Introduction

EURCHF is the abbreviation for the Euro area’s euro and the Swiss franc. This currency pair is a minor/cross currency pair. Here, EUR is the base currency, and CHF is the quote currency. Trading the EURCHF is commonly called trading the ‘swissie.’

Understanding EUR/CHF

The value of EURCHF determines the number of units of Swiss francs required to purchase one euro. It is quoted as 1 euro per X francs. For example, if the value of 1.3000, it means that one must pay 1.3000 francs to buy one euro.

EUR/CHF Specification

Spread

Spreads are the way by which brokers make their money. There is a separate price to buy a currency pair and a separate price to sell it. To buy, one must refer to the ask price, and to sell, one must refer to the bid price of the currency pair. The difference between these two prices is known as the spread. This spread usually differs from account type. The average spread on ECN and STP model account are as follows:

ECN: 0.9 | STP: 1.6

Fees

The fee is nothing but the commission charged by the broker on a single trade. The fee also varies base on account type.

Fee on STP account: NIL

Fee on ECN account: 1 pip

Note: The fee depends from broker to broker. Here, we have taken the average value by referring to some brokers.

Slippage

Slippage in trading is the difference between the trader’s desired price and the real executed price by the broker. The slippage value depends on two factors:

- Broker’s execution speed

- Currency pair’s volatility

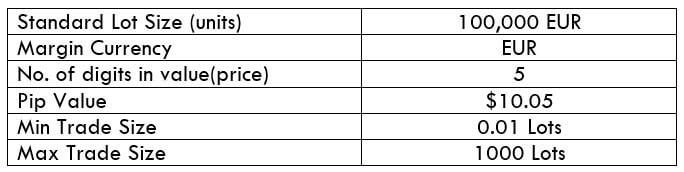

Trading Range in EUR/CHF

The trading range in EURCHF is the representation of the minimum, average, and maximum pip movement in different timeframes. These values can be used to assess one’s approximate profit or loss in a given time frame. For example, if the volatility on the 1H timeframe is five pips, then one can expect to be in a profit or loss of $50.25 (5 pips x $10.05 value per pip) in an hour or two.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

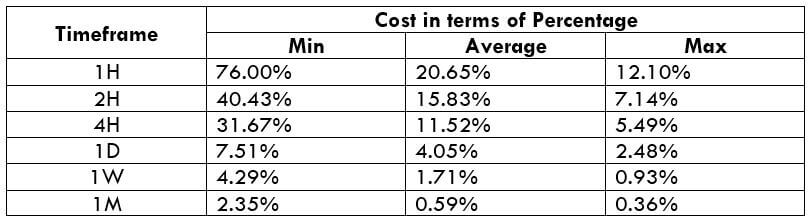

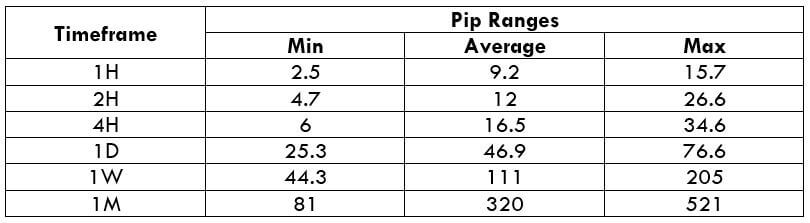

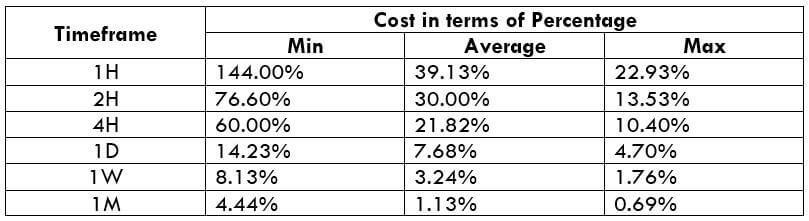

EUR/CHF Cost as a Percent of the Trading Range

Apart from assessing your profit and loss, one can find the best time of the day to enter and exit a trade. For this, another table is inserted that represents costs in terms of percentage. And the magnitude of these percentages determines the range of costs on each trade.

ECN Model Account

Spread = 0.9 | Slippage = 2 | Trading fee = 1

Total cost = Slippage + Spread + Trading Fee = 2 + 0.9 + 1 = 3.9

STP Model Account

Spread = 1.6 | Slippage = 2 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 1.6 + 0 = 3.6

Comprehending ‘Cost as a percentage of trading range’

Note that the mentioned percentages are a unitless quantity, and we consider only the magnitude of it. If the percentage value is high, then the costs are high. If they’re low, the costs are low too. Relating it to volatility, if the volatility is high, the costs are low and vice versa.

The Ideal way to trade the EUR/CHF

Now that we’ve comprehended what the cost percentages mean, let us determine the best times to trade the EURCHF currency pair. The minimum column of the table has the highest percentages, while the max column has the lowest percentages for each timeframe. It is neither ideal to trade when the volatility is high & costs are low nor when the volatility is low, and the costs are high. The only option left is the average column. The average column consists of the median values for both volatility and costs. Hence, this becomes the most suitable time to enter into this currency pair for trading.

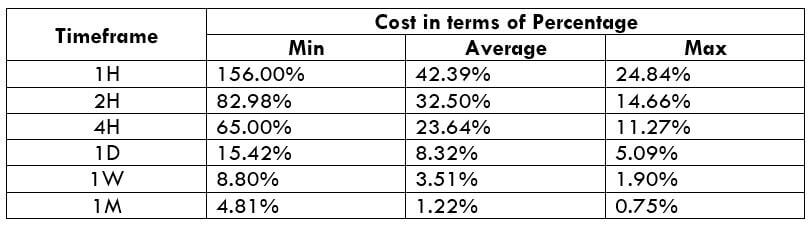

Limit orders and their benefits

Traders usually enter and exit trades using market orders. This is the sole reason for slippage to take place. This has a significant weight on the cost of the trade. However, placing a limit order instead will nullify the slippage on the trade.

The difference in the ‘costs as a percentage of trading range’ when the slippage is made nil is illustrated below.