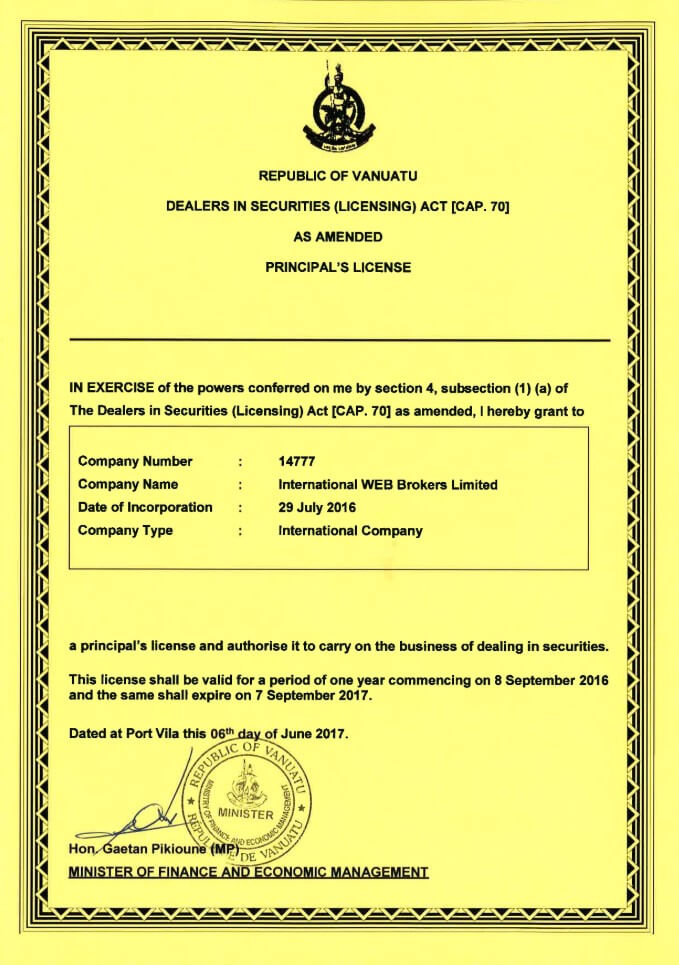

Everest Trade is a foreign exchange broker that is regulated by the VFSC, a zone of preferential taxation that is being regulated by the Financial Supervision Commission for trading in Forex and in the market of derivative financial instruments. There isn’t much information provided about them, so we will need to sue this review as an opportunity to find out more about them and to help you decide if they are the right broker for you to use.

Account Types

There isn’t an account comparison page and going through the site there isn’t any indication that there is more than one account type. As we go through this review if it becomes apparent that there are then we will outline any differences in each section. However, we believe that just the one account exists and so all information provided in this review is relevant to that one account.

Platforms

Everest Trade uses its own trading platform that is available as a web trader and as a mobile application for iOS and Android devices. The platform offers you basic trading abilities and order functionality. It lacks a lot of the customization that you see on platforms like MetaTrader and it also is lacking a lot of the compatibilities with expert advisors and indicators. It does have its own inbuilt indicators, but they are very basic. It would have been nice to see a more established platform available to use.

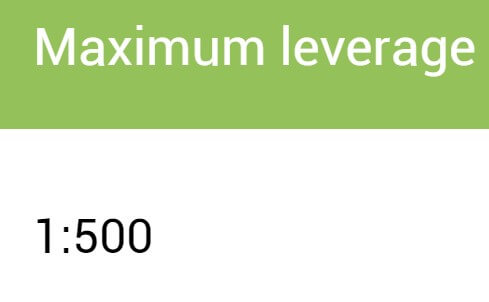

Leverage

The leverage that you receive is based on the instrument that you are trading. We have listed the different instruments along with the associated maximum leverage.

- Forex: 1:500

- Metals: 1:500

- Stocks: 1:5

- Commodities: 1:100 or 1:10 for Natural Gas

- Indices: 1:5

- EFTs: 1:5

The maximum leverage for Forex can be selected when opening up an account, we are not sure if it can be changed on an already open account but you should request a change by contacting the customer service team.

Trade Sizes

The trade sizes are also dependant on the instrument that you are trading. We have outlined the minimum trade size, increment size, and maximum trade size for each asset group below.

- Forex: 0.01 lot min / 0.01 lot incrmeent / 1,000 lot max

- Metals: 0.1 lot min / 0.1 lot incrmeent / 1,000 lot max

- Stocks: 1 lot min / 1 lot incrmeent / 10,000 lot max

- Commodities: 1 lot min / 1 lot incrmeent / 100,000 lot max

- Indices: 1 lot min / 1 lot incrmeent / 10,000 lot max

- EFTs: 1 lot min / 1 lot incrmeent / 10,000 lot max

We would advise not trading over 50 lots in a single trade, but instead break up larger requests into smaller trades to help with execution and slippage issues.

We would advise not trading over 50 lots in a single trade, but instead break up larger requests into smaller trades to help with execution and slippage issues.

Trading Costs

There are no added commissions when trading as the available account uses a spread based structure that we will look at later in this review. There are however swap charges which are fees for holding trades overnight, they can be viewed within the trading platform you are using.

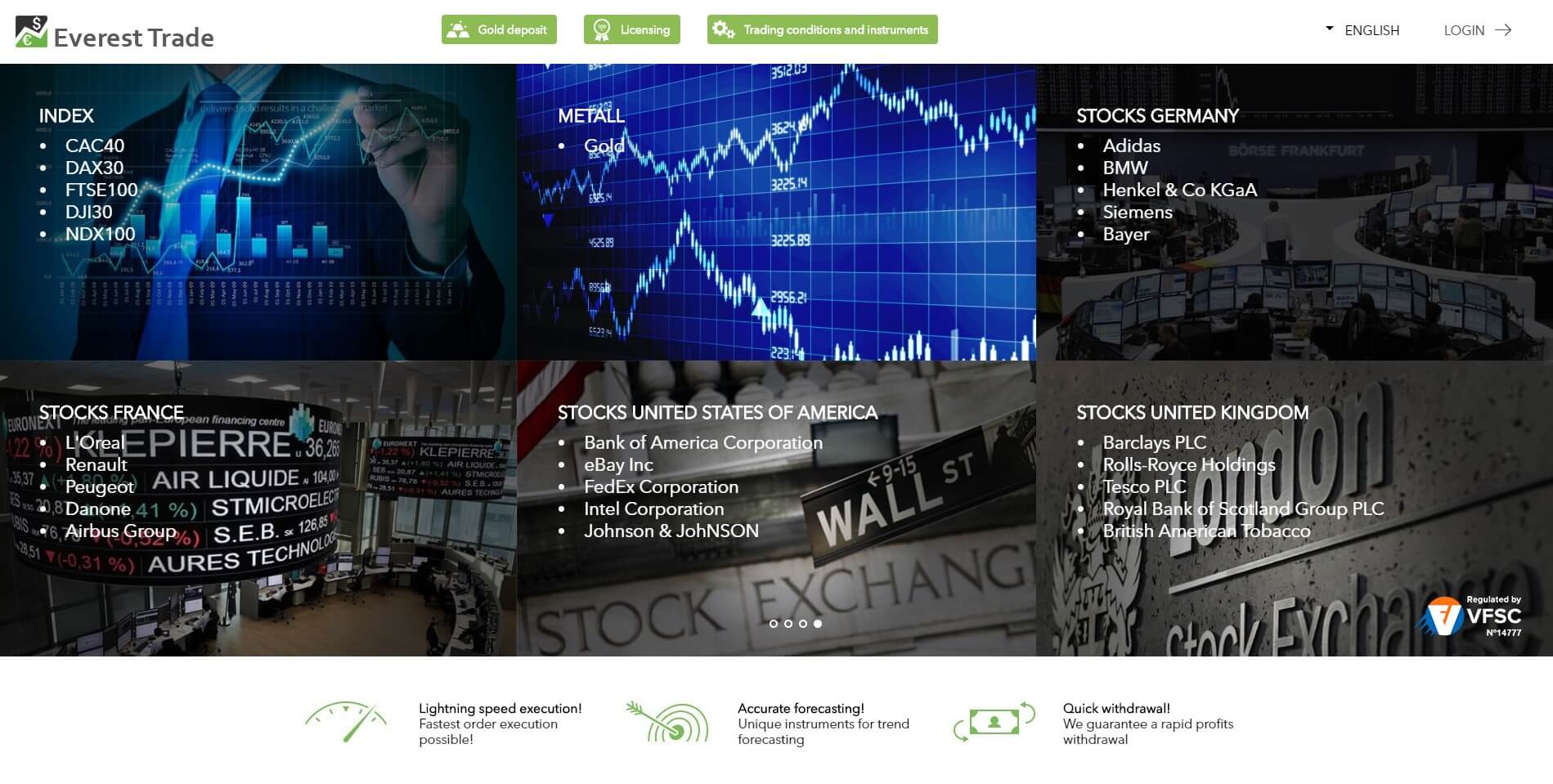

Assets

The assets and instrument shave been broken down into a number of different categories, we have listed them below along with the instruments within them.

Forex:

AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURACD, EURCHF, EURGBP, EURJPY, EURNOK, EURNZD, EURPLN, EURSEK, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, GBPSEK, GBPUSD, NOKSEK, NZDCAD, NZDCHF, NZDJPY, NZSUSD, USDCAD, USDCHF, USDCNH, USDJPY, USDMXN, USDNOK, USDPLN, USDRUB, USDSEK, USDSGD, USDTRY, USDZAR.

Metals:

Only Gold is available to trade.

Stocks:

Plenty of stocks are available including Aviva, Barclays, Adidas, Siemens, Amazon, and Apple.

Commodities:

Brent Crude Oil, WTI Crude Oil, Natural Gas.

Indices:

CAC 40, DAX 30, FTSE 100, Dow Jones, Nasdaq 100, S&P 500, Nikkei 225.

EFTs:

iPath S&P 500, Samsung.

Spreads

The spreads are not specified on the site but they appear to be starting from around 1.1 pips. The spreads are variable which means they will move with the markets and any added volatility can make them grow larger. Different instruments will also have different starting spreads.

Minimum Deposit

The minimum deposit required to open up an account is currently y$100 and this will get you access to the one account available. We do not know if this amount reduces once an account is already open.

Deposit Methods & Costs

There isn’t a dedicated page for deposits and withdrawals but there are some images of Visa, MasterCard, Maestro, and Bank Wire Transfer. There may be more options available but they are not stated, we also do not know if there are any additional fees added for deposits.

Withdrawal Methods & Costs

We only have the same images to go by when it comes to withdrawals too, so we believe the available methods are Visa, MasterCard, Maestro, and Bank Wire Transfer. Just like with the deposits there is no information surrounding withdrawal fees but be sure to check with your own bank or processor to see if any fees are added by them.

Withdrawal Processing & Wait Time

This is another section where we don’t have any concrete information, we would expect any withdrawal requests to be fully processed between 1 to 7 working days from the request it is made.

Bonuses & Promotions

It does not seem like there are any promotions or bonuses active, this does not mean that there won’t be in the future so if you are interested in bonuses you should get in touch with the customer service team to see if there are any coming up that you can take part in.

Educational & Trading Tools

There does not seem to be any educational content on the site or any tools to help with your trading. This is a shame as a lot of modern brokers sare now trying to help their clients improve on their trading and knowledge, so it would have been nice to see Everest Trade do something along those lines too.

Customer Service

There isn’t a contact page on the broker’s website. In fact, there is no information on the site indicating any way to get in contact with them, which is a little concerning and enough to send most people looking elsewhere for an FX broker.

Demo Account

We do not know if demo accounts are available s there is no information surrounding them, this is a shame as demo accounts allow you to test out trading and strategies without any real risk.

Countries Accepted

This information is not on the site, we would suggest contacting the customer service team to find out if you are eligible or not but we don’t actually know how to contact them.

Conclusion

Information on the trading conditions was a little hard to find while finding information on the trading platform was even harder. There was also little information to be found on deposit and withdrawal methods, as well as on how to get in contact with Everest Trade. Not the greatest start, middle or end. All of that combined is enough for us to suggest looking elsewhere for your trading needs, as the best Forex brokers tend to be the ones who are the most forthright with the provision of key details such as these.