Introduction

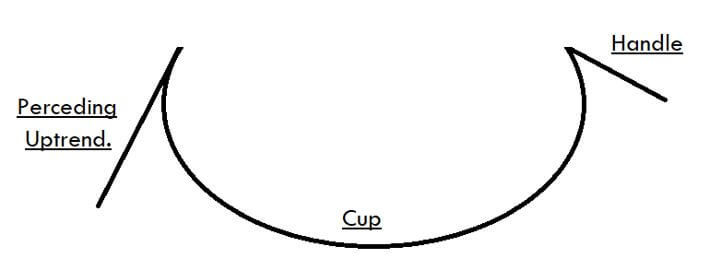

The patterns on the Forex charts occur when the price movement of an underlying asset is in the form of the shapes that we come across in daily life. These are visual patterns, and they provide a logical entry point along with appropriate stop-loss and take-profit order placements. The Cup and Handle is one such pattern; this is one of the oldest chart pattern identified by technical trading experts back in the late 20th century. This pattern is very reliable and very commonly used by traders across the world.

American trader and author ‘William J. O’ Neil’ defined the Cup and Handle pattern in his 1988 classic, “How to Make Money in Stocks.” This pattern occurs in all the types of the markets and is not confined to Forex or Stocks. We can also find this pattern in almost all of the timeframe. Most traders prefer trading this pattern on a higher timeframe. Having said that, this pattern produces reliable trading signals on the lower timeframes as well.

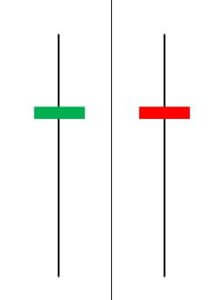

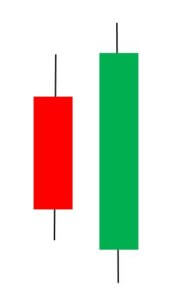

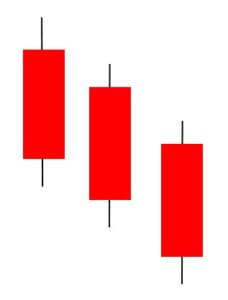

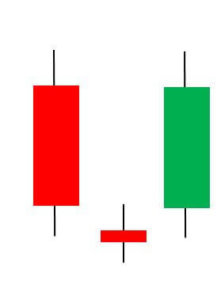

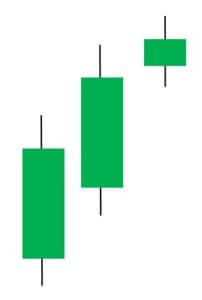

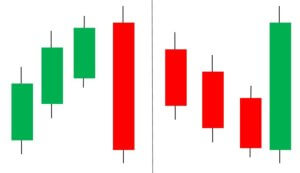

The Cup and Handle is a continuation pattern that occurs after the ongoing bearish or bullish trend. In an uptrend, when the price action reaches a peak point, if there is a price wave down, followed by a rally (approx. the same size of the wave down), this pattern is formed. It means that the price action has created a U-Shape or the Cup, and the Handle is for the confirmation and entering the trade. After the Cup, most of the time, price action turns sideways, or it drifts downwards that appear in the form of a handle on the price chart.

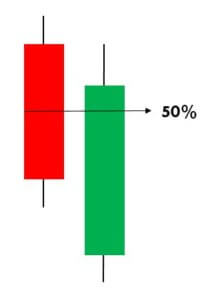

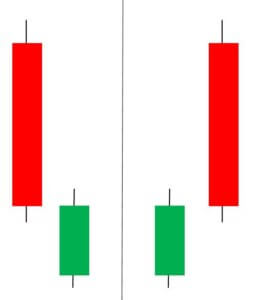

According to market situations, the Handle takes different forms. It prints in the form of a triangle, rectangle, or even congestion. The critical point for the Handle is that its extension shouldn’t be smaller than the Cup. The Handle should not even drop into the lower half of the Cup. For instance, if a cup forms between 0.1000 and 0.1100, the Handle must not go below 0.1050. Identifying the Cup and Handle pattern on the price charts is easy compared to the other patterns that we have discussed until now.

The Cup And Handle Pattern – Trading Strategy

Buy Example

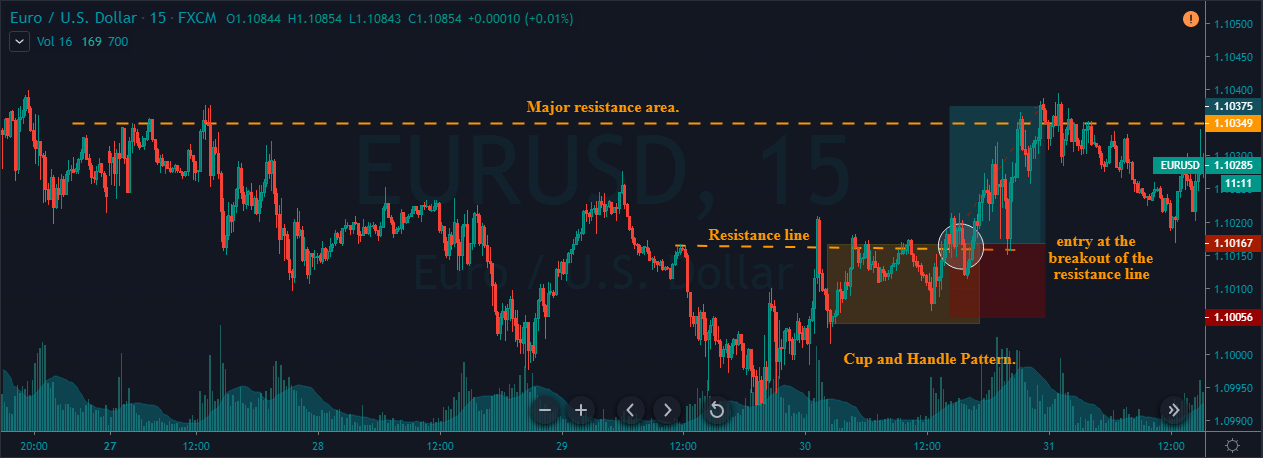

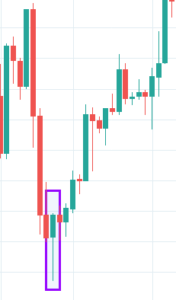

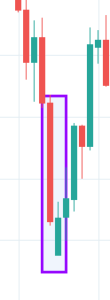

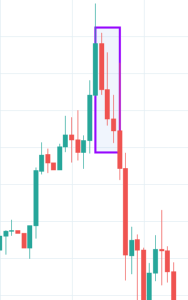

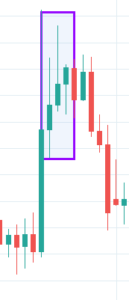

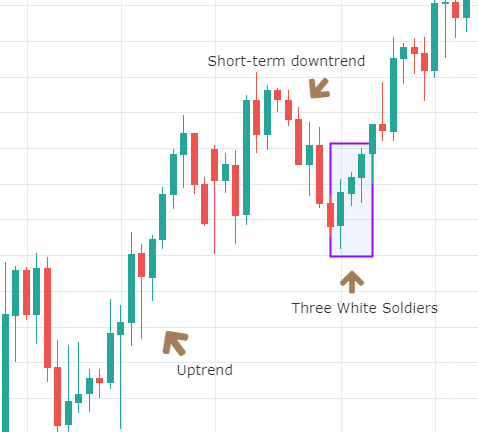

The below image represents the formation of a Cup and Handle pattern on the EUR/USD 15 minute chart. The highlighted part in the below chart is the Handle, and we can see the Cup on to its left.

There are many different ways to enter a trade using this pattern. In this particular example, let’s learn the most common way, which is the breakout method. A lot of advanced traders prefer trading the breakouts as they are reliable and work pretty well with the Cup and Handle pattern as well.

In the above chart, we can see that we had entered the market by placing a buy order when the price broke the primary resistance line. Now we can see why breakout trading is very reliable while trading this pattern. Our take-profit order was at the major resistance area, and stop-loss was just below the Handle. Here, we have seen how to trade this pattern for intraday trading. However, if you are a swing trader who plans to hold your position for more extended targets, please check out the next example.

Sell Example

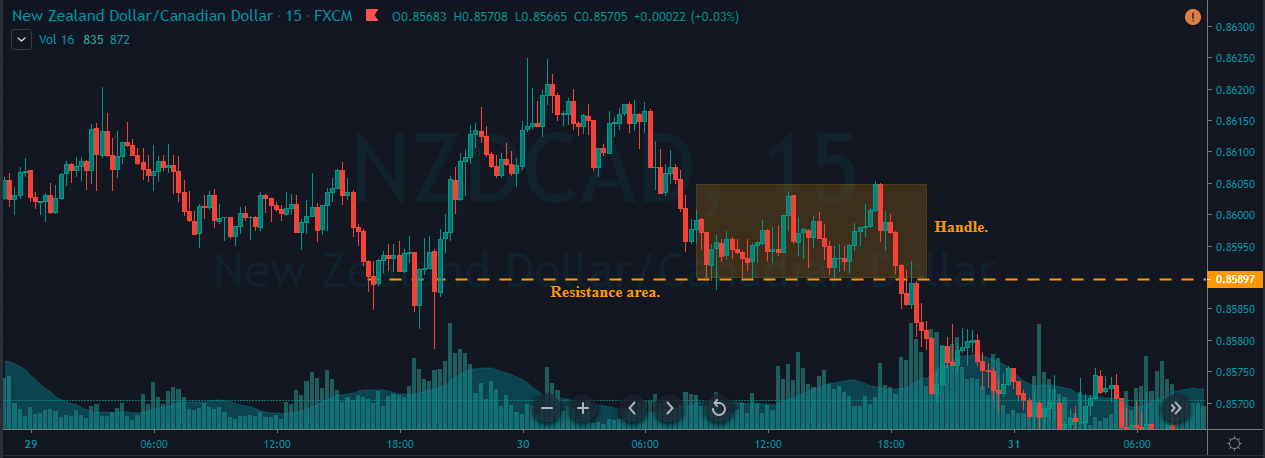

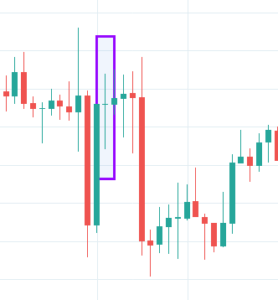

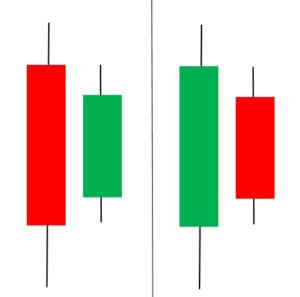

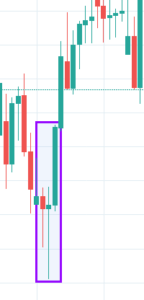

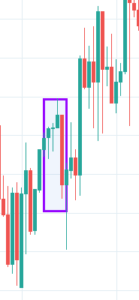

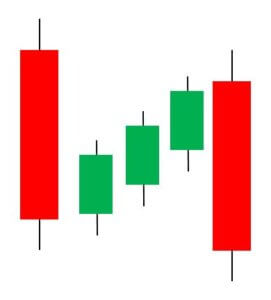

In the below NZD/CAD 15 min Forex chart, we can observe the formation of an inverted Cup and Handle pattern.

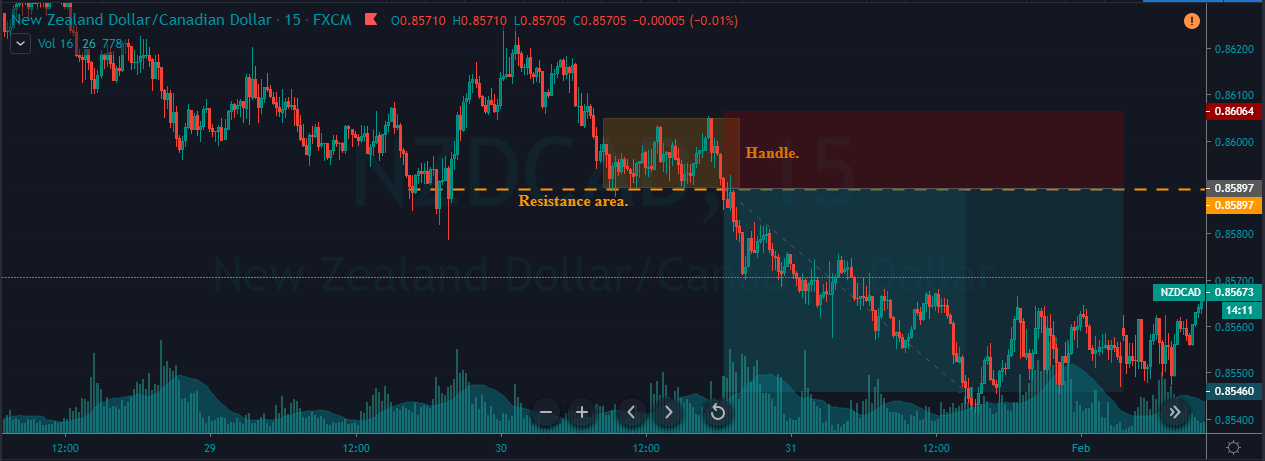

Right after the formation of the Cup, the price moved in sideways and resulted in a handle-like structure. After struggling a bit, the price broke the support line and made a new lower low. We have taken the entry in this pair after the appearance of a bearish confirmation candle. Right after our entry, we can see the market dropping down and printing a new low.

As a basic rule, the stop-loss placement was just above the Handle, and we ride more extended targets in this pair. We closed all of our positions when the market had a hard time print a new lower low. If you are a trader who likes to ride deeper targets, close your position when you see a consolidation. The reason is that a consolidation phase implies that both the buyers and sellers are strong. So at that point, it is not easy for the price to print a brand new lower low.

Limitations Of The Cup and Handle Pattern

Everything strategy or a pattern will have some limitations to it, and the Cup and Handle pattern is no exception. Market experts believe that this pattern is unreliable to trade in an illiquid market. The depth of the Cup plays a significant role in the strategy to perform. If the depth of the Cup is more, it might generate false trading signals.

This pattern can be found quite often on a lower timeframe. Most of the time, on lower timeframes, the Cup forms without the Handle. So make sure to pair this pattern with other reliable indicators or price action techniques to filter out the false signals.

Bottom Line

William O’Neil spent 20 years to broaden his views towards various patterns and ways to trade them. The Cup and Handle pattern is one of the results of all that fantastic experience. His broader view allowed him to shift his attention from the classical trading patterns to wonderful patterns like these. Remember that you need to be at least a little better than the other traders out there to ace the market.

Hence it is important to have a different point of view that millions of traditional retail traders out there. The problem with the setup is that most of the traders use a similar approach to exit their positions. The way we showed you to close the positions when the market turns into consolidation is one such creative idea that we have to follow to have an edge. All the best!