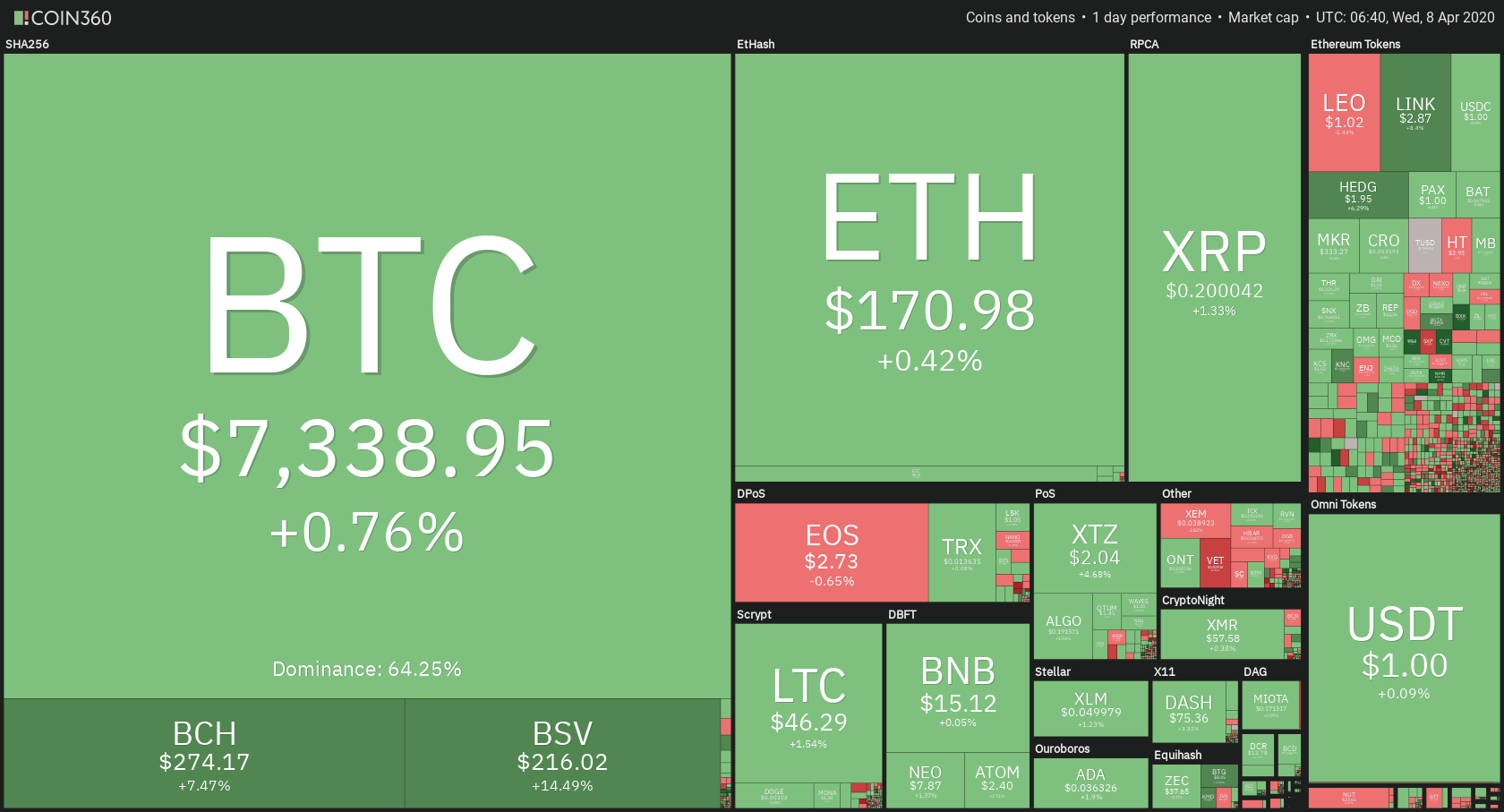

The cryptocurrency market established its position after the gains it made yesterday. Bitcoin is currently trading for $7,338, which represents an increase of 0.76% on the day. Meanwhile, Ethereum gained 0.42% on the day, while XRP gained 1.33%.

CyberVein took the position of today’s most prominent daily gainer, with gains of 47.18%. Bytecoin lost 8.52% on the day, making it the most prominent daily loser.

Bitcoin’s stayed at the same place dominance-wise. Its value is now 64.25%, which represents a 0.1% difference to the downside when compared to yesterday.

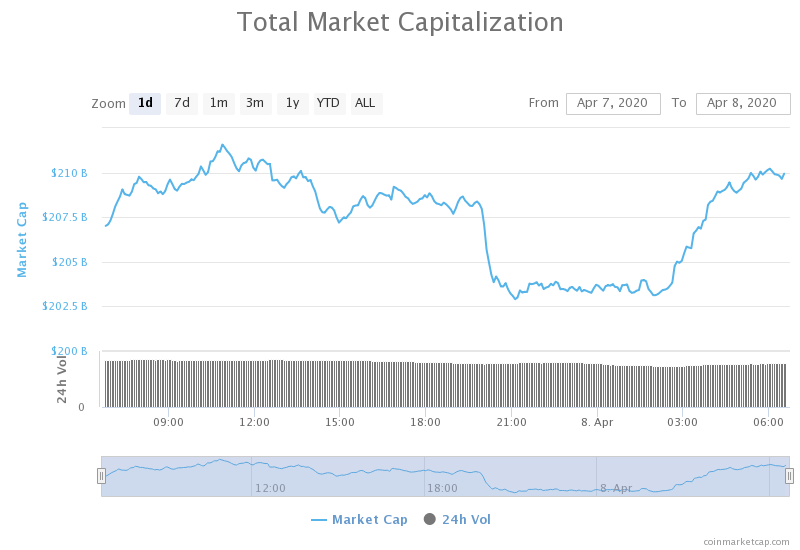

The cryptocurrency market capitalization increased over the past 24 hours. Its current value is $209.34 billion. This value represents an increase of $4.65 billion when compared to the value it had yesterday.

What happened in the past 24 hours

Twitter CEO, as well as the founder of Square Jack Dorsey, has started a fund, which will help with fighting COVID-19. The fund is called Start Small LLC. Dorsey is seeding the fund with $1 billion, which is roughly 28% of his wealth.

Honorable mention

BCH/BSV

Bitcoin Cash will complete its block reward halving in the next 9 hours, with Bitcoin Satoshi’s Vision following shortly after.

By performing a block reward halving, Bitcoin Cash will cut its block reward from 12.5BCH down to 6.25BCH.

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

Bitcoin has spent the day consolidating and testing the upside and downside relative to the level it is in right now. The largest cryptocurrency tried to break the $7,420 resistance level many times, but with no success. It also tested the $7,085 level once again, but the bulls quickly reacted to the price going down and jumped in to help stabilize the market.

Bitcoin’s volume is slightly lower than yesterday, while its RSI dropped out of the overbought territory and is now at the value of 64.

Key levels to the upside Key levels to the downside

1: $7,420 1: $7,085

2: $7,750 2: $6,850

3: $8,000 3: $6,640

Ethereum

Ethereum spent the past 24 hours fighting to stay above the $168 level. After a sharp increase in price, ETH dropped down from $176 to $162. However, the ETH bulls jumped in and brought the price above the $168 resistance level, making it support.

Though Ethereum’s volume reduced by quite a bit, it is still elevated compared to the previous week. Its RSI level is currently at 69.

Key levels to the upside Key levels to the downside

1: $178.6 1: $168

2: $185 2: $158

3: $193.6 3: $147.5

Ripple

XRP also tested where it will find a suitable place to consolidate. The price fluctuated between the $0.19 and $0.205, trying to find the stabilization point. XRP failed to break $0.205 to the upside, but also retested $0.19 right after failing to break to the upside. After failing to break to the downside as well, XRP consolidated right below the $0.2 level.

XRP’s volume is just slightly lower when compared to yesterday, while its RSI level is at 67.

Key levels to the upside Key levels to the downside

1: $0.2 1: $0.19

2: $0.205 2: $0.165

3: $0.227 3: $0.147