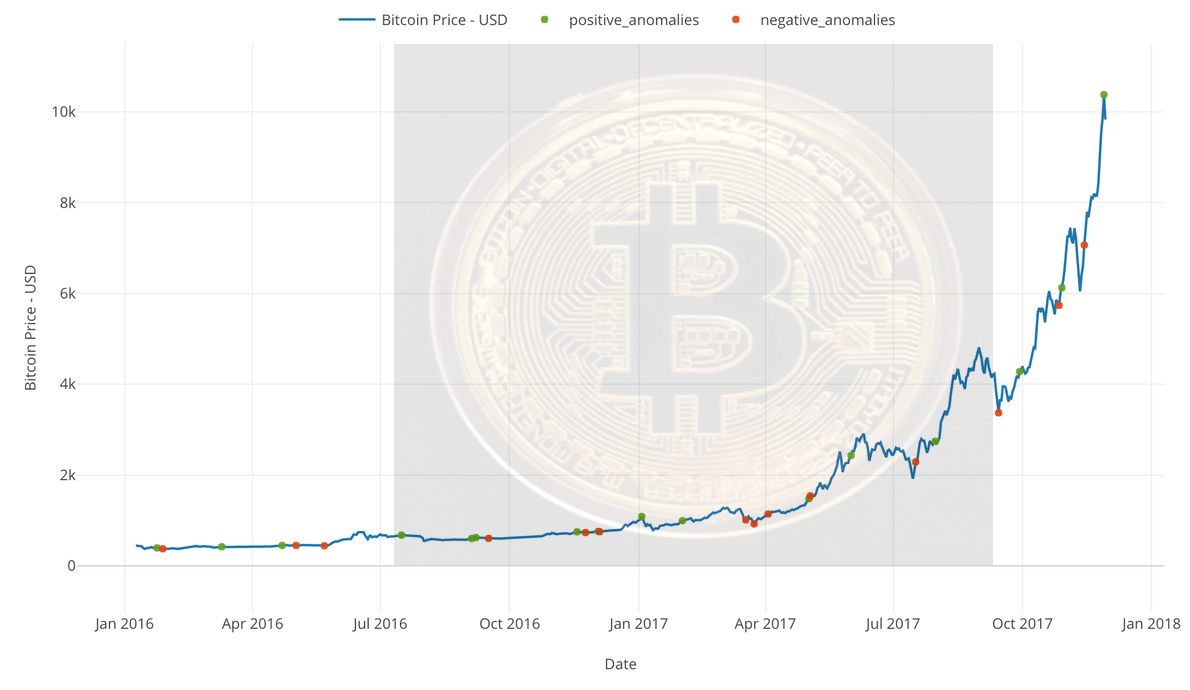

The idea behind Bitcoin, the first cryptocurrency, was a digital currency that could facilitate payments in a peer-to-peer, secure, trustless, and decentralized environment. But Satoshi Nakamoto probably hadn’t foreseen the extreme volatility that would be associated with Bitcoin and indeed the entire crypto market.

The unpredictable nature of cryptocurrencies has made them best suited for speculative investment and trading, and ill-suited for day to day transactions – the original vision.

Stablecoins have been proposed as the solution to this – users can have the best of both Fiat and cryptocurrency. USDC, a Circle company creation, is one of the stablecoins that are adding value to users by providing a secure, predictable, and reliable cryptocurrency.

What are Stablecoins?

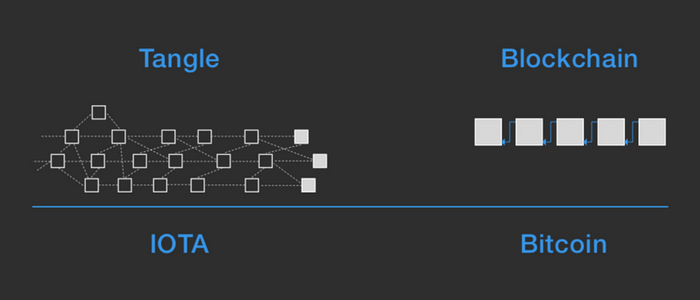

Stablecoins are a class of cryptocurrencies whose value is backed by an external asset. The idea behind stablecoins is to offer the price stability of Fiat currency while preserving the security and privacy offered by cryptocurrencies. A stablecoin can be pegged to a Fiat currency, another crypto asset, or a commodity. Other stablecoins mitigate volatility by controlling supply, much like central banks control the supply of natural currencies.

Ideally, a currency should possess the ability to be used for everyday transactions, including payments. But the extremely volatile nature of cryptocurrencies renders them unsuitable for such everyday use. For example, would you buy pizza today with Bitcoin Cash coins, not knowing if their value will increase tomorrow? In the same vein, would a merchant accept payment via the same coins, while knowing their value might drop the same day?

Stablecoins step in to solve this problem. Via these coins, users can transact with the confidence that the currency value is not going to be knocked tomorrow, and that their transactions are safe and private.

What is USD Coin?

USD Coin (USDC) is a stablecoin that’s pegged to the US dollar. Launched in September 2018, it’s based on the Ethereum network, and it’s an alternative to other stablecoins that are also backed by the US dollar, such as Stellar and TrueUSD (TUSD). USDC was launched as a collaboration between Circle, a peer-to-peer payments company, and Coinbase, the crypto exchange company.

How does USDC Work?

Every USD coin is backed by a US dollar, and tokenization is the process by which US dollars are turned into USD tokens. This process involves three steps:

- A user sends US dollars to the token holder/issuer.

- The token holder utilizes a smart contract to create USD coins equivalent to the amount of US dollars.

- The issuer sends the USDC to the user while keeping the US dollars in a reserve.

The process of redeeming USDC for USD is not very different:

- A user sends a request to the USDC issuer to redeem an equivalent amount in USD for USDC tokens.

- Issuer sends a request to the USDC smart contract to exchange the tokens for an equivalent amount in USD

- Issuer sends the USD to the user’s bank account. The user receives the sent amount, exclusive of all transaction fees.

Issuers of USDC are required to maintain and provide full disclosure of the reserve and liaise with financial institutions to maintain full reserves of the USD dollar.

How to Use USD coin

USDC is an ERC20 token, and hence it’s compatible with any ERC20-compliant application. To get started on the Circle USDC platform, you need to sign up for an account and link it with your bank account. This allows you to do any of the following:

- Tokenize US dollars

- Redeem USD coins

- Send and receive USDC to/from any Ethereum wallet address

It’s free to tokenize USD and redeem USDC. However, you will be charged a $50 fee for any erroneous or rejected bank transfers.

The minimum amount of USD coins you can redeem is 100, but you can tokenize as many US dollars as you want. Both transactions only take place on business days.

How Does USDC Differ from Other Stablecoins?

In order to identify which category of stablecoins USDC belongs to, we need to first identify the four categories of stablecoins:

i) Fiat-collateralized: these are stablecoins that are backed by Fiat currency, and are centralized by nature. Examples include Tether (USDT), Gemini Dollar (GUSD), and Paxos Standard Token (PAX).

ii) Crypto-collateralized: these are stablecoins that are backed by crypto assets. Examples include Makercoin (MKR) and Havven (HAV)

iii) Algorithmic non-collateralized: these are stablecoins that rely on a mechanically-generated algorithm that changes the supply of the token if need be so that the price remains stable in a volatile market. These stablecoins are modeled after how central banks regulate national currencies. Examples include Basis and Kowala.

iv) Hybrid: these are stablecoins whose model combines any of the above approaches. An example project is Carbon.

USDC falls in the first category of stablecoins. Generally, these stablecoins differ only subtly in structure or governance, but the idea remains the same: the backing by a real-life asset or value.

Tokenomics of USDC

As of April 3, 2020, USDC is trading at $1, with a market cap of $690, 167, 043, and a 24-hour volume of $1, 066, 065, 241. Its circulating supply is a total of 688, 989, 269. USDC’s total supply is 694, 228, 227. The coin is also #18 in market cap.

Where to Buy and Store USDC

USD Coin can be purchased from any of several popular exchanges, including Coinbase, Coinbase Pro, Binance, OKEx, Kucoin, Binance, CoinEx, Poloniex, and so on.

Some exchanges will let you buy directly with Fiat, while in other exchanges, you will need to exchange Fiat for crypto and then exchange it for USDC. Some common pairs include BTC, ETH, BNB, XRP, LTC, and DASH.

After you purchase your USDC, you can store it in any Ethereum wallet. Popular options include MyEtherWallet, MetaMask, and Jaxx wallets. You might also consider the safer option of a hardware wallet. Some popular options include Ledger Nano S and Trezor.

Conclusion

USDC is only two years old but has already catapulted to the top 20 in market rank. Perhaps this is a testament to the currency’s individual strength and potential, or it’s a demonstration of the potential of stablecoins in general. Either way, USDC doesn’t look to be slowing down any soon, and its users can be assured of a stable and reliable cryptocurrency.