USD/JPY Exogenous Analysis

In the exogenous analysis, we will analyze economic indicators that exhaustively compare the performance of the US and the Japanese economies. These factors impact the dynamic of the USD/JPY pair in the forex market. They include:

- US and Japan interest rate differential

- The difference in the GDP growth in the US and Japan

- Balance of trade

US and Japan interest rate differential

The interest rate differential is the difference between the interest rate in the US and that of Japan. Investors would prefer to invest their funds in a country that offers higher returns. Furthermore, carry traders are often bullish on the currency with a higher interest, which ensures that they earn higher yields.

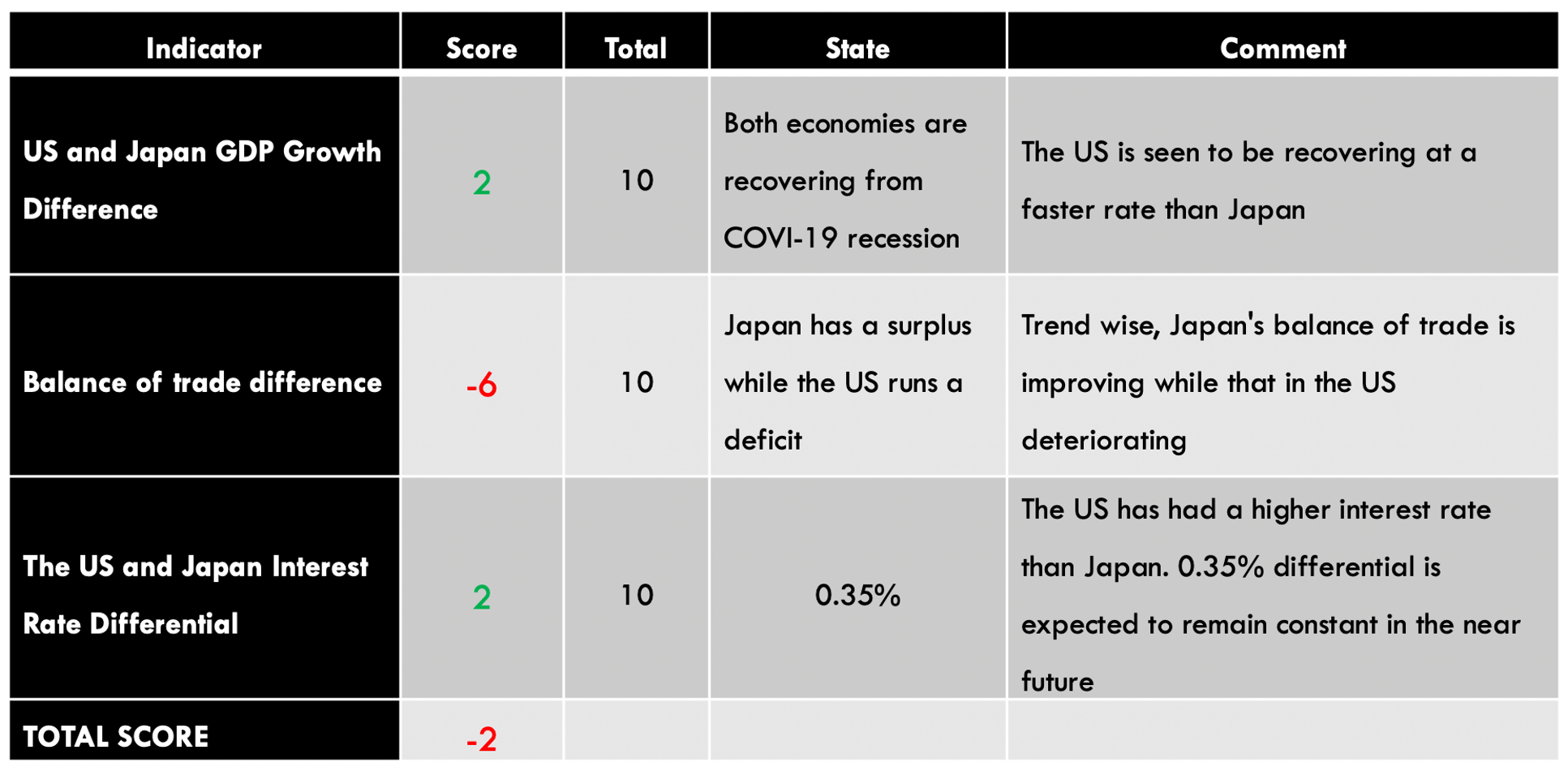

The Bank of Japan has kept the interest rates at -0.1% since 2016. The current federal funds rate in the US is 0.25%. Thus, the interest rate differential for the USD/JPY is 0.35%. Since there are no foreseeable changes in the interest rates in either country, we assign it an inflationary score of 2.

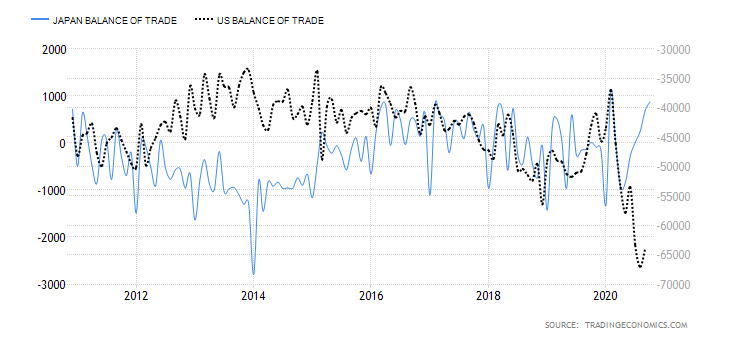

Balance of trade

Balance of trade determines whether a country has a trade surplus or deficit in international trade. A trade surplus results from a country’s exports being of higher value than that of its imports. A deficit occurs when the imports are of higher value than exports. Japan mostly exports machinery and electronics, which puts it at a significant advantage due to the value of these goods. On the other hand, the US is a net importer.

In October 2020, japan has a trade surplus of ¥872.9 billion, which has been steadily increasing since June. The US has a trade deficit of $63.9 billion, which has been growing throughout the year.

The balance of trade differential between the US and Japan has been widening in favor of Japan. Based on our correlation analysis with the USD/JPY, we assign it a score of -6. It means that if this trend persists, we expect the USD/JPY to be bullish in the near term.

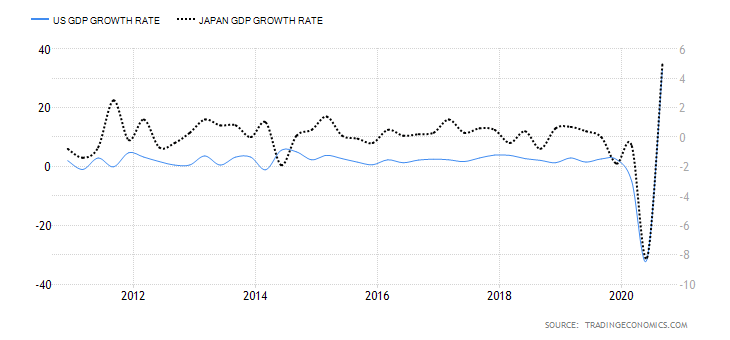

The difference in the GDP growth in the US and Japan

Although the US has a higher GDP than Japan, we can compare the two economies based on their growth rates.

The US economy had a GDP growth rate of 33.1% in Q3 2020, while Japan’s economy expanded by only 5%. The US economy is seen to be expanding at a faster pace than that of Japan. Based on the correlation with the price of the USD/JPY pair, we assign an inflationary score of 2. This means that we should expect a bullish trend on the USD/JPY pair if the US economy keeps expanding faster than that of Japan.

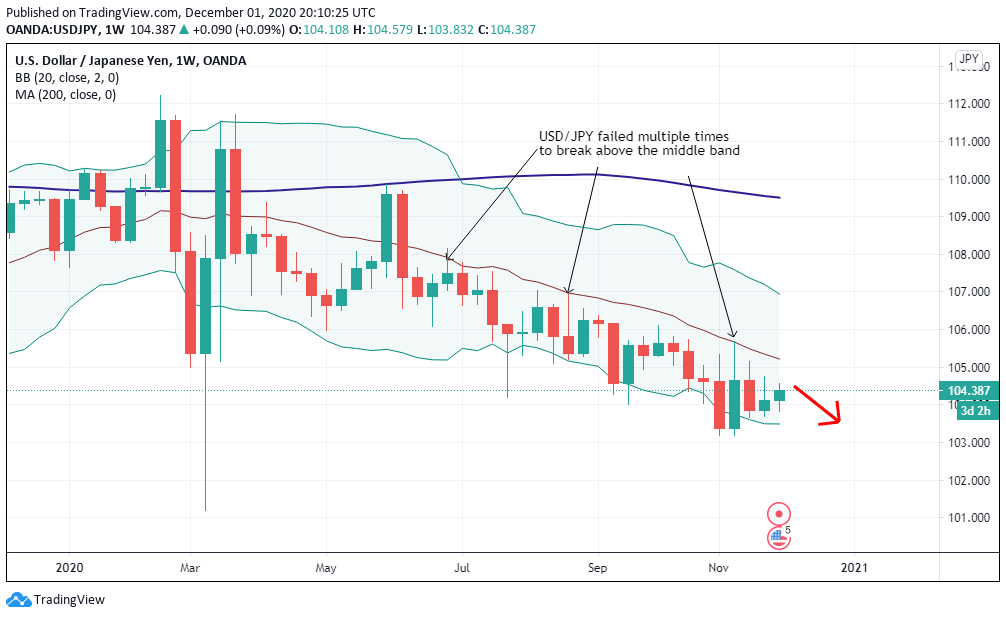

Conclusion

The total score from the exogenous analysis of the USD/JPY pair is -2. This implies that in the near term, we should expect a bearish trend in the pair.

The total score from the exogenous analysis of the USD/JPY pair is -2. This implies that in the near term, we should expect a bearish trend in the pair.

Technical analysis of the USD/JPY pair shows that the weekly chart is still trading way below the 200-period MA. Furthermore, the pair has failed to successfully breach the middle Bollinger band, which has served as its resistance level. All the best!