The Three Principles – Timespan Principle

In another correlation to Western analysis, Hosada’s Ichimoku Kinko Hyo system has a timing component within the system. The numbering system used in Ichimoku is unique when compared to Western analysis. The reason for the numbering and counts in Ichimoku is related to the cultural importance of some numbers in Japan versus others. Numbers that would be considered ‘lucky’ in Japan are the same numbers in the West and many other cultures – particularly 7 and 9. But those numbers themselves are not what is important. How, exactly, this numbering and count system came to be developed in the fashion that it was developed I do not know. The following is directly from Ichimoku Chats – An Introduction to Ichimoku Kinko Clouds by Nicole Elliot – I heavily suggest getting her book (the 2nd edition). The important numbers are:

9, 17, 26, 33, 42, 65, 76, 129, 172, 257

If you ever study the work of WD Gann, then these numbers are not only familiar but non-random.

Numbering

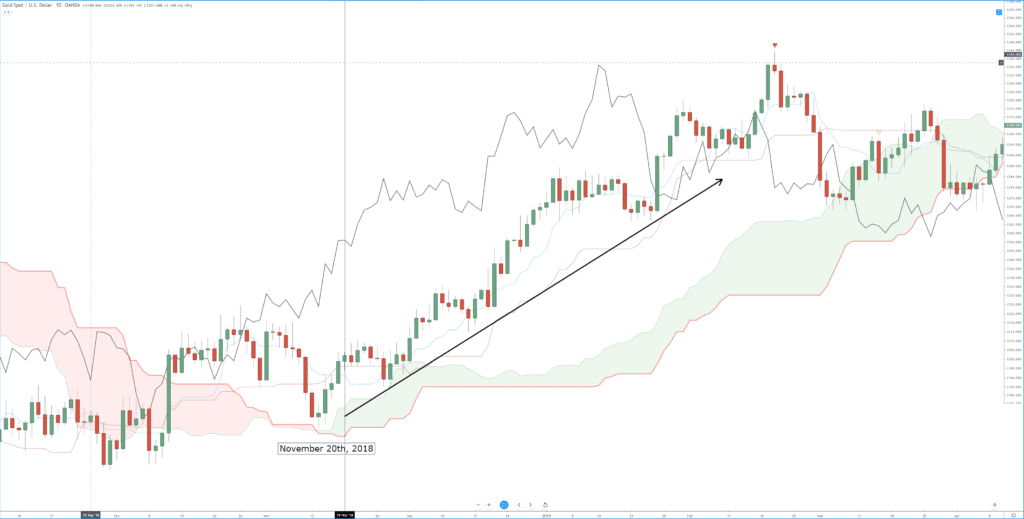

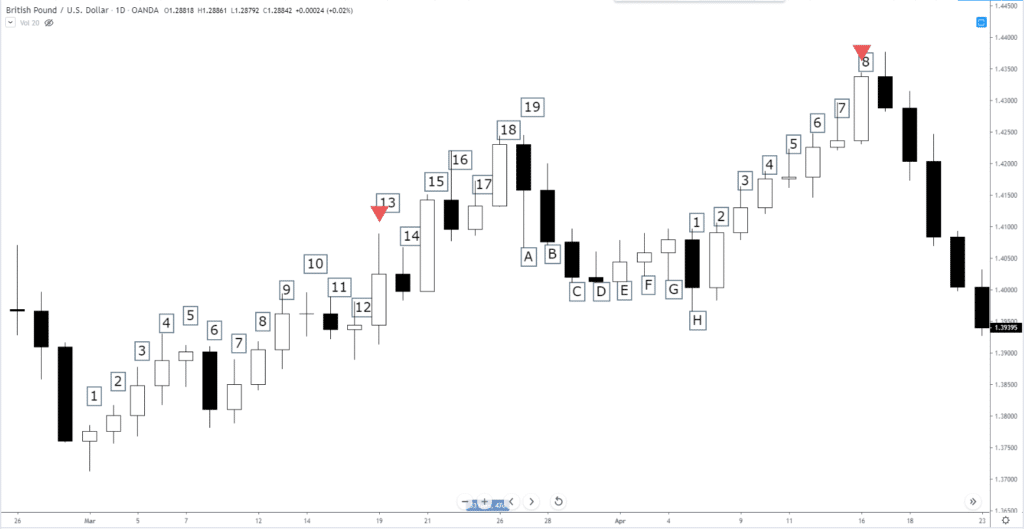

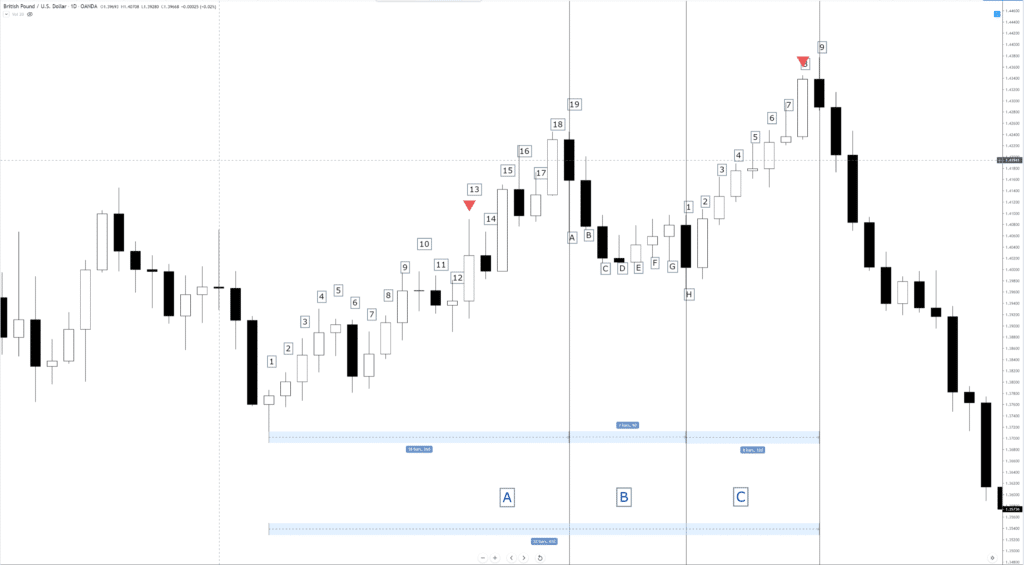

Numbering the candlesticks in a pattern is done with traditional Arabic numbers (1,2,3,4,5, etc.) and English letters (A, B, C, D, E, etc.). When counting how many candles are in a trend/wave, the last candle in an uptrend is counted as the first in the down wave and vice versa. See below:

Notice that candle 19 is also A, candle H is also 1. Also, notice that the time counts (total number of candles) in this ‘N’ wave all represent essential numbers in the Ichimoku number system. 19 is close to 17, H is close to 9, and 8 is close to 9.

Kihon Suchi – ‘Day of the turn.’

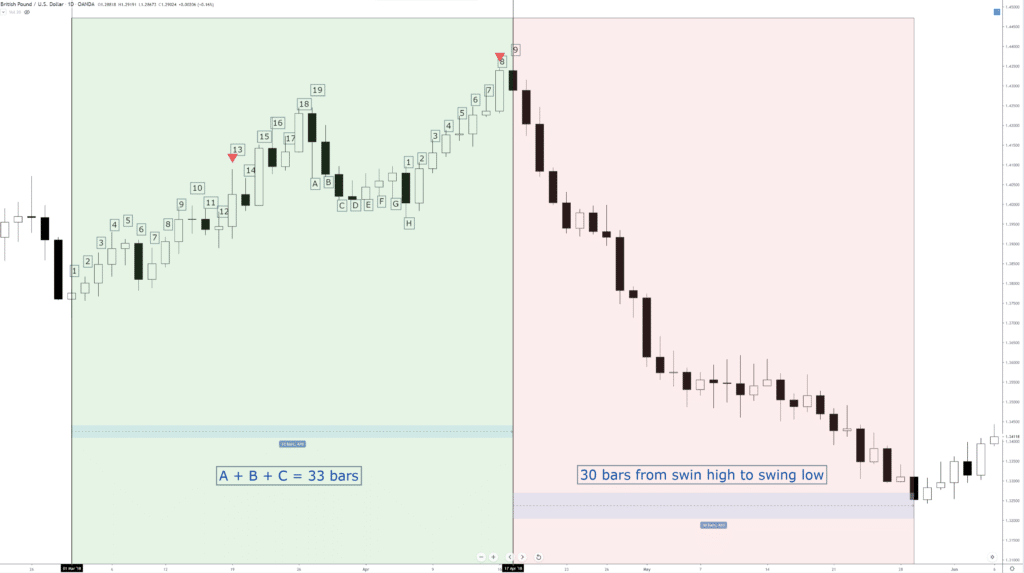

Nicole Elliot’s work is fantastic – it’s refreshing to read an analyst and trader who updates her work and goes through the grueling process of keeping it relevant. Kijun Suchi (‘the day of the turn’). The Kihon Suchi is the Hosada’s Timespan Principle put into practice. It is very similar to the use of Gann’s cycles of the Inner Year or horizontal Point & Figure counts to identify turns in the markets. Let’s use the image above again as an example. Below, I’ve separated the ‘N’ wave into A, B, and C.

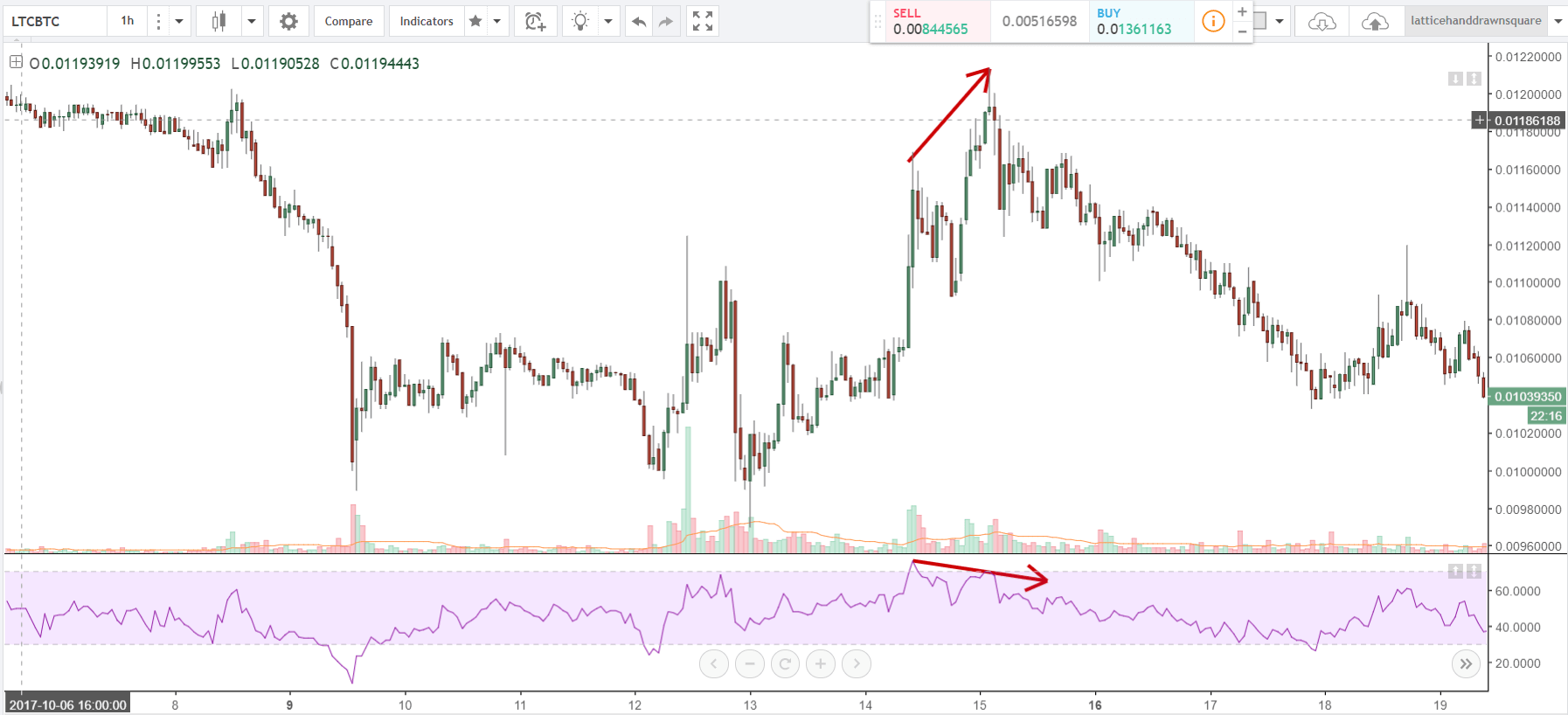

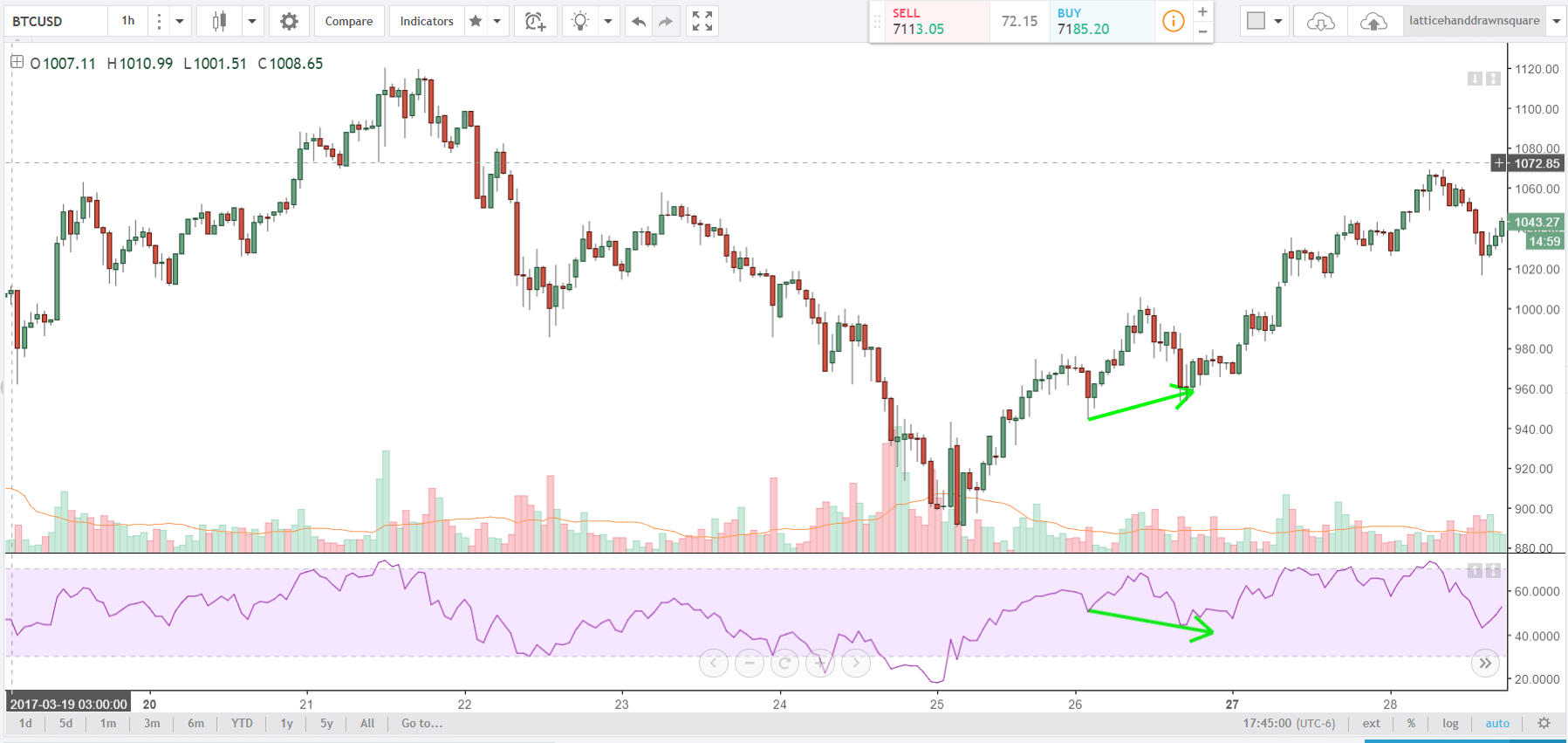

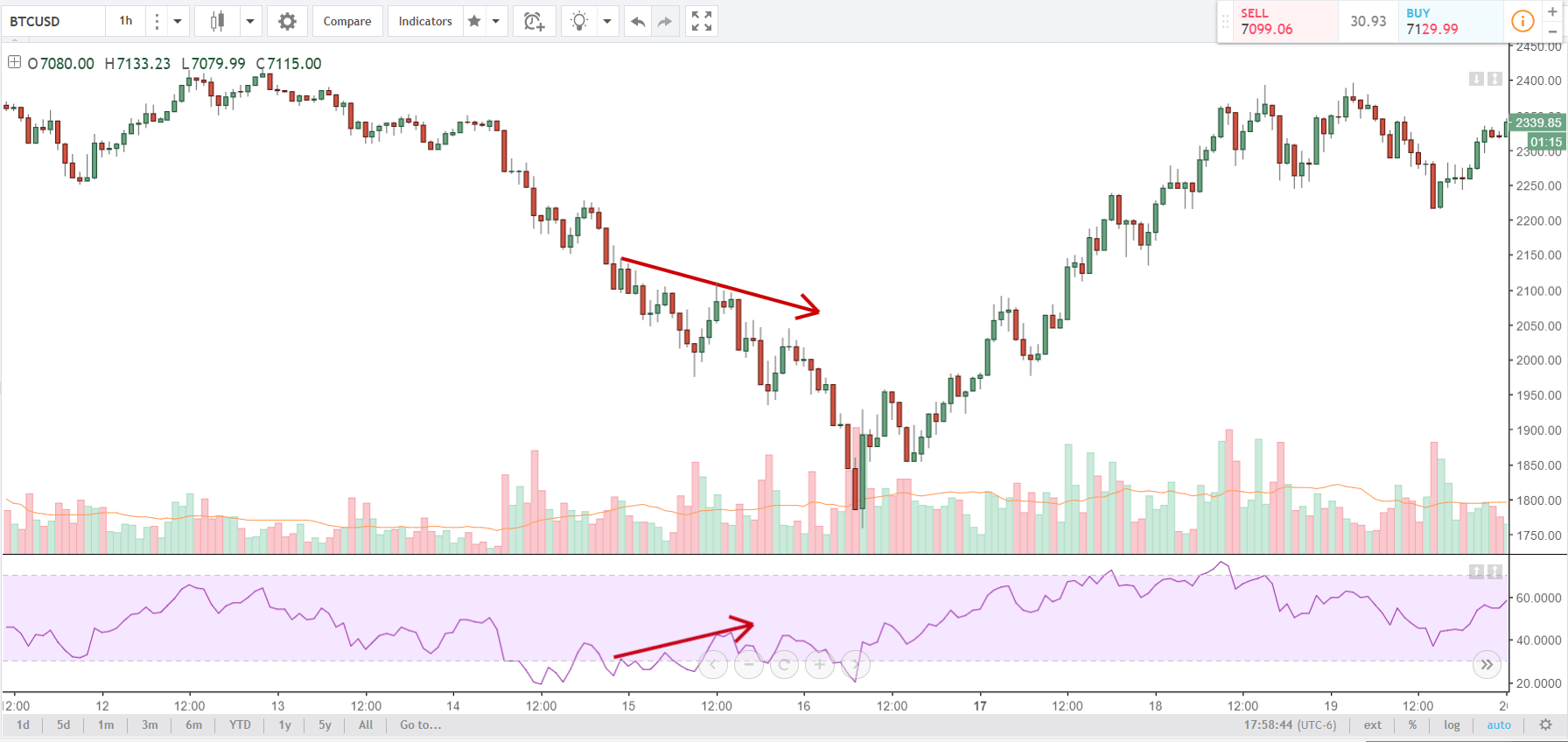

When adding the number of bars in A, B, and C, we always subtract 1 from each wave after the first. For example, if we counted five waves and the total was 100 bars, we would subtract 4 from 100; 96. On the chart above, the total number of bars of A, B, and C is 33 bars. We subtract 2 from 33 to get 31. This is where the Timespan Principle using Kihon Suchi comes into play. We should be able to project the end of the down drive that will occur after wave C. Does it work? Let’s see.

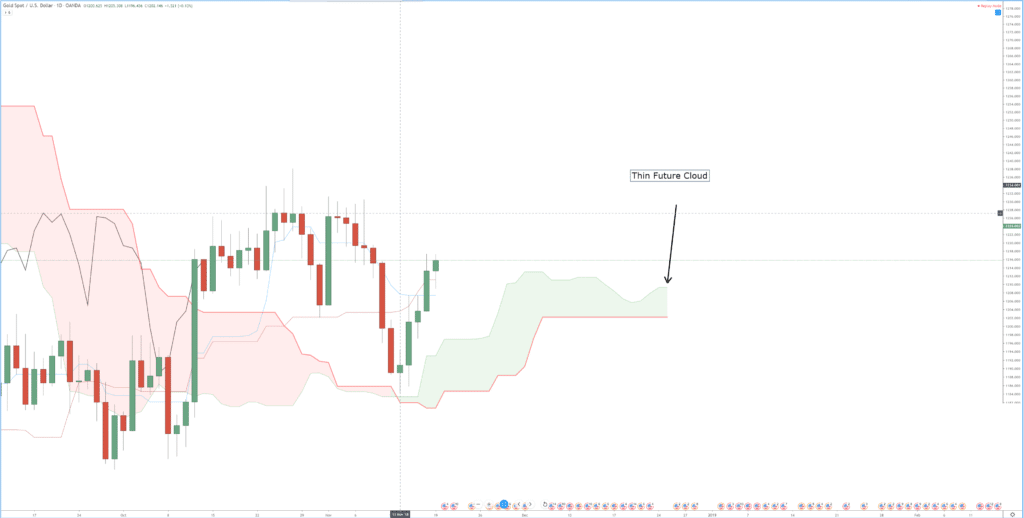

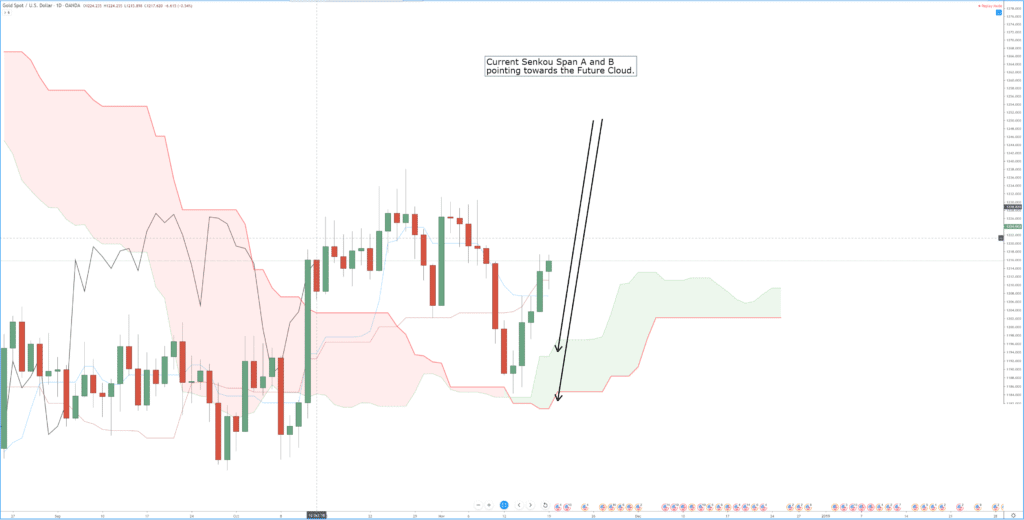

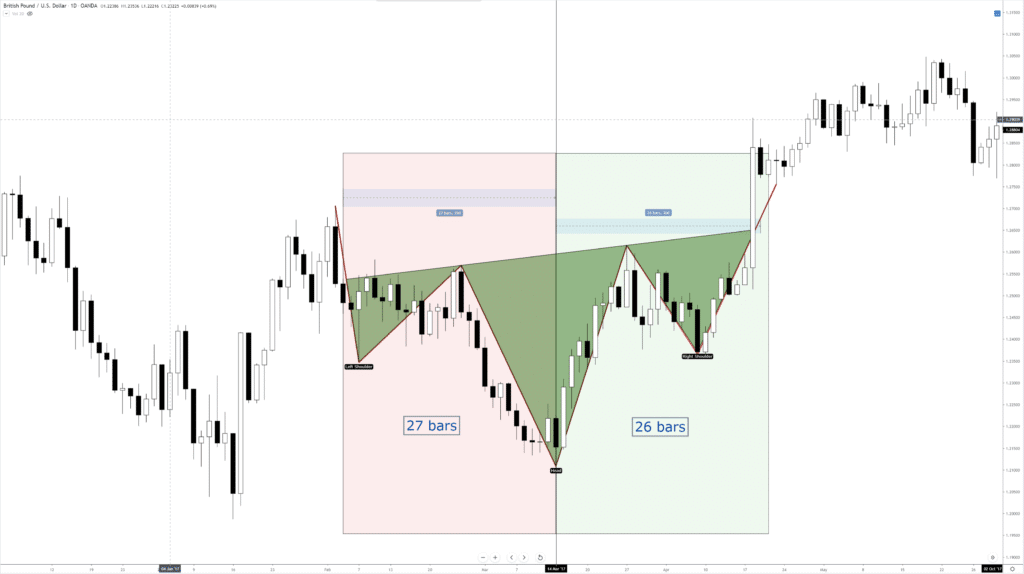

Below is another example. In reality, the use of the Timespan Principle is a very simplified version of a phenomenon known as a foldback pattern. But Japanese analysis focuses on the quality of equilibrium, so it makes sense to see this kind of behavior from a method that focuses on balance in all things.

Sources: Péloille, Karen. (2017). Trading with Ichimoku: a practical guide to low-risk Ichimoku strategies. Petersfield, Hampshire: Harriman House Ltd.

Patel, M. (2010). Trading with Ichimoku clouds: the essential guide to Ichimoku Kinko Hyo technical analysis. Hoboken, NJ: John Wiley & Sons.

Linton, D. (2010). Cloud charts: trading success with the Ichimoku Technique. London: Updata.

Elliot, N. (2012). Ichimoku charts: an introduction to Ichimoku Kinko Clouds. Petersfield, Hampshire: Harriman House Ltd.