For the years traders and market technicians often used some of the common and basic technical tools to analyze the market. These are some basic indicators, some common formations such as pennants, double bottoms, double top, flags are often used in the currency market. Some advanced traders use different ways to analyze the market, they focus on price action, Elliott waves, and the Diamond pattern which is not widely used by retailers, but is a quite popular and secret tool in the professional trader world.

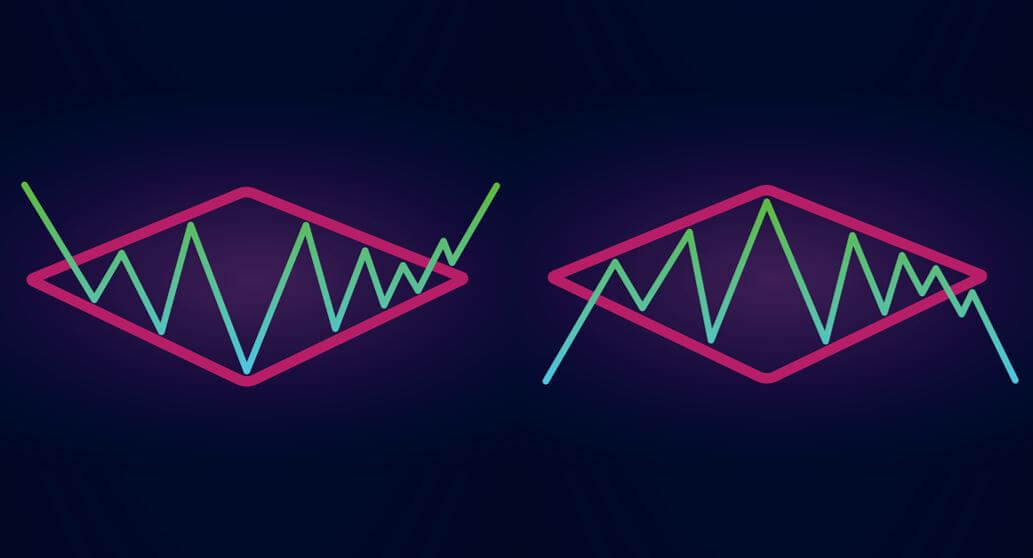

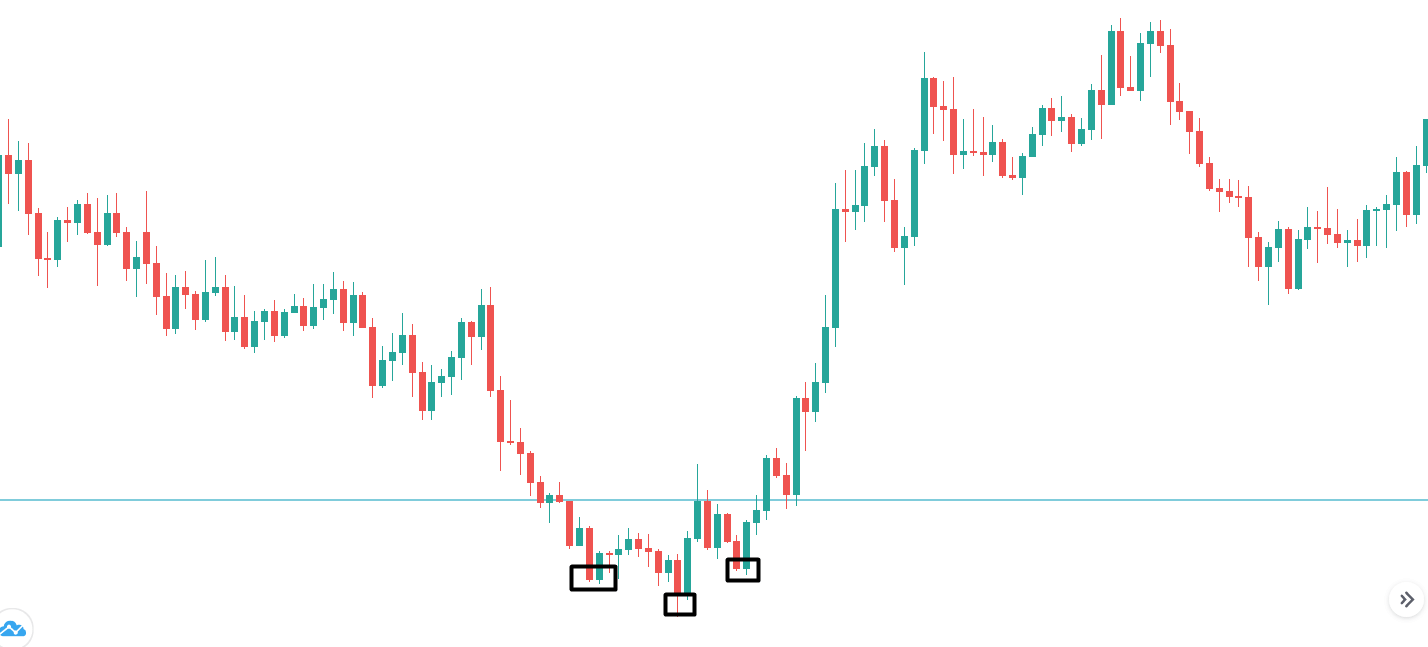

In this article, we will show you everything you need to know about the diamond pattern to capitalize on the various trading opportunities. There is two types of diamond pattern the Bullish and Bearish Diamond pattern. The bullish diamond occurs at the end of the downtrend which indicates the buying trade and the bearish diamond pattern occurs at the top of the uptrend which gives the buying opportunities. By reading the previous line you understood that diamond is the reversal pattern and it never offers the trend continuation trades, so always use this pattern to trade the reversals.

The forex market has higher liquidity as compared to the stock market, so it is easier for the traders to identify this pattern than in the stock market where gaps in price action frequently occur. The Diamond pattern occurs on every timeframe and it offers plenty of trading opportunities to every type of trader or investor.

Identifying The Diamond Pattern On The Price Charts

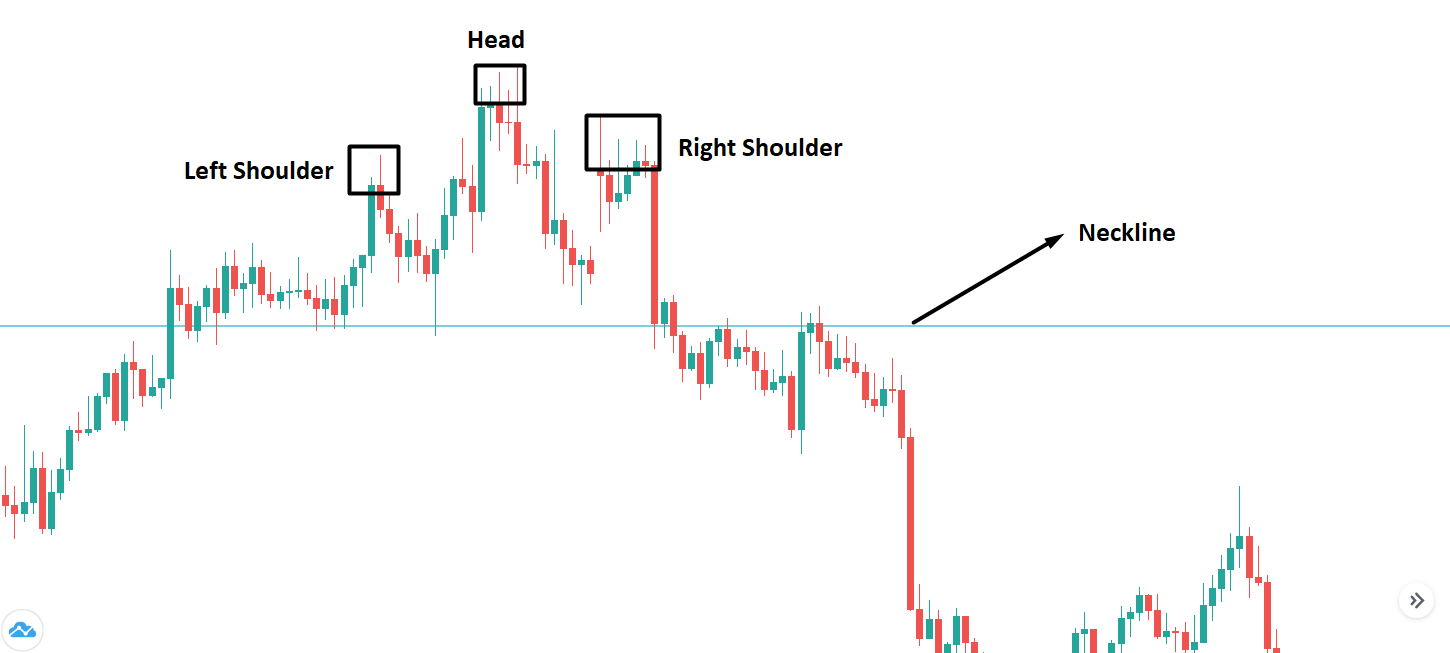

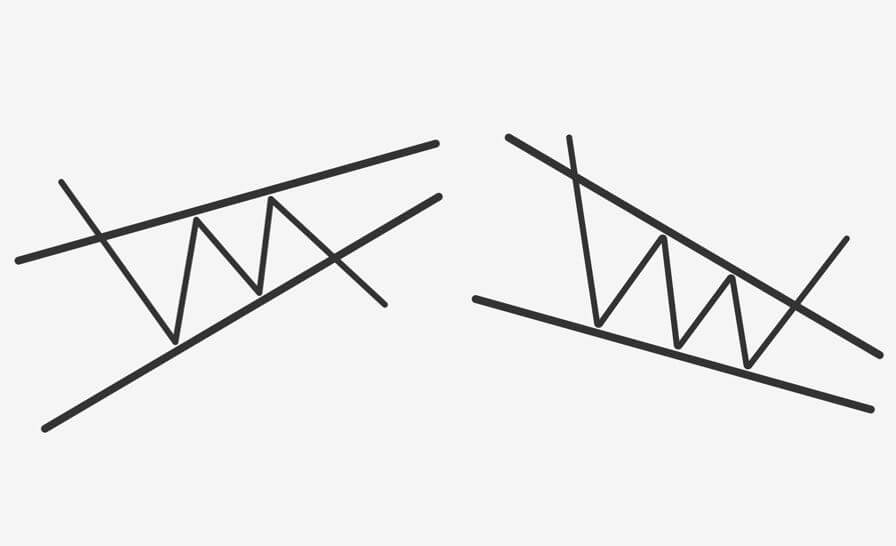

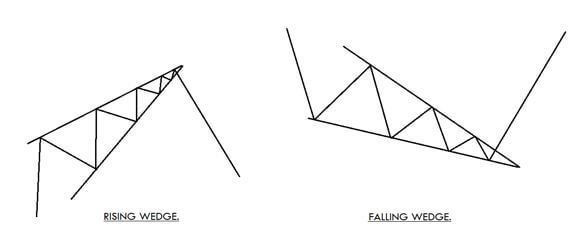

First of all, identify an off-shoulder head and shoulders formation on any asset chart. Next, we draw the resistance trend line from the left shoulder to the most recent higher high of the price action {line A}. Then from the higher high {head} to the right shoulder {line B} The price action should not break above the right shoulder trend line, if it is, then the pattern is invalid. To draw the lower trend line which is {line C} find out the most recent bottom tail and connect it to the left shoulder. Connect the right side support trend line from the bottom tail to the right shoulder line {line D.} Trading the diamond top pattern isn’t much harder than the other trading formations; here you only wait for the breakout to happen to take a trade. When price action breaks the pattern it indicates the buyers finally lost their control and sellers take over the whole show and they are ready to print the brand new lower low or higher high {according to the circumstances}.

Diamond Pattern Trading Strategies

Trading The Bearish Diamond Pattern

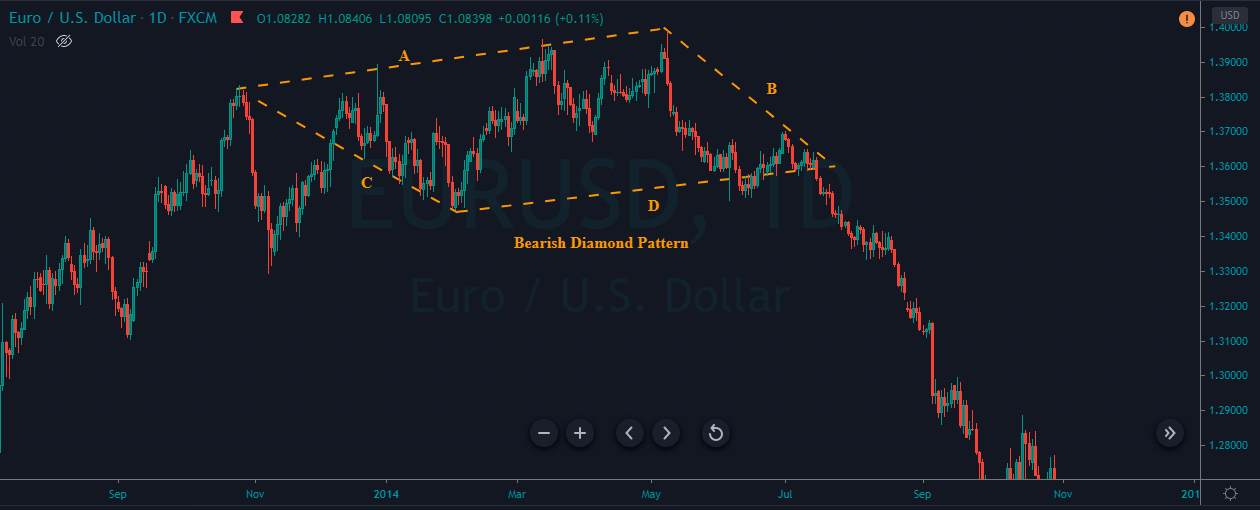

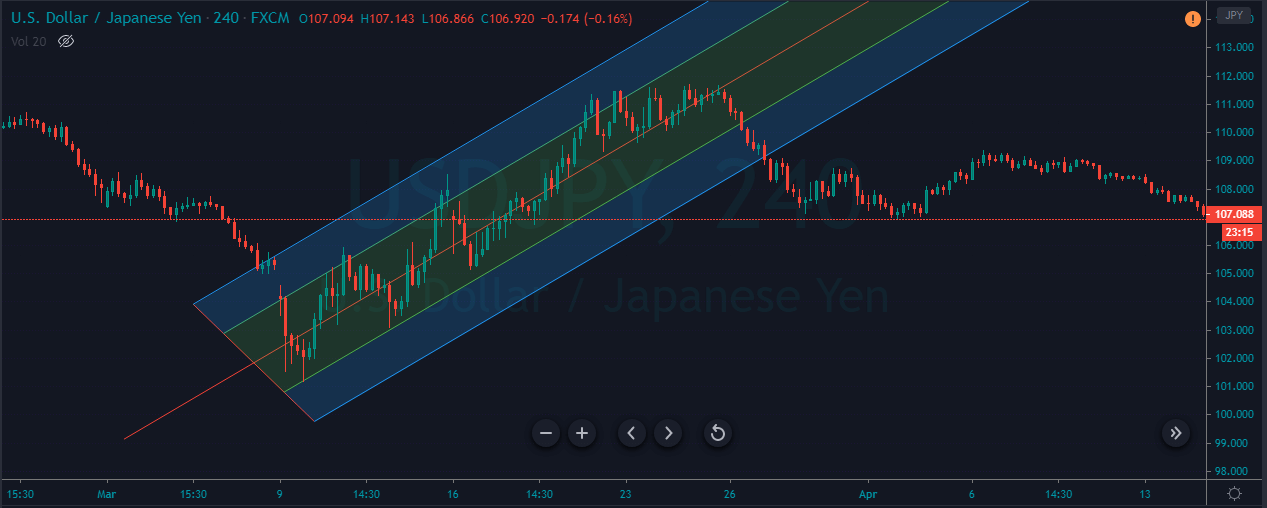

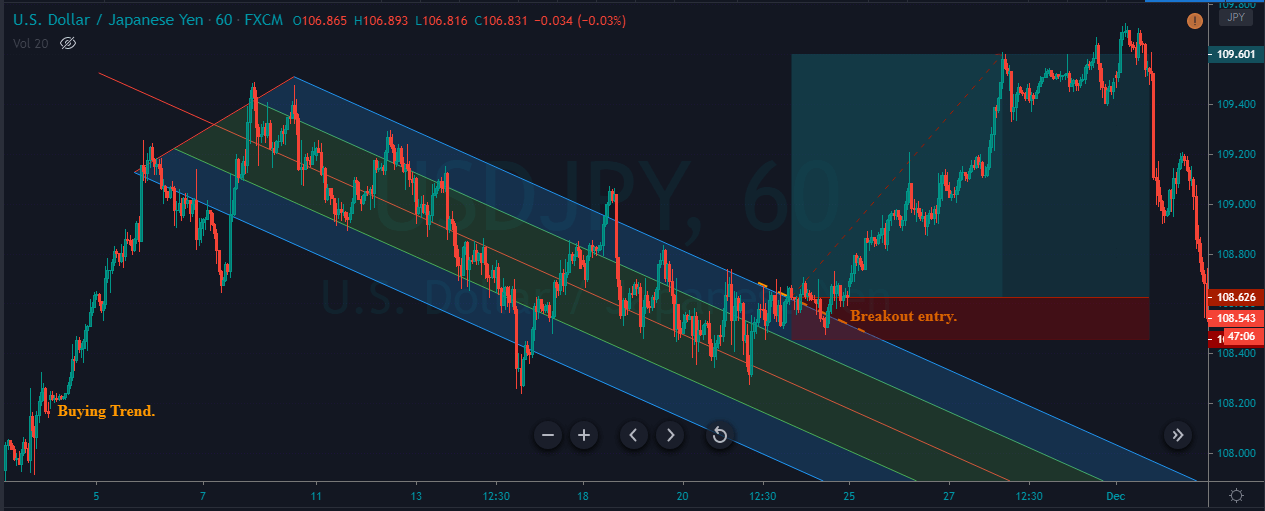

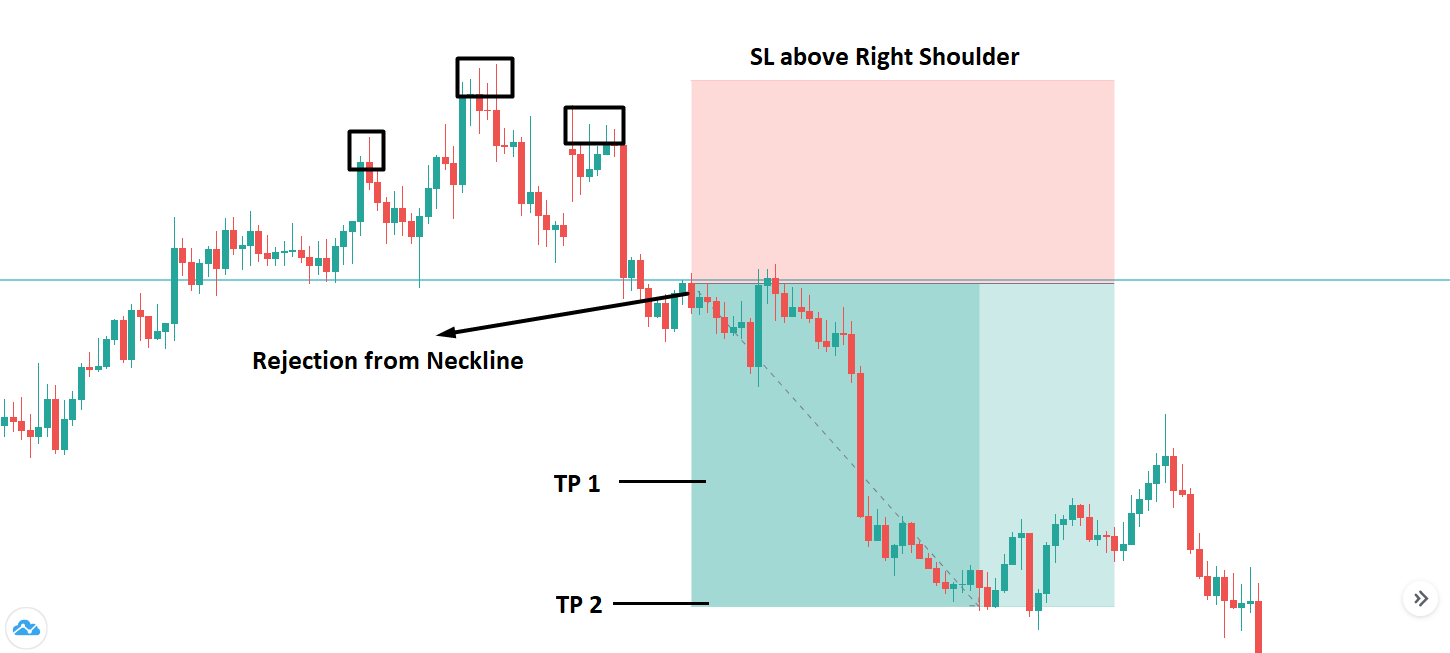

The image below represents the Diamond pattern on the EURUSD daily chart.

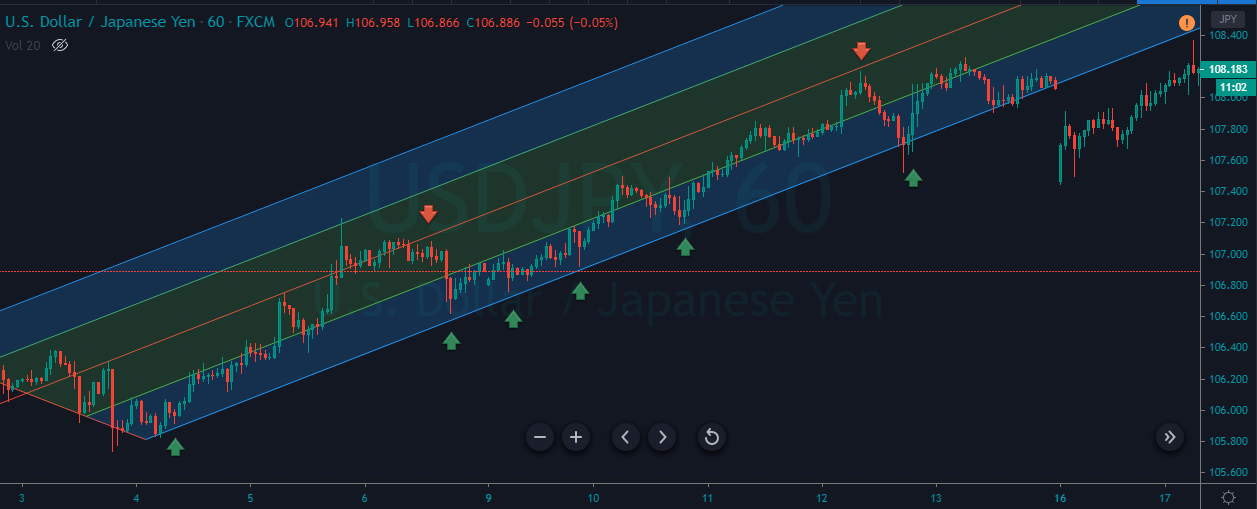

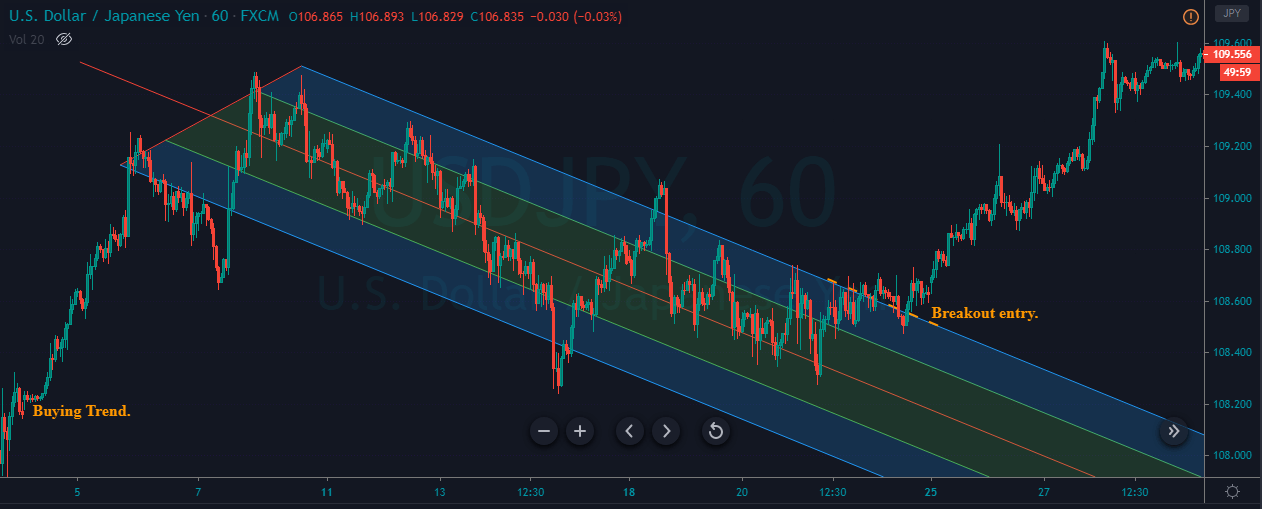

The image below shows our entry and exit in the EURUSD forex chart. As you can see in the image below, when price action followed all the rules of the bearish diamond pattern, we took the sell entry in this pair. Price action blasts after the breakout and it prints the brand new lower low. The Diamond pattern is quite a powerful pattern in the market, and it holds the ability to completely reverse the direction of the trend, so don’t take this pattern lightly, follow all the rules and go for the bigger targets. Initially, we set the smaller take profit in this pair, but the stronger seller move, convince me to go for the bigger targets in this pair. When the market gives you the opportunity milk the market as much as you can and go big.

Trading The Bullish Diamond Pattern

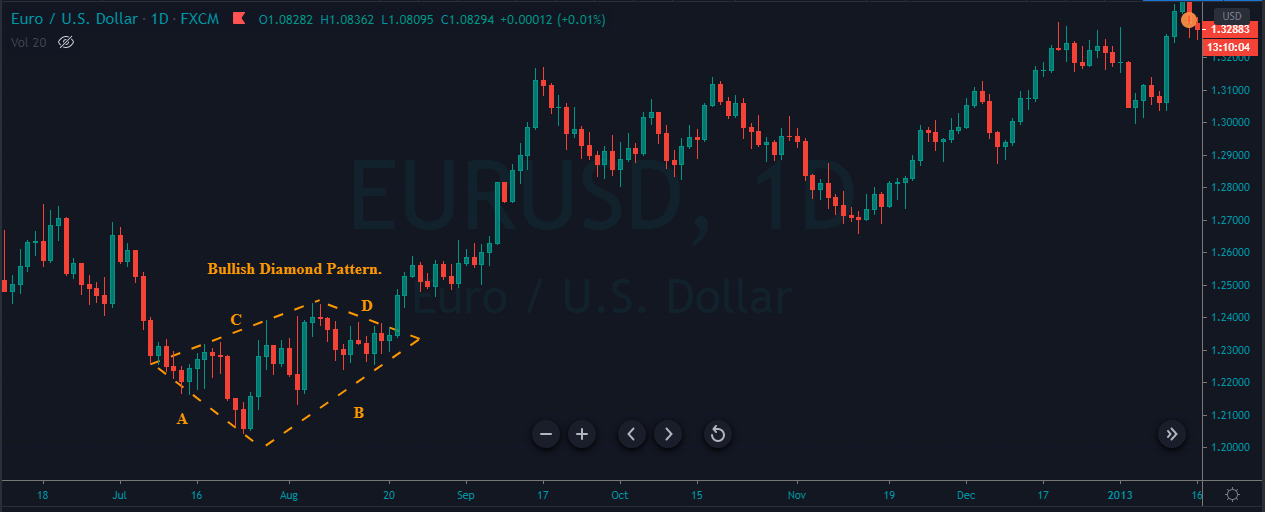

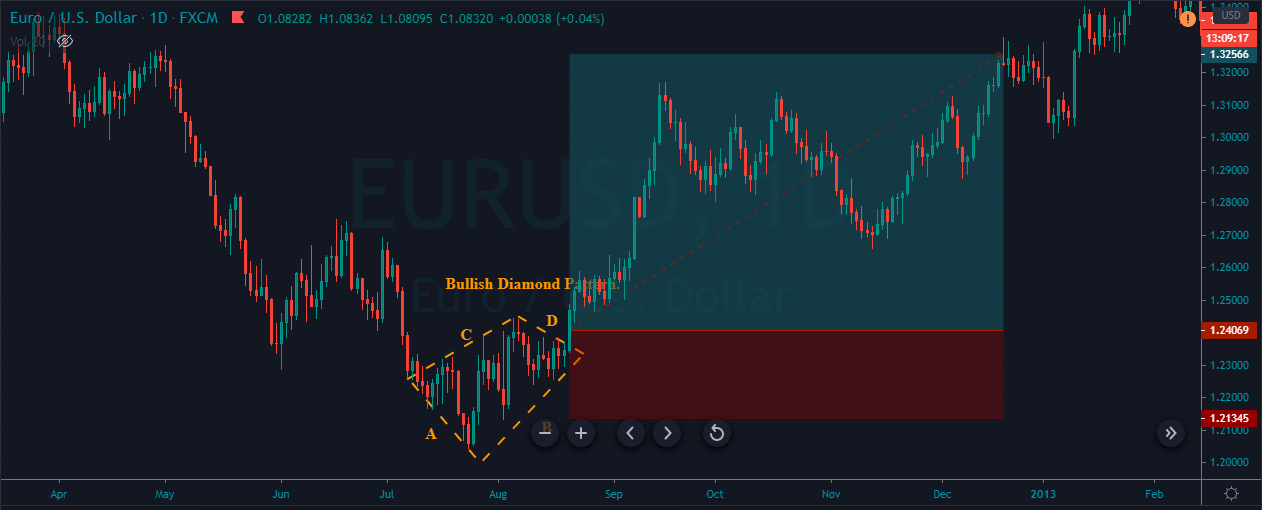

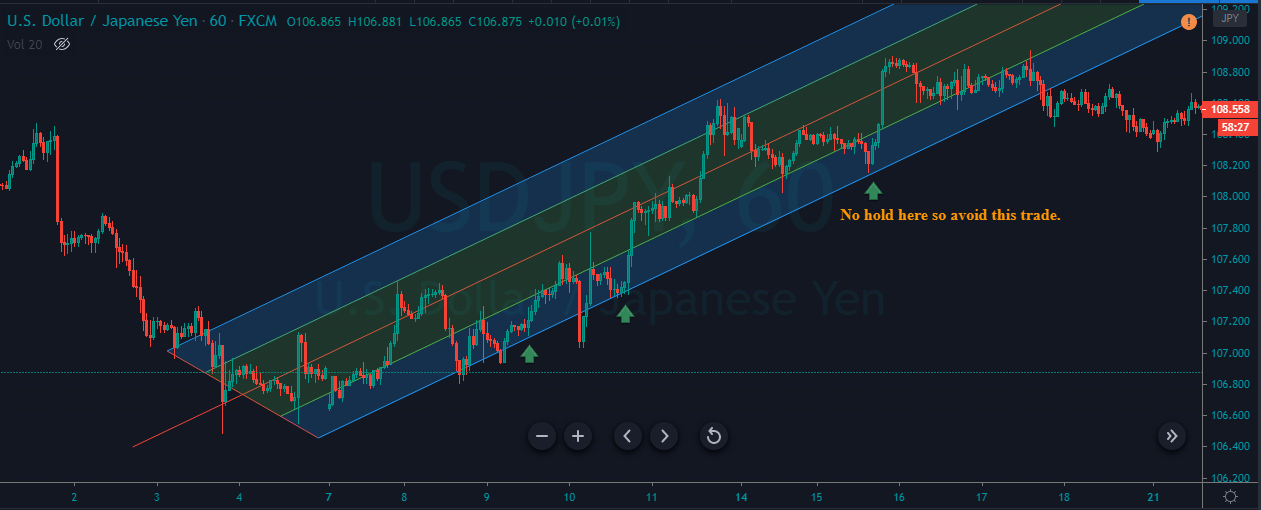

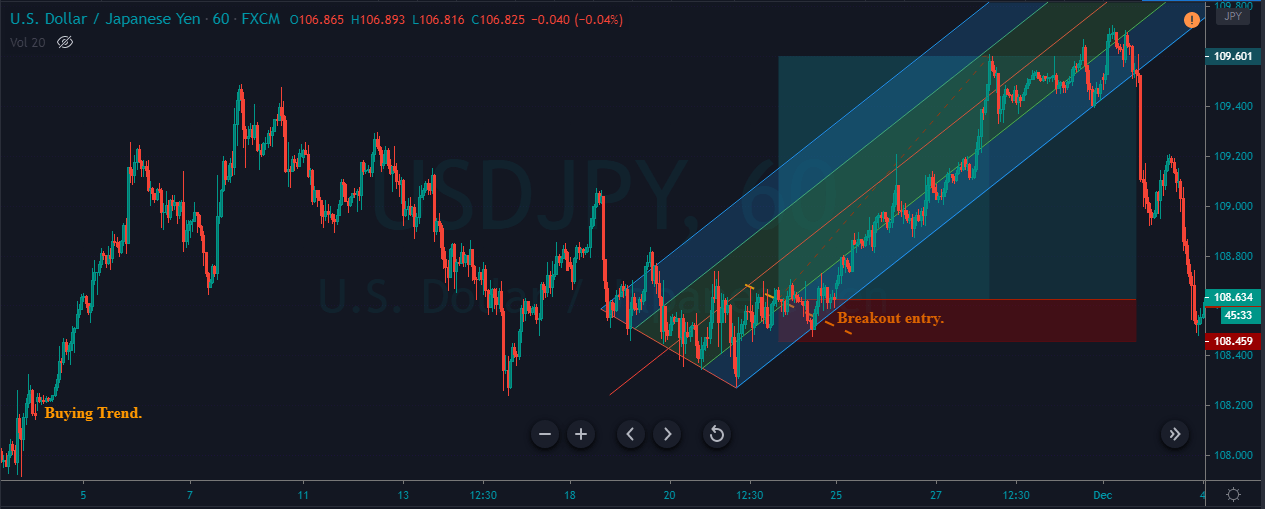

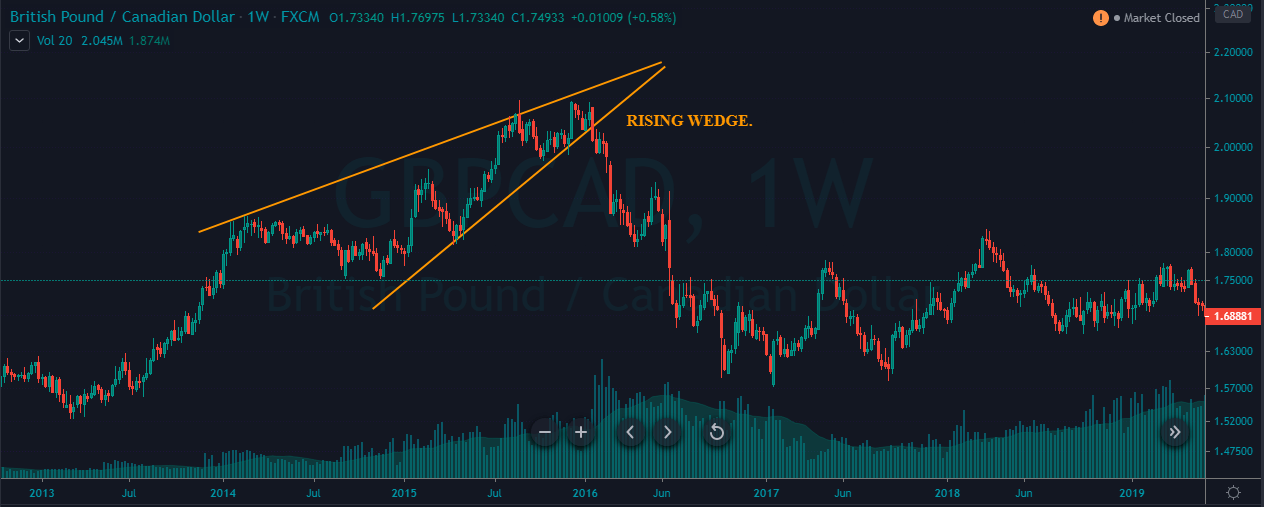

The image below represents the bullish diamond pattern on the EURUSD daily chart.

Before printing the diamond pattern, price action was in a strong downtrend, which is a good sign for us. What most of the traders do is they don’t like to follow all the rules and they sometimes trade the bullish diamond pattern in an uptrend and they end up losing in the trade. It’s not about the pattern only, the key to successfully trade all the pattern is to find out the pattern at the location where it makes the sense to trade.

As you can see in the below image when the diamond pattern appears and it fulfilled all our rules we took the buy entry in this pair. After our entry price action prints the brand new higher high but we choose to close our position at the major resistance zone. The stop-loss order was just below line D, because line D is a breakout line and it acts as a major support to price action.

Conclusion

The diamond patterns are very rare to find out on the price chart, but when this pattern appears it often gives a good risk to reward ratios trades. If you are a beginner at this pattern, then first of all train your eyes to find this pattern on the price chart. As you gain experience you will automatically start spotting this pattern on the price chart. First of all, form the top resistance line by connecting the left shoulder to the higher high of the price action {line A}. Then connect the higher high to the right shoulder {line B}. Next draw the support trend line from the left shoulder to the tail {line C} and the tail to the right shoulder {line D}. Wait for the price action to break below or above the pattern {according to the market circumstances} to take the trade. For identifying the better and more opportunities, it is suggestible to find out this pattern in a highly liquid pair. It doesn’t matter which timeframe you trade this pattern appears everywhere and in every market, just simply take the advantage of the pattern by following the rules.