Skilling is a Scandinavian owned forex broker based in Cyprus and licensed by the Cyprus Securities and Exchange Commission. Their mission is to create a unique trading platform designed to cater to traders of all levels, from beginners who have never traded to seasoned pros. They want to create a platform that connects everybody to the world’s financial markets and showcases its potential to them. In this review, we will be looking at the services being offered to see if they live up their mission or if they fall short.

Account Types

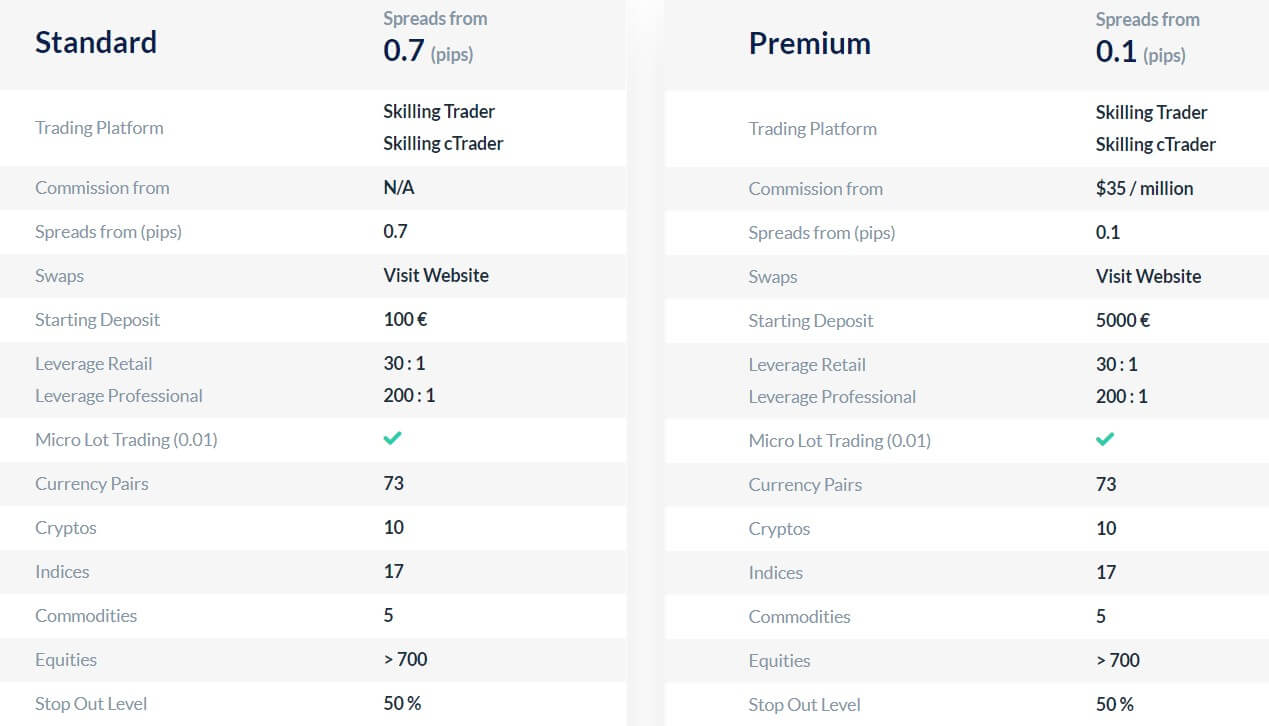

Two different accounts are available to choose from depending on your opening deposit amount and features that you prefer, let’s have a look at what is on offer.

Standard Account: The standard account requires a deposit of at least €100, It has spread starting from 0.7 pips and has no added commissions. It can use both available trading platforms (see next section of the review) and for retail customers, it has a leverage of 1:30 and a maximum of 1:200 for professional traders. Trading starts from 0.01 lots and there are 73 currency pairs, 10 cryptos, 17 indices, 5 commodities and over 700 equities to trade. The stop-out level is set at 50%, scalping is allowed and there is negative balance protection. This account is subject to swap charges.

Premium Account: The premium account increases the amount required to €5,000, this account has spreads starting from 0.01 pips but now has a commission of $35 / million, which is $3.5 per lot. The account can use both available trading platforms and retail traders can have leverage up to 1:30 while professional traders can have leverage up to 1:200. Trading starts from 0.01 lots and there are 73 currency pairs, 10 cryptos, 17 indices, 5 commodities and over 700 equities to trade. Stop out level remains at 50%, scalping is allowed and there is negative balance protection on this account, spreads are also present when using this account.

Platforms

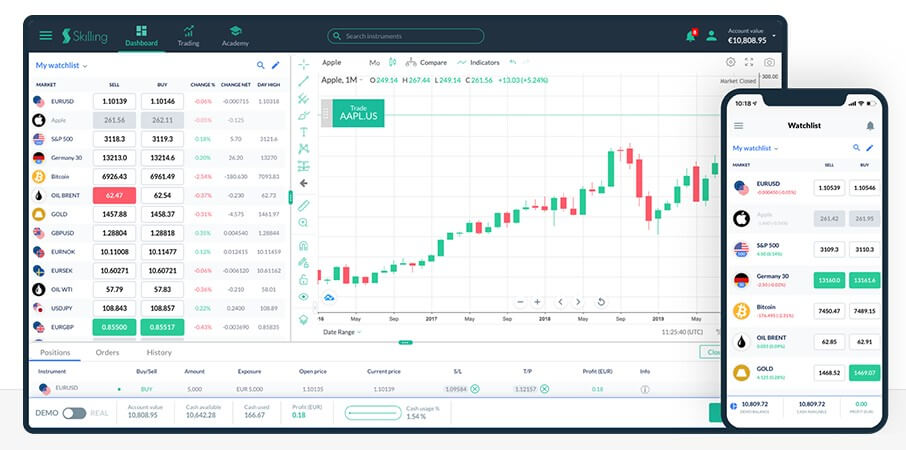

There are two different platforms on offer, so let’s see what they are.

Skilling Trader: The SkillingTrader is Skilling’s own trading platform, offering user-friendly and intuitive display, full web and mobile support, skilling trade assistant, multiple chart displays, ultrafast order execution, drawing tools, economic calendar built-in, 800+ instruments and more.

cTrader: cTrader is a leading multi-asset Forex and CFD trading platform, offering rich charting tools, advanced order types, level II pricing, and fast entry and execution. With a stunning user interface, it’s connected to the most sophisticated backend technology, and made available on multiple devices.

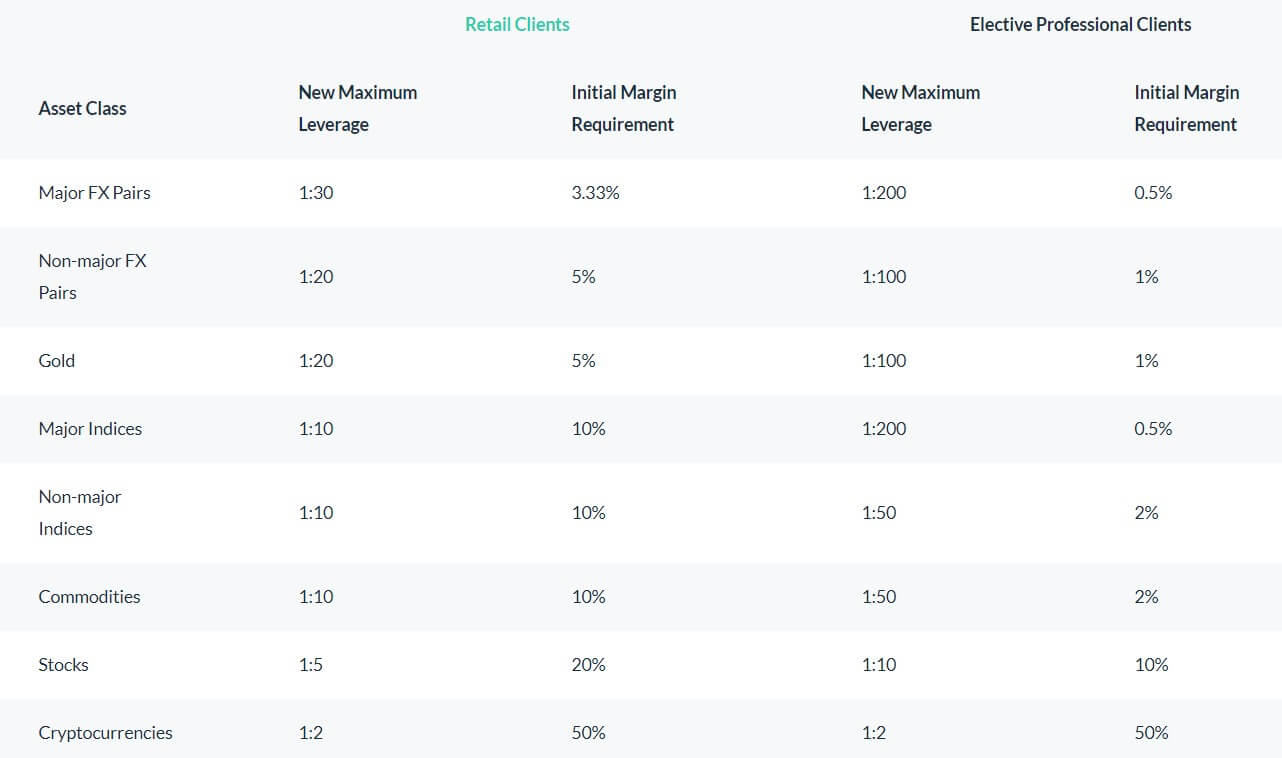

Leverage

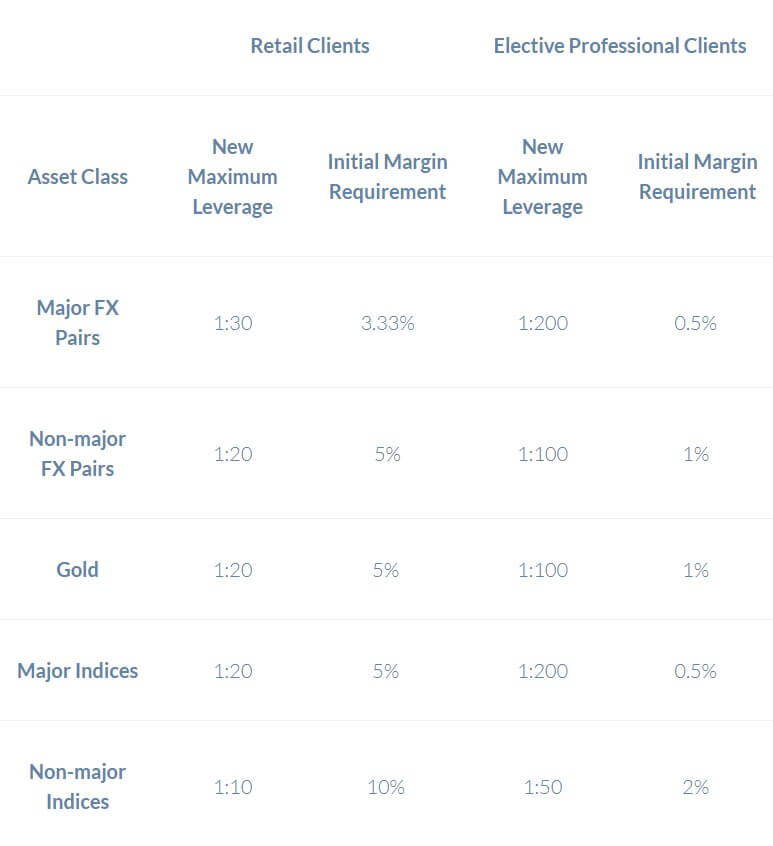

Leverage depends on a number of different factors, if you are classed as a professional trader then you can have leverage up to 1:200, however, if you are classed as a retail trader then you will need to adhere to the ESMA rules on leverage, we have outlined them below.

- Forex Majors – 1:30

- FX Minors – 1:20

- Index Majors – 1:20

- Index Minors – 1:10

- Precious Metals – 1:10

- Equities – 1:50

- Commodities – 1:10

Trade Sizes

Trading sizes start from 0.01 lots also known as micro-lots, the trades then go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. There isn’t a mention of the maximum trade size but we would not recommend trading more than 50 lots in a single trade as it can become increasingly harder for the markets and liquidity providers to execute trades effectively without any slippage.

Trading Costs

The standard account uses a spread based system that we will look at later in this review. The premium account has an added commission of $35 per million traded or $3.5 per lot traded. Swap charges are also present which is an interest in holding trades overnight, these can be viewed within the trading platform of choice or from within the Skilling website.

Assets

Skilling has broken down its assets into a number of different categories. There are 73 different Forex pairs including EURUSD, GBPUSD, USDJPY, USDCAD, and EURGBP. 715 different shares including the likes of Amazon, Microsoft, Facebook, Apple, and Google. 17 Indices including S&P 500, NASDAQ 100, Dow Jones 30, Germany 30 and UK 100. 5 different Commodities which are Oil WTI, Oil Brent, Gold, Silver and Natural Gas. Finally, there are 10 cryptocurrencies, including Bitcoin, Bitcoin Cash, Ehtereum, Litecoin, and Ripple.

Spreads

The spreads that you get depend on a few different factors, if you have the standard account then the spreads will be starting at 0.7 pips and if you have the premium account they will start from 0.1 pips. The spreads are variable which means they move with the markets and so when the markets are volatile they will be seen a lot higher. Different instruments also have different natural starting spreads, so while EURUSD may start at 0.7 pips, other pairs such as AUDNZD will always start a little higher.

Minimum Deposit

Minimum Deposit

The minimum amount required in order to open an account is 100 EUR, this gets you the standard account, if you want a premium account you will need to deposit at least 5,000 EUR. The minimum fo 100 EUR is the same for any subsequent top-up deposits on either account.

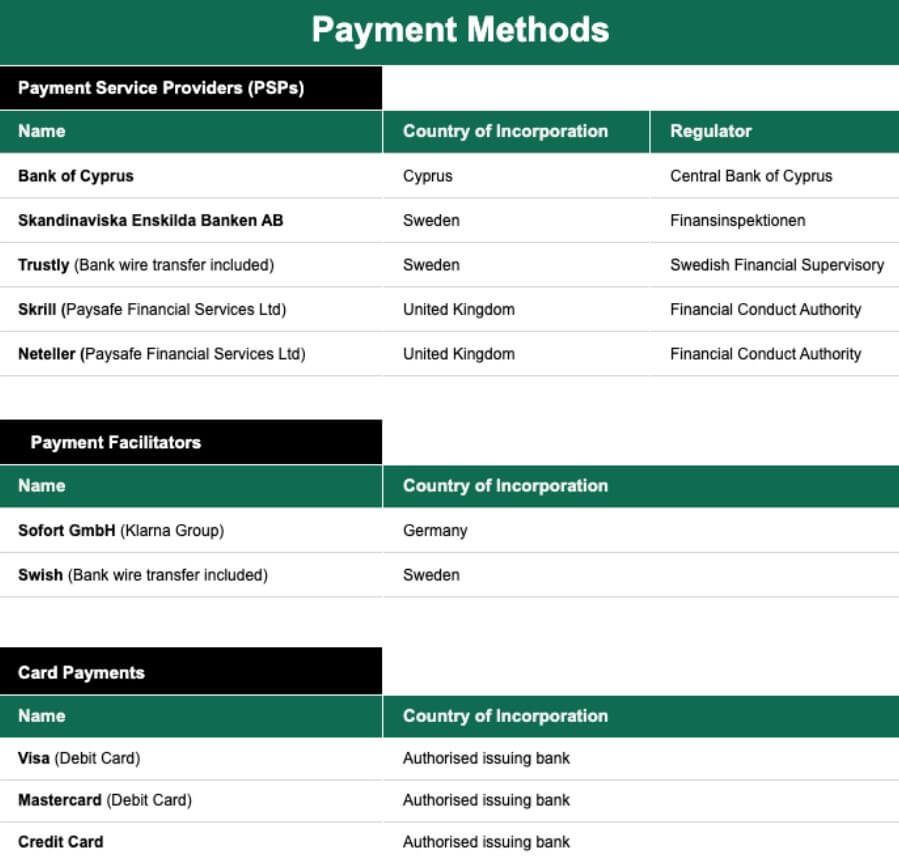

Deposit Methods & Costs

There are a few different available methods for depositing, they all have a 100 EUR minimum deposit and can be used to deposit in USD, EUR, GBP, SEK, and NOK. The methods available are Visa, Visa Electron, MasterCard, Neteller, Skrill, and Trustly (for bank transfers). There are no added fees from Skilling, but be sure to check with your bank or processor to see if they add any fees of their own.

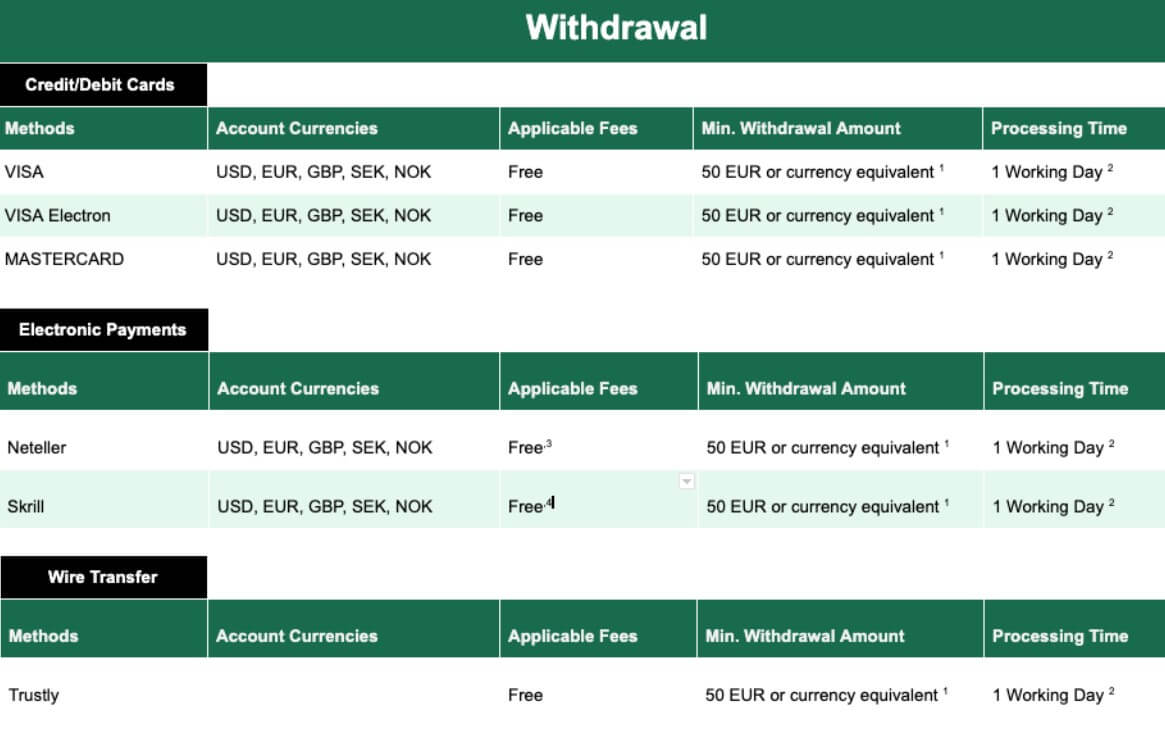

Withdrawal Methods & Costs

The same methods are available for withdrawal, for clarification, these are Visa, Visa Electron, MasterCard, Neteller, Skrill, and Trustly (for bank transfers). The good news is that once again there are no fees added to withdrawals, but as usual, be sure to check with your bank or processor to see if they add any fees of their own.

Withdrawal Processing & Wait Time

Skilling aims to process your withdrawal request as quickly as possible, they have outlined the following processing times.

- Trustly – 0 – 3 working days

- Credit / Debit Card – 1 working day

- Skrill – 1 working day

- Neteller – 1 working day

Bonuses & Promotions

There does not appear to be any bonuses or promotions active at the time of writing this review, if you are looking for bonuses, either check back regularly just in case one comes up or get in contact with the customer service team to ask if there are any upcoming promotions.

Educational & Trading Tools

We could not see or locate any information regarding training or trading tools so it does not appear that there are any which is a shame as a lot of brokers are now trying to improve the trading of their clients so it would be nice to see Skilling follow suite.

Customer Service

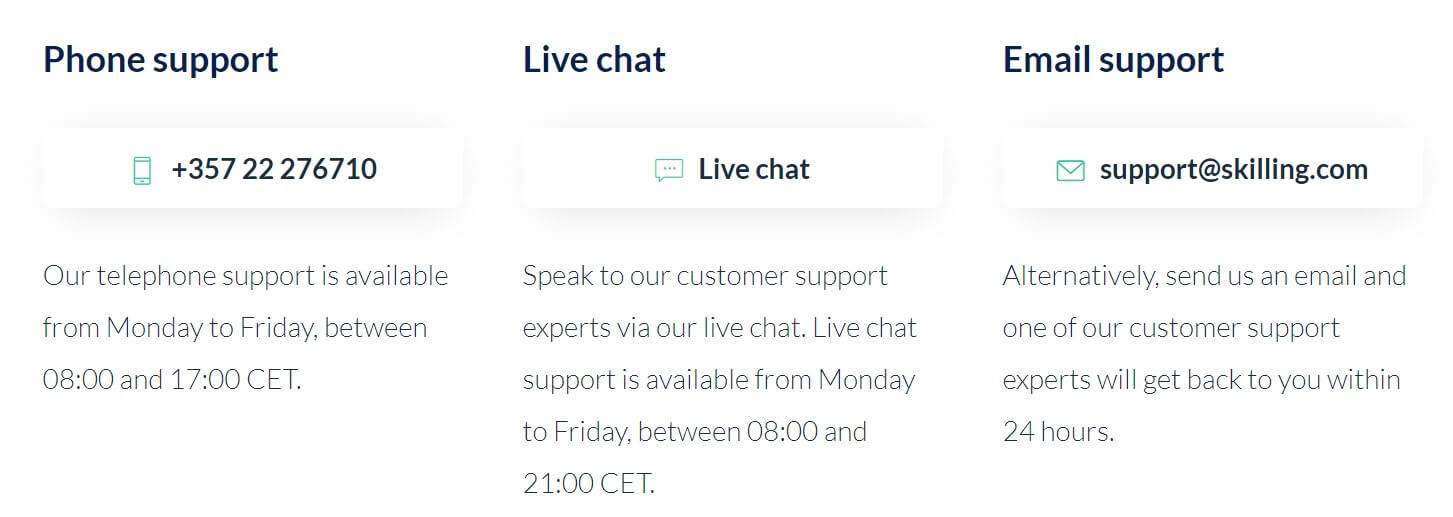

Skilling has tried to make getting in touch with them as easy as possible, they have done this by providing a number of different ways to get in touch. Initially, there is a phone number available to call, there are actually a number of different phone numbers, one for the UK, Sweden, Norway, Germany and a global one. There is also a live chat feature and an email to use should you wish to email them directly.

Phone support is open between 08:00 and 17:00 CET Monday to Friday, live chat is available from 08:00 to 21:00 CET Monday to Friday and you should expect an email reply within 24 hours.

Demo Account

Strangely there does not appear to be a demo account available, this is a shame as it is important for new clients to be able to test the servers and trading conditions and also important for existing clients to be able to test new strategies without risking their capital, so this is an area Skilling should look to improve.

Countries Accepted

There isn’t any specific information about countries being eligible or not, so if you are looking to sign up, we would recommend getting in touch with the customer service team to see if you are eligible or not.

Conclusion

Conclusion

It is clear that Skilling is working hard to be a great broker, they are offering very competitive trading environments with good costings. Plenty of assets to choose from so there will always be something to trade and their deposit and withdrawal methods are completely free which is always a bonus. The only downside is the lack of demo account, however, this is only a negative for new clients as they cant test the servers or conditions, at least existing clients can use another demo account from another broker to test their strategies. The decision to use them though is up to you.