If you’re going to be a successful forex trader, you’ll need a trading plan. Trading plans are notoriously helpful because they help traders to remain disciplined, trade consistently, keep emotions in check, and they can help you to improve your trading strategy. These are the key factors that need to be taken into consideration:

- Your trading plan structure and financial goals

- Research and education

- Strategy (using fundamental and technical tools)

- Risk management

- Timing

- Trade mechanics, documenting, and testing

Before you even begin to develop a plan, you need to figure out what type of trader you should be. You’ll want to think about how much time you actually plan to spend trading, for example. Some only trade part-time, while others trade full-time. Your motivations are another important item to consider. Are you trading to become successful in the long-term, as a hobby, to have more time to spend with friends and family, or for some other reason? Defining your goals and expectations is important when figuring out how you should trade and how much you will need to invest. This is what you need to figure out:

- Why do you want to become a trader? What are your motivating factors?

- How much time can you carve out for trading?

- Do you have an appropriate amount of money to achieve your financial goals?

- What are your strengths and weaknesses? An example of a trading weakness would be anxiety.

- Figure out whether you are a fundamental or technical trader.

Once you’ve figured out all of the above, you’ll be ready to start investing time into research and education. From there, it’s time to develop a trading strategy that fits with your goals, the amount of time you have for trading, your education level, and what type of trader you are. These are the concepts that need to be included in your trading strategy:

- Types of analysis tools that will be used (technical or fundamental – or both)

- When and how those tools will be used

- Timeframes to use the tools

- Sequence of analysis

- Types or orders that will be used (market, trailing stop, etc.)

- What types of trades to place

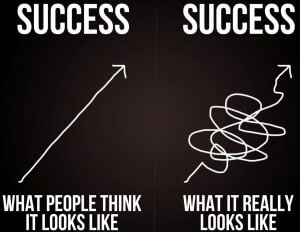

Once you have a set plan, you must remember to use it. Many traders spend a great deal of time working on their plan but fail to use it later down the road. Also, don’t forget the last step. Once you have a plan, you’ll need to test it and document your results. A trading journal is the best way to keep track of this information and to get an overview of how your plan is or isn’t working.