Introduction

After acquiring a fair bit of knowledge about Single and Double candlesticks patterns, let’s now proceed and learn the Triple Candlestick Patterns. A Triple Candlestick Pattern, as the name clearly suggests, is formed by three candles. In the next couple of articles, we discuss two Continuation patterns and two Reversal patterns to understand how these patterns are formed. Also, most importantly, we will be learning how to trade these patterns as well. So in this article, we will be discussing the basic & well-known Continuous Triple Candlestick Patterns – Three White Soldiers and Falling Three Methods.

Three White Soldiers Candlestick Pattern

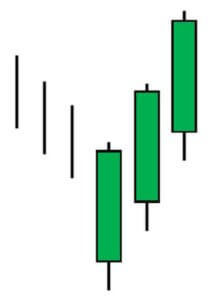

Three White Soldiers is a bullish triple candlestick pattern that predicts the reversal of the short term downtrend. The reversal of this short term trend leads to the continuation of the long term trend, and hence this pattern is classified as a continuation Pattern. This pattern consists of three long-bodied candles that open within the previous candle’s body and close above the previous candle’s high.

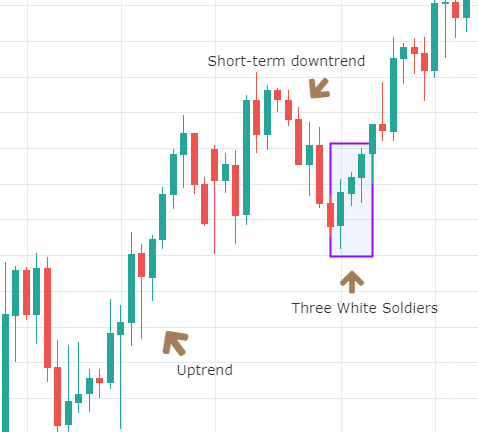

Below is how the Three White Soldiers candlestick pattern looks on the price chart

Criteria for the pattern

- The second and third candles should open within the body of the previous candle

- All three candles in the pattern should not have very long shadows.

- The continuation pattern is confirmed by other technical indicators such as the RSI and EMA.

Three White Soldiers pattern is used by traders for both entry and exit. Traders, who were short in the currency pair will look for exit and traders who were following the long term uptrend take a bullish position and enter the market.

Falling Three Methods

The Falling Three Methods is a major trend continuation pattern and is sometimes referred to as five candle patterns because of the confirmation candles at the first and fifth positions. These two long candles confirm the trend and its continuation. The sole of this pattern is the three counter-trend candlesticks in the middle. This pattern should never be considered as a reversal pattern; it is a clear trend continuation pattern.

Below is an image of how the pattern looks on the price chart

Criteria for the pattern

- The Falling Three Methods is a bearish continuation pattern with two long candlesticks in the direction of the main trend and three counter-trend candles in the middle of the two big bearish candles.

- The series of small-bodied candles should be of the same color. However, a bearish Doji as the third candle can also be considered.

This pattern is used by traders to initiate new short positions or add to an existing one. A trade is taken only after the fifth candle, which confirms that the trend is going to continue. There are also traders who use the 10-day moving average to confirm that the market is in a downtrend. While trading this pattern, one needs to make sure that this pattern is not at the key support level.

Conclusion

These are two famous triple candlestick trend continuation patterns. Make sure not to use these patterns stand-alone. They must be paired with other credible technical tools like indicators or chart patterns to confirm the authenticity of signals they generate. In the upcoming lesson, let’s look at some of the Reversal Triple Candlestick Patterns. Cheers!

[wp_quiz id=”61436″]