Forex Options VIII – Market Overview of Option Strategies

In the previous videos, we have discovered the basics of options and the main topics that need to be mastered to trade them, such as Deltas, Volatility, Time to expiration, risk profiles, and market timing.

In this video, we will sketch the main strategies using options, with one goal in mind: to simplify the decision process.

Elements to success

There are two elements to consider when trading options: Volatility and price direction. A trader should consider if he wants to seek a directional strategy or a neutral one. After deciding that whether bullish, bearish, or neutral, the trader must look at the current and future implied volatility to decide which is best: to buy or write options.

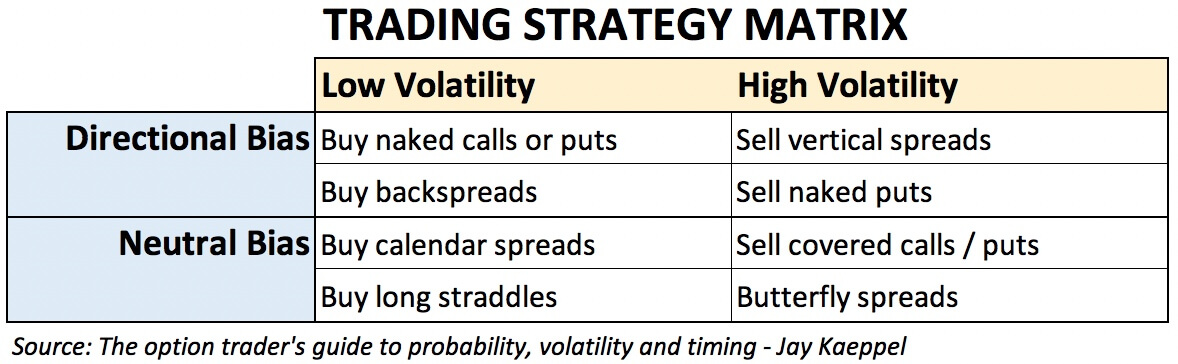

The strategy matrix

These strategies will be covered in the following video presentations, and our critical variables of volatility and market direction will play the primary role in the decision-making process. The process will always be the same: you should decide first if you’re bullish, neutral, or bearish, and then assess the volatility.

To help in the decision making, it could be handy to have:

A chart with the price action of the underlying instrument, to help us visualize the situation of the market action

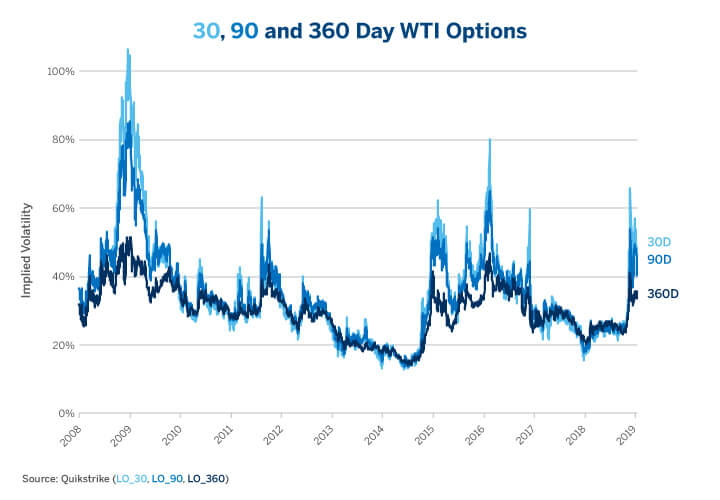

An implied volatility graph of the option in question, to assess whether it is at a low or high point

Source: cmegroup

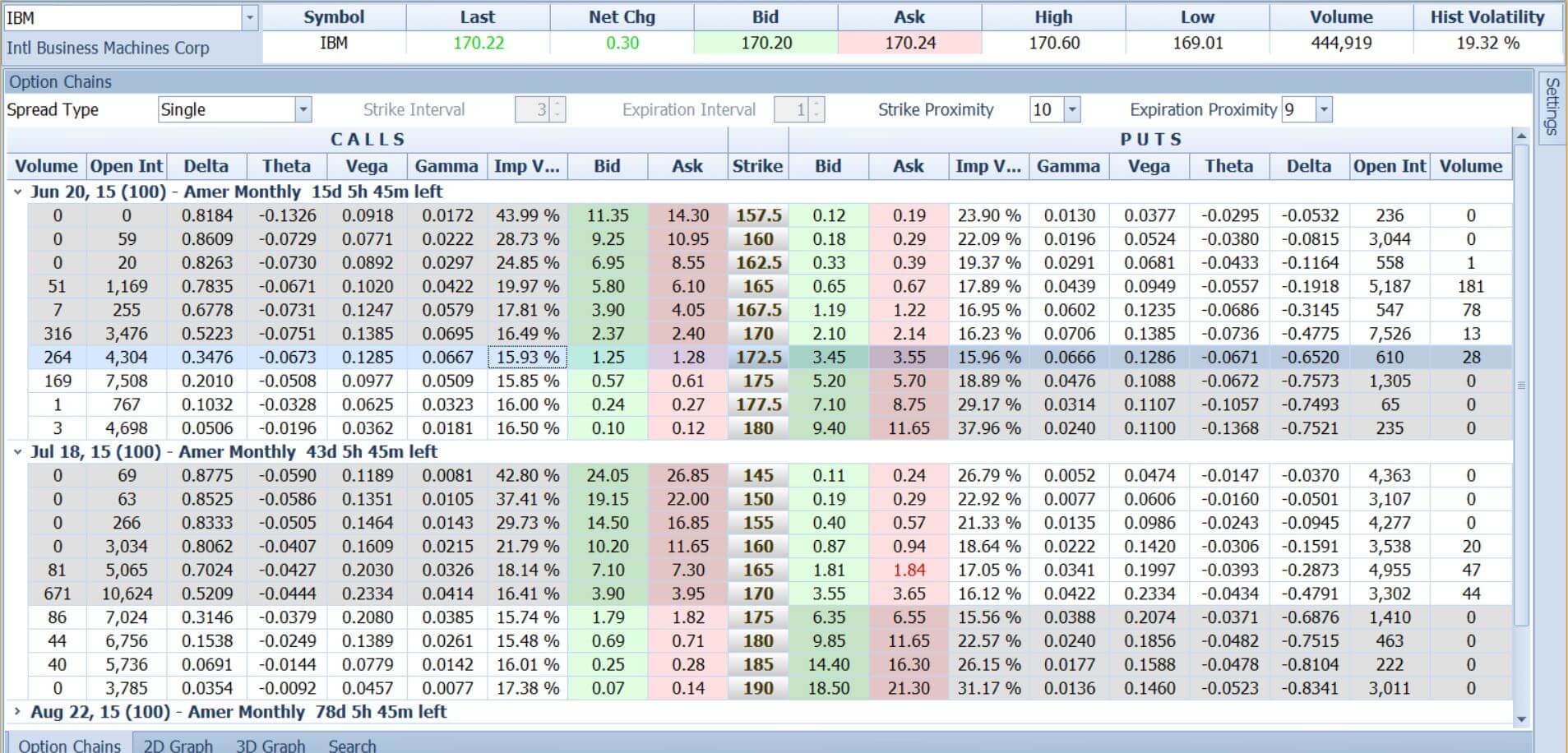

The options chain with prices of the asset, to help us see the proximity to the spot price and also the expirations.

Source: traderji.com

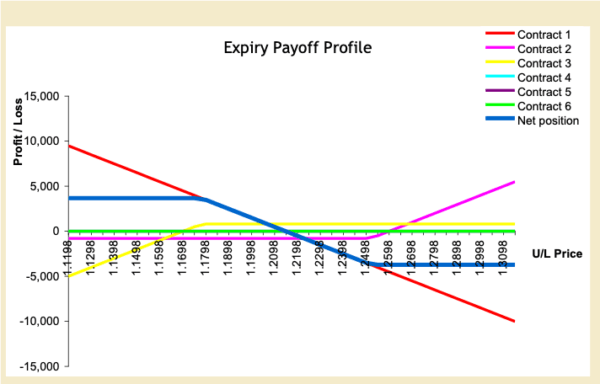

A risk profile graph. That kind of graph is available in the majority of the option-trading tools. A risk profile helps not only assess the potential profits but also visualize the worst-case scenario.

Source: gfmi.com

Position Management:

To option traders, the most challenging decision is to exit. Thus, besides knowing when to use the strategy and the right moment to enter a trade, it is essential to understand when to exit for a profit and cut losses.

The strategies we will cover in the coming videos are

Buying a naked option

Buying a backspread

Buying calendar spreads

Buying Straddles

Selling a Naked put

Selling a vertical spread

Butterfly spread

Dental neutral strategies

Adjustments to increase profits