Amenda Markets is an independent forex broker and wealth management firm offering broker and asset management services as well as solutions for issues related to investments of private and corporate clients. Amenda Markets is licensed and regulated by the Financial and Capital Market Commission of Latvia. We will be using this review to look into the service on offer and so see how they compare to the competition, it will also give you the chance to see if they are the right broker for your trading needs.

Account Types

It seems that there are just two accounts available, one catered towards retail clients and the other towards professional clients, elts have a look at what they offer.

Retail Account:

This account requires a minimum deposit of 200 EUR in order to open. The spreads on the account can apparently go as low as -1.5 pips, there is a trading fee of 0.0037% per side so 0.0074% per lot traded. There are swap fees on the account and the maximum leverage is 1:30. The account can be in USD, EUR, GPB or JPY and there is a minimum trade size of 0.01 lots, they go up in steps of 0.01 lots and there is no maximum trade size or a number of allowed open traded. The margin call level is set at 80% with the stop out level at 50%. It uses market execution and both hedging and scalping are allowed. The account has access to MetaTrader 4 as a trading platform, no restrictions on expert advisors and has negative balance protection.

Professional Account:

This account requires a minimum deposit of $10,000 in order to open. The spreads on the account can apparently go as low as -1.5 pips, there is a trading fee of 0.0037% per side so 0.0074% per lot traded. There are swap fees on the account and the maximum leverage is 1:125. The account can be in USD, EUR, GPB or JPY and there is a minimum trade size of 0.1 lots, they go up in steps of 0.01 lots and there is no maximum trade size or a number of allowed open traded. The margin call level is set at 120% with the stop out level at 80%. It uses market execution and both hedging and scalping are allowed. The account has access to MetaTrader 4 as a trading platform, no restrictions on expert advisors and does not have negative balance protection.

Platforms

Just the one platform is available and that is MetaTrader 4 from MetaQuotes. MT4 combines advanced features with an intuitive interface that allows you to set up your personal computer as a personalized trading station. MetaTrader 4 (MT4), developed by MetaQuotes, is one of the most popular and awarded trading platforms worldwide, utilized by over 300 brokerage companies and banks worldwide for their core trading services and operations, serving millions of traders and investors globally. It can be used as a desktop download, mobile application or used directly within your internet browser.

Leverage

Amenda FX follows the guidelines from the ESMA which are as follows:

Leverage limits on the opening of a position by a retail client from 30:1 to 2:1, which vary according to the volatility of the underlying:

30:1 for major currency pairs;

20:1 for non-major currency pairs, gold, and major indices;

10:1 for commodities other than gold and non-major equity indices;

5:1 for individual equities and other reference values;

2:1 for cryptocurrencies

Trade Sizes

Trade sizes on the Retail account start at 0.01 lots and go up in increments of 0.01 lots, there does not seem to be a limit on the size of a trade or how many you can have open at any one time.

The Professional account has trade sizes starting from 0.1 lots and goes up in increments of 0.01 lots so the next trade would be 0.11 lots and the 0.12 lots. There also does not appear to be a limit or a maximum number of trades you can have open at any one time.

We would suggest not trading over 50 lots in a single trade on either account due to execution and slippage issues.

Trading Costs

Both account types have the same commission which is 0.0037% per side, this means it is charged when opening an account and also when closing, so the overall commission is 0.0074% per lot traded.

There are also swap fees, these are charges for holding trades overnight and they change based on the interest rated between currency pairs and can be either positive or negative. They can be viewed within the MetaTrader 4 trading platform.

Assets

There isn’t a huge selection of available assets, we have outlined them for you below.

Forex:

EUR/USD, EUR/CAD, EUR/CHF, USD/JPY, USD/CAD, USD/CHF, EUR/JPY, CAD/JPY, CHF/JPY, CAD/CHF, EUR/AUD, EUR/NZD, EUR/SGD, EUR/NOK, EUR/SEK, AUD/USD, NZD/USD, AUD/JPY, NZD/JPY, GBP/AUD, GBP/NZD, AUD/CAD, AUD/CHF, AUD/NZD, GBP/PLN, EUR/PLN, EUR/HUF, AUD/SGD, NZD/SGD, NZD/CAD, NZD/CHF, EUR/GBP, GBP/USD, GBP/JPY, GBP/CAD, GBP/CHF, EUR/CZK, EUR/MXN

Metals:

XAU/USD, XAU/EUR, XAG/USD, XAG/EUR, XPT/USD

It is a shame that there are no other commodities or indices available as a lot of traders are now expanding to include them in their trading portfolios.

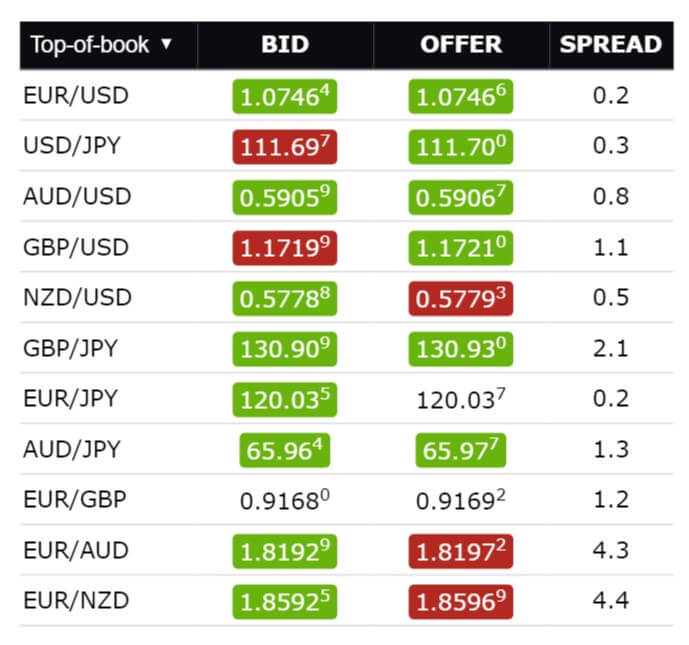

Spreads

The account page claims that the spreads can be as low as 1.5 pips, this would mean that you are in fact paid the spread by the broker, we have not seen this before and looking a the live spreads, it also doesn’t look like it happens here (at least not when we looked).

The spreads are starting as low as 0.1 pips, they are variable which means that are influenced by the markets, when there is added volatility they are seen to be higher different instruments also have different spreads so while EURUSD may be at 0.1 pips, NZDUSD is currently at 0.3 pips.

Minimum Deposit

The different account has different deposit requirements.

Retail Account:

If you are part of the EU then the minimum deposit is EUR 200, if you are not from the EU then the minimum deposit requirement is 2,000 EUR, USD, GBP or 200,000 JPY.

Professional Account:

This account requires 10,000 USD, EUR, GBP or 1,000,000 JPY in order to open.

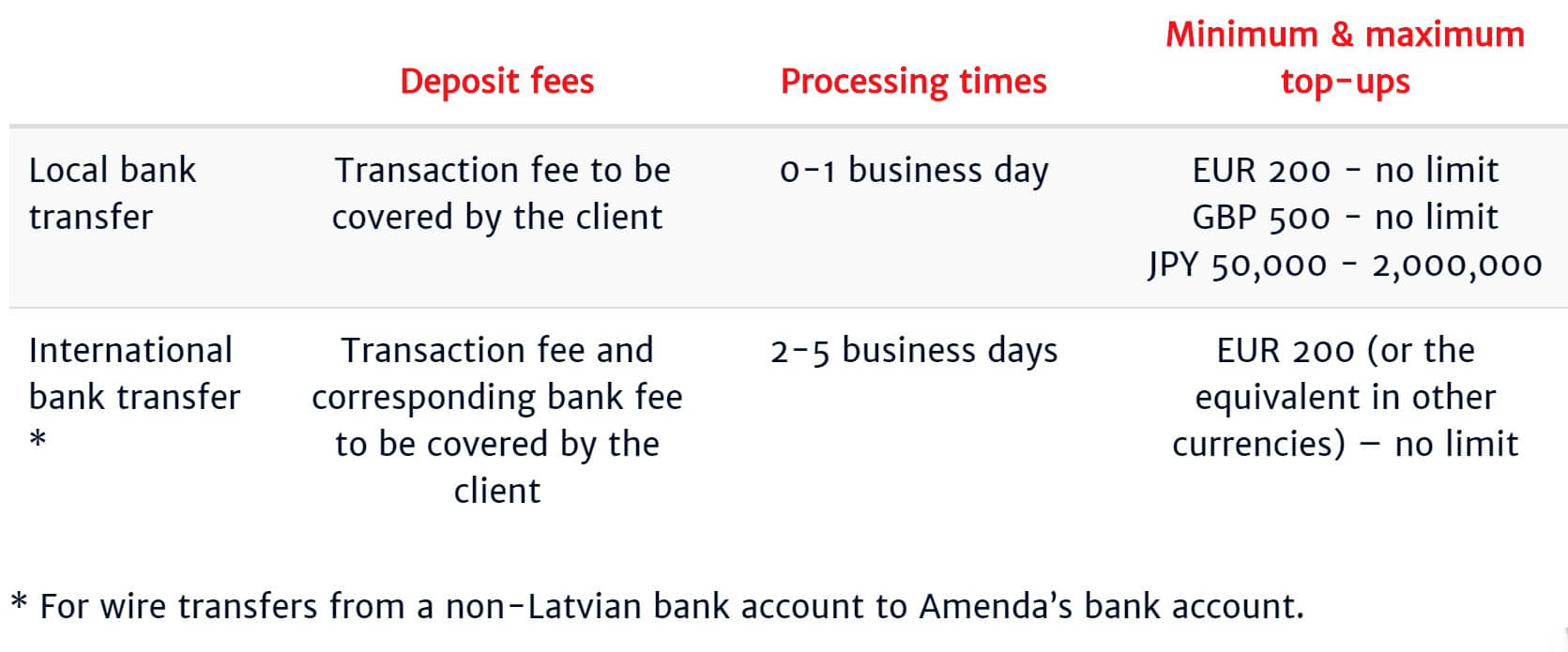

Deposit Methods & Costs

At the moment it seems that only Bank Wire Transfer is available to deposit with, the deposit page states that the client will be responsible for any transaction fees or bank fees that are charged, they do not state how high they are as they will depend on each individual transfer and bank.

Withdrawal Methods & Costs

At the time of writing this review, only Bank Wire Transfer is available to withdraw with, Credit/Debit Card sand China UnionPay is listed but both state that they are coming soon.

There is an added fee of 15 EUR added by Amenda for all bank withdrawals, this is on top of any additional transfer or processing fees charged by both their bank and your own bank.

Withdrawal Processing & Wait Time

Withdrawal requests via Bank Wire Transfer will take between 2 to 5 business days to fully process and clear into your account for use.

Bonuses & Promotions

There doesn’t appear to be any active promotions or bonuses on the site, this does not mean there won’t be any so if you are thinking about joining and would like a bonus you should contact the customer service team to see if there are any coming up that you could take part in.

Educational & Trading Tools

There doesn’t seem to be any educational material on the site which his a shame a lot of brokers are now trying to help their clients improve on their trading, so it would be nice to see Amenda Markets do something similar for their client base.

Customer Service

There isn’t a dedicated contact up page which is a little strange instead you have to hover over the logo in the top right to get any information. You can contact Amenda Market using the provided postal address, email address or phone number, they also have contact through various social media such as twitter.

Address: Amenda Markets AS IBS, Elizabetes iela 63-24, Riga, LV-1050

Phone: +371 6677 7830

Email: [email protected]

Demo Account

A demo account allows you to test out the markets and new strategies without any real risk, there are a few key differences between a demo account and a live account, the demo account has 00% executability which there is a small change of rejection on a live account, there is instant execution on a demo account while a live account depends on the markets, no slippage on the demo while there is on live accounts and the spreads will not be able to be 100% accurate. The demo account with Amenda lasts for just 14 days before they expire.

Countries Accepted

The following statement is present on the site: “Amenda Markets AS IBS is registered for the provision of investment services and ancillary (non-core) investment services in the following member states of European Union and European Economic Area: Austria, Czech Republic, Denmark, Estonia, Finland, France, Italy, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Slovakia, Spain, Sweden, and United Kingdom.”

If you are still not sure of your eligibility or your country is not listed then you should get in touch with the support team to find out if you are able to trade with Amenda FX.

Conclusion

Amenda Markets offers just the two accounts, one for retail and one for professional clients. One of the stand out conditions mentioned is the negative spreads, we have not seen this before and when looking at the live spreads they were not present for us. The trading conditions are ok, the spreads are low and the commission is not excessively high. There is a small lack of options when it comes to what is available to trade, however, there are enough currency pairs to keep you occupied, it would be nice for there to be more commodities or indices though. Deposit and withdrawal methods are also very limited, there are also fees for withdrawing which is a shame.

You now have the information needed to decide if Amenda Market is the right broker for you. If not then check out some of the other levies to help find the one that works for you.