Indexes are popular as they represent the economic activity in certain areas. Therefore it is often the case to see a company stock move inline with the index it belongs to. Some traders turn to trade only indexes instead, it is easier to conduct fundamental analysis based on aggregated performance than to follow what a single company is doing – unless a trader is very familiar with its capital structure, reports, and its services or products.

German traders are very interested in trading their DAX index, what’s more, they are very informed about their economy and even beginner traders have a good knowledge base to start trading the DAX right away. Following our previous series of articles about carrying over our forex trading experience and systems to other markets, this article will be about what we need to adjust to being as good in the index asset category. We will present just some opinions from professional prop traders, following the algorithm structure and ruleset already described before. If you have a system already with good results in forex, there is no reason not to transfer that knowledge and the system to seize opportunities from other markets.

Since each asset category has specialties, indexes require attention to several market aspects, additional work is also a lot of testing. By exploring other markets from forex, the overall capital gain potential is increased to a big extent, just by having 10% from forex, 10 from precious metals, 2% from commodities trading, and an additional 10% from indexes make a difference. Of course, mastering one market before moving to another is the right approach, although people are not prone to get out of the comfort zone. The percentages above are for an average trader who has a proven system and a plan set in place already, it is not an elite benchmark, but it is an elite gain all combined. To compare, elite traders and investors have a 15% return from one market per year, consistently.

Do not be impressed by an expert advisor or signals provider with their presented unrealistic returns as it is almost always extremely high to attract your attention only. After we address the fundamental peculiarities, we will make adjustments to our algorithm or technical analysis.

Trading indexes for individual traders is done through the CFDs. These contracts allowed great freedom in terms of what we can trade, be it precious metals futures, commodities, or indexes. Long and short positions are possible even with stocks over the CFDs. Now, CFDs have leverage and therefore margin, allowing traders to have bigger buying power than what is otherwise possible. Leverage also amplifies the amount traders can lose, going beyond zero. In classic buy and holding strategies, you can lose all of your investment value only if that asset goes to zero, which is not likely, nearly impossible for precious metals. Using CFDs, depending on leverage amount, you can lose all investments if the asset falls in value, even if it is just a 10-15% drop. Money management we carry over from forex will make your trading completely protected from this risk since we are very strict on how much we allocate for each position. Traders should first understand CFD type financial instruments before trading, they bring certain benefits and increased risks compared to traditional stock trading.

Indexes you are about to trade are volatile compared to forex. Their daily ATR (14) value is very high, much higher than precious metals, and could go to 13000 pips. Consequently, you will also find trading indexes require more capital. The usual amount in your demo account such as 50.000 USD may not be enough, contracts are not the same size as well as the price per one unit. Also, note trading indices carry an increased risk of unexpected trade “glitches”, and by this we mean your positions could be closed by broker adjustments to their products. Such changes are usually announced by email and they are mostly about indices from certain countries where elections or other events are expected to heavily affect their equities market.

Brokers can change the terms during these times as they see fit, mostly it is just the leverage reduction, although, they can completely close the assets from trading. If you happen to have a position in such assets, they are likely to be forcibly closed. Sudden spread widening is also an issue with volatile assets such as indexes, if the volatility spike is extreme it could trigger your Stop Loss levels even though they are properly set in line with your trading plan. Therefore, demo trading for a longer period is a must.

Indexes price action is very active, you will have a lot of signals and you can even be thrilled how good you are. If you are lured into real money trading with indexes before forward testing your system for a few months, it could cost you. Backtesting will take more effort than with other assets, there will be plenty of signals to mark and measure, and they all have to be compared. Every time you make adjustments, be it another indicator or money management rule, collecting results and comparing them will be the biggest part of your job. Forward testing will discover new issues such as above mentioned volatility spikes and spreads that may cause your successful backtested system to perform much worse in real-time. When this happens, be ready to make a new plan or elements to cut the losers first, then think about pushing for more winning signals without compromise.

CFDs are somewhat restricted to US citizens. Alternatives to this limitation exist, one of them is trading ETFs instead. There are inverse ETFs that allow shorting whenever you are actually in a long trade, and for certain ETFs, you even have 1:3 leverage. So Exchange Trade Funds are more than enough substitute to CFDs, however, you will need to do research about them, they have specifics we are going to talk about in another article.

Now let’s get into the technical adjustments and setup for indexes according to technical prop traders’ recommendations. Firstly, you may notice correlations between the markets or indexes. If you are familiar with our opinion about correlations from articles about precious metals and forex trading, indexes are not much different. Correlation comes and goes without any clue why. Let’s take a look at the charts below, the daily timeframe shows very correlated movements between different indexes.

The S&P 500 (sky blue line) has exaggerated price action in this whole year outlook compared with the rest of the most popular indexes. Nikkei also has somewhat uncorrelated moves in certain places but overall positively correlated with the rest. Now, take a look at the weekly timeframe.

The zoomed out decade period shows completely different charts. At some points, we see a correlation, and then it is gone. Nikkei 225 (yellow line) is drastically different but all come into positive correlation during the COVID-19.

Nikkei 225 remains flat on this latest 2020 weekly time frame chart, even with a mild bullish sentiment in the last two months while S&P 500, DAX, and Dow Jones Industrial are starting to slope down. It is hard to use any correlation info to the actual trading, it is not consistent and traders know consistency is a must. Some might notice a tighter correlation between US-based indexes since they are measured in the same country. The most uncorrelated index is the Nikkei 225. Now, similarly to precious metals trading, you do not need to trade various indexes for diversification purposes, it is redundant as indexes can move in and out of sync. It is recommended to trade only two indexes, regardless if there is a correlation or not. As our prop traders say, less is more in this case, you do not get any special advantage by having positions in more than two. If you have a signal on two indexes, one from the US and the other from the EU, trade them both only if they are not correlated on a daily chart. If they are correlated, trade the one with smoother price action. By comparing the DAX and CAC you can notice DAX is more smooth, so it is an easy choice.

Note indexes have different uptime, they close at different times too. So the daily chart, the easy-going trading routine only at the session end could be a bit shaken if you expand to trade indexes. Your trading routine would also need some adjustment if your lifestyle allows it. Know you will be in constant action, indexes move all the time because traders, institutions, and investors need to be active, their jobs demand it and their investors require gains.

If you keep your trading scope to 4 indexes, 2 from the US and 2 from the EU, you may want to explore Asian markets, the Hang Seng index. This Hong Kong (HK50) index has very attractive price action for trend traders that developed systems according to our recommendations and structure. HK50 rarely has flat periods for more than a few days. HK 50 has many fundamental drivers and still, apart from elections events, you can ignore them all! If you stick to the daily and higher timeframes, just do what your system tells you, no need to look at the event calendars. Non-Farm payroll might affect an index from the US, but the trend will prevail with only one or two candles in the correction way after the event. Indexes have such drivers they do not react too much and the memory does not hold for long.

On top of the HK50, you may go even further to the Australian index, also symbolized as AUS200 or ASX 200. This index has its specific price action and this is a good thing. It is not moving as the US and the EU indexes, therefore you can also pick one from other geographic markets. India 50 is another example of alternative markets you can trade when you need something uncorrelated. Just know the ATR values with these are extreme, in one day you can find candles that moved 7000 pips in one day. Make sure your money management is sound before trying. Some brokers do not offer less popular indexes so you may not find Taiwan MSCI and other alternatives. Make sure you find a good combination and limit your scope, keep it simple. Pick 3 or 4 different indexes, a couple from the US and EU, and one or two from Asia or Oceania.

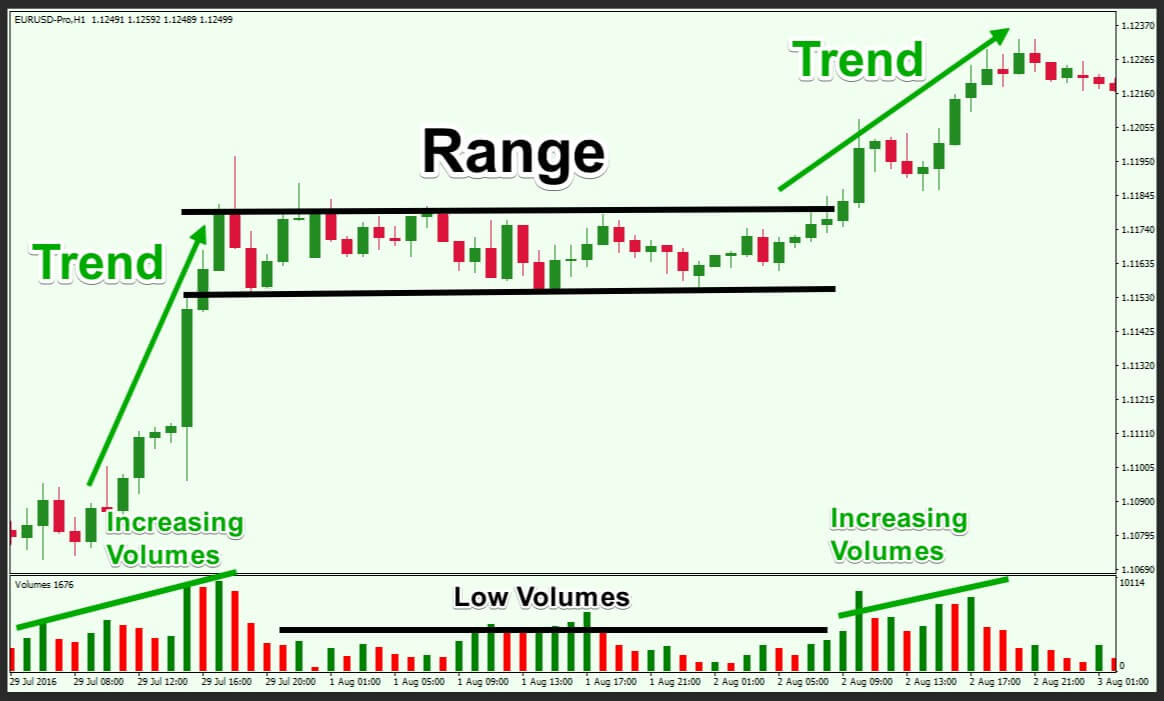

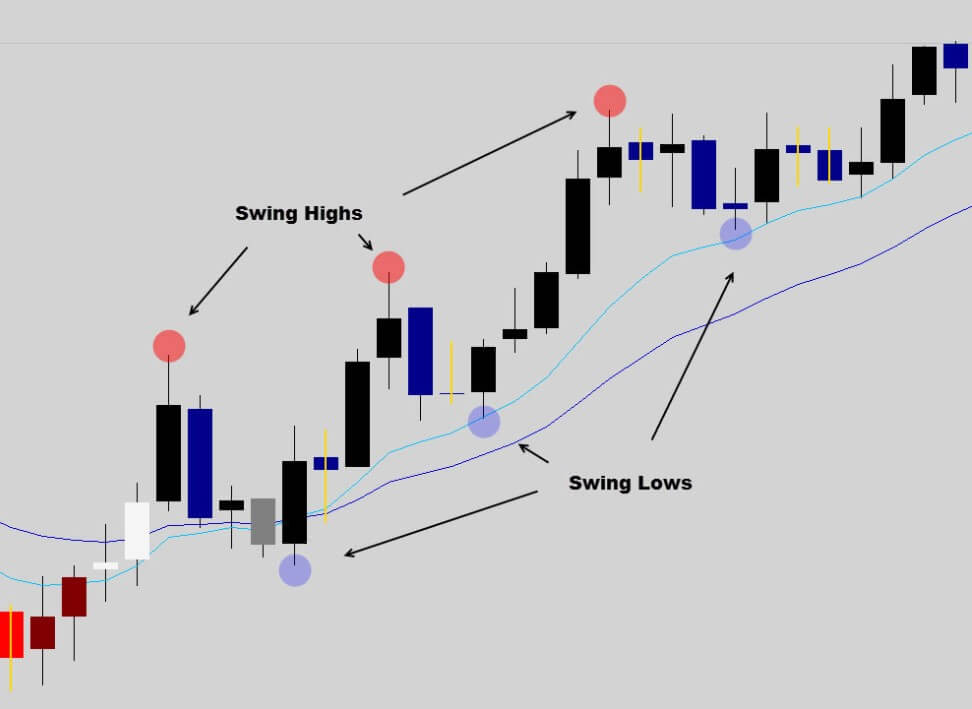

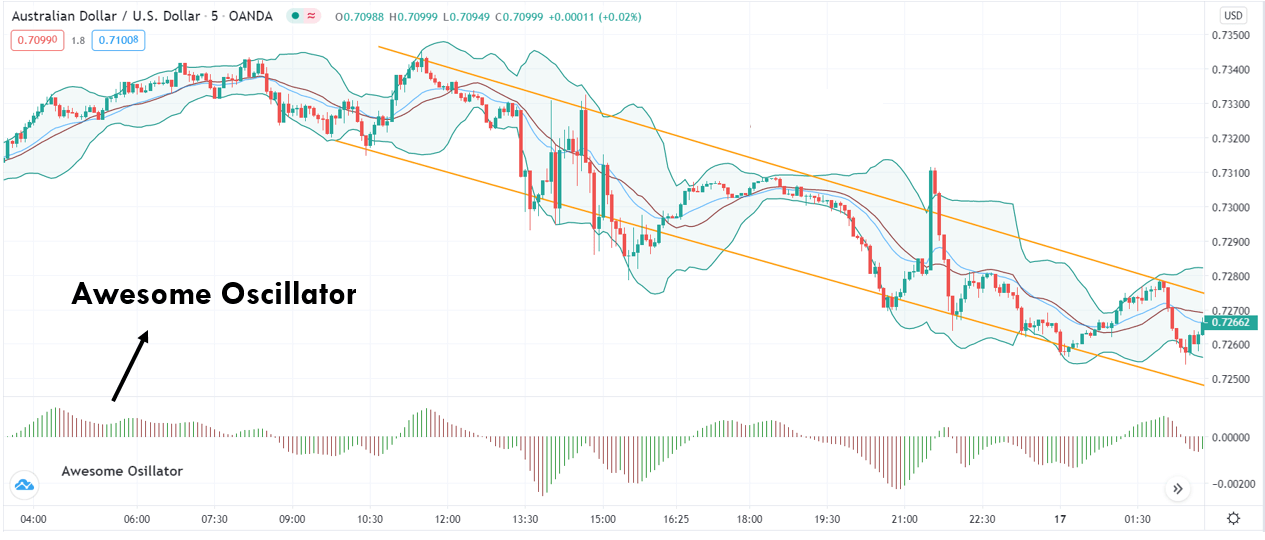

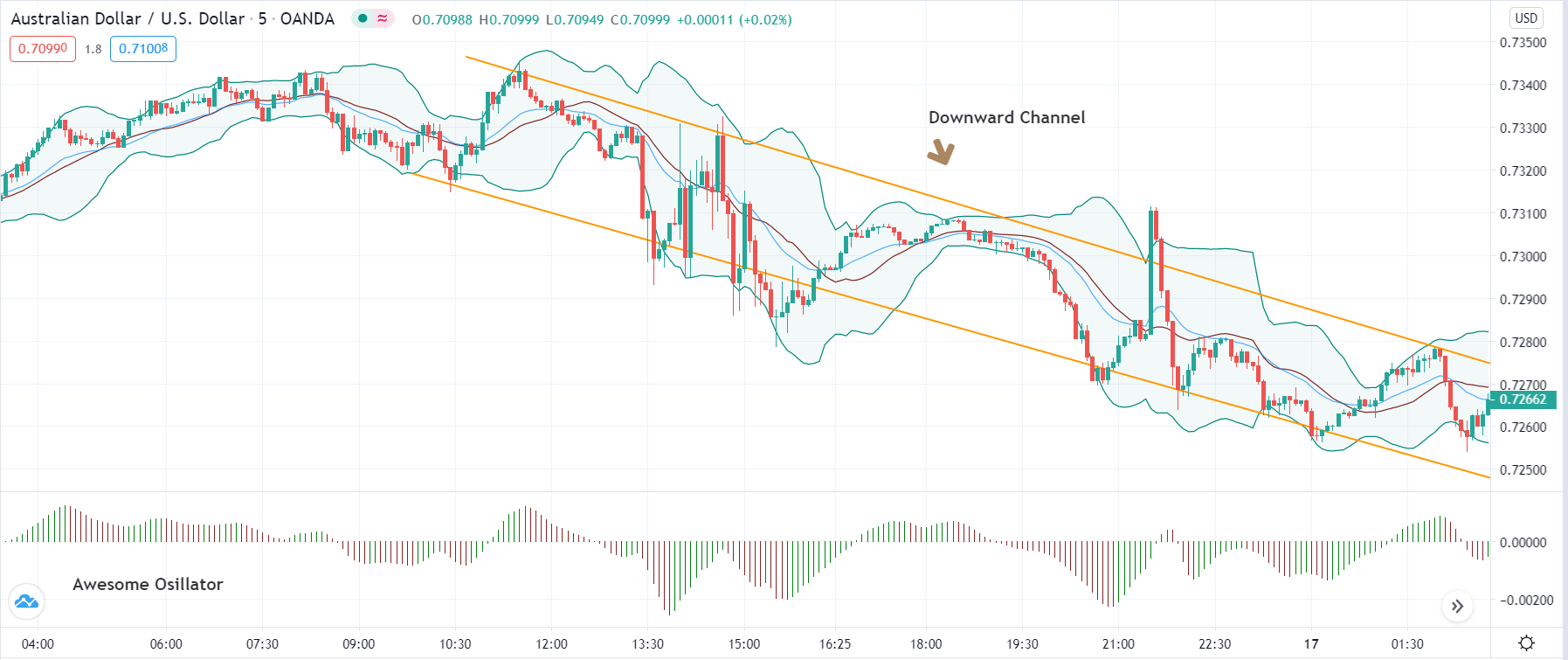

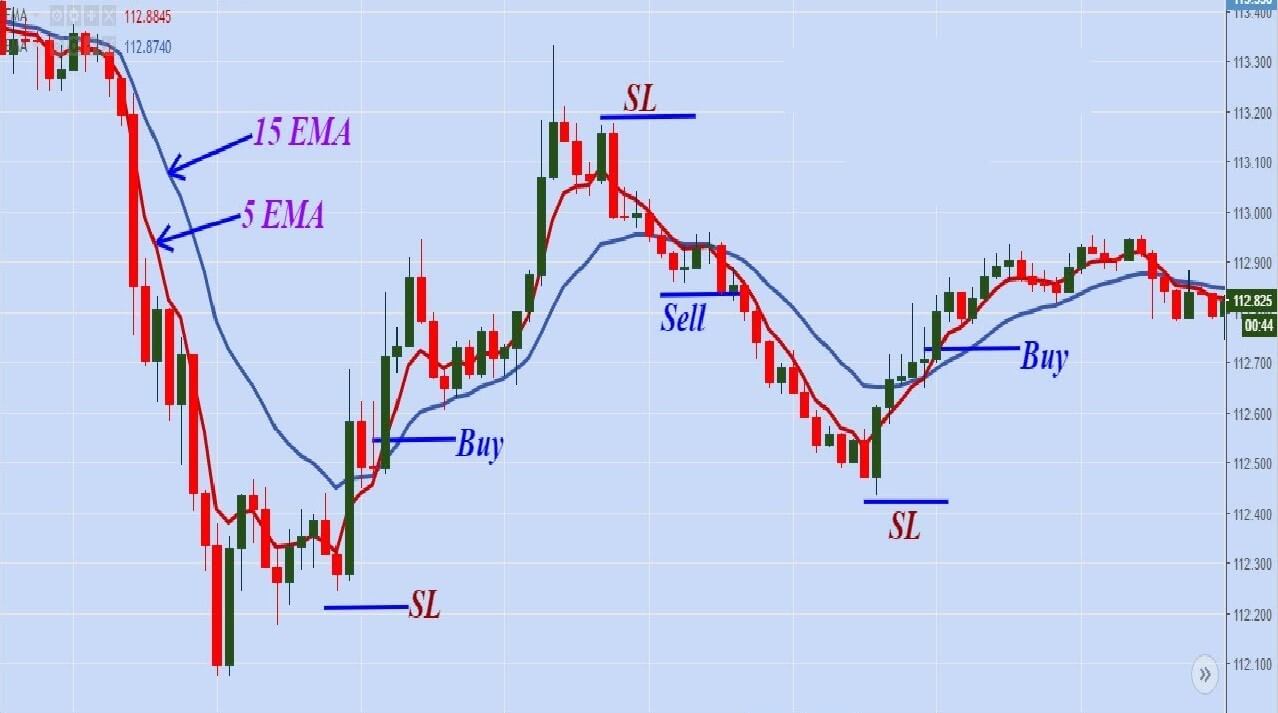

Finally, let’s see what you need to change with your technical algorithm. It should have 6 components as we have discussed before. Indexes move relentlessly, therefore the volume indicator is not needed here. Even when there is no general direction, it is short-lived. Choppy price action like with certain currency pairs is not going to be present with indexes, expect a lot of strong trends. As a result, you do not need any volume measures, trade indexes like you would Oil. To remind you, implement adequate confirmation indicators to indexes, as well as exit indicators, and eliminate the baseline element too. What you end up having is two confirmation indicators and one exit adequate for indexes, ATR (14) indicator if you need to calculate position sizes, Stop Loss and Take profit levels, nothing else.

In conclusion, indexes are up for grabs since you know about forex trading. Carrying over that trading style to other markets is an easy process, yet you still have to do a lot of testing. The exact recommended levels for risk management can be modified if you feel you would have better results otherwise, make sure you know what you are doing, ATR values are extremely high here. If you are from the US, know there are many ways you can trade Indexes even if you do not have access to CFDs. Lastly, know you are going to apply your trading knowledge and quickly master new markets with it. You have a higher goal now and that is to add on consistent returns wherever you can, be it forex, precious metals, oil, or indexes.

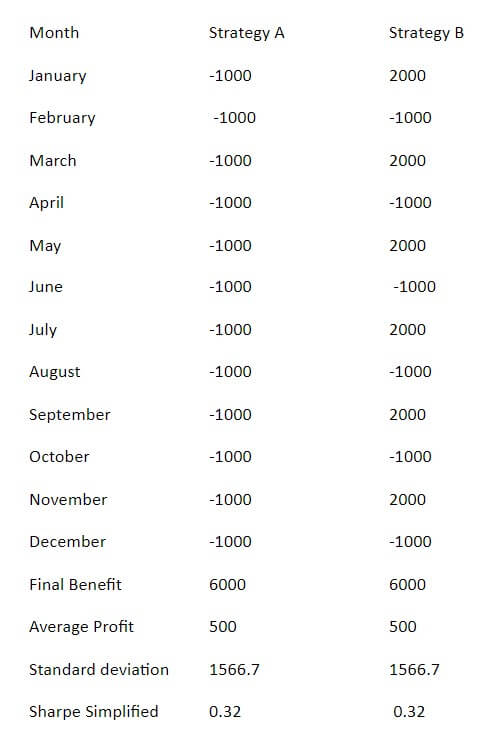

There are a couple of things here that are important to understand. Firstly, when you are starting out you will have a hundred questions about whether you should stay in a trade longer or shorter, whether you should enter earlier or later, and so on. The fact is that nobody can tell you based on one situation. It takes a much larger sample size – dozens or tens or even hundreds of situations – to reveal what works. And over such a long timeframe, what is revealed is not just what works better but what works better for the individual trader.

There are a couple of things here that are important to understand. Firstly, when you are starting out you will have a hundred questions about whether you should stay in a trade longer or shorter, whether you should enter earlier or later, and so on. The fact is that nobody can tell you based on one situation. It takes a much larger sample size – dozens or tens or even hundreds of situations – to reveal what works. And over such a long timeframe, what is revealed is not just what works better but what works better for the individual trader.

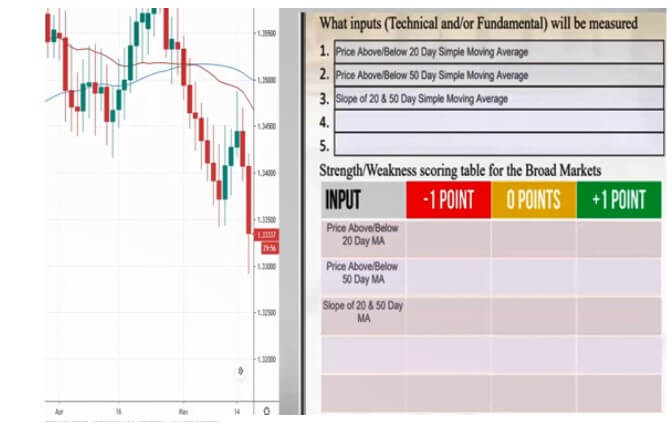

Before we look at the reasons why you possibly should change your strategy, create your own and what you put into it, because if you missed out one or more of these things then you may just need to alter your own rather than look for an entirely new one. Did you take your time to play it? Including risk management, your

Before we look at the reasons why you possibly should change your strategy, create your own and what you put into it, because if you missed out one or more of these things then you may just need to alter your own rather than look for an entirely new one. Did you take your time to play it? Including risk management, your

Some traders assume that managing news events is possible, believing that by possessing these information items gives them control over the market, to the extent that they deem generating a great number of pips in little time possible. Their viewpoint on news events boils down to the idea that the moment such news comes out, they will take specific action accordingly. Should the news be strong, they will go long on their chosen currency and vice versa. They believe that any timely reaction will easily bring them many pips, and we cannot but confirm that such a belief is based on solid grounds. Nonetheless, the fact that some traders managed to achieve this does not prove its quality. Not only does it happen occasionally, which immediately introduces a higher than necessary risk, but it also leads to false conclusions. Wanting to stay on top of news events is equal to trying to beat the traders’ main opponent, the big banks, and attempting to fight the one who decides how the prices will move is a very bad idea in the long run. Failure is inevitable when your adversary is unbeatable, so any attempt to control the news already implies more risk than anyone should have to take on.

Some traders assume that managing news events is possible, believing that by possessing these information items gives them control over the market, to the extent that they deem generating a great number of pips in little time possible. Their viewpoint on news events boils down to the idea that the moment such news comes out, they will take specific action accordingly. Should the news be strong, they will go long on their chosen currency and vice versa. They believe that any timely reaction will easily bring them many pips, and we cannot but confirm that such a belief is based on solid grounds. Nonetheless, the fact that some traders managed to achieve this does not prove its quality. Not only does it happen occasionally, which immediately introduces a higher than necessary risk, but it also leads to false conclusions. Wanting to stay on top of news events is equal to trying to beat the traders’ main opponent, the big banks, and attempting to fight the one who decides how the prices will move is a very bad idea in the long run. Failure is inevitable when your adversary is unbeatable, so any attempt to control the news already implies more risk than anyone should have to take on.