Introduction

Taking a Trade Using Fibonacci Levels

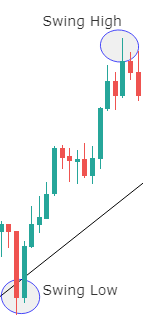

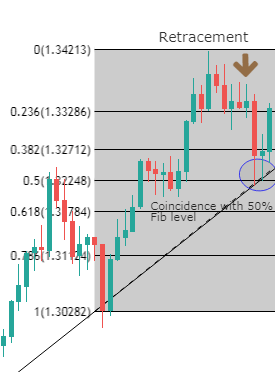

Entering a trade using the Fibonacci levels is pretty straight forward. We have to wait for the price to retrace and reach the appropriate Fib levels. In an uptrend, these Fib levels are 50% and 61.8%. In a downtrend, these levels are 50% and 38.2%. Hence, both 61.8% & 38.2% are known as Golden Fib ratios. Once the price reaches these levels, you can enter a trade after getting a confirmation. A detailed explanation of this can be found in this article.

Pairing Fibonacci Levels With Other Technical Tools

Fibonacci levels can be used stand-alone to enter a trade. But it is always recommended to use other technical tools to be extra sure about your trades. This is because the Fib levels are not foolproof. That means the price may not respect these Fib levels 100% of the time. More about this can be understood here.

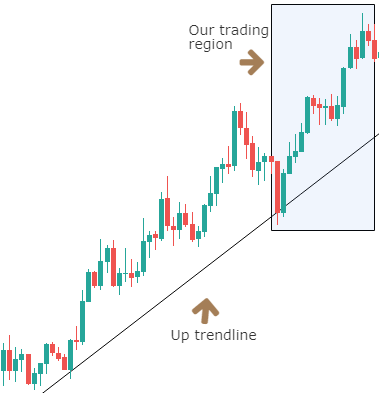

So, to be extra affirmative on what you are doing, make sure to combine the fib levels with other reliable indicators. Some of the tools we used to explain this concept are Support & Resistance levels, Trendlines, Candlestick Patterns, etc.

Using Fibonacci Levels For Risk Management

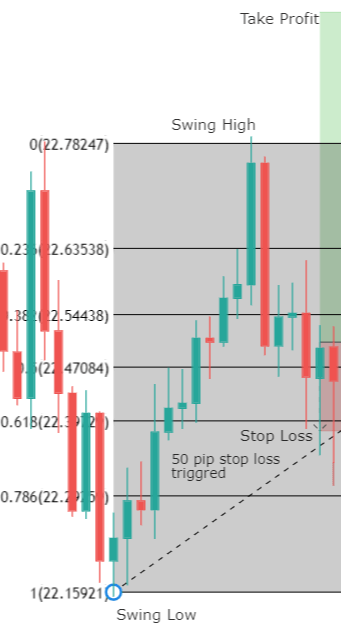

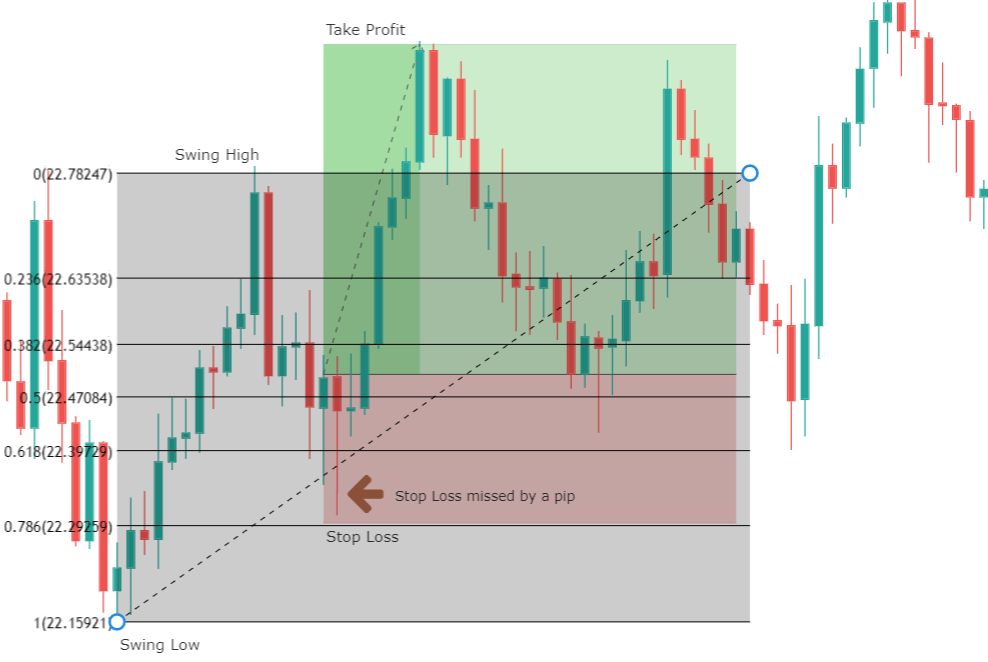

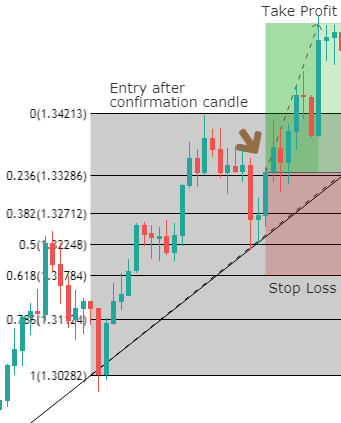

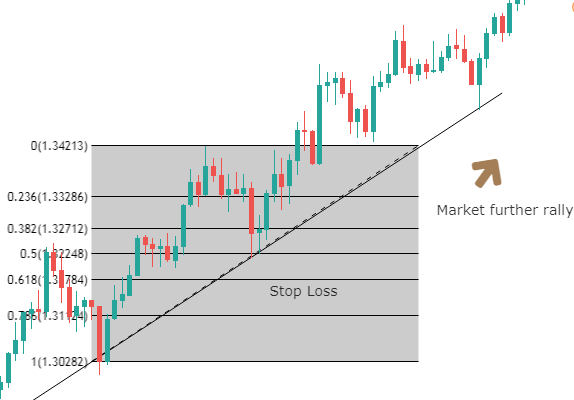

Not just for entires, Fibonacci levels can also be used for managing and exiting a trade. We know how important risk management is in trading. These levels will help us in managing risk and maximizing profit if used correctly. What we are trying to tell here is that Fib levels act as a perfect tool to place our Stop-Loss and Take-Proft orders accurately.

Fibonacci extensions must be used to decide the placement of various Take-Profit levels. To place accurate Stop-Loss, just used the Fib level, which is below the point of entry in an uptrend. Likewise, use the Fib level, which is above the point of entry in a downtrend. For a more detailed explanation, you can refer to the below articles.

Downloading The Fibonacci Indicator

Fibonacci indicators these days are very well designed and readily available in the market for free. Almost all of the trading platforms are equipped with a Fibonacci indicator that can be accessed on to the charts with just a click. If you are using the TradingView platform, a comprehensive Fibonacci indicator is present in the left side panel. If you are a MetaTrader user, there are some default Fib indicators, but the best one is the Auto Fib, which can be downloaded here.

Other Applications Of Fibonacci Levels

The applications of the Fibonacci levels are not confined to the ones discussed above. There are many other places where these ratios & levels are used for various other reasons. For instance, to confirm almost all of the Harmonic patterns, we use Fibonacci levels. An example of one such article can be found here. In this example, we have confirmed the formation of the Butterfly pattern on the price charts by using Fibonacci levels alone. So every technical trader needs to know and learn how to use these levels to have the edge over financial markets.

That’s about Fibonacci levels. If you have any doubts, let us know in the comments below. In the upcoming course lessons, we will be discussing more technical tools like Moving Averages, Indicators, Oscillators, etc. Hence, stay tuned for more informative content.