RCPro was founded in 2010 and is based in Estonia. Their vision is to build a new generation of professional traders through training and education. They try to offer a high-quality service in terms of trading environment and platforms as well as a lightning-fast support team. In this review, we will be looking at what is on offer to see if they live up to their vision.

Account Types

There are four different accounts on offer, the Classic, Silver, Gold and Islamic accounts, let’s take a look at what each of them offers.

Classics Account: The classic account is the entry-level account, it has a minimum deposit requirement of $500, and this account uses the MetaTrader 4 platform, it has forex, metals, equities, indices bonds and commodities available to trade. The account currency must be in USD and there is no added commission on the account. The margin call level is 150% and the maximum trade size is 50 lots. A few additional features include an account manager with a professional degree in economics, a plethora of materials that help you understand trading, free tutorial trading sessions consisting of 3 lessons, the trading platform is compatible with a mobile phone and, daily recommendations from your account manager

Silver Account: The silver account requires an increased deposit amount of $2,500 and also uses the MetaTrader 4 trading platform it has forex, metals, equities, indices bonds and commodities available to trade. The account currency must be in USD and there is no added commission on the account. The margin call level is 150% and the maximum trade size is 50 lots. The following features are also available for this account: Account manager with a professional degree in economics, a plethora of materials that help you understand trading, free tutorial trading sessions consisting of 5 lessons, daily recommendations from your account manager and, a trading platform is compatible with mobile phone.

Gold Account: The gold account increases the minimum deposit further up to $10,000, the account also uses MetaTrader 4 but now there are fewer assets to trade with only forex, metals, indices, and commodities being available. The account currency must be in USD and there is no added commission on the account. The margin call level is 150% and the maximum trade size is 50 lots. A few additional features include an account manager with a professional degree in economics, more advanced materials that are designed for you to learn the most advanced strategies, free tutorial trading sessions consisting of 7 lessons, free access to all sorts of video tutorials, daily review by your market analyst, daily recommendations from your account manager and, a trading platform is compatible with mobile phone

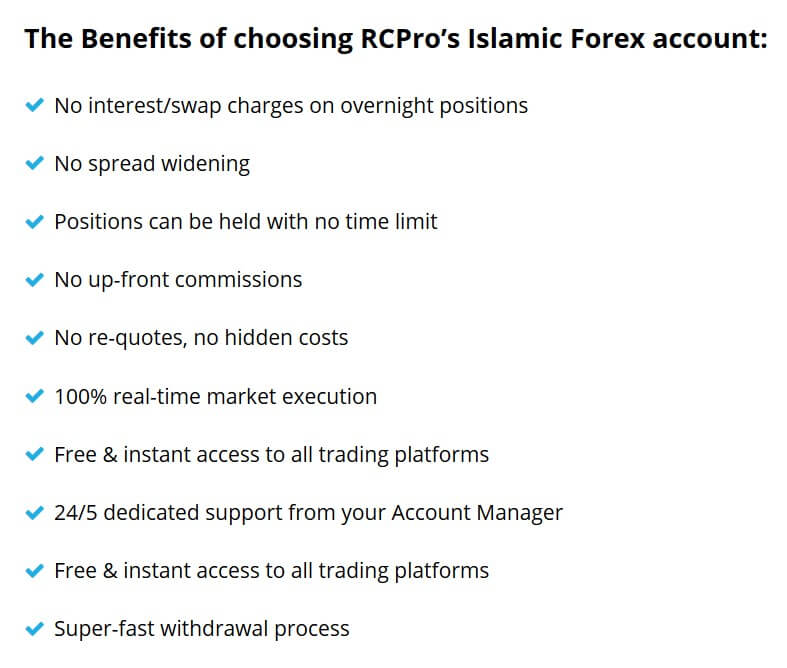

Islamic Account: The Islamic account is for people who can not pay or receive interest in holding trades overnight, also known as a swap-free account. The account comes with the following features: Buying and selling occur immediately and there is no postponement clause, all currencies are properly documented between the buyer and the seller, the deal must be paid for in full without any delay if there are any usurious rates the contract is invalid.

Platforms

RCPro uses MetaTrader 4 as their sole trading platform, if there is only one platform available then there could be a lot worse ones than MT4.

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more. Millions of people use MT4 for its interactive charts, multiple timeframes, one-click trading, trade copying and more. In terms of accessibility, MT4 is second to none, available as a desktop download, an app for Android and iOS devices and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Leverage

The maximum leverage available depends on the instrument that you are trading, we have set out a simple list below detailing the maximum leverage available by asset type.

Forex Majors: 1:200

Forex Crosses: 1:200

Indices: 1:100

Metals: 1:200

USA Shares: 1:20

Commodities: 1:100

Energy Futures: 1:100

Europe Shares: 1:20

Trade Sizes

Trade sizes for all instruments start at 0.10 lots (also known as mini lots). There is no indication as to what the increment size is for trades so we can not tell you if the next trade size would be 0.11 lots or 0.20 lots. The maximum trade size is 50 lots which is a good amount as any higher and it becomes harder for the markets and liquidity providers to execute the trades quickly and without any slippage.

Trading Costs

There are no commissions added to any of the accounts as they all use a spread based system which we will look at later in this review. There are swap charges on all accounts except for the Islamic account, these are charged for holding trades overnight and can be both positive or negative. The swap charges can be viewed directly within the trading platform.

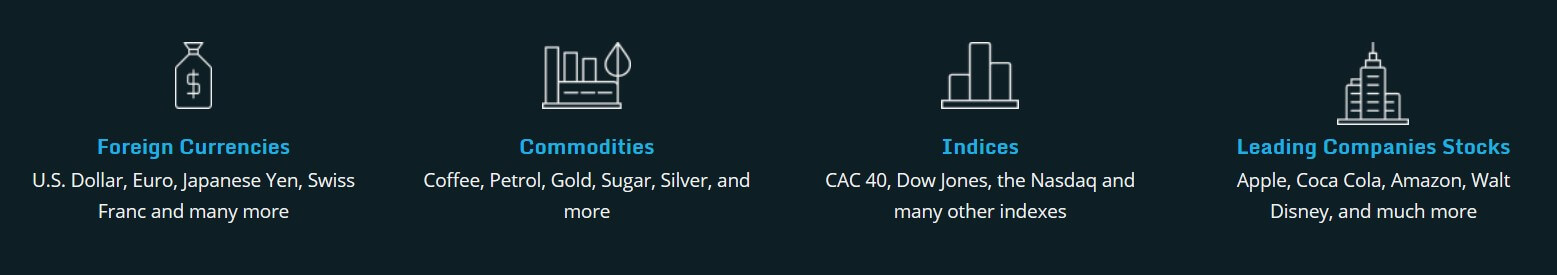

Assets

Assets are broken down into various categories including Forex Majors, Forex Crosses, Indices, Metals, USA Shares, Commodities, Energy Futures and, Europe Shares. Selections of available assets include EUR/USD, NZD/USD, CAD/JPY, EURCHF, NASDAQ, S&P 500, Gold, Silver, Apple Shares, Google Shares, Corn, Coffee, Natural Gas, Brent Crude Oil, BMW and, FIAT.

Spreads

Spreads are dependant on a number of different things, for example, the asset that you trade will have a different natural starting spread, if we look at EUR/USD, it has a starting spread of 3.2 pips while CAD/JPY has a starting spread of 4.9 pips. It should also be noted that these spreads re variable (also known as floating) so when the markets are volatile, the spreads will be higher due to movement in the markets. The stated numbers are the starting spreads and they will often be seen higher.

Minimum Deposit

The minimum amount required to open an account is $500 which gets you the classic account, if you wanted a different account then you would need a deposit of $2,500 or $10,000. Often when you open an account, any further deposits requirements are reduced for top-ups but there is no indication as to whether this happens with RCPro or not.

Deposit Methods & Costs

There isn’t a whole lot of information on deposits, the information that is available is pretty basic but gives us an idea of available methods. You can currently use Credit / Debit cards, both Visa and MasterCard, you can also use Bank Wire Transfer and E-wallets, however, which e-wallets are not indicated on the website. RCPro does not charge any fees on deposits, however, it is important to check with your processor to see if they add any fees of their own.

Withdrawal Methods & Costs

You can use the same methods to withdraw as you did to deposit, you must withdraw to the same method used. You may be asked to provide additional documentation when requesting a withdrawal which is a shame to see, as the broker is making it easy to deposit and hard to withdraw, a practice we never like to see. There is no mention of any fees or the lack of them.

Withdrawal Processing & Wait Time

Withdrawals requests at RCPro will take up to 24 business hours to process, once this process is complete the amount of time it takes will depend on the method used, most e-wallets will receive funds within 30 minutes, others such as bank transfer can take up to 7 days to be available in your account.

Bonuses & Promotions

The only bonus mentioned on the RCPro website is regarding a cashback program. The amount of cashback that you get depends on the balance of your account. You can receive up to $10 per lot traded as cashback each time you trade. The cashback is paid as cash and the funds can be withdrawn if desired. There does not seem to be any other bonuses or promotions active at this time.

Educational & Trading Tools

In terms of trading tools, there is the basic economic calendar that tells you of any upcoming news events and which markets they will affect. Then for education, there is a section based around trading strategies however it is very basic and does not go into much detail about any of them. There is a trade copying service, however, there are no examples of them so we can not comment on the accuracy or profitability of them.

Customer Service

The contact us page offers a way to get in touch with RCPro should you have any queries or concerns. There is the standard online submission form that you can fill in and should then expect a reply via email. There is also an email address available to use directly along with phone numbers and physical addresses. The site does not state the opening hours but we would assume that they will be closed over the weekends when the markets are also closed.

Demo Account

Looking around the site we could not locate any information about demo accounts so it appears there may not be any. Potential new clients like to use demo accounts to test out the servers and trading conditions offered, current clients like demo accounts as a way to test out new trading strategies without risking their own capital. It would be a big boost to RCPro if they make demo accounts available to their current and potential new clients.

Countries Accepted

There isn’t a statement or any information regarding who can or can not use the service if you would like to find out if you are eligible for an account or not we would recommend getting in contact with the customer service team.

Conclusion

RCPro gives their vision as a broker wanting to offer competitive environments however their trading conditions are far from competitive, the spreads are very high giving quite a large costs, despite there being no commission it is an expensive broker to use. There are enough instruments to give you things to trade but it would have been nice to see more variety. The promotion looks good but the lack of demo accounts along with the other information provided can make it hard to recommend them as a broker to sue at this point in time.

We hope you like this RCPro review. If you did, please be sure to check out some other reviews here at Forex Academy to help you find the broker that is right for you.

One reply on “RCPro Review”

They are an offshore fraud company with no license at all. Their accounts are not real money accounts but demoaccounts that they manipulate and controll. They can cancel your trades, to help you out, and even offer insurance, meaning that if you loose your money they can get them back, if you pay 20 % in insurance. The only reason not a lot of people report them is because all “customers” end up loosing everything on trades, not even knowing Rcpro is behind the loses. If you succed to be successfull in your trades and want to make a withdrawal, there is no way you will get any money. Only if its small size withdrawals you will get the money, just for them to get your trust. When making deposits they will tell you to transfer money to many different accounts all over the world, with strange beneficiary names, like food companies, and private individuals in Saudi Arabia.

All you who have lost your money trading with them, you should know, you never lost anything because you never even got a real money account to begin with, even less made any real trade.

The banks are now suspecting them, and holding on to their money, awaiting more evidence to be found. Contact HSBC in Hong Kong, about this fraud to get your money back