Professional traders are the people that are putting the food on their table with what they make with trading, so they must be doing well. They have gotten to this stage through a lot of dedication and learning. While the learning and time that they have put in helped them get there, they are able to stay there by following a number of different rules, of course not every trader will follow every single rule, but they most certainly will be looking at a number of them and following them on a day to day basis.

So let’s take a look at what some of rules that the professional traders may be following:

Keeping discipline: Discipline is an incredibly important trait and aspect of trading. Without it anything can happen, trades will be going in left right and centre and they will be going in without any actual reason. Discipline ensures that you will always be following your trading strategies and the rules that have been created by them. Once that strategy has been realised, they must remain on it, any sort of deviation can cause a loss and ultimately cause a strategy or even an entire account to fail. So maintaining self-control and discipline is one of the most valuable traits that a professional trader could have.

Not being influenced by others: A professional trader has their own plan and their own trading ideas. This is why when actively trading, a professional trader will not be accessing forums or chat rooms, they will not be talking to others about their trades, instead, they will be concentrating on their own plan and their plan alone. As soon as they start looking at others or talking to others, the information that they have will start to become muddy, so sticking to themselves and avoiding others while actively trading can be vital to staying on the straight and narrow line.

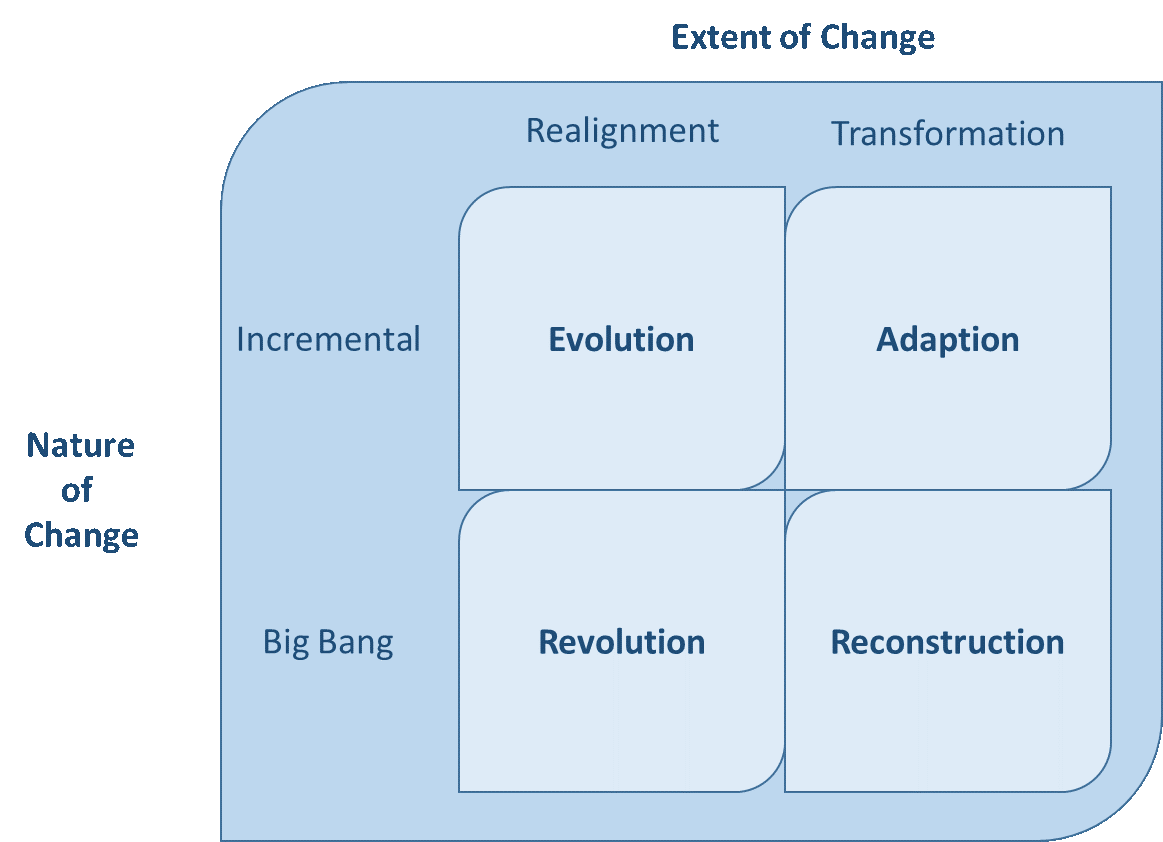

Updating their trading plan: A trading plan will not stay the same forever in fact it shouldn’t stay the same for long at a time. A professional trader will constantly be updating and adapting their strategies. If you were to just stick with the original plan without making any additional changes, as soon as the market conditions begin to change, then your strategy won’t be able to cope with the changes. A professional trader will constantly be changing bits of the strategy to meet the current trading conditions and to be adaptable to work in whatever state that markets are currently in.

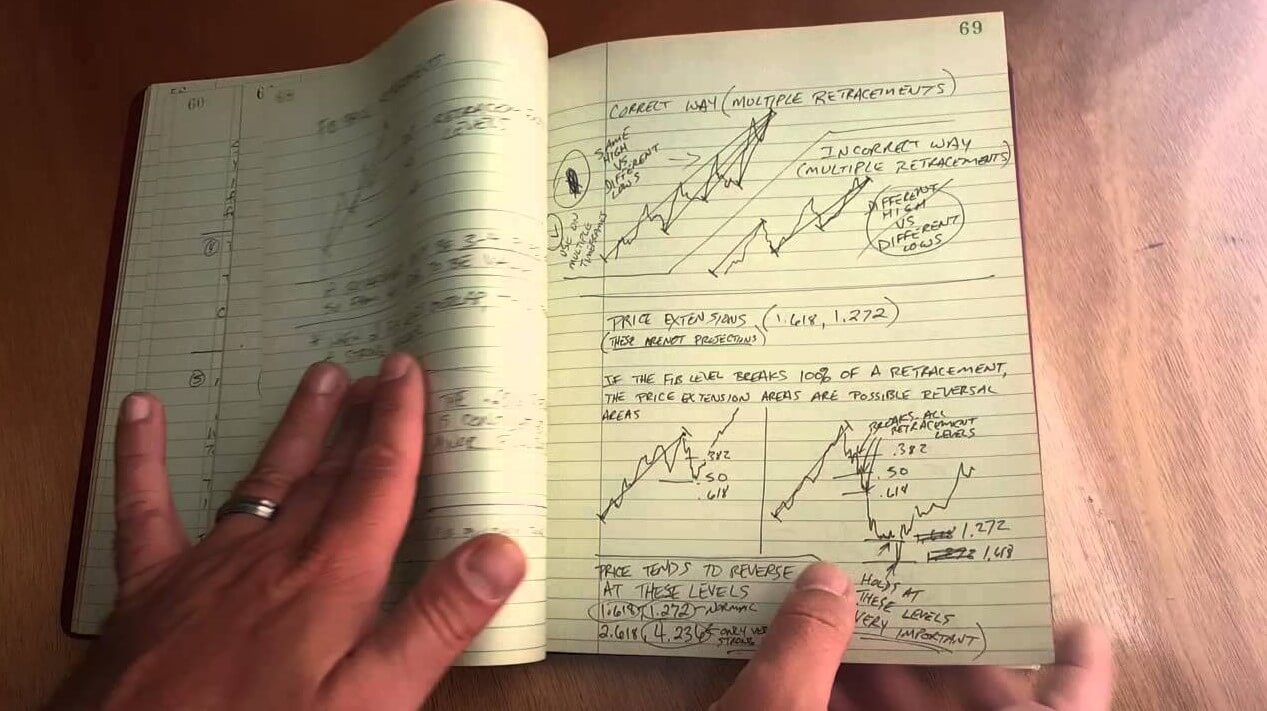

Not cutting corners: A trader should not cut corners, this is particularly relevant when we look at both the analysis and the placing of trades. When doing your analysis, you cannot cut corners, as soon as you do, there is an opportunity that something will be missed, and no matter how small it is, it has the potential to make a good trade go bad. It is the same with making your trades, as soon as you cut a corner and enter or exit a trade without all criteria being met, it can cause a good trade to end up as a loss, so maintaining your plan and following it through completely is vital.

Not always going for the obvious: Sometimes when trading there could be a pattern forming or some news coming out that makes things look pretty obvious, there is nowhere that the markets can go apart from down. However, there have been plenty of times where the obvious has not happened, a lot of political news, economic news, and the consensus can all make it appear that something will go down, yet it continues to rise. This is why you cannot just follow the obvious, further analysis is always needed and you should not just blindly follow the crowd.

Not breaking rules: Rules are there for a reason, they are there to keep you on the short and narrow and to ensure that all of your trades are staying consistent with each other. Your Strategy has set these rules to ensure that you are profitable overall, as soon as you break a rule you are also breaking that ratio that was generated. As soon as a rule is broken, the overall strategy is thrown out of sync. Sticking to the rules is paramount if you have any hope at remaining profitable in the long run. This is why professionals always stick to their rules and very, very rarely break them.

Avoiding the gurus: Gurus claim to have the knowledge that a lot of other people do not. They claim to be able to predict the markets at a greater level to most people, so you need to ask yourself, why are they spouting their information over social media instead of trading it themselves? Professional traders know things, they know that the gurus do not have any more knowledge or information than anyone else and so they ignore them, using your own analysis and information is far more valuable than letting someone else cloud your judgment with their information and analysis.

Regular breaks: One of the things you would have been told about is the need to take regular breaks, a way to clear your mind and refresh yourself for some more trading. Professional traders will often plan their breaks, taking them during times where the markets are a little quieter, this can often be the times near to a market changeover or during times of no active trades. What is important is that breaks are being regularly taken as any professional trader will know that sitting in front of the computer for hours on end is not healthy for your mind or body.

Organising your personal life: If there are issues and stresses in your personal life, it is only a matter of time until those issues and feelings bleed into your trading., Having other things in the back of your mind can create distractions to your trading. Coming into trading stressed about something else can cause you to make mistakes or to cut corners which will only start to lead to losses. It is important that you are able to get your personal life in order so that you can fully concentrate on your trading It can be hard sometimes if you cannot fully sort it, find a way to separate the issues from your trading, so you can focus 100% on your trading when you are there to trade.

Not hating the markets: When the markets decide to move against you, you cannot begin to hate them and you cannot feel like you need to get even with them. The markets do not care about you, and they do not know who you are. You should be feeling the same way about the markets. You are there to make money, not to make a new friend, if they go against you, you need to be able to move on, as soon as you start to want to get back at it, your strategy will go out the window and further losses will be on their way.

Chasing losses: Do not do it, do not do it at all, leading on from the previous points, if you have made a loss, do not try to win it back This is one of the most dangerous things that you can do and simply leads to gambling. Your risk management will go out of the window, how would you chase losses? You chase them by either putting on additional trades or by putting in a larger position, whichever way you do it, you are increasing your risk and increasing the potential for more losses.

Control your confidence: Another aspect of your personality that you need to be able to keep in control is your confidence levels. It is great to be confident as this normally means that things are going the right way, what we do not want is for you to be overconfident. Overconfidence can cause you to take additional risks with larger trade sizes and can even encourage you to take shortcuts with your strategy, entering trades when the criteria aren’t fully met, something that a professional trader would avoid at all costs.

Don’t use too many tools: Tools are fantastic, they can give you a lot of information and they can help you to analyze the markets a lot quicker. The unfortunate thing is that if you use too many indicators or other tools, then you are taking your own thoughts and personalities out of the trading system. If you are not thinking about what you are analysing or trading, then you have no knowledge as to why you are doing it, and no way of adapting should things start to go the wrong way. It is fine to have some tools to help you, but you need to be able to limit them to ensure that you are still fully invested in your own strategy and trading.

There is no holy grail: New traders come into trading thinking that there must be a holy grail of trading, a strategy that can always be profitable and will make you rich. A professional trade knows that this is not real, there is no such thing as the perfect strategy. One strategy will work in one trading conditions but not another, so understanding that your strategy will not always work is paramount to protecting yourself.

Build an arsenal: A beginner trader may have a single strategy, it will work in one condition and maybe on a couple of assets. A professional trader will build themselves an arsenal of strategies, this allows them to be far more adaptable, using different strategies for different market conditions and also allowing you to focus on more currency pairs or assets as each strategy can be optimised for the characteristics of specific assets.

You are not here for a paycheck: Many traders come into trading to try and get rid of their day to day job, while this is a great goal to set yourself, a lot of professional traders will tell you that they are not taking a wage each month, the markets do not necessarily allow for it. You need to work to increase your equity, as soon as you start taking out money, you are taking out your equity, you need to be able to build without taking out capital to begin with. Once you have built up a decent level, then you can start to think about taking some money out.

Simplicity can be better: Sometimes it is the simple trades that make the most profits, there is no point in overcomplicating things with thousands of indicators or little bits of information. A professional trader will tell you that sometimes simply using your own analysis and just one or two indicators is more than enough, as soon as you bring in too much information, it can cloud your judgment and bring in a lot of contradicting information that can completely throw your trading game and strategy completely out of synch.

Accepting our losses: Losses happen. No matter how good you are, you will experience losses. You will always make losses. What you need to be able to do is to accept the, do not let them cloud your future decisions and choices. Every loss that you make should be a chance to learn, why did it go wrong? What caused it to change? There are always questions that you are able to ask yourself that can help you to be a better trader in the future. Be sure not to chase those losses, just learn from them, clear your mind, and move on to your next trades.

Avoid false reinforcement: Sometimes you can be thinking of a certain trade, things seem to be going ok, but there are a few bits of your criteria which are not being met, hearing other say something similar can give you the reinforcement to take the trade, unfortunately, as your criteria still have not been met, it is false reinforcement, you should not use what someone else has said to overrule one of your trading rules. Trust your own strategy and analysis, and don’t take reinforcement from those outside of your own strategy.

There are a lot of rules there, some things you are probably already doing, something probably not. There are of course additional things that raiders do on a day to day basis. It is important that you set your own rules that you need to be following, it is important to create your own, once you have created them, it is vital that you stick to them. Your rules of trading are how you trade and why you trade, create them, stick with them, be successful with them.