To measure risk-reward, price action traders must identify the level of support/resistance accordingly. It gets tricky sometimes. In today’s lesson, we are going to demonstrate an example of that.

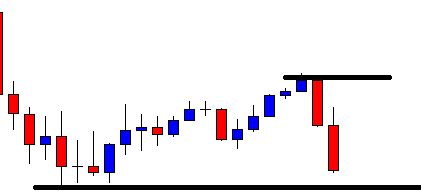

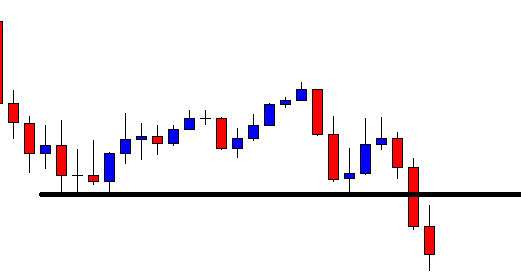

This is an H1 chart. The chart shows that the price has a bounce at a level. Upon producing a bullish engulfing candle, it heads towards the North. It finds its resistance and produces a bearish engulfing candle followed by another bearish one. If it makes a breakout and confirms the breakout, the sellers may trigger short entry by setting stop-loss above the level of resistance and take profit with 1R.

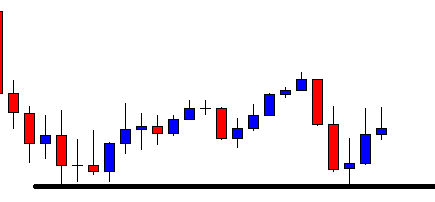

The price does not make a breakout, but it heads towards the North. The sellers must wait to find out what happens next. It may go back to the level of resistance, have a rejection at double top, and make a breakout.

It may even make a breakout from here. Let us find out from the next chart what happens.

The price finds its resistance at a new level. It produces a bearish engulfing candle again. If it makes a breakout at the level of support and confirms it, it would be a short signal.

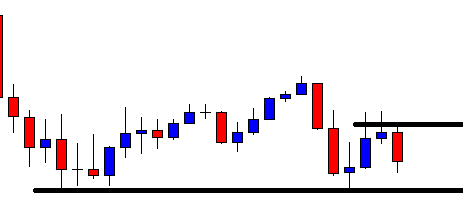

The chart produces a bearish candle, which breaches the level of support. If the next candle closes below the last candle, the sellers may trigger a short entry.

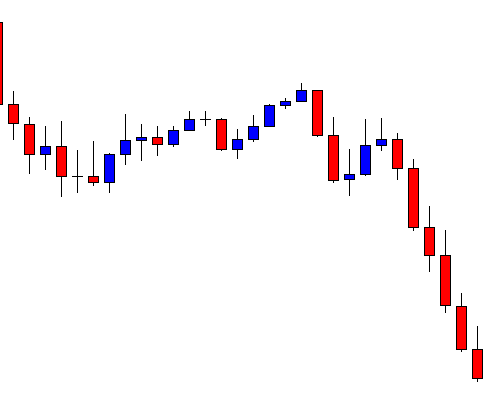

The next candle confirms the breakout. The sellers may trigger a short entry right after the candle closes. Question is where do they set their stop loss and take profit? Do they use the new level of resistance to set stop loss and take profit or use the old one? We find out the answer in a minute.

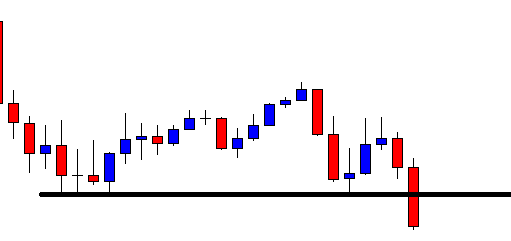

The price heads towards the South with good bearish momentum. Trade setup works as well as it usually does in breakout trading strategy. The price keeps making lower lows, and it seems it may go further down. However, since the price makes an upward correction before making the breakout, we may consider the second level to set our stop loss. We may set our take profit with 1R by measuring the same number of pips from the entry point to stop loss as well. This provides fewer pips as a reward, but to be safe with an entry like this, we may do this. The price often makes a consolidation, or it makes a correction (once it hits 1 R from the new resistance/support) after such breakout. A correction/consolidation sometimes leads towards a trend reversal as well. Thus, there is no point in taking a loss for hunting some extra pips. Always remember ‘safety first.’