Introduction

You would have heard most of the successful traders and market gurus say ‘let your winning trades run.’ That is very true, but do you know how to do that? You would have probably asked this to yourself many times. In today’s article, let’s understand a strategy that helps you in turning your small trades to big ones using a strategy called Pyramiding.

This Forex Pyramid Strategy helps you in increasing the chances of making consistent returns as a Forex trader. Using this strategy, we can scale our winning position and make the most of the trend. This strategy cannot be used in every market situation. If you do that, it will be the most destructive thing you do to your trading account.

Pyramiding our trades work very well in trending market conditions only. To make consistent returns from the market, we need to buy or sell strategically to add to an existing position. Always remember that when we are right, we must be really right, and when we are wrong, we must cut our trades immediately. The concept of this strategy can be applied to both long and short positions.

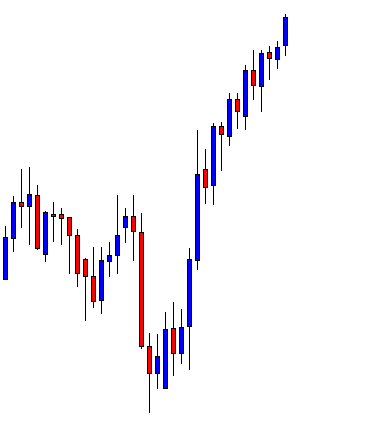

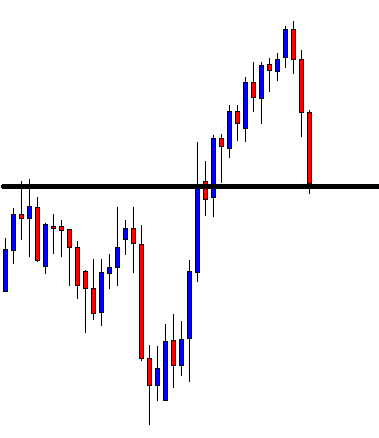

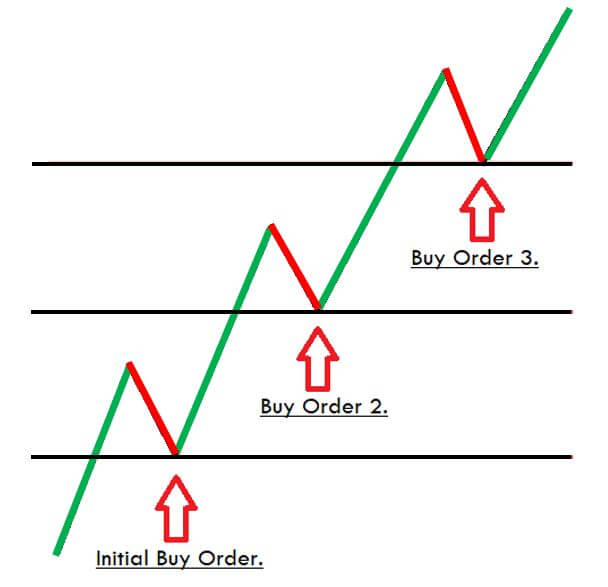

We can get a basic idea of the pyramid strategy from the below image. Here, we can see the price action printing brand new higher highs and lower highs continuously. The market is clearly breaking the resistance line and taking that line as a support. Note that the price action must break the resistance line with strong power. The price should also show the sign of holding at the support line.

The key to successful Pyramiding is to have a proper risk to reward ratio in place. That means our risk should never be greater than the reward. So if our target is 50 pips, our stop-loss must not be greater than the 25 pips.

Rules to Trade the Pyramid Strategy

🏁 Pick a market that is in a strong uptrend and wait for the price action to break the significant resistance area. Let the price test that resistance line as support.

🏁 Go long when the market gives you a buy signal. You can even look out for the appearance of any bullish candlestick patterns like Engulfing, Dragonfly, or a Bullish pin bar, etc.

🏁 Let that trade run because the market is in a strong uptrend.

🏁 Then wait for the price to break through the second resistance line and retest it as strong support.

🏁 Notice if the price is holding at the support line, and if it prints any buying candlestick pattern, go long again by extending your buy position. Make sure to trail your stop-loss after taking the second position.

🏁 Repeat the same, and do not forget to place your trailing stop-loss orders just below the entry points.

The same is vice-versa when the market is in a downtrend and when we are going short. By following this, we have built a good amount of buying position with minimum risk involved. Also, as discussed, the key to successful Pyramiding is to maintain proper risk to reward in each of the trades. As a thumb rule, our risk must never be greater than half the potential reward.

Trading The Pyramid Strategy

Market Identification - Strong Uptrend or Downtrend.

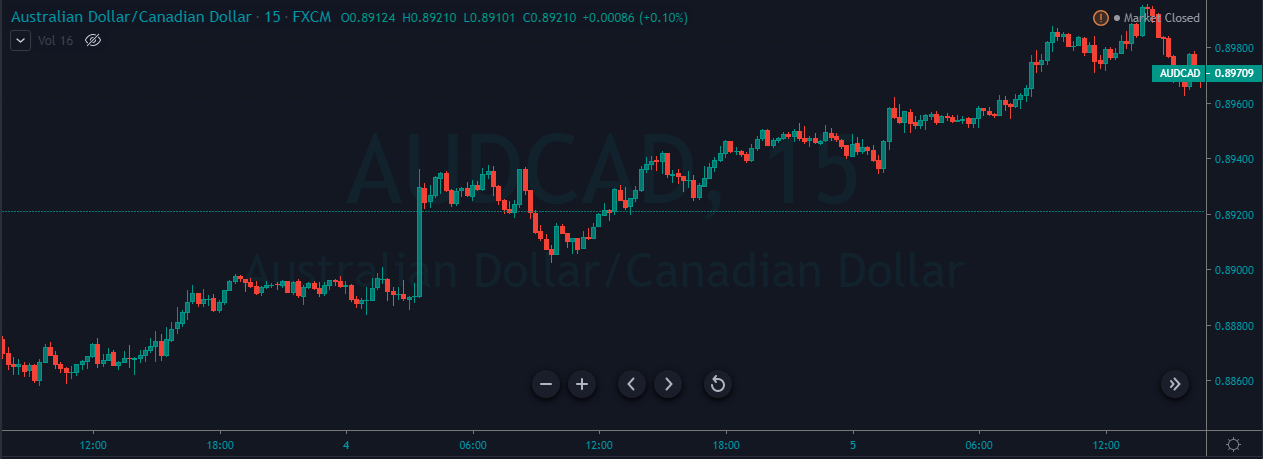

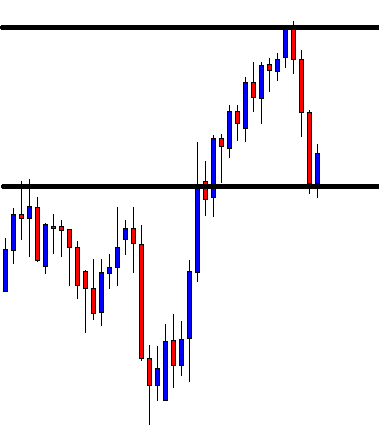

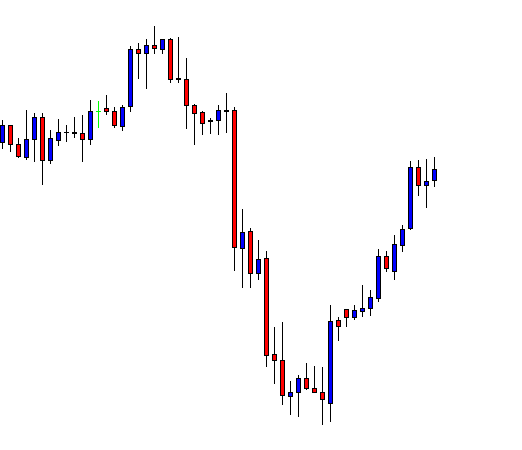

The below price chart represents the AUD/CAD Forex pair, which is in a strong uptrend.

To understand the strategy better, let’s consider a $10,000 trading account. In this particular pair, we decided to buy two mini lots on a retest of each of the levels. The take-profit for each trade is varied as per the market conditions, but the stop-loss for each new position should not be more than 15 pips.

Market Entries

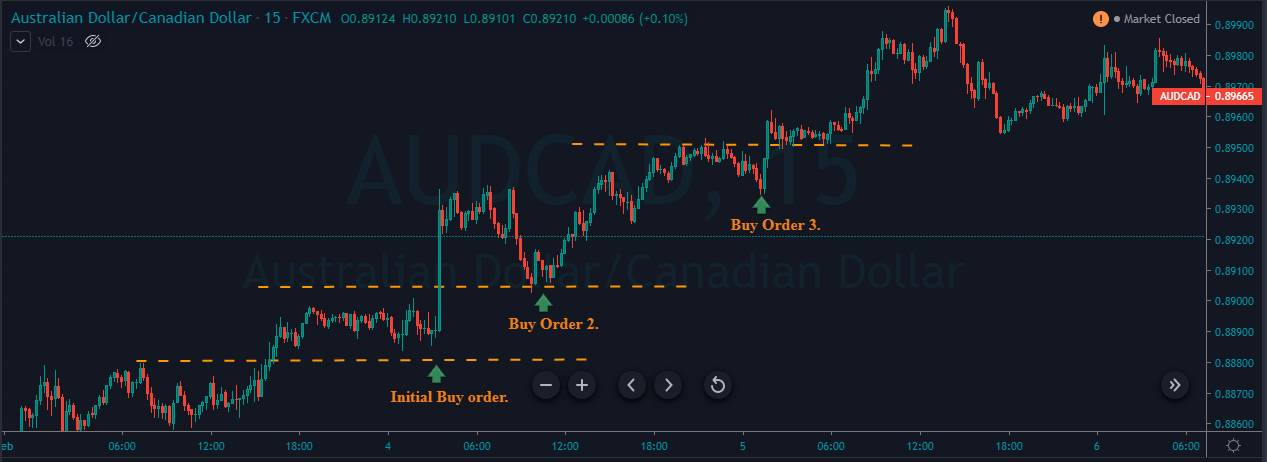

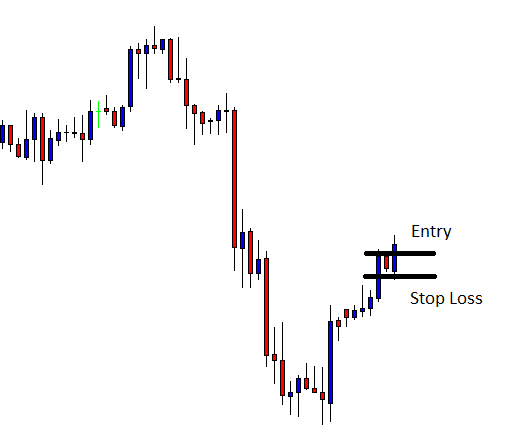

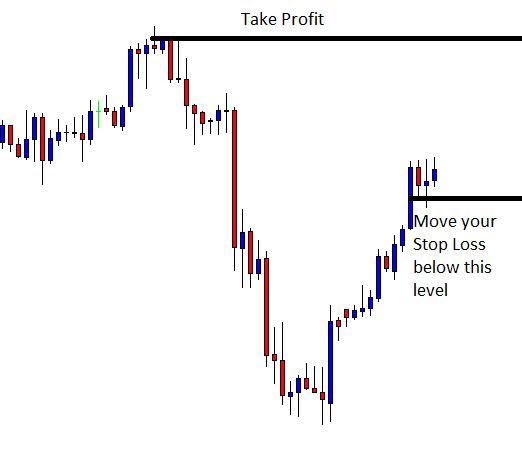

In the below chart, we can see the market broke through a resistance level. We have decided to buy 20,000 units right after the price took the broken resistance line as support. In a few hours, we have observed the price action blasting to the north and broke a new resistance level. The price again started to retest the level as new support.

At this point, we decided to buy 20,000 more units. You can see that the buy order 2 in the below chart indicates the second trade, and we have trailed the stop-loss below the second position. We found the trend to be super strong still, so we let this trade to run for the deeper targets.

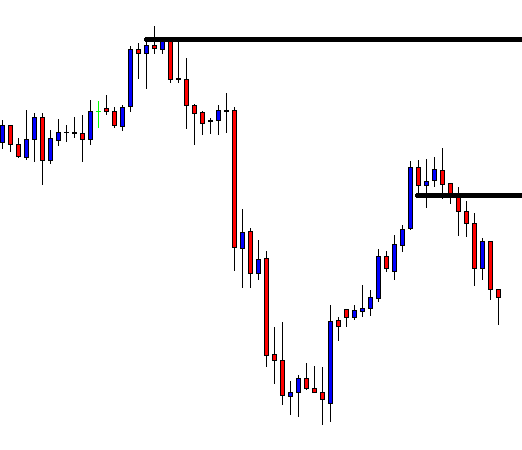

On the 5th of February, the price again broke through a new resistance level and retests as a support area. By seeing the uptrend’s strength, we have bought another 20,000 units and placed the trailing stop-loss order just below the third position.

We did a lot of buying up until this point and built 80,000 units in one single pair. So the real question by the end of the third position is how much of our money is at risk? Nothing. The worst-case scenario would be us making 10% profit by the end of the third position.

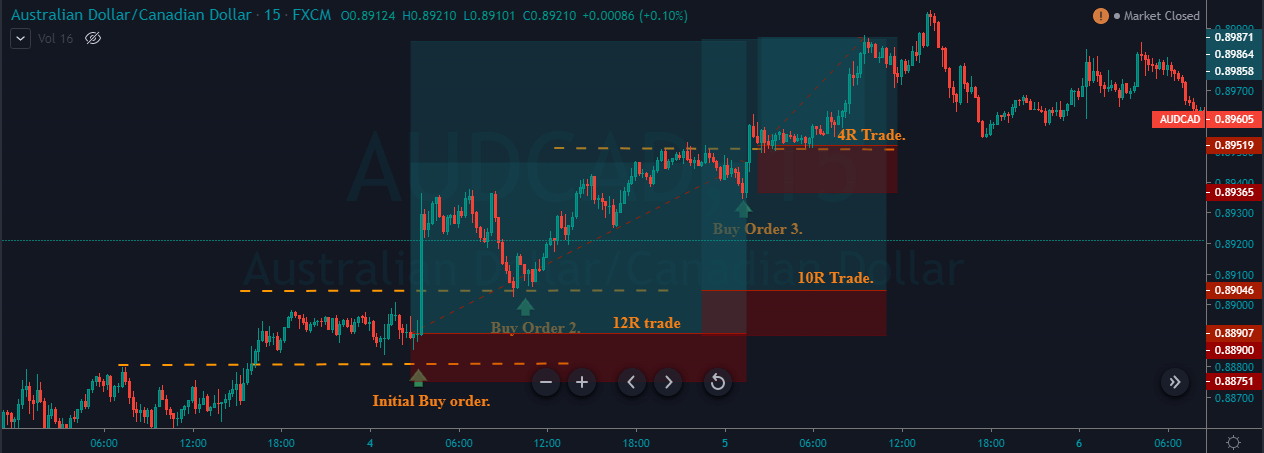

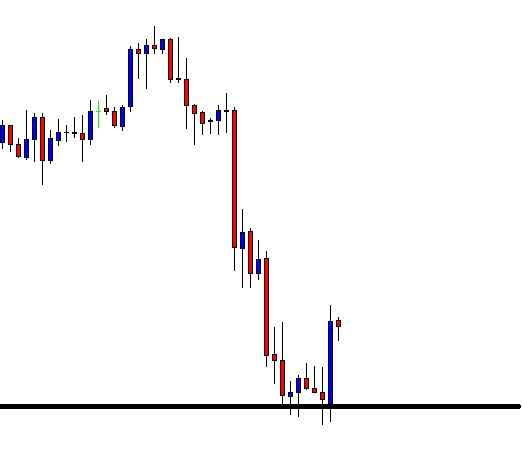

Final Trade Set-Up

In the above chart, we can see the final trade setup of all the three trades we took. By the end of all the three trades, we made a profit of 28 percent. The profits on each of the trades have compounded throughout the process, where the risk in each trade remains the same. Overall, we have generated 12R, 10R, and 6R in the first second and third trades, respectively.

Conclusion

Never forget that the pyramid strategy works very well only in the trending markets. Also, try to avoid using this strategy in volatile markets. Pyramiding is a great way to compound our profits in a winning trade. Knowing when to use and when not to use the pyramid strategy is the crux here. Hence it is advisable to read the different market situations on a demo account first before using this strategy on a live account.