Introduction

Arbitrage is known as ARB, and this trading technique is used to facilitate the purchase and sale of similar assets simultaneously. This offers traders the opportunity to gain profits from different price levels. This form of trade acquires profit by leverage market inefficiencies. So if there is a price difference between identical securities in various markets, we get winning opportunities. This is a great method to gain risk-free profit from discrepancies in prices. While this method comes to determining the ideal arbitrage opportunities and implementing it efficiently is quite challenging.

There are two types of crypto arbitrage:

Regular Arbitrage

It refers to purchasing and buying the same digital assets on various exchanges with considerable price differences.

Triangular Arbitrage

It encompasses price differences between three currencies on the same exchange. Traders to leverage the price difference through various conversions.

Although both approaches can be highly profitable, there are more challenges to identify opportunities for triangular arbitrage. Moreover, a large volume of trading on a similar exchange may qualify the trader for competitive fees, resulting in a positive impact on the profits.

Arbitrage Trading in the Crypto Market

While the concept remains the same, it involves different assets. There are hundreds of exchanges operating across the globe that allow people to purchase cryptocurrencies. Cryptocurrency prices are constantly changing across different exchanges. There are many social, political, and economic reasons that contribute to these changes. Arbitrage trading in this landscape is quite straightforward and depends on determining profitable paths.

Identifying the Right Path in Arbitrage Trading Paths

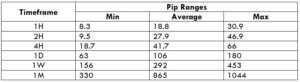

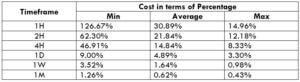

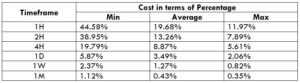

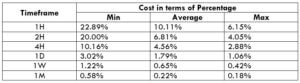

Arbitrage trading is extremely sensitive to time. Variations in the prices are temporary in nature. Potential trading profits generally stand between 1% and 6% per transaction. Therefore, traders need to leverage the right arbitrage software and tools to scan and monitor the market in real-time.

The opportunity for the cryptocurrency is calculated by determining the overlap between the lowest ask prices and the highest bid prices. So when the price of the bid is higher in one exchange than the asking price on another crypto exchange, this is designed as an arbitrage opportunity. Similar to any other method of crypto trading, there are certain risks associated with it. But people have created different strategies to mitigate the risks as much as possible.

Advantages of Crypto Arbitrage Trading

💰 With the right profit, it is a credible way to boost the capital. Similarly, it is all about speed, and you will make money quicker with regular trades.

💰 Most exchanges do not share and operate on their own. Typically, cryptocurrencies experience many rapid rises and sudden falls, resulting in price disparities and profitable arbitrage potentials.

💰 There are over 200 exchanges where you can purchase and sell cryptocurrencies. This means there are tons of profitable arbitrage opportunities.

Contrary to the market speculations, crypto arbitrage has witnessed massive success. It has proven a way to make some extra money without putting much effort. Considering that digital money is not subjected to social influences, and no-one controls them, people are highly inclined towards their potentials to increase in value in the near future.

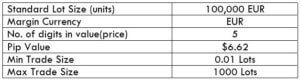

Spread

Spread