Is there really anything to fear when trading exotic currencies and volatile pairs?

People tend to approach exotic currencies and volatile currency pairs with a kind of irrational, knee-jerk reaction. They’re either revolted and back away or they’re mysteriously drawn in like a moth circling a porch light. Is this irrationality merited? Does it get you anywhere? Let’s take a look. To unpack this properly, it’s best to approach these two ‘monsters’ separately – starting with exotic currencies.

Exotic Currency Pairs

So, is it worth trading exotic currency pairs? To the untrained observer, it might look like the short answer is simply ‘no, it isn’t worth it’. But this answer has to come with a disclaimer because, in reality, it depends on two other things. First thing’s first, what do we mean when we say “exotic currency? The problem is that one man’s exotic currency is another man’s daily bread. Ask any two traders what their definition of an exotic currency is and you’ll likely get two different answers because there is no actual definition that everybody sticks to. Some people will quite happily identify a less commonly traded combination of the eight major currencies as being exotic.

Take, for example, the euro-AUD combination. It’s easy to understand why they would think of that as exotic since the EUR-AUD pair is traded very rarely indeed compared to just about any pairing with the dollar that you can think of. Even if you pair the dollar with come currencies outside the major eight, like the Swedish krona or the Mexican peso, you will have a combination that is more frequently traded than euro vs. the Aussie dollar.

A better working definition – and one which we’re going to go with here – might be to say that any combination outside the eight major currencies should be considered exotic. And here’s why. The eight major currencies are all part of a network of developed, first-world economies. This isn’t a judgment call, by the way. We’re not saying here that any one country is better than another – what we’re looking for here is stability in terms of the news cycle and unpredictable fluctuations. The fact of the matter is that if you trade outside the major eight currencies, you run a greater risk of an anomalous news event sending the price spinning off in an unpredictable direction and blowing out your stop/loss.

That is simply bad news if you are a good technical trader. To be clear, it’s actually bad for any forex trader. When you step outside of the major eight currencies, it becomes increasingly difficult to keep on top of the news cycle. Of course, unusual news events are going to pop up from time to time no matter what currency combinations you trade but as you move outside the major eight, they will be both more frequent and more violent.

That is not to say that there isn’t something tempting about trading exotic currencies. Many readers will know that when you take a look at exotic pairs, it can look very exciting. This applies even to the currencies that you will most commonly encounter outside the eight major currencies. These include the Chinese yuan, of course, the Mexican peso, the Swedish krona, the Turkish lira, the Russian rouble, and the Indian rupee. Sometimes a pair with one of these can move thousands of pips at a time. It’s easy to look at a movement like that and say to yourself, “If I could just enter one big trade here for a few thousand pips, I could walk away rich!”

Unfortunately, that’s not how it works. It’s easy to get drawn into easy-looking trades like that but the problem – and it’s a big problem – is that some of these currencies can move very dramatically and with no warning and for no clear reason. A big win can be truly tempting but a big loss has the potential to completely wipe you out. The Chinese yuan is interesting here for a couple of reasons. There is no denying that it is traded against the dollar much more than it used to be. However, while we’re still in the US-China trade war, it is best to steer clear of trading the Chinese yuan. The ongoing trade war introduces too much risk into the equation.

How Does One Approach Trading Exotic Currencies?

Firstly, you should venture beyond the eight major currencies and all of the combinations of them only if you have a sufficient amount of experience. In short, there is not a whole lot of benefit to expanding beyond the 28 currency pairs that the eight major currencies offer unless you have completely mastered these first. If you have only been trading for a couple of years or less even, then you are not ready but, if you have a lot of experience under your belt, then venture a little further by all means. But proceed with caution.

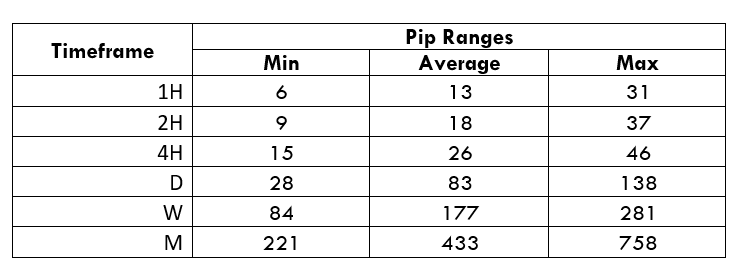

Caution being the watchword here, because another thing you will have to do before you do try your hand at trading exotic currency pairs, is a little risk mitigation. One of the ways you can do this is to select a currency outside the major eight that you feel good about exploring and start testing it on demo mode. Your first step is to backtest it by applying your trading methodologies to it historically. Your next step is to forward test it by demoing it for a few months until you have built up both a good sense of how it behaves – especially in terms of its spread vs. ATR. Forward testing is a good way to iron out the kinks in your risk profile and to minimise any surprises that could crop up.

Where to Begin?

If you are determined to expand beyond trading the eight major currencies and feel ready to do so, your first task will be to identify a good currency to get started with. A good place to start might be the Singapore dollar. There are a few reasons that make SGD a good choice. For starters, in many ways, it behaves in a way that’s similar to the Japanese yen, at least for now. It is less volatile than the Japanese yen but we’ll touch upon volatility later in the article and you’ll see that it isn’t a big problem. As with the yen, the main advantage of SGD is that it is impervious to news events that relate specifically to it.

If you are determined to expand beyond trading the eight major currencies and feel ready to do so, your first task will be to identify a good currency to get started with. A good place to start might be the Singapore dollar. There are a few reasons that make SGD a good choice. For starters, in many ways, it behaves in a way that’s similar to the Japanese yen, at least for now. It is less volatile than the Japanese yen but we’ll touch upon volatility later in the article and you’ll see that it isn’t a big problem. As with the yen, the main advantage of SGD is that it is impervious to news events that relate specifically to it.

This means that it essentially acts as a kind of blank canvas for the currency you are pairing it with. In a sense, this releases you from having to worry about two currencies simultaneously and allows you to focus your attention on just one. This is as true for the Japanese yen as it is for SGD. Of course, this is how things are at the moment and how they have been historically. If Singapore were to be plunged into any kind of turmoil, this would change but, for now, it is surprisingly stable. News events just do not affect it at all.

A Note of Caution

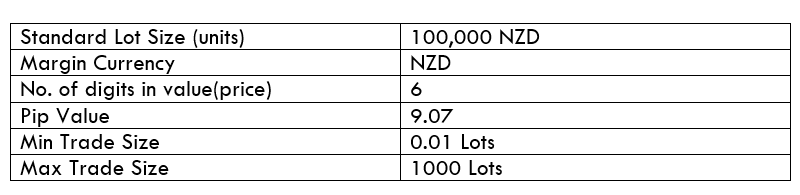

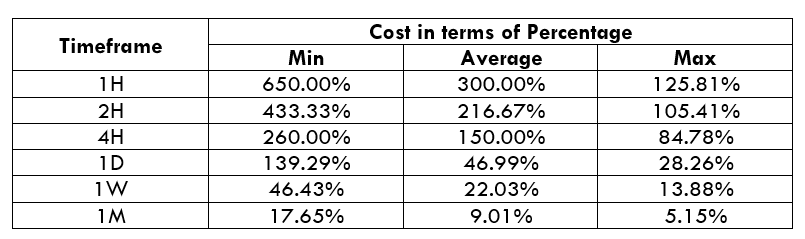

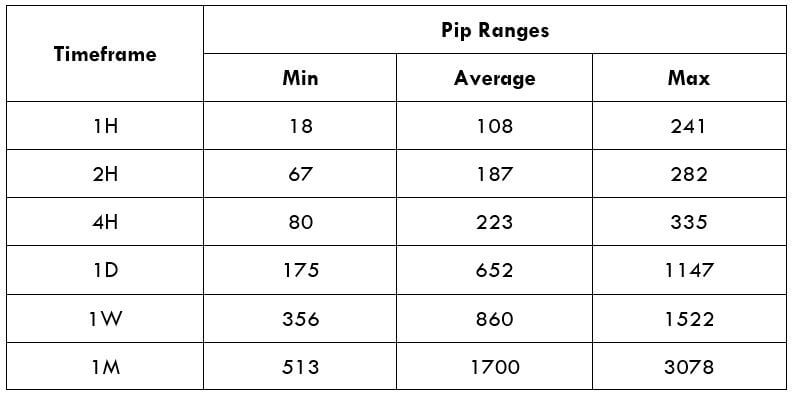

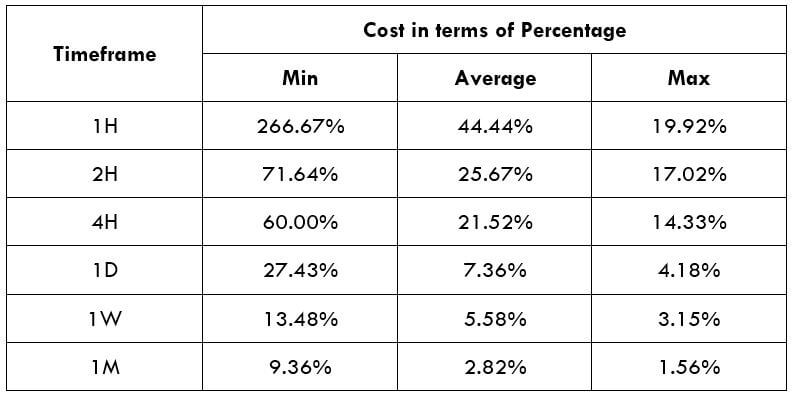

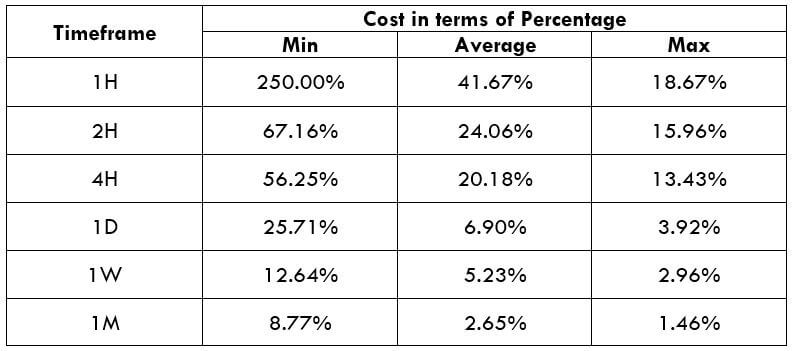

The only real alarm bell regarding the Singapore dollar is that it has a high percentage of spread as compared with its ATR. It is, in fact, likely to have a more lopsided spread vs. ATR percentage than most other currencies you will be trading or even looking at right now. However, as we will cover later in this article, that does not necessarily have to be a problem. Particularly if you do your due diligence and backtest and forward test the currency as discussed. So, don’t let the spread vs. ATR percentages scare you off immediately and take a look at the Singapore dollar if you are keen on exploring exotic currencies.

Managing Volatility

Another one of those things that in many cases gives traders the heebie-jeebies, is trading volatile pairs. Fear is almost certainly a big factor. It’s almost as though it’s the word itself – volatility – that causes a lot of that fear. The good news is that that fear is irrational and can be managed and molded into something useful.

Speed-Phobia

Aside from the word volatility sounding scary, there are two main reasons that traders have an aversion to trading volatile pairs. We will tackle both of them here in turn. The first is that volatile pairs of currencies move fast. They move faster than currency combinations you are comfortable with and that, it seems, makes a lot of people back away. The thing is, there is no real reason it should. Understanding the percentages here and using them to your advantage is key. It sounds easy enough, doesn’t it? The thing is, if you understand the percentages then you will understand that trading a currency combination that moves slowly is exactly the same as trading one that moves quickly.

The key is risk profiling. If you are trading a fast pair, you will have to manage the risk by trading less per pip than you would on a slow pair. If you can manage the risk in that way, you should arrive at a situation where you stand to lose the same on a fast pair as you would on a slow pair, if things go south on you and you hit your stop/loss. Of course, you should never trade the same amount per pip on a slow pair of currencies and a fast pair – if you do, your trading problems are bigger than just accounting for volatility. So, to close down the risk of trading a faster pair of currencies, you have to have a good, well-thought-out risk profile in place. If you can do that, then trading fast-moving currencies should be almost the same as trading slower combinations.

Fear of Spreads

The second thing about volatile currencies that gives most traders pause is something we saw earlier with the Singapore dollar. Volatile currencies will have a high spread vs. ATR ratio. The way to combat that is to pull away from your five-minute chart and trade on a longer time-scale like your daily chart. Trading on a daily chart will negate almost all of the effects of spread vs. ATR from volatile currency pairs. If you trade the daily chart, particularly for volatile combinations, you just won’t have to worry about spreads anymore. You will never again look at a currency pair and decide not to trade it because it looks too volatile based on its spread vs. ATR. If you’re looking at it from a five-minute chart perspective, then the high spread vs. low ATR is certainly something you will want to avoid. But don’t forget that it is a hurdle that can be overcome with a different approach. That approach is to go to trade your daily chart.

So by applying the right kind of risk profiling and modifying your trading to take in the daily chart, you can turn the fear of volatile currency pairs into gold. And it won’t be because you overcame your fears like some zen master, through meditation and self-improvement, it will be because you’ve applied smart trading techniques and knowledge to overcome something that was otherwise irrational with a well-considered, methodological approach to a problem.

Time to Recap

Approach exotic currencies with a dose of caution. Make sure you have the experience to know what you are doing and do not trade outside the eight major currencies until you know the risks that go with exotic currency pairs and the knowhow to overcome them. Carefully choose your starting currency and make sure you do your due diligence by properly back and forward testing it thoroughly. Ultimately, if you’ve only been trading for a couple of years, there is no good reason to trade outside the major eight currencies.

Finally, there is no reason to fear volatility. If you approach what initially looks scary with a rational, considered approach, including careful risk profiling and an awareness of when to trade the daily chart, you never need fear volatility ever again.