Introduction

We have discussed all the major Harmonic trading patterns in our previous course lessons. The purpose of this article is to provide a comprehensive summary so that it will easy to navigate for you. Although you have a fair idea on how to trade these patterns, it is essential to practice them over and again to master them. From our personal experience, we can say that Harmonic patterns are THE most difficult patters to trade, and there are many reasons for it.

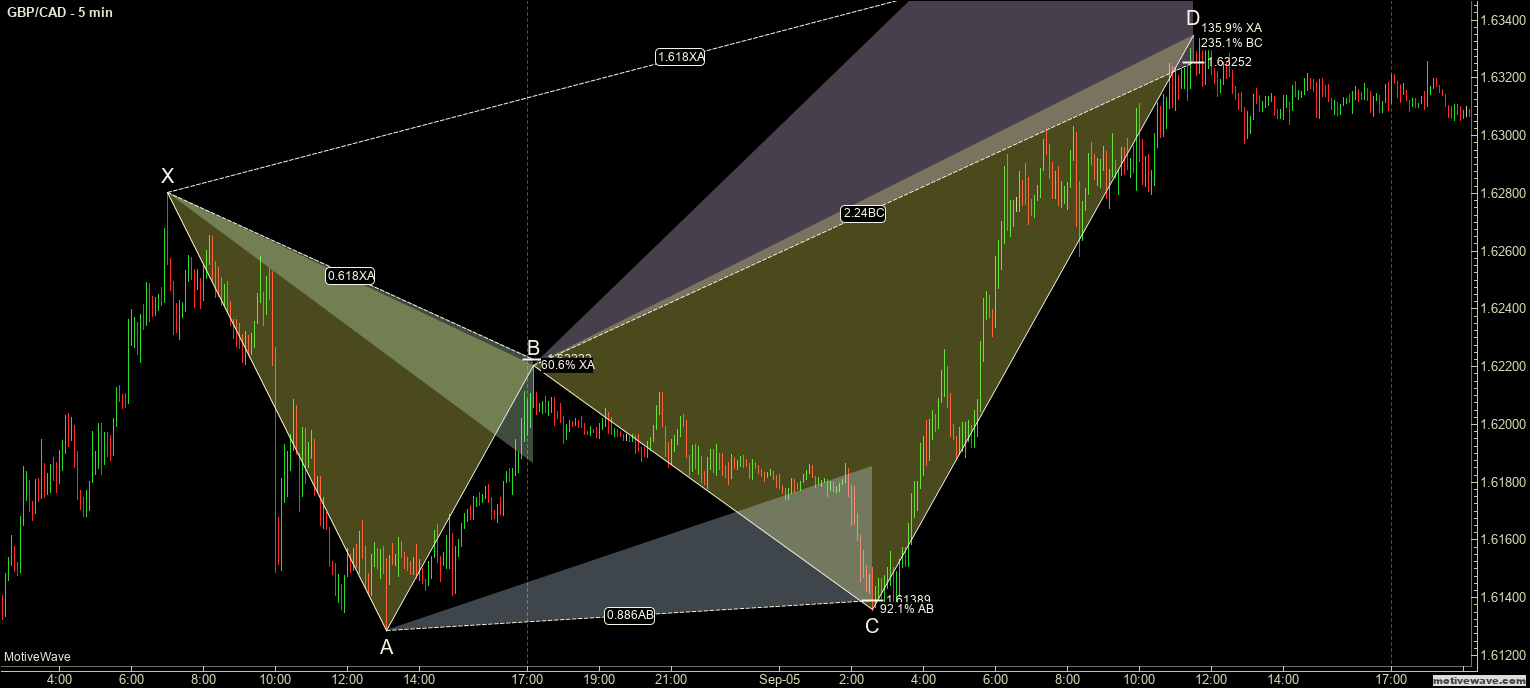

One of the critical reasons why it is so difficult to trade these patterns is because of its lack of appearance on the price charts. That is, we hardly be able to see these Harmonic patterns forming in any of the currency pairs. Having said that, once we identify and trade them correctly, we can easily make a massive sum of profits when compared to trading other Forex patterns. Hence, as a technical Forex market analyst, you must be able to identify and trade these patterns with the utmost accuracy.

In our previous course lessons, we have mentioned detailed ways to identify these patterns on the price charts using Fibonacci levels. Each of the pattern legs needs to respect specific Fibonacci extensions and retracement levels in order to confirm their formation. So make sure to take the help of these Fib ratios for easy identification. As always, keep practicing the trading of these patterns in a demo account until you master them.

Below are the links for the course lessons related to the Harmonic Patterns.

Introduction To Harmonic Pattern – Link

Trading The AB=CD Pattern – Link | Extended Trading Strategy – Link

Trading The Crab Pattern – Link | Extended Trading Strategy – Link

Trading The Butterfly Pattern – Link | Extended Trading Strategy – Link

Trading The Bat Pattern – Link | Extended Trading Strategy – Link

Trading The Gartley Pattern – Link | Extended Trading Strategy – Link

The only thing that is crucial while trading or identifying these patterns is to be patient. As you all are aware by now, it takes a lot of time for a Harmonic pattern to form. There will be many cases where three legs of the pattern will be formed accurately, but the final leg rules won’t be met, and as a result, the entire pattern gets invalidated. Don’t be disappointed or impatient at that point. After all, trading is a game of skill and patience; the more patient you are, the better results you will see. All the best!