London Capital Group is a veteran broker doing business since 1996 and has grown into a multi-branch company regulated by 3 different authorities. In 2018 LCG got delisted from the London Stock exchange to become a privately held company, effectively detaching from the LGC Group Holdings. The main reason behind this step according to the press is to cut losses. LCG has 3 domains or website versions, and depending on the client country the regulation could be from CySEC, FCA or Securities Commission of Bahamas (SCB) for their international website. The registration will give you an option to select BHS, CySEC or FCA Account as all can be opened at the same time.

For traders, the biggest practical difference is the leverage allowed. LCG is well known for its extensive asset range and one of the big players on the scene boasting with $20 trillion executed trades volume and $1 billion in deposits. There are also multiple awards in different categories, from platform innovations to the best Forex Fundamental Analysis Provider. LCG launched its platform, LCG Trader in 2016, as a specialized platform that will effectively use and integrate their services. On top of this, LCG states they offer security, tight spreads, and analysis. As for the security, FCA regulation includes the FSCS compensation scheme up to £85,000 or up to €20,000 ICF compensation for the CySEC regulated account in the case of LCG insolvency.

For traders, the biggest practical difference is the leverage allowed. LCG is well known for its extensive asset range and one of the big players on the scene boasting with $20 trillion executed trades volume and $1 billion in deposits. There are also multiple awards in different categories, from platform innovations to the best Forex Fundamental Analysis Provider. LCG launched its platform, LCG Trader in 2016, as a specialized platform that will effectively use and integrate their services. On top of this, LCG states they offer security, tight spreads, and analysis. As for the security, FCA regulation includes the FSCS compensation scheme up to £85,000 or up to €20,000 ICF compensation for the CySEC regulated account in the case of LCG insolvency.

The LCG website is well designed, polished, with great transparency and information availability. The content is mixed with marketing as expected, like stating that LGC Group is publically listed, but this has nothing to do with London Capital Group Limited. Still, it does leave an impression of a serious broker for professional and intermediate traders. Interestingly, all these features did not result in good user ratings. On several independent benchmarking sites, LCG received average or bad ratings and none of these reviews received attention form the LCG staff.

In the following sections of this LCG review, we will evaluate their service so traders can see if LCG is a match for their trading style and other requirements.

Account Types

LCG offers Classic and the ECN Account type. Classic Account does not have any special traits except no minimum deposit requirements and relatively competitive spreads. This is the standard account as the ECN type will require a much higher minimum deposit, and additionally, a minimum balance required to maintain it.

The ECN Account has a bit lower leverage than Classic under the BSC regulation but still high enough. ECN Account has a commission charge and spreads from 0 pips for Forex instruments, no requotes and is classified as a Direct Market Access type. Islamic Account or Swap-free is also available upon request. All Accounts have the same asset range and no other differences except for the spread, leverage, and commission. More detail on each category in the following sections.

Platforms

LCG established the LCG Trader platform and holds the license for the MetaTrader 4. MT4 is a well-known platform and LCG offers it in the Web-accessible version as well as for Desktop and laptop computers running on Windows and Mac OS. Mobile versions are also available for Android and iOS. MT4 Multiterminal version is offered for managing multiple accounts and usually used for MAM. Upon installation, MT4 showed 4 LCG servers, LCG-Live 1 and 2 and LCG-Demo 1 and 2, all with around 54ms latency.

We are met with the default layout, with four major forex charts without visible One-click trading buttons. The client version is the latest and set to defaults with the LCG physical address in London not mentioned on the website. The default 4 forex pairs are not open for trading by default as they belong to symbols that are closed for trading and this may confuse first-time users. Some of the symbols have a dot suffix and some are disabled for trading. These are used just for conversion purposes as we are informed by the LGC staff.

The symbols are neatly grouped into groups and subgroups that match the category they belong to. Some groups have E or C suffix, probably signaling the Classic and ECN account assets. The instruments’ specification window is showing all the important trading information. Trading Terminal is showing all trading costs and other relevant data. Execution times were 114ms on average with very small deviations, rarely going up above 117 ms.

LCG proprietary platform is one of the best web-accessible platforms in the industry. The platform is also available for mobile devices running on Android and iOS. Spot on you will notice all the tools and features that experienced traders will understand without hassle. The platform has good looking charts with a similar color palette like Tradingview, completely modular windows with the flex auto arrangement. Each chart window has toolbars to the left, right and on top of the frame.

Starting for the top, traders will have the instrument selector, chart linking, and timeframe options. Timeframes are not classical and the standard has M1, M2, M3, M4, M5, M10, M15, M30, H1, H4, H12, D1, W1, MN and the Tick variant has the range from 1 to 1000 ticks. Right next is the Single chart mode switch. The left toolbar side has the chart type selection with Bar, Line, Candlestick, Dots, Heaikin Ashi and HLC. Below is the Indicators selection, we have counted more than 60 indicators equally distributed into 5 categories, Trend, Oscillators, Volatility Volume, and Others.

The indicators will have settings to change line colors, add levels apply different calculations, etc but still, custom indicators from MT4 can be superior in terms of setting versatility and combining with others. Templates are similar in function like in MT4 and also workspaces can be saved. The left sidebar contains the windows arrangement buttons, and various on-chart drawing and measuring tools. These include Crosshair measurements, Market Spanshots, Trendlines, Channels, Fibonacci tools, Shapes, Text, and Coloring.

Price Alert button is the last and will serve as a selectable on-chart pointer where the alert will be triggered. The alert window will give you options to set a higher or lower range trigger to Ask/Bid price. The alert can play a sound and pop up. The right part of the platform holds the Watchlist and the instrument Finder. The watchlist can be customized but we have noticed that the Spread and other information MT4 has is not available.

Trading instruments are neatly categorized into logical relevant groups with the finder toolbar. There are also settings for fast trading orders, dark theme switch, notifications, Email Alerts, and hotkeys list. The platform is fully packed with integrated services from the broker. An interesting and useful Analyze mode is added where traders will find data about their trading risk, exposure, drawdown, and many more, similar to the MT4 Strategy Tester. Newsfeed, Live Chat, Economic Calendar, Trading Central Signal service, all are integrated into the platform.

The right side panel contains information about the selected market including the DoM on 3 levels, Standard DoM, Price DoM, and VWAP DoM. In addition to all this, the Sentiment indicator is present on many useful places for a glance. Ordering options are also more advanced than in MT4 that professional traders will appreciate. We were connected to Frankfurt servers and we had a latency of just 19ms. Overall, the platform deserves all the rewards.

Leverage

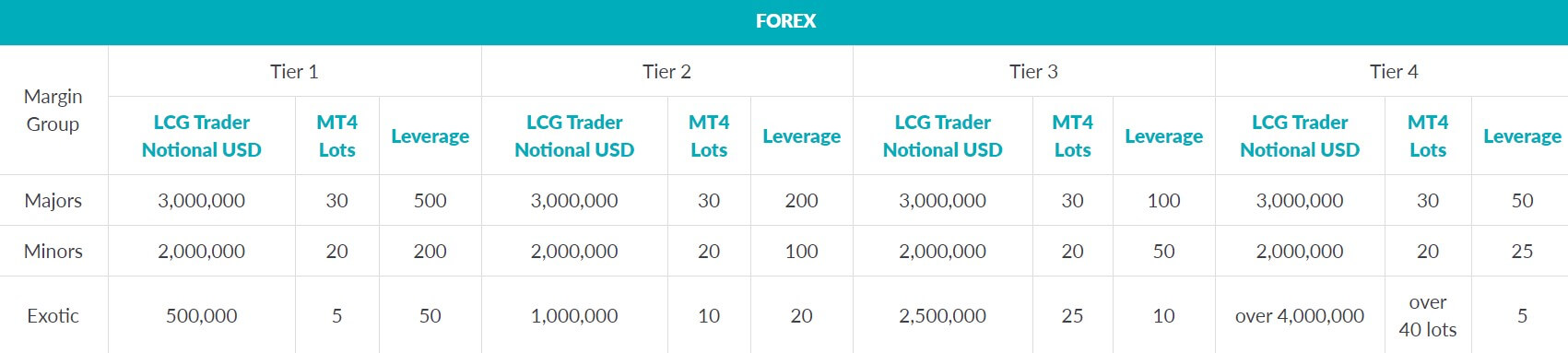

The leverage levels depend on the account type, asset, trader categorization and on the regulation. ECN account under the BSC has 1:200 leverage for most, non-exotic Forex currency pairs, except for CHF/JPY pair which has 1:50 leverage. Exotic forex currency pairs have 1:50 leverage. For Spot Gold quoted in the USD is 1:200 and for Silver is 1:100. Indexes have leverage from 1:100 for uncommon and 1:500 for majors while spot Oil assets have 1:200. Cryptocurrencies have interesting, uncommon leverage of 1:8 according to our measurements in MT4.

Classic account traders under the BSC regulation will have 1:500 leverage for the major forex currency pairs while for minors it is reduced to 1:200. Exotics have 1:50 maximum leverage. Spot Gold has 1:200 and Silver 1:100, the same as with ECN. Indices, Commodities and the rest of the asset categories do not have differences according to the account types.

Under the EU or FCA regulation, the leverage for the ECN and Classic account is the same for the Retail traders, 1:30 for majors and 1:20 for exotic currency pairs. Spot precious metals have 1:20 for Gold and 1:10 for Silver. Indexes have 1:20 or 1:10 leverage depending on the grade and all Commodities have 1:10 leverage. Retail traders will also have 1:5 maximum leverage for Stocks.

Classic and ECN account Professional traders under the FCA or CySEC regulation will have the same leverage as traders under the BSC regulation stated above. BSC regulation does not have trader categorization.

The broker applies dynamic leverage adjustments according to the volume. So a trade above 3 million will automatically have reduced leverage to 1:200, then to 1:100 above 6 million units and so on. The full table scheme will be visible in the LCG Trader.

Trade Sizes

LCG supports micro-lot trade sizes or 0.01 lots for Forex instruments for both account types. Spot Gold and Silver is stated to have a 0.1 lots minimum trade size although what we have seen in the MT4 platform is 0.01 lots. Indices have 0.1 lot minimum except for Nikkei 225 which has 0.01 lit minimum trade size.

Commodities all have 0.1 lots minimum while Bitcoin has 0.01 lot minimum stated in MT4. Note that the Cryptocurrencies offer is not published on the website. What we have noted in the MT4 is 0.01 lot minimum trade size a maximum of 7 lots per trade for Bitcoin. For other cryptos, it is 0.1 lots minimum and 50 lots maximum.

Stops level is zero for almost all forex currency pairs, the exception being the GBP based exotics like GBP/ZAR with 150 points stop level. Although for spot Gold and Silver, it is set to 50 pips which are not negligible. Cryptocurrencies have 20 points Stops level while Oil types have 1 point.

Margin Call and Stop Out levels are not disclosed but from other sources, we have found out that Stop out is set at 50% margin level and Margin Call is at 100%.

Trading Costs

LCG non-spread costs are account, platform and asset-specific. ECN account has the tightest spreads and LCG charges a commission of $45 per $1M traded on the LGC Trade platform and $10 per lot on the MT4 for any asset. This commission is not disclosed in the MT4 instrument specification. Classic Account is commission-free as broker fees are included in the spread. LGC will also have a markup on the spreads for Shares and they go from 0.1% to 0.25% for the SEAQ market. ETF will also have markup to the actual spread from 2 cents per share to 0.2%.

Swaps are under normal levels with frequent positive values. LGC website states 0.04% “admin fee” for overnight open positions but this figure is not additional cost. The swaps shown in the MT4 specification window or the LCG Trader are the full charge or credit. Forex swaps are calculated in points and tripled on Wednesdays. For the EUR/USD the long position swap is -9.32 points and 4.28 for short.

Other majors like USD/JPY also have a positive swap, on the long side is 2.8 points and -7.9 on the short. In the majors’ group, almost all currency pairs had one positive swap and almost all negative swaps are single digit. The exception being the GBP/CAD with -8.76 pints long and -0.36 points short swap, USD/CAD with -3 points on both sides and the EUR/CAD with double-digit negative swap on the long side, -12.22 and 5.28 on short.

Minors had more negative swaps but still, only GBP/NZD had a double-digit negative swap, -14.6 for long and -12.1 points for short position. Exotics currency pairs have a much higher swap as expected. The biggest swap is noted for the EUR/MXN pair with -627 points for long and 215.66 for a short position. USD/RUB pair had the biggest all negative swaps, -287.33 for long and -110.83 points for short.

Precious metals swaps are also calculated in points. Spot Gold quoted in the USD has -11.8 points for long and 3.4 positive swaps for a short position. For the cryptocurrencies category, the swaps are calculated in points too but tripled on Fridays. The long and short position swap is the same, for the BTC/USD is -469.34 points or in other words $4.6934 per traded Bitcoin per day.

Assets

LCG has one of the biggest asset ranges on the market. Starting with Forex class, all the majors and minors are present, and a great number of exotics extend the range to over 60 total pairs. Traders will see a lot of emerging market currencies with GBP, EUR, and USD as a base currency. We have found pairs like GBP/ZAR, EUR/ZAR and more common USD/ZAR. This is also true for PLN, NOK, HUF, CZK, TRY, SGD (also AUD/SGD), PLN (also CHF/PLN), MXN, and SEK. Others are available with the USD like USD/CNH, USD/HKD, and USD/RUB.

Precious metals are the weakest offer with only Gold and Silver offered. Some Gold futures also are on the list but none of the other precious metals like Platinum or Palladium are found.

Commodities range is very good. The spot market is focused on Oil types. Both Brent and WTI are listed. In the futures offer traders can also have both Oil types and 13 more commodities. These are US Coffee, World Sugar, Cotton No.2, Orange juice, Soybean, US Cocoa, Wheat, High-Grade Copper, Carbon Emissions, Gas Oil, Heating Oil, Natural Gas, and US Unleaded Gasoline.

Indexes range is one of the best in the industry with 27 total. Some of these are CFD futures and are repeating. There are a lot of uncommon like Russ 2000, Netherlands 25, Swiss 20, Spain 35, Hong Kong 35 and Italy 40. We have found some additional indices not listed on the website like the very popular Cannabis Index and Wall Street Cash Index.

Stocks are categorized into the country and other classification groups. There are more than 4000 tradeable shares in the LCG platform while in MT4 only 3 groups are present with a much lower number of spot stock CFDs. A total of 16 groups are present in the LCG Trader and one of them is focused on Cannabis company stocks. MT4 has UK, US and EU groups with around 100 total companies. This offer is great but is somewhat limited to the LCG Trader platform only.

Bonds and Interest rates are not common to see available for trading. LCG offers a total of 6 Bond types and 3 CFDs on Interest Rates. Bonds offer include BOBL, Bund, Gilt, Schatz, US 10 Year and 30 Year bonds. Interest Rates CFDs are very rare to see, what is offered is Euribor, Short Sterling, and Swiss Euroswiss. These assets are not available in MT4.

ETFs are also offered by LCG. They are only available in their LCG Trader platform and do not have an assigned group so traders will have to search them by typing ETF or similar. They are scattered throughout the shares groups.

Cryptocurrencies are listed on both platforms but are not published on the website. Major coins are present while less common cryptos are Dash, EOS, Ethereum Classic, Litecoin, NEO, Monero, and Ripple. These are also quoted in USD, EUR, GBP, JPY, and even CHF, expanding the range with interesting trading alternatives.

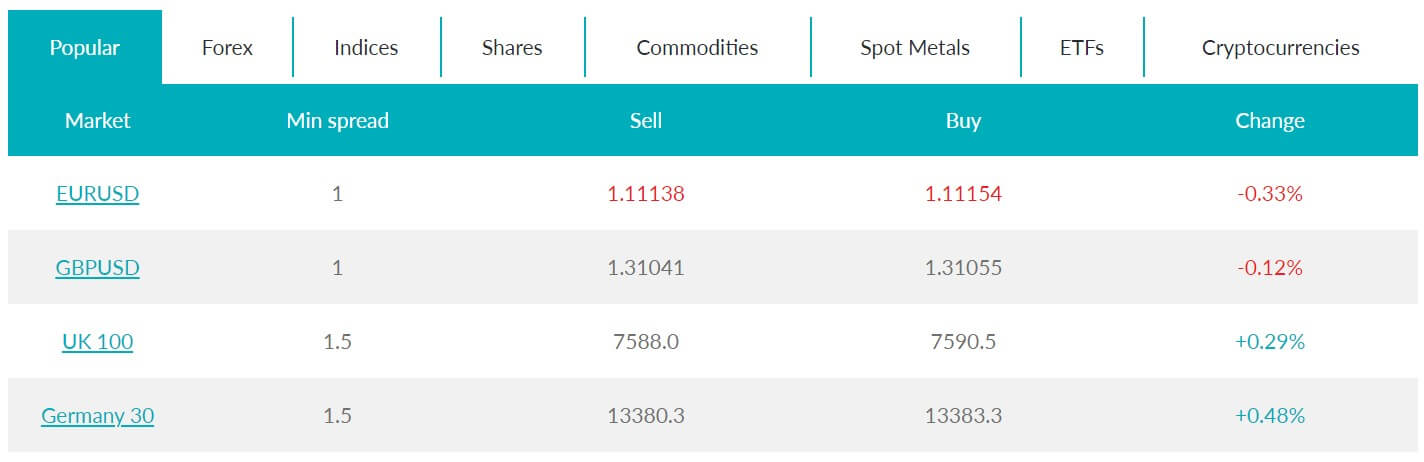

Spreads

LCG is a variable type spread broker for all accounts. The spreads for the ECN account are tighter but include a commission. The spreads range is not live on the website nor there is a demo for this account. We have observed ECN account MT4 spreads for most traded assets across categories and they are competitive. The usual marketing phrase from 0 pips is not far from the truth as EUR/USD has 2 points spread. Spot Gold has 20 pips and bot Oil types have 3 points spread. Bitcoin remains unchanged and has the same spread as the Classic account of 3610 points of $36.1. This means the biggest benefit out of this account is for Forex category.

Classic account has average spreads and for some traders, it may be a dealbreaker.EUR/USD has 15 points spread as well as USD/JPY while other major forex pairs have significantly higher spreads. GBP/USD has 21 points, GBP/JPY 35 points, EUR/CHF 25 points and so on. Minors forex pairs, again, have increased spreads comparing to other brokers. For example, NZD/JPY has 87 points spread, GBP/AUD 86 points, CHF/JPY 38 points, AUD/CAD 40 points, and GBP/NZD 138 points. The biggest spread belongs to the USD/RUB with almost 2000 pips, followed by USD/ZAR with 2200 points, USD/MXN 1743 points, GBP/NOK 1822 points, EUR/TRY 1500 points. USD/CHN has 220 points spread and the SGD quoted pairs have around 9 pips. Spot Gold has an acceptable 34 pips spread while both Oil types have 3 points.

Minimum Deposit

The minimum deposit for the ECN account is $10,000 and requires to maintain this balance level for eligibility. The Classic account does not have a minimum requirement.

Deposit Methods & Costs

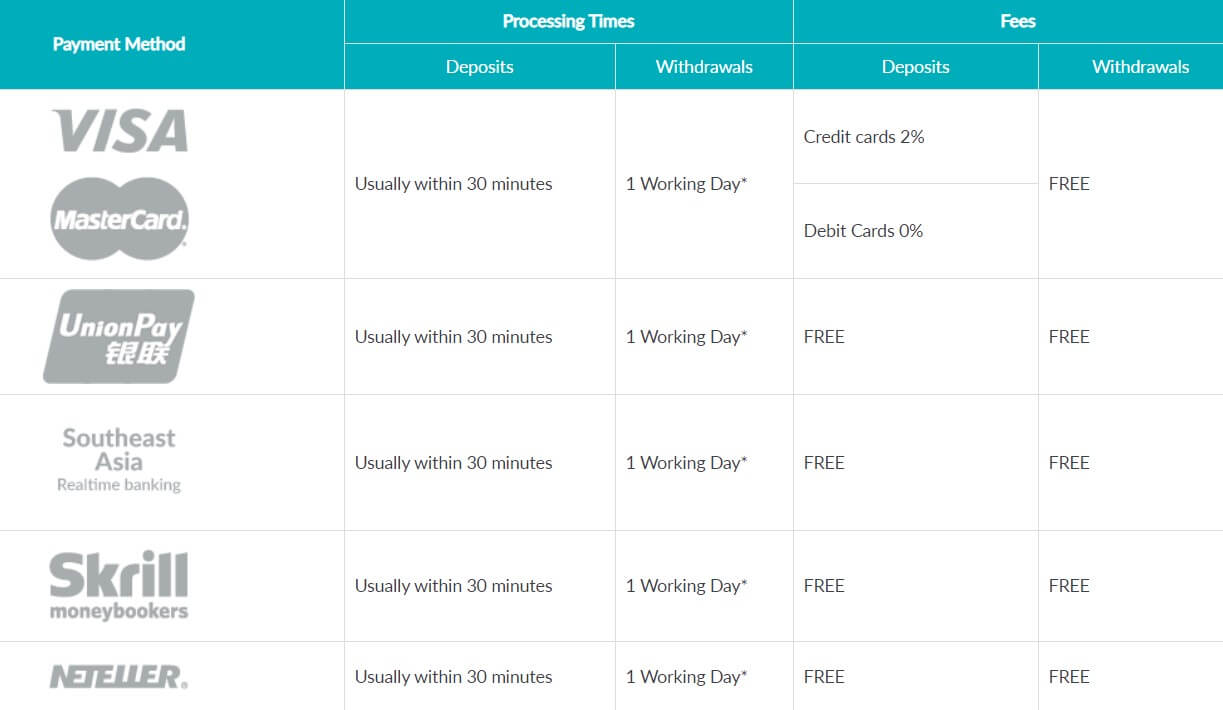

LGC has a deposit channel open for Debit/Credit Cards, Bank transfers, and digital payment processors like Skrill and Neteller. The cost for the Debit/Credit cards is 2%, LGC does not accept some VISA Electron cards and American Express. Note that all options may not be available for all countries or regulations.

Withdrawal Methods & Costs

Even if a trader is registered under the Bahamas regulation the same method for withdrawal must be used as with the deposit. Credit Cards will have a fee of 2% while Debit is free of charge. Bank transfers do not have any additional charges by the broker as well as online payments like Skrill and Netteler. Note that any Withdrawals less than £50 may be rejected by the broker.

Withdrawal Processing & Wait Time

Withdrawals are requested within my LCG area where the process is automated once the form is submitted. Mobile optimized My LCG portal also has the ability for withdrawals. The broker will finish the process within the same business day and the funds will reflect inside the trader’s account in 30 minutes for online payment processors, and 3-5 business days for the bank transfer method.

Bonuses & Promotions

No bonuses or promotions are presented. Affiliate and Introducing Broker programs are offered with solid compensation schemes.

Educational & Trading Tools

LCG has a dedicated section for Education and Analysis. It consists of Economic Calendar, Technical Analysis, Latest News, Analysis Videos, Trading Videos, Glossary, Webinars and Support Guides. On top of this, the broker has integrated some of these services into the LCG Trader platform and also offers Guaranteed Stop service for a fee.

Economic Calendar on the website is very well developed with multiple filters for countries, impact, timeframe, category, and the ability to save settings for the next session. Also, the Calendar features a search box for quick results. Clicking on the event will reveal more details about it, the link to the source and the figures related. A similar Economic Calendar is integrated into the LCG Trader platform.

Technical Analysis is available in the My LCG client portal and also inside the LCG Trader. The analysis on the website is presented on a slowly rolling bar with trading instruments. Hovering over the asset will open a window with the analysis detail for that asset. The content has the broker preference trade, an alternative scenario, comment or argument based on MACD, RSI and MA, and the support/resistance lines. The success rate of these projections is not disclosed.

The latest news page is full of fresh and important news only. The news content is very good with a mix of technical detail and the implications of the fundamental event. The arguments are very logical and results backed, making this section a very valuable addition for traders.

The latest news page is full of fresh and important news only. The news content is very good with a mix of technical detail and the implications of the fundamental event. The arguments are very logical and results backed, making this section a very valuable addition for traders.

Analysis Videos section consists of two kinds of videos, Market Insight and Week Ahead. These are not updated and the latest videos are from August 2019. Although the Week Ahead videos are fresh, about 15 minutes long, and of high-quality content. LCG put a lot of effort into these.

Trading videos also have two categories, Basics, and Advanced. The Basics cover topics like “What is Forex“, “Common trading Mistakes”, “Analysis: technical vs fundamental” etc. The videos are of high-quality content and production. The Advanced category has 10 videos and very interesting topics. For example, “How the LCG Cannabis Index works”, “MACD- the momentum indicator”, “Risk management and trading plans”, etc.

Webinars and live sessions available by booking only. We do not have an insight into their quality but we can assume they follow the same form as the videos and held by the same staff. Topics covered at the moment of this LCG review are: “Market Analysis”, “Platform Guide – LCG Trader”, “Trading Education”, and “Platform Guide – MT4”, The duration is from 20 to 50 minutes.

Webinars and live sessions available by booking only. We do not have an insight into their quality but we can assume they follow the same form as the videos and held by the same staff. Topics covered at the moment of this LCG review are: “Market Analysis”, “Platform Guide – LCG Trader”, “Trading Education”, and “Platform Guide – MT4”, The duration is from 20 to 50 minutes.

Support Guides is a helping section with How-To guides on basic topics. The section is divided into Introduction to Trading, How To Guides, and Customer Support. The content has a good mix of text and graphics and a bit of marketing. Some topics are “All about the LCG Cannabis index”, “How to Apply Indicators to a Chart”, and “What is the Spread in Trading?”. There are 10 articles in total and we are not sure what is the purpose of having 3 groups.

Finally, to mention the Guaranteed Stop service. This Stop Loss is an absolute risk protection form flash crash scenarios that can happen on any market. No slippage execution is guaranteed. There is a premium for using a Guaranteed Stop included in the spread. This premium is presented as a multiplier applied to trade size. Not all instruments have this option.

Note that the Trading Central analysis and news feed is integrated into the LCG Trader platform and is available for live accounts.

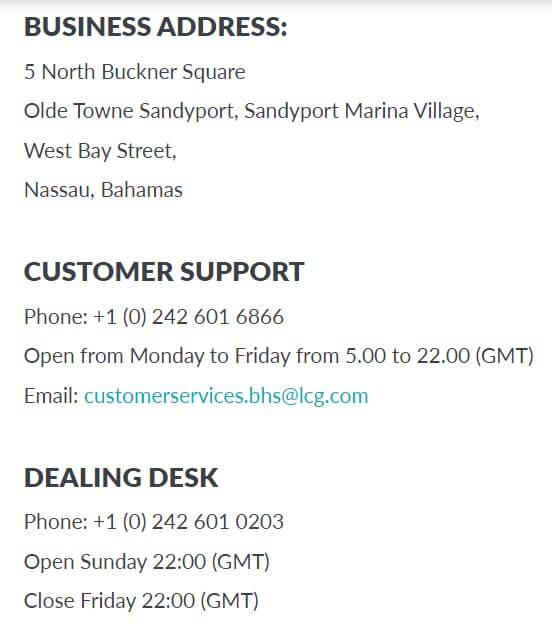

Customer Service

LGC support is not 24/5 but opens from 6 am to 8 pm UK time Monday to Friday. As we are informed they will soon introduce 24h customer service. The chat service requires a minute or two to receive a reply and any subsequent query will also leave you unattended for a few minutes more. It is also integrated into the LGC Trader platform The staff is knowledgeable and willing to help, even for more demanding tasks they will not refer you to write an email. The company also has a dedicated phone line.

Demo Account

The demo account cannot be opened within the MT4 platform so you will need to register with a valid email first. From the My LCG area, it is possible to open multiple demo accounts on different platforms. Each will have 10,000 virtual currency. The demo reflects the actual trading conditions. Demo for the ECN account type can be requested by email and the LCG staff will consider your request.

Countries Accepted

Unsupported countries are Singapore, Belgium, Canada, New Zealand, Australia, and the United States regardless of the regulation.

Conclusion

This section will give additional key information to this London Capital Group review. The biggest selling points of this veteran broker are the LGC Trader platform, extended asset offer, and great tools complementary. This comes at the cost of having somewhat increased spreads which will avert fast trading traders. The ECN account that offers much better conditions for some assets sets a steep wall with the minimum balance requirement.

Traders also need to pay attention to the user rating as this broker has below average grades and most of the reports are similar. The main issue is the withdrawal denial for traders in substantial profit. Even the FCA regulation does not have a great effect here, any fine will not be a problem for a big broker like LCG. We cannot confirm this practice but the majority of similar reports leave a suspicion. Also, note that the company is restructured since it became privately held recently, management could have different policies that could affect to a better or worse for the trader.