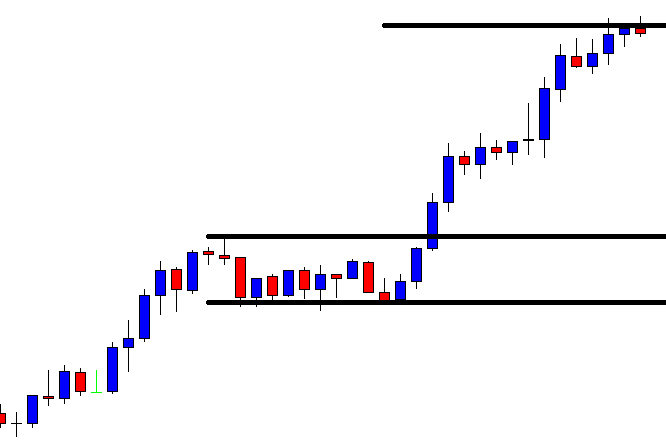

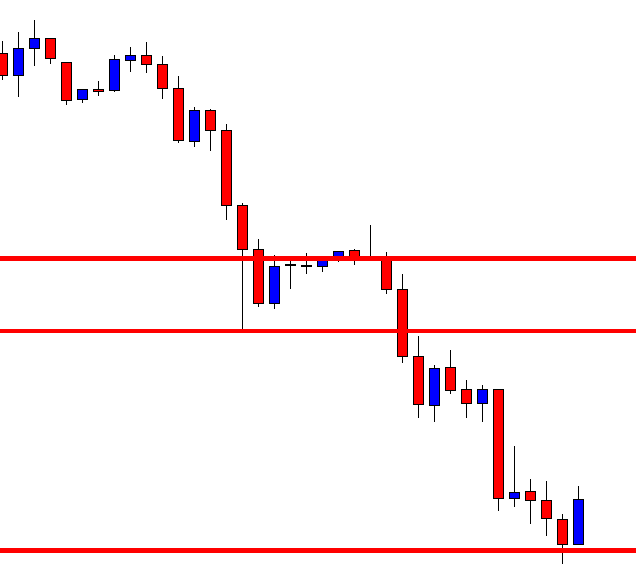

We are going to demonstrate an example of the H1 breakout strategy in today’s lesson. Usually, the H1 breakout strategy does not make traders wait too long to hit the target. However, if the breakout level is a double top or a double bottom level on the H4 chart, the price gets even more momentum to hit the target. Today’s breakout level is a double bottom level on the H4 chart. Let us now find out what happens after the breakout.

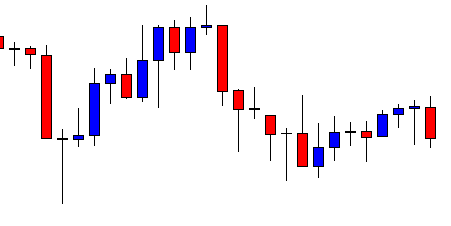

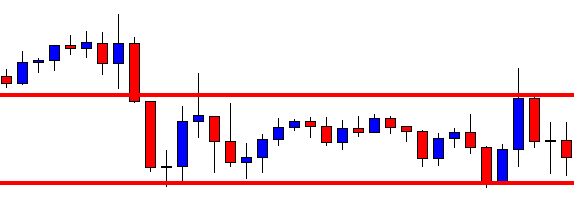

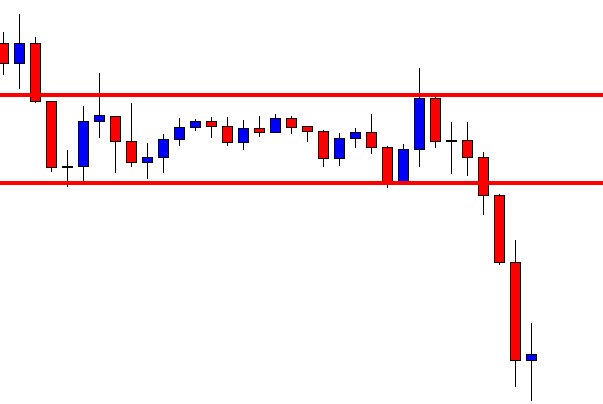

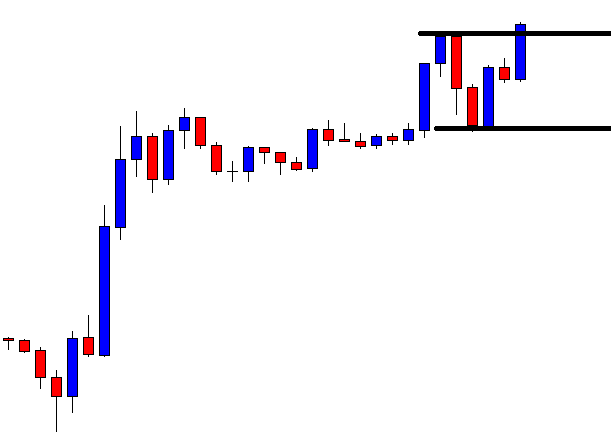

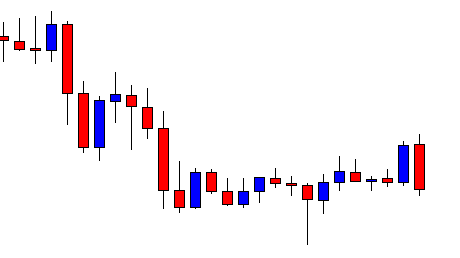

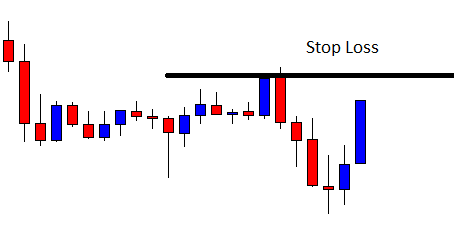

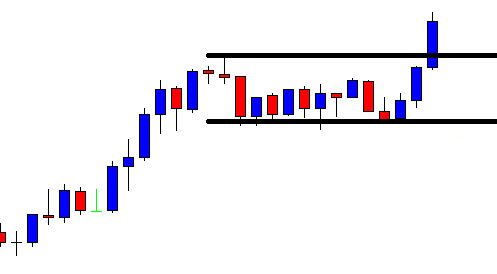

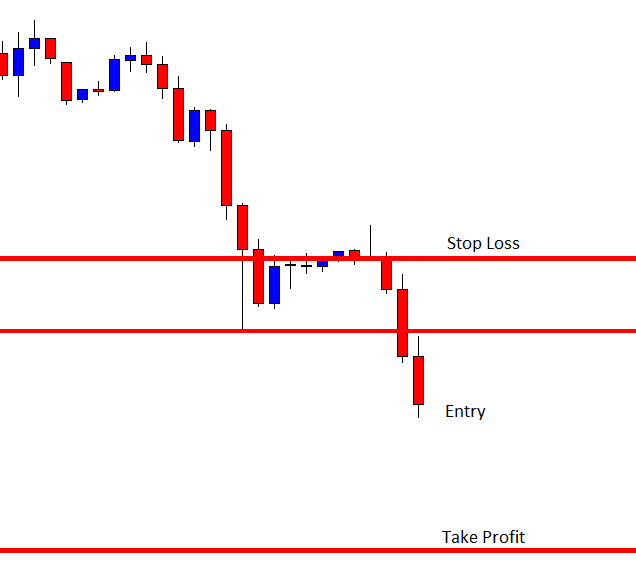

After making a bearish move, the price makes a correction. The last candle on the chart comes out as a bearish engulfing candle. This means the price finds its resistance. If it heads towards the swing low and makes a breakout, price action sellers may jump into this chart to make some green pips by going short in the pair.

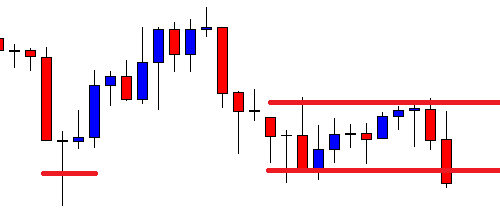

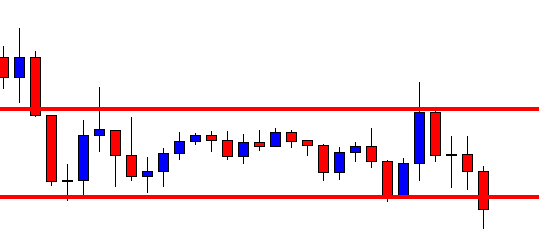

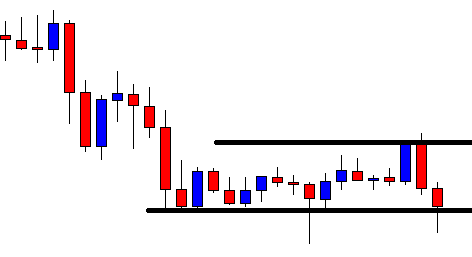

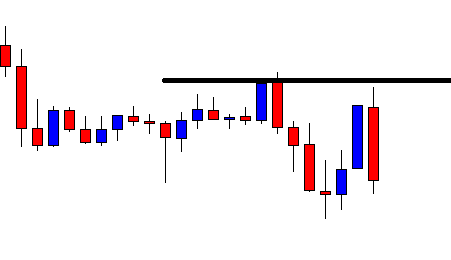

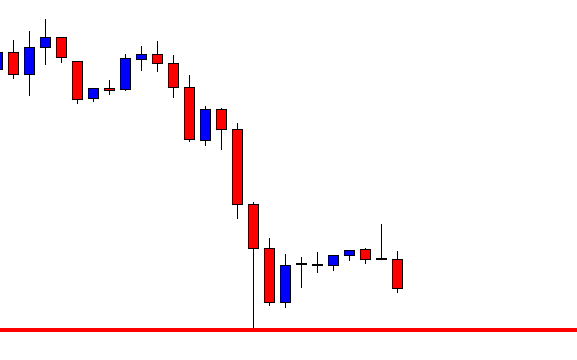

The last candle makes a breakout at the level of support. This is an explicit breakout. Please note that the price bounces at the same level earlier. This means this is a double bottom support level on the bigger chart. This is an H1 chart. Thus, this must be a double bottom support level of the H4 chart.

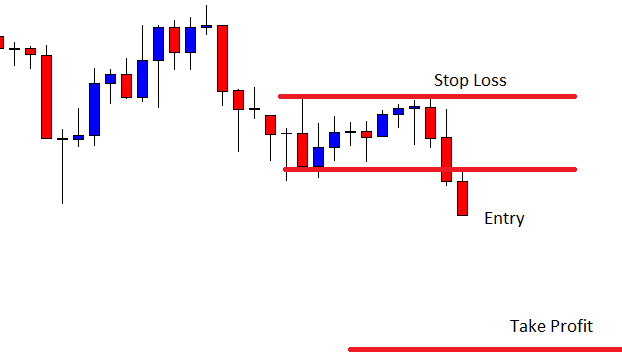

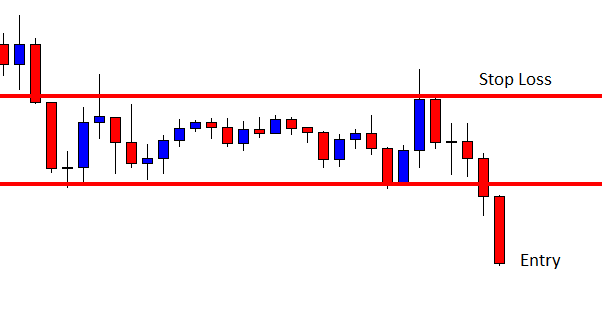

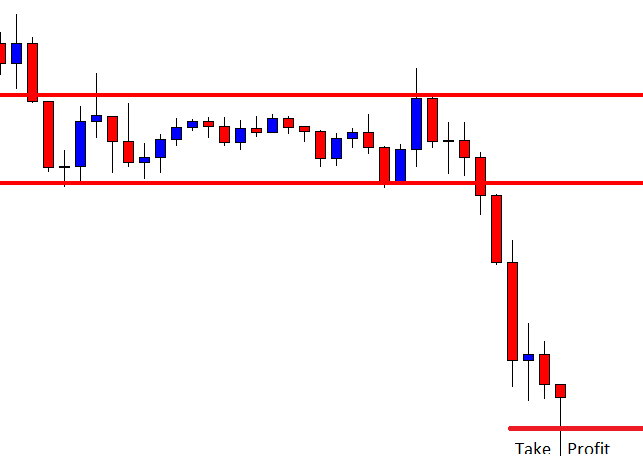

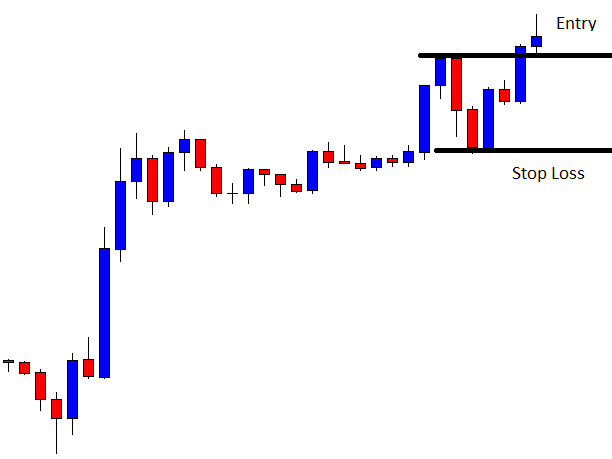

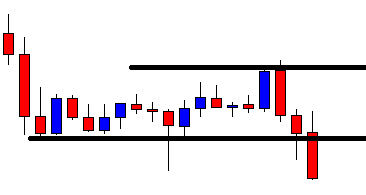

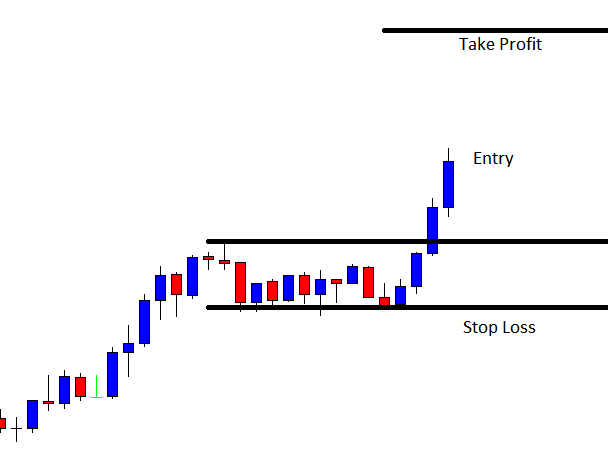

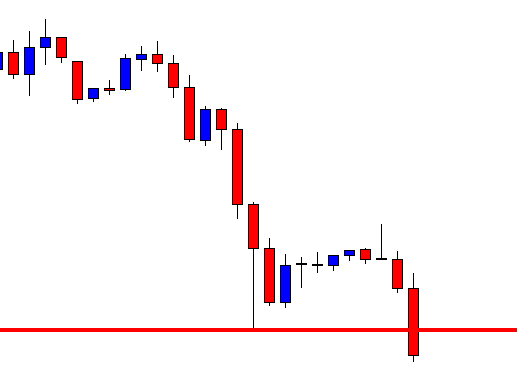

The next candle closes below the breakout candle. It confirms the breakout. The sellers may trigger a short entry right after the last candle closes by setting stop-loss above the level where the trend starts and setting the take profit with 1R.

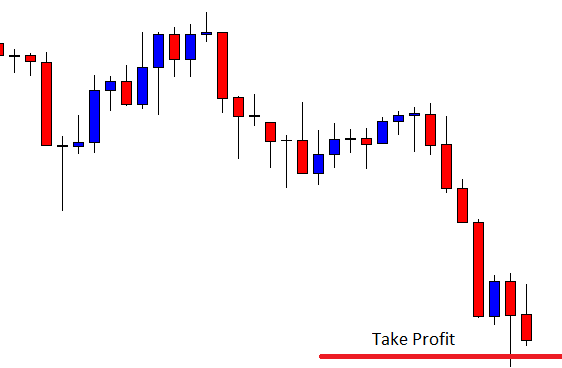

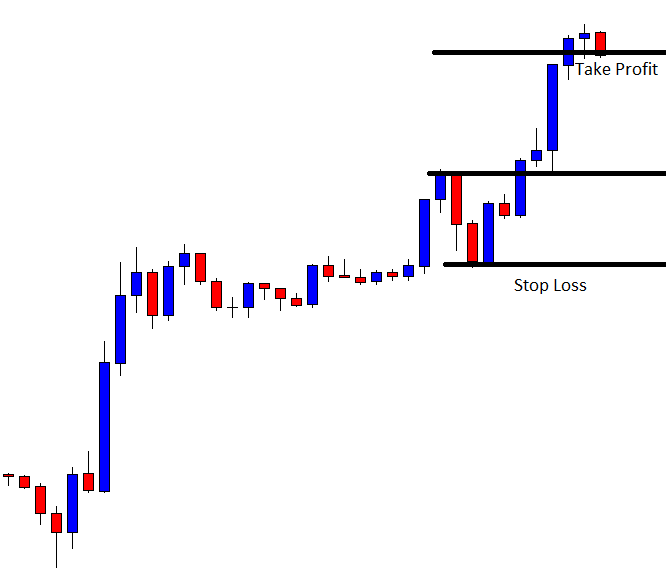

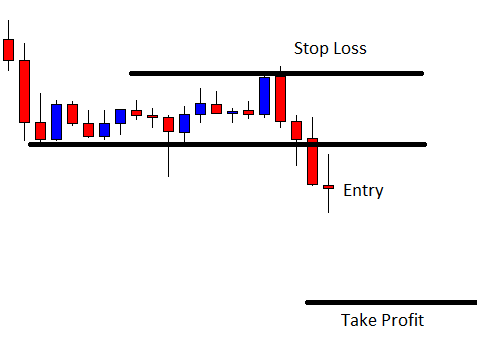

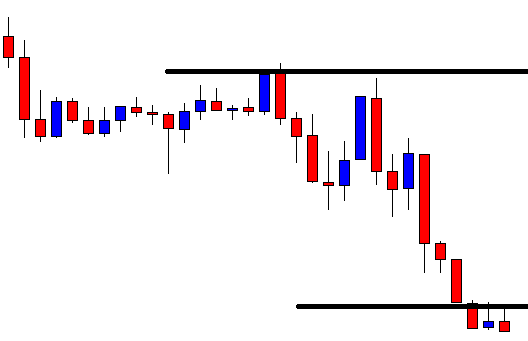

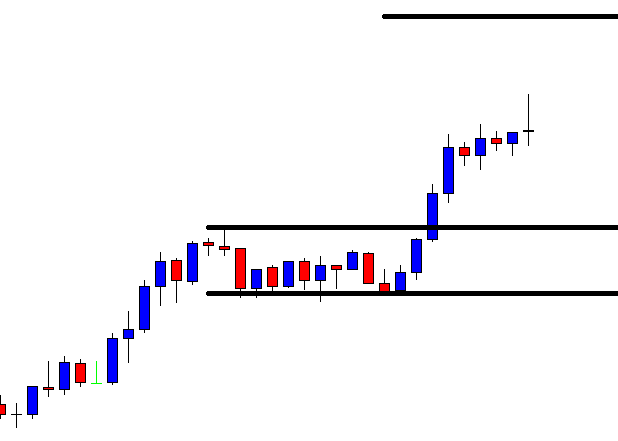

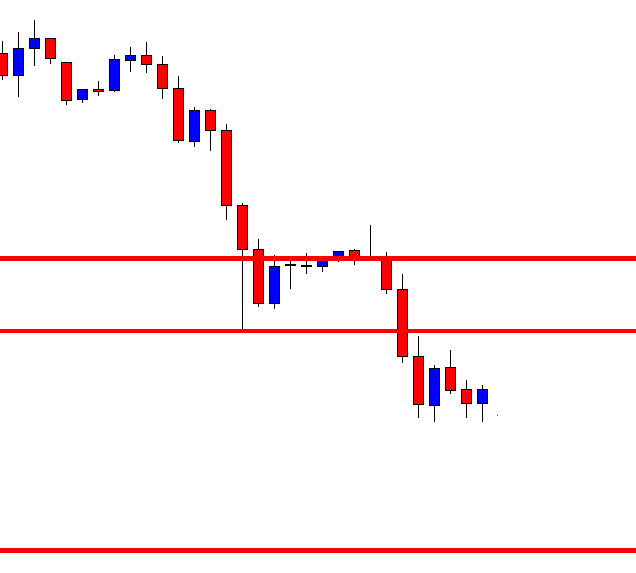

The price heads towards the South with extreme pressure. The price is about to hit the target on the next candle after triggering the entry. It does not, but the sellers get their message. A strong bearish candle like this suggests that the pair would remain bearish at least for two more candles. That would be enough to hit the target.

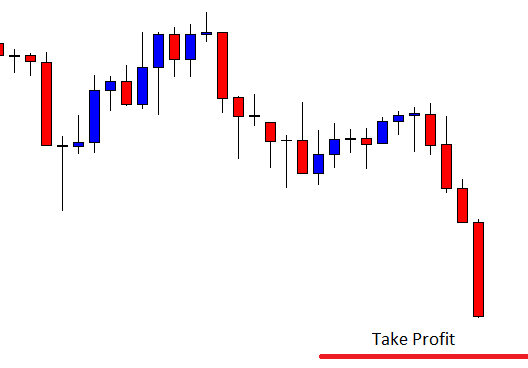

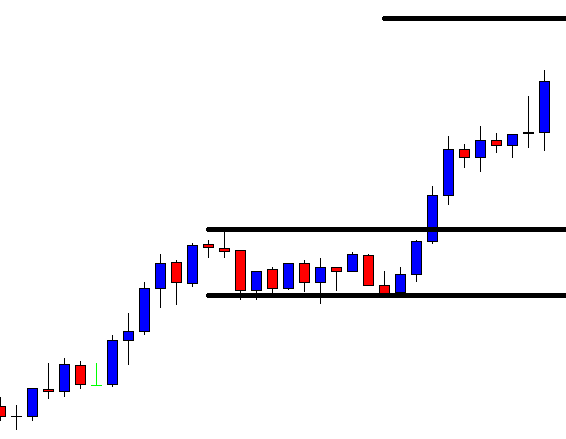

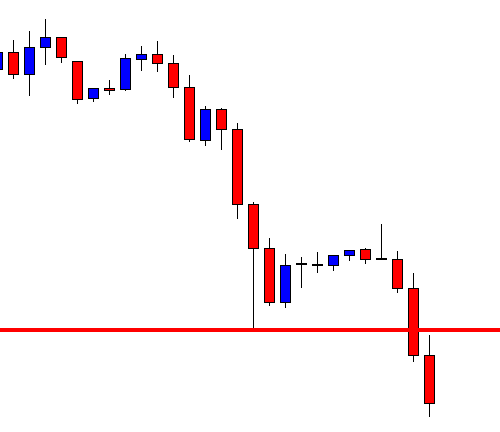

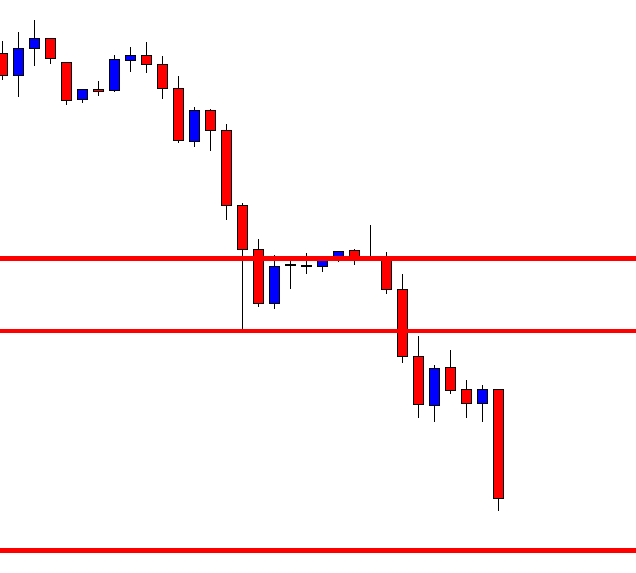

The chart produces a bullish inside bar before hitting the target. If we count, it takes only three candles to hit take profit level. As mentioned, the H1 breakout strategy hits take profit level in a hurry. So does this one. If we calculate the next candle after the signal candle, we see that the candle comes out as a very strong bearish candle and generates strong bearish momentum. This is often seen when the H1 chart makes a breakout at a level, which is a double top or double bottom level on the H4 chart too. We do not need to concentrate on this if we aim to trade on the H1 breakout strategy. However, noticing such things help us be better traders to some extent.