The initiative could be defined as an emotional skill, attitude, or act of anticipation and proposing solutions before someone asks for it. Being aware of the initiative is a proactive behavior where we have the ability to put ourselves in a better position. The initiative is a skill we learn in childhood but one we can develop in adulthood. It is about making things happen, overcoming difficulties and barriers that appear when we are trying to achieve a goal. It is a dare to thinking differently, it is a flame that lies inside all of us. To have initiative is the difference between optimistic and pessimistic, between active and passive, between direct or be directed.

Why is it important to have initiative? One of the first elements that we need to have in our trading psychology is initiative because there is going to be different times in our life where we could be lost without it. When someone attempts to become a professional forex trader someday, he is separating himself from everybody else. The ability to act or to take charge, understanding the rewards of movements, and try to learn more is what makes a difference. Most people, almost everybody we know doesn’t do this because they are too lazy or too scared to take that jump. As forex traders or potential forex traders, we don’t want to be like everybody else. Most people don’t have the motivation to ever even look at that direction or so many people know exactly what it is but wouldn’t be caught dead trading it because they are scared. You guys decide what is worse. Forex involves risk, we can lose every last cent we put into it, most traders were there a lot of times but only a few were able to shake it off because they were fearless and studious in their game. Everybody wants to come up with excuses. Excuses like: “I wasn’t born here”, “I am a female”, “I’m an immigrant”, “I don’t have enough money to start this”…

The problem is, nobody cares. No matter the situation is we need to educate ourselves, we need to work smart and we need to be relentless. In a world we live in, there are multi-billion dollar industries that are created to keep us unmotivated, lazy, and unproductive and they really work, they are pretty good at what they do. A significant majority of people around us are lazy and they never take initiative. The reason most people don’t even bother jumping into forex trading, even if they’re a little bit interested in it, is just because of the fear of losing everything. This is no different from any other investment out there. The fear of losing everything and having serious responsibility for something are probably the two main feelings that could mess with our motivation. The truth is that most of our fears are often just illusions and they might be completely illogical. The worst-case scenario is never as bad as we think it is going to be. There is a small story in the book called “The 4 Hour Workweek”. Back in the ’80, a guy goes to Ghana to do some volunteer work and there he finds out that Ghana starts to fall apart. Major turmoil hit that country and he got stuck there, he couldn’t come back. He was stuck there eating just cornmeal and spinach every day for breakfast, lunch, and dinner.

That was only available, even there was a problem with clean water. So his worst fears of going to a place like this were pretty much realized. Soon after he was like: “Ok, this is not the end of the world, I have everything that I need to survive. Apart from that, I have a lot of new friends and I am actually having fun”. Years later not only does he look fondly on his time there but he knows that if for some reason he were to fell into abject poverty it wouldn’t be that tragic. When he was there, the things he learned and the friends he made were irreplaceable. From this story, we can learn that our absolute worst-case situation can be temporary especially if we are in some developed country. If we are smart enough and if we have resources we can get out of any bad situation. So at the recession-proof market like forex is, our progression could be unlimited and we should stop worrying about losing everything. We don’t want to let that fear be on our way.

Another reason that we have heard from people is that forex is too complex and overwhelming to learn. Surely that forex is not an overnight thing to learn but there are tons of online material out there that is easily accessible and completely free. Forex is around 4 trillion dollars a day market that traders are trying to go in and extract money from over and over so there could be a lot of benefit for those who are persistent and want to build a career in trading. Honestly, the worst thing is not doing anything. The biggest risk we can ever take is simply not taking any. Why? Because we could end up with no retirement money. Most people have absolutely nothing saved. Relying on someone always and all the time might not be the safest house for us, nobody wants that.

Another reason that we have heard from people is that forex is too complex and overwhelming to learn. Surely that forex is not an overnight thing to learn but there are tons of online material out there that is easily accessible and completely free. Forex is around 4 trillion dollars a day market that traders are trying to go in and extract money from over and over so there could be a lot of benefit for those who are persistent and want to build a career in trading. Honestly, the worst thing is not doing anything. The biggest risk we can ever take is simply not taking any. Why? Because we could end up with no retirement money. Most people have absolutely nothing saved. Relying on someone always and all the time might not be the safest house for us, nobody wants that.

Unfortunately, that is probably the path of many levitating souls around us. We need to believe that we are capable of achieving wonderful things and if we don’t attempt them and follow through them, then we might completely fail. We don’t want that to happen. We don’t want to grow old with regrets in our eyes. The initiative is not one time only action. We need to understand even if we had that initiative to get started and that part wasn’t a problem, it is going to come into play again. We will need initiative more than once, probably more than twice in our trading career. There could be a few different phases on our trading path where we might need a firm initiative. Many of us trading demo account right now which is great but there will come a time where we need a transition into real money and that is going to be a serious challenge for us. We could try to lay back and not even maintain demo trades, but if we try to carry that strategy over into transitioning to real money, we might end up destroyed. Watching our money going up and down in a real money account knowing that is actually our money could largely play tricks on us.

The fact of going from the demo into the real account is a big leap for many people. That might be too much for some people so we need to be ready and not off-guard when that moment comes. But simply some people don’t feel comfortable about investing, they don’t want to do it themselves. They feel more secure to hand it over to somebody else. Eventually, we are going to walk in that fire where we trade with our real money and it is not going to be easy. So we could try to trade our own money and hope we can get good enough return year after year to compound interest and maybe get our retirement savings or our spending money. We could also try to trade other people’s money whether it means setting up our practice and trying to draw clients or join up with the big company, prop firm, or hedge fund. So transitioning through these different phases we will need strong initiative if we want our mindset to evolve. Just a simple walk through these stages is a big psychological leap but if we want to be professionals one day these are the routs we need to take. Knowing that we are going to be tested, judged and that we are going to deal with real money are some factors that are part of the process but the potential rewards could easily outweigh any fears we might have of underperforming.

We need to take the initiative and give ourselves a chance. For some of us who still struggle with initiative, a good thing to do might be to read the book called “Rich Dad Poor Dad”. This might have an impact on some people to try to approach differently to certain things in their life. The mentality, approach, end-game, and mindset are some of the key elements that we should be always trying to upgrade in our trading psychology so we could hopefully be in the right headspace. After those progressions, we just need to make sure not to leave that headspace ever. So for all of you guys, good luck and never give up.

Choosing the right broker when trading is vital, it needs to be one that you can trust, and that has a decent reputation. What many people will tell you will be to go for a

Choosing the right broker when trading is vital, it needs to be one that you can trust, and that has a decent reputation. What many people will tell you will be to go for a

Similarly to the point above, you need to be using a demo account, and you need to be using it for quite a while before you even think about making any money. The demo account is there for you to test out your strategies and to ensure that you have got them working properly before actually risking any of your actual capital. It is vital that you use these accounts properly and use them to ensure that you are ready for live trading.

Similarly to the point above, you need to be using a demo account, and you need to be using it for quite a while before you even think about making any money. The demo account is there for you to test out your strategies and to ensure that you have got them working properly before actually risking any of your actual capital. It is vital that you use these accounts properly and use them to ensure that you are ready for live trading.

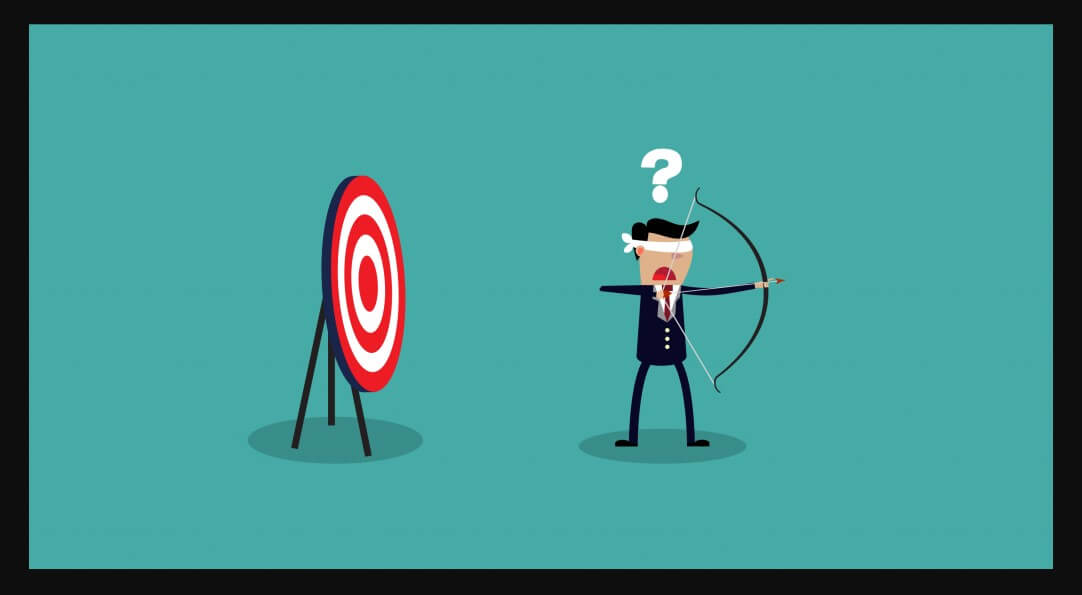

A lot of people like a good gamble, but you should stick to sports or the casino, forex, and trading really is not the place that you should be making those bets. If you are only interested in throwing your money at a certain outcome without any regard for anything else going on, then it would be better to avoid trading altogether. Trading is all about working out the probabilities and then seeing which side has the most and so which way the markets are more likely to move. Just randomly choosing a direction without knowing them is the same randomly betting on a football team while not knowing the players. The moral of the story is to simply not gamble, do not trade in this way, it will only lead to losing your account,

A lot of people like a good gamble, but you should stick to sports or the casino, forex, and trading really is not the place that you should be making those bets. If you are only interested in throwing your money at a certain outcome without any regard for anything else going on, then it would be better to avoid trading altogether. Trading is all about working out the probabilities and then seeing which side has the most and so which way the markets are more likely to move. Just randomly choosing a direction without knowing them is the same randomly betting on a football team while not knowing the players. The moral of the story is to simply not gamble, do not trade in this way, it will only lead to losing your account,

One of the major things that traders often take for granted is the importance of proper risk management, it really doesn’t matter if you are new or an experienced trade risk management should have been ingrained into your mind. The problem is that as you see others making a lot more money or many extra pips each month, it can make you want to grab some of those yourself. It would be great getting all those pips right? The problem is that you are not currently in a situation to do this, so the only way for you to achieve that in a short amount of time is to throw your risk management out of the window, something that we know can have disastrous effects on your account and trading strategy.

One of the major things that traders often take for granted is the importance of proper risk management, it really doesn’t matter if you are new or an experienced trade risk management should have been ingrained into your mind. The problem is that as you see others making a lot more money or many extra pips each month, it can make you want to grab some of those yourself. It would be great getting all those pips right? The problem is that you are not currently in a situation to do this, so the only way for you to achieve that in a short amount of time is to throw your risk management out of the window, something that we know can have disastrous effects on your account and trading strategy.

This sort of goes hand in hand with your eating habits, exercise is fantastic not just for your body but your mind as well. What do you feel once you have finished a workout or the next day, apart from the aches and pains, you probably find that you have a lot more energy, not to mention that you probably sleep a lot better.

This sort of goes hand in hand with your eating habits, exercise is fantastic not just for your body but your mind as well. What do you feel once you have finished a workout or the next day, apart from the aches and pains, you probably find that you have a lot more energy, not to mention that you probably sleep a lot better.

No confidence in the trading plan: If someone has created a trading plan but does not actually have any confidence in it, this can cause them to double guess the choices that have been made and the levels that have been set, this can cause them to cut their profits just to get out of a trade. You should not be trading on a plan that you are not confident in, if you are not confident then work on it, work out why you are not and then fix that issue before reading on a live account. Only trade a system that you know you are confident and that you can leave alone to do its thing.

No confidence in the trading plan: If someone has created a trading plan but does not actually have any confidence in it, this can cause them to double guess the choices that have been made and the levels that have been set, this can cause them to cut their profits just to get out of a trade. You should not be trading on a plan that you are not confident in, if you are not confident then work on it, work out why you are not and then fix that issue before reading on a live account. Only trade a system that you know you are confident and that you can leave alone to do its thing.

You can’t learn everything you need to know overnight. Many beginners spend a little bit of time reading articles or conducting research, but they jump into trading too quickly. If you don’t use the proper risk management and a good trading strategy, you’ll never make money. Being well-educated in this field will help to set you up for success.

You can’t learn everything you need to know overnight. Many beginners spend a little bit of time reading articles or conducting research, but they jump into trading too quickly. If you don’t use the proper risk management and a good trading strategy, you’ll never make money. Being well-educated in this field will help to set you up for success.

Now, you should not be discouraged if you have put a lot of time into making yourself a better trader, even if your system does not show great results. If you got up to that level, you are on the right path, for the next 30, 40 years and more, your life will be financially free. This also induces stress-free and even can be said a healthy life for the long term. Fortunately and unfortunately, depending on how you look at it, money solves many of the problems today. Forex is a blank slate, the internet is also, giving you the opportunity, it comes down if you want it.

Now, you should not be discouraged if you have put a lot of time into making yourself a better trader, even if your system does not show great results. If you got up to that level, you are on the right path, for the next 30, 40 years and more, your life will be financially free. This also induces stress-free and even can be said a healthy life for the long term. Fortunately and unfortunately, depending on how you look at it, money solves many of the problems today. Forex is a blank slate, the internet is also, giving you the opportunity, it comes down if you want it.

Here is a pro tip for traders at this point. These traders should have a system which is backtested, forward tested, and is used in live trading. This system should be considered that will last for life as a profit-making machine in the forex market. Even if you are trading for a prop company or still in the admittance process, put yourself to test – trade an uncomfortable amount of money with your system. By uncomfortable is meant an amount that will seriously hit your home funds balance if you lose everything. This may sound crazy and irresponsible but this money should be recoverable, especially if you have a job or other sources of income. When big money is on the line, this test will help you. Take it as a sacrifice now for the next 50 years or so of your life.

Here is a pro tip for traders at this point. These traders should have a system which is backtested, forward tested, and is used in live trading. This system should be considered that will last for life as a profit-making machine in the forex market. Even if you are trading for a prop company or still in the admittance process, put yourself to test – trade an uncomfortable amount of money with your system. By uncomfortable is meant an amount that will seriously hit your home funds balance if you lose everything. This may sound crazy and irresponsible but this money should be recoverable, especially if you have a job or other sources of income. When big money is on the line, this test will help you. Take it as a sacrifice now for the next 50 years or so of your life.

Let’s be completely honest, trading forex can be an expensive business, the problem is, that it has been made so accessible with accounts being able to be opened from as low as $10. The problem with this is that $10 is just not enough money to trade with. It’s fantastic that it is so accessible, allowing those to trade who never would have been able to 10 years ago, but what they do not tell you about these low deposits is that it just is not enough to

Let’s be completely honest, trading forex can be an expensive business, the problem is, that it has been made so accessible with accounts being able to be opened from as low as $10. The problem with this is that $10 is just not enough money to trade with. It’s fantastic that it is so accessible, allowing those to trade who never would have been able to 10 years ago, but what they do not tell you about these low deposits is that it just is not enough to

What do buying and selling currencies look like? First of all, there is always someone buying a pair of currencies and someone selling a pair. The process of making a profit by buying and selling goes like this: You buy US $3000 by selling 2000 euros. This means that you are predicting the value of the US dollar will increase against the euro. If you were right, then, another step needs to be taken to make a profit. You need to sell your US $3000 into euros. Now you will obtain more than 2000 euros. The process as you can see is quite simple.

What do buying and selling currencies look like? First of all, there is always someone buying a pair of currencies and someone selling a pair. The process of making a profit by buying and selling goes like this: You buy US $3000 by selling 2000 euros. This means that you are predicting the value of the US dollar will increase against the euro. If you were right, then, another step needs to be taken to make a profit. You need to sell your US $3000 into euros. Now you will obtain more than 2000 euros. The process as you can see is quite simple.

Out in the real world, telling someone that your losses are a blessing might get you a few funny looks. However, in many walks to life, a loss can be one of your greatest tools, it can teach you far more about yourself and the performance than a win ever could.

Out in the real world, telling someone that your losses are a blessing might get you a few funny looks. However, in many walks to life, a loss can be one of your greatest tools, it can teach you far more about yourself and the performance than a win ever could.

You might be wondering why brokerages would offer free funds in the first place. The general idea is that traders will open accounts to take advantage of the promotion and would then continue to trade through the broker. A broker that offers a no-deposit bonus would hope that the trader would decide to deposit their own money after using up the bonus or making some profit from it.

You might be wondering why brokerages would offer free funds in the first place. The general idea is that traders will open accounts to take advantage of the promotion and would then continue to trade through the broker. A broker that offers a no-deposit bonus would hope that the trader would decide to deposit their own money after using up the bonus or making some profit from it.

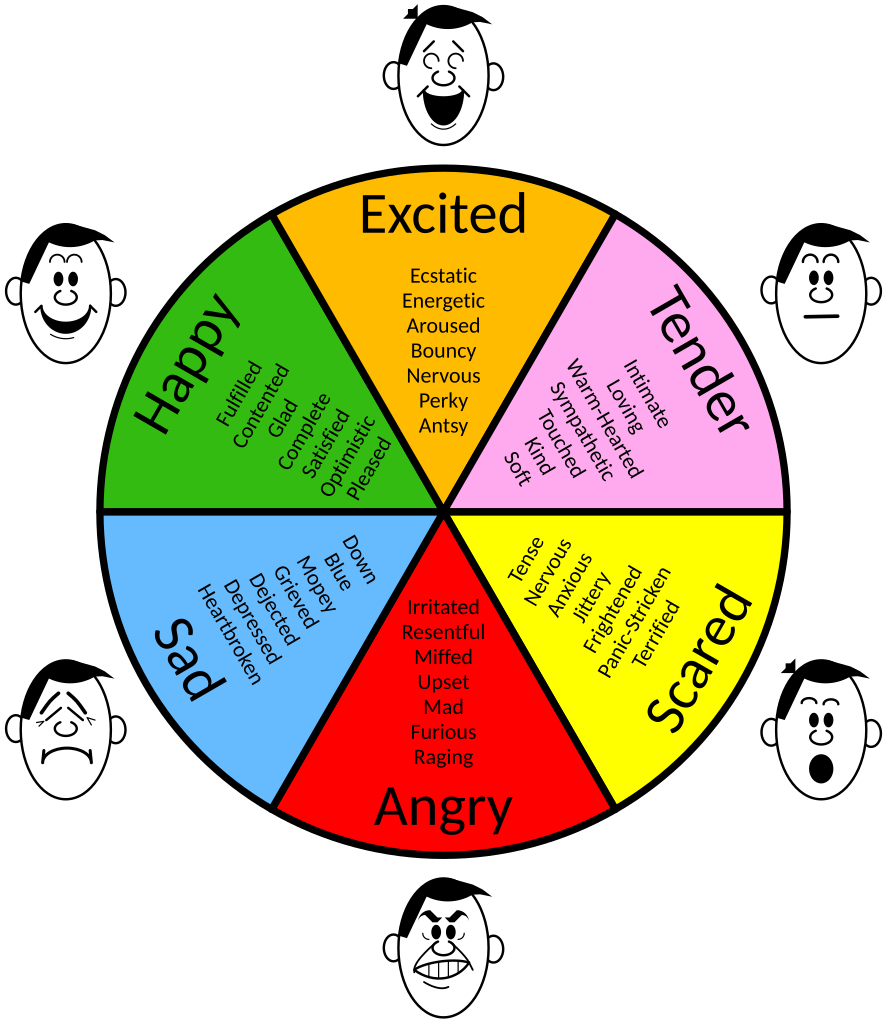

Preservers find themselves worrying about their losses too much and can fall victim to making trading choices out of fear or anxiety. These traders need to understand that you won’t win every time, and that’s perfectly fine.

Preservers find themselves worrying about their losses too much and can fall victim to making trading choices out of fear or anxiety. These traders need to understand that you won’t win every time, and that’s perfectly fine.

So, if you happened to be wondering if your investment strategy is the right one, just ask yourself the question of what is more important – being right or being profitable. While this is often easier said than done, we should first put effort into understanding which skills can help you begin or jump-start your career as a cryptocurrency trader. If you are a successful crypto trader or a

So, if you happened to be wondering if your investment strategy is the right one, just ask yourself the question of what is more important – being right or being profitable. While this is often easier said than done, we should first put effort into understanding which skills can help you begin or jump-start your career as a cryptocurrency trader. If you are a successful crypto trader or a

Although it doesn’t hurt to have good trading results, today’s firms will not even ask for it, since many people can produce fake good resumes, you just have to be a good trader. But, if you do have the experience, all that learning and testing won’t go to waste, as firms today tend to release you into the wild, they will test you through their platform and trading. If you produce good results under pressure they will hire you for a long time. Everyone’s experience is different. These lines are just recommendations, showing you options, providing you with more chances for success.

Although it doesn’t hurt to have good trading results, today’s firms will not even ask for it, since many people can produce fake good resumes, you just have to be a good trader. But, if you do have the experience, all that learning and testing won’t go to waste, as firms today tend to release you into the wild, they will test you through their platform and trading. If you produce good results under pressure they will hire you for a long time. Everyone’s experience is different. These lines are just recommendations, showing you options, providing you with more chances for success.

In contrast, we have a recreational gambler who sees a blackjack table and say: “Oh cool, I could play, I’m feeling lucky tonight”. The professional gambler is on that table as well but he has crystal clear goals. He is like: “I am going to play for 4 hours or until I lose 2000 bucks”. Eventually, If he loses this amount of money or after 4 hours he will get up and leave. Those people have a schedule, they have planned out their business. Here we have all these analogies because we want to point out how important it is that we have to have our business schedule. The stock market is open only seven and a half hours a day, when we speak about currencies one of the great things and the worst things is that is always open. So there is a chance where we can sit at any time and ruin our trade with just one click of a mouse.

In contrast, we have a recreational gambler who sees a blackjack table and say: “Oh cool, I could play, I’m feeling lucky tonight”. The professional gambler is on that table as well but he has crystal clear goals. He is like: “I am going to play for 4 hours or until I lose 2000 bucks”. Eventually, If he loses this amount of money or after 4 hours he will get up and leave. Those people have a schedule, they have planned out their business. Here we have all these analogies because we want to point out how important it is that we have to have our business schedule. The stock market is open only seven and a half hours a day, when we speak about currencies one of the great things and the worst things is that is always open. So there is a chance where we can sit at any time and ruin our trade with just one click of a mouse.

Now, starting with demo accounts or small accounts is beneficial to smooth out the trading process, see where you are thin, and to show that you can do good trading in the long run with steady results. This is how we want to present ourselves to trading companies. When they engage you, trading companies will arrange their own tests. They will set a test period and see how you do under pressure, which is usually about 6 months. Don’t be upset by this time period, there is no other way for them to expose lesser traders that can’t maintain steady results. Constant results are hard to achieve, and that will separate a “trader” from a professional trader.

Now, starting with demo accounts or small accounts is beneficial to smooth out the trading process, see where you are thin, and to show that you can do good trading in the long run with steady results. This is how we want to present ourselves to trading companies. When they engage you, trading companies will arrange their own tests. They will set a test period and see how you do under pressure, which is usually about 6 months. Don’t be upset by this time period, there is no other way for them to expose lesser traders that can’t maintain steady results. Constant results are hard to achieve, and that will separate a “trader” from a professional trader.