Historical data shows that the crypto market has returned over 900% since 2017. Of course, the journey hasn’t been all smooth, as evident from the often unprecedented dip and high trends of the market. But in the long haul, its valuation has been increasing as more investors join the trade.

With this in mind, the idea of targeting long-term gains is more appealing than chasing short-term profits, which are often not as much as the former.

While investing in the long-term promises greater returns, it should be noted that the method requires patience and keeping your emotions under check in all market tides. To achieve this, you should only invest an amount that you can live without; so no matter what happens, you won’t have the urge to sell your cryptos to sustain yourself. Also, having a cushion to fall back on will prevent you from panic-selling.

Why Should you Consider long-term Crypto Investment?

Foregoing the short-term profits in favor of long-term gains is not only highly rewarding but also less risky. As such, you don’t have to worry about missing out on leveraging into a position or timing the market.

Day trading/short-term investment is characterized by numerous transactions whose fees can quickly accumulate and eat into your profits. But when investing in the long-term, all you have to do is pick a few cryptocurrencies and then wait. This helps reduce the number of transactions, saving you the fees that come with active trading.

Indicators of Long-term Value

Building a long-term portfolio boils down to the type of digital currencies you invest in. With over a thousand cryptocurrencies in the market, it can be overwhelming to choose one that pays off in the long run. Here are a few factors to consider when choosing cryptocurrencies for your long-term life portfolio:

1) Market Cap

Generally, the market cap of a digital coin is its trading price multiplied by its circulating supply. Usually, cryptos with a higher market price are less volatile compared to those with a lower market cap.

Large market cap coins like Bitcoin and Ethereum dominate the crypto market, which is an indication of their long-term viability. Even in bear markets, these coins tend to weather the storm and keep their value relatively higher.

At the same time, it doesn’t mean that you shouldn’t invest in cryptos with a lower market capitalization. In fact, such coins may eventually outdo the dominant coins in terms of returns since they are still in the budding stage.

However, the lower-cap cryptos tend to be risky since not all of them grow exponentially as anticipated, with some even being fraud projects. As such, it makes sense to scrutinize the viability of lower-market cap coins before investing in one.

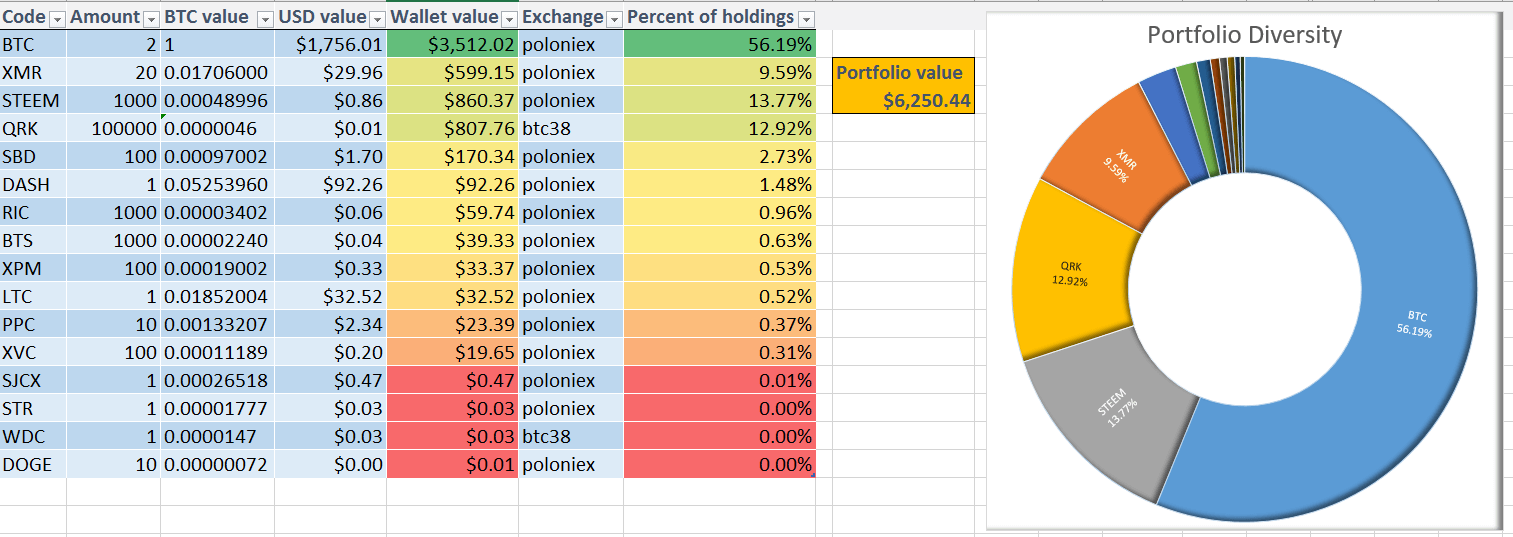

Besides their potential to offer great returns, coins with a lower market cap are an ideal diversification tool. Rather than allocating all your funds to the dominant coins, you may consider allocating a certain percentage to the lower-market cap coins. But first, you need to assess your risk tolerance. In this case, if you are a conservative investor, allocate a higher percentage of your funds to coins with a higher market cap, and the vice versa is true.

2) Utility Value

The true measure of a coin’s ability to survive for long in the market is whether it has a real-world user base or a concrete project backing it up.

A coin’s utility value can be determined by its user base. For instance, Bitcoin has the largest number of users in the crypto market, thus holds more utility value compared to a less used digital coin. In the case of ETH, the coin derives its value from the Ethereum blockchain, which allows developers to build decentralized apps. Other cryptocurrencies with real-world use include Stellar, Ripple, and WanChain.

Other worthy considerations to help you determine a coin’s value include its governance and market opportunity. In this case, a coin’s governance means a solid framework regulating its supply, for instance, the mining process of the coin. Market opportunity, on the other hand, refers to a coin’s ability to provide a solution to the problem it intends to solve.

3) Industry

The industry in which a coin is tied to not only predicts its long-term growth but also offers an opportunity to spread your risk. Apart from Bitcoin, most of the cryptocurrencies are designed to offer solutions to a particular industry. For instance, Vechain and Waltonchain intend to improve the supply chain industry. If, from your analysis, you believe that the two coins will steadily increase in value, you may consider investing additional capital in them.

You can also spread your investment across other coins linked to the computing, networking, and financial industries to achieve a diversified portfolio.

Don’t Be Too Rigid

Now that you understand the essential steps in building a long-term portfolio don’t confine your earning potential to the structure of your portfolio. This means that you don’t have to completely stay away from short-term profits. When you spot a rising trend early enough, be sure to sell part of holdings to make a profit.

It’s easy to be carried away by the quick profit to the point of disrupting your long-term portfolio. For this reason, you may consider adding a few low priced coins in your portfolio. These coins tend to offer better short-term gains, especially in a bullish market. Most importantly, adding them into your portfolio means that you won’t have to sell your long-term holdings in pursuit of the quick rewards. As such, you won’t compromise your long-term goal.

Conclusion

While the above tips will help you build a long-term portfolio, you should note that the crypto-market is highly volatile. To keep up with the trends, it demands that you regularly track and rebalance your portfolio in line with your objectives. Also, it’s a good idea to keep tabs on market events such as government laws in your jurisdiction regarding cryptocurrencies. These events usually have an impact on price movements.