Now that we know the importance of having a plan, let’s discuss the necessary components of a trading plan.

A trading plan should consist of at least these elements:

- A basket of instruments

- A trading system consisting of timeframes, permissioning filter, entry rules, trade management: stop-loss, take profits.

- A position sizing methodology

- A trading record

- Trade-forensics analysis.

In this article, we will provide an overview of these elements.

A basket of Instruments

Every asset has its characteristics, and its market movement differs from others on volatility, liquidity, and ranges. Therefore, professional traders track a limited basket of instruments to trade. A few, even, specialize and trade just one instrument.

Every asset has its characteristics, and its market movement differs from others on volatility, liquidity, and ranges. Therefore, professional traders track a limited basket of instruments to trade. A few, even, specialize and trade just one instrument.

The best criteria to decide which are best are:

- Liquidity: It means how much trading volume it moves. Illiquid assets are easy to manipulate, spreads (the difference between the bid and ask prices) are wider, and the trading rules fail more often.

- Price Action: The instrument should have enough swings in the trading timeframe to merit trading it. Instruments that do not move or move too erratically are prone to failed trades. A security that trends are the best.

- Familiarity: As said, your trading results improve if you’re familiar with how an asset moves, its usual support and resistance levels, the typical length of swings, and so on.

- Economic Data: Economic news releases affect the security and trading signals fail at the time of the release. Therefore, it is advisable not to trade it in the vicinity of a news release.

The Trading System

As said in our previous video, financial markets are unbounded territories where each trader needs to set his own rules; otherwise, they will be influenced by his emotions and fail. A trading system is their set of rules that enable them a long-term success.

As said in our previous video, financial markets are unbounded territories where each trader needs to set his own rules; otherwise, they will be influenced by his emotions and fail. A trading system is their set of rules that enable them a long-term success.

Timeframes

The chosen timeframe should match the availability to trade. A trader with a day job would need to select a daily or a 12-hour timeframe, whereas a full-time trader could use shorter frames, such as 15-min, one, two, or four-hour timeframes.

The chosen timeframe should match the availability to trade. A trader with a day job would need to select a daily or a 12-hour timeframe, whereas a full-time trader could use shorter frames, such as 15-min, one, two, or four-hour timeframes.

Similarly to asset selection, the trader must familiarize himself with how his assets move in these timeframes and evaluate the liquidity and range at different times and weekdays to choose the best periods to trade.

Permisioning filter

A permisioning filter is a way to avoid trading under determined circumstances. It can be a filter that allows only trading in the direction of the primary trend or an overbought/oversold sign that should be on for a determined candlestick or pattern formation to be valid.

A permisioning filter is a way to avoid trading under determined circumstances. It can be a filter that allows only trading in the direction of the primary trend or an overbought/oversold sign that should be on for a determined candlestick or pattern formation to be valid.

The key idea of the permisioning filter is to screen the trades and pick the ones with the best odds of success.

Entry rules

Entry rules can be technical or fundamental rules to time the market, although we will focus on technical rules.

There are two philosophies regarding entries.

- Enter on the trend’s weakness

This methodology aims to profit from pullbacks of a primary trend to optimize the price entry. Different indicators and patterns may help time the entry: MA crossovers, Oscillators, or reversal candlestick patterns such as the engulfing pattern or morning star and evening star.

- Enter on the trend’s strength.

Enter on strength aims to profit from an increasing momentum of the price. We acknowledge the trend’s strength is increasing and recognize the trend will continue for a while. Technical indicators such as the Momentum, RSI, and MACD may help time the entry. Price action patterns, such as range breakouts, are quite useful too.

Trade Management

Trade management is a vital element of any trading system. It is responsible for getting out of unprofitable positions, trails the stops to break-even, and above to optimize profits or close the trade when the target is hit or when a technical signal warns of a trend reversal.

Many top traders value more trade management than entries. The money is won on exits, they say.

Money management should be consistent with the concept of cutting losses short and letting profits run. A sound trading system should present an average reward/risk ratio at least over 1.5, and ideally above 2.

Position sizing

Position sizing is the part of your plan that tells you how much risk you should take on a trade. We have had a complete video section on this subject, which we encourage you to study. To summarize it here, position sizing is the tool to help you reach the trading objectives and put drawdown under the levels that fit you. Finally, proper position sizing enables you to minimize the risk of ruin while optimizing your trading account’s growth.

Position sizing is the part of your plan that tells you how much risk you should take on a trade. We have had a complete video section on this subject, which we encourage you to study. To summarize it here, position sizing is the tool to help you reach the trading objectives and put drawdown under the levels that fit you. Finally, proper position sizing enables you to minimize the risk of ruin while optimizing your trading account’s growth.

The trading record / Trade-forensics

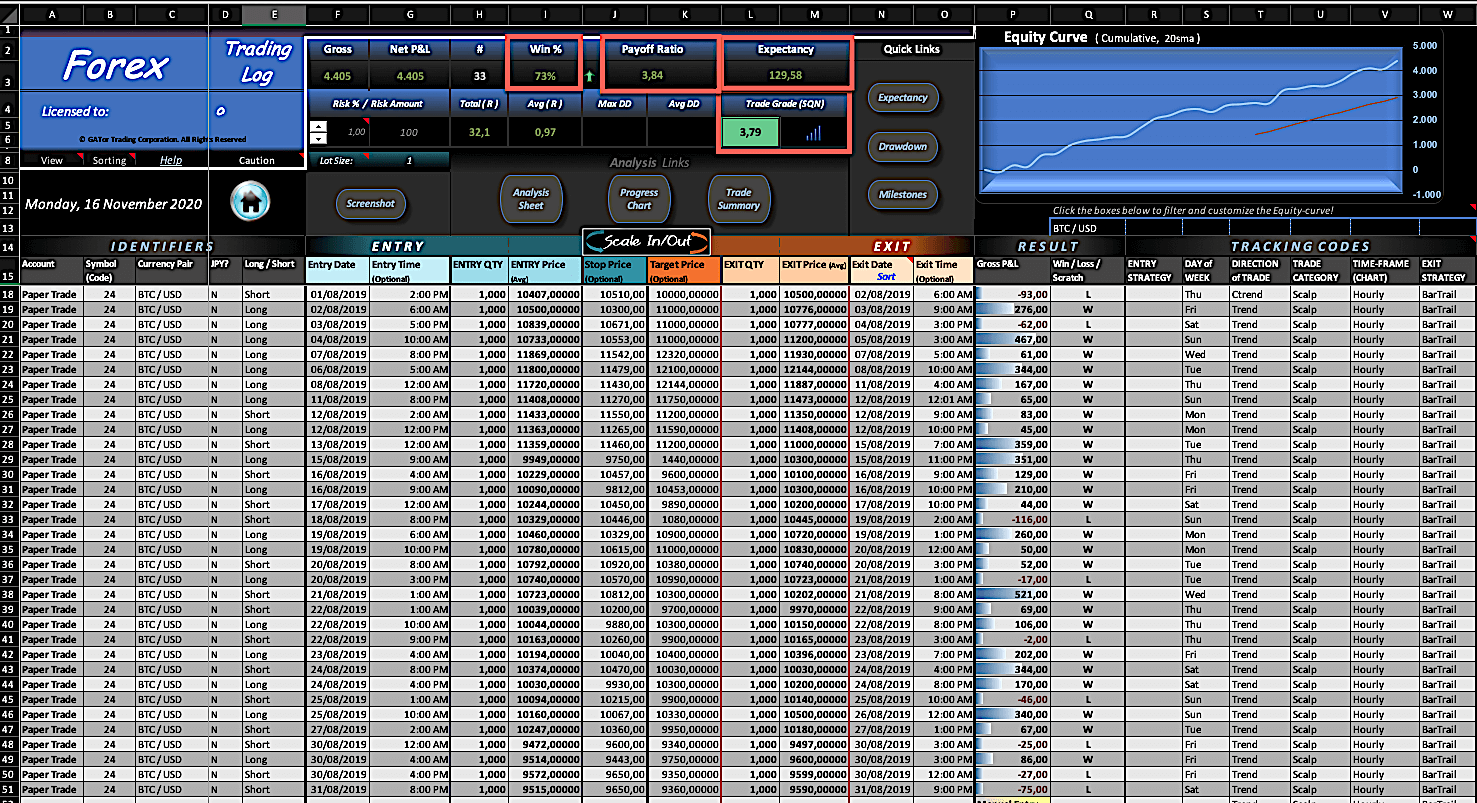

The path to improvement is an analysis of past results. Nobody is perfect, and, also, markets aren’t immutable but changing. A trading record is necessary to evaluate your system’s performance, detect and correct weaknesses, such as stops or target placements, errors in timing – too late or too early on a trade, and evaluate how permisioning filters work. Finally, the trading record will help traders know their system’s key parameters: the average profit and its standard deviation, percent winners, and average reward/risk.

The path to improvement is an analysis of past results. Nobody is perfect, and, also, markets aren’t immutable but changing. A trading record is necessary to evaluate your system’s performance, detect and correct weaknesses, such as stops or target placements, errors in timing – too late or too early on a trade, and evaluate how permisioning filters work. Finally, the trading record will help traders know their system’s key parameters: the average profit and its standard deviation, percent winners, and average reward/risk.

Key Elements of the trading record:

The main data you should record on the spreadsheet record are:

- Entry date/time

- entry price

- trade size

- entry level

- stop-loss level

- $risk of the trade

- planned take-profit level

- Exit price

- Exit date/ time

Other desirable parameters that would help optimize stops and take-profit targets are:

maximum adverse price of the trade if there were no stops.

maximum favorable price of the trade if not considering the take-profit

The first one would help you find better places for the stops, and the second one will show you the best place for the take-profit placement.

Main Parameters:

With the suggested trading record entries, you will be able to measure the key parameters of your system:

Average profit: Total profits/ number of trades

Standard deviation of profits: Use Excel’s Standard Deviation formula

Percent winners: Nr of Winners/ total trades x 100.

Average Reward/ risk: Sum of Profits / sum of $risk

You may find an example of a trading record in this forex.academy article. Furthermore, since we consider it an essential element to your trading success, we offer you to download our freely available trading log. You are free to adapt it to your taste and needs.

Forensics

After the closure of a trade, you should analyze its quality, regarding execution and goals. A losing trade does not have to be of low quality if executed according to your system’s rules. But it is necessary to determine if you’re acting according to the rules and assess how much of the available profit did you take.

Points to consider

- Percent of the available profit ( if any)

- percent of the loss you’ve taken ( if any)

- Timing: has it been right, too early, or too late?

- Exit timing: right, too early, or too late?

- Stop-loss: Can stop-loss settings be improved?

- Take profit: Can they be improved?

- Average Reward/risk: is it according to your settings?

Also, after a determined number of trades/weeks, you should assess:

- Is the system improving or worsening over time?

- Losing streaks: are normal for the system you’re using or due to bad stop-loss settings?

- How many trades could be on profit if you’ve loosened your stops?

- How much profit could you pocket if your take-profit levels were moved here/there, based on the maximum favorable price data?

This ends our overview of the main elements of the trading plan.