As a forex trader, you should always be working on self-improvement to make a better impact on your trading decisions. Making an effort to address problems like allowing negative emotions to interfere with your choices or not spending enough time researching trading topics you could learn more about are a couple of examples of things that can impact your trades. If you find that you aren’t meeting your trading goals, ask yourself these questions:

Are You Setting Realistic Goals?

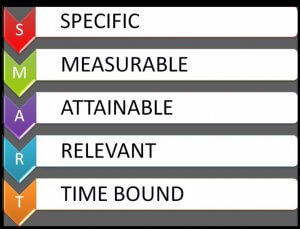

When setting trading goals, many beginners start out with one thing in mind – making money. The truth if this is your only goal, you aren’t doing yourself any favors. It’s also a bad idea to set goals that focus on making exact figures, as it’s nearly impossible to predict that you will make a certain amount of money in x amount of time. It’s ok to have long-term goals, as long as you understand that it will take time to reach them. However, even your long-term goals need to be obtainable. If your goal is to make a million dollars and you’ve only invested $100, you aren’t setting a realistic goal. In the meantime, you should set short-term goals that are possible to reach. Here are a couple of examples of good short-term trading goals:

- To spend x amount of time each day researching different trading topics

- To actively log each trade in a trading journal and to review those results after a certain period of time, like a week or a month

- To invest x amount of money into your trading account each time you get paid, even if it is only $5 or $10.

- To finish reading a book that was written by a successful forex trader

As you can see, the above goals can be reached fairly easily, but it will take some effort to get there. The reward centers in your brain will thank you when you complete one of these goals, which is better than feeling stressed out because your only goals are long-term and out of reach.

Do You Have a Plan to Actively Meet Your Goals?

Sure, you might want to make money, but how do you plan to get there? You’ll need an active trading plan, which covers the following topics and more:

- How you will find and execute trades

- How large of a position you will take (i.e. your risk-tolerance)

- What assets you will and won’t trade

Your trading plan basically covers what and when you trade, including decisions that involve entering and exiting trades. From there, you’ll also want to think about a trading strategy. A strategy is different from a plan because it outlines what type of trader you are. For example:

- Day traders typically open a few positions each day and close them before the end of the trading day

- Swing traders might open one large position or a couple of medium ones and leave them to accumulate for days or weeks

- Scalpers open several positions a day (sometimes even 100 or more) and attempt to profit off very small price movements

The strategy you choose can offer benefits and drawbacks. For example, a scalper only makes a small profit off each trade, so one big loss can wipe out their earnings for that day. A swing trader is subject to swap fees, which are charged by brokers for leaving positions open overnight. Day traders don’t have to worry about these fees, but each person might not have the time or patience to take up day trading.

The point is that you need to have a good trading plan and strategy set up to reach your goals. You won’t be able to make money without putting thought into the how’s and why’s of the way you trade. If you’ve been trading without a real plan, now’s the time to figure it out. If you already have one and aren’t meeting your goals, perhaps it’s time to look at your plan as a whole and to see if any changes need to be made.

Are You Tracking Your Progress?

We’re referring to a trading journal here. Some traders might start out using one, only to abandon it once they get a little more experience under their belt. Others might never use one at all. When you keep a trading journal, you log information about each trade you make, including your profits/losses, why you entered or exited when you did, any emotions you were feeling at the time, and so on. Later, you can go back and review that data to look for reoccurring issues that may need to be addressed. Sure, you might notice if you lose money, but without a trading journal, you may not be sure of your total profits or losses for a certain period of time. Once everything is in front of you, you might realize that something else is causing you to fall short of your goals. For example, maybe you exited several trades too early after losing money because you were feeling fearful after taking those losses. From a bird’s eye view, it’s easier to pinpoint where the real problems are coming from.