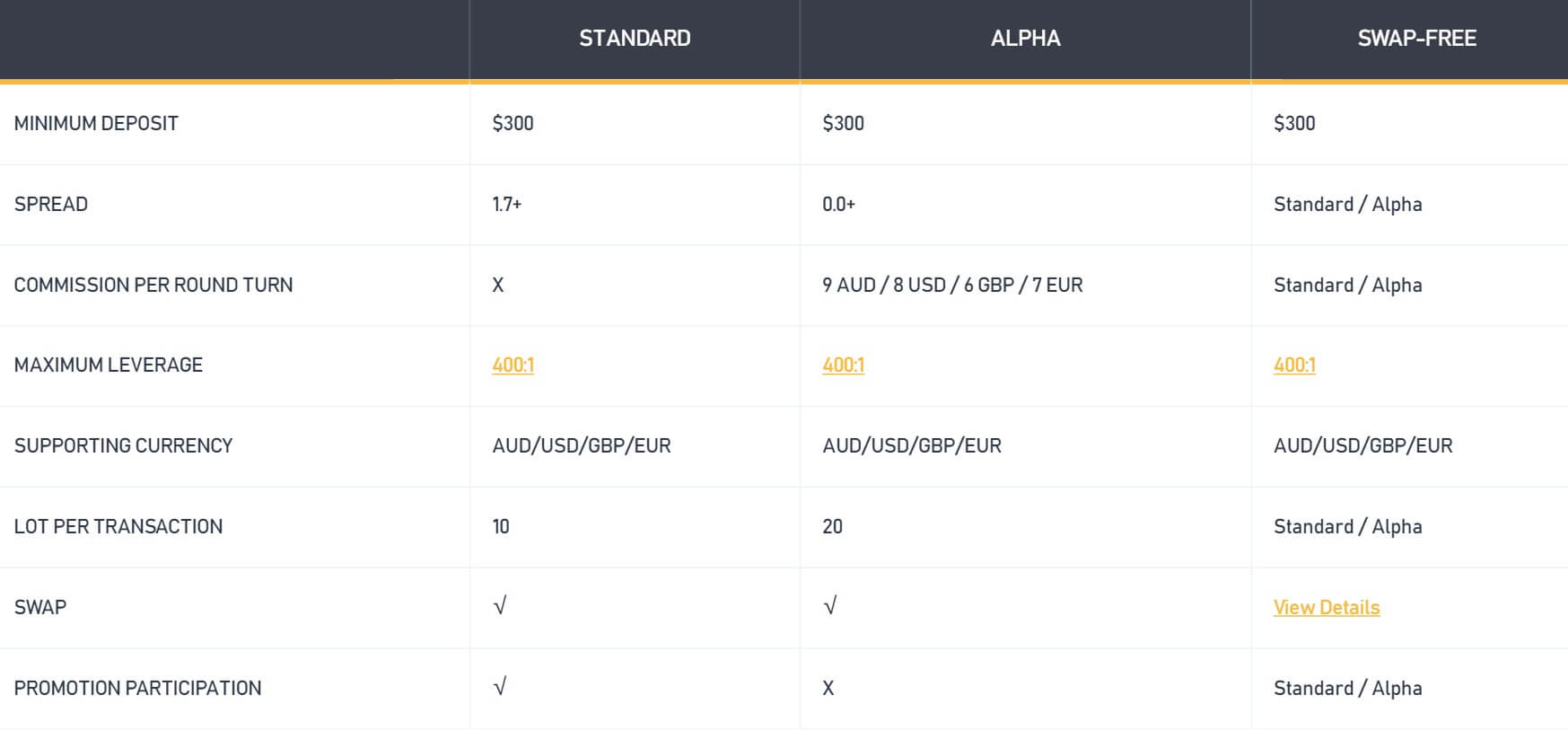

All three accounts shave maximum leverage of 1:400. This can be selected when first opening up an account and can be changed on ana already active account by sending a request to the customer service department. If your account balance goes above $100,000 then the maximum leverage available is reduced.

All three accounts shave maximum leverage of 1:400. This can be selected when first opening up an account and can be changed on ana already active account by sending a request to the customer service department. If your account balance goes above $100,000 then the maximum leverage available is reduced.

Minimum Deposit

Minimum Deposit