Above the market is an order type that executes above the current market prices or we can say order triggers in the future at the desired price we set. For, E.g., EURJPY is in a downtrend, and prices hovering around 132.50. Well, you believe that if the price action goes below the 130 Major level, then the asset is off the races.

Unfortunately, you are doing a 9 to 5 job, and trading is your part-time business and you are unable to watch the market the whole day. Therefore you place the order to automatically sell five lots of EURJPY once the prices can go beyond 130. At this point in the game, one of the two things happened. If the prices go below 130, your order will be a trigger. If the price action failed to cross the 130 major levels, your order is never executed. We have covered the basics here now let’s dig a little further.

TYPE OF ORDERS ABOVE THE MARKET

BUY STOP ORDER

Buy stop order is the order price that you set above the current market price to buy. If you place a buy stop order, then your broker will automatically trigger your order once the price is reached. No one knows at what price your order will fill; it should be close to your buy stop order price. Most traders use the buy stop orders to open a long position on a breakout or to close a short position that is going against you.

SELL LIMIT ORDER

The sell limit order is also above the market order. Here you believe that the market will run to a specific level and then it fails to move further and sooner we going to experience a downtrend. Therefore you are looking to open a short position at a significant level. Assume there is a significant resistance level at 130 levels in the EURJPY pair and you set the sell limit order because you believe when the prices hit this level, we will witness a downtrend.

TRADING STRATEGIES FOR USING THE ABOVE THE MARKET ORDERS

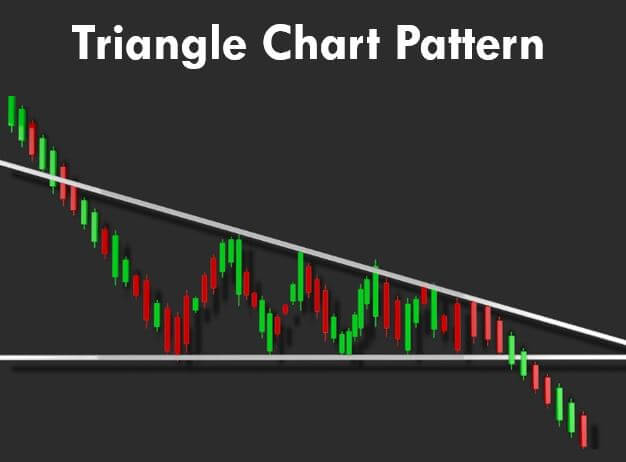

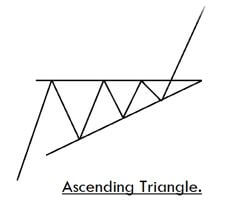

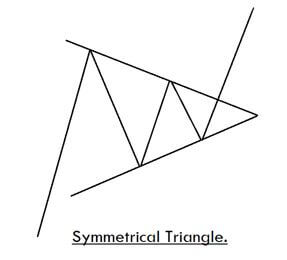

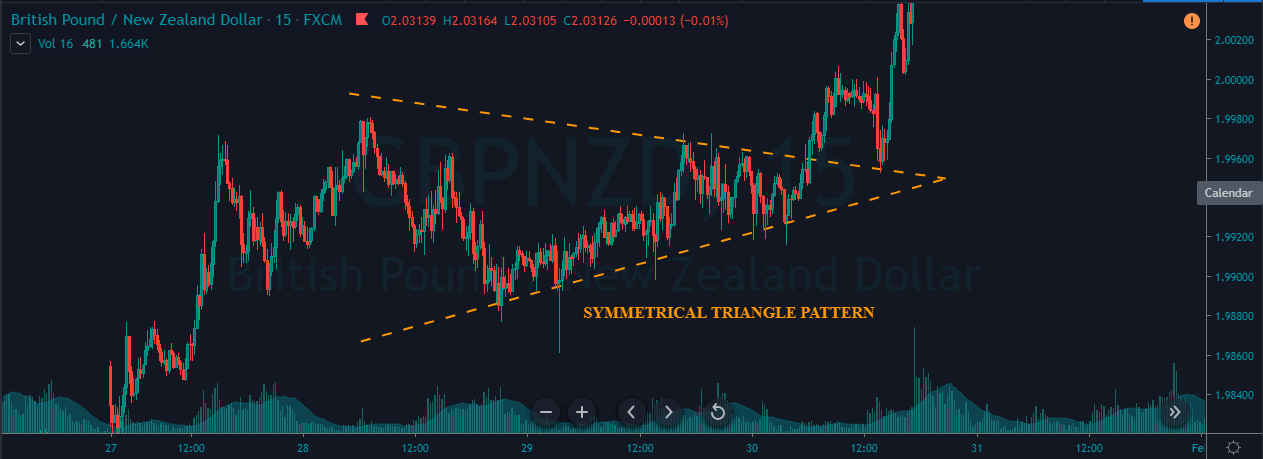

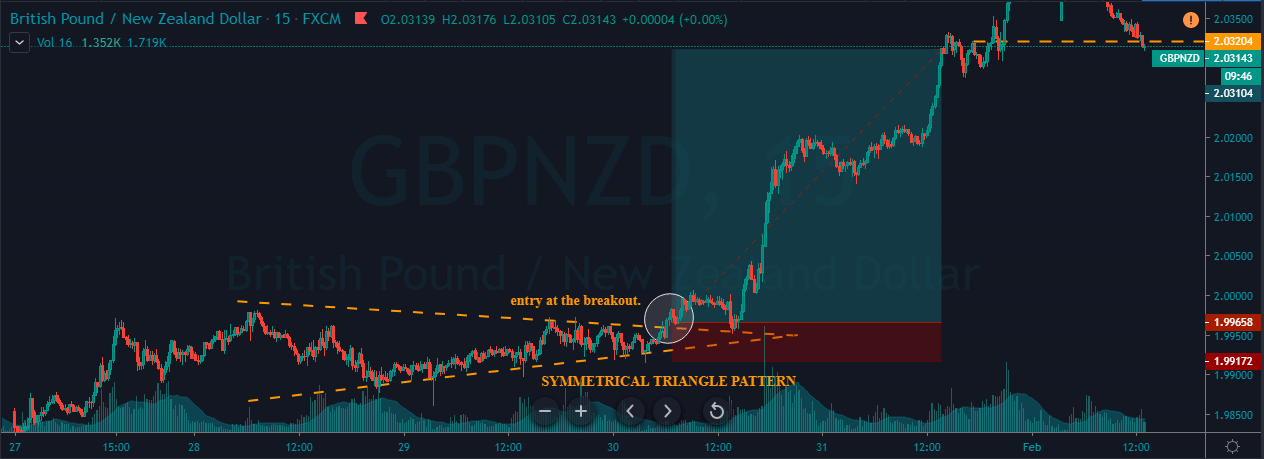

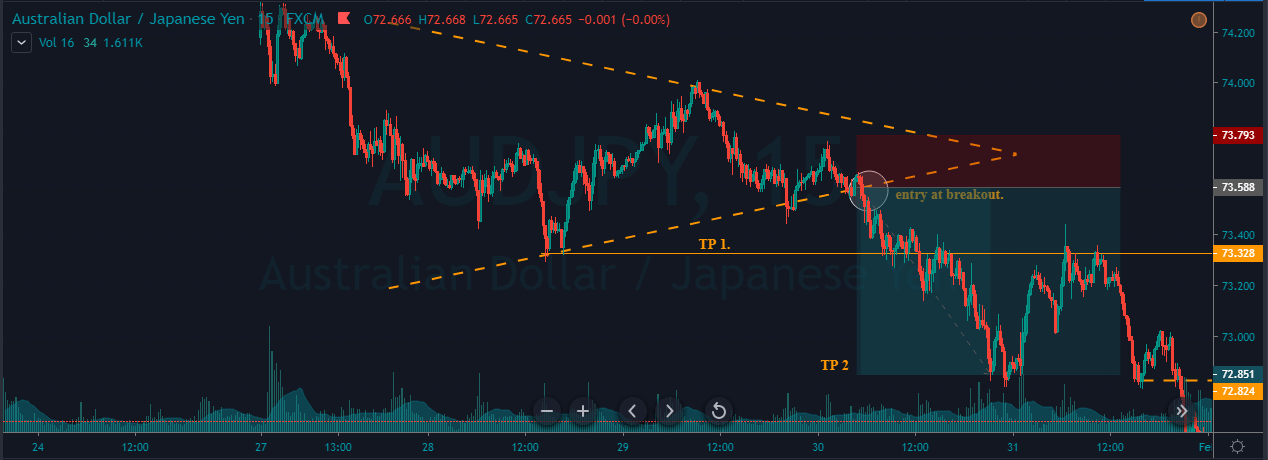

BUY STOP ORDERS AND SYMMETRICAL TRIANGLE

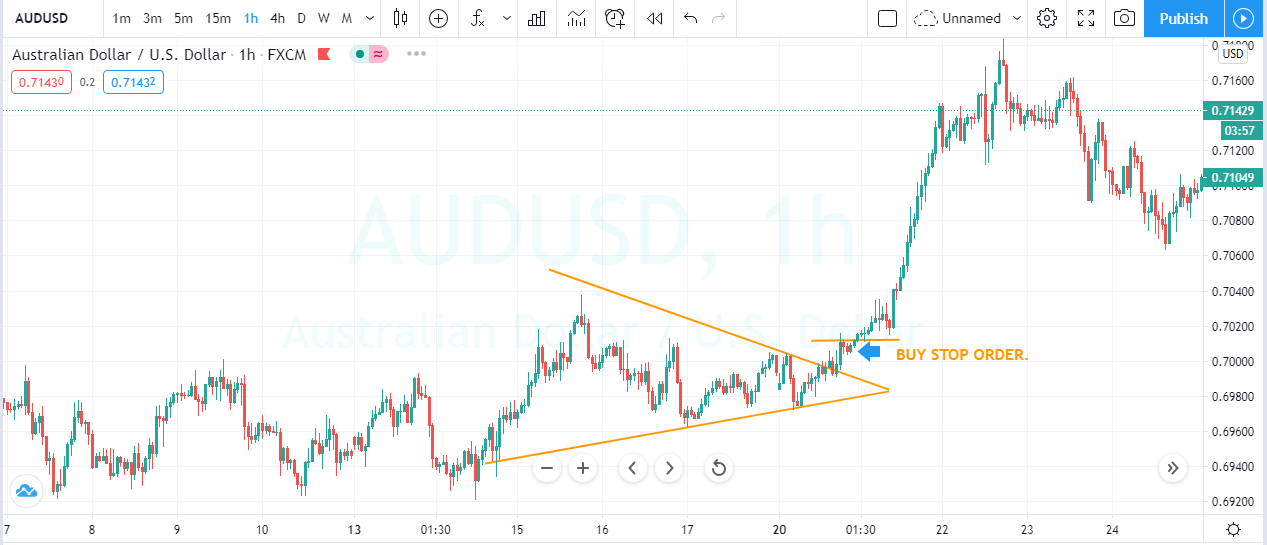

Buy stop order works very well in bullish chart patterns. Here in this strategy, we are using the symmetrical triangle to trigger the buy stop order by connecting two lower high and higher low draw the symmetrical triangle on the price chart, and place the buy stop order outside the symmetrical pattern. Your buy order will be trigger when the price action breaks the pattern. Place the stop loss order below the pattern and go for a brand new higher high.

The image below represents the symmetrical triangle chart pattern on the AUDUSD forex pair. The blue arrow was the area where you should place the buy stop order. After the breakout when the price action triggered the buy stop order, the stop loss should be placed below the resistance line of the pattern. The resistance line acts as dynamic support to the price action, which helps the traders to stay in a trade and always choose the brand new higher high for the take profit.

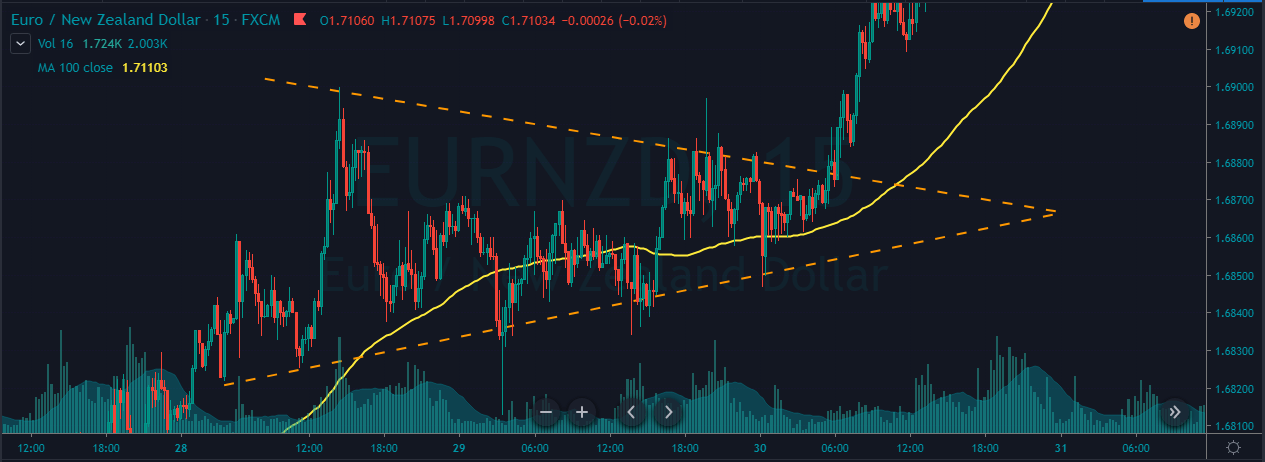

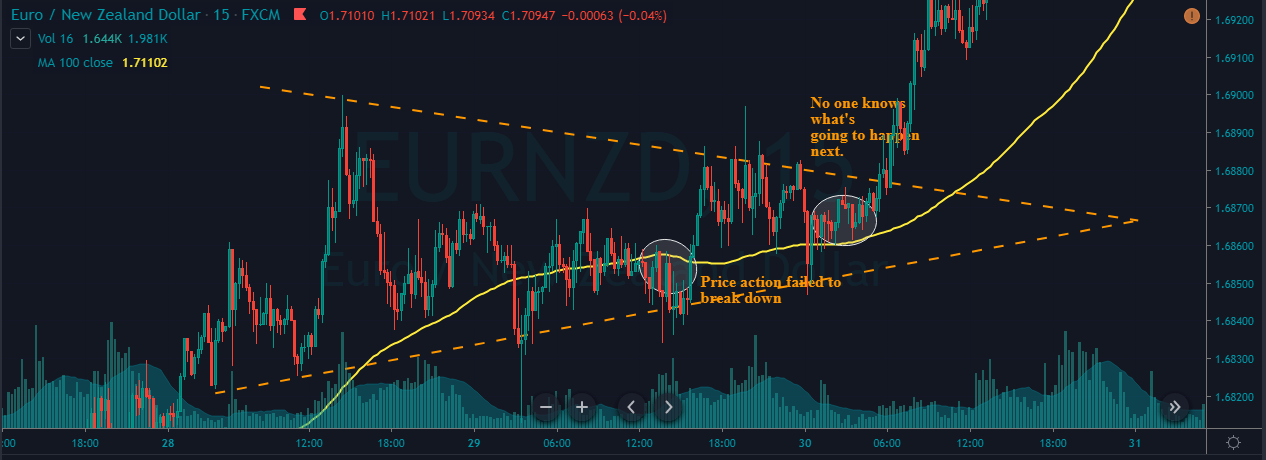

HIGHER HIGH BREAKOUT TRADES

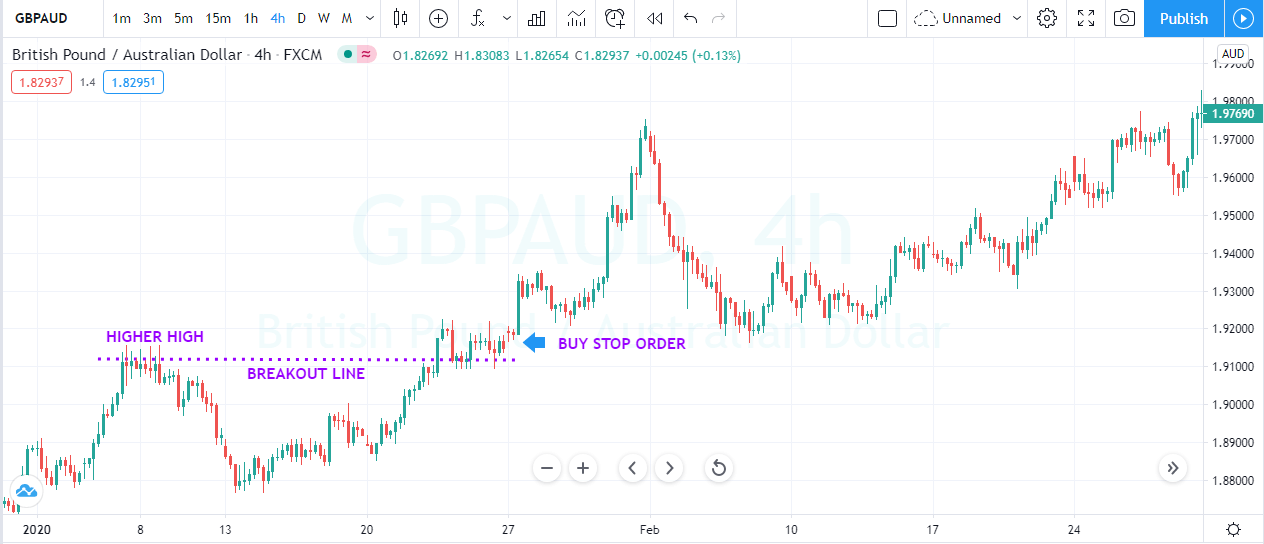

The buy stop order is efficient for trading the trending market conditions. Find out the trending market, wait for the price action to print brand new higher high, after the brand new higher high let the price action to pull back enough and place the buy stop order above the most recent higher high. Wait for the prices to break the most recent higher to trigger your order. Most of the time, when price action breaks the recent higher high, it is a very high likelihood that the prices will continue more elevated in the same direction. No one knows how much the price action goes higher after the breakout, but it is advisable to close your trade when the price action approach to the significant resistance level.

The image below represents the buying trade in the GBPAUD forex pair. The currency was in an uptrend, and after the pullback, it breaks above the most recent higher high. After the breakout, our buy stop order was triggered, and we choose to go for the brand new higher high.

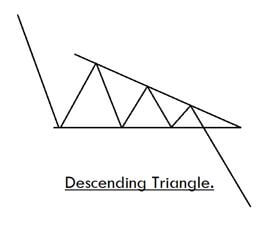

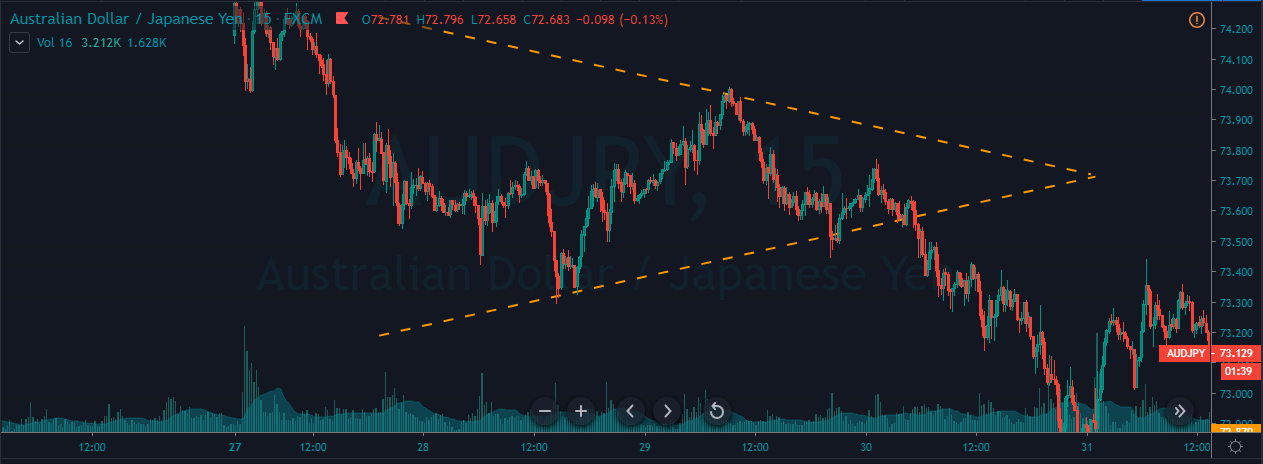

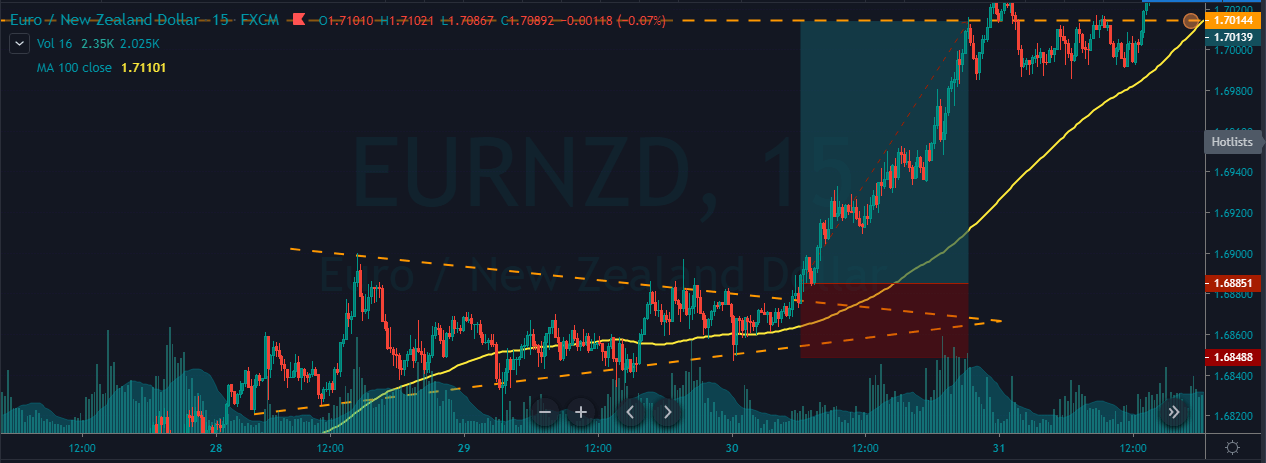

USING THE SELL LIMIT ORDER TO TRADE THE BREAKDOWNS

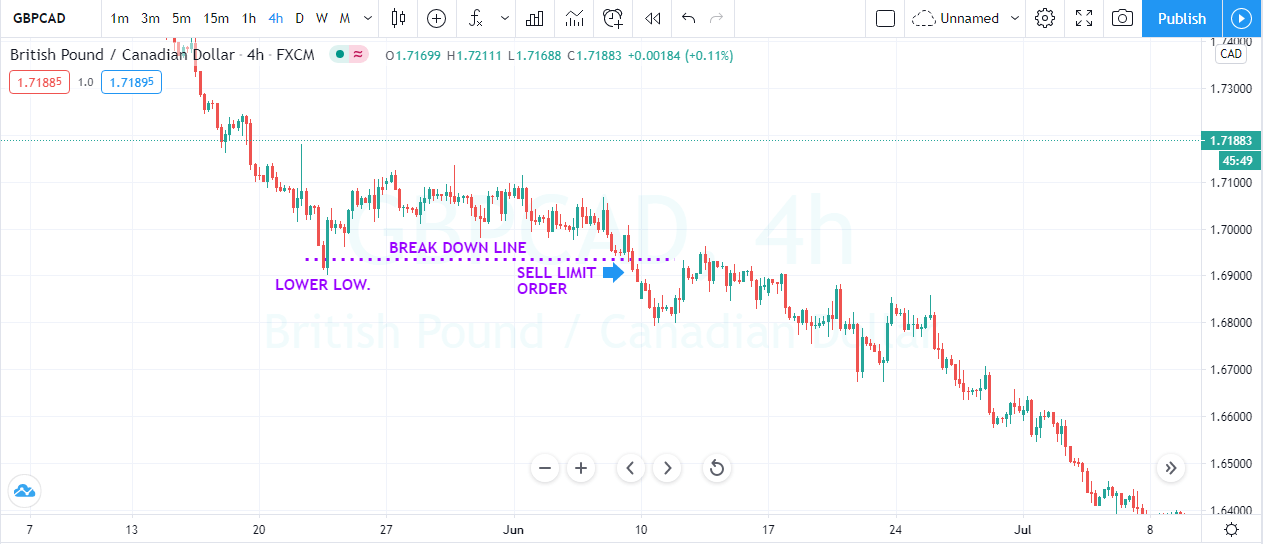

The sell limit order is useful to trade the downtrend markets. Look for the downtrend markets, wait for the pullback to happen, and place the sell limit order below the most recent lower low. Wait for the prices to break the most recent lower low to activate your sell limit order. On the left side of the chart looks for the significant level to close your selling position. The stop-loss order should be above the most recent lower low.

The below image represents the downtrend on a GBPCAD forex pair. As you can see around the 22nd of May, we witnessed the lower low in the pair. As the price action pulled back enough, it starts to roll over again and breaks the most recent lower low. At the break of the lower low, we choose to put the sell limit order and sooner market triggered our order, and we witnessed the brand new lower low.

SELL LIMIT ORDER AND BEARISH TREND

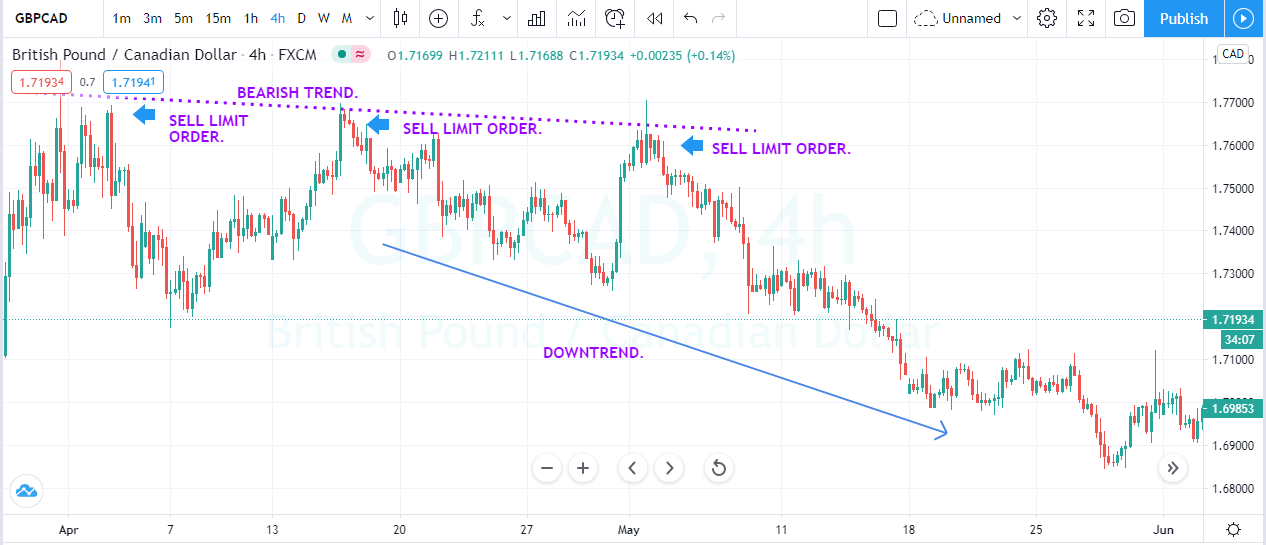

Find out the trending lower asset, which keeps approaches the timeframe support area. At those stages of the market, you will witness that the selling trend has a hard time to print lower low because buying pressure of the main level affecting the prices, but overall sellers are still in control. After the number of corrective moves draws a downtrend line across this resistance line. Place the sell limit order at the downtrend line in anticipation for the price to roll over and continue its downtrend.

The image below represents the selling trades in the GBPCAD forex pair. The pair was firmly in a downtrend, and when the prices approached the major support area, we witnessed some strong buying moves. Each buying move was printing the lower high, and we used that lower high to activate our sell limit orders. In total, we took three trades with the stop loss above the trend line, and for booking profit, we choose the brand new lower low.

CONCLUSION

To trade above the market means to place the order at the desired price, which will trigger automatically. There are two types of above the market orders.

- BUY STOP – Buy the asset when the price action approached your desire price in an uptrend.

2. SELL LIMIT – Sell the ASSET when the price action approached the desired price in a downtrend.

The above the market orders are beneficial and convenient ways for part and full-time traders. Even part-time traders use these orders to execute their trades. Align your trading strategies with the above the market type orders to make some serious money from the market.