In this article, we will discuss and explore options you have once you are already trading on Forex. It is also for beginner traders so they can understand all the benefits of becoming a consistent, successful trader. At one point, as an established professional Forex trader, you would need to consider options with the capital you can extract from Forex. The skills traders gain in their career are universal. They do not apply only to Forex. It is not only the mindset, but it is also the system(s) they have built. This way they can use the money from one business and use to invest in another. The money will be multiplied many times over throughout their life. Of course, some people may not be interested in this, and they are probably not reading this as motivated future traders. However, this group will most likely have only one way of winning, while Forex traders have many ways to win.

Buy and Hold strategies are not very well presented and the people that talk about them do not give you anything substantial traders can use. There are a couple of them and in this article, we will discuss some applicable to Forex traders. Also, why to Buy and Hold Strategies are important, the number of people who have one is so small compared to the ones who do not. Forex traders have a huge advantage to those who are investing long term. This advantage will be discussed later. Note this is just an opinion and observation by certain professional prop traders.

People come to Forex for the most attractive reason, to gain a lot of money in the short term. This is possible although very unlikely. Forex is therefore interesting to those who do not have much to invest. However, the sooner you have, the better. It is imperative to start using the Buy and Hold strategy at the beginning of your life or as soon as you can. Regret you did not will come after many years. The long game or long term investing is not popular. The rewards are late. Sometimes too far for us to consider it as a solution to our present problems. We give present problems priority even if we have a solution for our future problems in the present. Part of this mindset is the same reason why many fail to trade on Forex. It is finding a quick fix for their financial and career problems, they want to quit their captivating job and break free.

This might be a good idea if your life expectancy is short, although for most it Is not. Having an early start will be very soothing for the future you, the longer you delay, the Buy and Hold strategy will have a diminishing effect. Once the strategy is started, it keeps snowballing and you will start to make good decisions that are lifechanging. Feeling secure in your future will relieve you of stress and you will feel the security few people do. So, from another view, you already have something right away, peace of mind. Another reason Buy and Hold investment may be unappealing in the fact many people are tied to the money they made by working hard, the idea they need to start investing stirs fear, they are hanging to the money they have. This is not a wise decision.

The book “The Richest Man In Babylon” by George S. Clason is a classic but the most interesting part is when a poor man comes to the rich and asks him how to become rich. The answer is first you need to earn 10 coins a month, then, put one away. Make this a rule you will not break. The poor guy protested, stating he will not have anything left at the end of the month, he needs every penny. This is not an option, however, to become rich you will need to make this step. After a while, the poor man came back and said there is no difference except now he has some savings, and that he never felt better.

Even if you are a good, profitable trader, earning money in one way is the same as saying you are putting all eggs in one basket. Not wise, you should play the offense and defense at the same time. The defense analogy part is known as Passive Income. The best teams play both sides, why not you. While you are making nice gains off Forex, do not spend the whole batch, set one part aside, and create your evergrowing capital. This move will take trading anxiety away because even when your trading comes to a halt, you will have the Passive side still working behind the scene. Imagine that terrible month where all of your previous year gains are negated, it feels like a year is wasted. But if you have that other Passive side, it will not feel that bad.

The Mystery of Buy and Hold Strategies

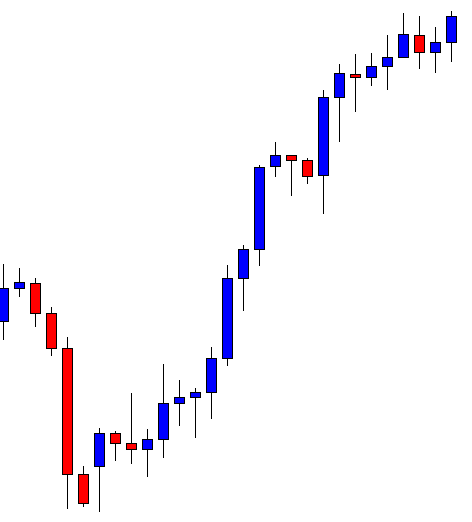

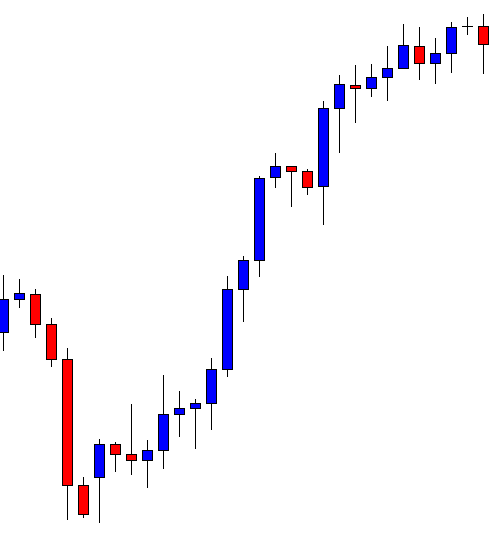

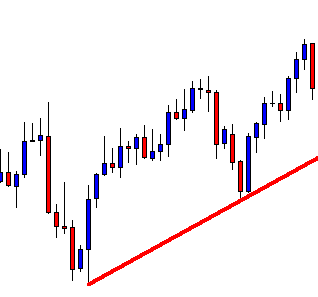

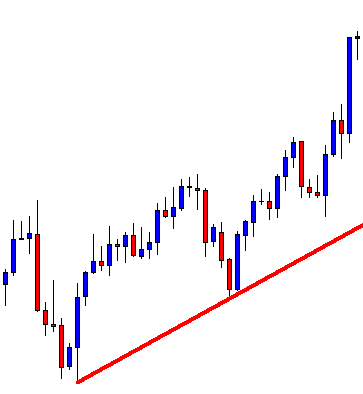

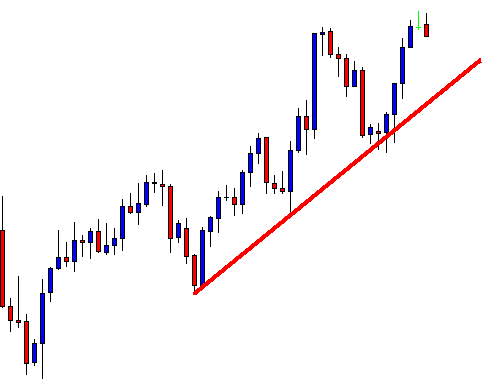

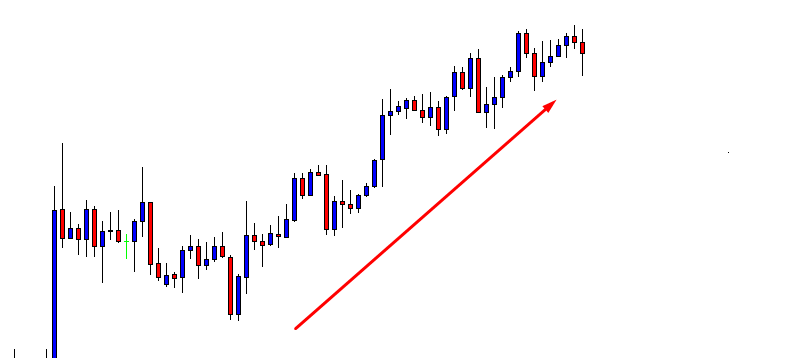

Buy and Hold strategies are not explained and not present on the internet, because the internet places the most popular first, not the most beneficial to you. So how we can use our forex trading skills to become better than most of the population who is doing this? Some common sense takeaways are often overlooked with this strategy and we, as forex traders will know what to do better. There is a lot of ways you cad do a Buy and Hold strategy. They are not all great but let us start with the Buy and Hold Forever idea. This one is not too bad to follow, there are a good argument and logic behind this strategy. When you look at the stocks or Indexes history, they just rise up and up, even when they crash a bit they end up recovering and rising again. The history will repeat, cycles will do their thing until the repetition does not hold and something new occurs.

That equities rally may just stop rising, you simply do not know. All you have are the odds. The odds imply that it does not matter when you enter the market with the Buy and Hold forever strategy as long you keep that forever mentality. This means if you invest in Gold and it starts to decline in price, you do not blink, do not bailout. On the contrary, this is an opportunity to buy more, you are playing the long haul. The plan is set here to hold the asset for a very very long time as the price moves up and up. Withdrawal is not set in the plan and it is not uncommon people never withdraw. They might come to the point of old age where all that money is not very useful to them and pass it on to their kids. There are many iterations of this approach and there is nothing wrong with it.

The Buy and Hold until you cash out big is the one with many weak spots, and here is why. The plan is to collect all the investments and put everything into the pocket. This form of Buy and Hold is very common, especially with the people who are into investments. They may have an idea to wait until the price is very high (high relative to what?) and cash it out, then use the money for something else or just count the bills. This plan is not a good one. Until you have a precise number when this investment ends, it is not a good plan. Now, for example, if we take an excited blackjack player who comes with just $100 and lifts his game to $40.000, he will just keep playing. He will play $40,000 for more until he is back to $100 all in one day. These people did not have a plan.

The same people who bought Bitcoin when it was just $1000, hyping when it reached almost $20,000. Then the talk about the BTC made millionaires circles, but the truth is only about 40 out of hundreds of thousands of people got out at the right time. The majority let the hype run and when it is over some may even go with the Buy and Hold Forever strategy. Od course, they would for sure sell near the $20,000 mark and buy it back when it went down if this option is available. After all, just be sure to avoid this strategy.

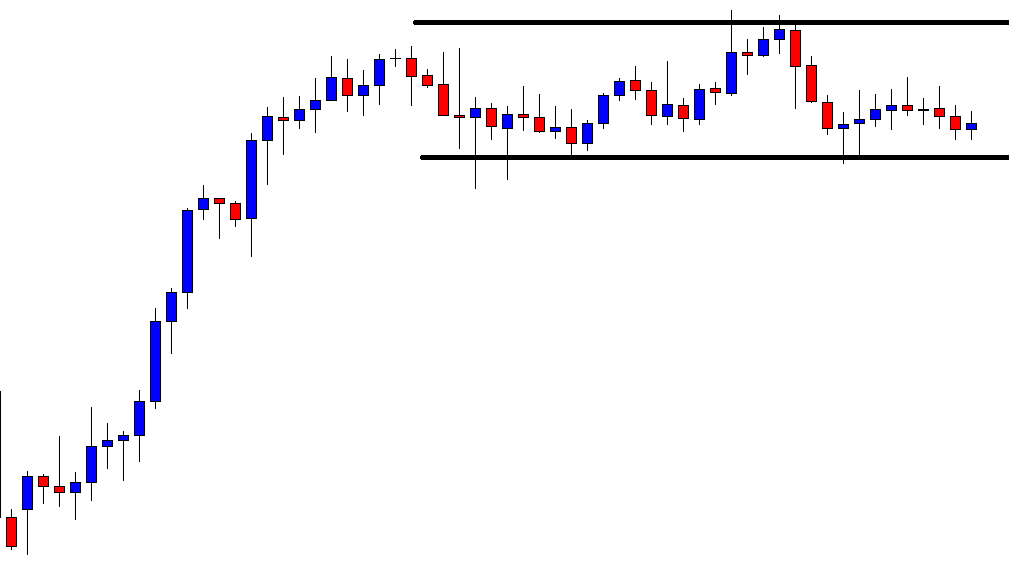

Forex would like the approach with a structure, even in the Buy and Hold strategy. This is a type where investors Buy and Hold and cash out along the way. Where are the points in time and level where you cash out, is subjective. It depends on the investor’s tolerance, how long to hold, and what is the asset held. Forex traders will have a plan and structure for this. Again, having a passive income element is very important as your trading will not be as great as before.

Long-Term Swing Trading

Long-term Swing trading types may not really be in the category of the Buy and Hold idea, but it is also very interesting for forex traders who have a plan and a system. More on this strategy later. Just to point out what makes forex traders better right off the bat is their Money Management structure. Without Money Management, there is no money. If you are strictly following the Buy and Hold Forever strategy then you probably do not need to worry about Money Management.

However, people who follow this strategy fail with their psychology trading element. When you think of it, all they have to do is invest and do nothing. The do-nothing part is a very hard thing to do it seems. Warren Buffet can do it but most cannot. When the markets stir up with volatility, their fears kick in as their asset is going down. Then they get out at the wrong time. Trading by fee is the worst possible way to trade, and it is often what beginner traders do, not just forex traders. So it can be said that all decision making is just better when the emotions are not in the way. Forex traders beat this with their systems. Unfortunately, others do not have the system. The rules for forex trading is easy. Trade according to your system, then go away, and repeat.

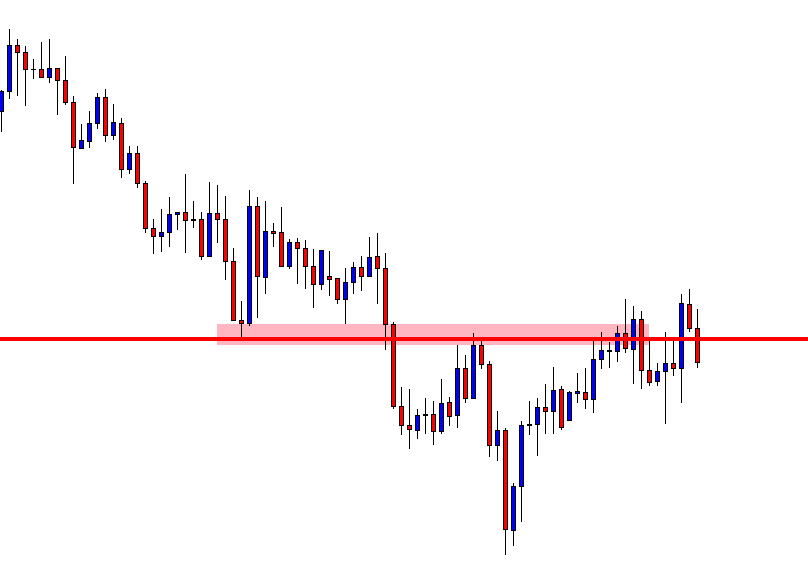

Taking the above into consideration, we can create some common-sense rules you can follow. Just by using these general pointers and then create your strategies over time, you will probably do very well with the Buy and Hold investing. Have a plan. Most do not have one, which gives you an advantage right away. Execute the plan. Write it down and follow it like it is holy. Writing it down will also write it in your mind. This will make a psychological effect that helps to obey the plan. A forex trader can also use their trading platforms to set Take Profit levels, etc.

You may be caught in a mania, an emotional excitement when your asset shoots up. There will be an urge to move that TP level higher or cancel it altogether just to see where is the limit of this fortune. If your plan set the TP, then messing around with it is not an option, no exceptions. There are no regrets, as another opportunity always shows up. Regret is another emotion that may cause bad decisions so enjoy your cool just by following the plan no matter what. At the begging, you will have these urges, but in time it will vanish.

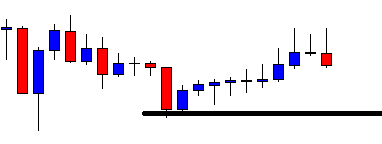

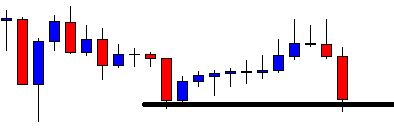

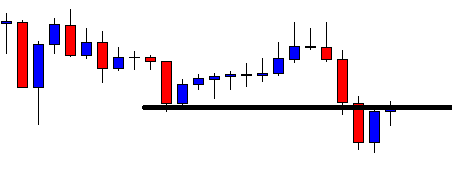

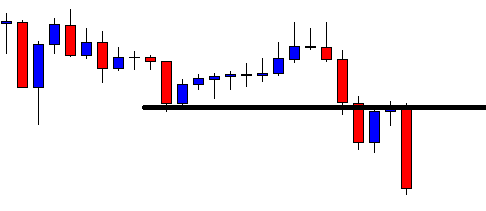

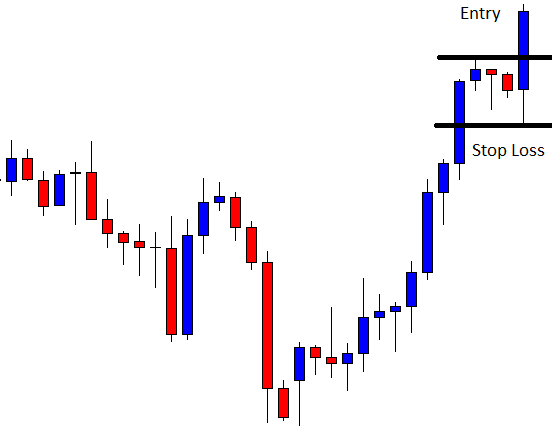

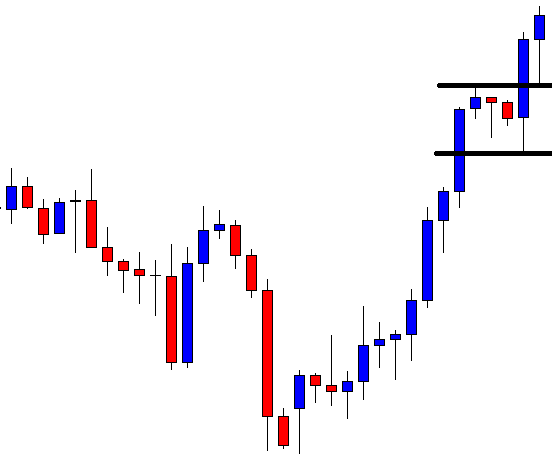

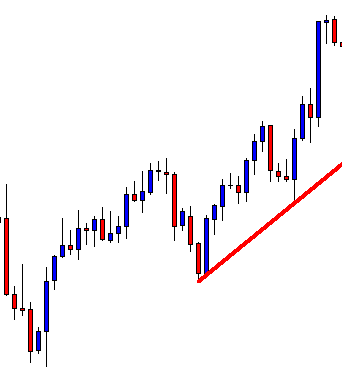

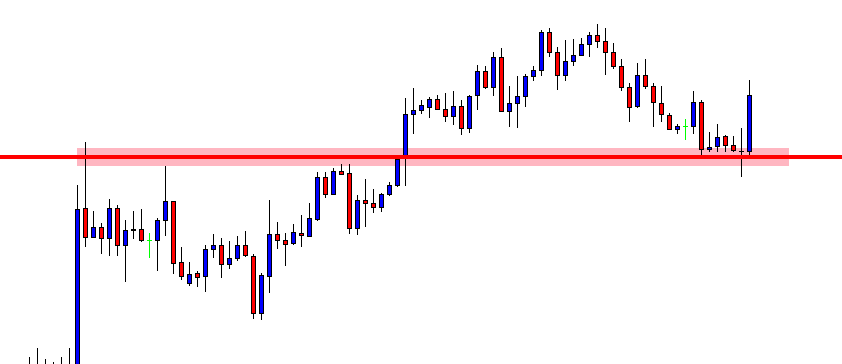

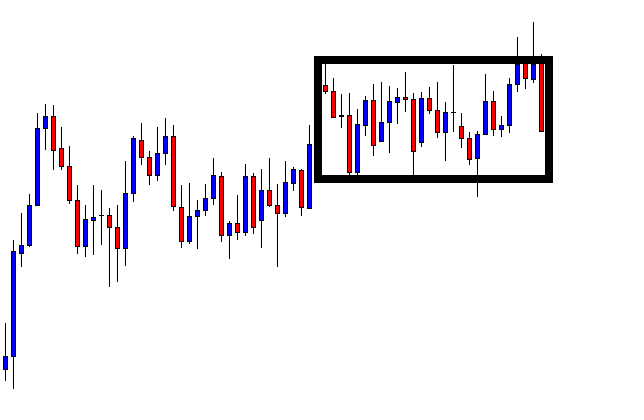

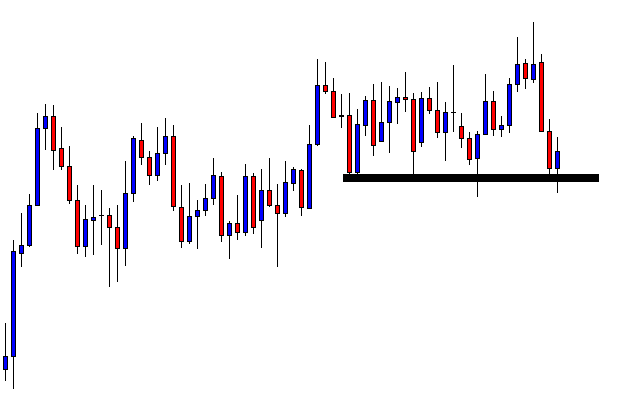

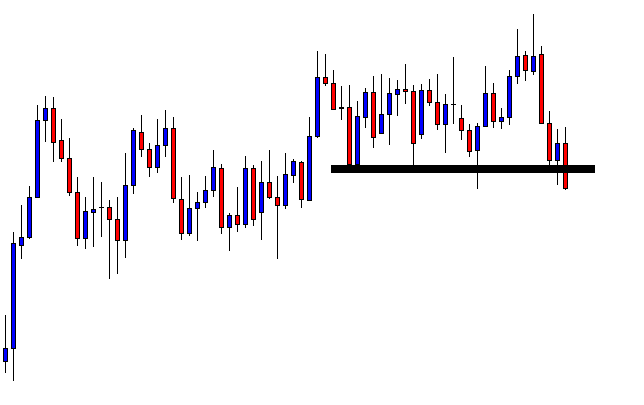

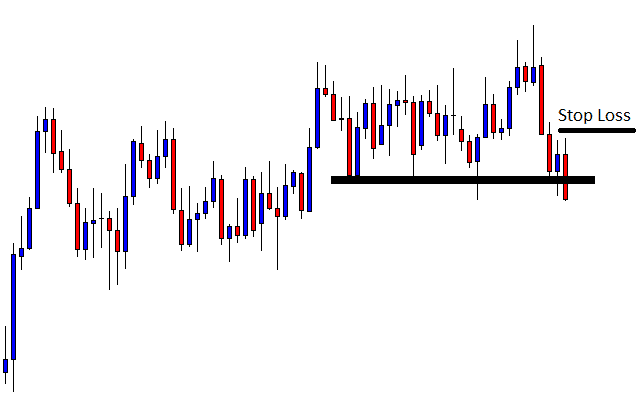

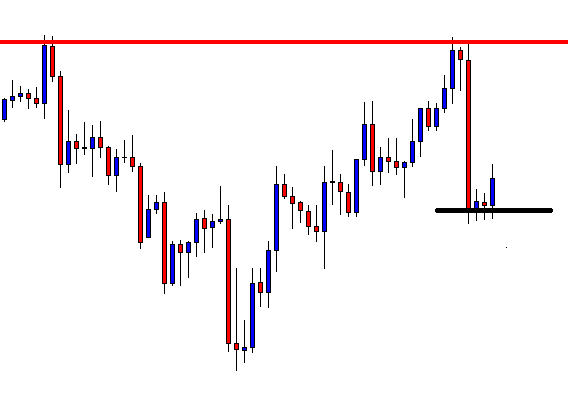

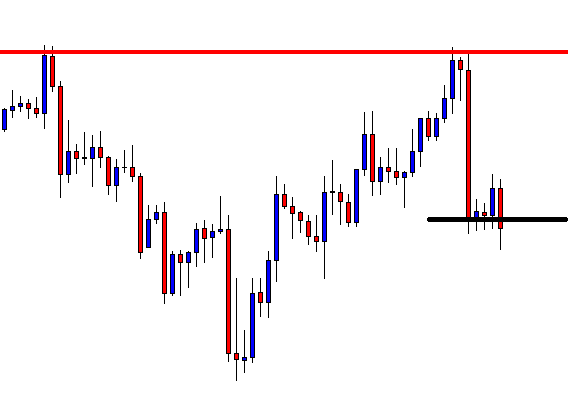

Buy and Hold Cash Out

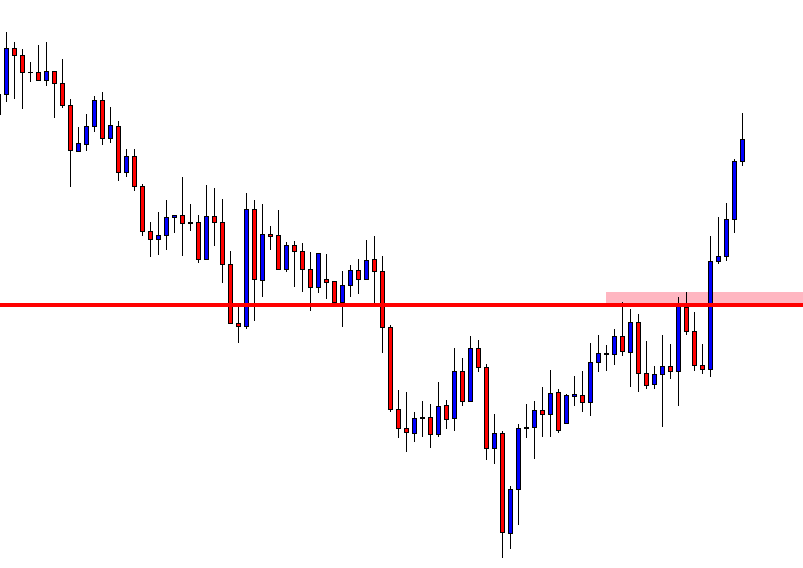

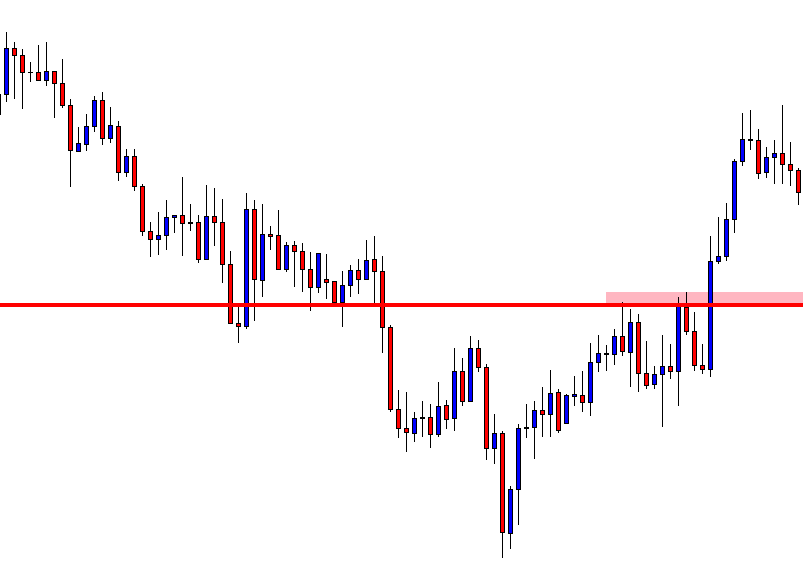

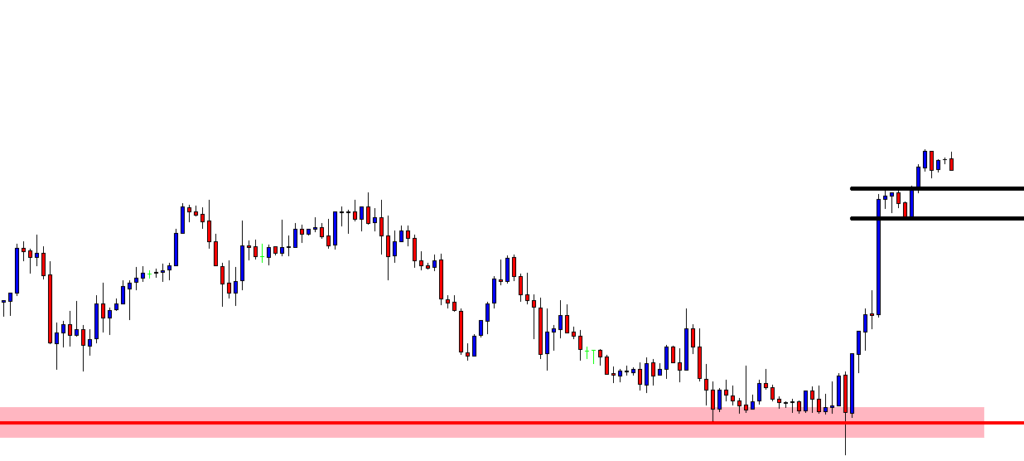

Now let us go back to that Buy and Hold and cash out along the way strategy where you can apply the plan. Forex traders already have their Money Management plan so they can set a Stop Loss if it is not a Buy and Hold Forever type. How deep the SL level will be is on the trader to determine, but have one in place. Have a Take Profit level too at some nice gain point, at least one, and then move your SL to breakeven when TP gets hit. This is all basic common sense and an example you should already know if you are a forex trader. In the Buy and Hold strategies, it is also applicable.

Since in this type you cash out along the way, you can put multiple TP levels and leave that little bit in the asset. That little bit can be saved for your potential “flyer” rally breaking the sky limits with the trailing stop so you do not miss those life-changing investments. It may not be amazing that just a part of your initial investment captured that rally but you can rest easy, you have a system that is making it all happen again. This basic plan will get you in the top 95-99% of investors, and it can even get better.

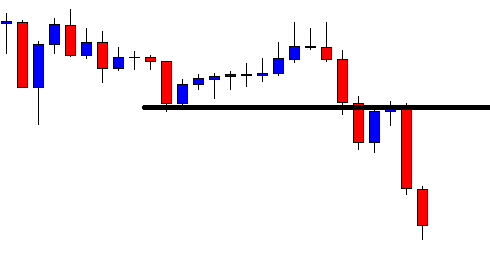

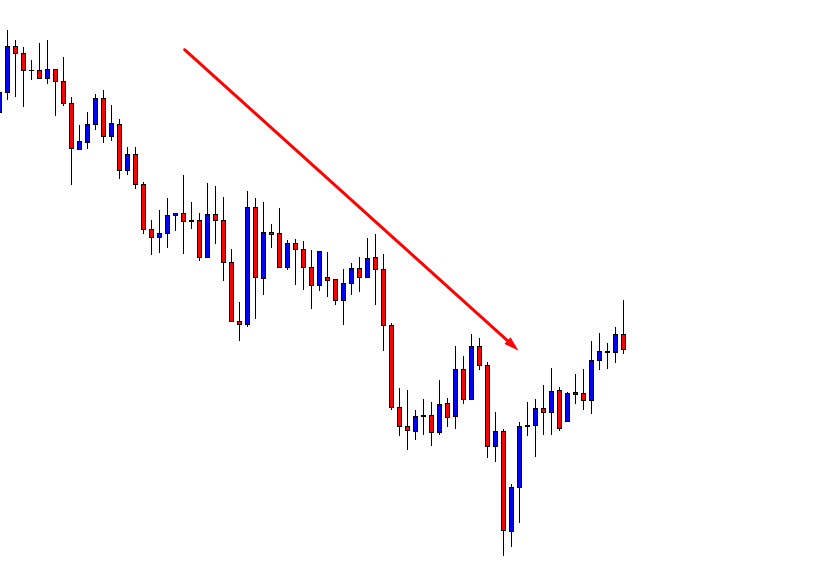

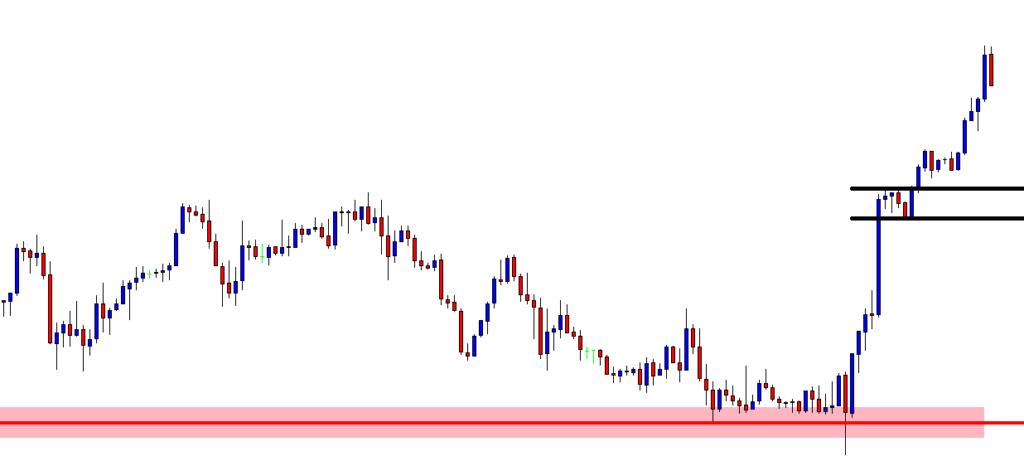

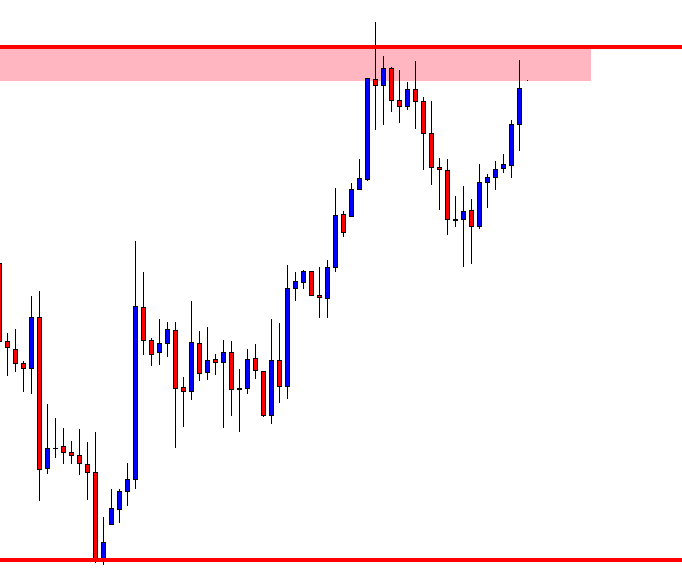

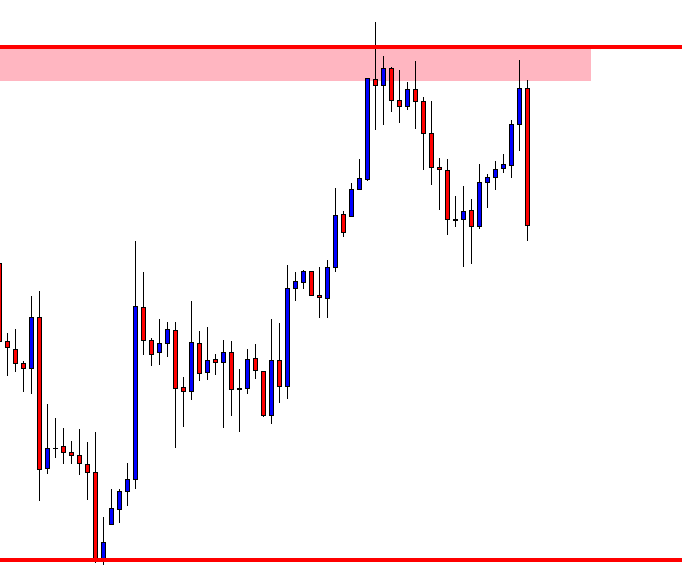

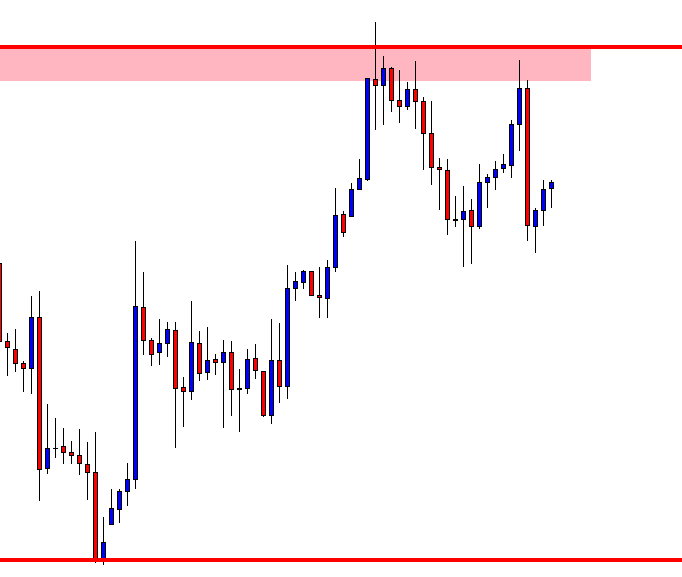

So we know we have great odds in our favor by having a plan, but nowadays we also have the ability to go short, not just long. We can do it on gold, commodities, ETFs, and many more assets. This almost double our odds, there is no need now to sit out the drops. Surprisingly, many people do not use this ability and there is no reason why forex traders should too. Further improvement of the forex trader odds is by selecting the assets that almost have no chance of dropping to zero or going so low they do not have a chance of recovery. These assets are stocks, some companies do not have chances of recovery, for example like Sears. Gold is an asset that will probably not going to drop to zero, Energy ETF baskets too. The final and great advantage forex traders have is their technical analysis system. With the well made and tested system forex traders have better odds than investors and even financial advisors.

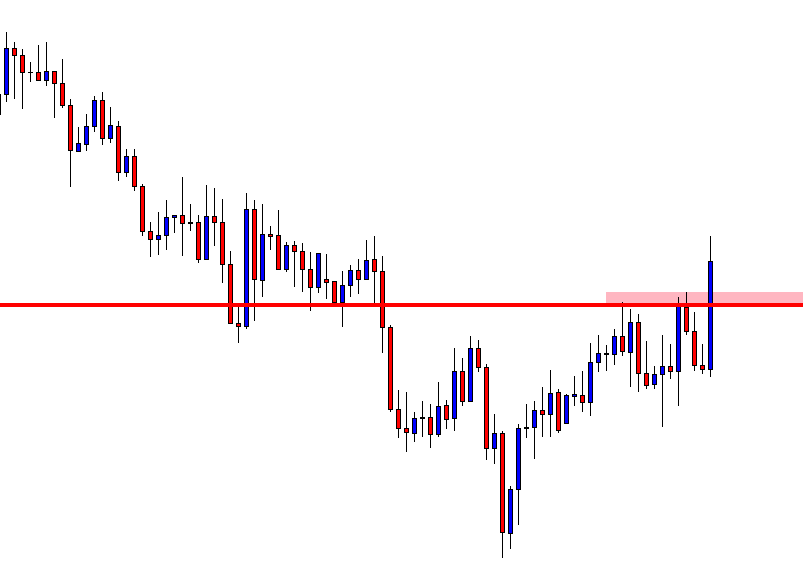

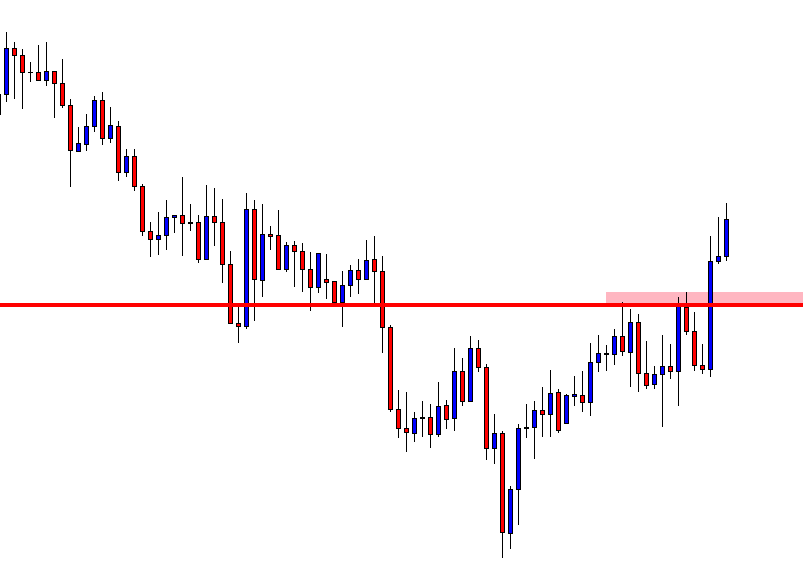

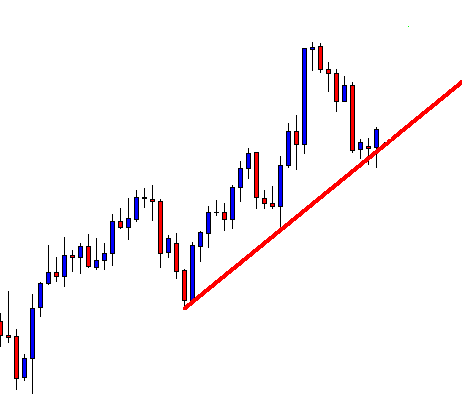

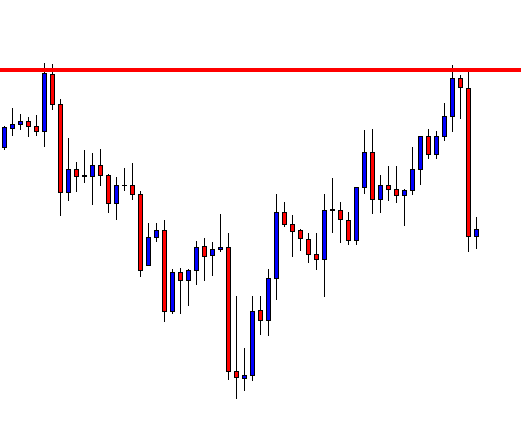

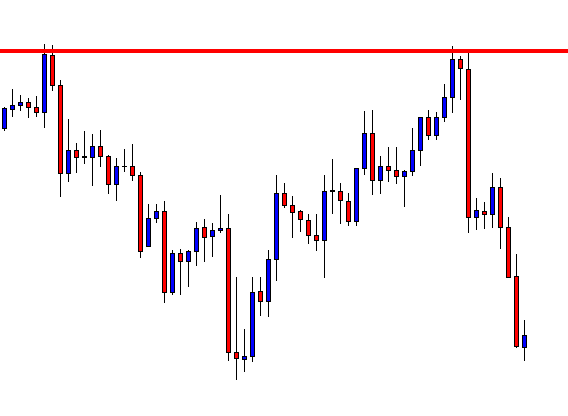

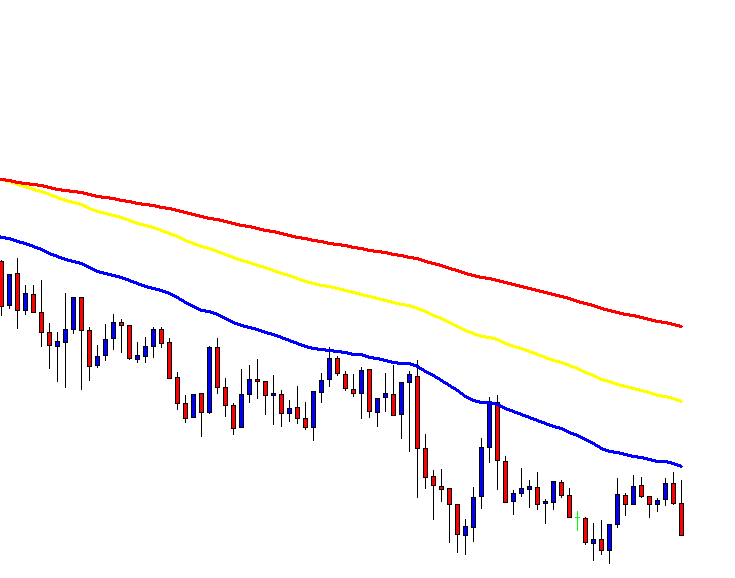

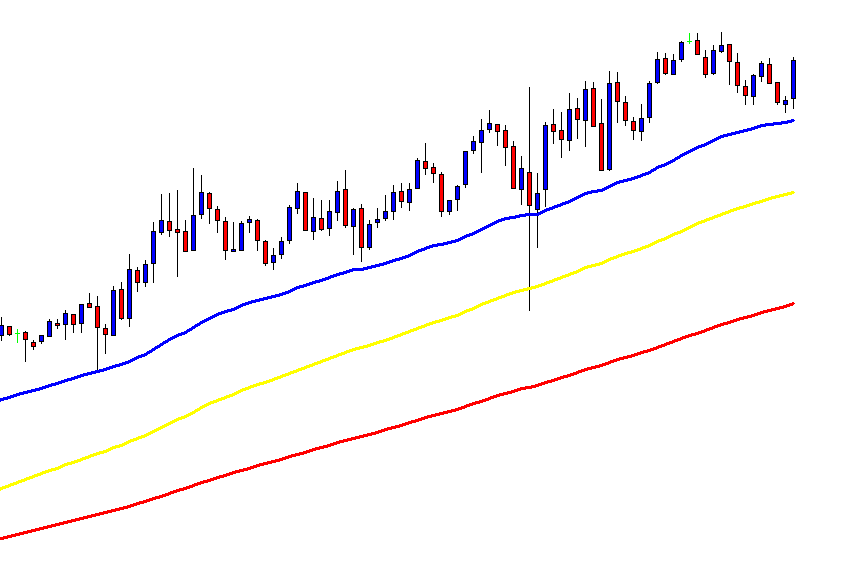

Now you need to decide do you want to Sell and Hold or Buy. There are many inverted ETFs that will allow you to short indexes. So are we in the seller’s market or the buyer’s market now? If you think we are in the cyclic bubble right now then you may go in the selling direction but know that you might be wrong. This means you should not go all-in on the short side. Also, the algorithm will tell when is the right time to make a trade. The timeframe used for trading is not optimal for long term investment so increasing to monthly is recommended.

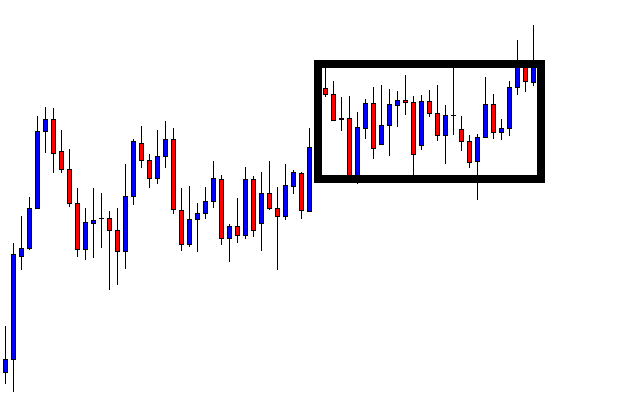

For that Long term Swing trading strategy, the weekly timeframe is the most optimal. Swing trading on this timeframe is not really considered Buy and Hold but it is for those who want to participate in the price action. If you have the system that works universally on every timeframe, then why not use it to squeeze more. Whatsmore, trading on a weekly will relieve you of the trouble if the market is in the sellers or buyers zone.

Finding new skills takes time and effort, but ultimately it will help to improve your overall trading abilities. However, a new skill when looking at trading could be quite simple, it could be a new currency pair or a new commodity, it could be simply understanding how the markets work on another timeframe. While they are only very small things, each one of these things that you learn will increase your overall understanding and will also help you to adapt to any unforeseen conditions in the future that you otherwise may not have been able to cope with.

Finding new skills takes time and effort, but ultimately it will help to improve your overall trading abilities. However, a new skill when looking at trading could be quite simple, it could be a new currency pair or a new commodity, it could be simply understanding how the markets work on another timeframe. While they are only very small things, each one of these things that you learn will increase your overall understanding and will also help you to adapt to any unforeseen conditions in the future that you otherwise may not have been able to cope with.