It is possible to invest in Nasdaq in a simple way, both in the general market (through an index) and in individual stocks. Just choose the financial instrument that best suits your needs and open an account with a broker. Nasdaq is the name of a financial market, usually associated with technology, but why? What advantages does this have? One of the most important questions is, how is it possible to invest in this market?

What is Nasdaq?

The term Nasdaq is an acronym. It corresponds to the National Association of Securities Dealers Automated Quotation (National Association of Securities Dealers Automated Quotation). It is a market; a stock exchange. The largest in the United States behind the NYSE (New York Stock Exchange). This market also has its own representative indices, and they also adopt the name Nasdaq (which we will see shortly). It is worth noting that the Nasdaq Stock Market does not have a physical location (such as the New York Stock Exchange parquet), but is based on a telecommunications network.

The birth of the Nasdaq, as a stock market, takes place when the Securities Exchange Commission (SEC), the US stock market regulator, asked the National Association of Securities Dealers (NASD) to regulate the OTC (Over The Counter) market in the ’60s.

To give us an idea, before the Nasdaq saw the light of day, in the United States, the stocks of companies could be bought and sold in three ways:

- At the New York Stock Exchange (NYSE)

- In the American Stock Exchange (AMEX)

- Outside a stock exchange (OTC market; “over the counter”: agreements between two parties, outside an official market)

Buying and selling OTC stocks is not illegal, however, neither are all the guarantees of security, transparency, liquidity, etc. Therefore, the SEC called for a better organization. This led to the automation of the market (by the NASD), which has already been discussed and, thus, the NASDAQ was created in 1971. But there was a question that did not end up pleasing: it was still an OTC market and therefore a second category market. The companies listed in the same began in this way because they could not access the “real parquet”. In other words, his ambition was to go on the AMEX market and, as a climax, enter the NYSE (the largest stock exchange).

In order to have the opportunity to be listed on the stock exchange, different companies must meet a number of requirements. However, the conditions imposed by the NYSE are very strict and make it difficult for young companies to access. In this way, many companies started trading in this new market. These were mainly technology firms and, for this reason, the Nasdaq has always identified with technology. Its fully electronic operation also influenced the attractiveness of companies belonging to this sector.

But the National Association of Securities Dealers Automated Quotation (NASDAQ) was not willing to be a “second-class” market. Thus, in 1975, it developed its own listing rules and separated the stocks of stronger companies from the OTC. In 1982 the most powerful companies of the Nasdaq split up and created the Nasdaq National Market. Finally, in 1991 stock market regulators recognised the stocks of Nasdaq companies as equal to those listed in AMEX or NYSE.

Currently, this market is operated by the company Nasdaq Stock Market (later privatized). In addition, it is par excellence, the market where technology companies (electronics, biotechnology, telecommunications, computing) are listed. Companies such as Microsoft or Intel are listed on this Stock Exchange. On the other hand, its popularity came from the hand of the great Internet bubble, in the 90s.

We should look at all the listed companies, analyse them one by one and make an average of the movements they have experienced individually. In this way, we will have an idea of whether the market, in general terms, has behaved bullish or bearish. But there is a simpler way: take a set of the most representative stocks and, through an average (weighted, in most cases) of the share price, check their evolution. This is precisely a stock market index.

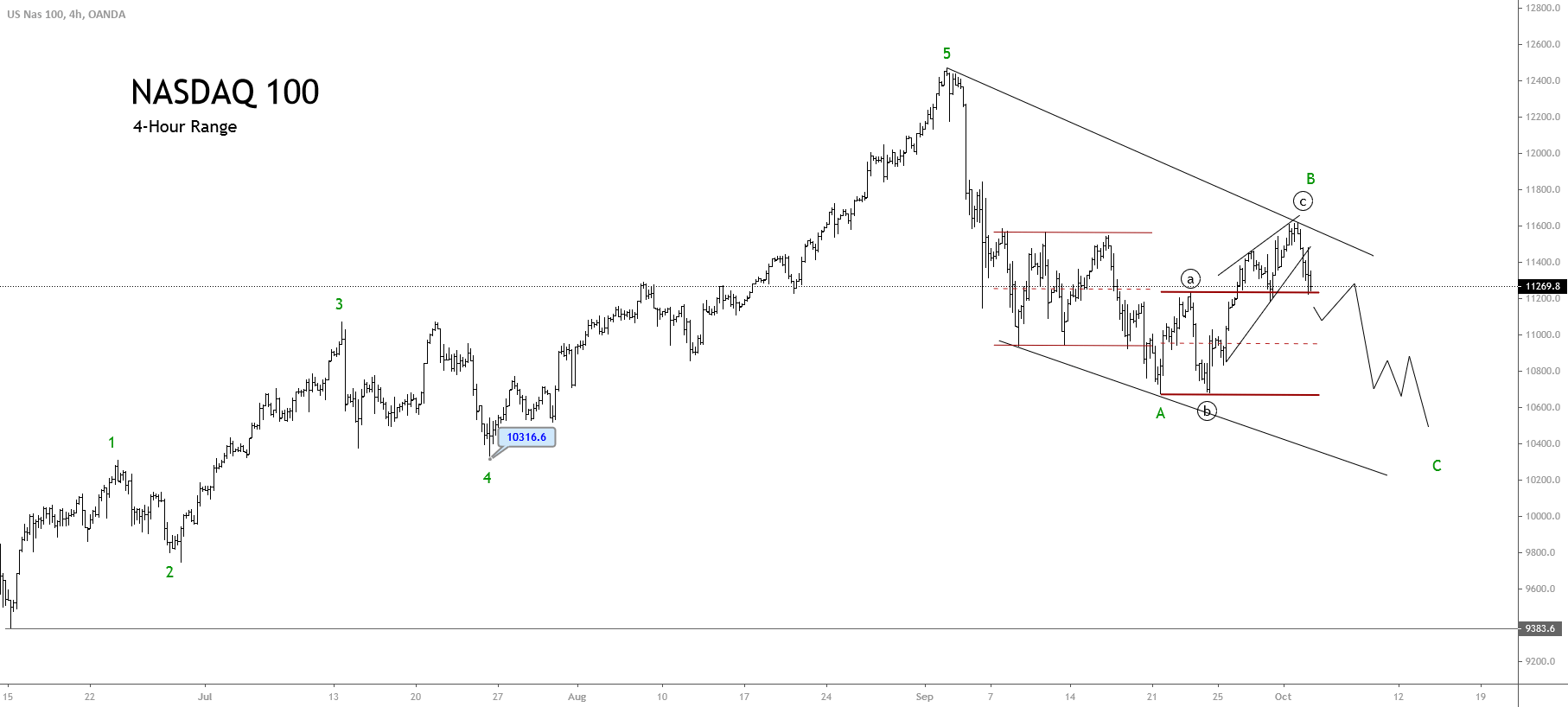

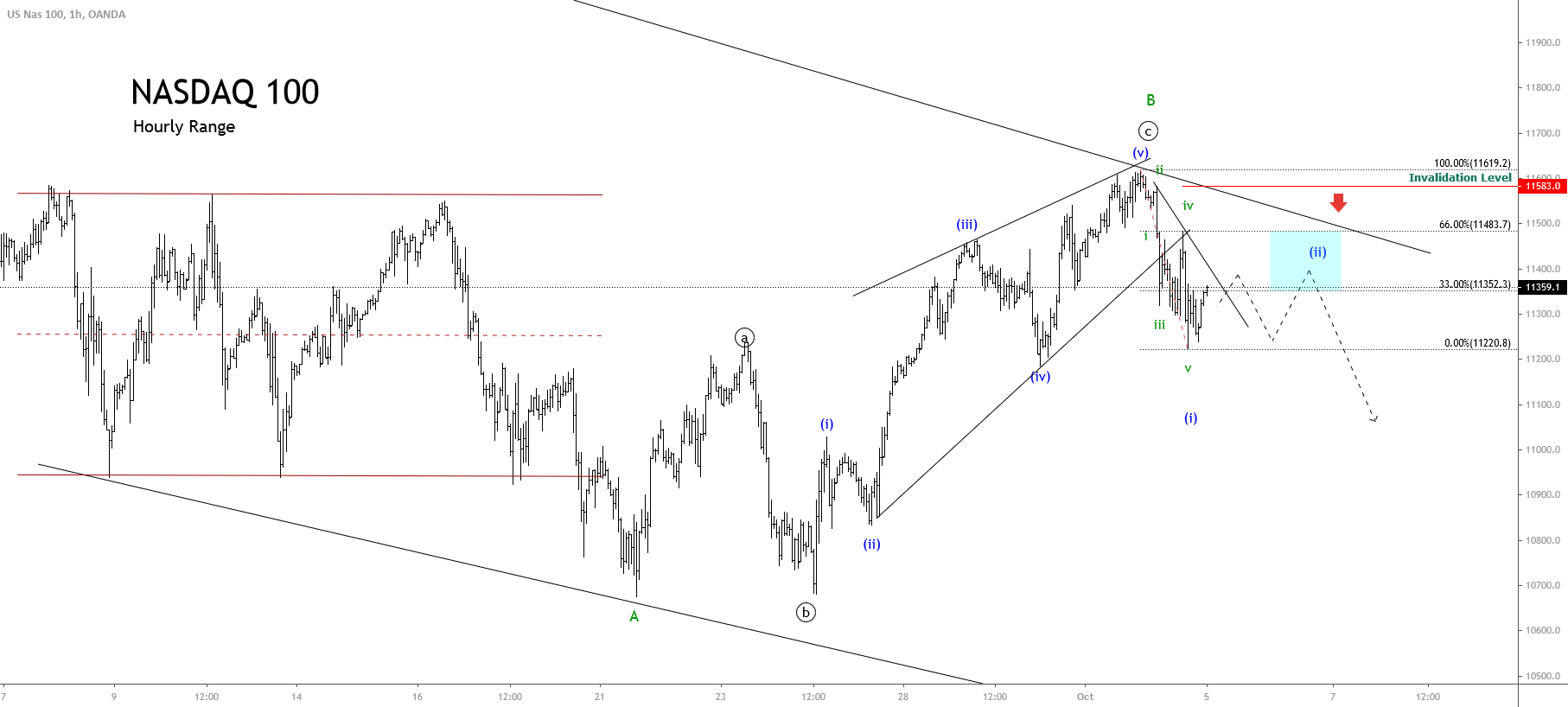

As we discussed earlier, investing in an index is like investing in the market as a whole. In this case, investing in a Nasdaq index is investing in a basket of securities composed of a number of more representative Nasdaq companies: Follow the evolution of an entire market.

Nasdaq 100: The Nasdaq 100 index was created on 31 January 1985 and is made up of the 100 largest technology companies listed in the Nasdaq Stock Market (actually there are 103, since 3 of the companies that make up the index issue two classes of stocks). It does not include stocks of financial companies (nor those dedicated to investment); for this reason, the Nasdaq 100 represents the technology sector well. The Nasdaq Stock Market is open to both US and foreign firms (since 1998). In this way, this index reflects the performance of the 100 largest companies in the technology industry in the world.

Nasdaq Composite: This index is composed of all companies listed in the Nasdaq market. In this “Electronic Stock Exchange” are traded securities of more than 3 thousand companies. It may include stocks of financial, investment and technology companies in general.

Nasdaq Biotechnology: Nasdaq Biotechnology is part of the pharmaceutical and biotechnology companies listed on the Nasdaq Stock Market (and only listed on this market), as well as other requirements).

Nasdaq Financial: includes all financial companies that have been excluded from the Nasdaq 100.

Why Invest In Nasdaq?

Not all stocks listed on the Nasdaq are purely technological. But this market has a strong orientation to that sector. In the Nasdaq 100 index, technology has a weight of 54%. In it, we can find the leading companies in this industry worldwide. The good evolution of technology firms has traditionally been associated with an expansive phase of the business cycle. However, because of the great social changes we are experiencing, technology is increasingly present in our lives.

Technology has a real application in any aspect of our day today. Just to mention a few examples:

- Transportation (vehicles increasingly equipped in comfort and safety).

- Telecommunications (social networks, new forms of leisure and information, B2C, B2B, 5G, etc.).

- Health care (robotics, biotechnology, etc.).

- Financial services (electronic banking, Fintech, Robo advisors, Blockchain and cryptocurrencies, etc.).

- Computer science (home automation, cloud computing, artificial intelligence, big data, etc.).

Although some analysts and investors talk about the possibility that a bubble could be created by the growth experienced by this sector in recent years, The fact is that the profits registered by technology companies and the progress they can experience cause the value of this type of company to also be increased.

Many companies in this sector are in the top 10 of the largest companies in the world:

- Apple

- Microsoft

- Amazon

- Alphabet (Google)

- Alibaba

So, it’s very possible that we find solid values, rich in liquidity, and with a good balance sheet position in the technology sector.

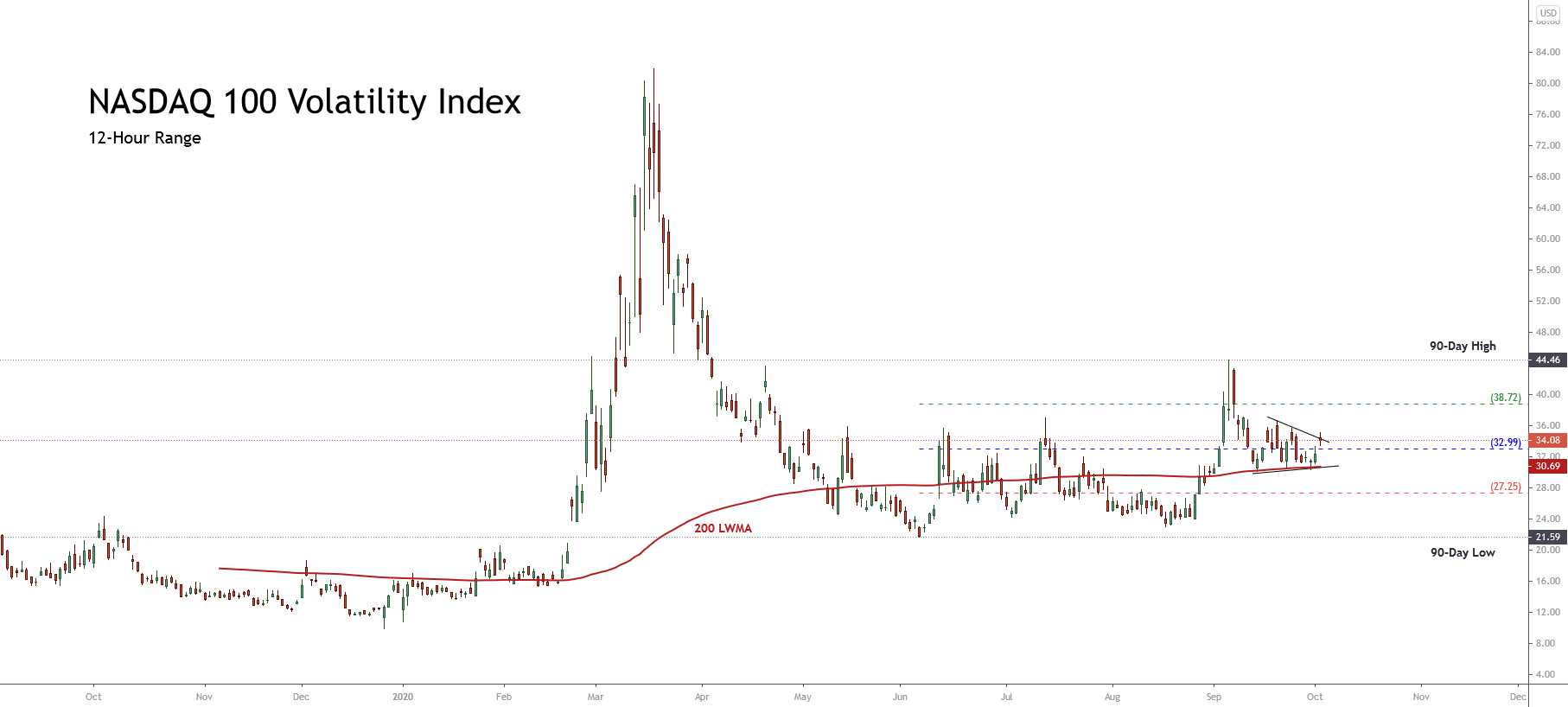

Technology companies have also always been associated with volatile securities. This is partly true: the volatility of this sector, little by little, is being equated with that of more mature ones; they no longer have the risk potential of the 1990s and during the year 2000 (when the “dot com” bubble burst).

To sum up: this is an industry with growth potential. The disruption caused by technology is causing a change in this type of company. We can no longer talk about a high-risk sector as a whole; it has stable companies.

In any case, technological companies are characterized by the need for constant innovation, the quality of management is a factor that should be studied. These are high-growth values. Good management can make a difference (and turn a company into the new Facebook or Netflix). Just remember that “Resources must always be allocated in the most efficient manner!”