The cryptocurrency market is currently in a state of consolidation. However, while the market is consolidating, NEO has been moving up. Due to fundamental news (China’s stance on cryptocurrency), this cryptocurrency increased in price over 100% over the past few weeks. If we look at the past 24 hours, Most of the market is precisely where it was 24 hours ago. Bitcoin went down 0.27%, and it is now trading at $8,744. Ethereum lost 0.16%, while XRP went down 0.34%.

Of the top100 cryptocurrencies by market cap, the biggest gainer is Aurora, with 24.80% daily gain. The biggest loser of the day was RIF Token, which lost 8.62% of its value.

Bitcoin’s dominance remained at the same place from the last time we checked the markets. Its dominance now sits at 65.92%, which is an increase of 0.05% from yesterday’s value.

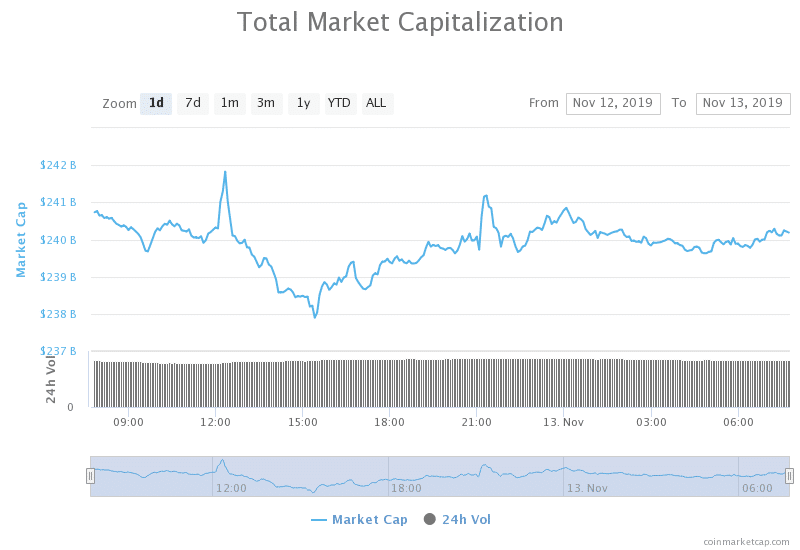

The cryptocurrency market as a whole now has a market capitalization of $240.2 billion, which represents a decrease of $0.6 billion from yesterday’s value.

What happened in the past 24 hours

There was no big fundamental news that could spark up any moves to the upside or downside in the past 24 hours. As a result of that, the markets kept consolidating, and the price of most cryptocurrencies didn’t move.

However, China’s positive stance on cryptocurrency is still relevant news, especially for NEO. Its price increased by over 100% in the past few weeks. This Chinese cryptocurrency is tied to the government, so any positive news on cryptocurrency coming from China will most likely be followed by NEO’s increase in price.

Michael Novogratz warned the United States of their position in the fintech and blockchain revolution. He stated that China’s blockchain and cryptocurrency revolution might be a threat to the current position of the US in the global economy. He also said that China is already ahead in research on fintech and that the United States is just trying to catch up.

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

After Bitcoin’s price tumbled to $8,550, bulls rallied to put it over the $8,640 support level. Bitcoin spent the past 24 hours moving between its support level and $8,820 resistance level. One attempt of breaking this range to the upside was quickly dismantled.

Bitcoin’s volume is still very low, but it has not dropped when compared to yesterday. The values remained relatively the same. The key level of 8,820 added as the price respected resistance at the price point.

Key levels to the upside Key levels to the downside

1: $8,820 1: $8,640

2: $9,120

3: $9,250

Ethereum

Ethereum didn’t move much for the past 24 hours. Its price is still contained within a range between the resistance line of $193.5 and a support line of $185. Ethereum’s bears rallied in a try to break the $185 level to the downside, but the bulls did not allow for that to happen, and the price returned above $185. At one time in the past 24 hours, the price reached $182 for a brief amount of time.

The key levels remain the same as Ethereum is back in the same position as it was yesterday.

Key levels to the upside Key levels to the downside

1: $193.5 1: $185

2: $198 2: $178.6

3: $163.5 3: $167.8

XRP

XRP hasn’t seen a lot of movement in the past 24 hours, either. Its price is contained between the support level of $0.266 and resistance standing at $0.285. As the range between support and resistance is a bit bigger than with Bitcoin’s current support-resistance distance, the price’s ability to move is also a bit bigger. Still, there was almost no movement in the past 24 hours.

XRP’s volume is still slightly elevated, while its RSI value is approaching oversold levels.

Key levels to the upside Key levels to the downside

1: $0.285 1: $0.266 (major support)

2: $0.31 2: $0.245

3: $0.325