Most of the content about the technical analysis will try to give you a narrow view of how we approach this analysis. And there is a reason for that. People will want what they can understand, masses are not amused with complex analysis, only a handful of people will really dive into what this analysis has to say. Therefore, limiting the technical analysis to line drawing, pattern recognition, and candlesticks is also a limitation to what you can learn unless you do your own research.

Learning technical analysis is not hard to do, it can be as deep and complex as you want or very simple. Interestingly, technical analysis guides and books tend to repeat the same ways and tools of doing it even though it is a very wide concept. When we talk about the basics, the most dominant technical analysis methods are the Price Action patterns, candlesticks, pivots, support and resistance lines, and trend lines. They are regarded as basic since they are derived directly based on what is seen on the chart. We would also like to add they are mostly subjective even with the “rules” that define them. Technical indicators are the second method of chart analysis, also called secondary indicators by some professionals as they calculate based on the original price action data.

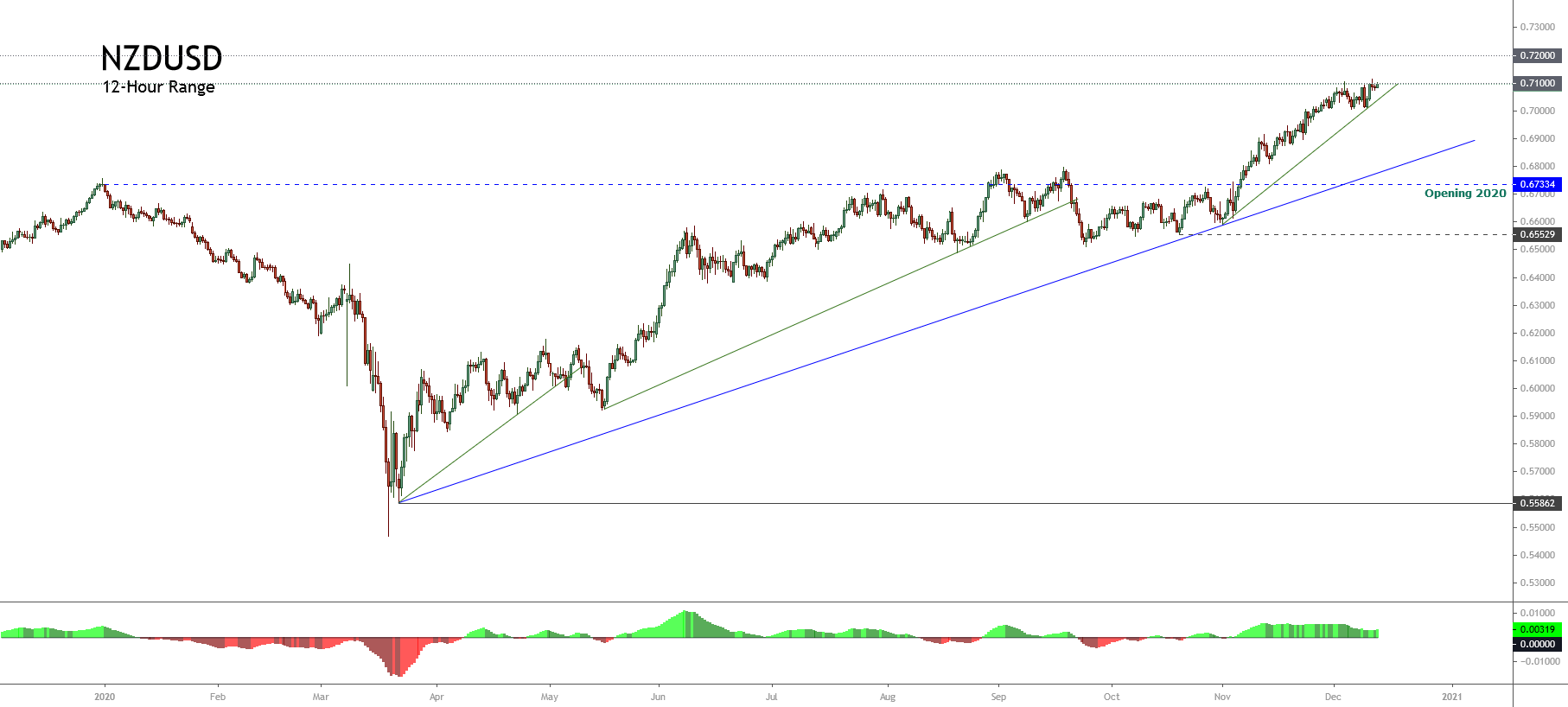

Volume or volatility is the third technical dimension, often missed by some analysts but very important to professionals. The last technical analysis dimension we would like to add is the timeframe or time scope. As we move on to each of these concepts, you can find traders who are successful using just the price action or only indicators without much regard to fundamental analysis. The main idea behind this is that they do not want to be distracted by the news that may not be as important or true and only want to keep the analysis based on factual data – historic price movements represented as charts.

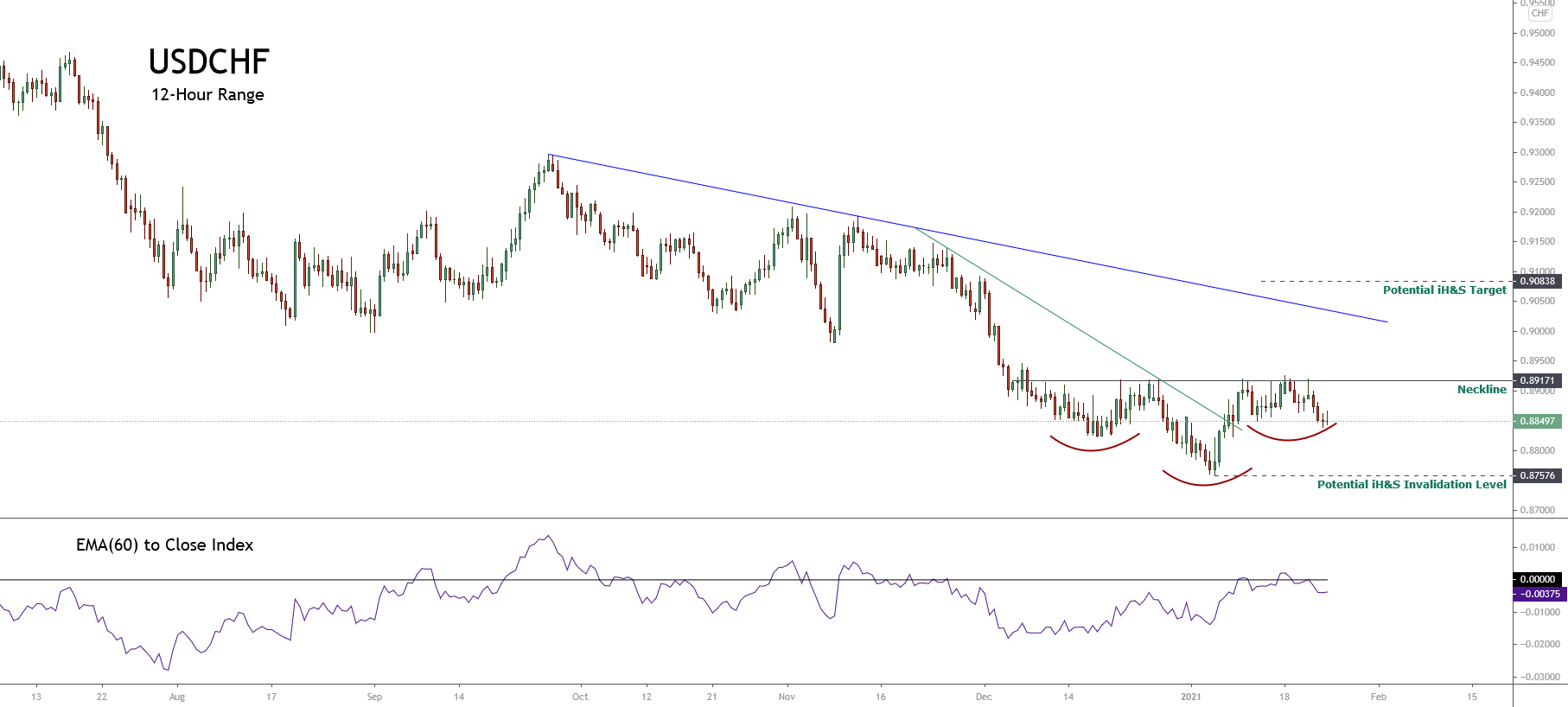

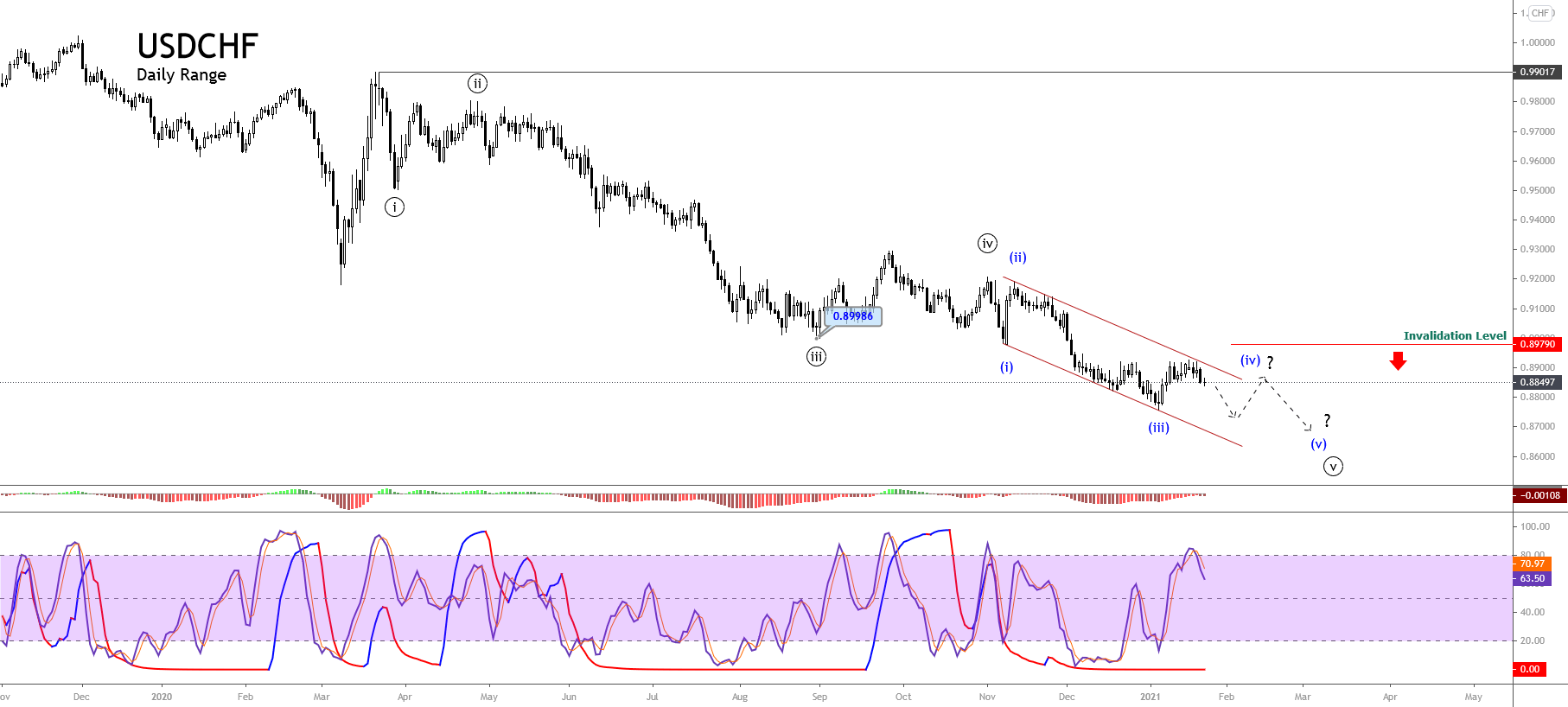

PA patterns are created by the price movement on the y-axis and time on the x-axis. As these shapes and patterns repeated, analysts collected them, making several most popular patterns regarded as most reliable. The patterns serve to predict the future price action once they are formed, all of these patterns point the price will likely go up o down. The most common patterns are double tops and bottoms forming the letter W and M, cup and handle, ascending and descending triangles, and the head and shoulders.

There is no good statistical record of how reliable are these patterns as they are subjective, one analyst can see the pattern others do not, or the patterns can stack one inside the other. However, they are used in conjunction with other tools and timeframes. All this can make you wonder if there is any reason to believe patterns exist or the movement is random, at the end of the day it is just another element to help you decide. The final judge of your technical analysis is the account balance.

Candlesticks have more information about the price movement than a single line. They have several structural elements: the body color, the wick, and the top and bottom body levels. Based on these, analysts have created a plethora of patterns that aim to predict when a trend or reversal is about. Similar to price action patterns, candlestick patterns reliability cannot be tested objectively, only you can test and fit them in with other indications. Candlesticks are essential to creating pivot points, moments where the price turned in another direction.

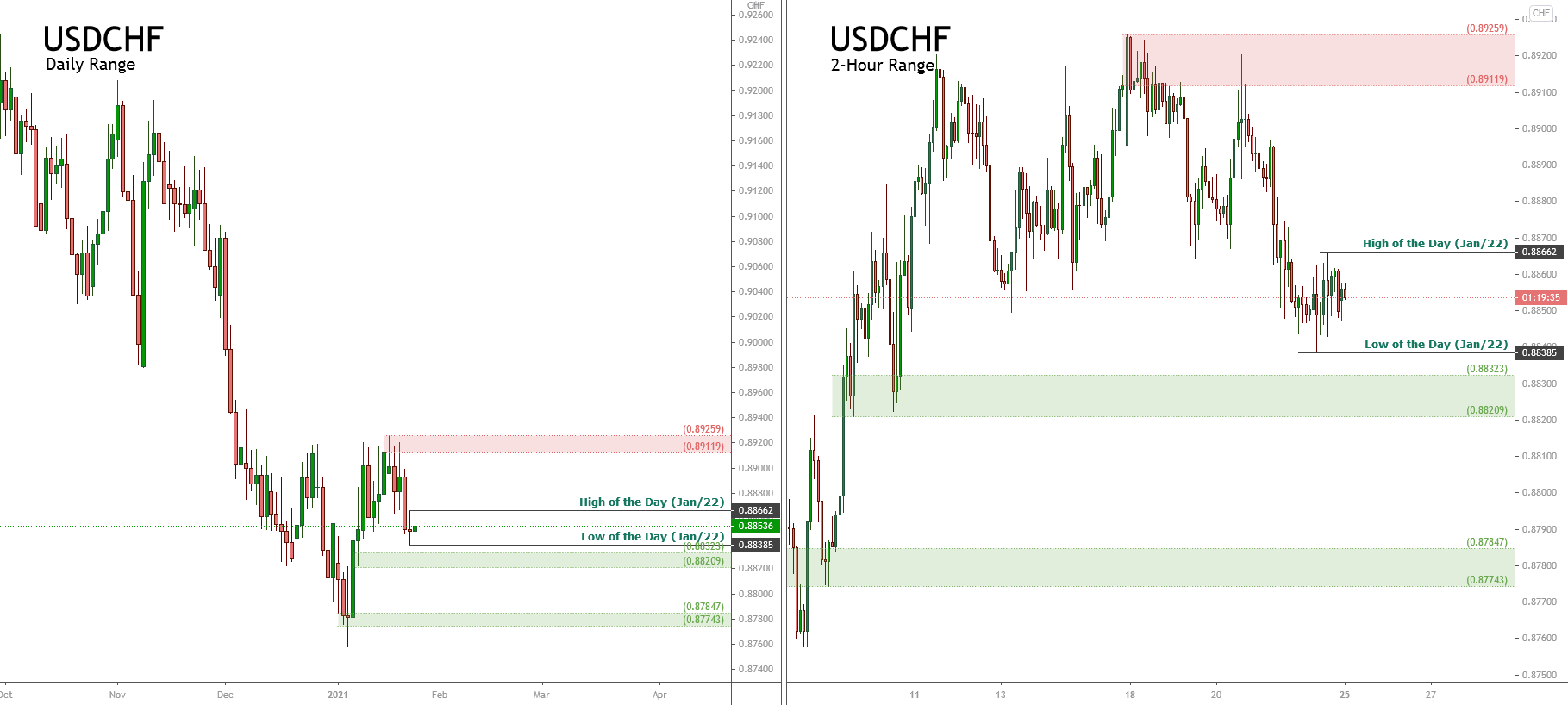

Pivot points consist of at least three candles and they mostly serve to draw lines, be it support and resistance, trend, channel, or Fibonacci retracement lines. Some traders will draw lines where others would not, thus a definitive support or resistance line cannot be drawn for all. The same applies to trend lines and other constructs where their form will depend on the beholder. While support and resistance lines indicate likely price direction reversal once they are reached, their interpretation can also help breakout strategies.

Now traders can get confused about whether they should enter a trade on an S/R line breakout or wait for a reversal. Of course, the price will not exactly break through the support or resistance line or bounce right off it, you will mostly see something in between. Consequently, this presents a question of how reliable can such analysis be. If we use multiple questionable elements for one comprehensive analysis, one can wonder would multiple more reliable elements result in better technical analysis and therefore trading.

These basic technical analysis elements form the complete picture for a pure PA trader, with the addition of volume. Volume cannot be represented by a candlestick alone, nor by observing PA patterns or any other basic technical analysis element. Volume is measured and is represented as a special tool. Traders mostly use it to confirm a trend is emerging, to confirm a breakout, and also to exit any trades if the market is not active enough. Some trading strategies rely on low volume markets or sessions to avoid surprise movements. If we combine volume with other technical analysis tools, the result is almost always beneficial. Some strategies use volume or volatility to filter losing trades, others use volume for entries.

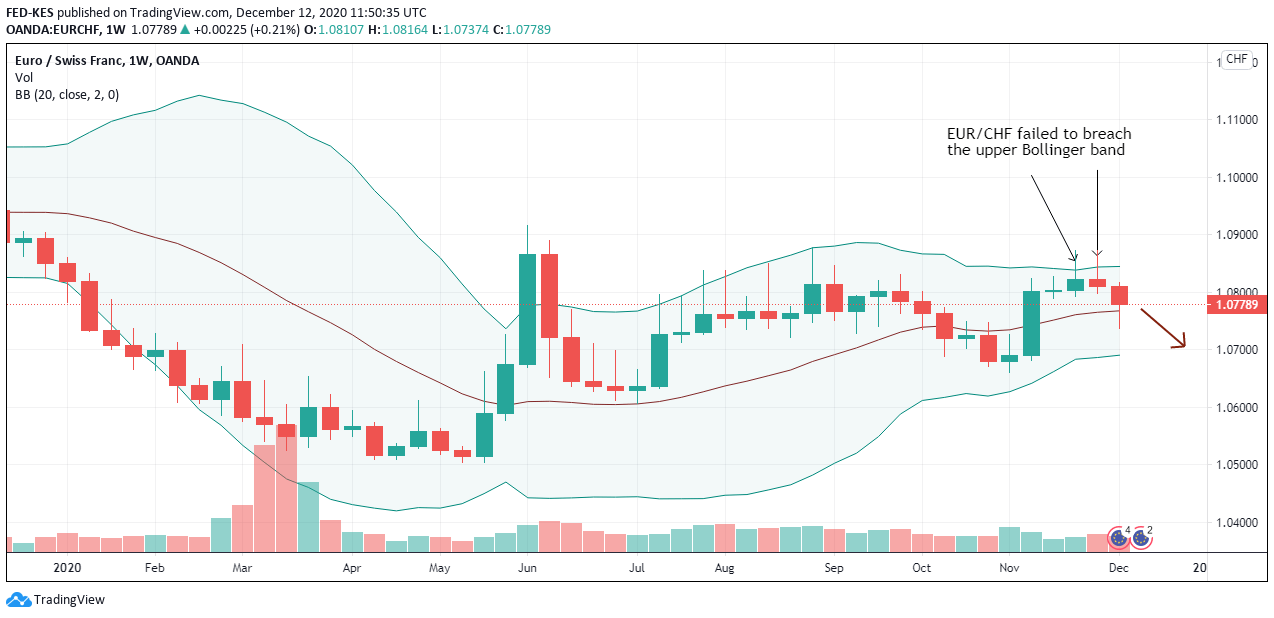

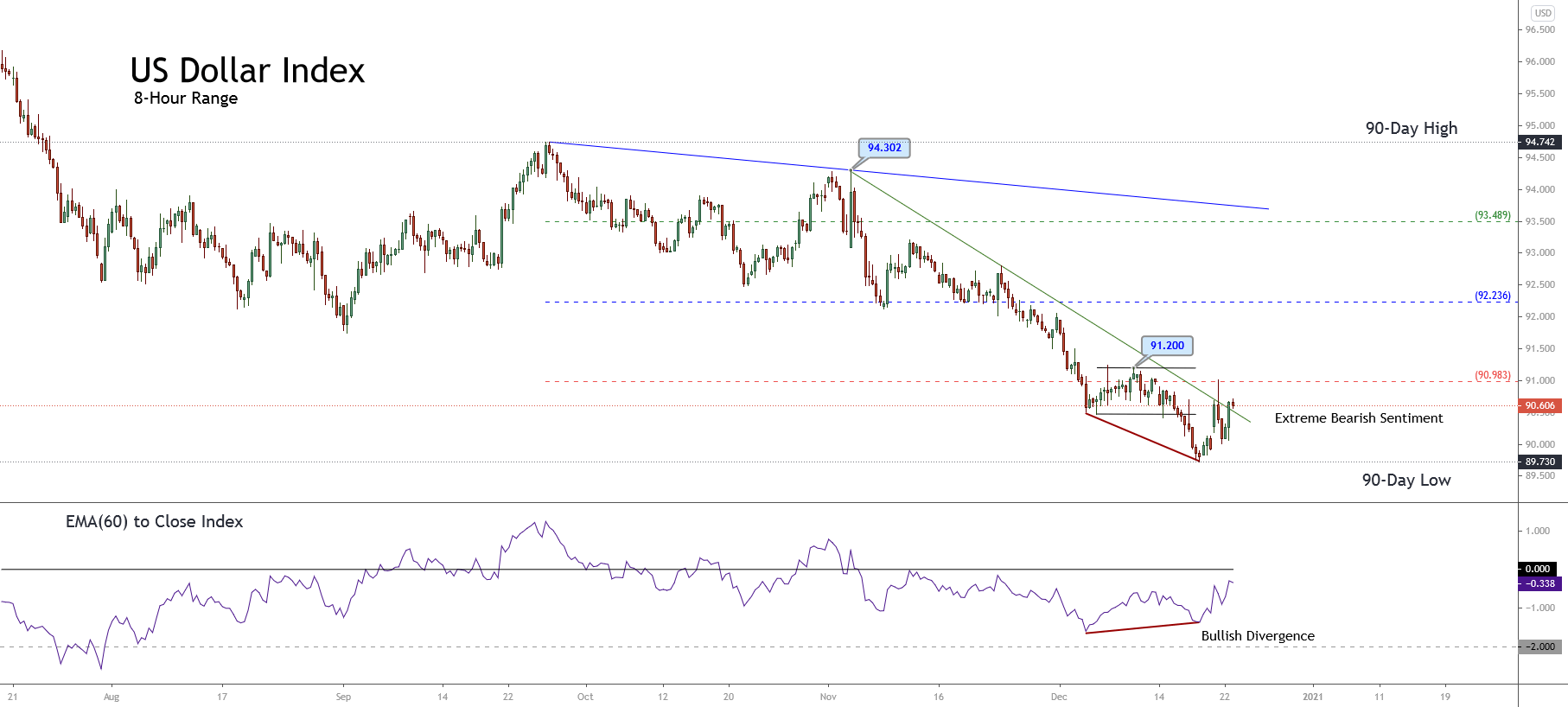

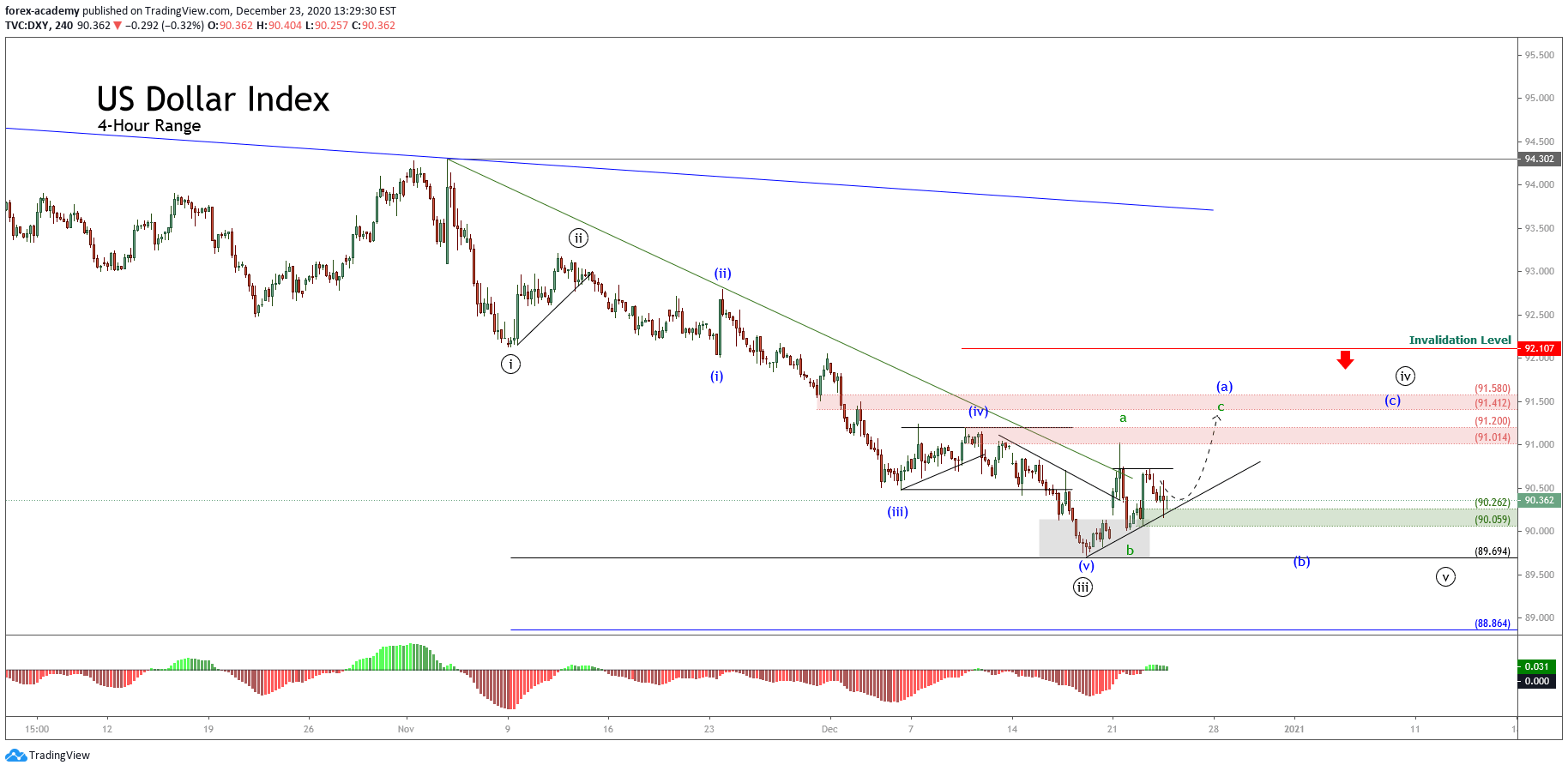

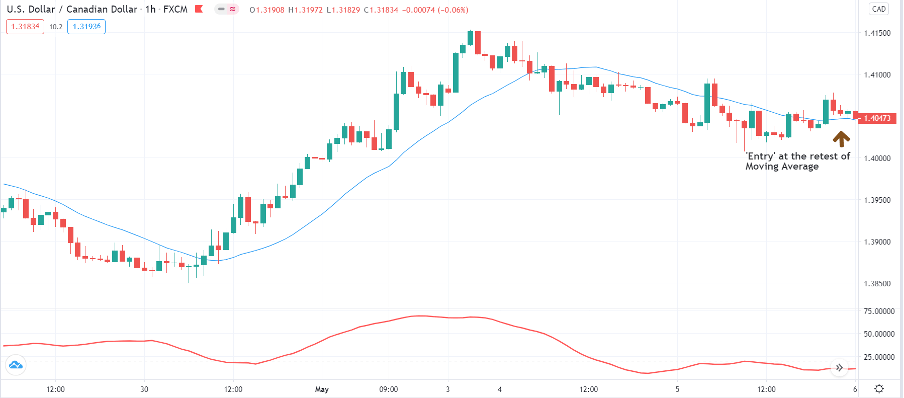

Secondary indicators are derived from the price action statistics, numbers. At its base, they are formulas that give out a number of values. These values can be presented on a chart or in some other form in a separate plane. The basic secondary indicator is the Moving Average. MAs are very common and can be calculated in so many ways to reflect a specific price action interpretation. They can also contain other measurement values in an effort to be more reliable, lag less, and so on. One such example is the Volume Weighted MA where volume is also included in the calculation.

How a trader will use MAs depends on his goals and imagination, adding more different MAs can produce various uses, or, as some professionals do, use the MA and the price on the chart to produce trade signals when they cross. Indicators can be very complex to include many factors derived from the price action, to the point they represent complete trading solutions. Unlike PA patterns, support and resistance lines, and other subjective basic technical analysis tools, indicators are exact since they are based on data numbers. However, this does not mean they are reliable as reliability depends on the formula and how it is interpreted.

The basic principle of technical analysis is the combination of several indicators. Some professionals just rely on how the chart looks to them and make trade decisions based on that. They do not need anything exact. Others need exact points, values, signals to the point their complete money management is based on this analysis. There are also mixed type analysis, PA lines, and patterns combined with Moving Averages and volatility indicators. The goal is to use the right combination that collectively gives meaning to a particular trader.

It is not only about combining several tools but also combining timeframes. The analysis will likely be more reliable if other time scopes are included. This will help traders to pinpoint optimal trade exits and entries and also see the bigger picture of what is going on in the market. Some strategies may require lower timeframes such as 5 minute or 15-minute candles, while other systems may work only on the daily timeframe. After all, technical analysis will become unique to a particular trader, aimed and aligned to his goals and personality. Also, be wary of over-optimizing and overcomplicating technical analysis, it is not going to result in the best performance.